公司簡介

| BPF 檢討摘要 | |

| 成立年份 | 2004 |

| 註冊國家/地區 | 印尼 |

| 監管 | BAPPEBTI、JFX |

| 交易產品 | 多邊及雙邊期貨合約(黃金、植物油、外匯對、指數) |

| 模擬帳戶 | ✅ |

| 交易平台 | Pro Trader App(iOS 及 Android) |

| 客戶支援 | 電話:+62 21 2903 5005 |

| 傳真:+62 21 2903 5132 | |

| 電郵:corporate@bestprofit-futures.co.id | |

BPF 資訊

PT. Bestprofit Futures (BPF) 是一家成立於2004年的印尼公司,受BAPPEBTI和JFX監管。提供多元化的期貨交易產品。公司提供Pro Trader應用程式進行移動交易,並提供模擬帳戶供練習使用。該公司的服務面向零售和專業期貨投資者,提供具競爭力的價格和支援當地市場。

優缺點

| 優點 | 缺點 |

| 受BAPPEBTI和JFX監管 | 無伊斯蘭帳戶 |

| 支援模擬帳戶 | 有關存款和提款的資訊有限 |

| 低固定交易費用(3點 + 增值稅) |

BPF 是否合法?

是的,PT. Bestprofit Futures (BPF) 是印尼的受監管經紀商,持有來自BAPPEBTI的零售外匯牌照(牌照號碼499/BAPPEBTI/SI/X/2004)和雅加達期貨交易所(JFX)的牌照(牌照號碼SPAB-071/BBJ/05/04)。

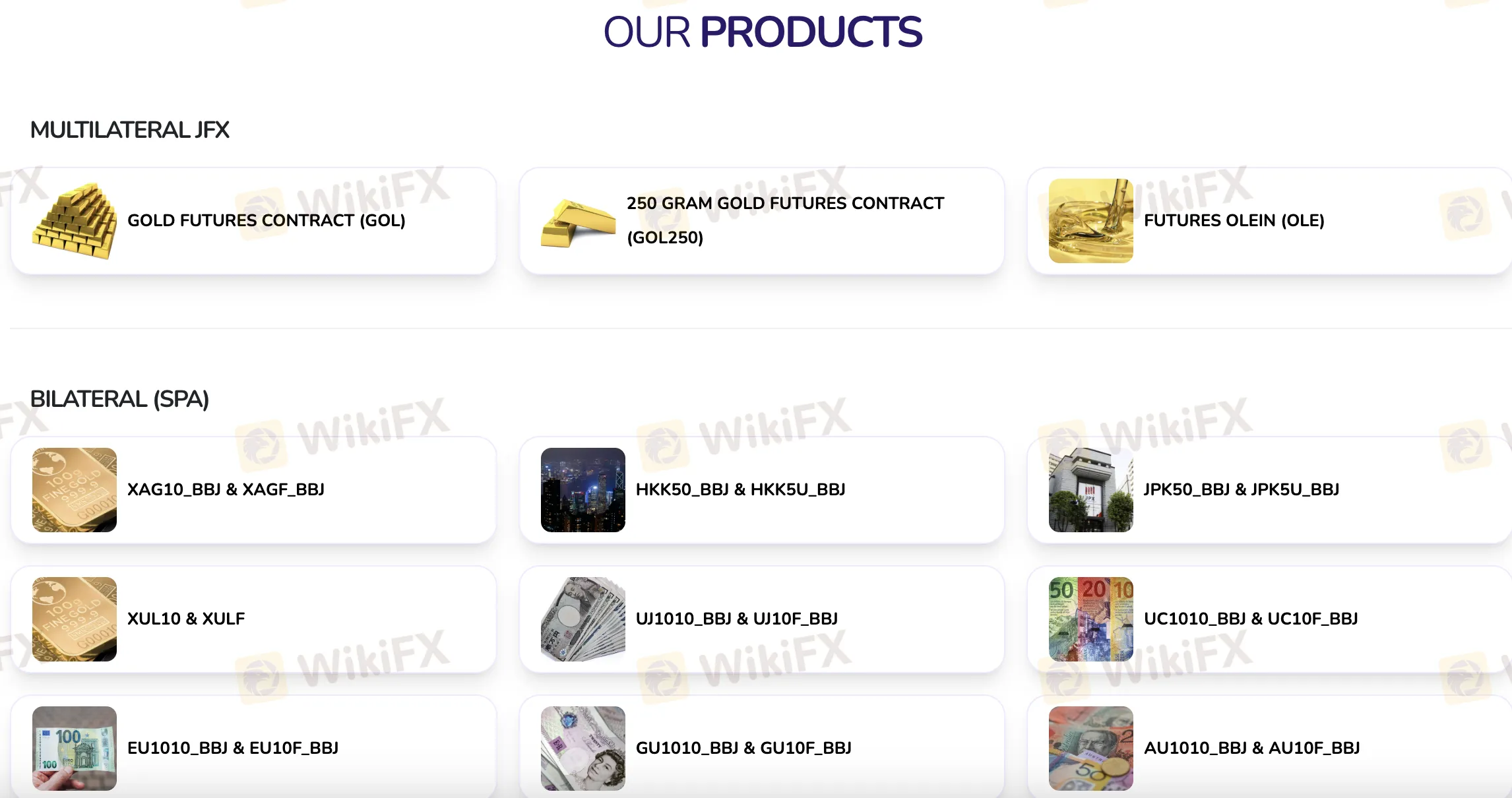

交易產品

PT. Bestprofit Futures (BPF) 提供多種不同的期貨交易產品,如雅加達期貨交易所(JFX)的多邊合約和不同商品、貨幣和指數的雙邊(SPA)合約。

| 類別 | 交易產品 |

| 多邊(JFX) | 黃金期貨合約(GOL) |

| 250克黃金期貨(GOL250) | |

| 植物油期貨(OLE) | |

| 雙邊(SPA) | XAG10_BBJ |

| XAGF_BBJ | |

| HKK50_BBJ | |

| HKK5U_BBJ | |

| JPK50_BBJ | |

| JPK5U_BBJ | |

| XUL10 | |

| XULF | |

| UJ1010_BBJ | |

| UJ10F_BBJ | |

| UC1010_BBJ | |

| UC10F_BBJ | |

| EU1010_BBJ | |

| EU10F_BBJ | |

| GU1010_BBJ_ |

帳戶

PT. Bestprofit Futures (BPF) 提供兩種主要類型的帳戶:真實/實盤交易帳戶和模擬帳戶。沒有關於伊斯蘭(無掉期)帳戶的可用性的信息。

BPF 費用

在PT. Bestprofit Futures (BPF)的交易成本與印尼期貨市場其他公司收取的相符。費用簡單公平,採用固定交易價格,3點加11%增值稅。與印尼其他提供類似指數期貨產品的受監管經紀相比,這被視為適中。

交易平台

PT. Bestprofit Futures (BPF) 支持透過Pro Trader 手機應用程式,在iOS和Android上均可使用進行交易。