Resumo da empresa

| BPF Resumo da Revisão | |

| Fundação | 2004 |

| País/Região Registrada | Indonésia |

| Regulação | BAPPEBTI, JFX |

| Produtos de Negociação | Contratos Futuros Multilaterais e Bilaterais (Ouro, Olein, Pares de Moedas FX, Índices) |

| Conta Demonstrativa | ✅ |

| Plataforma de Negociação | Aplicativo Pro Trader (iOS e Android) |

| Suporte ao Cliente | Telefone: +62 21 2903 5005 |

| Fax: +62 21 2903 5132 | |

| E-mail: corporate@bestprofit-futures.co.id | |

Informações sobre BPF

PT. Bestprofit Futures (BPF) é uma empresa indonésia que está no mercado desde 2004 e é regulamentada pela BAPPEBTI e JFX. Oferece uma ampla gama de produtos de negociação de futuros. Possui o aplicativo Pro Trader para negociação móvel e contas de demonstração para prática. Os serviços da empresa são voltados tanto para investidores de futuros de varejo quanto profissionais, oferecendo taxas competitivas e suporte para os mercados locais.

Prós e Contras

| Prós | Contras |

| Regulado por BAPPEBTI e JFX | Sem contas islâmicas |

| Suporta contas de demonstração | Informações limitadas sobre depósito e saque |

| Taxas fixas de transação baixas (3 pontos + IVA) |

BPF é Legítimo?

Sim, PT. Bestprofit Futures (BPF) é uma corretora regulamentada na Indonésia, detentora de uma Licença de Forex de Varejo da BAPPEBTI (Licença No. 499/BAPPEBTI/SI/X/2004) e da Bolsa de Futuros de Jacarta (JFX) (Licença No. SPAB-071/BBJ/05/04).

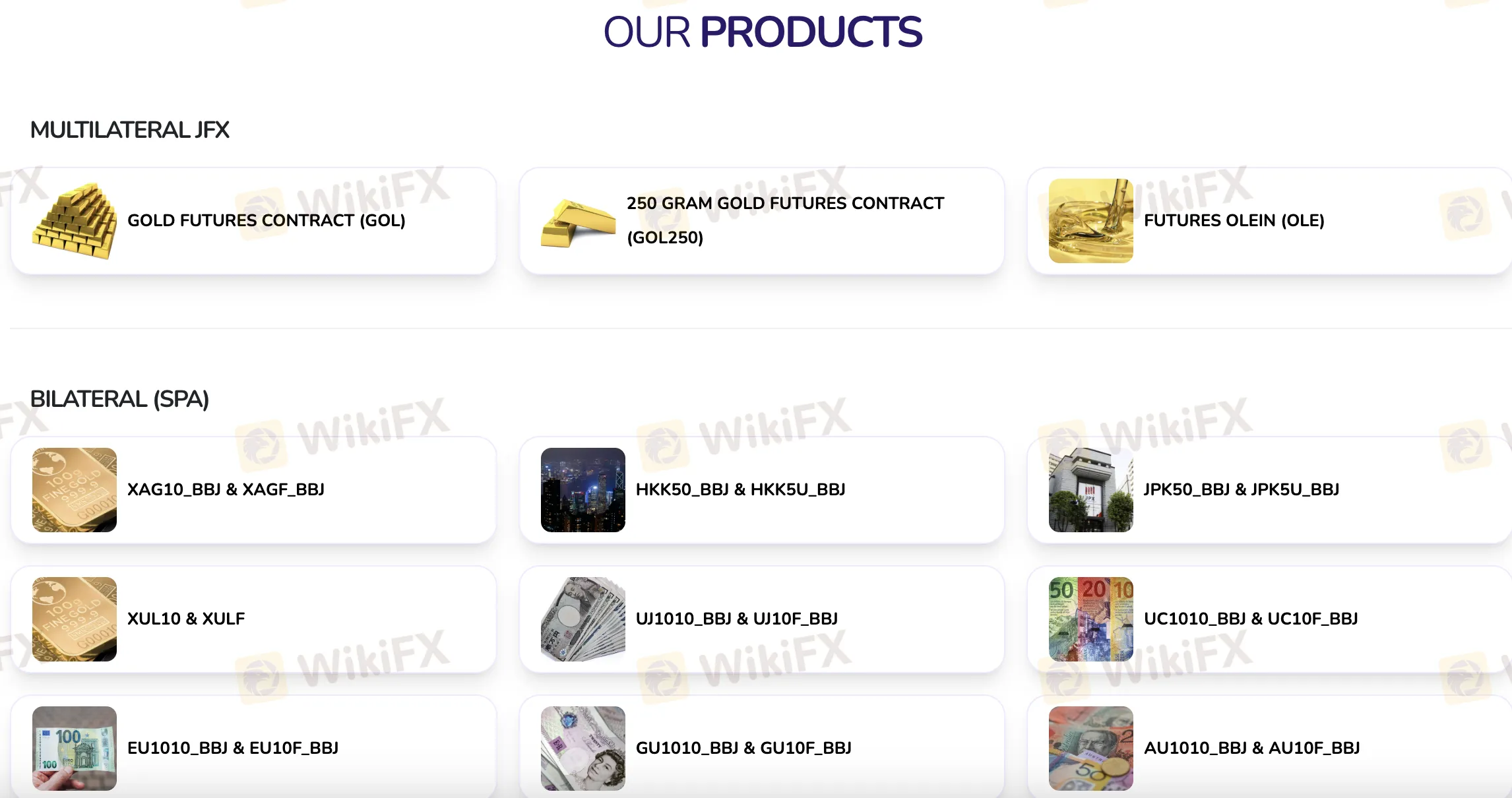

Produtos de Negociação

PT. Bestprofit Futures (BPF) possui diversos produtos de negociação de futuros, como contratos multilaterais na Bolsa de Futuros de Jacarta (JFX) e contratos bilaterais (SPA) em diferentes commodities, moedas e índices.

| Categoria | Produto de Negociação |

| Multilateral (JFX) | CONTRATO FUTURO DE OURO (GOL) |

| CONTRATO FUTURO DE OURO DE 250 GRAMAS (GOL250) | |

| FUTUROS DE OLEIN (OLE) | |

| Bilateral (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

Conta

PT. Bestprofit Futures (BPF) oferece dois tipos principais de contas: uma conta de negociação real/viva e uma conta demo. Não há informações que confirmem a disponibilidade de contas islâmicas (livres de swap).

Taxas do BPF

Os custos de transação na PT. Bestprofit Futures (BPF) estão alinhados com o que outras empresas no mercado de futuros da Indonésia cobram. As taxas são simples e justas, com um preço de transação fixo de 3 pontos mais 11% de IVA. Comparado a outros corretores regulamentados na Indonésia que oferecem produtos de futuros de índices semelhantes, isso é considerado modesto.

Plataforma de Negociação

PT. Bestprofit Futures (BPF) suporta negociações através do aplicativo móvel Pro Trader, disponível tanto no iOS quanto no Android.