회사 소개

| TradeSmart리뷰 요약 | |

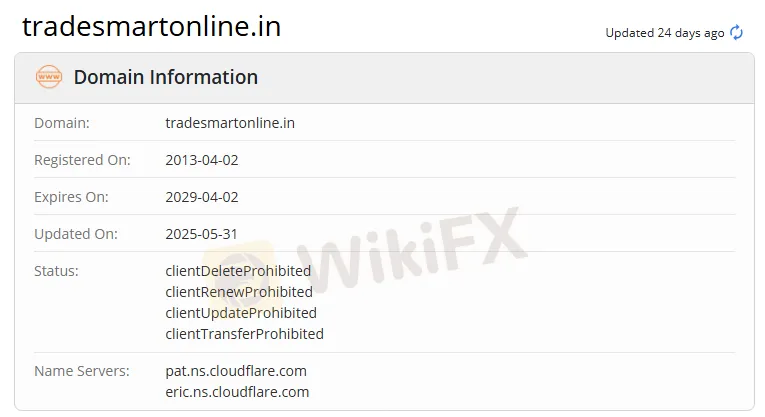

| 설립 연도 | 2013 |

| 등록 국가/지역 | 인도 |

| 규제 | 규제 없음 |

| 거래 상품 | 주식, 선물, 옵션, 통화 및 상품 |

| 제품 | TradeSmart 모바일 앱, TradeSmart 데스크톱, TradeSmart 웹, TradeSmart API, BOX, TradeSmart MF, 인스타옵션 및 통합 |

| 레버리지 | 최대 1:5 |

| 스프레드 | / |

| 거래 플랫폼 | TraderSmart APP |

| 최소 입금액 | / |

| 고객 지원 | 전화: +91 022-61208000 |

| 이메일: contactus@vnsfin. com | |

| 소셜 미디어: Facebook, Twitter, Instagram, LinkedIn, YouTube, Telegram | |

| 주소: A-401, Mangalya, Marol, Andheri East, Mumbai - 400059 | |

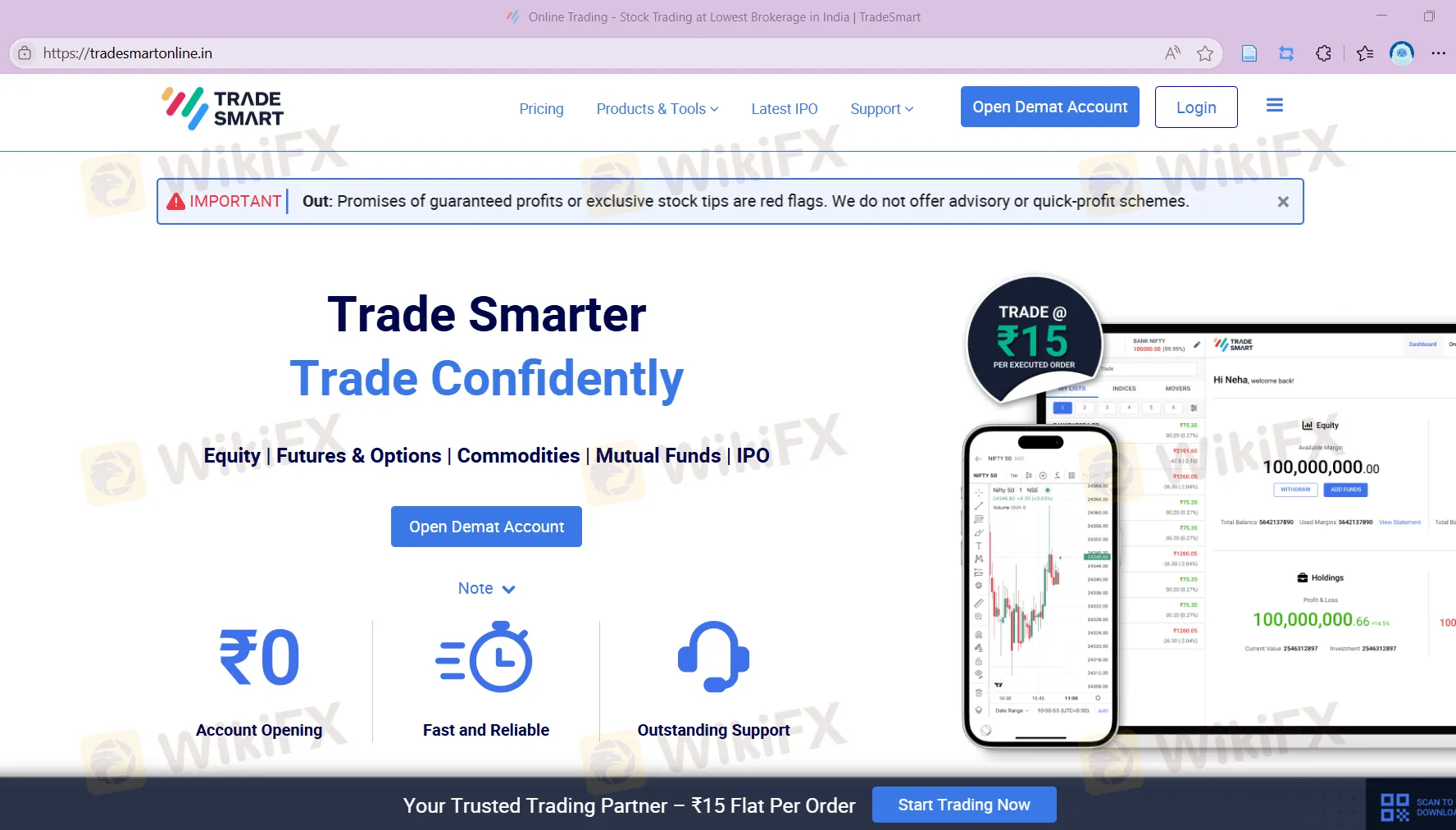

TradeSmart 정보

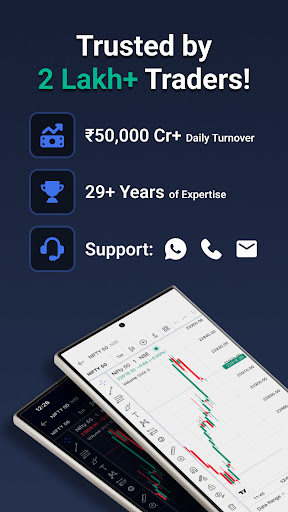

2013년에 설립된 인도 본사를 둔 TradeSmart은 금융 서비스 제공업체입니다. TradeSmart 모바일 앱, TradeSmart 데스크톱, TradeSmart 웹, TradeSmart API, BOX, TradeSmart MF, 인스타옵션 및 통합을 포함한 다양한 거래 도구 및 플랫폼을 제공합니다. 다양한 고객 요구를 충족시키기 위해 회사는 저주파 및 소규모 트레이더를 위한 밸류 계정과 고주파 및 대량 트레이더를 위한 파워 계정 두 가지 유형의 계정을 보유하고 있습니다.

그러나 TradeSmart은 현재 규제를 받지 않고 있으며 그 합법성이 우려의 대상입니다.

장단점

| 장점 | 단점 |

| 다양한 제품 제공 | 규제 없음 |

| 계정 기능에 대한 제한된 정보 | |

| 불분명한 수수료 구조 | |

| 입출금에 대한 제한된 정보 |

TradeSmart 합법성

번호 TradeSmart은 규제되지 않았습니다, 거래자들은 거래 시 주의를 기울여야 합니다.

TraderSmart에서 무엇을 거래할 수 있나요?

| 거래 상품 | 지원 |

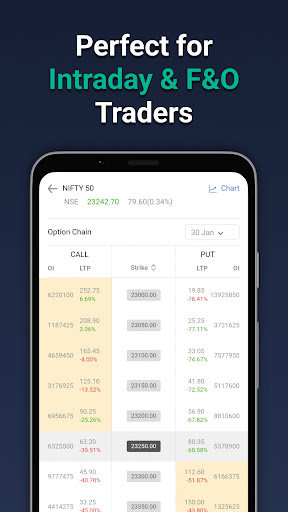

| 주식 | ✔ |

| 선물 | ✔ |

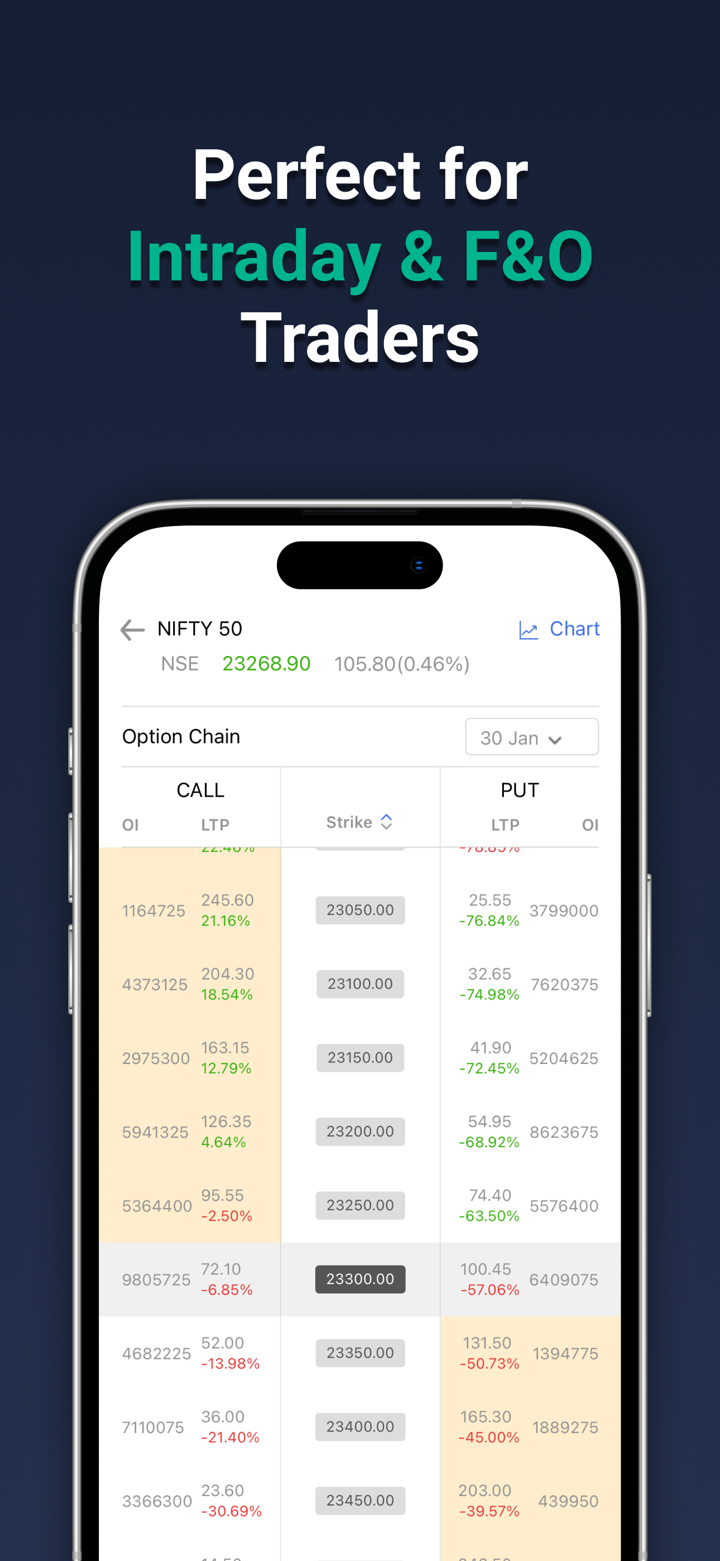

| 옵션 | ✔ |

| 통화 | ✔ |

| 상품 | ✔ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| ETFs | ❌ |

제품

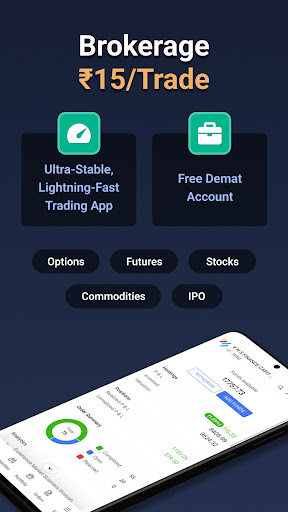

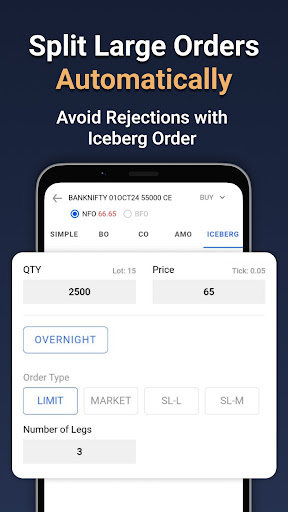

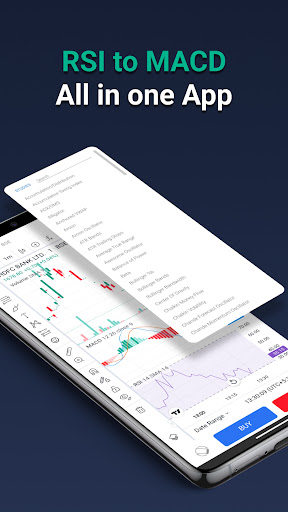

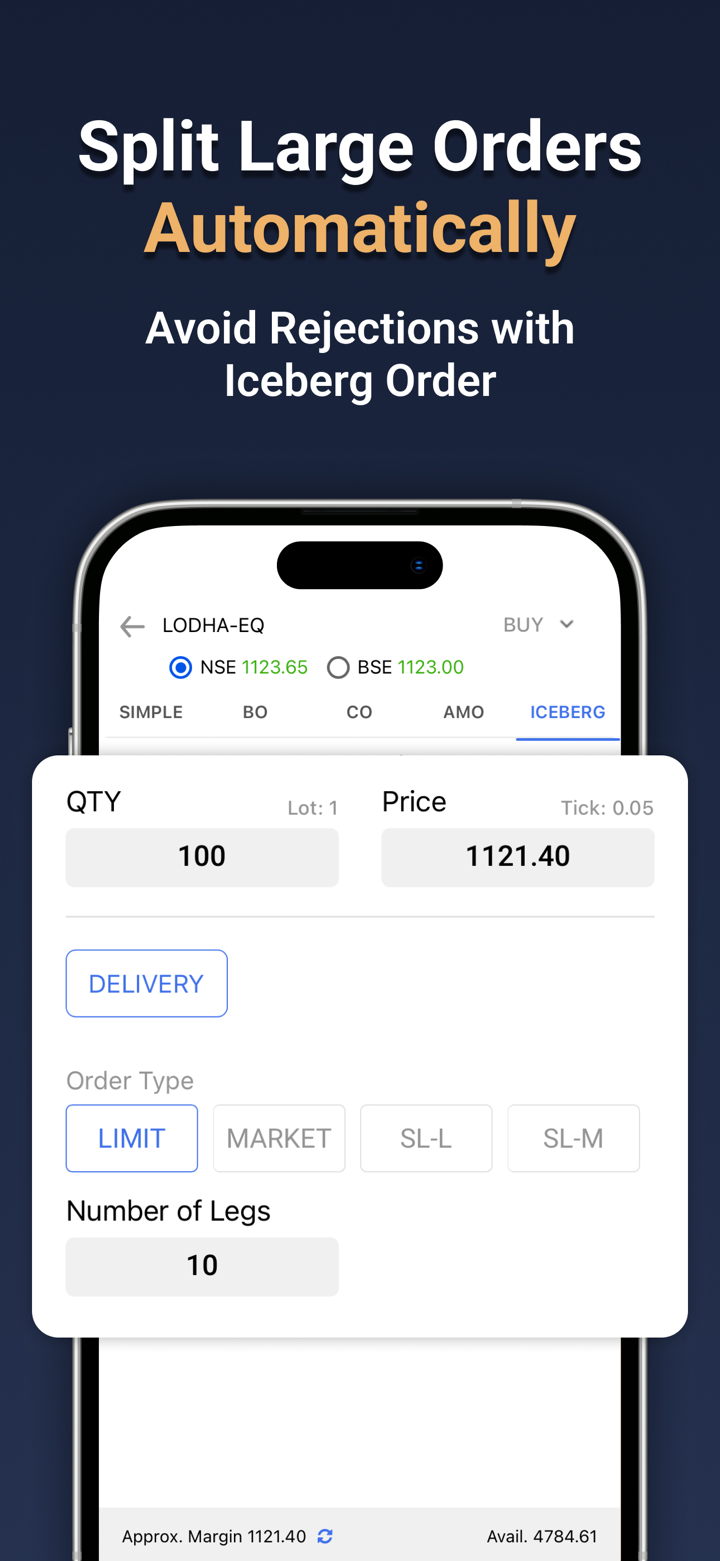

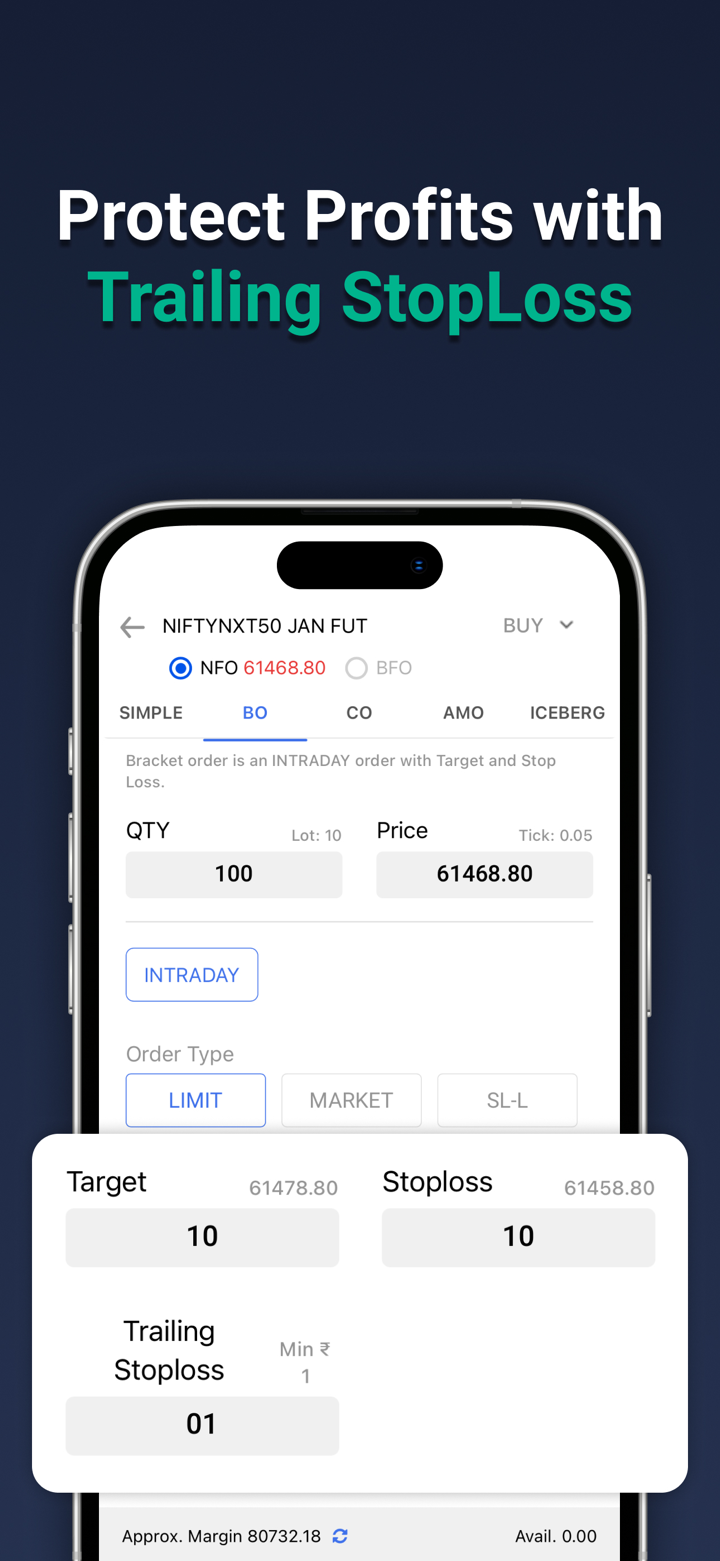

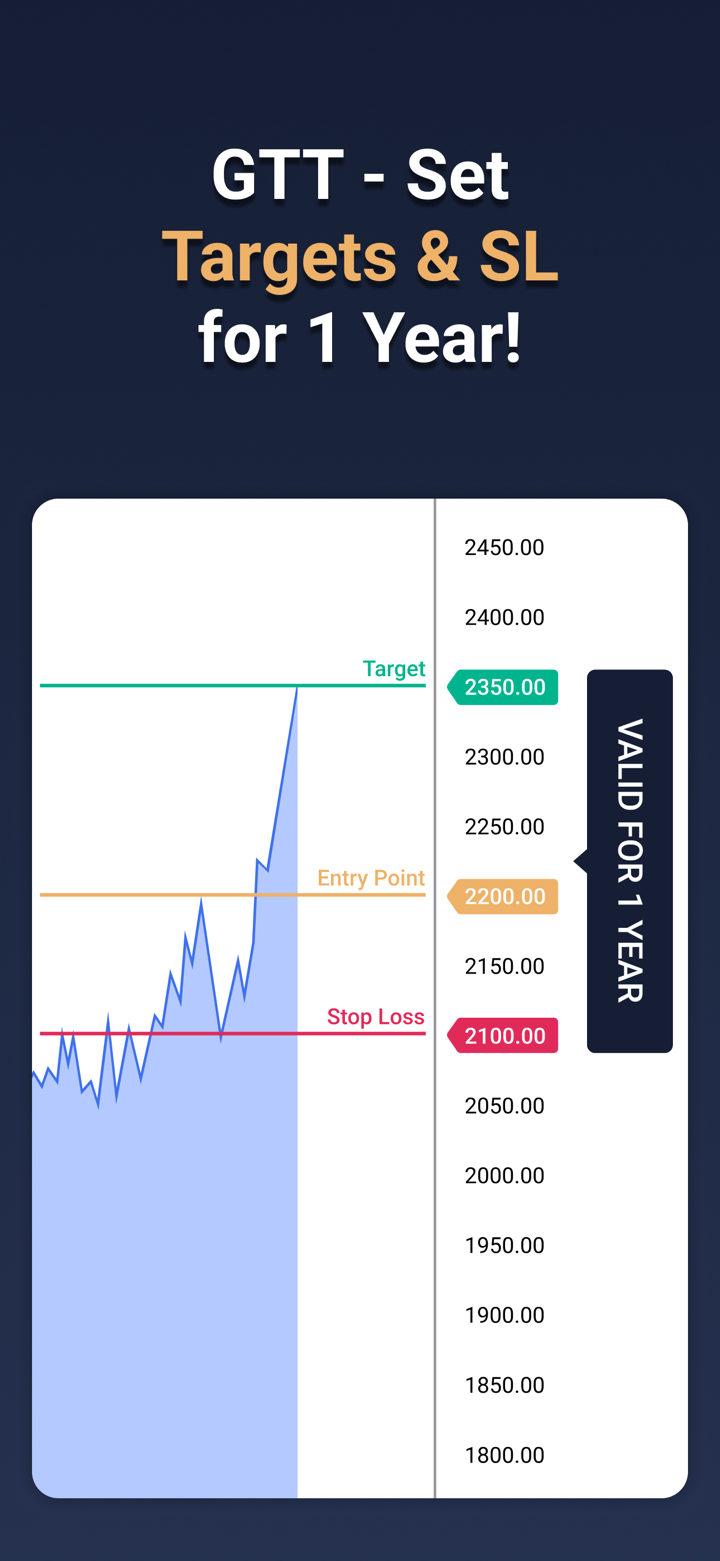

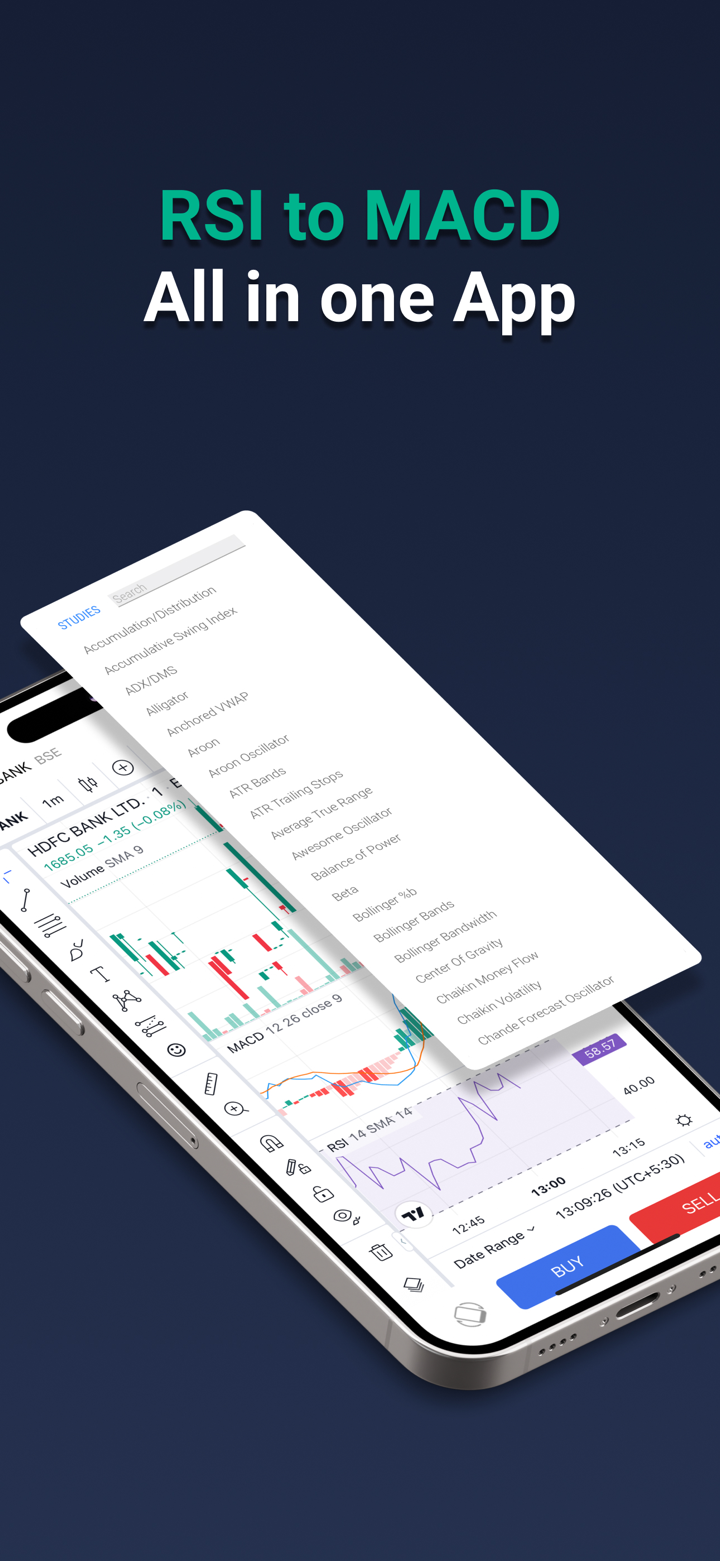

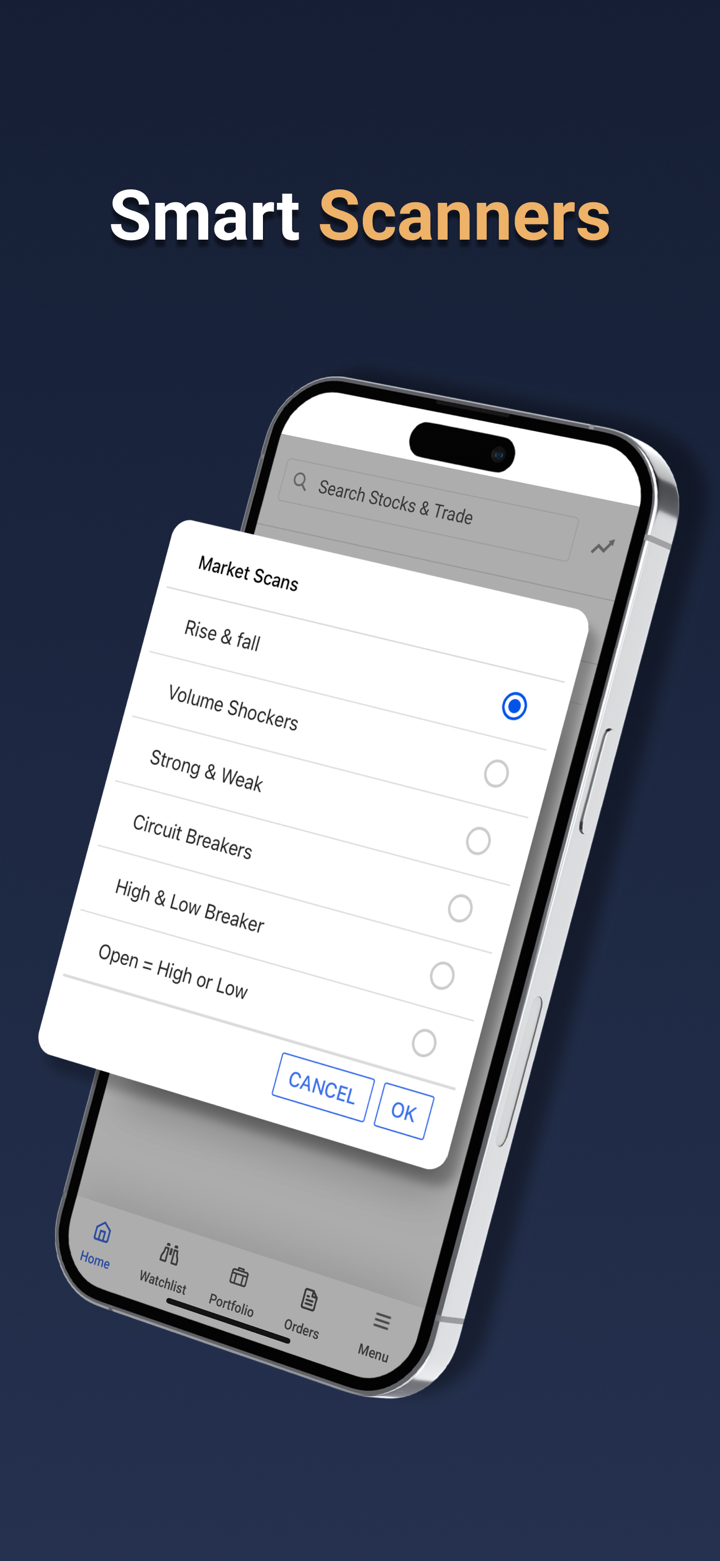

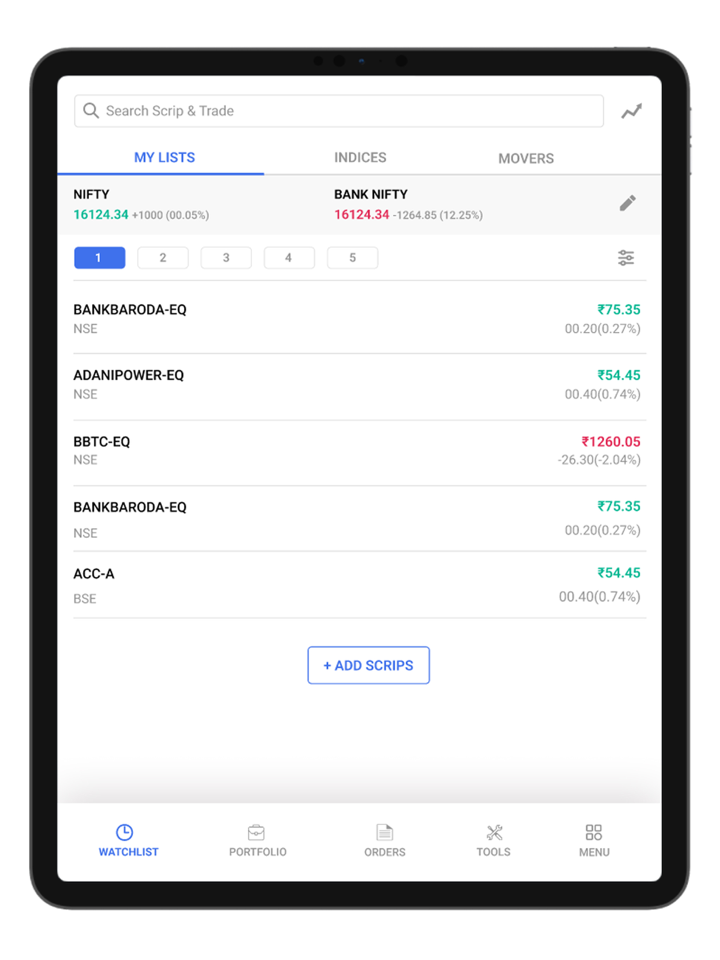

TraderSmart의 제품에는 다양한 거래 도구가 포함되어 있습니다: TradeSmart 모바일 앱, TradeSmart 데스크톱, TradeSmart 웹, TradeSmart API, BOX, TradeSmart MF, 인스타옵션, 그리고 통합.

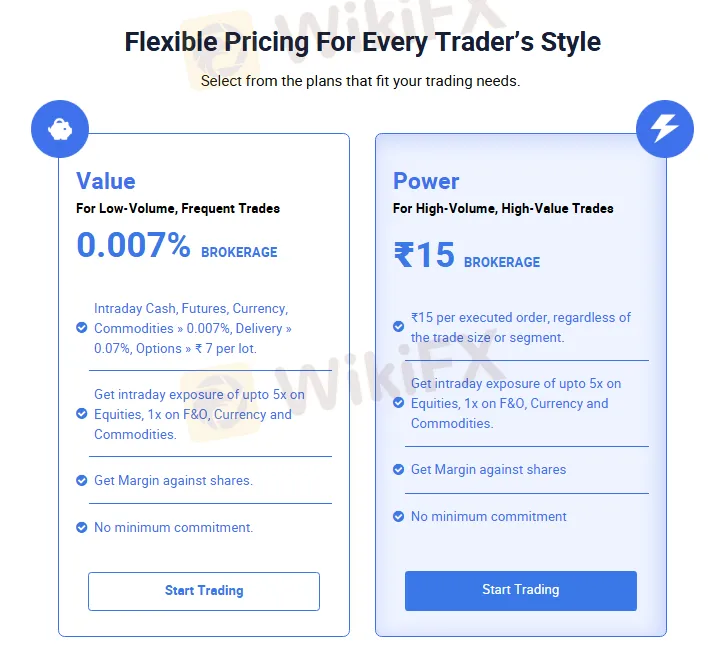

계정 유형 및 수수료

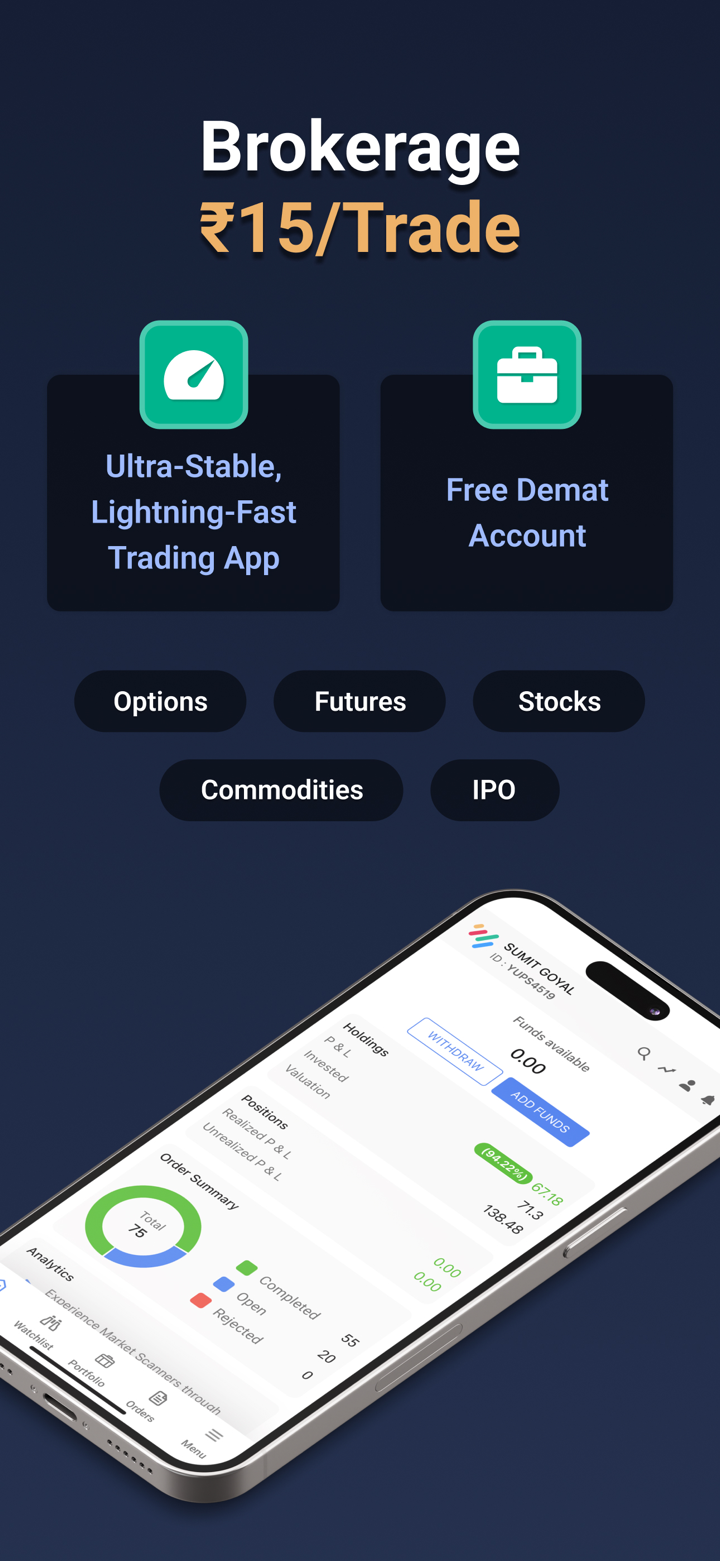

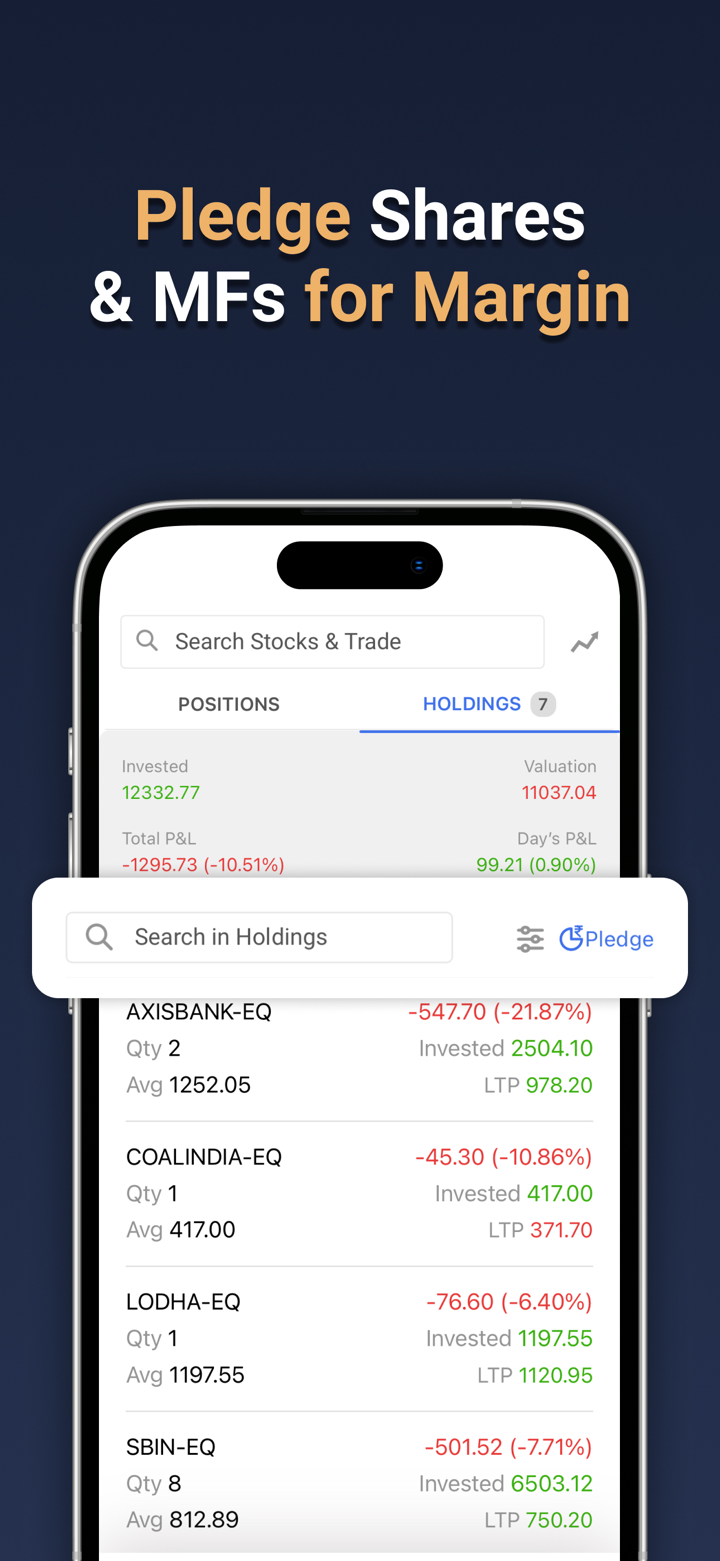

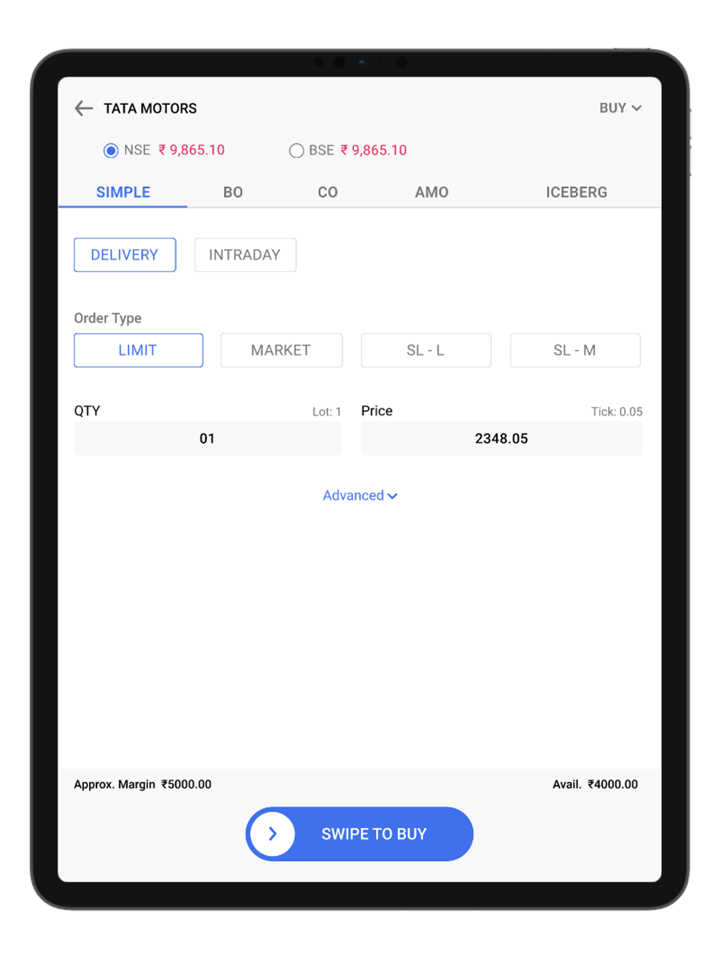

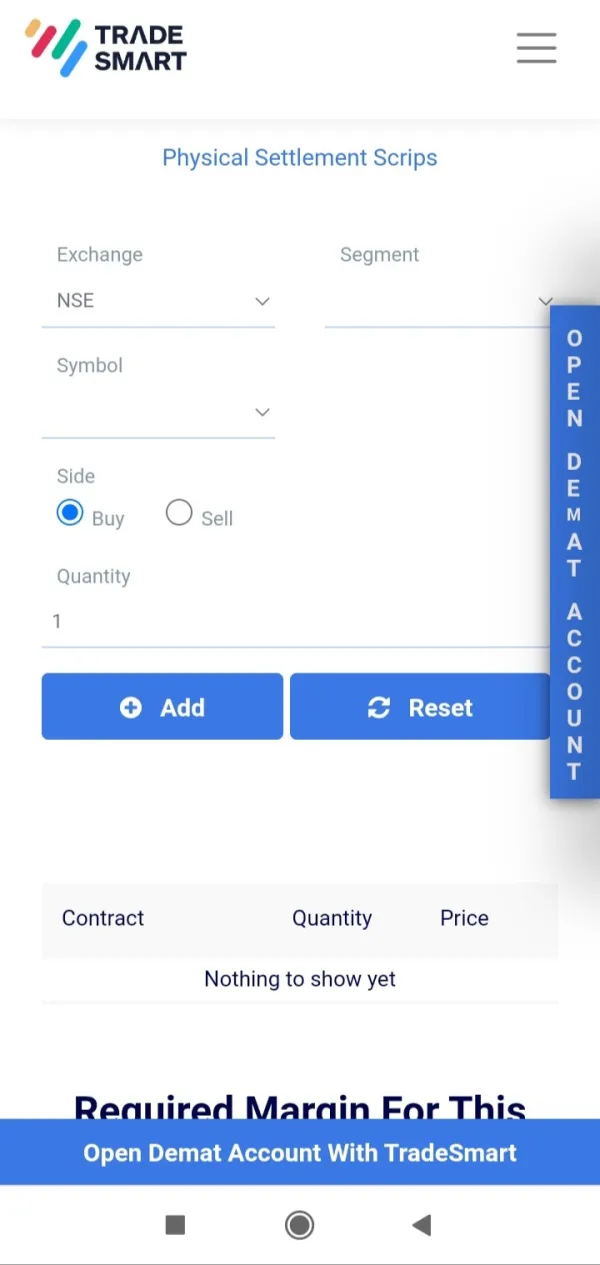

TradeSmart은 거래자들에게 거래용 Demat 계정을 제공합니다. 거래자들이 선택할 수 있는 두 가지 프로그램인 Value와 Power가 있습니다.

Demat 계정의 주요 역할은 유가증권의 저장, 관리, 거래를 디지털화하여 투자자들에게 효율적이고 안전하며 투명한 투자 경험을 제공하는 것입니다.

아래는 두 가지 계정 계획에 대한 정보입니다:

| Value 계정 | Power 계정 | |

| 대상 거래자 | 저거래량, 고빈도 거래자 | 고거래량, 고가치 거래자 |

| 수수료 | 0.007% | 주문당 ₹15 (거래 규모나 유형에 관계없이) |

| 당일 현금, 선물, 통화 | 저거래량, 고빈도 거래에 적합 | 고거래량, 고가치 거래에 적합 |

| 상품 > 0.007%, 배송 > 0.07%, 옵션 > ₹7 per lot | 저가 상품 및 옵션 거래 지원 | 고가 상품 및 옵션 거래 지원 |

| 레버리지 | 주식, F&O, 통화, 상품 최대 1:5 | 주식, F&O, 통화, 상품 최대 1:5 |

| 주식 담보 대출 지원 | 예 | 예 |

| 최소 약정 | 아니요 | 아니요 |

레버리지

TradeSmart은 주식, F&O, 통화, 상품에 대해 1:5의 레버리지를 제공합니다. 고 레버리지는 이익 뿐만 아니라 손실도 증폭시킬 수 있음을 유의하십시오.

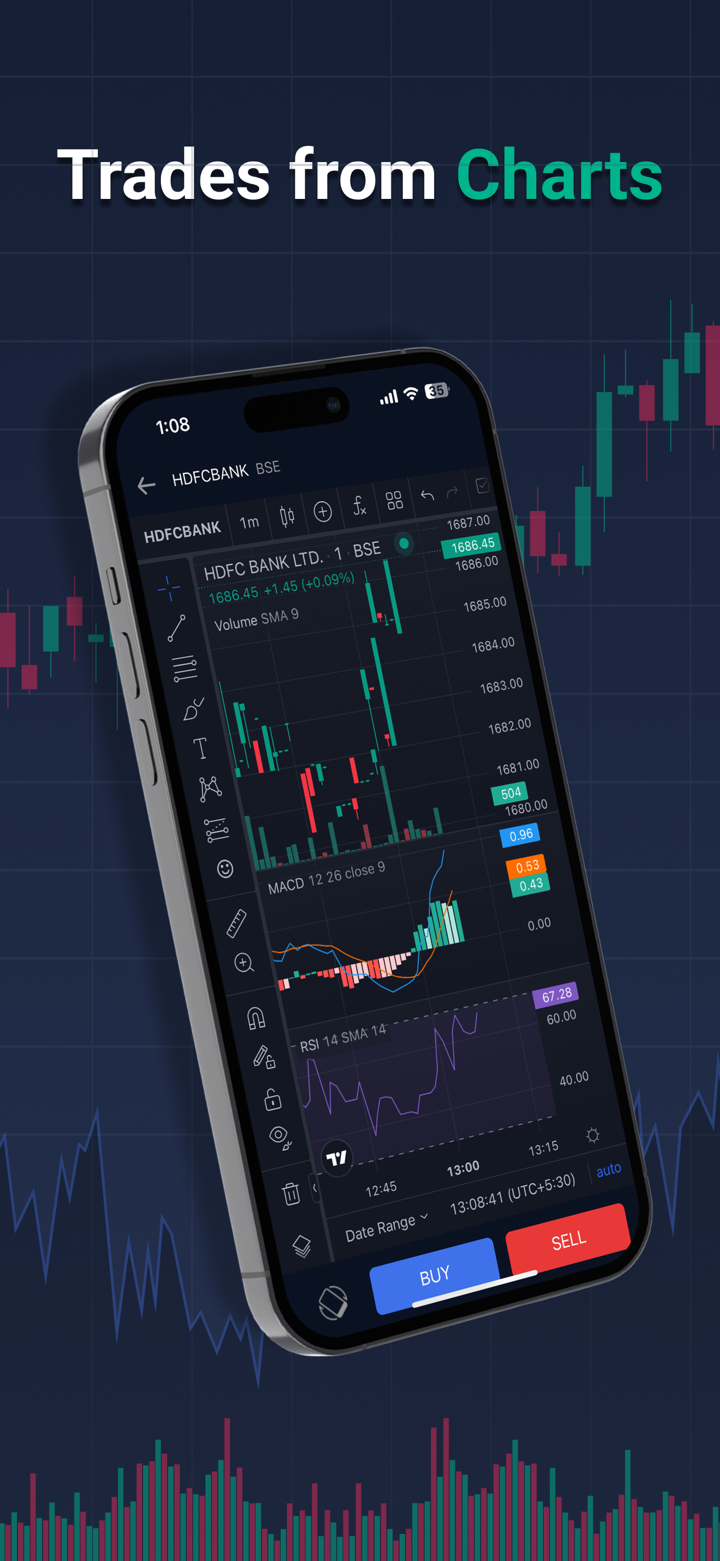

거래 플랫폼

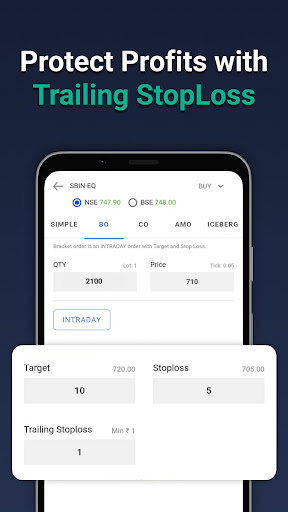

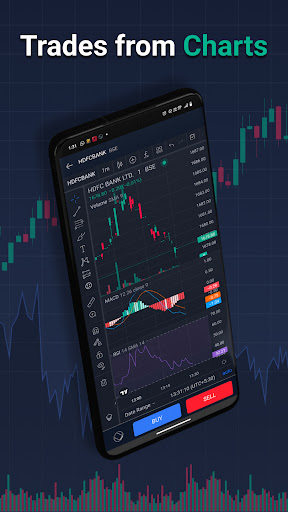

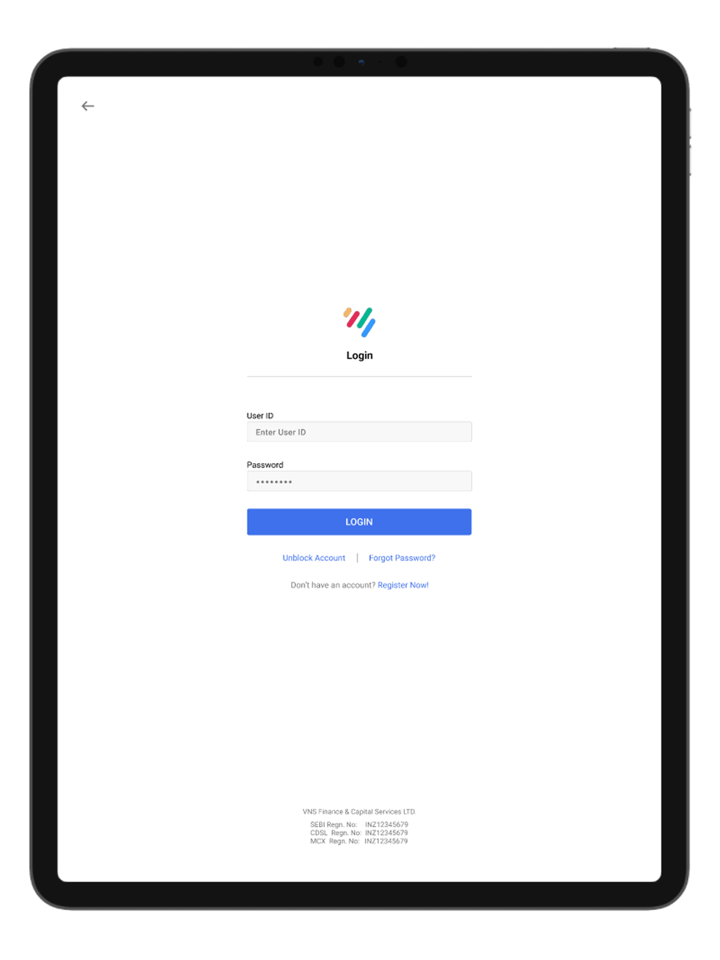

TradeSmart은(는) 독점적인 TraderSmart APP을(를) 사용한 거래를 지원합니다. 이 플랫폼에서 거래 시 수수료로 거래 당 Rs. 15가 부과됩니다.

| 거래 플랫폼 | 지원 여부 | 사용 가능한 장치 | 적합 대상 |

| TraderSmart | ✔ | 데스크톱, 모바일, 웹 | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |

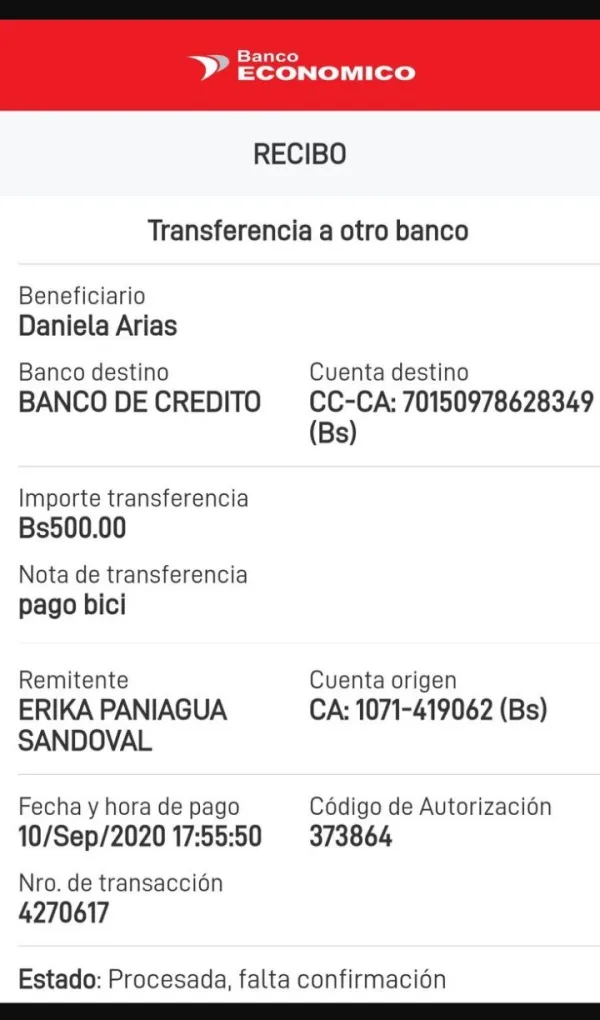

입출금

TraderSmart은(는) 은행 송금 및 NEFT 송금을 통한 결제를 받습니다.

아래에 나열된 총 29개 은행이 지원됩니다:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank, and AU Small Finance Bank.