Описание компании

| BPF Обзор | |

| Основана | 2004 |

| Страна/Регион регистрации | Индонезия |

| Регуляция | BAPPEBTI, JFX |

| Торговые продукты | Мультилатеральные и билатеральные фьючерсные контракты (Золото, Олейн, Валютные пары, Индексы) |

| Демо-счет | ✅ |

| Торговая платформа | Приложение Pro Trader (iOS и Android) |

| Поддержка клиентов | Телефон: +62 21 2903 5005 |

| Факс: +62 21 2903 5132 | |

| Эл. почта: corporate@bestprofit-futures.co.id | |

Информация о BPF

PT. Bestprofit Futures (BPF) - индонезийская компания, работающая с 2004 года и регулируемая BAPPEBTI и JFX. Она предлагает широкий спектр фьючерсных торговых продуктов. У нее есть приложение Pro Trader для мобильной торговли и демо-счета для практики. Услуги компании ориентированы как на розничных, так и на профессиональных инвесторов в фьючерсы, и они предлагают конкурентоспособные тарифы и поддержку для местных рынков.

Плюсы и минусы

| Плюсы | Минусы |

| Регулируется BAPPEBTI и JFX | Отсутствие исламских счетов |

| Поддержка демо-счетов | Ограниченная информация о депозите и выводе средств |

| Низкие фиксированные комиссии за транзакции (3 пункта + НДС) |

BPF Легальность

Да, PT. Bestprofit Futures (BPF) - регулируемый брокер в Индонезии, имеющий лицензию на розничный рынок форекс от BAPPEBTI (Лицензия № 499/BAPPEBTI/SI/X/2004) и Биржа фьючерсов Джакарты (JFX) (Лицензия № SPAB-071/BBJ/05/04).

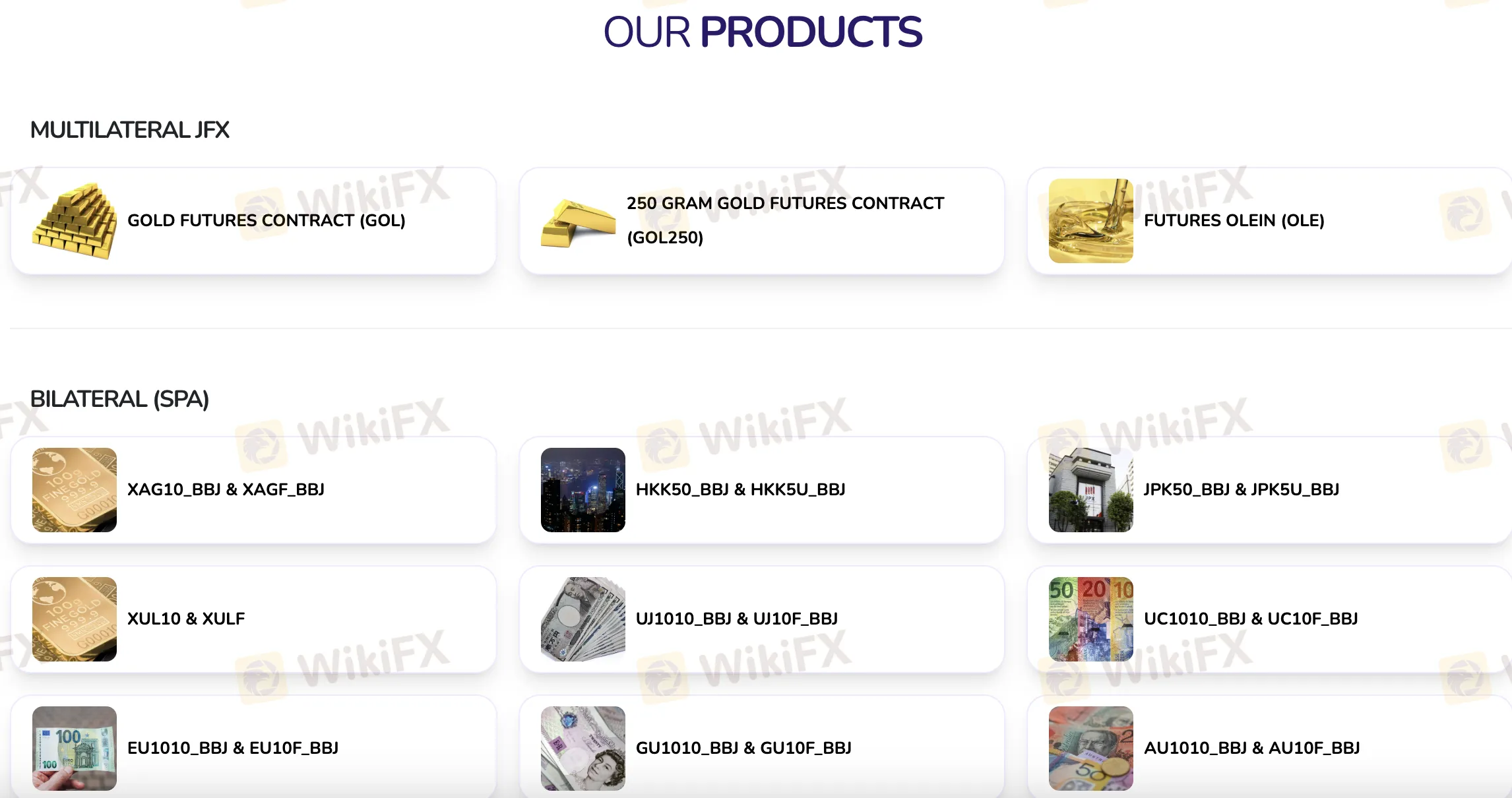

Торговые продукты

PT. Bestprofit Futures (BPF) предлагает множество различных фьючерсных продуктов, таких как мультилатеральные контракты на Бирже фьючерсов Джакарты (JFX) и билатеральные контракты (SPA) на различные товары, валюты и индексы.

| Категория | Торговый продукт |

| Мультилатеральные (JFX) | ФЬЮЧЕРСНЫЙ КОНТРАКТ НА ЗОЛОТО (GOL) |

| ФЬЮЧЕРСНЫЙ КОНТРАКТ НА ЗОЛОТО 250 ГРАММ (GOL250) | |

| ФЬЮЧЕРСНЫЙ КОНТРАКТ НА ОЛЕИН (OLE) | |

| Билатеральные (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

Счет

PT. Bestprofit Futures (BPF) предлагает два основных типа счетов: реальный/живой торговый счет и демо-счет. Нет информации, подтверждающей наличие исламских (без свопов) счетов.

Сборы BPF

Транзакционные издержки в PT. Bestprofit Futures (BPF) соответствуют тому, что взимают другие компании на индонезийском фьючерсном рынке. Сборы просты и справедливы, с фиксированной транзакционной ценой 3 пункта плюс 11% НДС. По сравнению с другими регулируемыми брокерами в Индонезии, предоставляющими аналогичные продукты фьючерсов на индекс, это считается умеренным.

Торговая платформа

PT. Bestprofit Futures (BPF) поддерживает торговлю через мобильное приложение Pro Trader, доступное как на iOS, так и на Android.