회사 소개

| KIT 리뷰 요약 | |

| 설립 연도 | 2000 |

| 등록 국가/지역 | 러시아 |

| 규제 | 규제 없음 |

| 제품 및 서비스 | 자산 관리, 통화 변환, 마진 대출, ETF, 주식, 선물 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | Valdi Market Access |

| 최소 입금액 | / |

| 고객 지원 | 전화: 8 800 700-00-55 |

| 팩스: +7 (812) 332 32 91 | |

| 소셜 미디어: 텔레그램, VK, YouTube | |

| 주소: 러시아 세인트피터부르크 Marata 거리 69-71, 비즈니스 센터 "Renaissance Plaza", 191119 | |

KIT 정보

KIT Finance는 2000년에 설립되어 러시아를 본사로 하는 규제되지 않은 브로커로, 러시아 중앙은행이나 기타 주요 기관에서 라이선스를 받지 않았습니다. Valdi Market Access와 같은 기관급 기술을 사용하여 러시아 및 전 세계 금융 시장에 액세스할 수 있습니다.

장단점

| 장점 | 단점 |

| 러시아 및 글로벌 시장 모두 접근 가능 | 규제되지 않음 |

| 기관 및 전문 고객 지원 | 투명성 부족 |

| 긴 운영 역사 | |

| 고급 거래 도구 및 인프라 | |

| 다양한 연락 채널 |

KIT 합법성

KIT Finance는 규제되지 않은 브로커입니다. 러시아에 등록되어 있지만 러시아 중앙은행과 같은 인정받은 러시아 금융 당국에 의해 중개 또는 투자 목적으로 감독받지 않습니다.

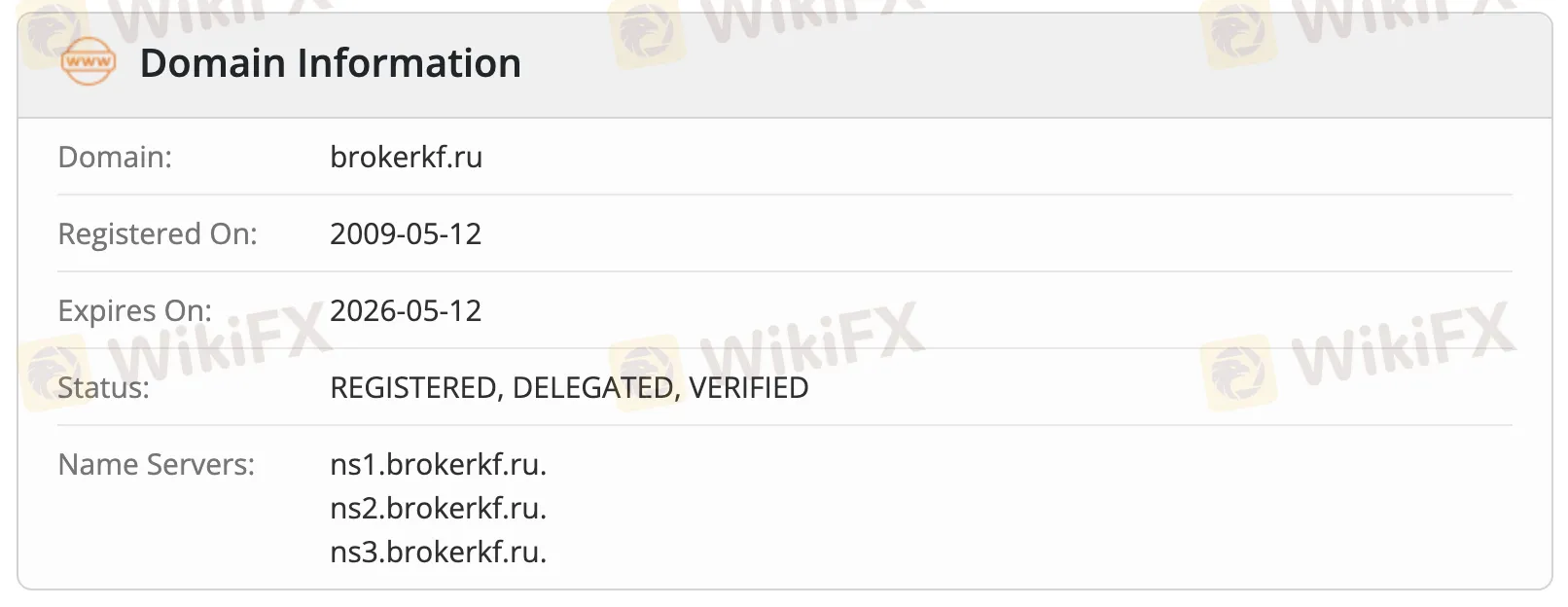

WHOIS 레코드에 따르면, 도메인 brokerkf.ru는 2009년 5월 12일에 등록되었으며 "REGISTERED, DELEGATED, VERIFIED" 상태로 현재 유지되고 있습니다. 해당 도메인은 2026년 5월 12일에 만료되며 자체 이름 서버인 ns1.brokerkf.ru, ns2.brokerkf.ru 및 ns3.brokerkf.ru에서 호스팅됩니다.

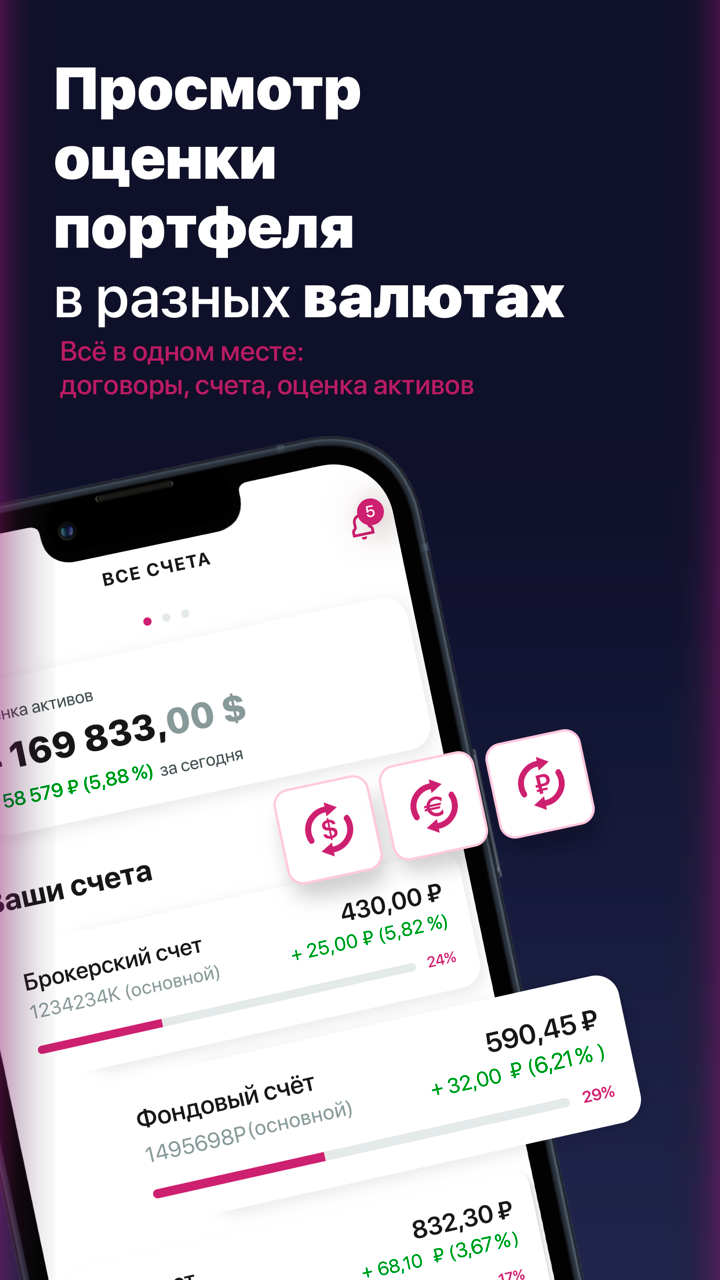

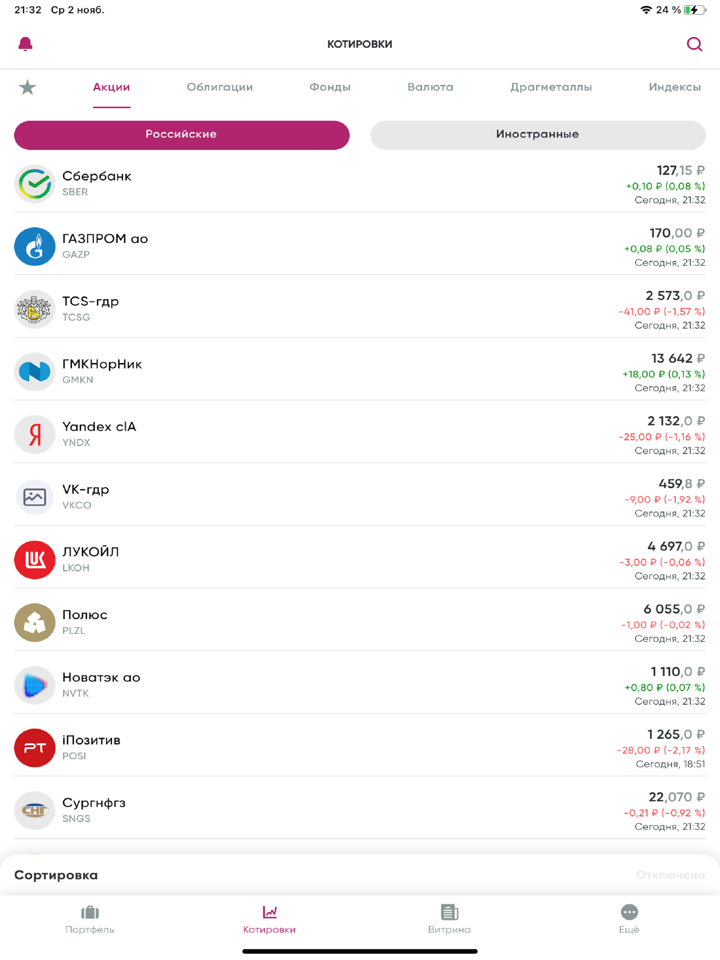

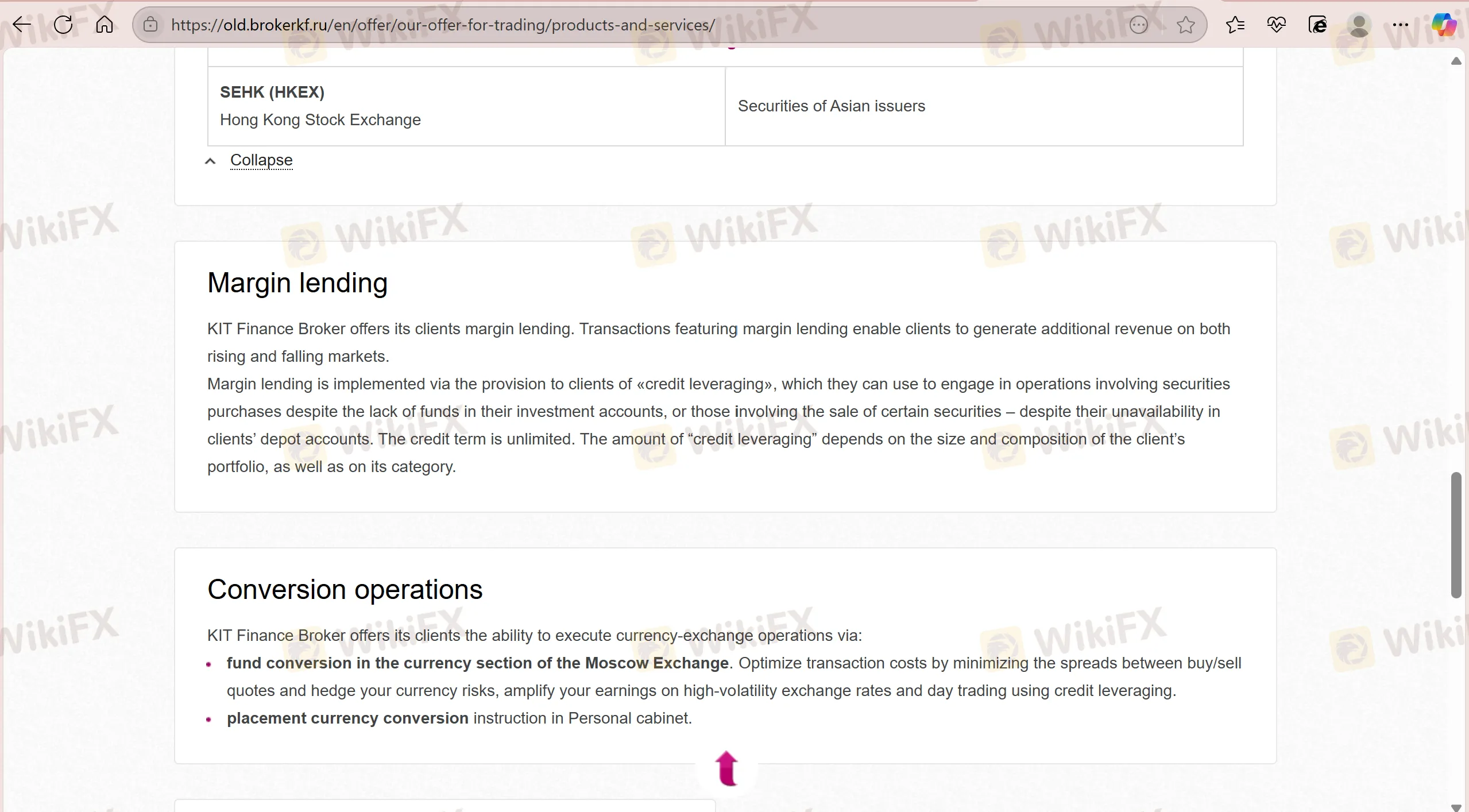

제품 및 서비스

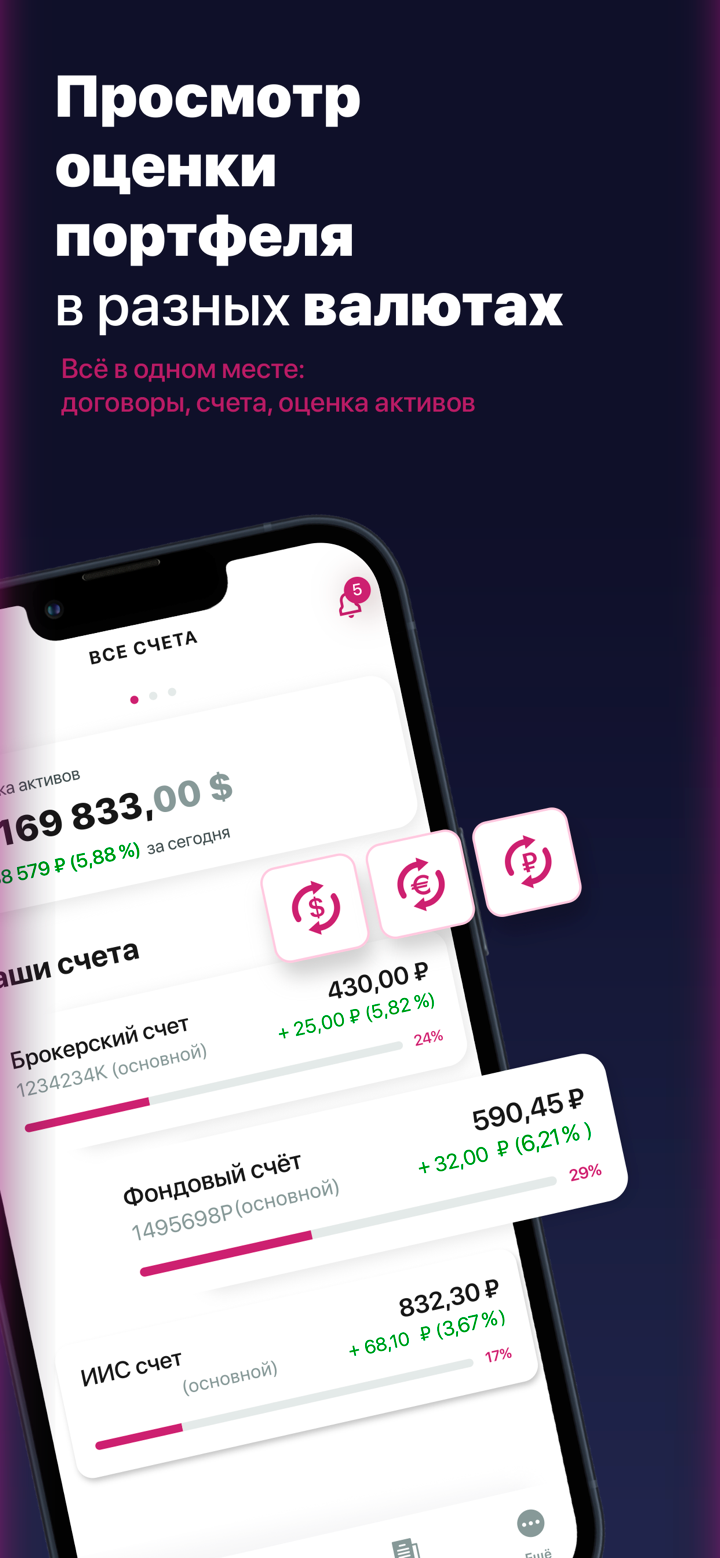

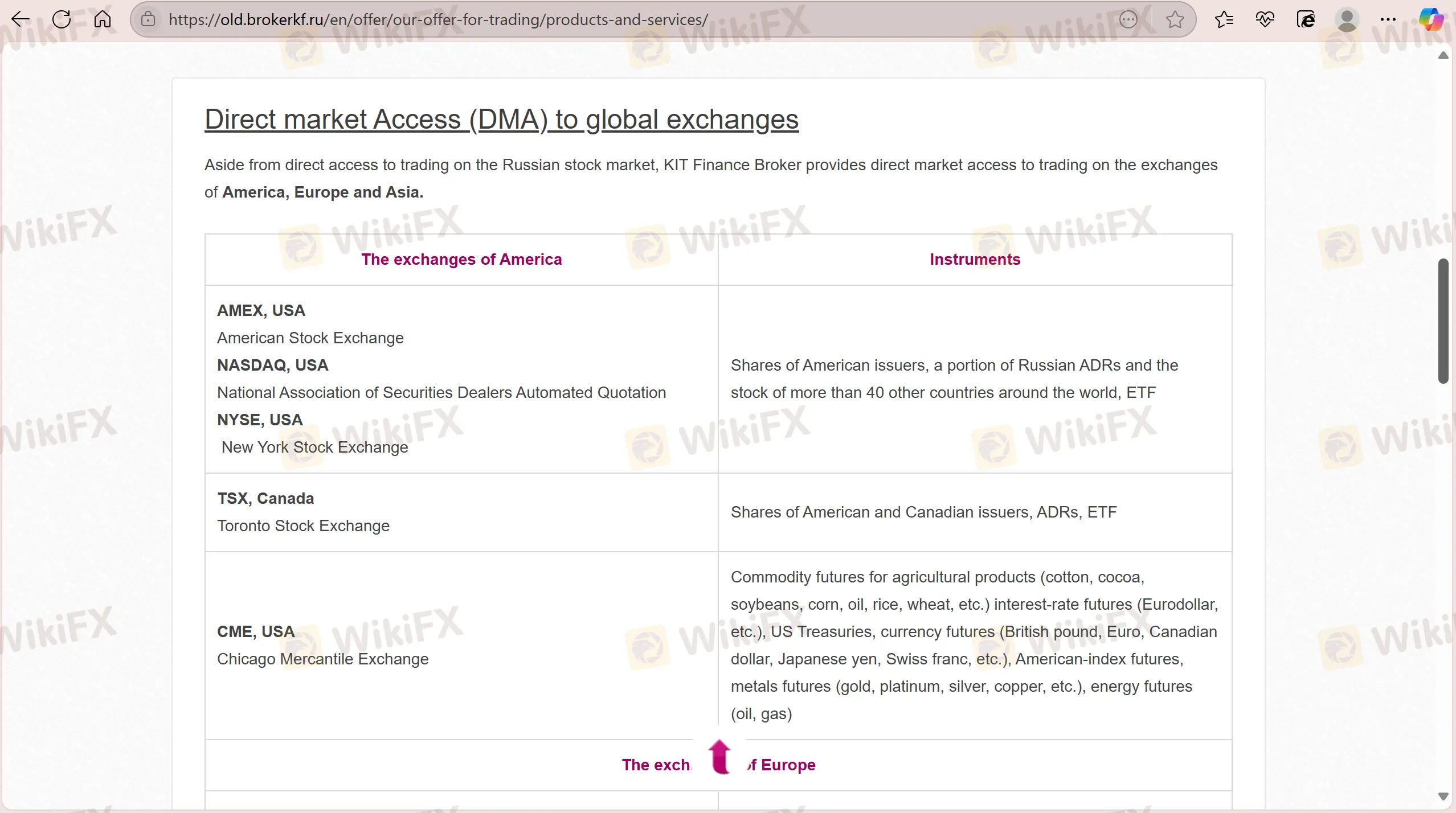

KIT Finance는 러시아 및 글로벌 시장을 위한 중개 및 거래 서비스를 제공하며 은행, 보험사, 자산 관리자 등 기관 고객과 개인에게 서비스를 제공합니다.

| 상품 / 서비스 | 지원 |

| 주식 | ✔ |

| ETFs | ✔ |

| 선물 | ✔ |

| 자산 관리 | ✔ |

| 마진 대출 | ✔ |

| 통화 변환 | ✔ |

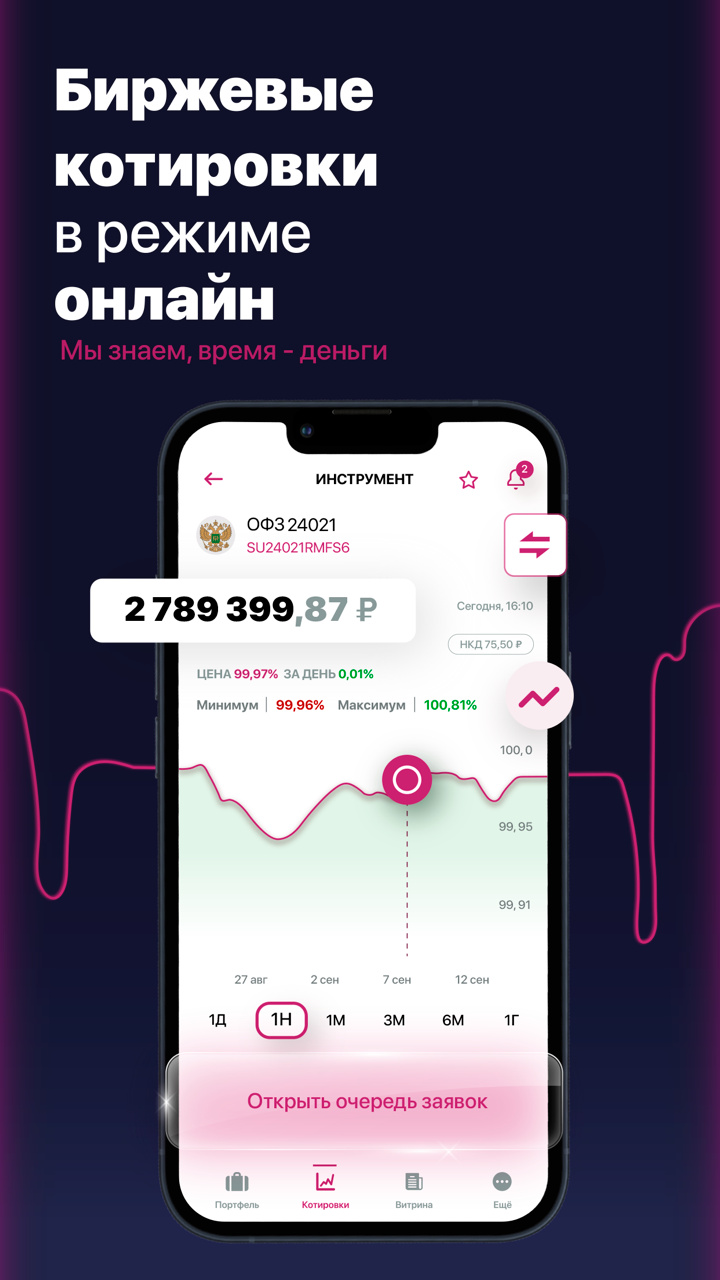

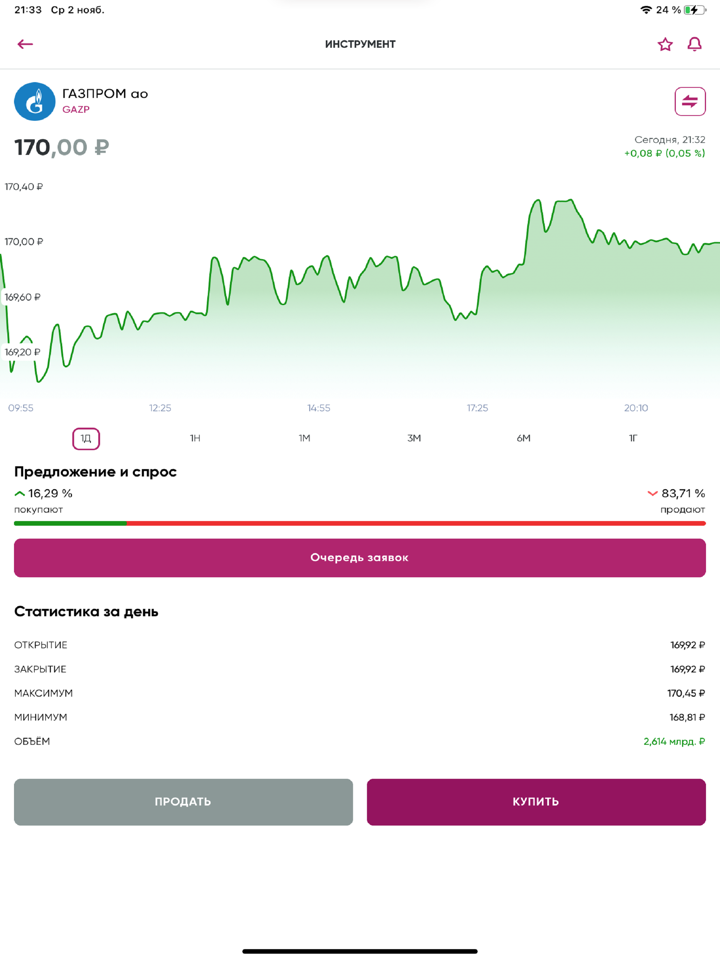

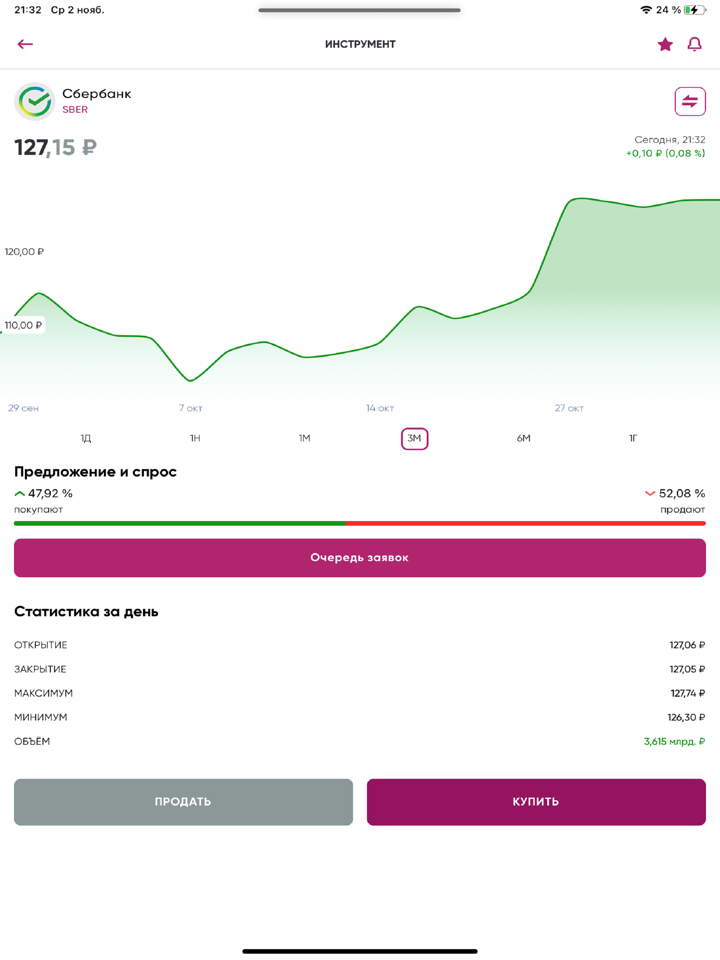

거래 플랫폼

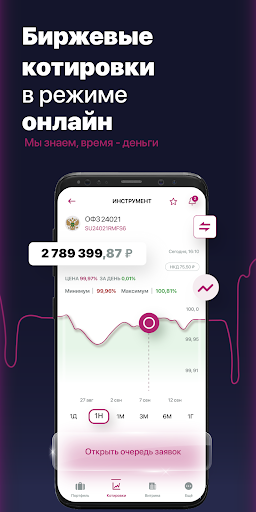

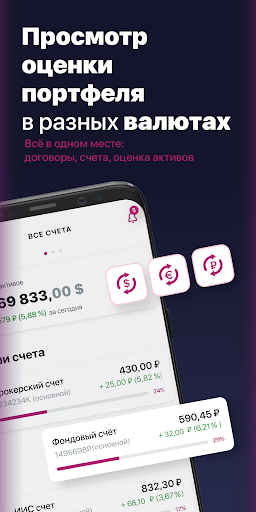

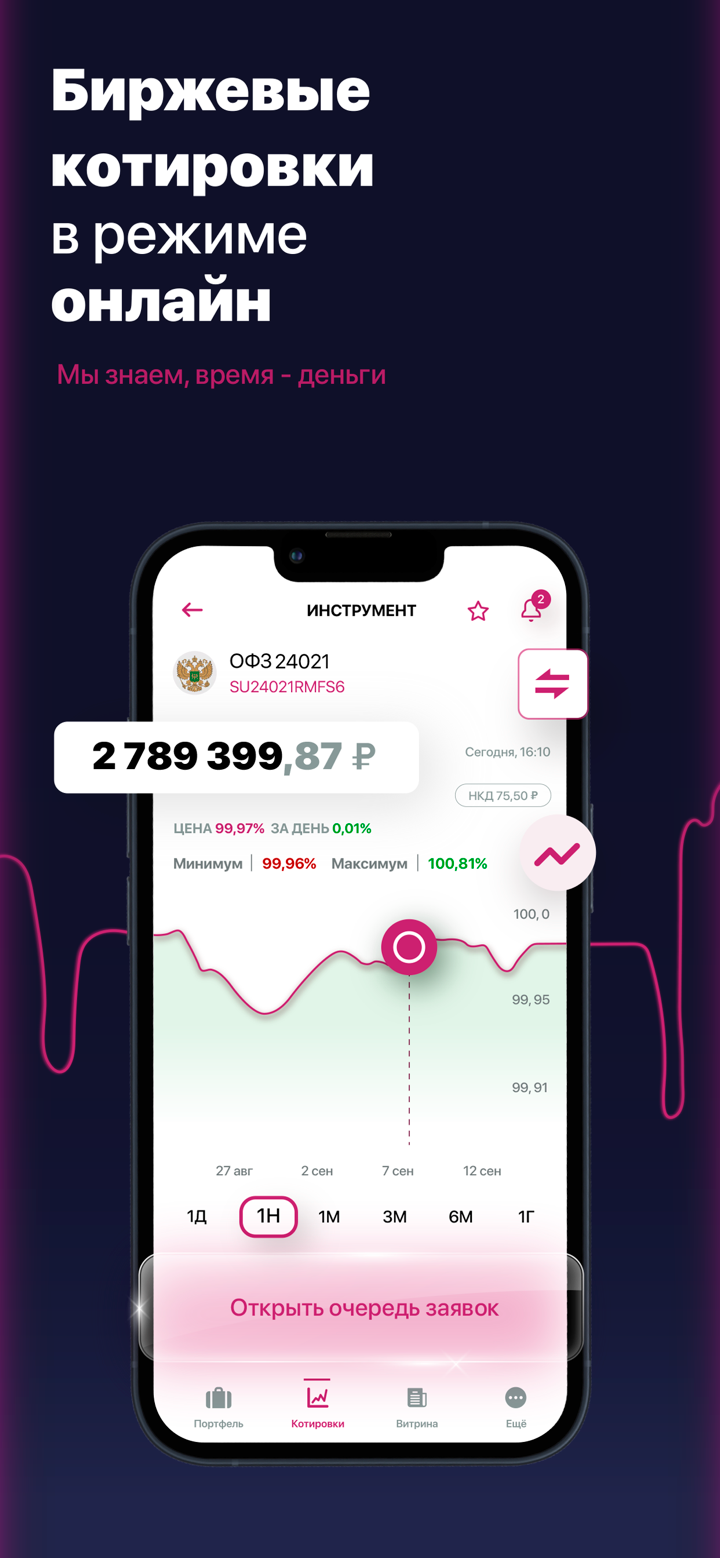

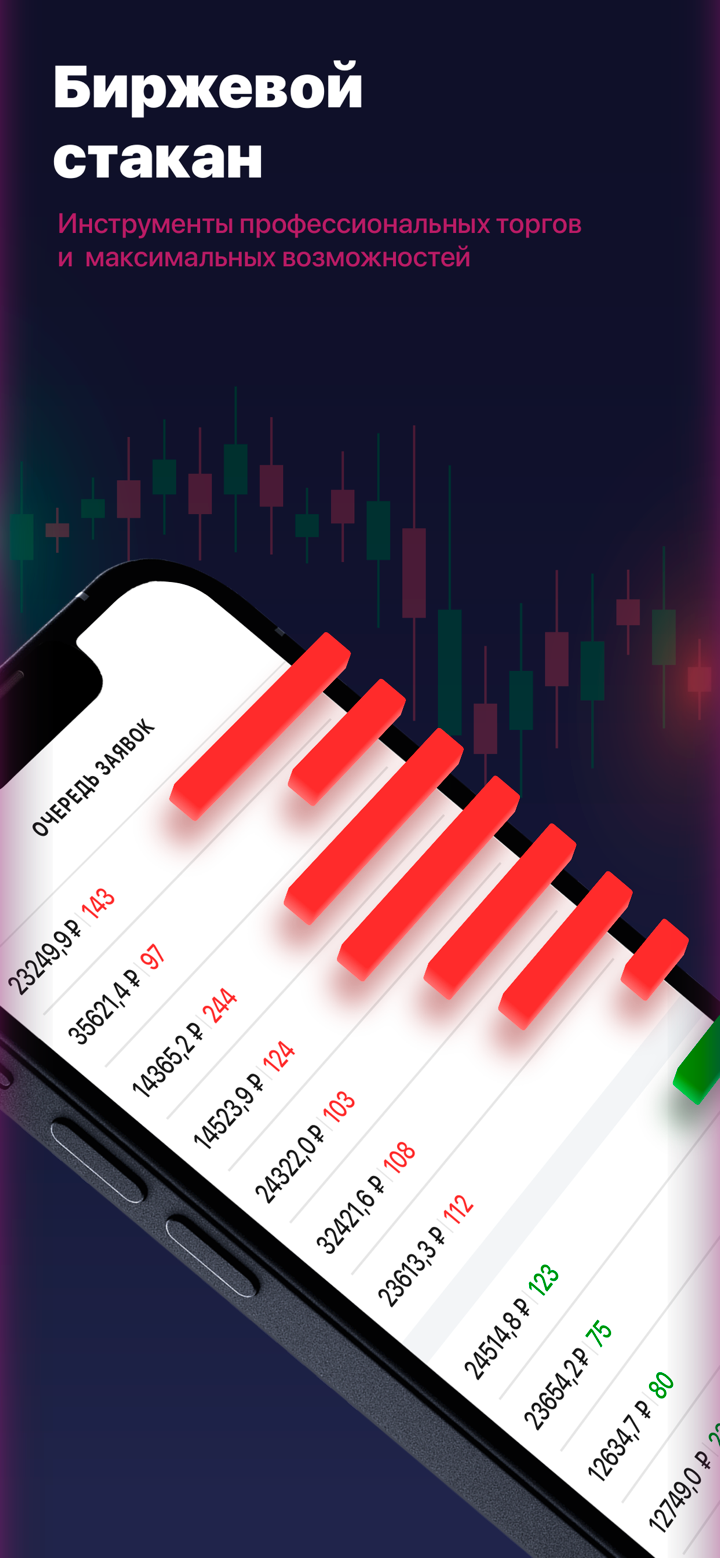

KIT Finance는 기관 및 전문가 사용자를 대상으로 한 견고한 거래 플랫폼인 Valdi Market Access를 제공합니다. 실행부터 리스크 관리, 준수 및 결제까지 거래 수명주기 전반을 다루며 SunGard Global Network (SGN)을 통한 속도, 자동화 및 저지연 통신에 중점을 두고 있습니다. 일반 소매 사용자를 대상으로하지 않습니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| Valdi Market Access | ✔ | 데스크톱 (Windows) | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |