회사 소개

| BPF 리뷰 요약 | |

| 설립 연도 | 2004 |

| 등록 국가/지역 | 인도네시아 |

| 규제 | BAPPEBTI, JFX |

| 거래 상품 | 다자간 및 양자간 선물 계약 (금, 올레인, 외환 페어, 지수) |

| 데모 계정 | ✅ |

| 거래 플랫폼 | Pro Trader 앱 (iOS 및 Android) |

| 고객 지원 | 전화: +62 21 2903 5005 |

| 팩스: +62 21 2903 5132 | |

| 이메일: corporate@bestprofit-futures.co.id | |

BPF 정보

PT. Bestprofit Futures (BPF)는 2004년부터 사업을 영위하고 있으며 BAPPEBTI 및 JFX에 의해 규제되는 인도네시아 회사입니다. 다양한 선물 거래 상품을 제공하며 Pro Trader 앱을 통해 모바일 거래 및 연습용 데모 계정을 제공합니다. 회사의 서비스는 소매 및 전문 선물 투자자를 대상으로 하며 경쟁력 있는 요금과 지역 시장 지원을 제공합니다.

장단점

| 장점 | 단점 |

| BAPPEBTI 및 JFX 규제 | 이슬람 계정 없음 |

| 데모 계정 지원 | 입출금에 대한 제한된 정보 |

| 고정 수수료 낮음 (3포인트 + 부가가치세) |

BPF 합법적인가요?

네, PT. Bestprofit Futures (BPF)는 인도네시아의 규제된 중개업체로, BAPPEBTI (라이센스 번호 499/BAPPEBTI/SI/X/2004) 및 Jakarta Futures Exchange (JFX) (라이센스 번호 SPAB-071/BBJ/05/04)로부터 소매 외환 라이센스를 보유하고 있습니다.

거래 상품

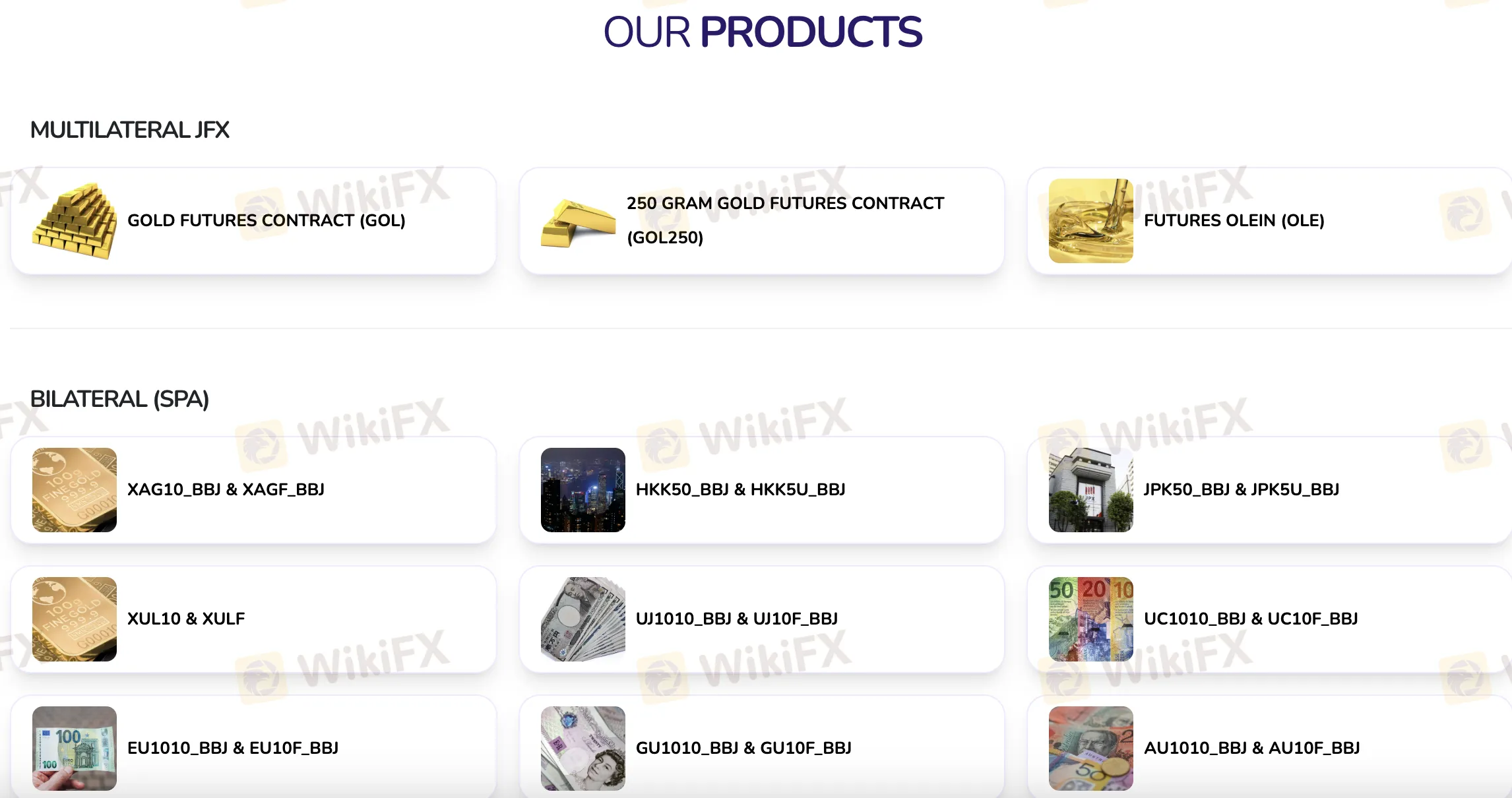

PT. Bestprofit Futures (BPF)는 JFX의 다자간 계약 및 다양한 상품, 통화 및 지수에 대한 양자간 (SPA) 계약과 같은 다양한 선물 거래 상품을 보유하고 있습니다.

| 카테고리 | 거래 상품 |

| 다자간 (JFX) | 금 선물 계약 (GOL) |

| 250그램 금 선물 (GOL250) | |

| 올레인 선물 (OLE) | |

| 양자간 (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

계정

PT. Bestprofit Futures (BPF)은 실거래/실시간 거래 계정과 데모 계정 두 가지 주요 유형의 계정을 제공합니다. 이슬람(스왑 무료) 계정의 가용 여부를 확인할 수 있는 정보는 없습니다.

BPF 수수료

PT. Bestprofit Futures (BPF)의 거래 비용은 인도네시아 선물 시장의 다른 회사들이 부과하는 요금과 일치합니다. 수수료는 간단하고 공정하며, 3포인트의 고정 거래 가격과 11% 부가세가 있습니다. 비슷한 지수 선물 상품을 제공하는 인도네시아의 다른 규제된 중개업체와 비교했을 때, 이는 점잖다고 여겨집니다.

거래 플랫폼

PT. Bestprofit Futures (BPF)은 iOS 및 Android에서 모두 사용 가능한 Pro Trader 모바일 앱을 통한 거래를 지원합니다.