Informations de base

Inde

Inde

Note

Inde

|

5 à 10 ans

|

Inde

|

5 à 10 ans

| https://tradesmartonline.in/

Site officiel

Indice de notation

Influence

C

Indice d'influence NO.1

Inde 6.01

Inde 6.01 Licences

LicencesAucune information réglementaire valide n'a été vérifiée. Veuillez faire attention au risque !

Inde

Inde tradesmartonline.in

tradesmartonline.in États-Unis

États-Unis

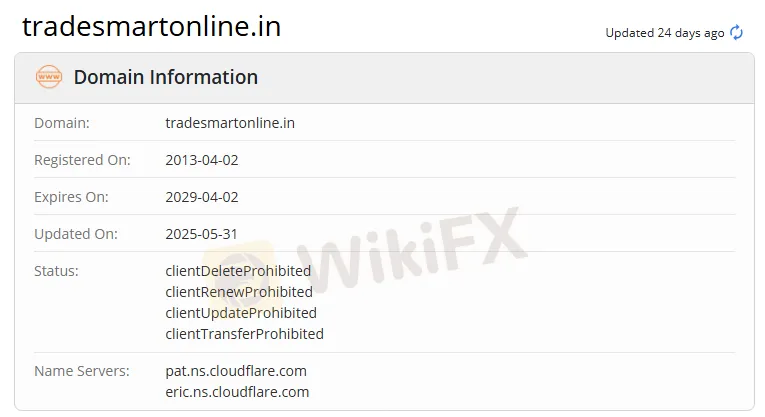

| TradeSmart概要 | |

| 設立年 | 2013 |

| 登記國家/地區 | 印度 |

| 監管 | 無監管 |

| 交易工具 | 股票、期貨、期權、貨幣和商品 |

| 產品 | TradeSmart 手機應用、TradeSmart 桌面、TradeSmart 網頁、TradeSmart API、BOX、TradeSmart MF、Instaoption 和整合 |

| 槓桿 | 最高達1:5 |

| 點差 | / |

| 交易平台 | TraderSmart APP |

| 最低存款 | / |

| 客戶支援 | 電話:+91 022-61208000 |

| 電子郵件:contactus@vnsfin. com | |

| 社交媒體:Facebook、Twitter、Instagram、LinkedIn、YouTube、Telegram | |

| 地址:A-401,Mangalya,Marol,Andheri East,孟買-400059 | |

成立於2013年,總部設在印度的TradeSmart是一家金融服務提供商。該公司提供多樣化的交易工具和平台,包括TradeSmart手機應用、TradeSmart桌面、TradeSmart網頁、TradeSmart API、BOX、TradeSmart MF、Instaoption 和整合。為了滿足不同客戶的需求,該公司設有兩種類型的帳戶:價值帳戶適用於低頻率和小型交易者,而權力帳戶適用於高頻率和高交易量的交易者。

然而,TradeSmart目前沒有受到監管,其合法性令人擔憂。

| 優點 | 缺點 |

| 提供多樣化產品 | 無監管 |

| 帳戶功能信息有限 | |

| 費用結構不清晰 | |

| 存款和提款信息有限 |

No. TradeSmart n'est pas réglementé, et les traders doivent faire preuve de prudence lorsqu'ils tradent.

| Instruments de trading | Pris en charge |

| Actions | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Devises | ✔ |

| Matières premières | ✔ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| ETFs | ❌ |

Les produits de TraderSmart incluent une variété d'outils de trading : TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption et Intégrations.

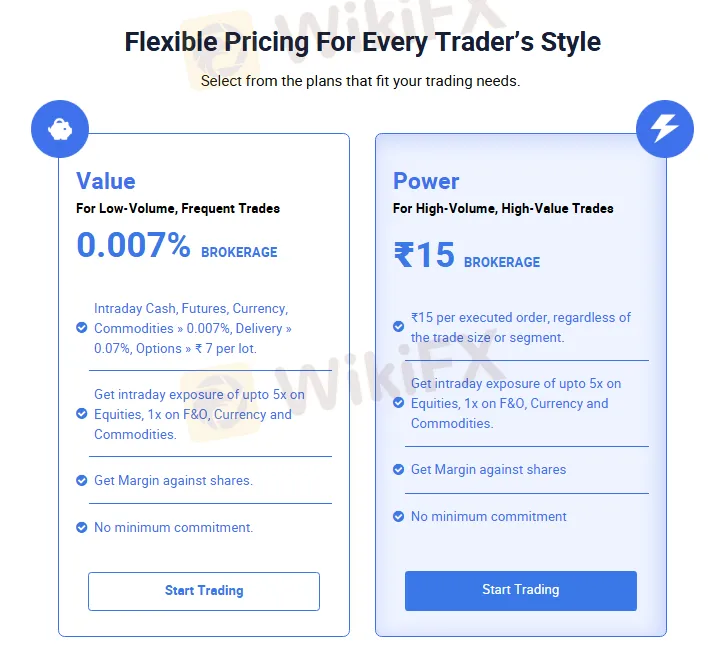

TradeSmart propose aux traders des comptes Demat pour le trading. Deux programmes différents sont disponibles : Value et Power, parmi lesquels les traders peuvent choisir.

Le rôle principal d'un compte Demat est de numériser le stockage, la gestion et le trading de titres, offrant aux investisseurs une expérience d'investissement efficace, sécurisée et transparente.

Voici des informations sur les deux plans de compte :

| Compte Value | Compte Power | |

| Traders cibles | Traders à faible volume et haute fréquence | Traders à haut volume et haute valeur |

| Frais de courtage | 0,007% | ₹15 par ordre (peu importe la taille ou le type de transaction) |

| Intraday Cash, Futures, Devises | Adapté au trading à faible volume et haute fréquence | Adapté au trading à haut volume et haute valeur |

| Mat. premières > 0,007%, Livraison > 0,07%, Options > ₹7 par lot | Prise en charge du trading à faible coût de matières premières et d'options | Prise en charge du trading à coût plus élevé de matières premières et d'options |

| Effet de levier | Jusqu'à 1:5 (Actions, F&O, Devises et Matières premières) | Jusqu'à 1:5 (Actions, F&O, Devises et Matières premières) |

| Support de marge contre actions | Oui | Oui |

| Engagement minimum | Non | Non |

TradeSmart propose un effet de levier de 1:5 sur les actions, F&O, devises et matières premières. Veuillez noter que l'effet de levier élevé peut amplifier non seulement les profits mais aussi les pertes.

TradeSmart prend en charge le trading en utilisant l'application propriétaire TraderSmart APP. Seulement Rs. 15 par transaction est facturé en tant que commission pour le trading sur cette plateforme.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| TraderSmart | ✔ | Ordinateur de bureau, Mobile, Web | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |

TraderSmart accepte les paiements via virement bancaire et transfert NEFT.

Un total de 29 banques sont prises en charge comme indiqué ci-dessous:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank, et AU Small Finance Bank.

In my experience as a trader looking into brokers, transparency around costs—especially spreads on major pairs like EUR/USD—is absolutely crucial. When assessing TradeSmart, I found their disclosure around spreads to be quite limited. According to the information available, TradeSmart focuses mainly on Indian equity, F&O, and commodities, but does support currency trading. However, there is no explicit information regarding the typical spreads for EUR/USD or for standard accounts in general. From my perspective, this lack of clear data raises potential concerns. With reputable brokers, I expect concrete details about spreads as it determines a major part of trading costs, particularly for active strategies. The only indication of trading costs at TradeSmart relates to their fixed commission of ₹15 per order, rather than variable spreads, and their platform does not appear to offer the widely-used MT4 or MT5 where such information is usually more standardized. For me, this uncertainty is a red flag: without verified spread information, it is not possible to accurately estimate total trading expenses. Given that TradeSmart is unregulated and there are gaps in fee disclosures, I approach this broker with significant caution. If locked-in, transparent spreads on EUR/USD are critical for your strategy, I honestly recommend that you request specific details directly from TradeSmart before proceeding or consider other brokers with established reputations and fully disclosed trading conditions. Careful due diligence is imperative to control risk in such environments.

Speaking from my experience as a forex trader, regulatory oversight is one of the most important factors I consider when evaluating a broker. In the case of TradeSmart, I did not find any evidence of regulation by a recognized financial authority. This lack of regulation is particularly concerning to me, as it means there are no external agencies monitoring TradeSmart’s operations, risk management practices, or client fund protections. Regulatory bodies are designed to enforce critical safeguards such as segregation of client funds, transparent pricing, dispute resolution, and minimum capital requirements. Without such oversight, I believe that my funds could be more exposed to operational risks or even potential misconduct on the broker’s part. From a risk management perspective, even if TradeSmart offers a modern platform and a variety of trading products, the absence of regulatory supervision leaves me with unresolved questions about what protections exist if something goes wrong—such as insolvency or withdrawal issues. Additionally, the single user complaint I came across about withdrawal problems only adds to these worries. Personally, I feel much more secure trading with brokers that are firmly regulated and whose practices are subject to frequent audits. In summary, in my judgment, TradeSmart’s regulatory status does not offer any meaningful safeguards for my money, and for me, that is a non-trivial consideration in broker selection.

Having traded in various markets for years, I always assess legitimacy through a strict lens of regulation, transparency, and user experience. In the case of TradeSmart, I have significant reservations. The most immediate concern for me is the lack of regulatory oversight—TradeSmart is not regulated by any recognized authority. This is flagged clearly in their profile, and, for me, operating without regulation inherently exposes traders to added risks regarding fund security, dispute resolution, and operational transparency. Despite their seemingly mature suite of trading platforms and a variety of instruments including stocks, futures, options, currencies, and commodities, the risks posed by their unregulated status outweigh these positives in my judgment. The unclear fee structure, limited details around account features, and ambiguities concerning deposits and withdrawals contribute further to my cautious stance. User feedback also gave me pause; a report details the inability to withdraw funds and a complete loss of deposit, which is a red flag from a trader's perspective. In my experience, even one such unresolved case is enough for deep concern given the financial stakes involved. While TradeSmart may cater well to some traders with its proprietary technology, the totality of evidence leads me to question its legitimacy and avoid engagement given the potential risks to capital and absence of regulatory safeguards.

In my experience as a forex trader, I pay close attention to regulation before trusting any broker with my funds. From my thorough review of TradeSmart, I must stress that this broker is not overseen by any recognized regulatory body. Although TradeSmart has been active for several years and offers a range of trading tools and account types, there is no evidence of a valid license from any financial authority, whether in India or internationally. Personally, I find the absence of regulation troubling. Oversight from an established regulator acts as a safeguard against unethical practices and ensures that client funds are handled with some degree of transparency and security. Without that independent supervision, the risk to traders—both in terms of financial safety and recourse in a dispute—increases significantly. For me, trading with an unregulated broker such as TradeSmart is simply not an option I would consider, no matter how polished the platform or competitive the fees. From a risk management standpoint, I urge other traders to exercise extreme caution. Regulated brokers are held to standards designed to protect investors; TradeSmart, in its current unregulated state, cannot provide that crucial layer of trust. In summary, TradeSmart operates without any formal regulatory oversight, and this is a serious red flag from a safety perspective in my professional opinion.

Veuillez saisir...

TOP

TOP

Chrome

Extension chromée

Enquête réglementaire sur les courtiers Forex du monde entier

Parcourez les sites Web des courtiers forex et identifiez avec précision les courtiers légitimes et frauduleux

Installer immédiatement