Información básica

Indonesia

IndonesiaCalificación

Indonesia

|

De 5 a 10 años

|

Indonesia

|

De 5 a 10 años

| https://www.bestprofit-futures.co.id

Sitio web

Índice de calificación

influencia

C

índice de influencia NO.1

Indonesia 3.19

Indonesia 3.19Núcleo único

1G

40G

1M*ADSL

Indonesia

Indonesia

| BPF Resumen de la revisión | |

| Establecido | 2004 |

| País/Región Registrada | Indonesia |

| Regulación | BAPPEBTI, JFX |

| Productos de Trading | Contratos de Futuros Multilaterales y Bilaterales (Oro, Olein, Pares de Divisas, Índices) |

| Cuenta Demo | ✅ |

| Plataforma de Trading | Aplicación Pro Trader (iOS y Android) |

| Soporte al Cliente | Teléfono: +62 21 2903 5005 |

| Fax: +62 21 2903 5132 | |

| Email: corporate@bestprofit-futures.co.id | |

PT. Bestprofit Futures (BPF) es una empresa indonesia que ha estado en funcionamiento desde 2004 y está regulada por BAPPEBTI y JFX. Ofrece una amplia gama de productos de trading de futuros. Tiene la aplicación Pro Trader para trading móvil y cuentas demo para práctica. Los servicios de la empresa están dirigidos tanto a inversores minoristas como profesionales de futuros, y ofrecen tarifas competitivas y soporte para los mercados locales.

| Pros | Contras |

| Regulado por BAPPEBTI y JFX | No hay cuentas islámicas |

| Soporta cuentas demo | Información limitada sobre depósitos y retiros |

| Tarifas fijas de transacción bajas (3 puntos + IVA) |

Sí, PT. Bestprofit Futures (BPF) es un broker regulado en Indonesia, con una Licencia de Forex Minorista de BAPPEBTI (Licencia No. 499/BAPPEBTI/SI/X/2004) y la Bolsa de Futuros de Jakarta (JFX) (Licencia No. SPAB-071/BBJ/05/04).

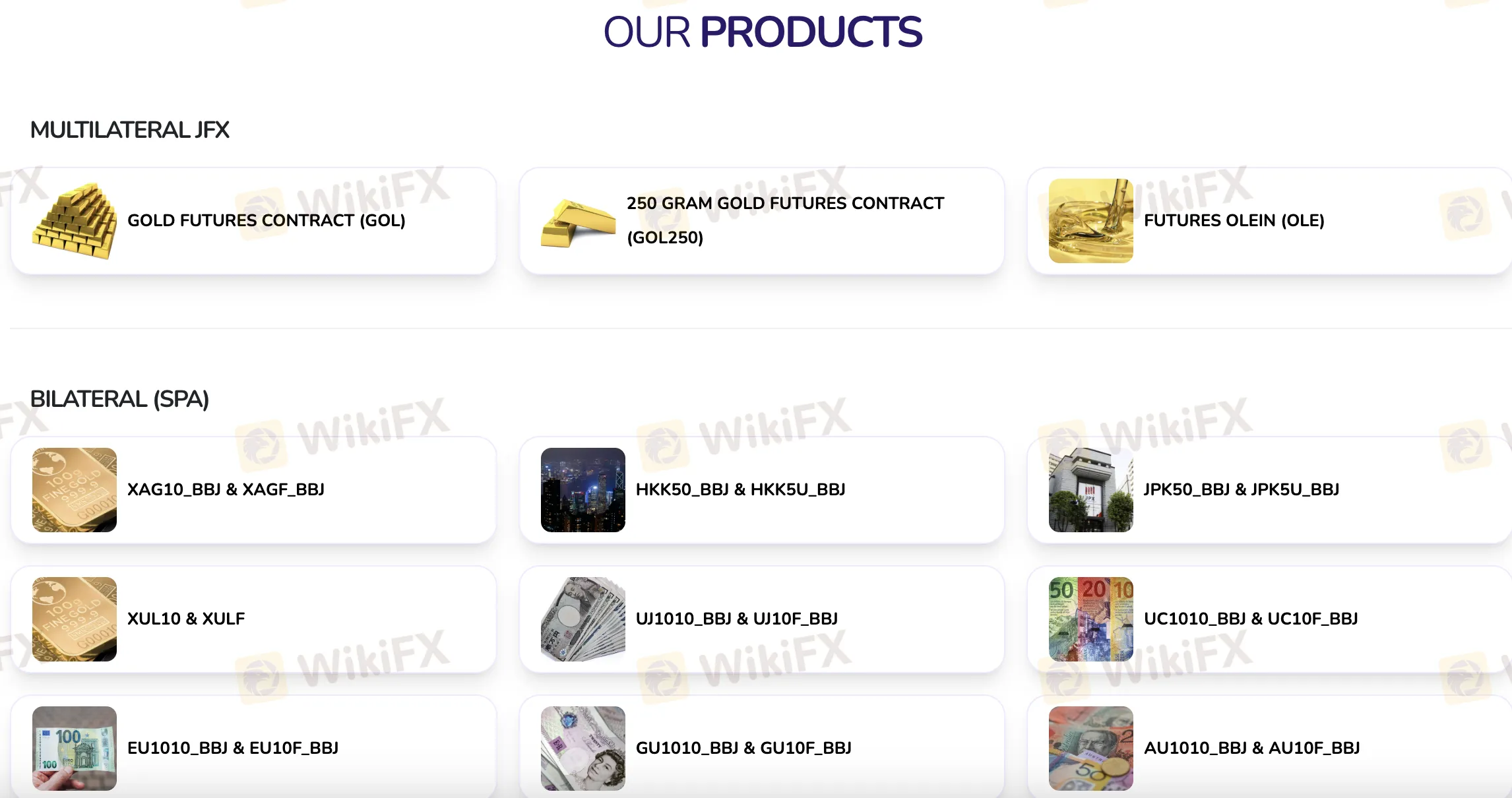

PT. Bestprofit Futures (BPF) tiene una variedad de productos de trading de futuros, como contratos multilaterales en la Bolsa de Futuros de Jakarta (JFX) y contratos bilaterales (SPA) en diferentes productos básicos, divisas e índices.

| Categoría | Producto de Trading |

| Multilateral (JFX) | CONTRATO DE FUTUROS DE ORO (GOL) |

| CONTRATO DE FUTUROS DE 250 GRAMOS DE ORO (GOL250) | |

| FUTUROS DE OLEIN (OLE) | |

| Bilateral (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

PT. Bestprofit Futures (BPF) ofrece dos tipos principales de cuentas: una cuenta de trading real/viva y una cuenta demo. No hay información que confirme la disponibilidad de cuentas islámicas (libres de swaps).

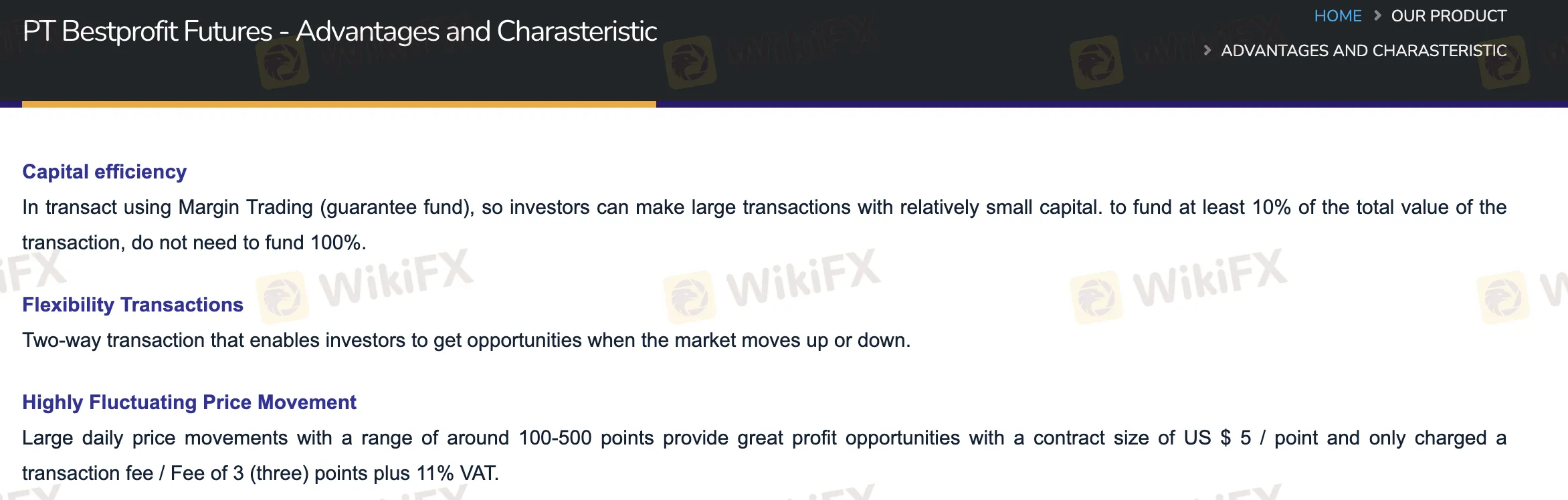

Los costos de transacción en PT. Bestprofit Futures (BPF) están en línea con lo que cobran otras empresas en el mercado de futuros de Indonesia. Las tarifas son simples y justas, con un precio de transacción fijo de 3 puntos más 11% de IVA. En comparación con otros corredores regulados en Indonesia que ofrecen productos similares de futuros de índices, esto se considera modesto.

PT. Bestprofit Futures (BPF) admite el trading a través de la aplicación móvil Pro Trader, disponible tanto en iOS como en Android.

In my experience as a forex trader who prioritizes regulatory scrutiny and operational transparency, BPF stands out as a broker with established credentials in Indonesia. What gives me a degree of reassurance is their dual regulation under BAPPEBTI and the Jakarta Futures Exchange (JFX), both well-recognized authorities in the local financial landscape. BPF has been operating for over a decade, which is often a positive indicator of industry longevity and ongoing compliance. For me, this is crucial because oversight can potentially minimize risks of malpractice. I am cautious, however, because the broker’s available information, especially regarding deposits and withdrawals, is rather limited. This lack of detail could be a point of concern for those who, like me, value process clarity before entrusting a broker with funds. On the plus side, I notice BPF’s trading fees are straightforward—3 points plus VAT—and demo accounts are supported, allowing for some risk-free practice. User feedback, while sparse, appears positive and supports the claim that BPF delivers on its basic functions. Personally, I find that combining regulatory credentials, company tenure, and transparent fees forms a solid foundation for trustworthiness. Yet, I would recommend a cautious approach due to the medium risk label and urge potential clients to seek more first-hand insights on account operations and fund safety before committing significant capital. For me, BPF is a legitimate, regulated broker in Indonesia, but as always, careful due diligence remains essential.

Drawing on my own cautious approach as a trader, I took time to analyze what BPF offers in terms of trading instruments. From my experience, BPF stands out as a futures-focused broker regulated in Indonesia, with oversight from both BAPPEBTI and the Jakarta Futures Exchange (JFX). Rather than providing conventional spot forex, stocks, or cryptocurrencies, the accessible products primarily revolve around multilateral and bilateral futures contracts. For me, this means I can trade futures based on gold and olein, as well as a range of currency and index futures. The structure features both JFX-listed multilateral contracts—like gold futures (including a 250-gram variant)—and bilateral contracts covering several foreign exchange pairs (such as EUR/USD, GBP/USD, USD/JPY) and indices. While these product types might be suitable for those already comfortable with futures trading and seeking exposure to commodities and select currency contracts, I have to acknowledge that BPF does not currently provide access to single stocks or the increasingly popular cryptocurrency derivatives. In my view, the focus on regulated futures contracts via official exchanges does provide a measure of risk management and transparency, yet the absence of broader asset classes means it may not meet the needs of all traders. As always, for me, it’s essential to ensure that a broker’s product range aligns with my own trading strategies and risk tolerance.

From my own research and direct experience reviewing BPF, I have not found any evidence that BPF offers specialized ECN or raw spread account types as seen with international forex brokers. Instead, their structure centers on two main account types: standard live accounts and demo accounts. When it comes to transaction fees, BPF clearly outlines a flat transaction fee model—specifically, they charge a fixed fee of 3 points per transaction plus 11% VAT, rather than the separate commission-per-lot model commonly associated with ECN or raw spread accounts elsewhere. For me, the lack of a dedicated ECN or raw account option is something to be mindful of, as it means spreads and pricing are set according to their established structure on the Pro Trader app and Indonesian exchanges. Their transparent, flat-fee approach can make costs predictable, but it’s critical to verify these details directly with their support before opening any account, since local regulatory norms in Indonesia can differ from international practices. As always, I recommend cautious due diligence, especially if you’re accustomed to international brokers with more advanced account structures.

Based on my experience trading with and researching BPF, I was unable to find any clear, publicly disclosed information regarding the minimum withdrawal amount on BPF’s official documentation or platform details. As a trader who prioritizes transparent terms and accessible client support, I always look for explicit figures about deposit and withdrawal policies before committing significant capital to any broker. With BPF, I noticed that while the broker is regulated by both BAPPEBTI and JFX, and generally provides a satisfactory level of operational transparency in areas like fees and account types, their lack of published detail concerning withdrawals is a point of caution for me. From my perspective, any reputable broker should make such fundamental information readily accessible, especially since withdrawal limitations can affect both trading flexibility and overall peace of mind. In practice, I’d always urge fellow traders to directly contact BPF’s customer support before making any funding decisions or executing a withdrawal request, so you can obtain up-to-date, precise information specific to your account and banking circumstances. This cautious approach helps ensure you’re not caught off guard by unexpected limits or delays.

Ingrese...

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora