Perfil de la compañía

| TradeSmartResumen de la reseña | |

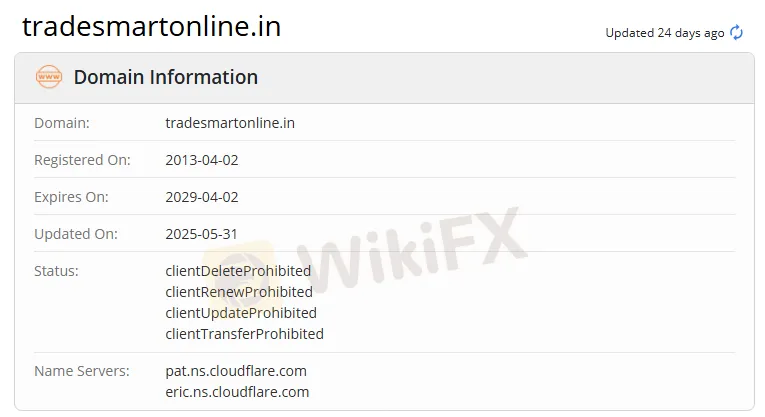

| Establecido | 2013 |

| País/Región registrado | India |

| Regulación | Sin regulación |

| Instrumentos de negociación | Acciones, futuros, opciones, divisas y materias primas |

| Productos | TradeSmart Aplicación móvil, TradeSmart Escritorio, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption e Integraciones |

| Apalancamiento | Hasta 1:5 |

| Spread | / |

| Plataforma de negociación | TraderSmart APP |

| Depósito mínimo | / |

| Soporte al cliente | Teléfono: +91 022-61208000 |

| Correo electrónico: contactus@vnsfin. com | |

| Redes sociales: Facebook, Twitter, Instagram, LinkedIn, YouTube, Telegram | |

| Dirección: A-401, Mangalya, Marol, Andheri Este, Mumbai - 400059 | |

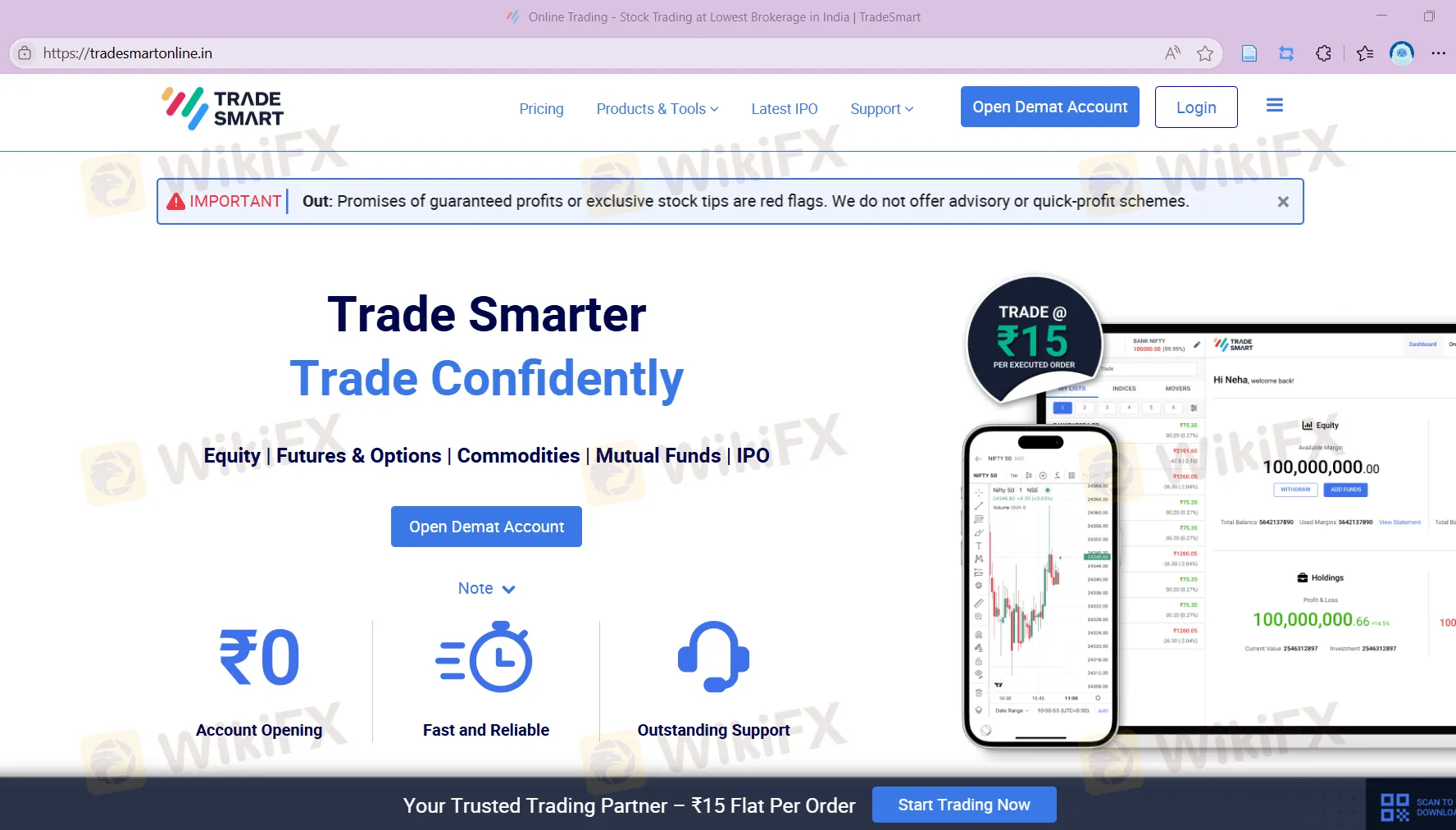

Información de TradeSmart

Fundada en 2013 y con sede en India, TradeSmart es un proveedor de servicios financieros. Ofrece una amplia gama de herramientas y plataformas de negociación, incluyendo la Aplicación móvil de TradeSmart, TradeSmart Escritorio, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption e Integraciones. Para satisfacer las necesidades de diferentes clientes, la empresa tiene dos tipos de cuentas: cuentas Value para traders de baja frecuencia y pequeños, y cuentas Power para traders de alta frecuencia y alto volumen.

Sin embargo, actualmente TradeSmart no está regulado y su legitimidad es motivo de preocupación.

Pros y contras

| Pros | Contras |

| Se ofrecen varios productos | Sin regulación |

| Información limitada sobre las características de la cuenta | |

| Estructura de tarifas poco clara | |

| Información limitada sobre depósitos y retiros |

¿Es TradeSmart legítimo?

El No. TradeSmart no está regulado, por lo que los traders deben tener precaución al operar.

¿Qué puedo operar en TraderSmart?

| Instrumentos de Trading | Soportado |

| Acciones | ✔ |

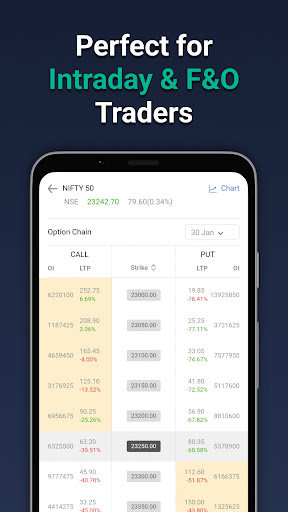

| Futuros | ✔ |

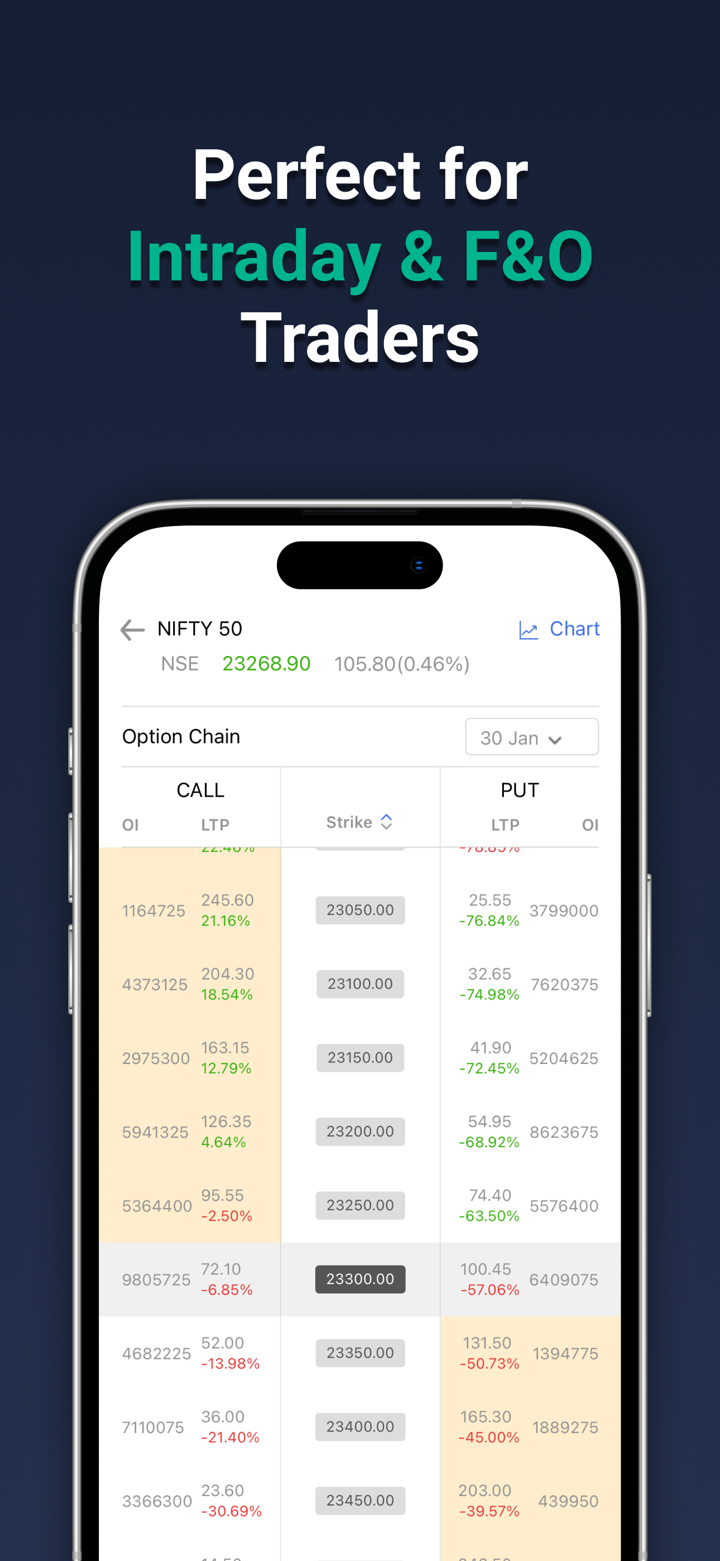

| Opciones | ✔ |

| Divisas | ✔ |

| Productos Básicos | ✔ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| ETFs | ❌ |

Productos

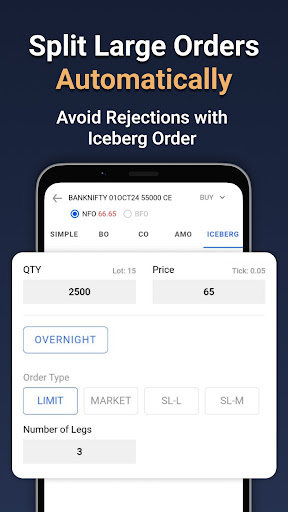

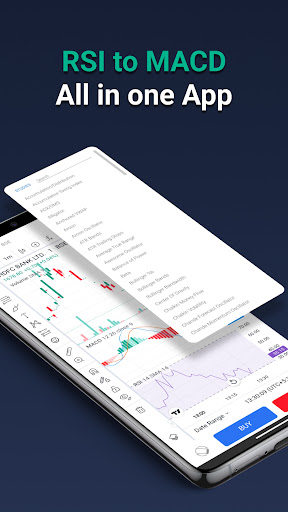

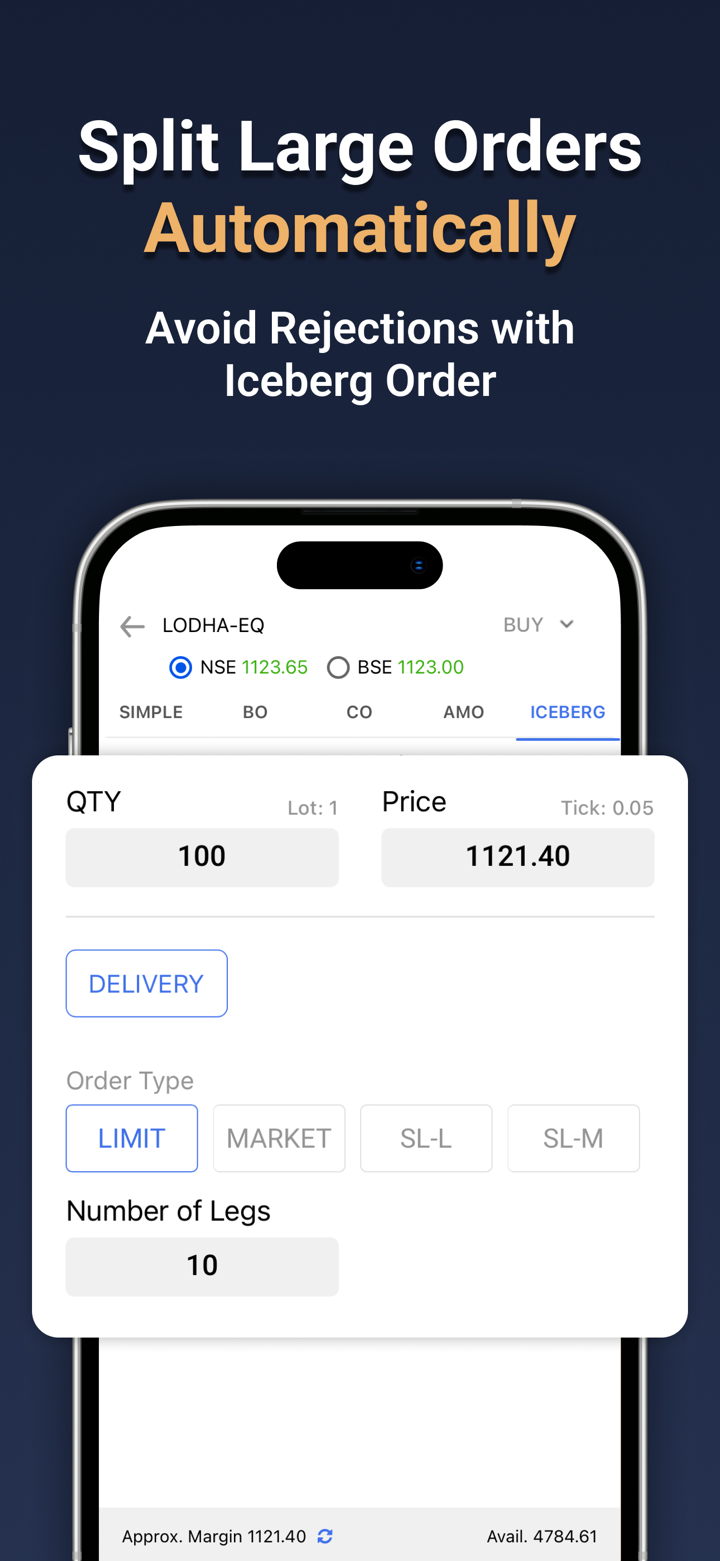

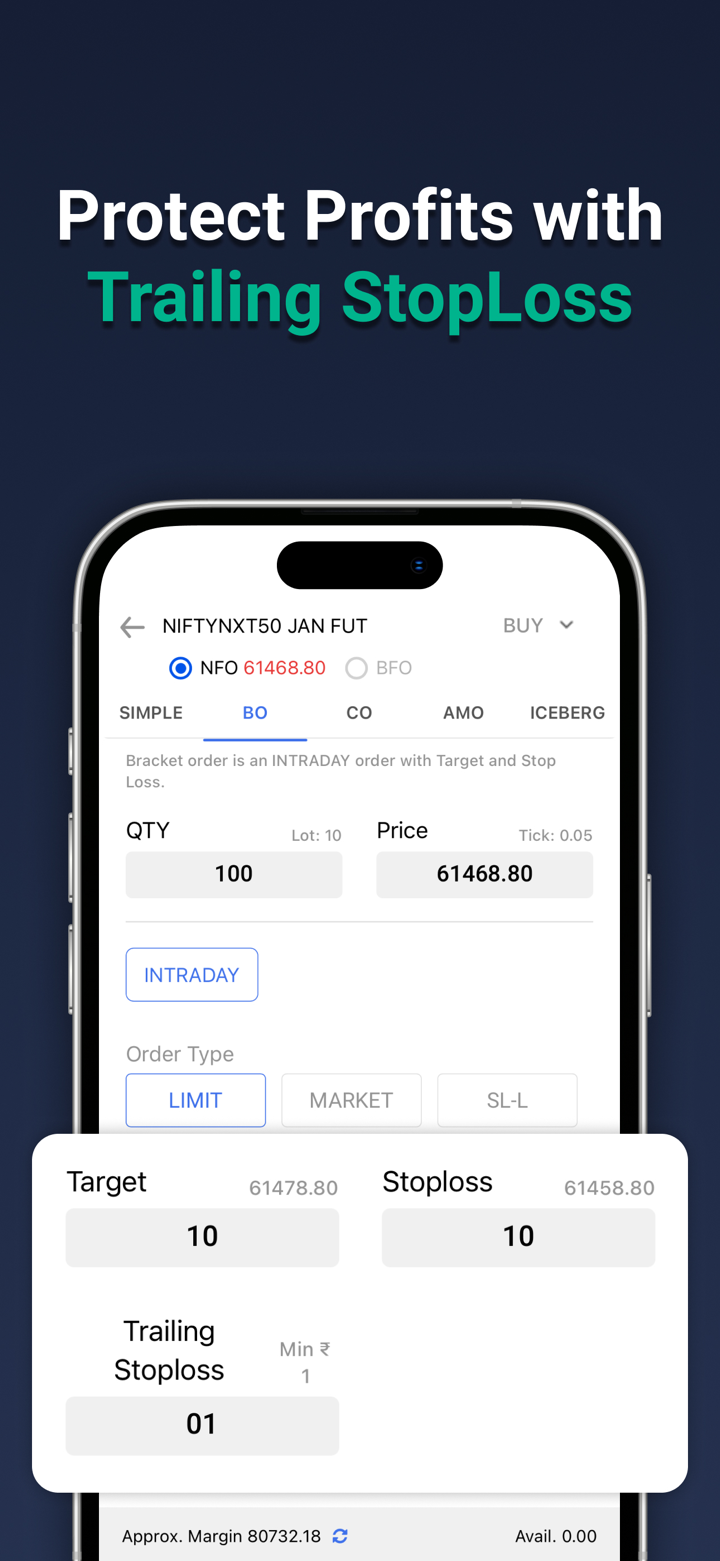

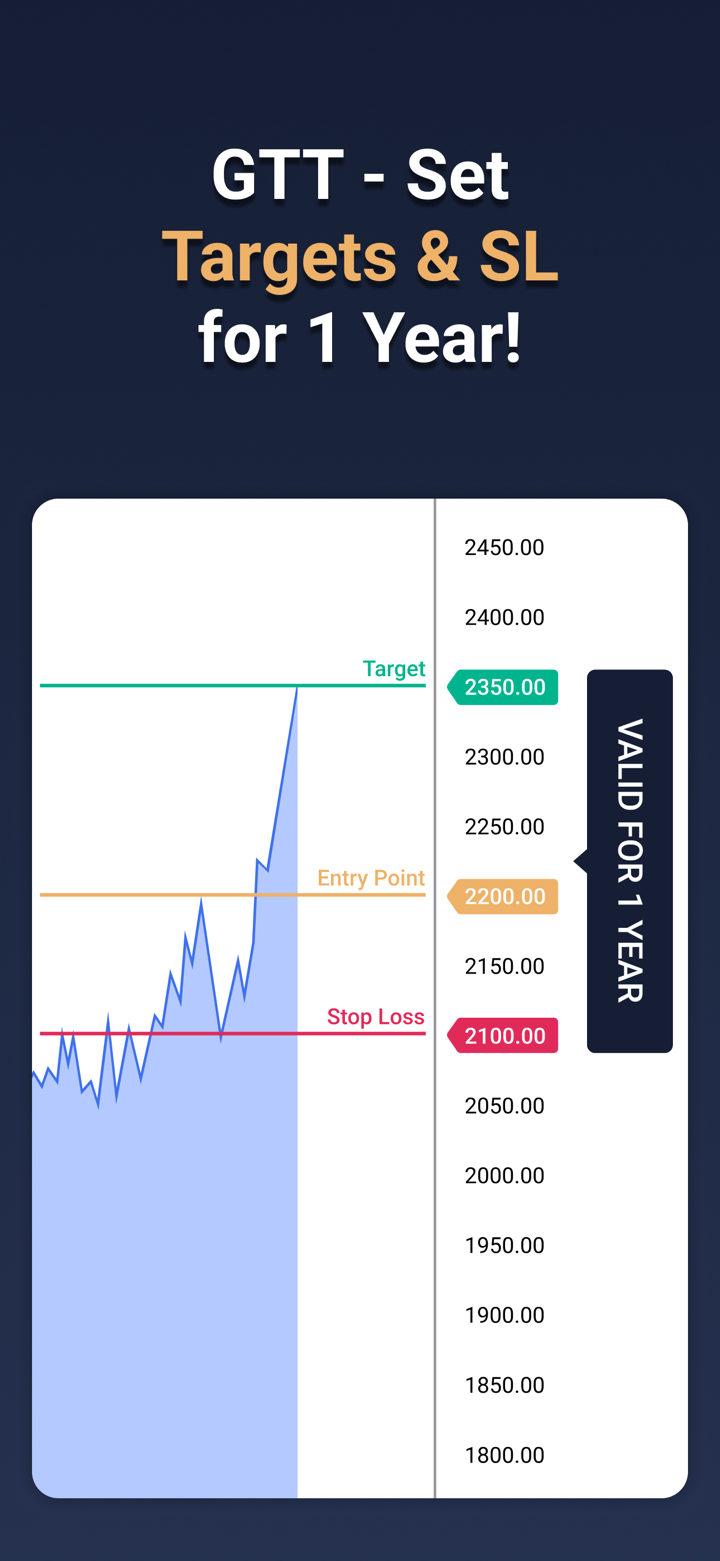

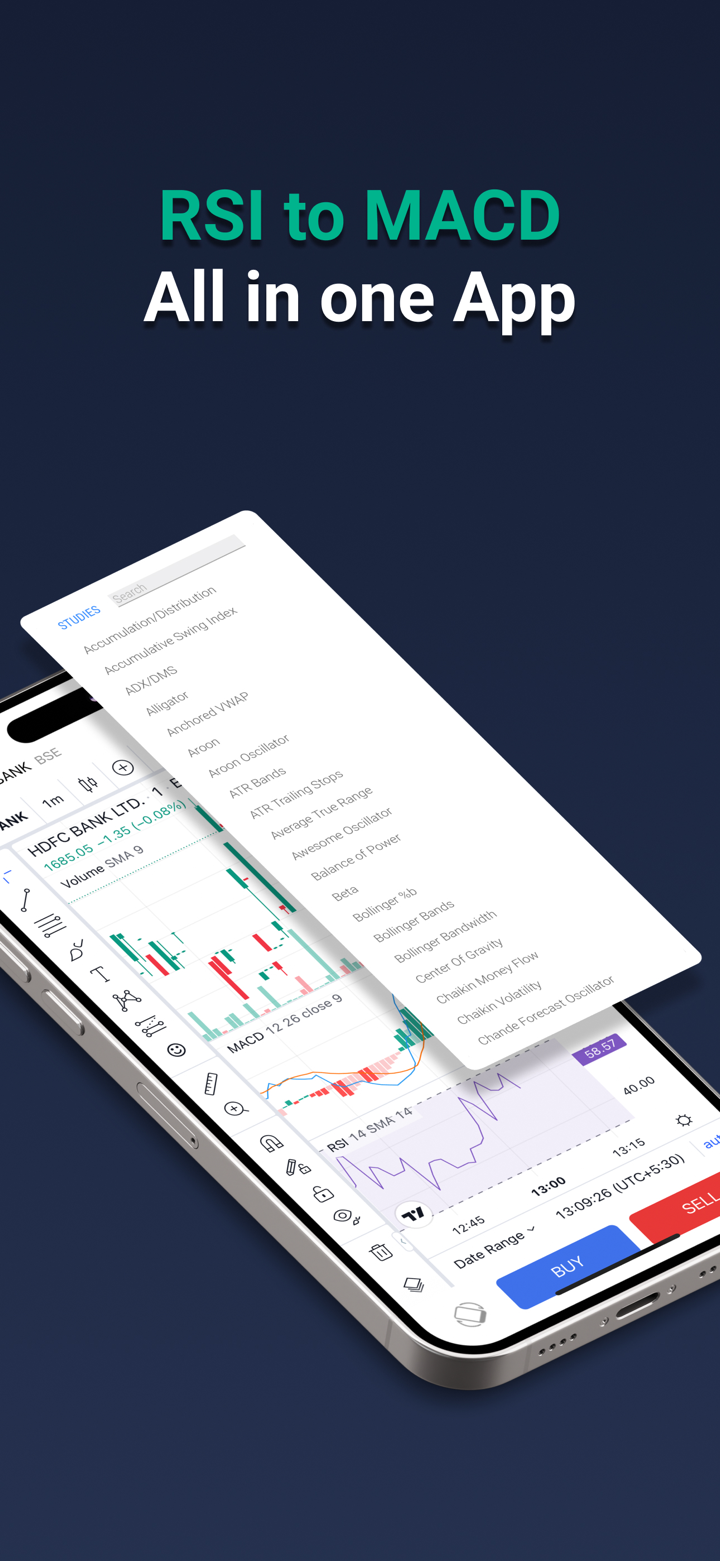

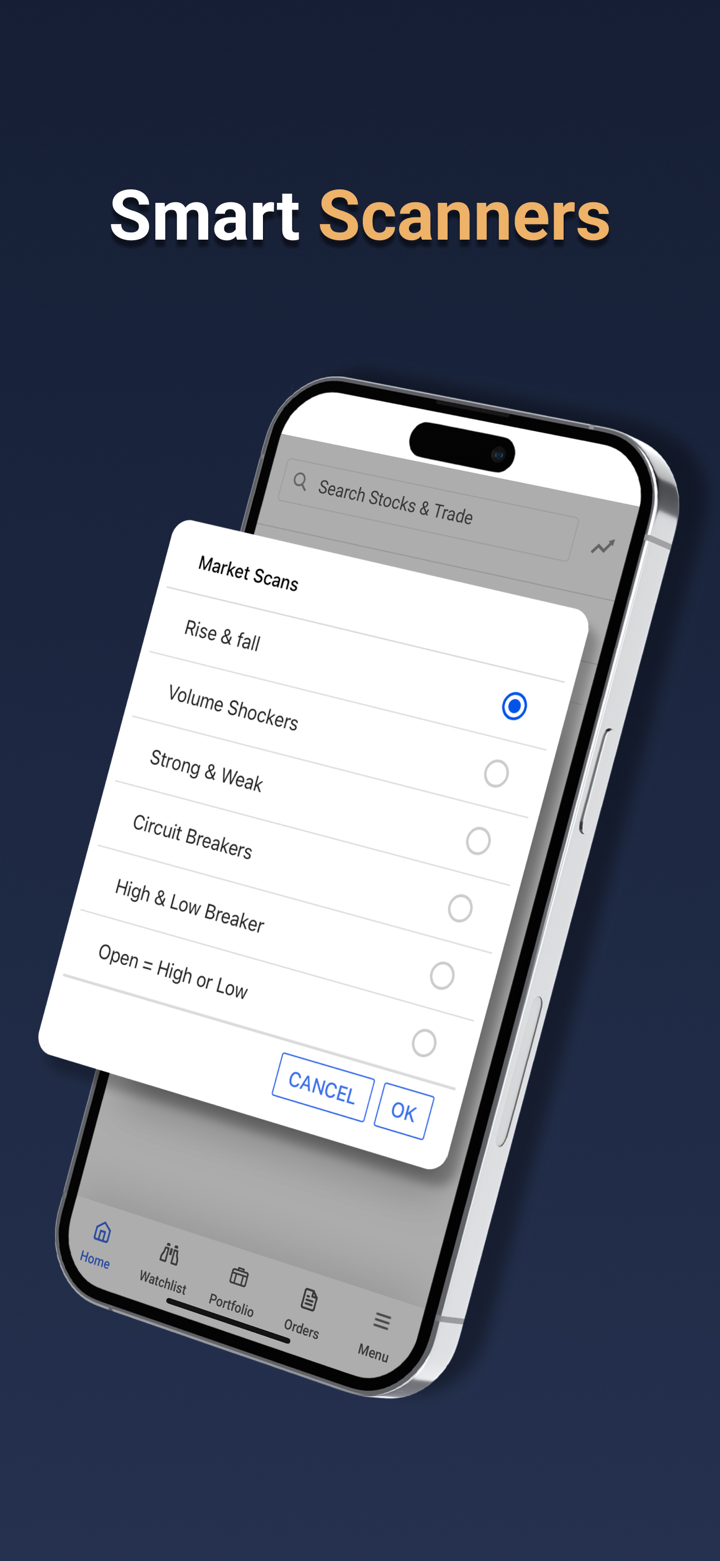

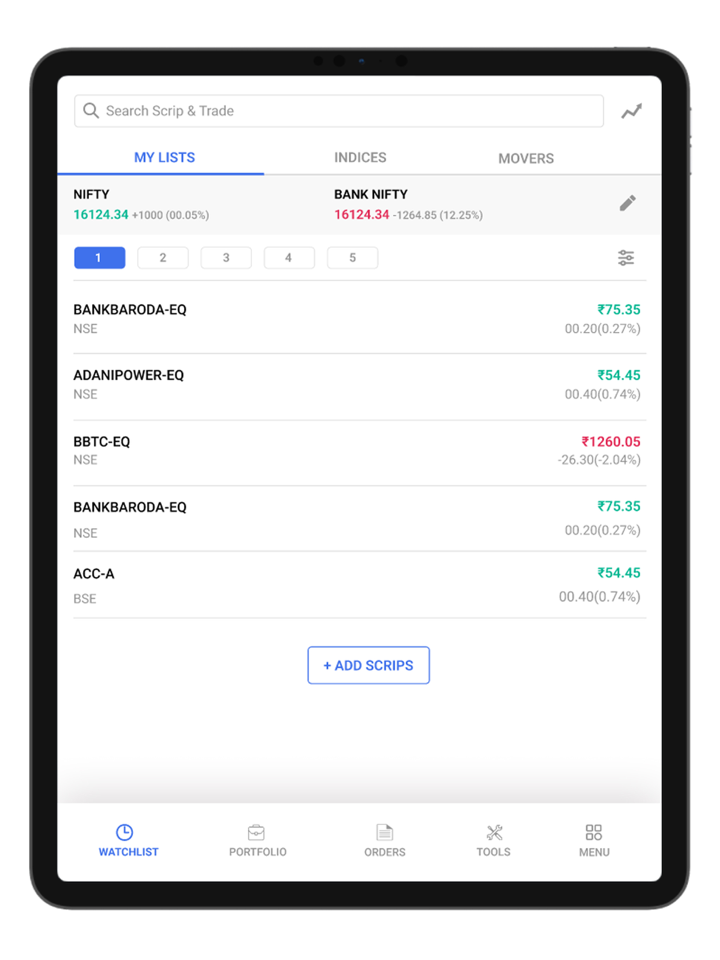

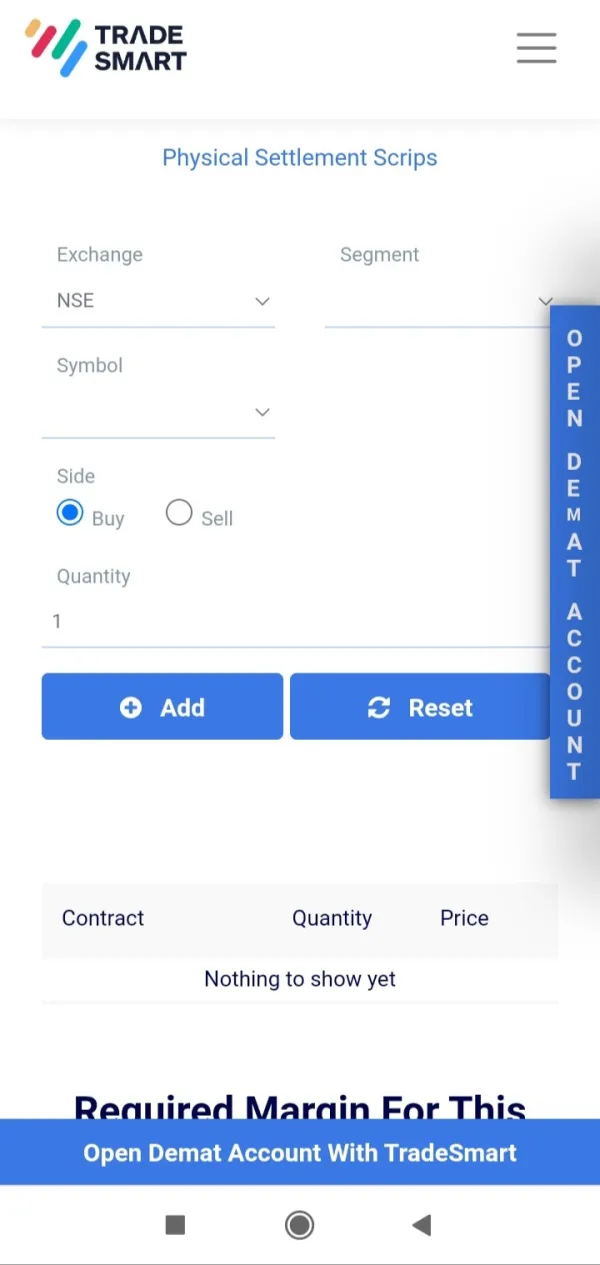

Los productos de TraderSmart incluyen una variedad de herramientas de trading: Aplicación Móvil TradeSmart, Escritorio TradeSmart, Web TradeSmart, API TradeSmart, BOX, TradeSmart MF, Instaoption e Integraciones.

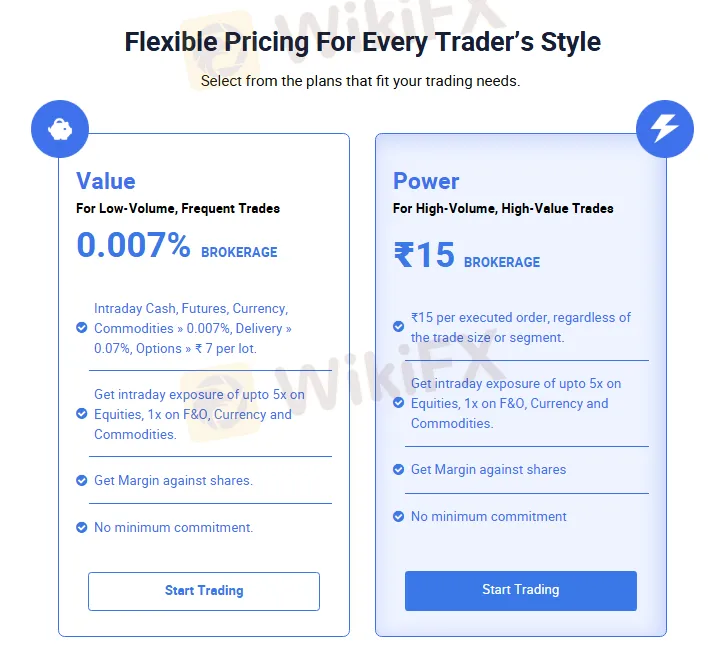

Tipos de Cuentas y Tarifas

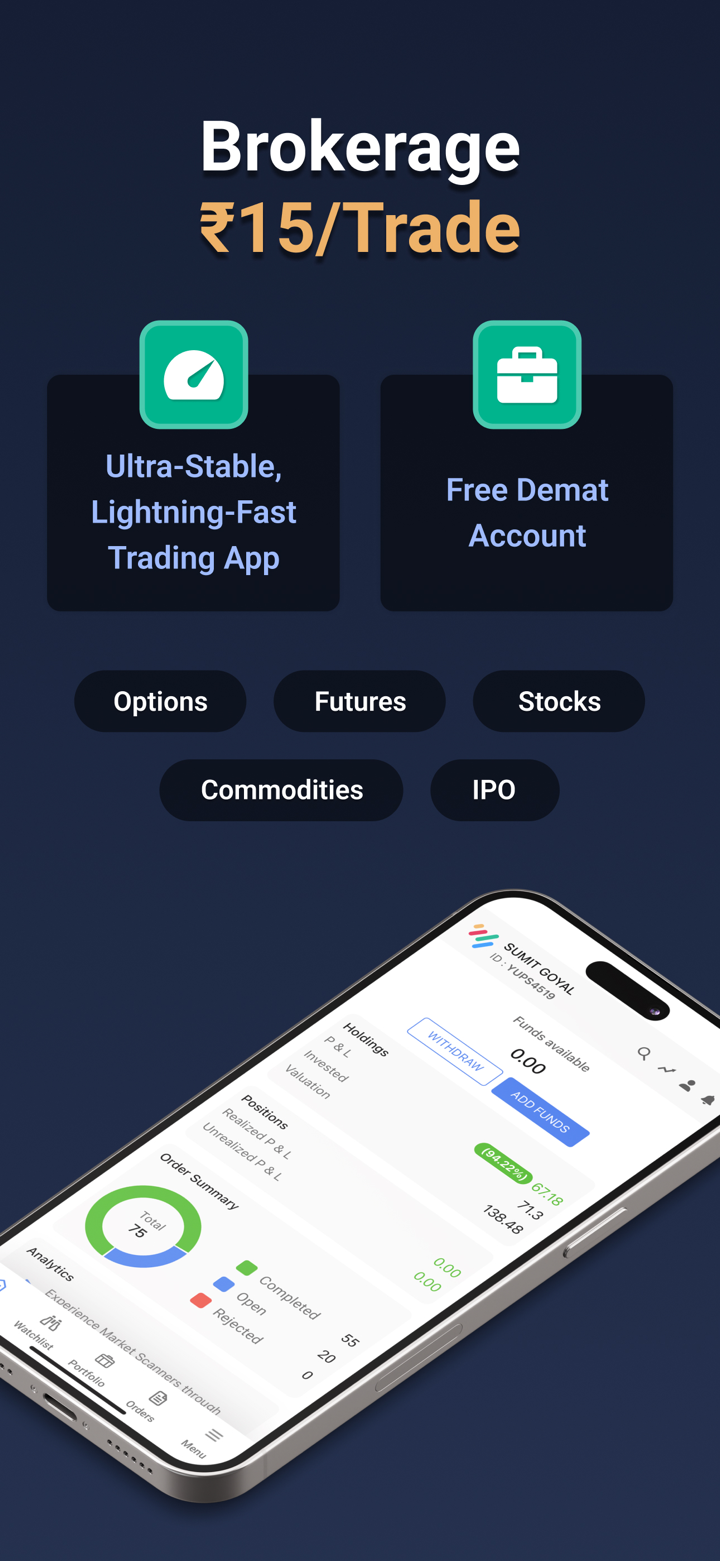

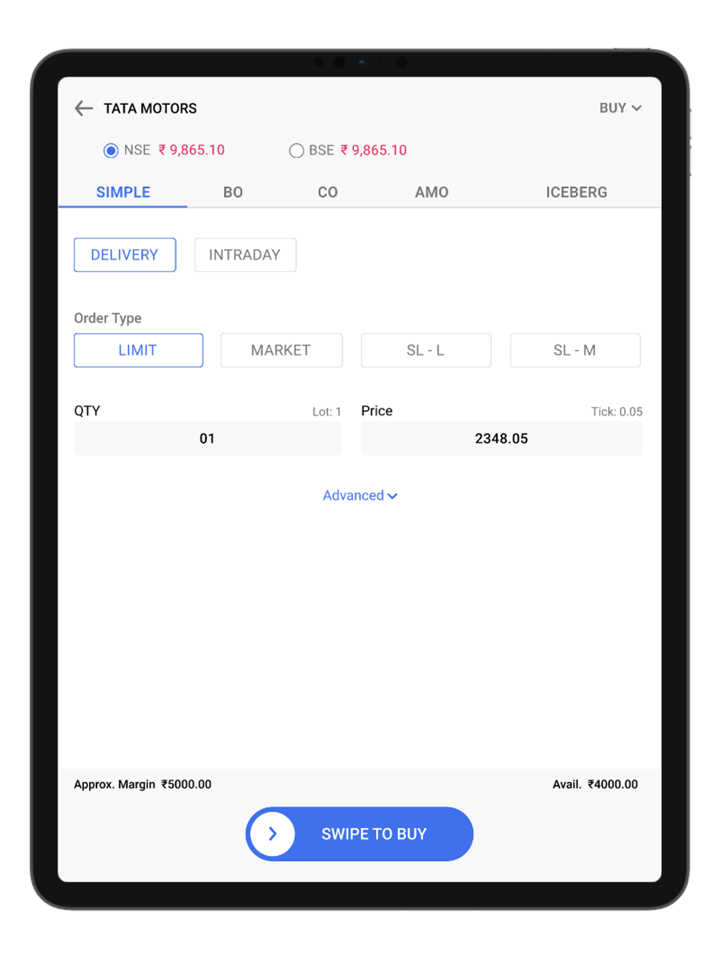

TradeSmart ofrece a los traders cuentas Demat para operar. Hay dos programas diferentes disponibles: Value y Power, para que los traders elijan.

El papel principal de una cuenta Demat es digitalizar el almacenamiento, gestión y trading de valores, brindando a los inversores una experiencia de inversión eficiente, segura y transparente.

A continuación se muestra información sobre los dos planes de cuenta:

| Cuenta Value | Cuenta Power | |

| Traders Objetivo | Traders de bajo volumen y alta frecuencia | Traders de alto volumen y alto valor |

| Comisión de Corretaje | 0.007% | ₹15 por orden (independientemente del tamaño o tipo de operación) |

| Intradía Efectivo, Futuros, Divisas | Adecuado para trading de bajo volumen y alta frecuencia | Adecuado para trading de alto volumen y alto valor |

| Productos Básicos > 0.007%, Entrega > 0.07%, Opciones > ₹7 por lote | Compatible con trading de productos básicos y opciones de bajo costo | Compatible con trading de productos básicos y opciones de alto costo |

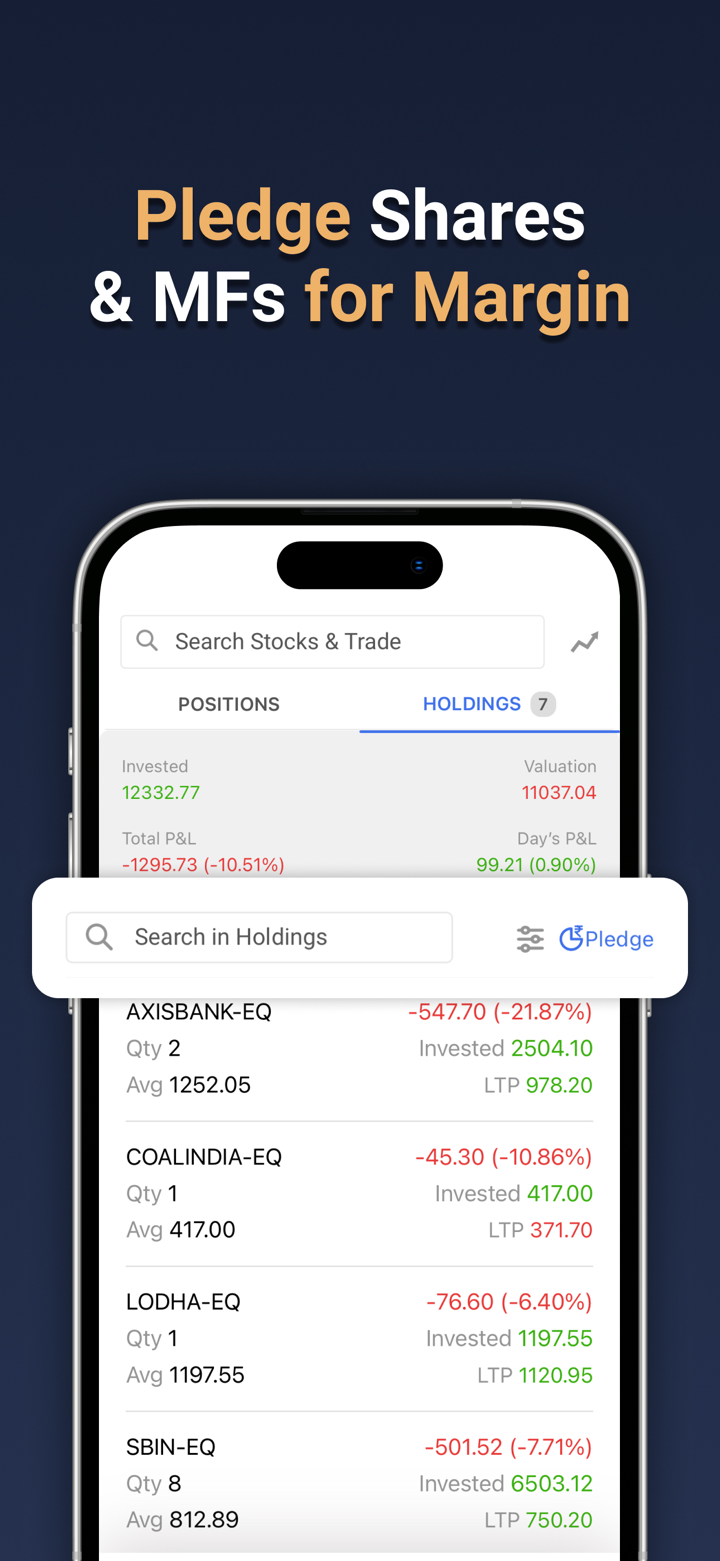

| Apalancamiento | Hasta 1:5 (Acciones, F&O, Divisas y Productos Básicos) | Hasta 1:5 (Acciones, F&O, Divisas y Productos Básicos) |

| Soporte de Margen contra Acciones | Sí | Sí |

| Compromiso Mínimo | No | No |

Apalancamiento

TradeSmart ofrece un apalancamiento de 1:5 en acciones, F&O, divisas y productos básicos. Ten en cuenta que un alto apalancamiento puede amplificar no solo las ganancias, sino también las pérdidas.

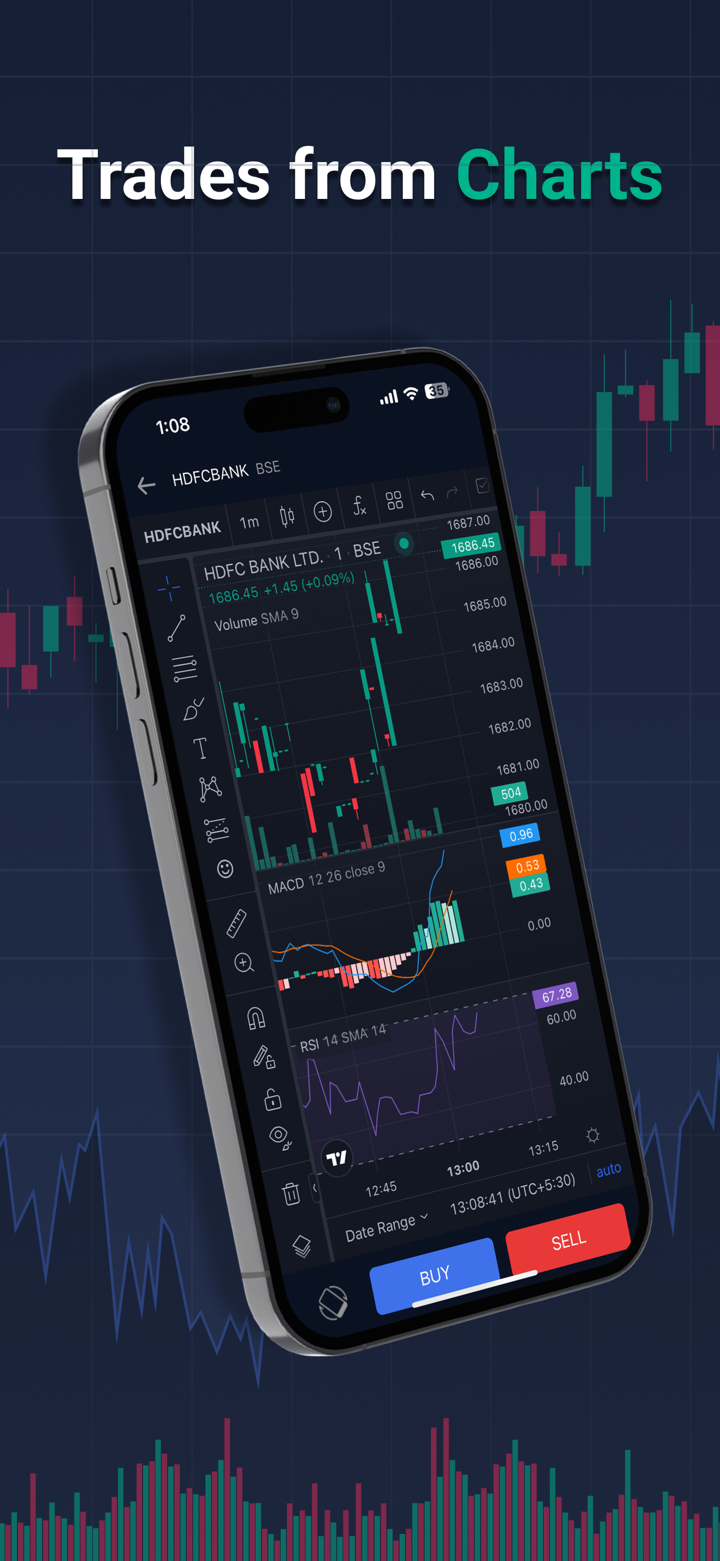

Plataforma de Trading

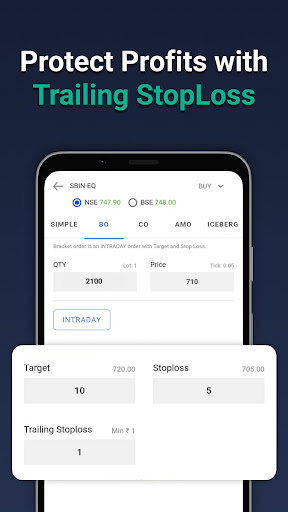

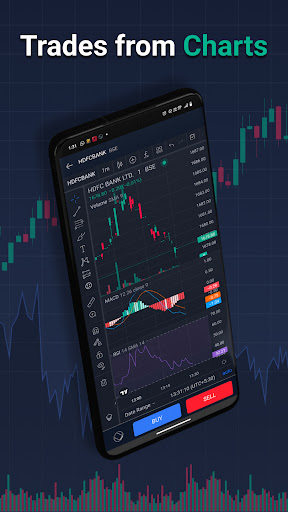

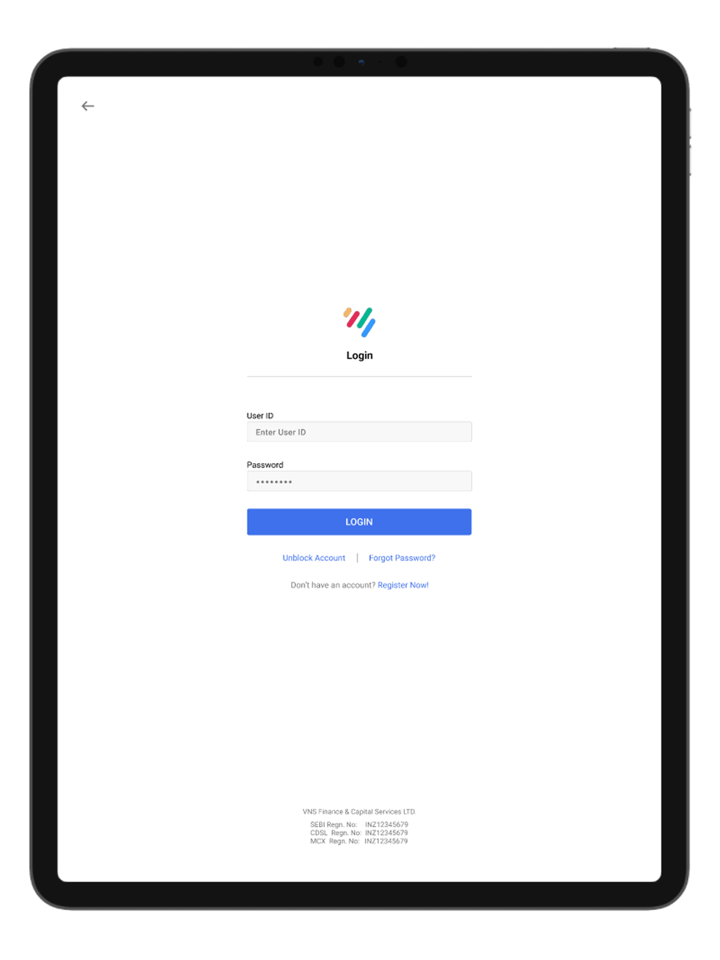

TradeSmart admite el comercio utilizando la aplicación propietaria TraderSmart APP. Solo se cobra Rs. 15 por operación como comisión por operar en esta plataforma.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| TraderSmart | ✔ | Escritorio, Móvil, Web | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

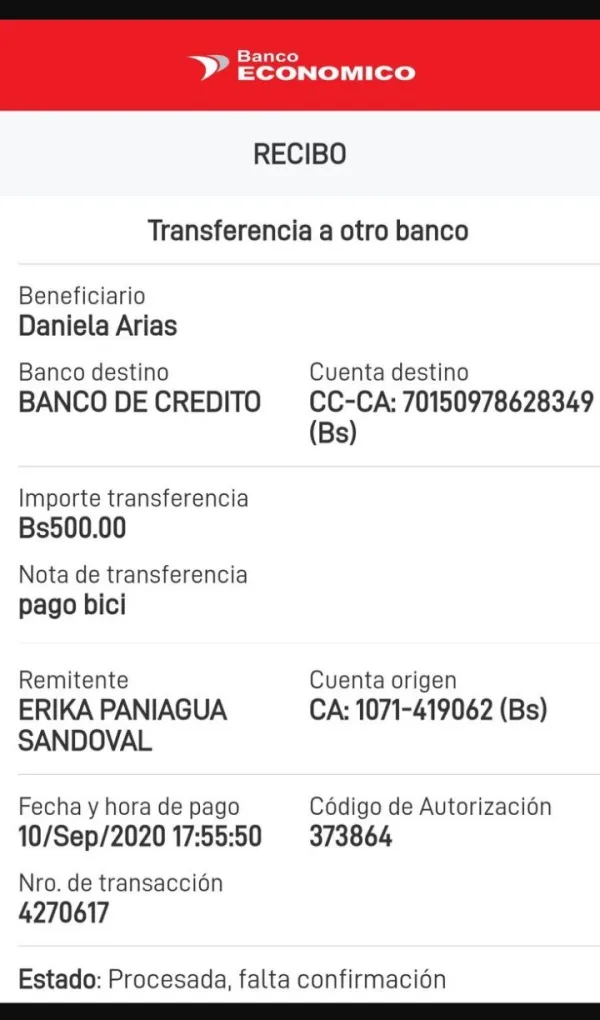

Depósito y Retiro

TraderSmart acepta pagos a través de transferencia bancaria y transferencia NEFT.

Un total de 29 bancos son compatibles como se indica a continuación:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank y AU Small Finance Bank.