Profil perusahaan

| BPF Ringkasan Ulasan | |

| Didirikan | 2004 |

| Negara/Daerah Terdaftar | Indonesia |

| Regulasi | BAPPEBTI, JFX |

| Produk Perdagangan | Kontrak Futures Multilateral & Bilateral (Emas, Olein, Pasangan FX, Indeks) |

| Akun Demo | ✅ |

| Platform Perdagangan | Aplikasi Pro Trader (iOS & Android) |

| Dukungan Pelanggan | Telepon: +62 21 2903 5005 |

| Fax: +62 21 2903 5132 | |

| Email: corporate@bestprofit-futures.co.id | |

Informasi BPF

PT. Bestprofit Futures (BPF) adalah perusahaan Indonesia yang telah beroperasi sejak tahun 2004 dan diatur oleh BAPPEBTI dan JFX. Perusahaan ini menawarkan berbagai produk perdagangan futures. Mereka memiliki aplikasi Pro Trader untuk perdagangan seluler dan akun demo untuk latihan. Layanan perusahaan ditujukan baik untuk investor futures ritel maupun profesional, dan mereka menawarkan tarif yang kompetitif serta dukungan untuk pasar lokal.

Pro dan Kontra

| Pro | Kontra |

| Diatur oleh BAPPEBTI dan JFX | Tidak ada akun Islami |

| Mendukung akun demo | Informasi terbatas tentang deposit dan penarikan |

| Biaya transaksi tetap rendah (3 poin + PPN) |

Apakah BPF Legal?

Ya, PT. Bestprofit Futures (BPF) adalah broker yang diatur di Indonesia, memegang Lisensi Forex Ritel dari BAPPEBTI (Nomor Lisensi 499/BAPPEBTI/SI/X/2004) dan Bursa Berjangka Jakarta (JFX) (Nomor Lisensi SPAB-071/BBJ/05/04).

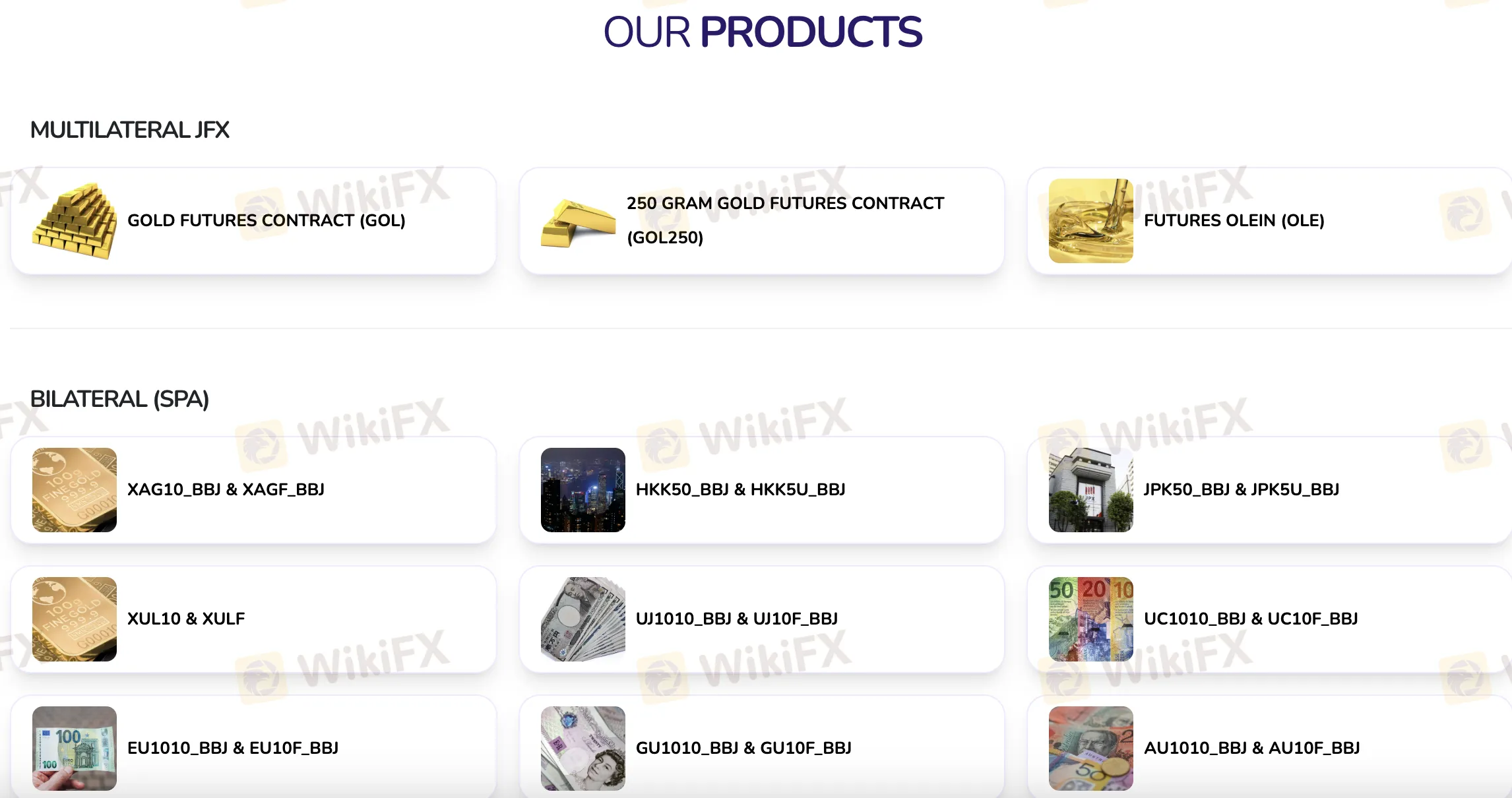

Produk Perdagangan

PT. Bestprofit Futures (BPF) memiliki berbagai produk perdagangan futures yang berbeda, seperti kontrak multilateral di Bursa Berjangka Jakarta (JFX) dan kontrak bilateral (SPA) pada berbagai komoditas, mata uang, dan indeks.

| Kategori | Produk Perdagangan |

| Multilateral (JFX) | KONTRAK FUTURES EMAS (GOL) |

| 250 GRAM KONTRAK FUTURES EMAS (GOL250) | |

| FUTURES OLEIN (OLE) | |

| Bilateral (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

Akun

PT. Bestprofit Futures (BPF) menawarkan dua jenis akun utama: akun trading nyata/riil dan akun demo. Tidak ada informasi yang mengkonfirmasi ketersediaan akun Islami (bebas swap).

Biaya BPF

Biaya transaksi di PT. Bestprofit Futures (BPF) sejalan dengan apa yang dikenakan oleh perusahaan lain di pasar futures Indonesia. Biayanya sederhana dan adil, dengan harga transaksi flat sebesar 3 poin ditambah 11% PPN. Dibandingkan dengan broker teregulasi lain di Indonesia yang menyediakan produk futures indeks serupa, ini dianggap sebagai biaya yang moderat.

Platform Trading

PT. Bestprofit Futures (BPF) mendukung trading melalui aplikasi seluler Pro Trader, tersedia di iOS dan Android.