Buod ng kumpanya

| BPF Buod ng Pagsusuri | |

| Itinatag | 2004 |

| Nakarehistrong Bansa/Rehiyon | Indonesia |

| Regulasyon | BAPPEBTI, JFX |

| Mga Produkto sa Paghahalal | Multilateral & Bilateral Futures Contracts (Ginto, Olein, Mga FX pairs, Indices) |

| Demo Account | ✅ |

| Platform sa Paghahalal | Pro Trader App (iOS & Android) |

| Suporta sa Customer | Telepono: +62 21 2903 5005 |

| Fax: +62 21 2903 5132 | |

| Email: corporate@bestprofit-futures.co.id | |

Impormasyon Tungkol sa BPF

PT. Bestprofit Futures (BPF) ay isang kumpanyang Indonesian na nagsimula noong 2004 at regulado ng BAPPEBTI at JFX. Nag-aalok ito ng iba't ibang mga produkto sa paghahalal. Mayroon itong Pro Trader app para sa mobile trading at demo accounts para sa pagsasanay. Ang mga serbisyo ng kumpanya ay nakatuon sa parehong mga retail at propesyonal na mga mamumuhunan sa hinaharap, at nag-aalok sila ng competitive na mga rate at suporta para sa lokal na mga merkado.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado ng BAPPEBTI at JFX | Walang Islamic accounts |

| Suporta sa demo accounts | Limitadong impormasyon tungkol sa deposito at pag-withdraw |

| Mababang fixed transaction fees (3 points + VAT) |

Tunay ba ang BPF?

Oo, PT. Bestprofit Futures (BPF) ay isang reguladong broker sa Indonesia, may hawak na Retail Forex License mula sa BAPPEBTI (License No. 499/BAPPEBTI/SI/X/2004) at sa Jakarta Futures Exchange (JFX) (License No. SPAB-071/BBJ/05/04).

Mga Produkto sa Paghahalal

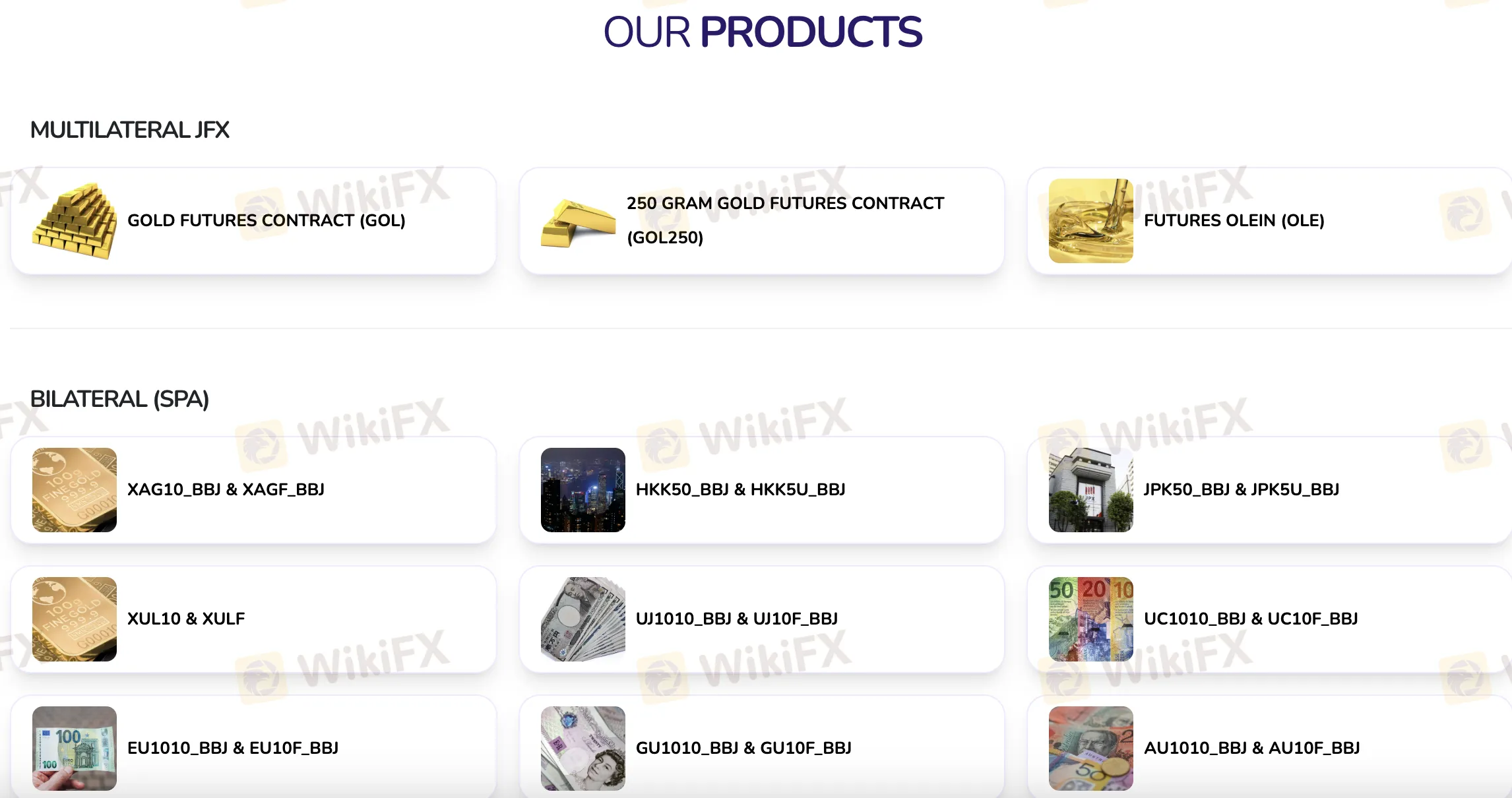

PT. Bestprofit Futures (BPF) ay may iba't ibang mga produkto sa paghahalal, tulad ng multilateral contracts sa Jakarta Futures Exchange (JFX) at bilateral (SPA) contracts sa iba't ibang mga kalakal, pera, at indices.

| Kategorya | Produkto sa Paghahalal |

| Multilateral (JFX) | GOLD FUTURES CONTRACT (GOL) |

| 250 GRAM GOLD FUTURES (GOL250) | |

| FUTURES OLEIN (OLE) | |

| Bilateral (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

Account

PT. Bestprofit Futures (BPF) nag-aalok ng dalawang pangunahing uri ng mga account: isang tunay/aktwal na trading account at isang demo account. Walang impormasyon na nagpapatunay sa availability ng Islamic (swap-free) accounts.

Mga Bayad sa BPF

Ang mga gastos sa transaksyon sa PT. Bestprofit Futures (BPF) ay kasuwato ng ibinabayad ng ibang kumpanya sa Indonesian futures market. Ang mga bayad ay simple at patas, may flat transaction price na 3 points plus 11% VAT. Kung ihahambing sa iba pang regulated brokers sa Indonesia na nagbibigay ng mga katulad na index futures products, ito ay itinuturing na katamtaman.

Platform ng Pag-ttrade

Ang PT. Bestprofit Futures (BPF) ay sumusuporta sa trading sa pamamagitan ng Pro Trader mobile app, na available sa parehong iOS at Android.