公司简介

| TradeSmart评论摘要 | |

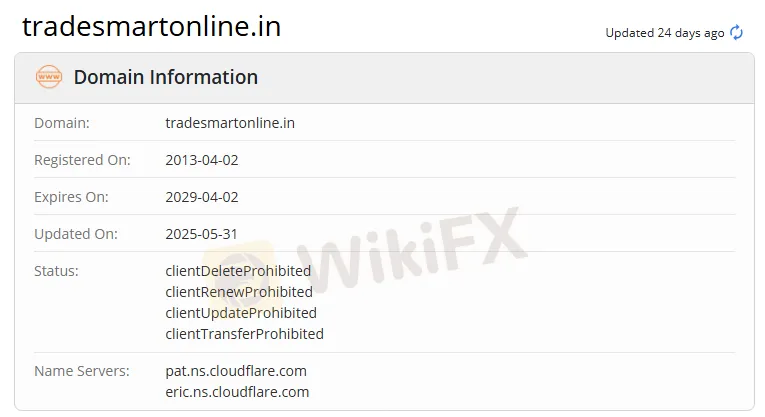

| 成立时间 | 2013 |

| 注册国家/地区 | 印度 |

| 监管 | 无监管 |

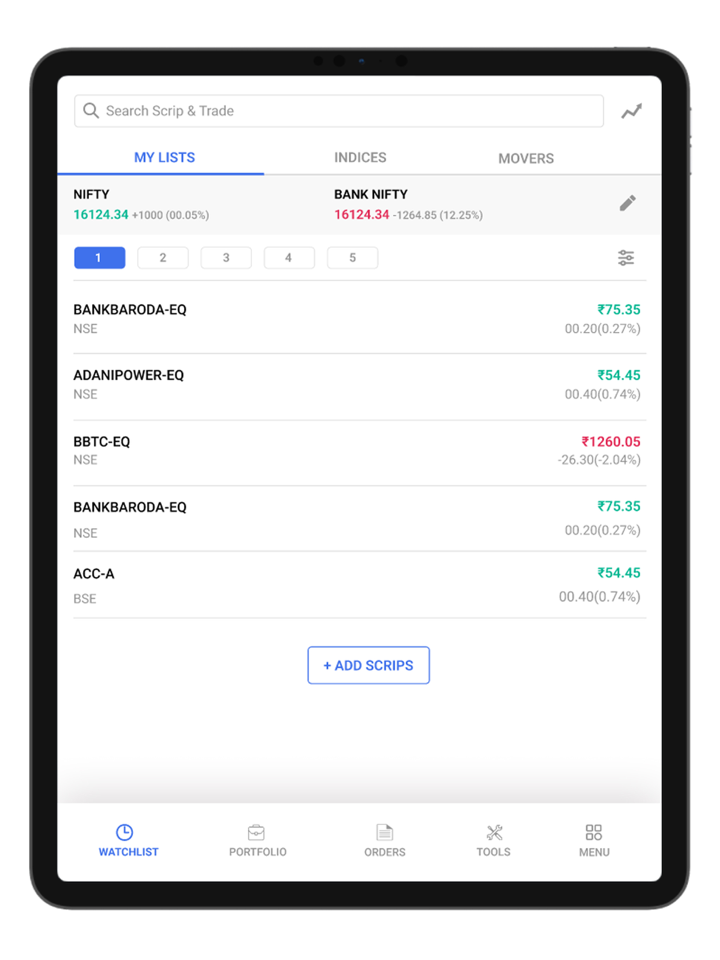

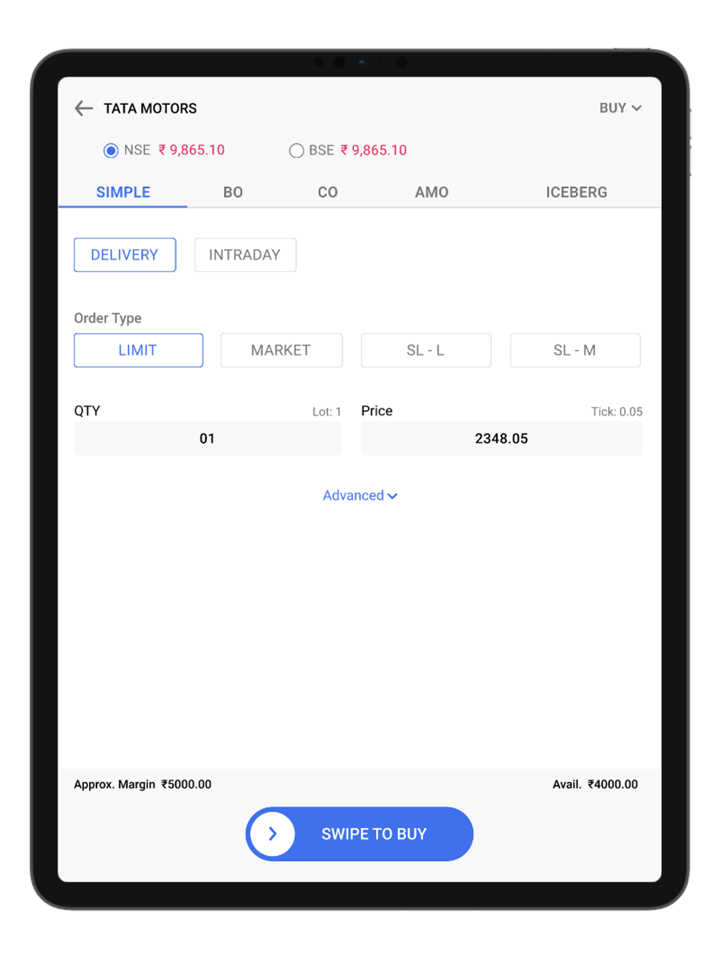

| 交易工具 | 股票、期货、期权、货币和大宗商品 |

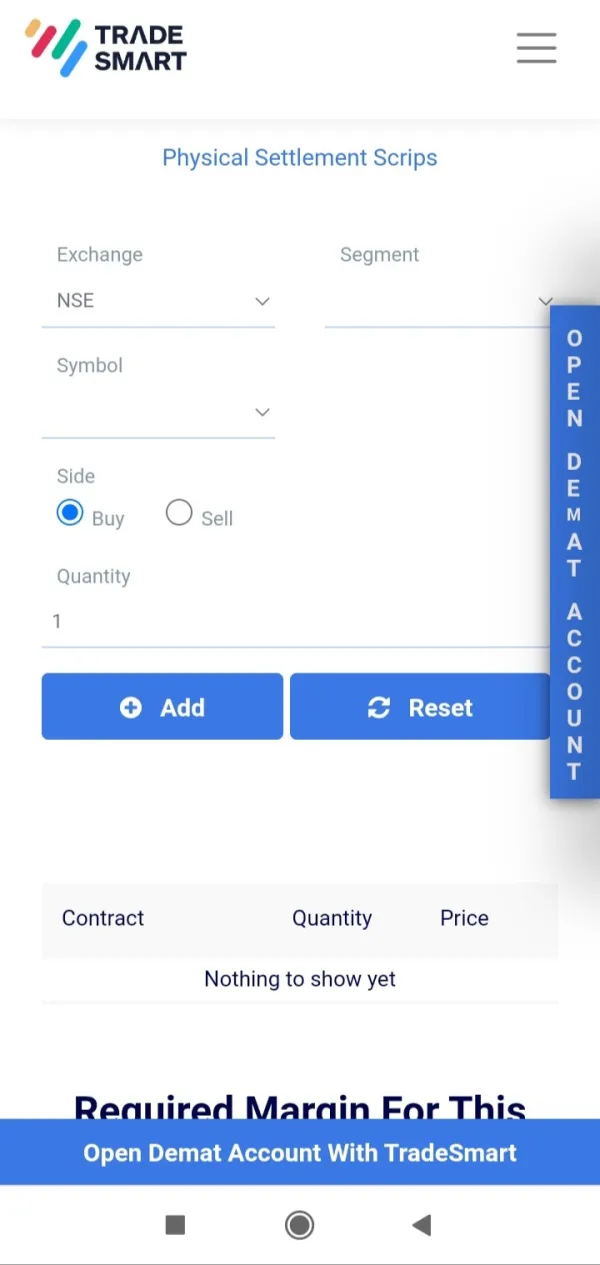

| 产品 | TradeSmart 移动应用、TradeSmart 桌面、TradeSmart 网页、TradeSmart 应用程序接口、BOX、TradeSmart MF、Instaoption 和集成 |

| 杠杆 | 最高达1:5 |

| 点差 | / |

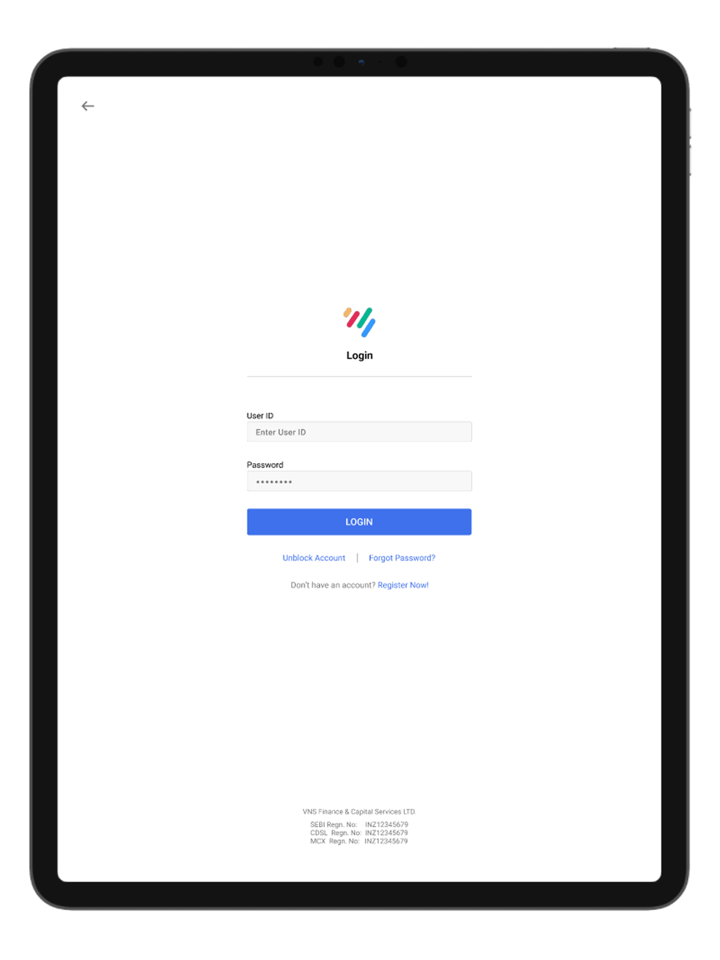

| 交易平台 | TraderSmart APP |

| 最低存款 | / |

| 客户支持 | 电话:+91 022-61208000 |

| 电子邮件:contactus@vnsfin. com | |

| 社交媒体:Facebook、Twitter、Instagram、LinkedIn、YouTube、Telegram | |

| 地址:印度孟买安德烈里东部马洛A-401,邮编400059 | |

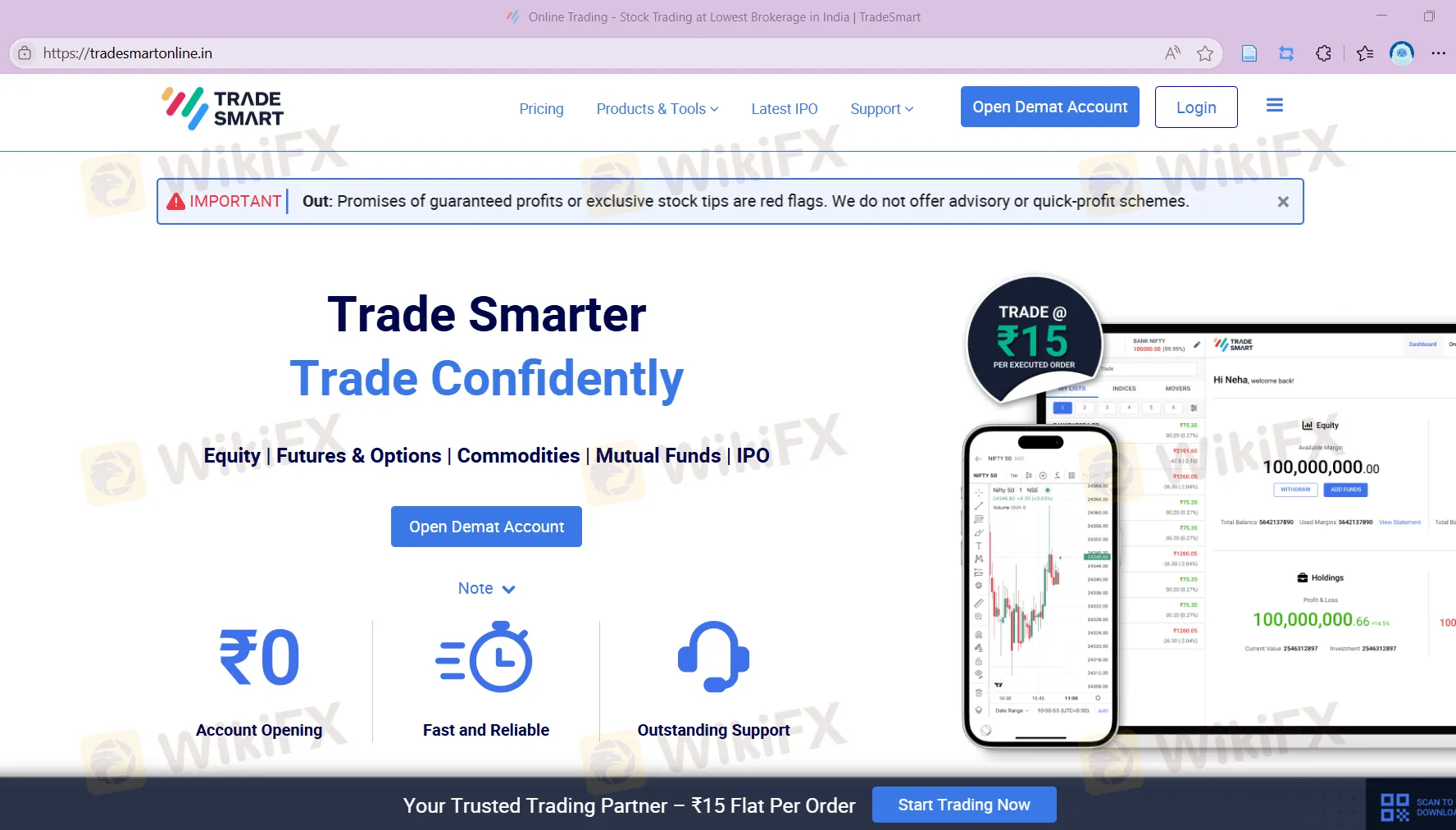

TradeSmart 信息

成立于2013年,总部位于印度的TradeSmart是一家金融服务提供商。该公司提供多样化的交易工具和平台,包括TradeSmart移动应用、TradeSmart桌面、TradeSmart网页、TradeSmart应用程序接口、BOX、TradeSmartMF、Instaoption和集成。为了满足不同客户的需求,该公司有两种类型的账户:Value账户适用于低频和小额交易者,Power账户适用于高频和大额交易者。

然而,TradeSmart目前没有受到监管,其合法性令人担忧。

优缺点

| 优点 | 缺点 |

| 提供多样化产品 | 无监管 |

| 账户功能信息有限 | |

| 费用结构不清晰 | |

| 存款和提现信息有限 |

TradeSmart 是否合法?

编号 TradeSmart 未受监管,交易者在交易时必须谨慎。

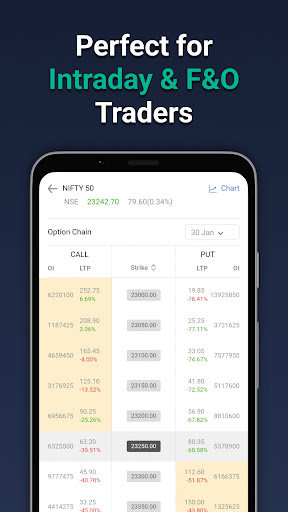

在 TraderSmart 上可以交易什么?

| 交易工具 | 支持 |

| 股票 | ✔ |

| 期货 | ✔ |

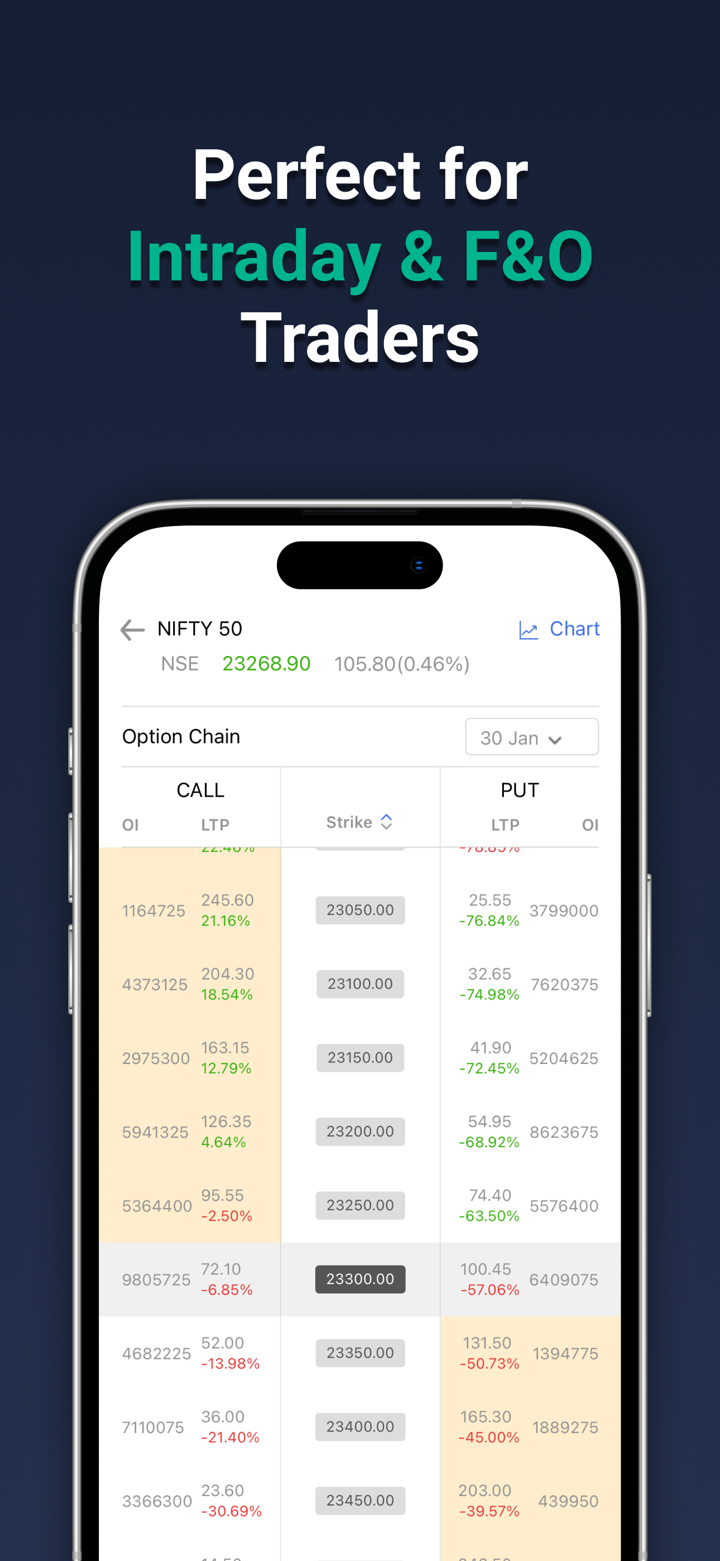

| 期权 | ✔ |

| 货币 | ✔ |

| 大宗商品 | ✔ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 交易所交易基金 | ❌ |

产品

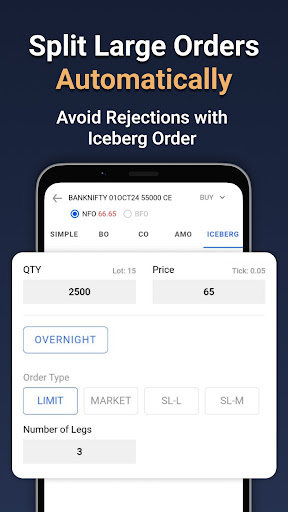

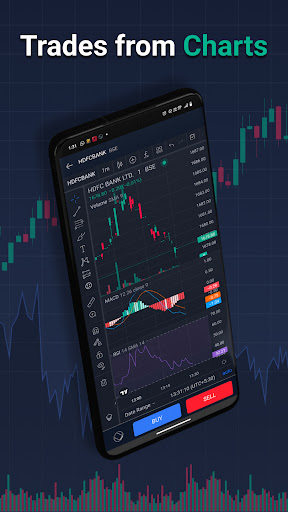

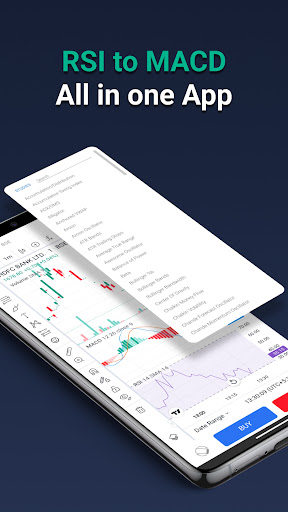

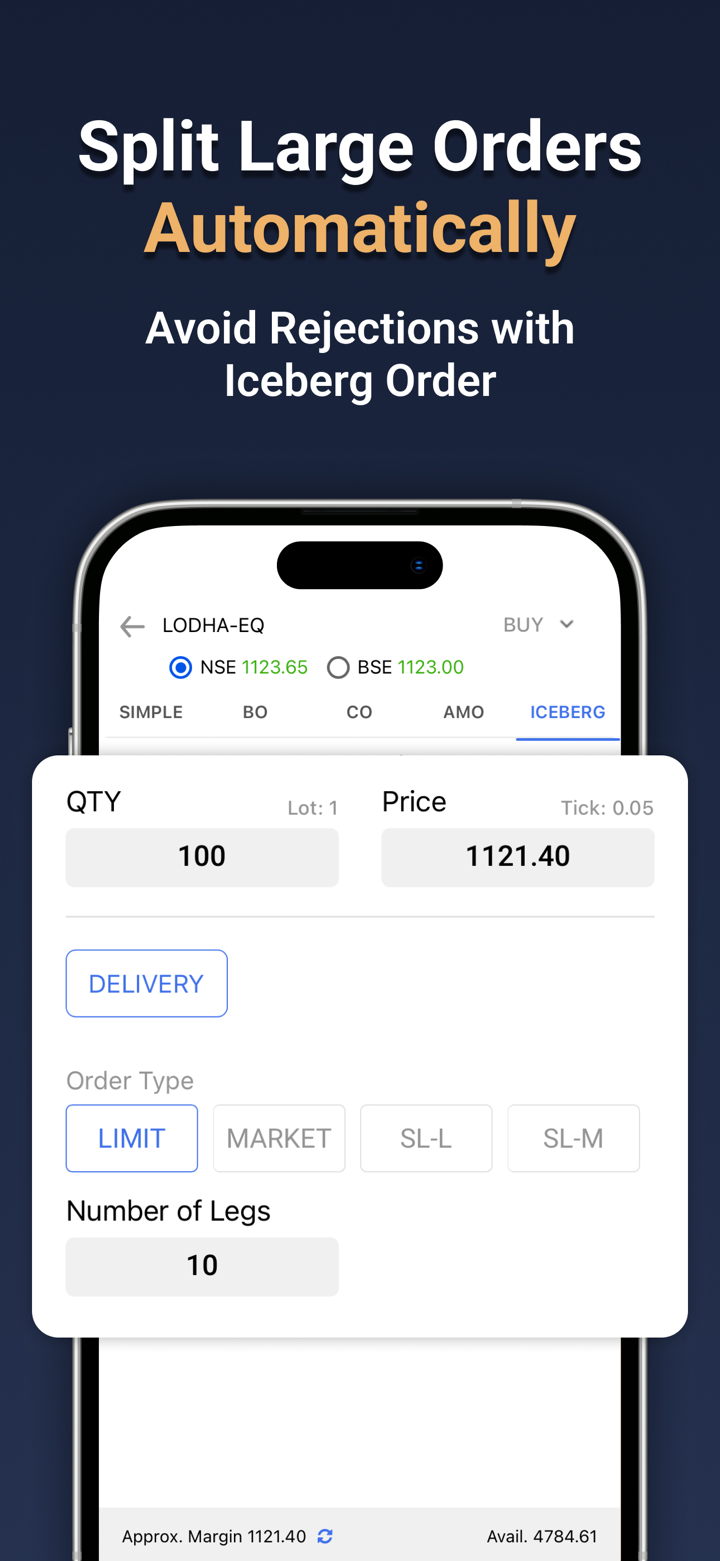

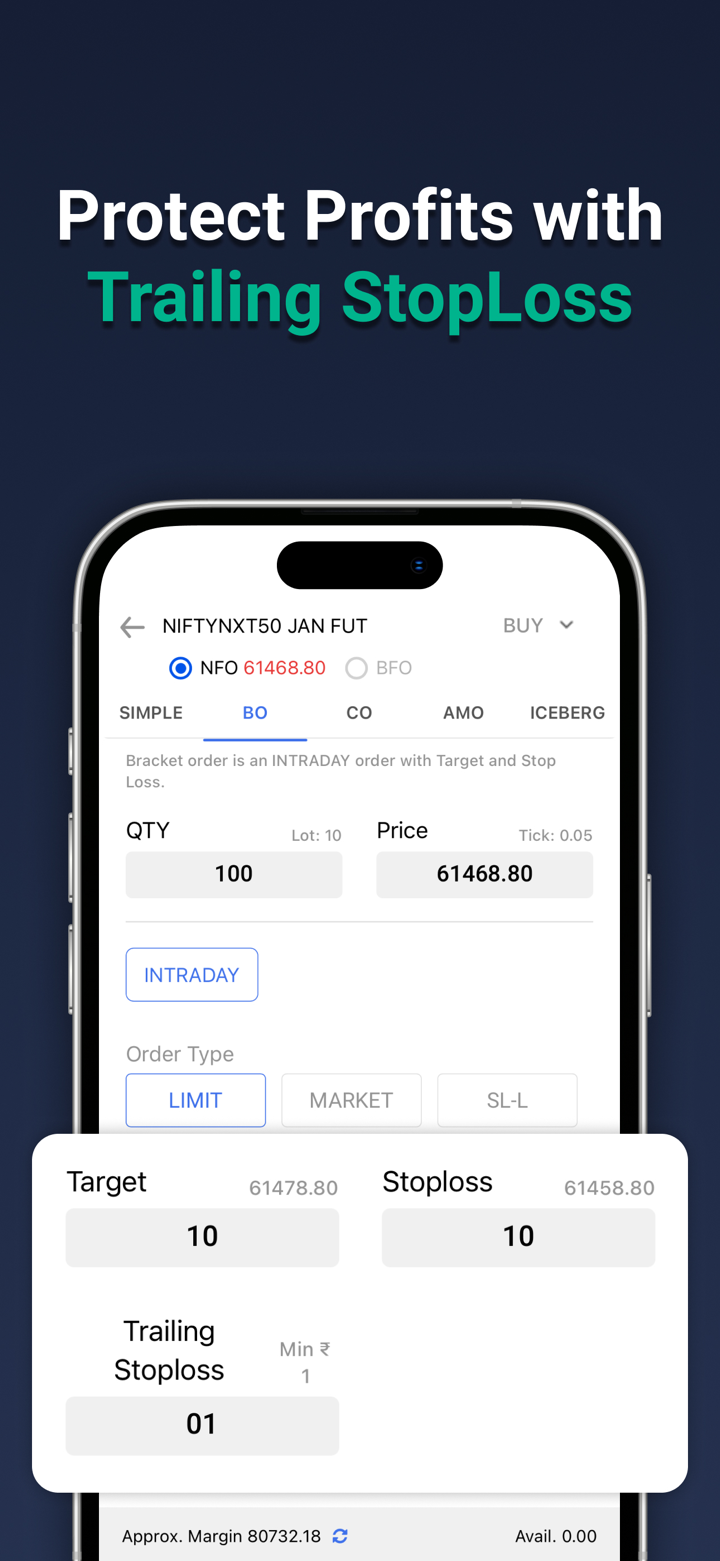

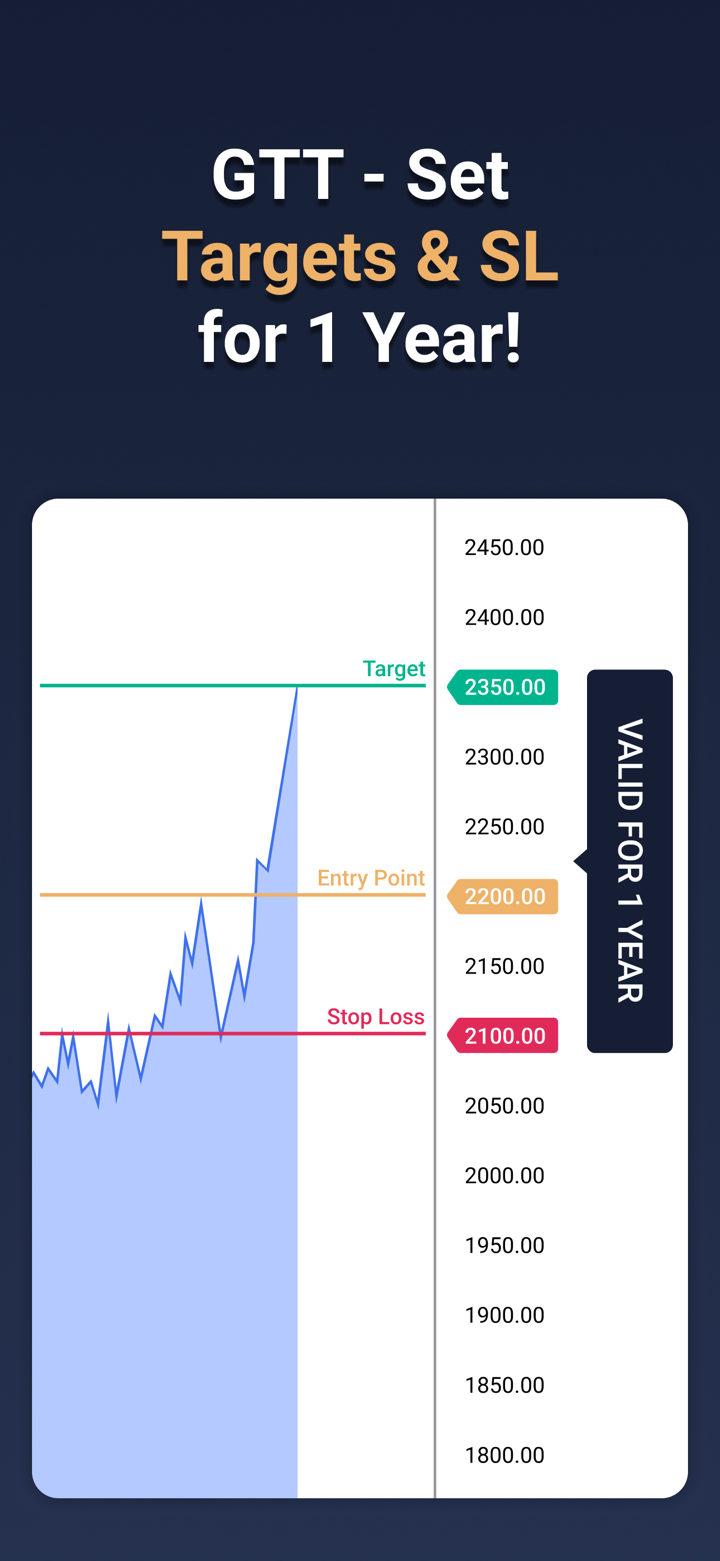

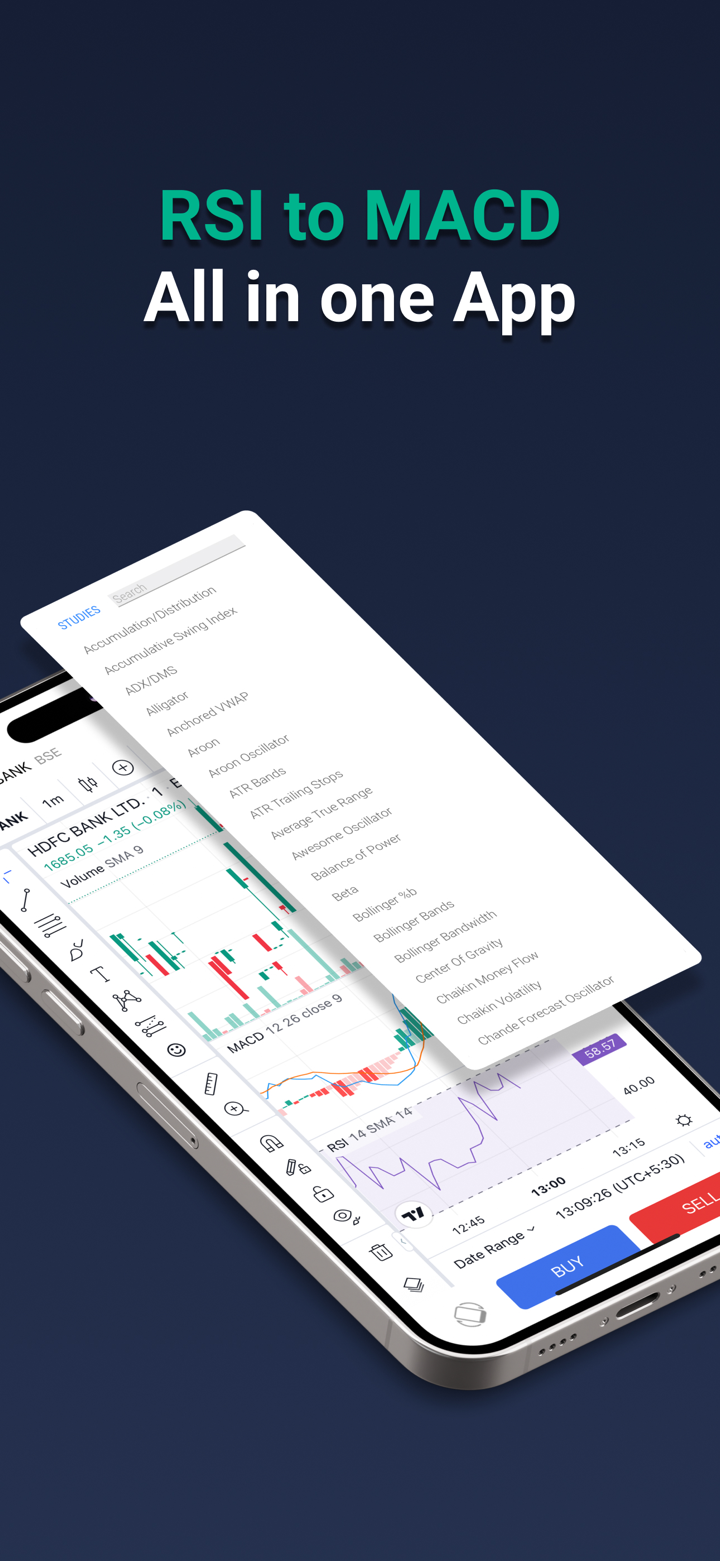

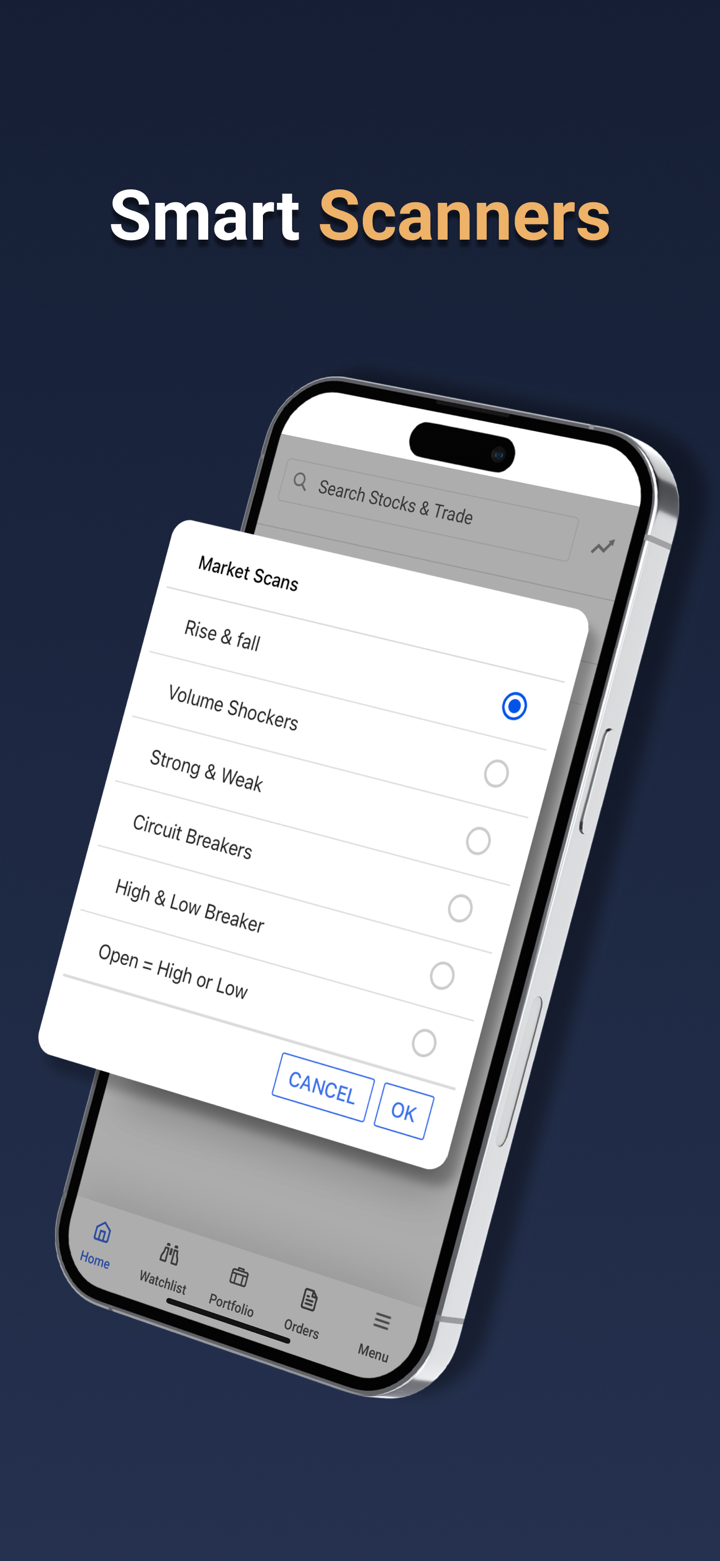

TraderSmart 的产品包括各种交易工具: TradeSmart 移动应用、TradeSmart 桌面、TradeSmart 网页、TradeSmart 应用程序接口、BOX、TradeSmart MF、Instaoption 和集成。

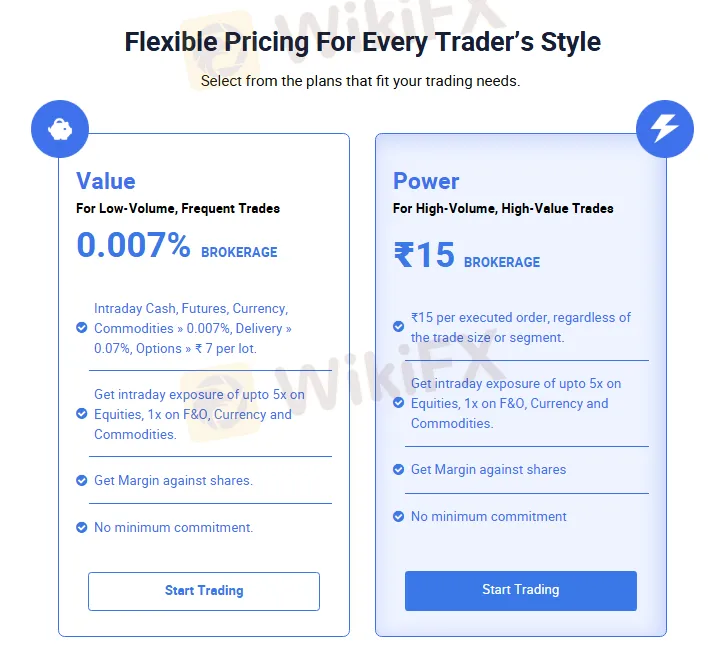

账户类型与费用

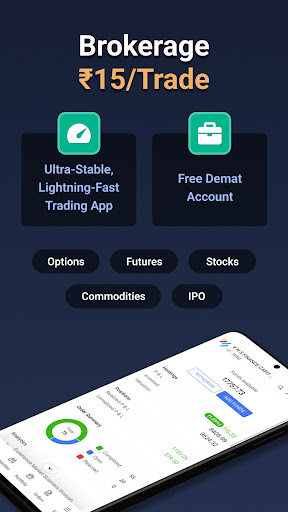

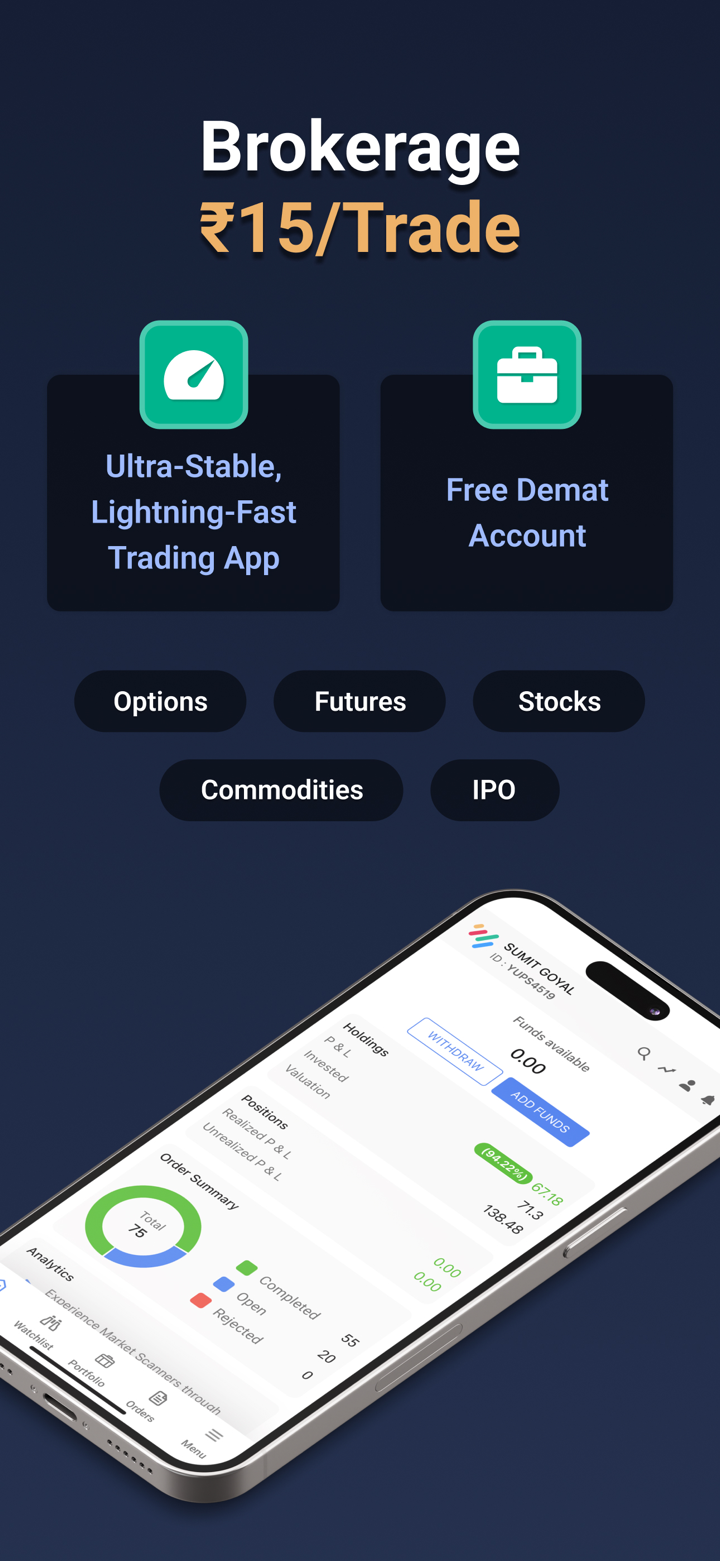

TradeSmart 为交易者提供 Demat 账户 进行交易。有两种不同的计划可供选择: Value 和 Power。

Demat 账户的主要作用是数字化证券的存储、管理和交易,为投资者提供高效、安全和透明的投资体验。

以下是两种账户计划的信息:

| Value 账户 | Power 账户 | |

| 目标交易者 | 低交易量、高频率交易者 | 高交易量、高价值交易者 |

| 佣金费率 | 0.007% | 每笔订单 ₹15(无论交易大小或类型) |

| 当日现金、期货、货币 | 适用于低交易量、高频率交易 | 适用于高交易量、高价值交易 |

| 大宗商品 > 0.007%、交割 > 0.07%、期权 > ₹7 每手 | 支持低成本大宗商品和期权交易 | 支持高成本大宗商品和期权交易 |

| 杠杆 | 最高 1:5(股票、期权、货币和大宗商品) | 最高 1:5(股票、期权、货币和大宗商品) |

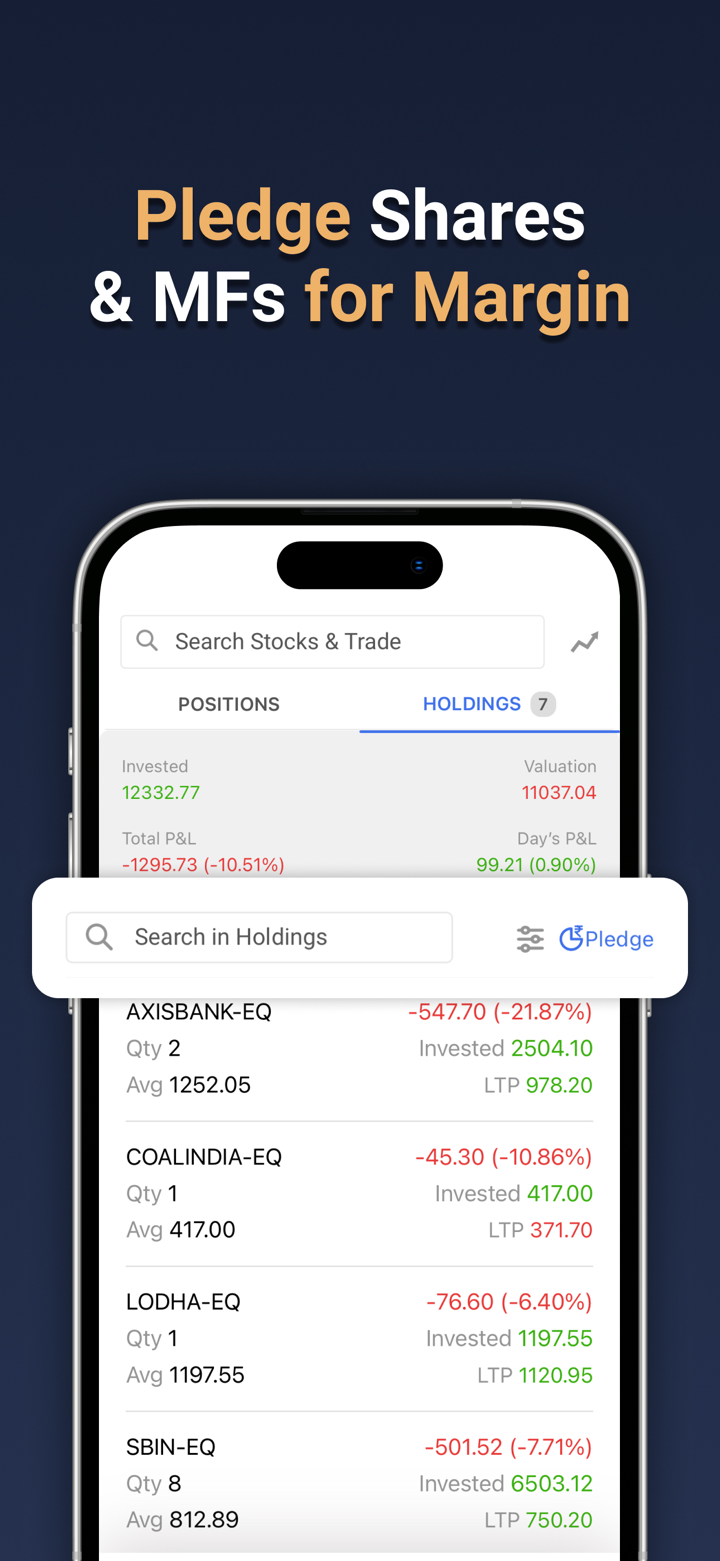

| 股票支持保证金 | 是 | 是 |

| 最低承诺 | 否 | 否 |

杠杆

TradeSmart 在股票、期权、货币和大宗商品上提供 1:5 的杠杆。请注意,高杠杆不仅可以放大利润,也会放大损失。

交易平台

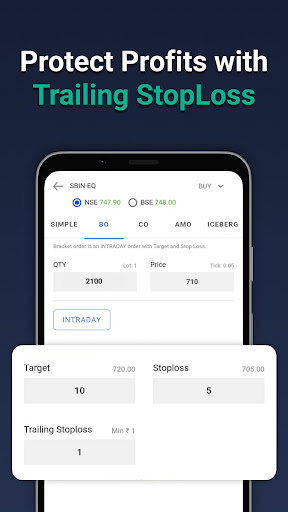

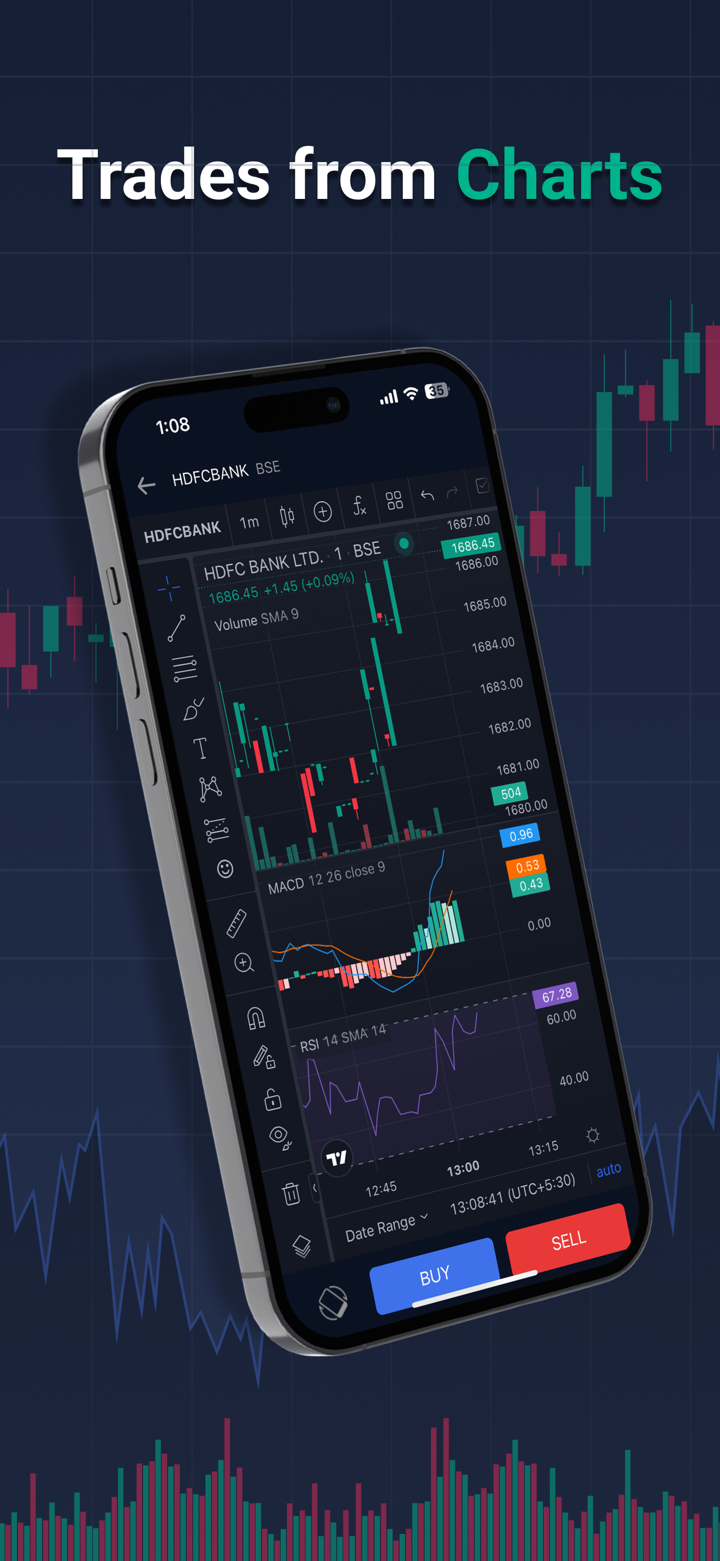

TradeSmart 支持使用专有的 TraderSmart APP 进行交易。在该平台上进行交易每笔收取 Rs. 15 的佣金。

| 交易平台 | 支持 | 可用设备 | 适用对象 |

| TraderSmart | ✔ | 桌面,移动设备,Web | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 经验丰富的交易者 |

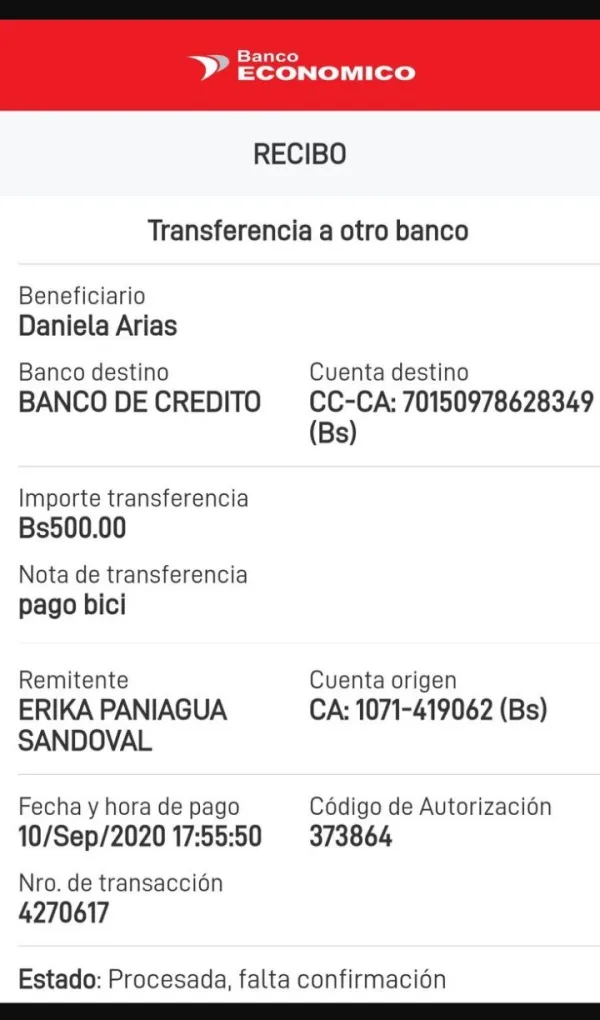

存款和取款

TraderSmart 接受 银行电汇和 NEFT 转账 付款。

以下列出了支持的 29 家银行:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank, 以及 AU Small Finance Bank。