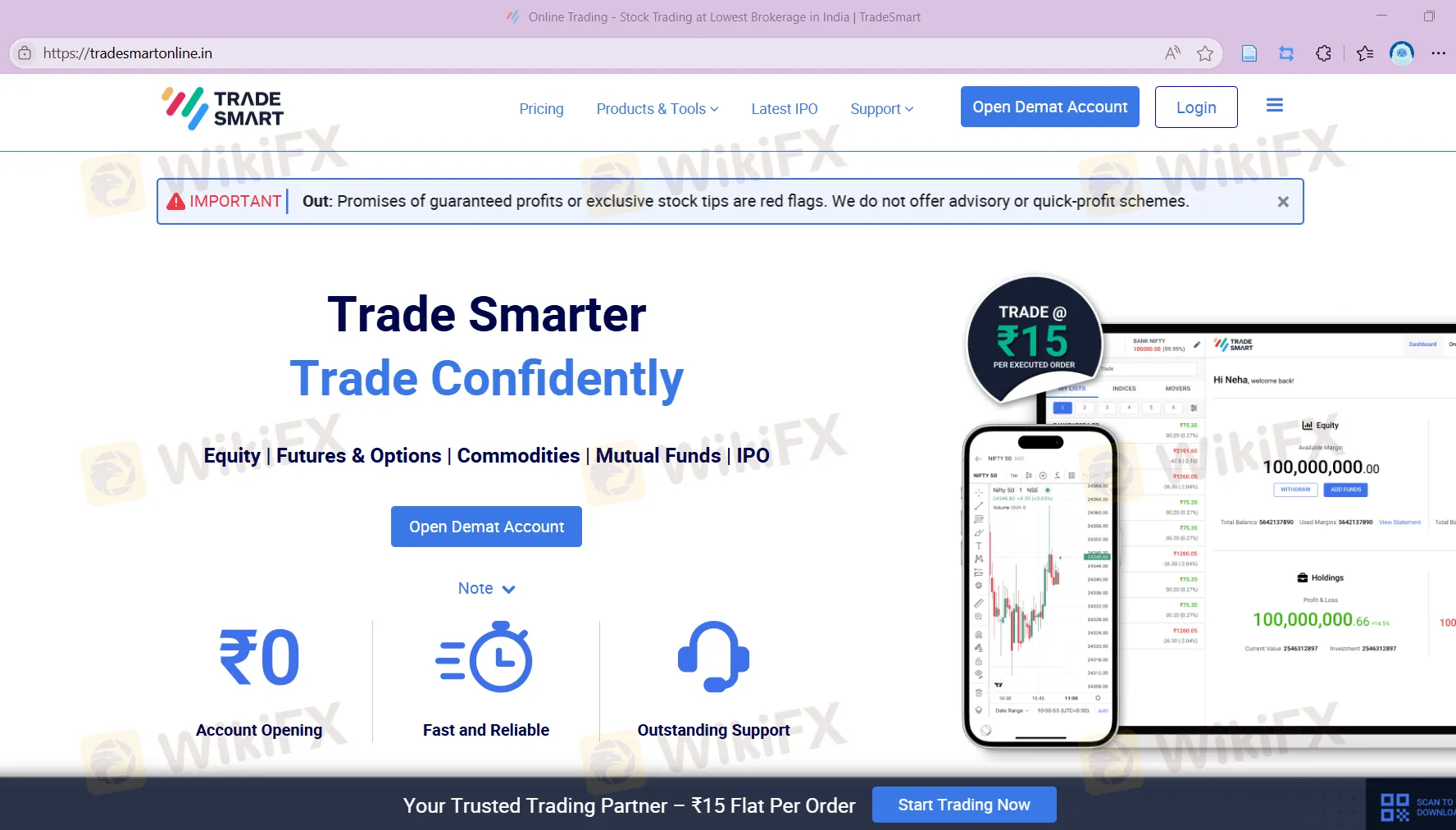

Profil perusahaan

| TradeSmartRingkasan Ulasan | |

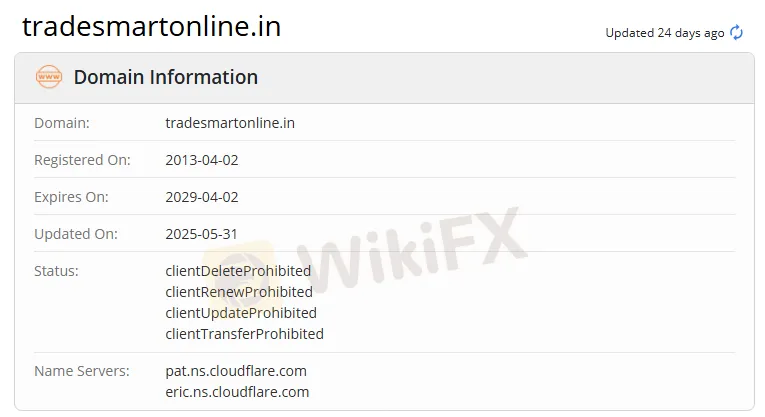

| Didirikan | 2013 |

| Negara/Daerah Terdaftar | India |

| Regulasi | Tidak Diatur |

| Instrumen Perdagangan | Saham, futures, opsi, mata uang, dan komoditas |

| Produk | TradeSmart Aplikasi Seluler, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, dan Integrasi |

| Daya Ungkit | Hingga 1:5 |

| Spread | / |

| Platform Perdagangan | Aplikasi TraderSmart |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: +91 022-61208000 |

| Email: contactus@vnsfin. com | |

| Media Sosial: Facebook, Twitter, Instagram, LinkedIn, YouTube, Telegram | |

| Alamat: A-401, Mangalya, Marol, Andheri East, Mumbai - 400059 | |

Informasi TradeSmart

Didirikan pada tahun 2013 dan berkantor pusat di India, TradeSmart adalah penyedia layanan keuangan. Perusahaan ini menawarkan beragam alat dan platform perdagangan, termasuk TradeSmart Aplikasi Seluler, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, dan Integrasi. Untuk memenuhi kebutuhan klien yang berbeda, perusahaan memiliki dua jenis akun: Akun Nilai untuk pedagang frekuensi rendah dan kecil, dan Akun Power untuk pedagang frekuensi tinggi dan volume tinggi.

Namun, saat ini TradeSmart tidak diatur dan legitimasinya menjadi perhatian.

Pro dan Kontra

| Pro | Kontra |

| Berbagai produk ditawarkan | Tidak diatur |

| Informasi terbatas tentang fitur akun | |

| Struktur biaya yang tidak jelas | |

| Informasi terbatas tentang deposit dan penarikan |

Apakah TradeSmart Legal?

No. TradeSmart tidak diatur, dan para trader harus berhati-hati saat melakukan trading.

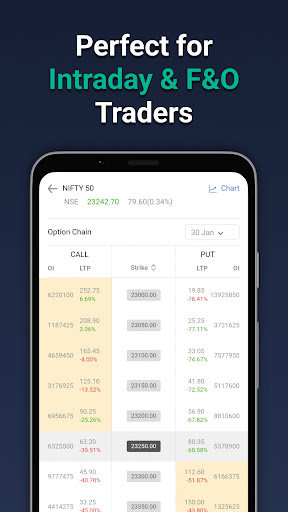

Apa yang Bisa Saya Perdagangkan di TraderSmart?

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| Futures | ✔ |

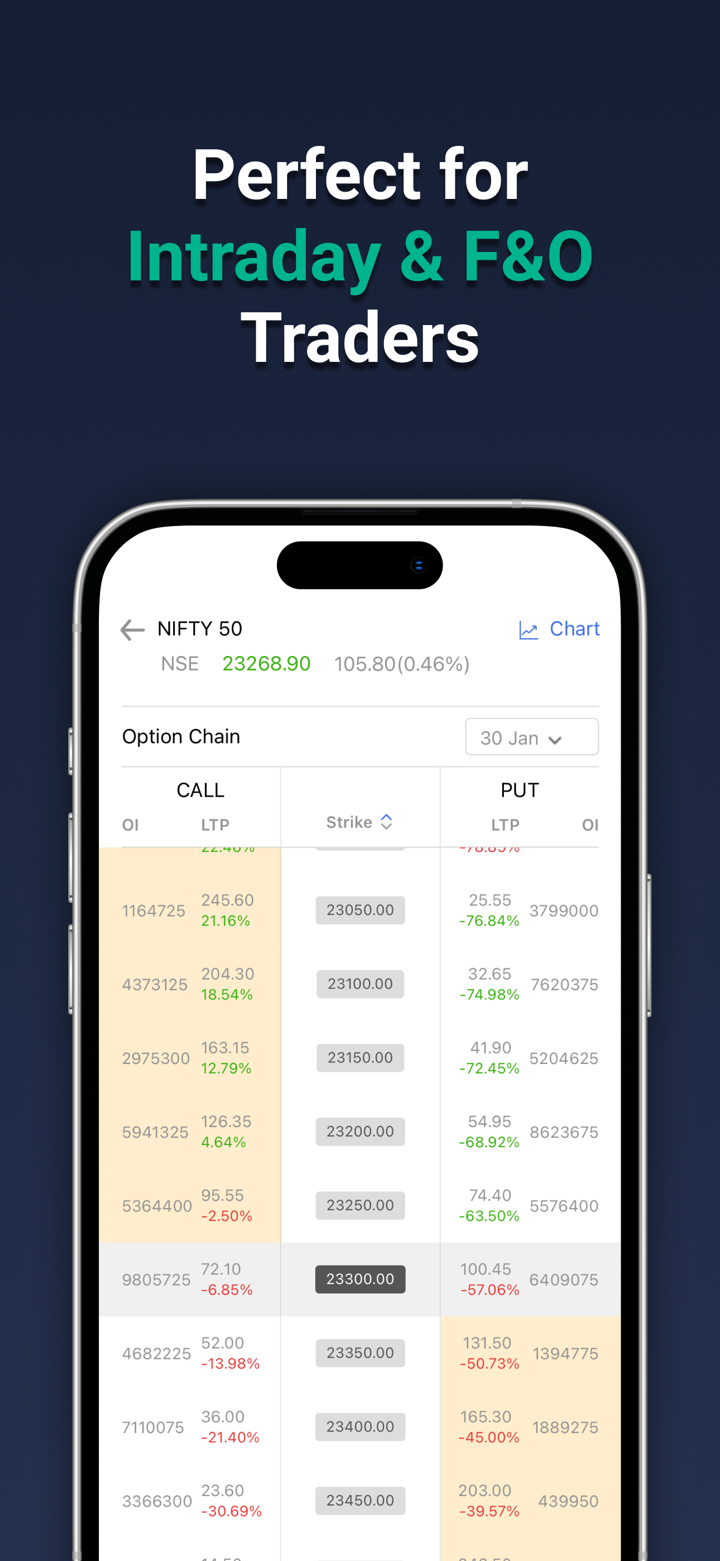

| Opsi | ✔ |

| Mata Uang | ✔ |

| Komoditas | ✔ |

| Indeks | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| ETF | ❌ |

Produk

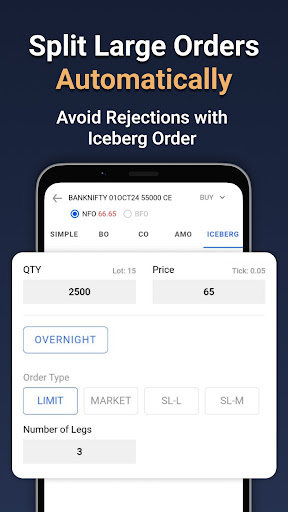

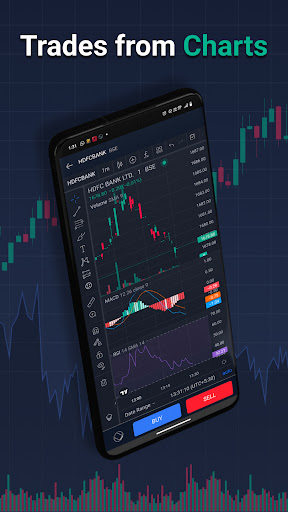

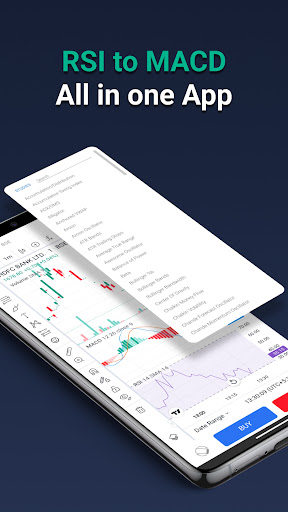

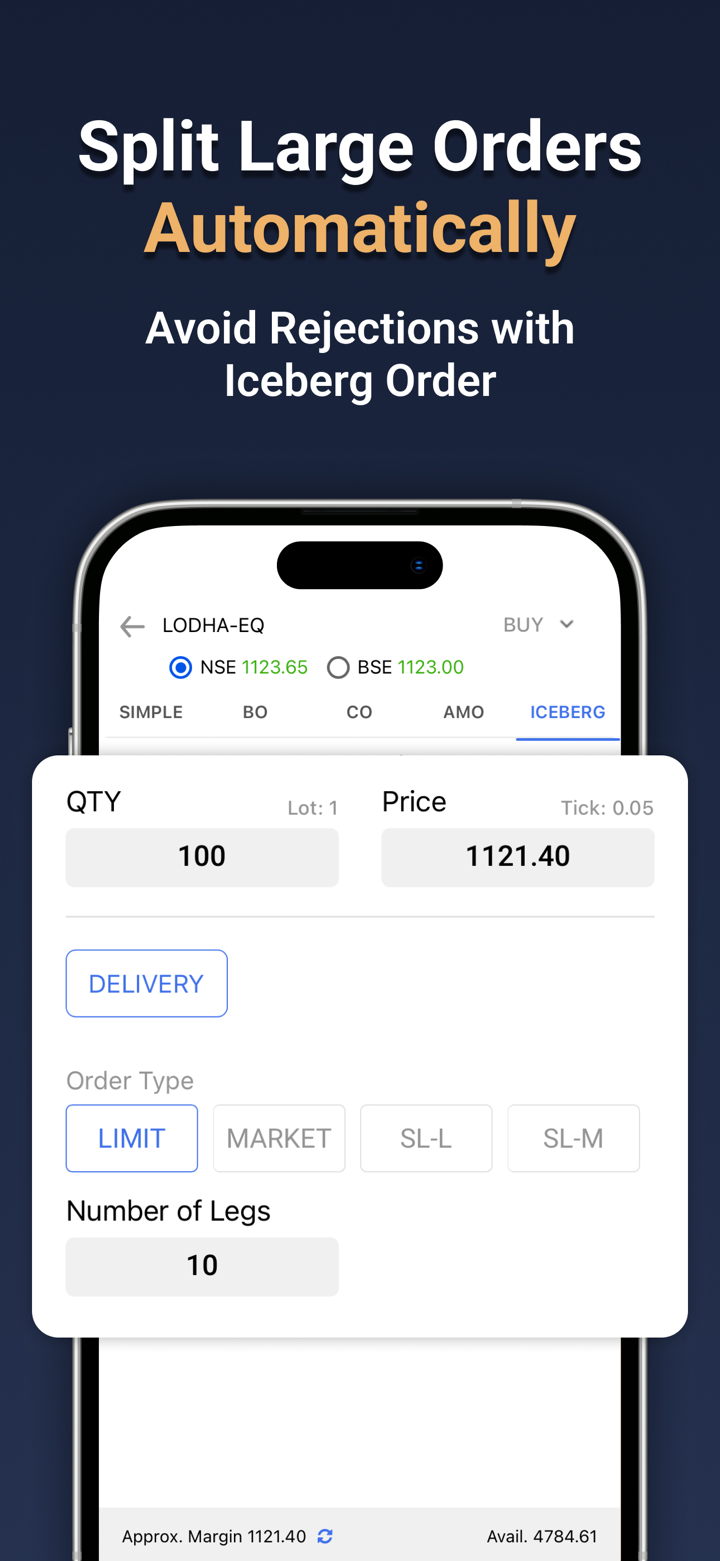

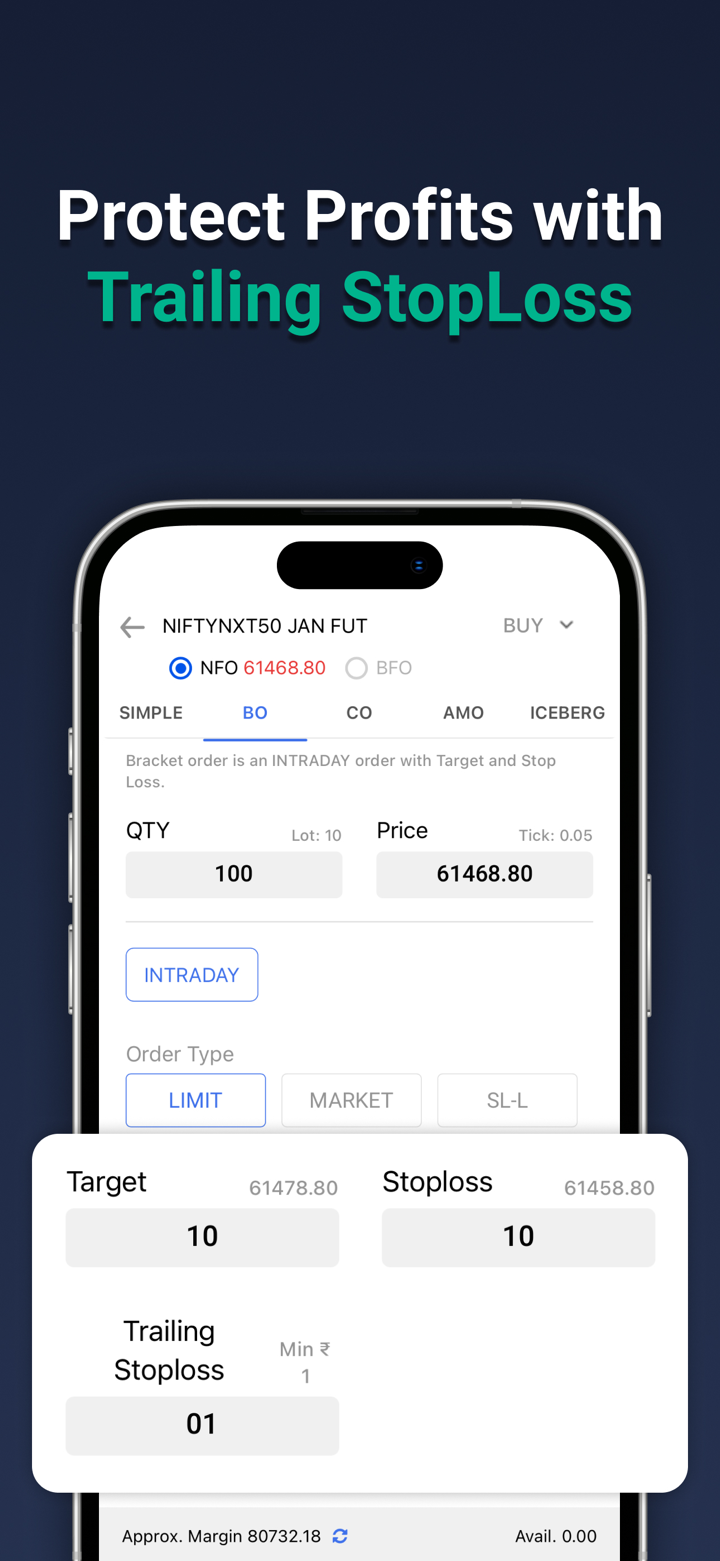

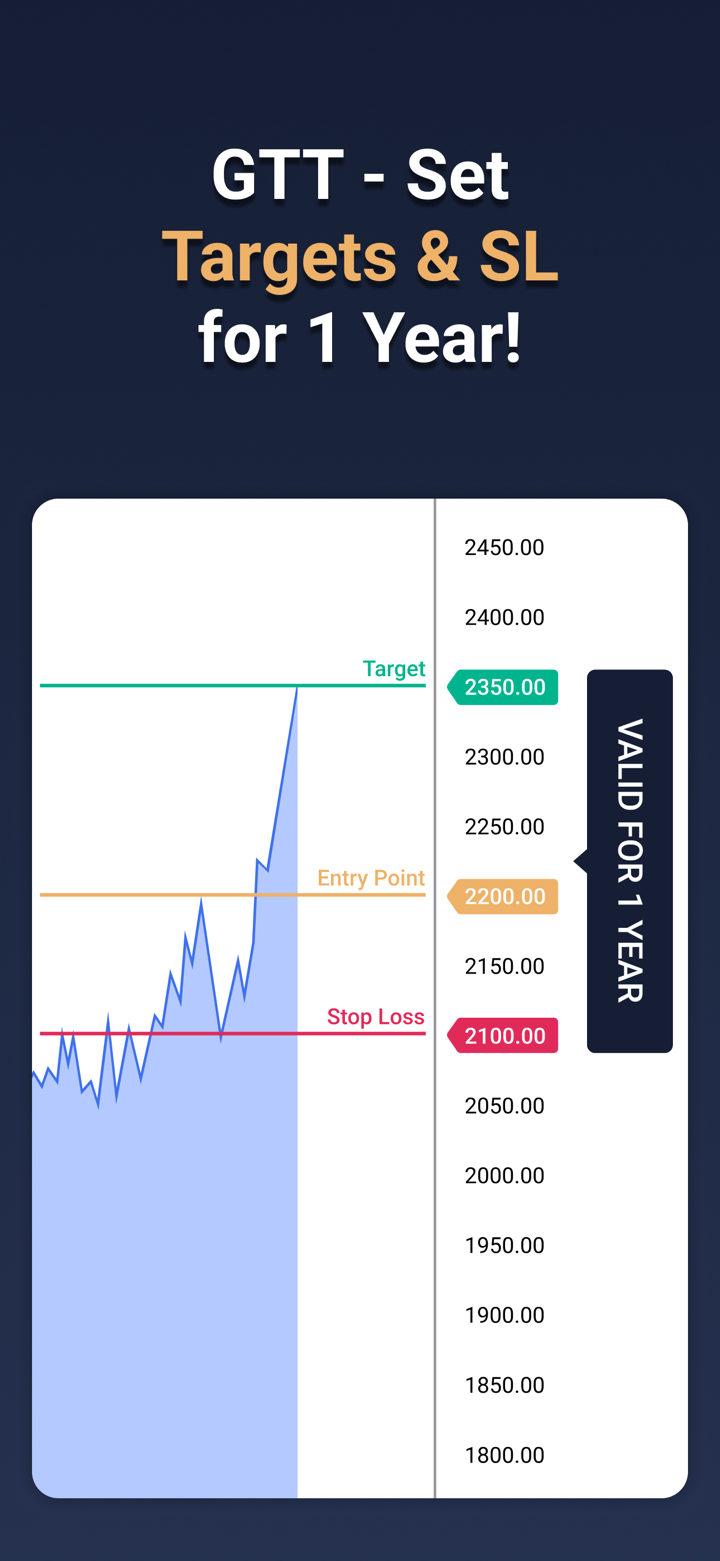

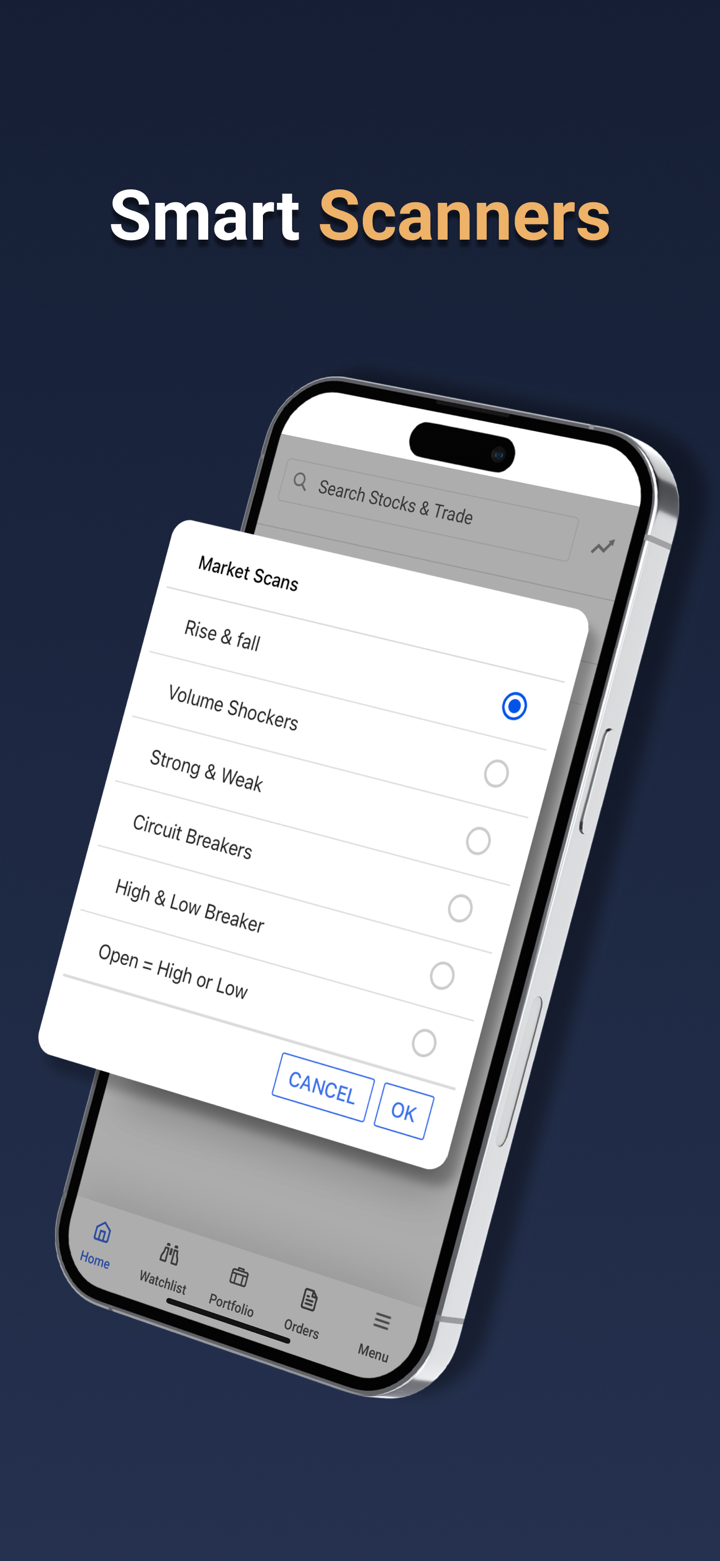

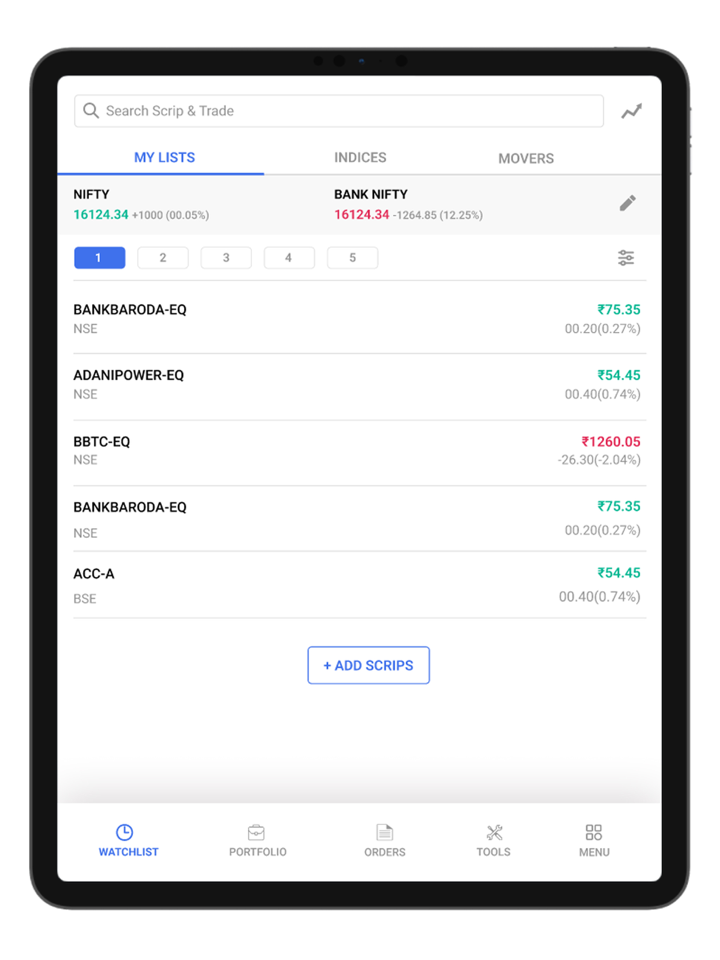

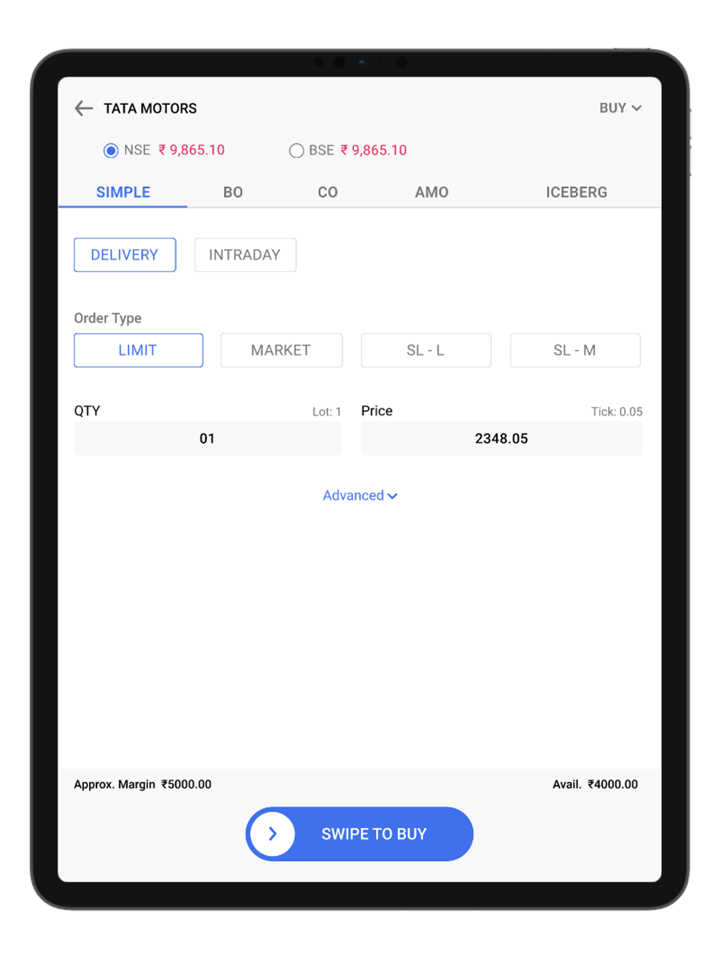

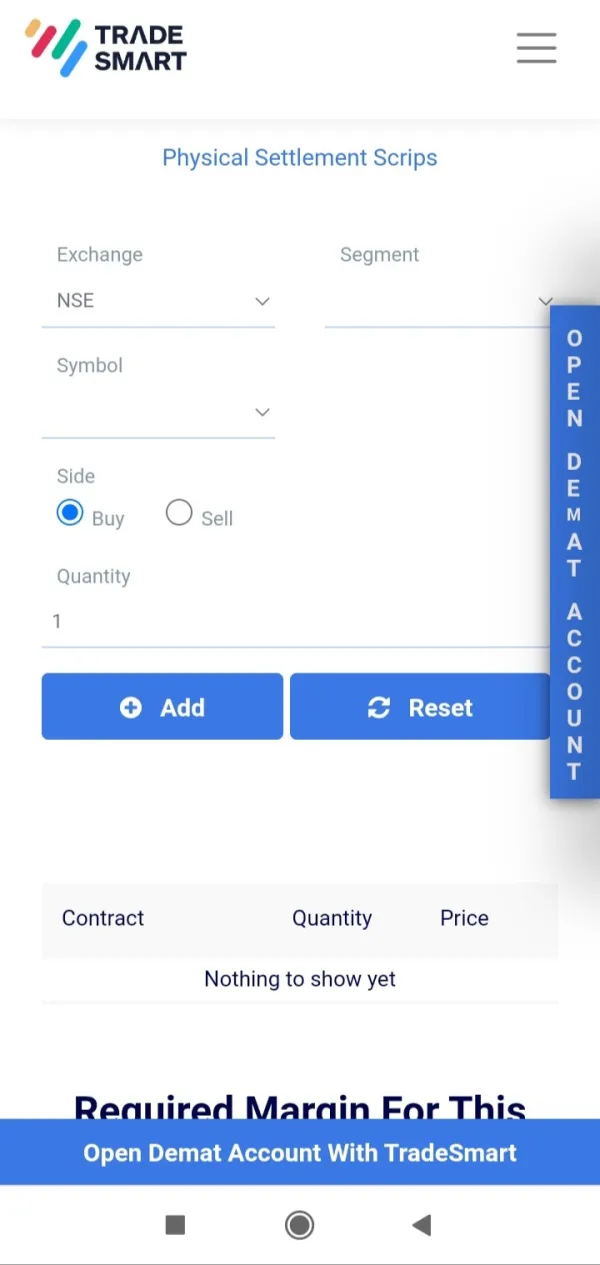

Produk-produk TraderSmart meliputi berbagai alat trading: Aplikasi Seluler TradeSmart, Desktop TradeSmart, Web TradeSmart, API TradeSmart, BOX, TradeSmart MF, Instaoption, dan Integrasi.

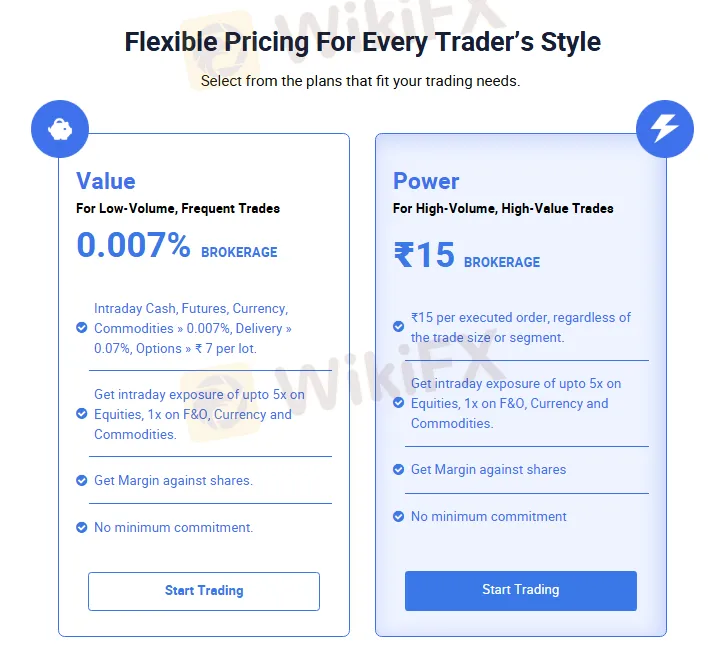

Jenis Akun & Biaya

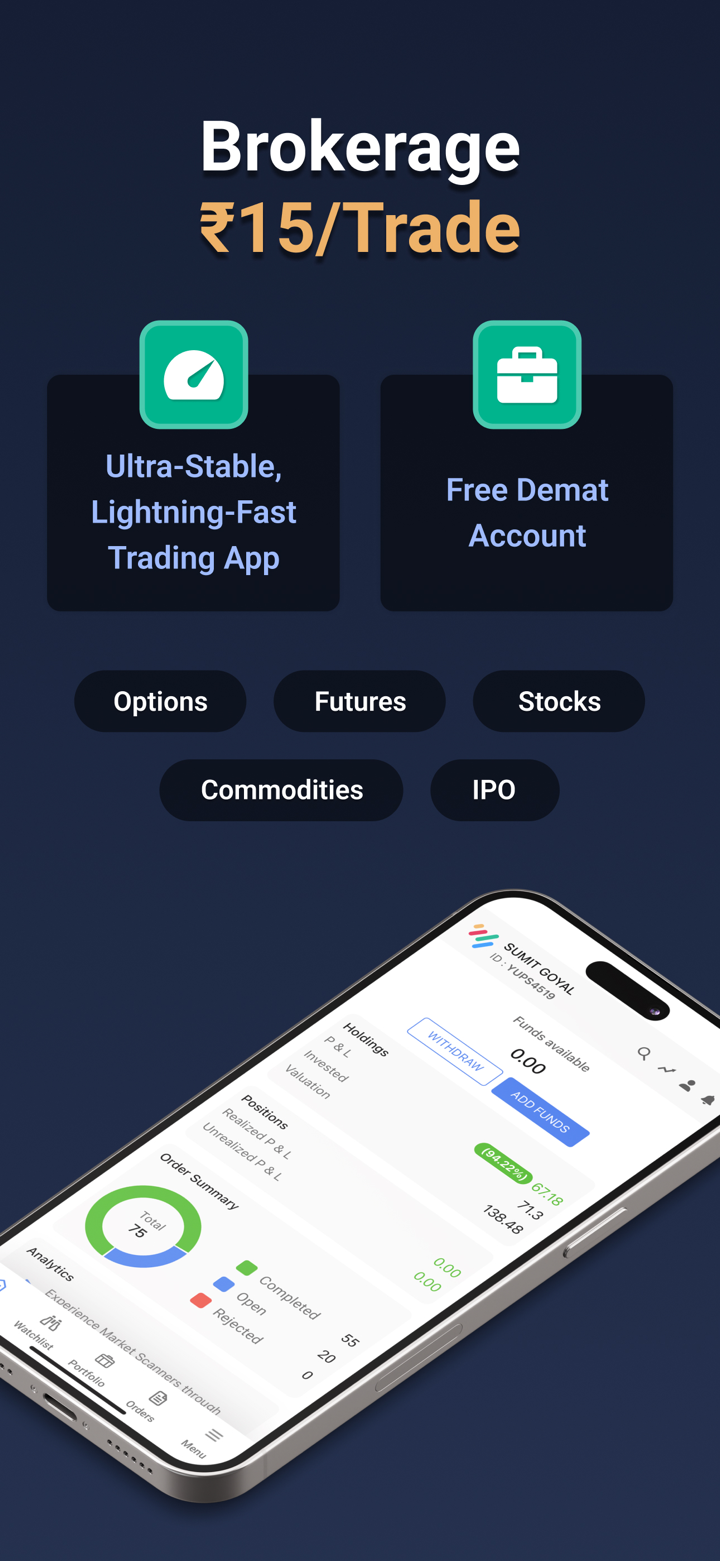

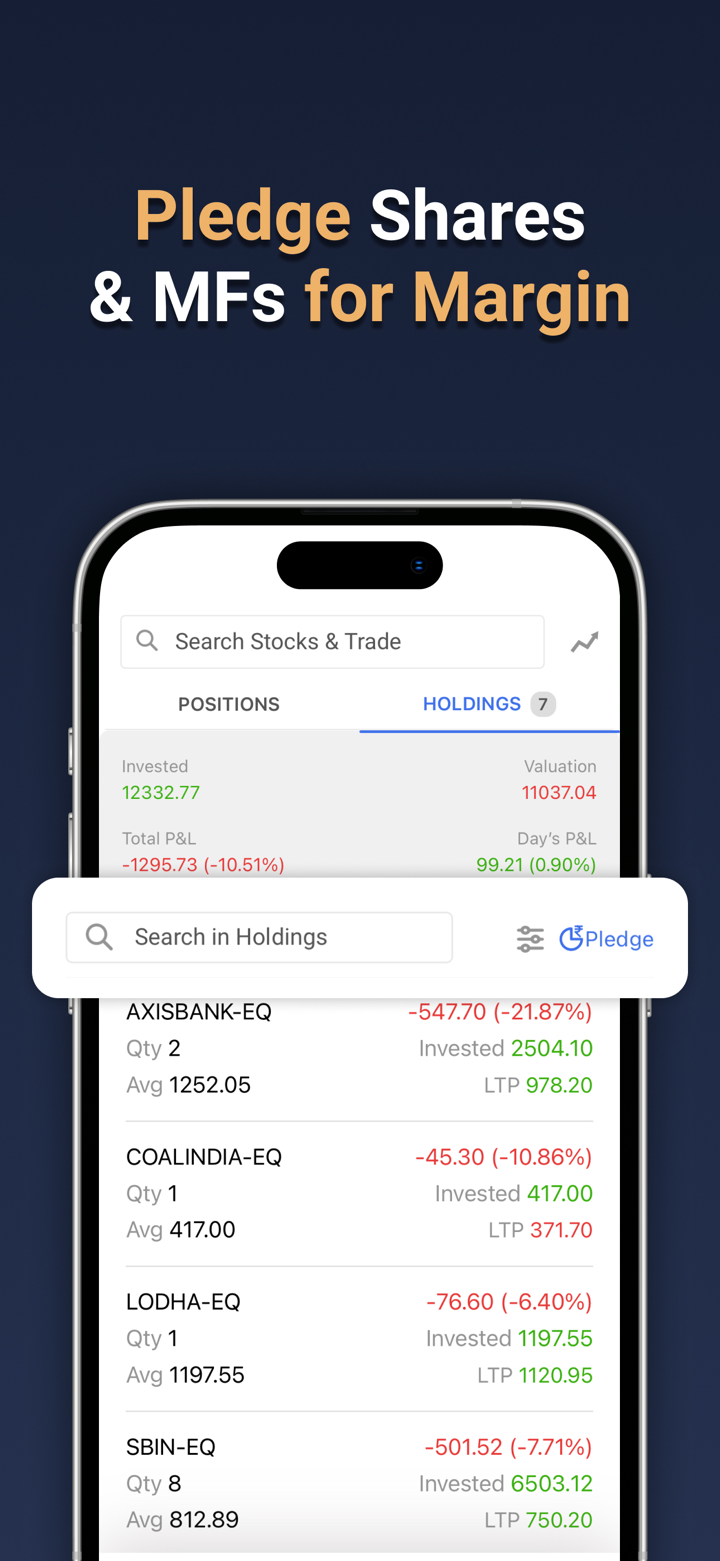

TradeSmart menawarkan para trader akun Demat untuk trading. Terdapat dua program berbeda yang tersedia: Value dan Power, untuk para trader memilih.

Peran utama dari akun Demat adalah untuk mendigitalkan penyimpanan, manajemen, dan trading sekuritas, memberikan pengalaman investasi yang efisien, aman, dan transparan bagi investor.

Berikut adalah informasi tentang dua rencana akun:

| Akun Value | Akun Power | |

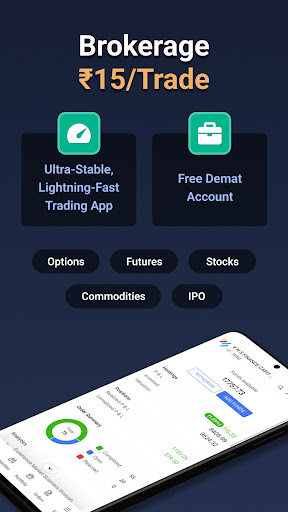

| Trader Target | Trader volume rendah, frekuensi tinggi | Trader volume tinggi, nilai tinggi |

| Biaya Broker | 0.007% | ₹15 per order (tidak peduli ukuran atau jenis trading) |

| Intraday Cash, Futures, Currency | Cocok untuk trading volume rendah, frekuensi tinggi | Cocok untuk trading volume tinggi, nilai tinggi |

| Komoditas > 0.007%, Pengiriman > 0.07%, Opsi > ₹7 per lot | Mendukung trading komoditas dan opsi dengan biaya rendah | Mendukung trading komoditas dan opsi dengan biaya tinggi |

| Daya Ungkit | Hingga 1:5 (Ekuitas, F&O, Mata Uang, dan Komoditas) | Hingga 1:5 (Ekuitas, F&O, Mata Uang, dan Komoditas) |

| Dukungan Margin Terhadap Saham | Ya | Ya |

| Komitmen Minimum | Tidak | Tidak |

Daya Ungkit

TradeSmart memiliki daya ungkit 1:5 pada saham, F&O, mata uang, dan komoditas. Harap dicatat bahwa daya ungkit tinggi dapat memperbesar tidak hanya keuntungan tetapi juga kerugian.

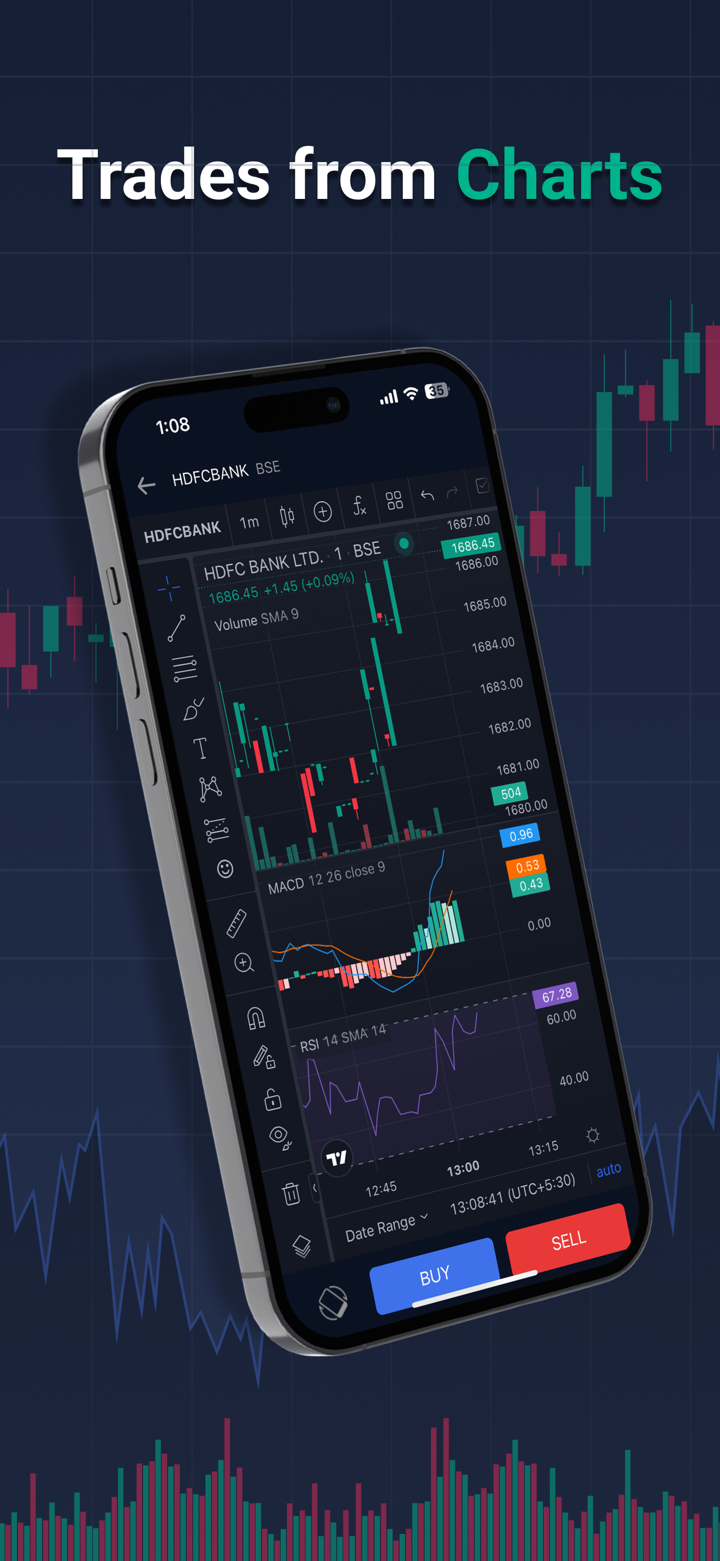

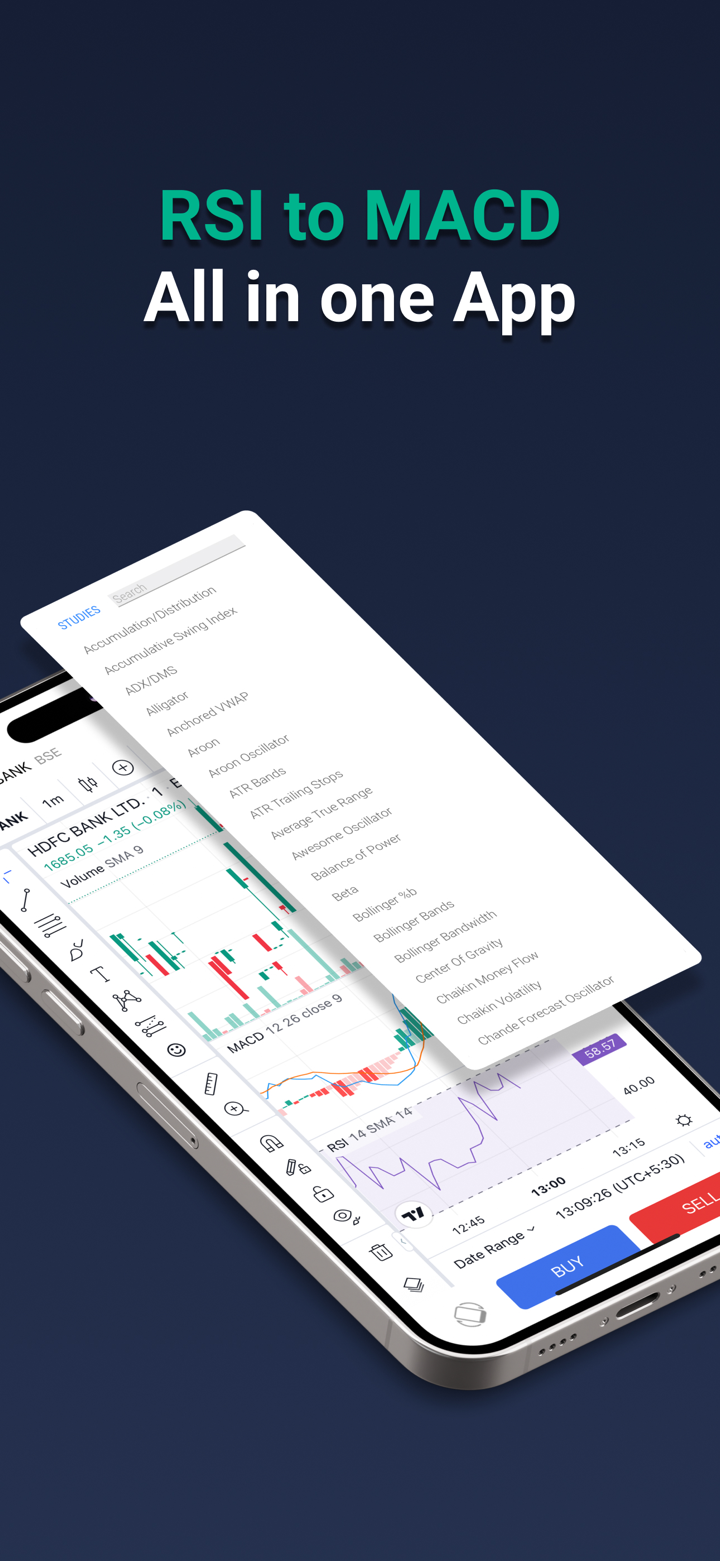

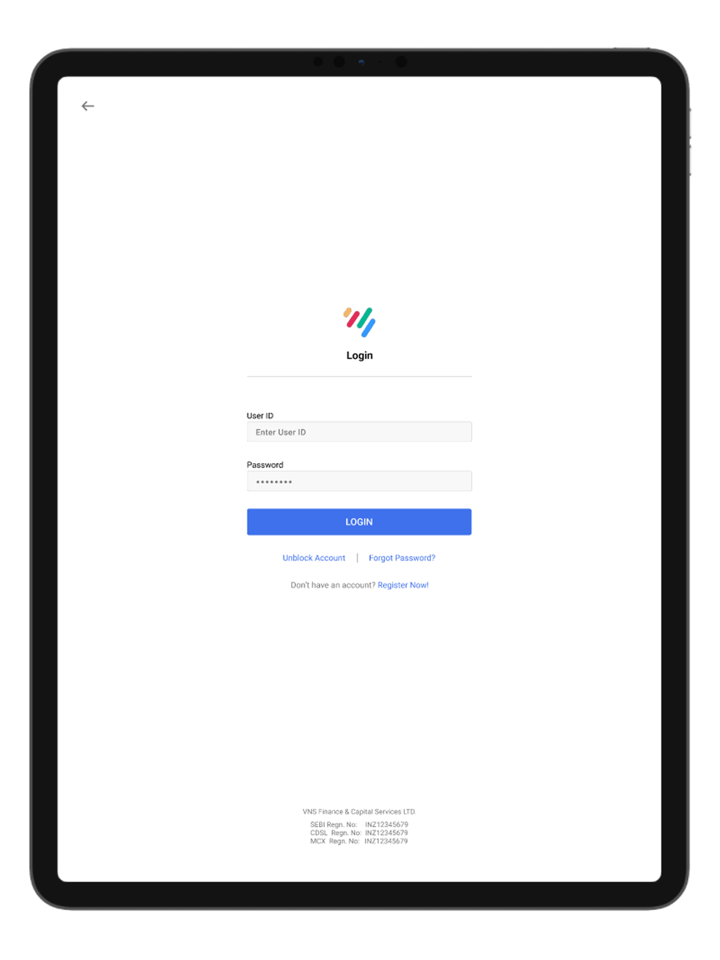

Platform Trading

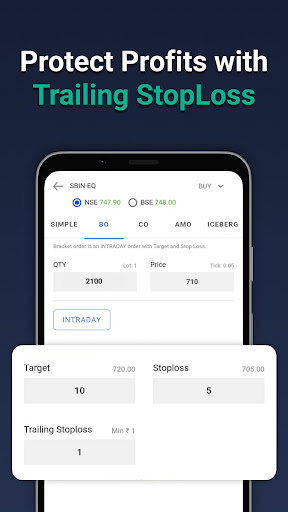

TradeSmart mendukung perdagangan menggunakan aplikasi TraderSmart APP. Hanya Rs. 15 per perdagangan yang dikenakan sebagai komisi untuk berdagang di platform ini.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| TraderSmart | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | / | Pedagang Berpengalaman |

Deposit dan Penarikan

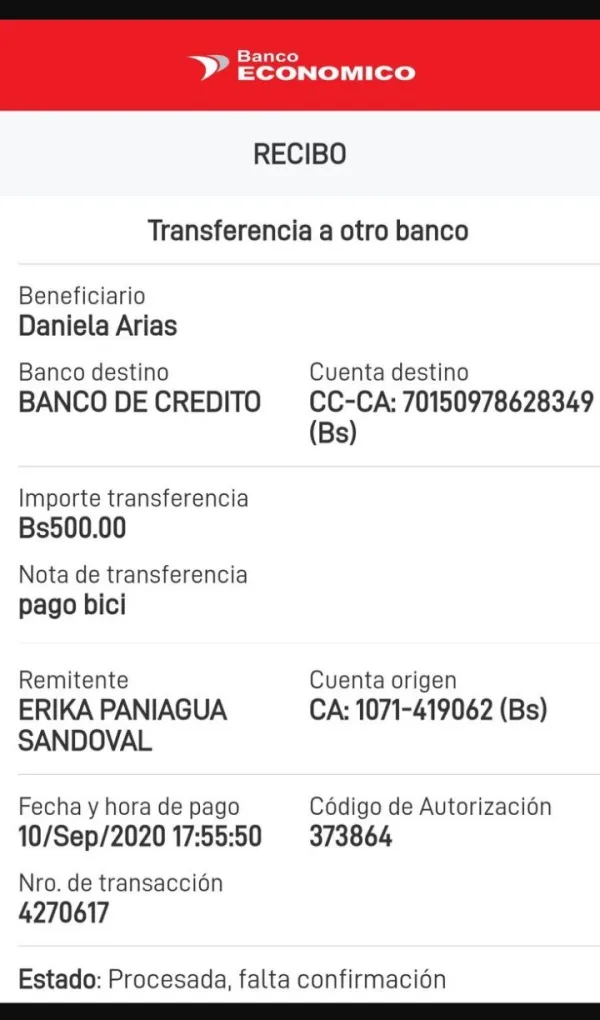

TraderSmart menerima pembayaran melalui transfer kawat bank dan transfer NEFT.

Sebanyak 29 bank didukung seperti yang tercantum di bawah ini:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank, dan AU Small Finance Bank.