Unternehmensprofil

| BPF Überprüfungszusammenfassung | |

| Gegründet | 2004 |

| Registriertes Land/Region | Indonesien |

| Regulierung | BAPPEBTI, JFX |

| Handelsprodukte | Multilaterale & bilaterale Futures-Kontrakte (Gold, Olein, Devisenpaare, Indizes) |

| Demo-Konto | ✅ |

| Handelsplattform | Pro Trader App (iOS & Android) |

| Kundensupport | Telefon: +62 21 2903 5005 |

| Fax: +62 21 2903 5132 | |

| E-Mail: corporate@bestprofit-futures.co.id | |

BPF Informationen

PT. Bestprofit Futures (BPF) ist ein indonesisches Unternehmen, das seit 2004 tätig ist und von BAPPEBTI und JFX reguliert wird. Es bietet eine breite Palette von Futures-Handelsprodukten an. Es verfügt über die Pro Trader-App für den mobilen Handel und Demo-Konten zum Üben. Die Dienstleistungen des Unternehmens richten sich sowohl an Einzelhandels- als auch an professionelle Futures-Investoren und bieten wettbewerbsfähige Preise und Unterstützung für lokale Märkte.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch BAPPEBTI und JFX | Keine islamischen Konten |

| Unterstützt Demo-Konten | Begrenzte Informationen zu Ein- und Auszahlungen |

| Niedrige feste Transaktionsgebühren (3 Punkte + MwSt.) |

Ist BPF legitim?

Ja, PT. Bestprofit Futures (BPF) ist ein regulierter Broker in Indonesien, der über eine Retail-Forex-Lizenz von BAPPEBTI (Lizenz Nr. 499/BAPPEBTI/SI/X/2004) und der Jakarta Futures Exchange (JFX) (Lizenz Nr. SPAB-071/BBJ/05/04) verfügt.

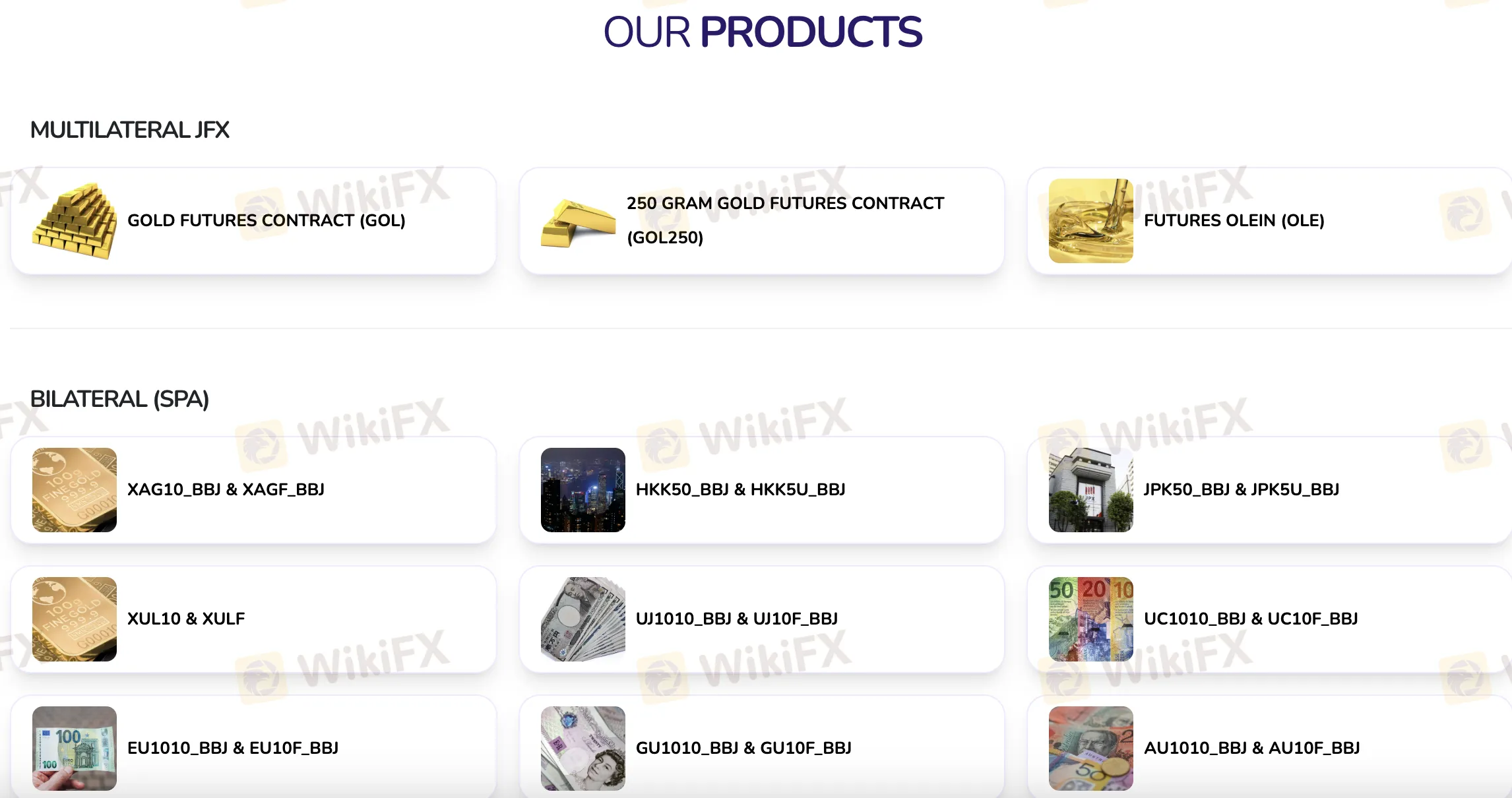

Handelsprodukte

PT. Bestprofit Futures (BPF) bietet eine Vielzahl von verschiedenen Futures-Handelsprodukten an, wie multilaterale Verträge an der Jakarta Futures Exchange (JFX) und bilaterale (SPA) Verträge über verschiedene Waren, Währungen und Indizes.

| Kategorie | Handelsprodukt |

| Multilateral (JFX) | GOLD FUTURES CONTRACT (GOL) |

| 250 GRAM GOLD FUTURES (GOL250) | |

| FUTURES OLEIN (OLE) | |

| Bilateral (SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

Konto

PT. Bestprofit Futures (BPF) bietet zwei Hauptkontotypen an: ein echtes/lebendiges Handelskonto und ein Demo-Konto. Es gibt keine Informationen, die die Verfügbarkeit von islamischen (swap-freien) Konten bestätigen.

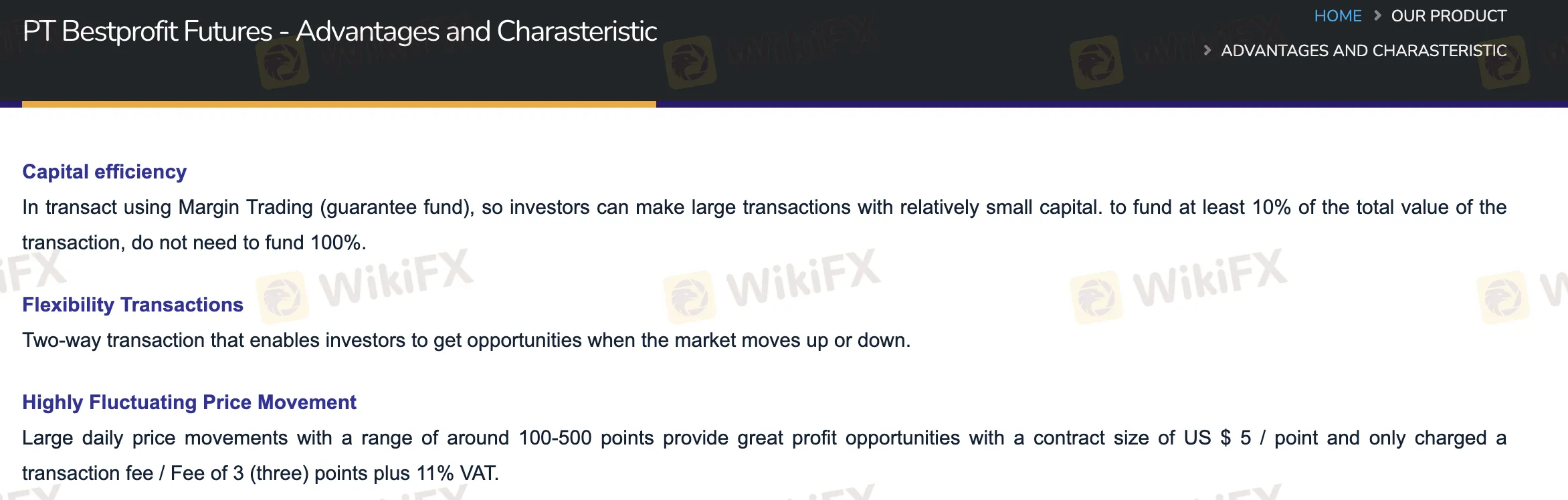

BPF Gebühren

Die Transaktionskosten bei PT. Bestprofit Futures (BPF) entsprechen dem, was andere Unternehmen auf dem indonesischen Futures-Markt berechnen. Die Gebühren sind einfach und fair, mit einem festen Transaktionspreis von 3 Punkten plus 11% Mehrwertsteuer. Im Vergleich zu anderen regulierten Brokern in Indonesien, die ähnliche Index-Futures-Produkte anbieten, wird dies als bescheiden angesehen.

Handelsplattform

PT. Bestprofit Futures (BPF) unterstützt den Handel über die Pro Trader Mobile App, die sowohl für iOS als auch für Android verfügbar ist.