Présentation de l'entreprise

| FINANCIÈRE BANQUE NATIONALE Résumé de l'examen | |

| Fondé | 1902 |

| Pays/Région enregistré | Canada |

| Réglementation | Organisation canadienne de réglementation des investissements (CIRO) |

| Produits et services | Gestion de patrimoine, gestion de portefeuille, planification fiscale, planification successorale, solutions bancaires |

| Compte de démonstration | ❌ |

| Plateforme de trading | FINANCIÈRE BANQUE NATIONALE Plateforme en ligne WM, Application NBC Wealth |

| Assistance clientèle | Téléphone : 1-800-361-9522 |

Informations sur FINANCIÈRE BANQUE NATIONALE

Fondée en 1902, National Bank Financial (FINANCIÈRE BANQUE NATIONALE) est une société financière canadienne dirigée par CIRO. Bien qu'elle ne propose pas d'outils de trading de détail conventionnels tels que le forex ou les crypto-monnaies, elle se concentre sur les solutions bancaires, la planification financière, la gestion de patrimoine et de portefeuille.

Avantages et inconvénients

| Avantages | Inconvénients |

| Surveillance réglementaire solide (CIRO) | Pas d'accès au trading forex, CFD, crypto-monnaies |

| Services complets de gestion de patrimoine | Frais globaux plus élevés par rapport aux normes de l'industrie |

| Plateformes mobiles et en ligne robustes | Pas de compte de démonstration |

FINANCIÈRE BANQUE NATIONALE est-il légitime ?

Autorisée par l'Organisation canadienne de réglementation des investissements (CIRO) sous une licence de Market Maker (MM), National Bank Financial Inc. (FINANCIÈRE BANQUE NATIONALE) est un organisme financier reconnu et réglementé. Bien que le numéro de licence spécifique soit confidentiel, FINANCIÈRE BANQUE NATIONALE conserve un statut contrôlé et fonctionne conformément aux règles financières canadiennes.

Produits et services

FINANCIÈRE BANQUE NATIONALE (National Bank Financial) propose principalement des services complets de gestion de patrimoine et de conseil financier, notamment la gestion de portefeuille, la planification successorale, les stratégies fiscales et les solutions bancaires.

| Produits et services | Pris en charge |

| Gestion de patrimoine | ✅ |

| Gestion de portefeuille | ✅ |

| Planification financière | ✅ |

| Planification fiscale | ✅ |

| Planification successorale | ✅ |

| Solutions bancaires | ✅ |

| Gestion discrétionnaire | ✅ |

| Forex, CFD, Actions, Crypto-monnaies, Matières premières | ❌ |

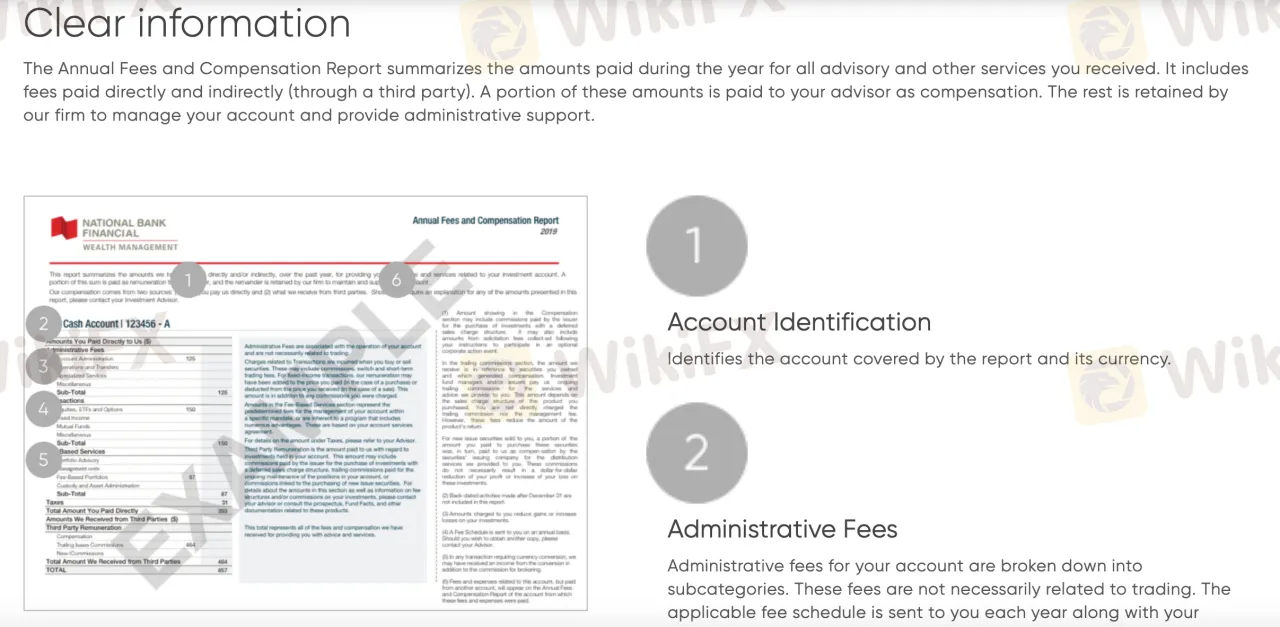

Frais de FINANCIÈRE BANQUE NATIONALE

Surtout pour les services de conseil et de gestion de portefeuille, la structure des frais de FINANCIÈRE BANQUE NATIONALE (National Bank Financial) est généralement supérieure à la norme de l'industrie. Bien que les écarts spécifiques pour chaque élément négociable ne soient pas rendus publics, leur approche privilégie les frais de conseil et d'administration par rapport aux frais de transaction.

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient à quel type de traders |

| FINANCIÈRE BANQUE NATIONALE Plateforme en ligne WM | ✔ | Navigateurs Web (PC/Mac) | Clients qui souhaitent gérer et consulter des portefeuilles avec des informations détaillées |

| NBC Wealth App | ✔ | Appareils mobiles iOS, Android | Utilisateurs mobiles ayant besoin d'un accès en déplacement à leurs investissements |

| MetaTrader 4 / MT5 | ❌ | – | Non pris en charge |

| TradingView | ❌ | – | Non pris en charge |