회사 소개

| AKBANK 리뷰 요약 | |

| 설립 연도 | 1948 |

| 등록 국가/지역 | 터키 |

| 규제 | 규제 없음 |

| 금융 서비스 | 외국인 은행, 다국적 은행, 부유층 은행, 사설 은행 |

| 거래 플랫폼 | Akbank Mobile |

| 고객 지원 | 전화: 444 25 25 |

AKBANK 정보

AKBANK은 1948년 터키에서 설립되어 외국인, 다국적, 부유층, 사설 은행을 포함한 다양한 전문 은행 서비스를 제공하는 규제되지 않은 회사로 운영됩니다. 회사는 투자를 위한 모바일 거래 플랫폼을 제공하며 장기간 온라인 존재하고 있지만 구체적인 수수료 세부 정보는 쉽게 이용할 수 없습니다.

장단점

| 장점 | 단점 |

| 장기간 존재 | 규제 부족 |

| 다양한 은행 서비스 | 구체적인 수수료 세부 정보 부족 |

| 고객 지원 채널 제한 |

AKBANK 합법적인가요?

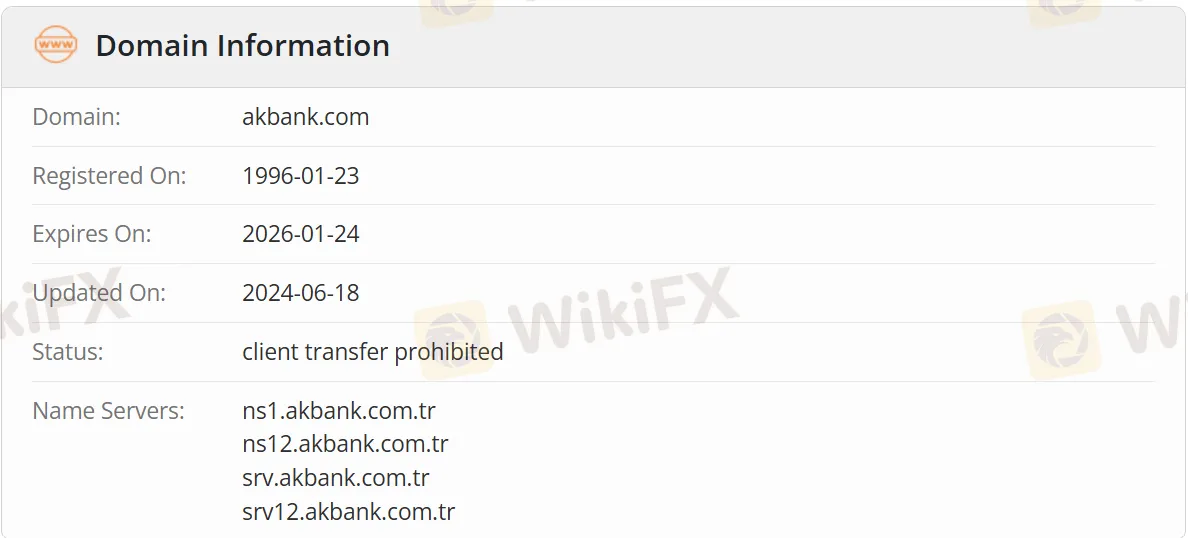

AKBANK은(는) 비규제된 브로커입니다. WHOIS 검색 결과, 도메인 akbank.com은 1996년 1월 23일에 등록되었습니다. 현재 상태는 "클라이언트 이전 금지"로, 도메인이 잠겨 다른 등록기관으로 옮길 수 없음을 나타냅니다. 잠재적인 위험에 유의하십시오!

AKBANK 제품 및 서비스

- 외국인 은행: AKBANK 외국인 은행은 터키의 외국인들에게 다양한 통화 은행, Ak Securities 및 Ak Asset Management을 통한 투자, Wings Card를 통한 여행 혜택, 세금 조언 및 맞춤형 보험을 제공하며, 모두 외국인 관계 관리자에 의해 관리됩니다.

- 다국적 은행: AKBANK은(는) 다국적 기업(MNCs)에게 현금 관리, 무역 금융, 자금 솔루션, 전자 뱅킹, 자금 조달 및 기업 재무를 포함한 맞춤형 은행 솔루션을 제공하며, 전용 팀과 견고한 인프라의 지원을 받습니다.

- 부유한 은행: AKBANK 부유한 은행은 전문 서비스 및 은행 상품의 장점을 제공하며, 부유한 관계 관리자를 통해 재무 상담을 제공합니다. 그들의 "1e1 은행"은 소중한 고객에게 독점적인 서비스와 개인 관계 관리자를 통한 맞춤형 재무 조언을 제공합니다.

- 사설 은행: AKBANK 사설 은행은 사설 은행 고객의 특정한 요구 사항과 목표를 충족시키기 위한 맞춤형 솔루션과 개인화된 서비스를 제공합니다. 그들은 정교한 재무 관리와 자문 서비스를 제공하기 위해 노력합니다.

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합한 대상 |

| Akbank Mobile | ✔ | iOS, Android | 모든 경험 수준의 투자자 |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |