Présentation de l'entreprise

| BPF Résumé de l'examen | |

| Fondé | 2004 |

| Pays/Région Enregistré | Indonésie |

| Régulation | BAPPEBTI, JFX |

| Produits de Trading | Contrats à terme multilatéraux et bilatéraux (Or, Olein, paires de devises FX, Indices) |

| Compte de Démo | ✅ |

| Plateforme de Trading | Application Pro Trader (iOS & Android) |

| Support Client | Téléphone : +62 21 2903 5005 |

| Fax : +62 21 2903 5132 | |

| Email : corporate@bestprofit-futures.co.id | |

Informations sur BPF

PT. Bestprofit Futures (BPF) est une entreprise indonésienne qui est en activité depuis 2004 et est réglementée par BAPPEBTI et JFX. Elle propose une large gamme de produits de trading à terme. Elle dispose de l'application Pro Trader pour le trading mobile et des comptes de démonstration pour la pratique. Les services de l'entreprise s'adressent aux investisseurs en contrats à terme, tant professionnels que particuliers, et ils offrent des tarifs compétitifs et un support pour les marchés locaux.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par BAPPEBTI et JFX | Pas de comptes islamiques |

| Prise en charge des comptes de démonstration | Informations limitées sur les dépôts et retraits |

| Frais de transaction fixes bas (3 points + TVA) |

BPF est-il Légitime ?

Oui, PT. Bestprofit Futures (BPF) est un courtier réglementé en Indonésie, détenant une licence de courtier Forex de détail de BAPPEBTI (Licence No. 499/BAPPEBTI/SI/X/2004) et de la Bourse des contrats à terme de Jakarta (JFX) (Licence No. SPAB-071/BBJ/05/04).

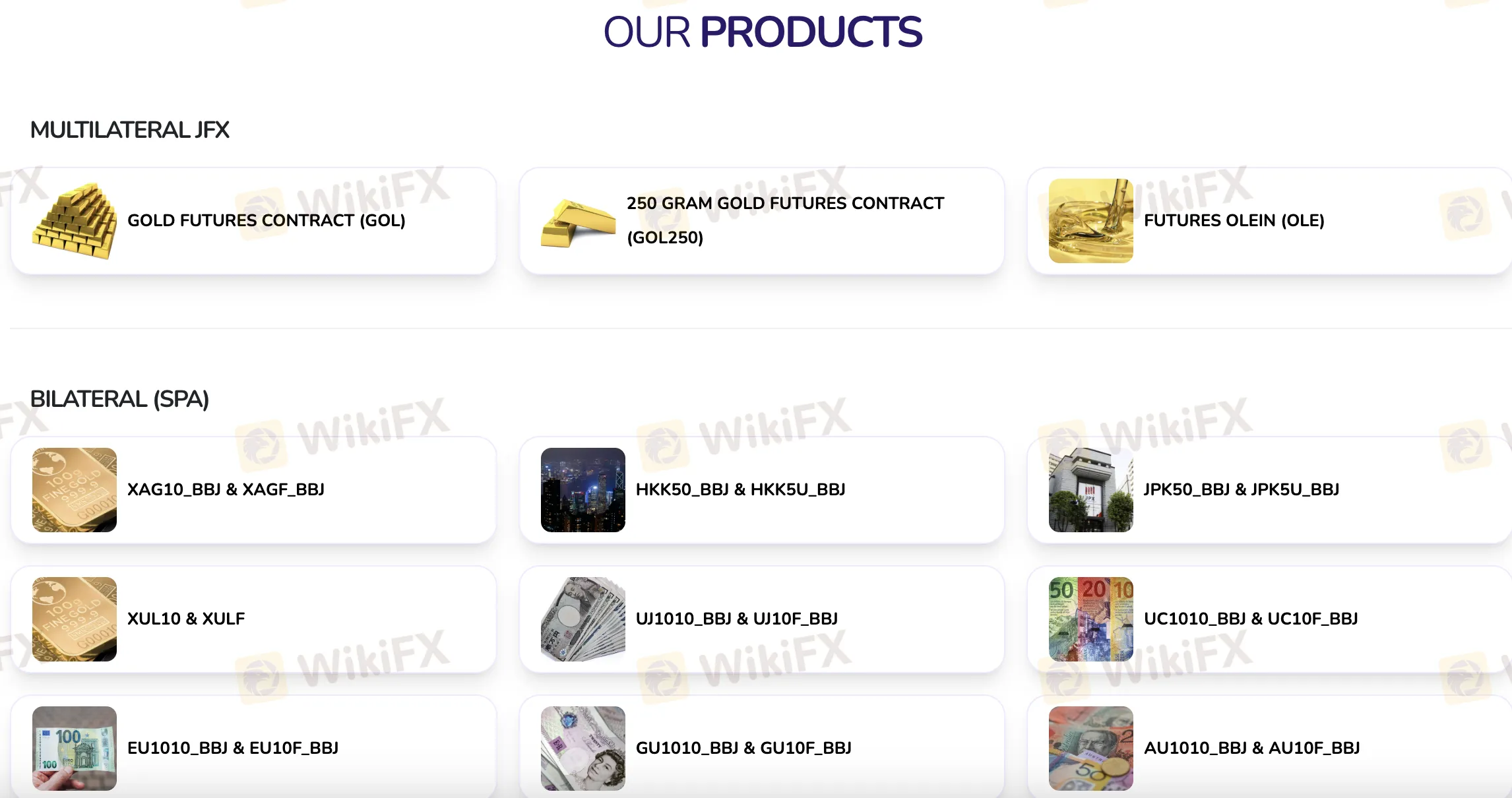

Produits de Trading

PT. Bestprofit Futures (BPF) propose de nombreux produits de trading à terme différents, tels que des contrats multilatéraux sur la Bourse des contrats à terme de Jakarta (JFX) et des contrats bilatéraux (SPA) sur différentes matières premières, devises et indices.

| Catégorie | Produit de Trading |

| Multilatéraux (JFX) | CONTRAT À TERME SUR L'OR (GOL) |

| CONTRAT À TERME DE 250 GRAMMES D'OR (GOL250) | |

| CONTRATS À TERME OLEIN (OLE) | |

| Bilatéraux (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

Compte

PT. Bestprofit Futures (BPF) propose deux types de comptes principaux : un compte de trading réel/en direct et un compte de démonstration. Il n'y a pas d'informations confirmant la disponibilité de comptes islamiques (sans swap).

Frais chez BPF

Les coûts de transaction chez PT. Bestprofit Futures (BPF) sont en ligne avec ce que facturent d'autres entreprises sur le marché des contrats à terme indonésien. Les frais sont simples et équitables, avec un prix de transaction fixe de 3 points plus 11% de TVA. Comparé à d'autres courtiers réglementés en Indonésie qui proposent des produits similaires sur les contrats à terme d'indices, cela est considéré comme modeste.

Plateforme de Trading

PT. Bestprofit Futures (BPF) prend en charge le trading via l'application mobile Pro Trader, disponible sur iOS et Android.