公司简介

| BPF评论摘要 | |

| 成立时间 | 2004 |

| 注册国家/地区 | 印度尼西亚 |

| 监管 | BAPPEBTI,JFX |

| 交易产品 | 多边和双边期货合约(黄金、棕榈油、外汇对、指数) |

| 模拟账户 | ✅ |

| 交易平台 | Pro Trader 应用程序(iOS 和 Android) |

| 客户支持 | 电话:+62 21 2903 5005 |

| 传真:+62 21 2903 5132 | |

| 电子邮件:corporate@bestprofit-futures.co.id | |

BPF信息

PT. Bestprofit Futures (BPF) 是一家印度尼西亚公司,成立于2004年,受BAPPEBTI和JFX监管。提供多样化的期货交易产品。公司有适用于移动交易的Pro Trader应用程序和模拟交易账户。该公司的服务面向零售和专业期货投资者,提供竞争性费率和对本地市场的支持。

优点和缺点

| 优点 | 缺点 |

| 受BAPPEBTI和JFX监管 | 无伊斯兰账户 |

| 支持模拟账户 | 有关存款和提款的信息有限 |

| 低固定交易手续费(3点 + 增值税) |

BPF是否合法?

是的,PT. Bestprofit Futures (BPF) 是印度尼西亚的一家受监管的经纪商,持有来自BAPPEBTI的零售外汇许可证(许可证编号499/BAPPEBTI/SI/X/2004)和雅加达期货交易所(JFX)的许可证(许可证编号SPAB-071/BBJ/05/04)。

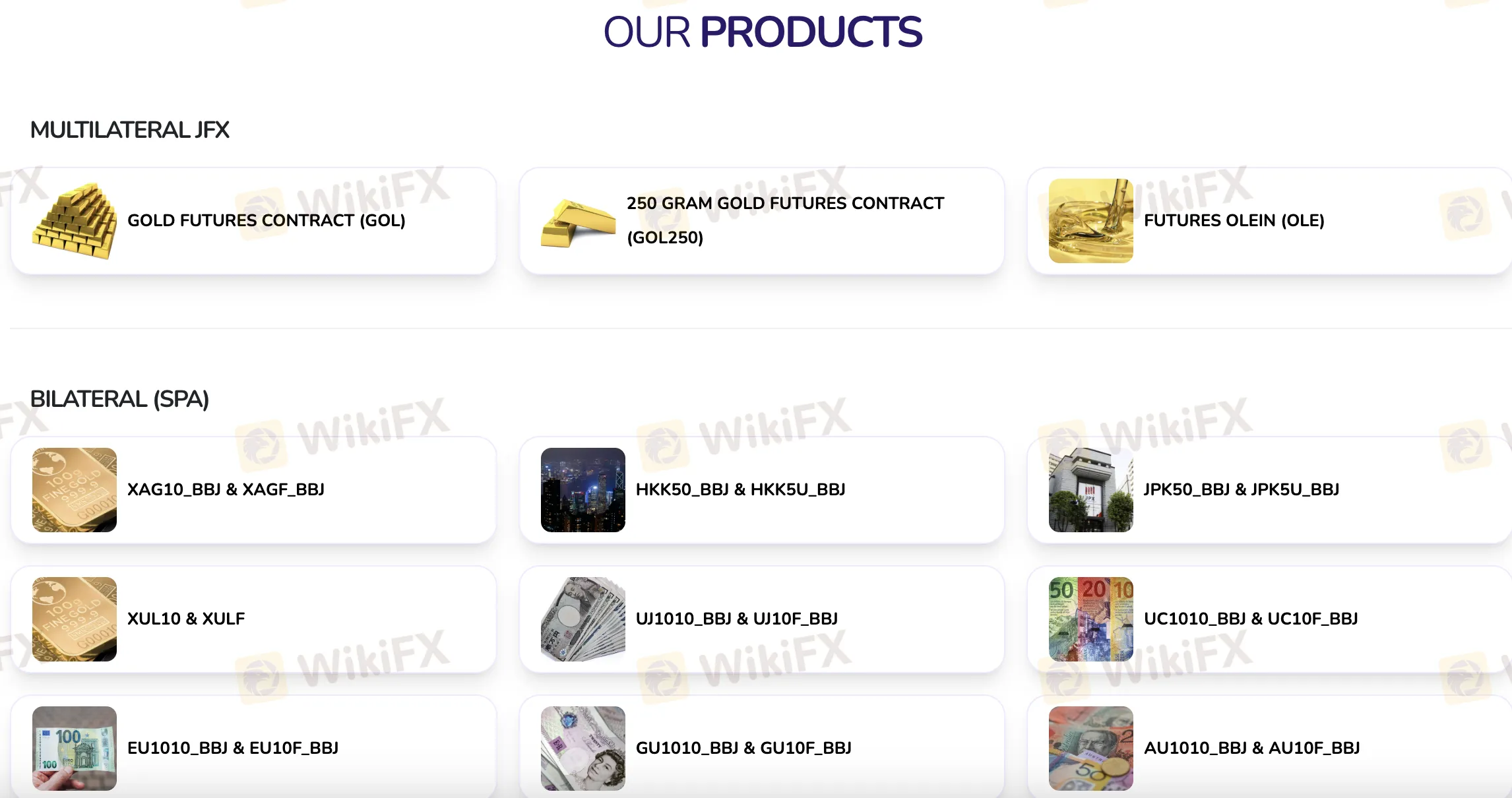

交易产品

PT. Bestprofit Futures (BPF) 拥有许多不同的期货交易产品,如雅加达期货交易所(JFX)上的多边合约和不同商品、货币和指数的双边(SPA)合约。

| 类别 | 交易产品 |

| 多边(JFX) | 黄金期货合约(GOL) |

| 250克黄金期货(GOL250) | |

| 棕榈油期货(OLE) | |

| 双边(SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

账户

PT. Bestprofit Futures (BPF) 提供两种主要类型的 账户:真实/实盘交易账户和模拟账户。没有信息证实提供伊斯兰教(无隔夜利息)账户的可用性。

BPF 费用

在PT. Bestprofit Futures (BPF),交易成本与印尼期货市场其他公司收取的费用相符。手续费简单公平,交易价格为3点加11%增值税。与印尼其他提供类似指数期货产品的受监管经纪商相比,这被视为适度。

交易平台

PT. Bestprofit Futures (BPF) 支持通过Pro Trader 移动应用进行交易,适用于iOS和Android。