Unternehmensprofil

| TradeSmartÜberprüfungszusammenfassung | ||

| Gegründet | 2013 | |

| Registriertes Land/Region | Indien | |

| Regulierung | Keine Regulierung | |

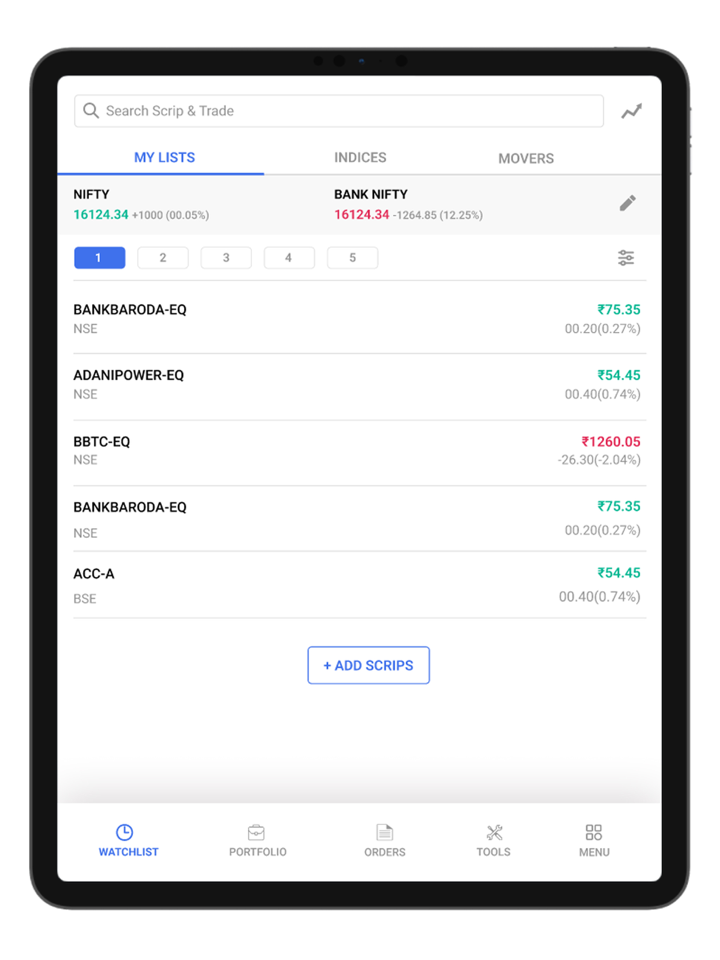

| Handelsinstrumente | Aktien, Futures, Optionen, Währungen und Rohstoffe | |

| Produkte | TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption und Integrationen | |

| Hebel | Spread | / |

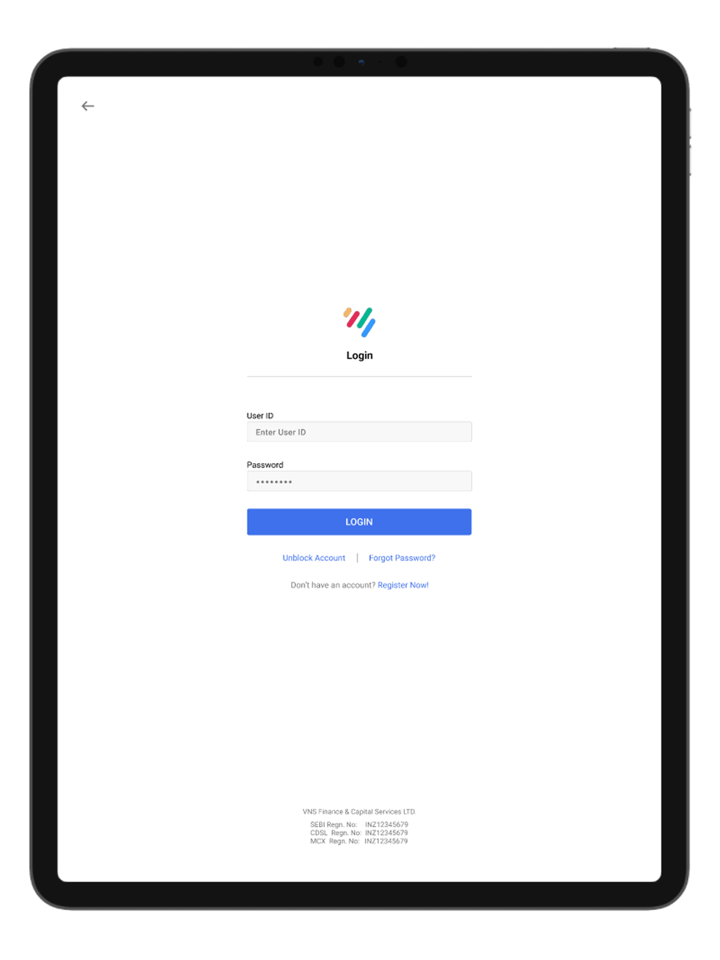

| Handelsplattform | TraderSmart APP | |

| Mindesteinzahlung | / | |

| Kundensupport | Telefon: +91 022-61208000 | |

| E-Mail: contactus@vnsfin. com | ||

| Soziale Medien: Facebook, Twitter, Instagram, LinkedIn, YouTube, Telegram | ||

| Adresse: A-401, Mangalya, Marol, Andheri East, Mumbai - 400059 | ||

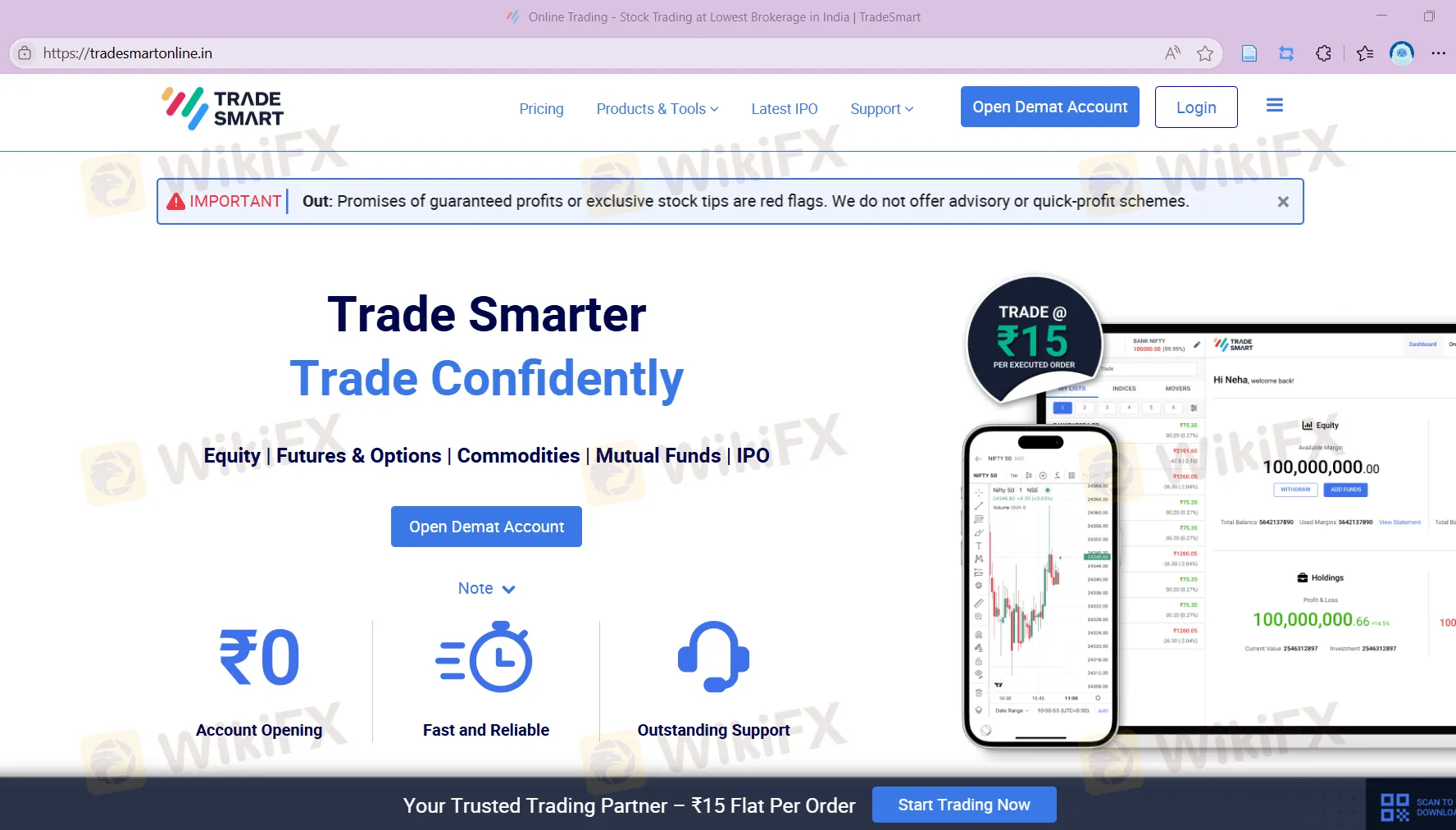

TradeSmart Informationen

Im Jahr 2013 gegründet und mit Hauptsitz in Indien ist TradeSmart ein Anbieter von Finanzdienstleistungen. Es bietet eine vielfältige Palette von Handelstools und Plattformen, darunter die TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption und Integrationen. Um den Bedürfnissen verschiedener Kunden gerecht zu werden, verfügt das Unternehmen über zwei Arten von Konten: Value-Konten für Gelegenheits- und Kleinanleger sowie Power-Konten für Vieltrader mit hohem Volumen.

Allerdings ist TradeSmart derzeit unreguliert, und seine Legitimität ist Grund zur Sorge.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene angebotene Produkte | Keine Regulierung |

| Begrenzte Informationen zu Kontofunktionen | |

| Unklare Gebührenstruktur | |

| Begrenzte Informationen zu Ein- und Auszahlungen |

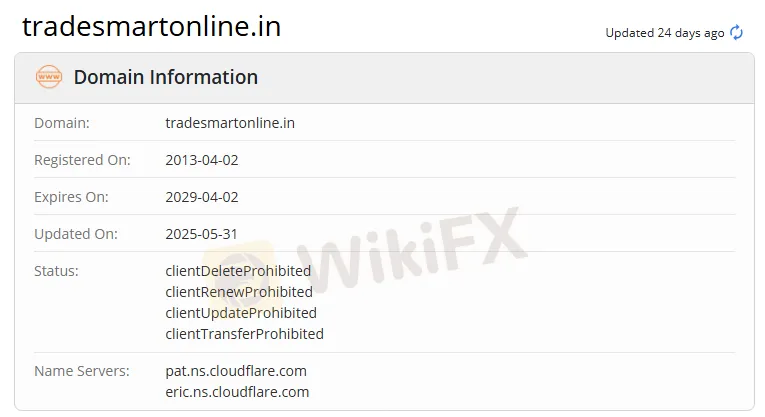

Ist TradeSmart legitim?

Nr. TradeSmart ist nicht reguliert, und Händler müssen beim Handel vorsichtig sein.

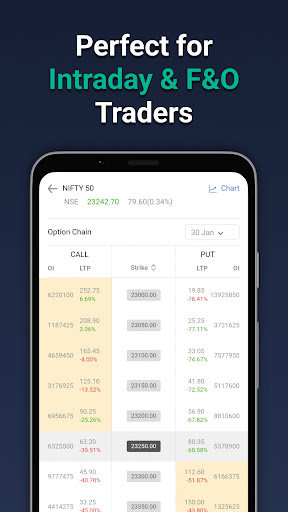

Was kann ich bei TraderSmart handeln?

| Handelsinstrumente | Unterstützt |

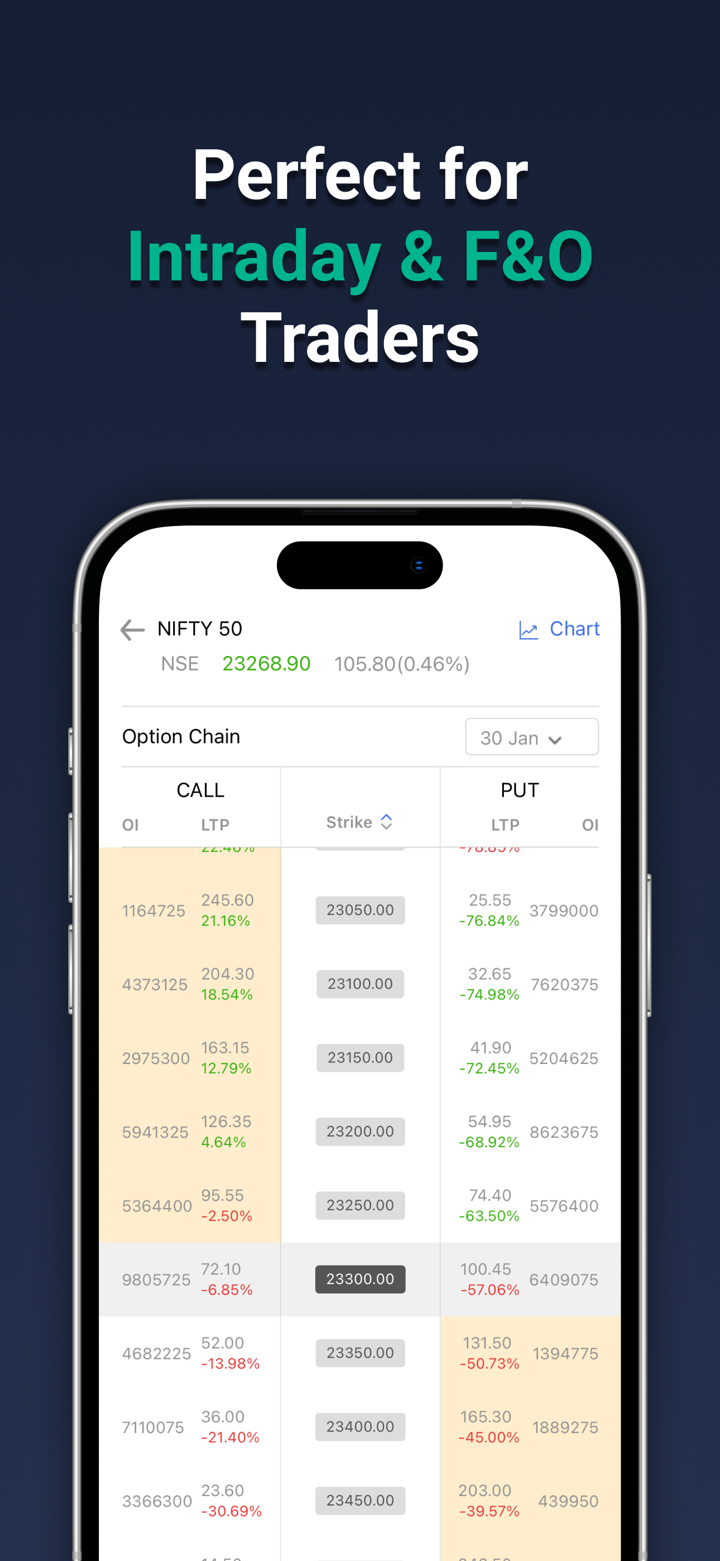

| Aktien | ✔ |

| Futures | ✔ |

| Optionen | ✔ |

| Währungen | ✔ |

| Waren | ✔ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| ETFs | ❌ |

Produkte

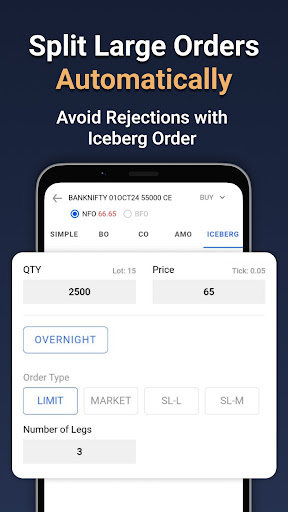

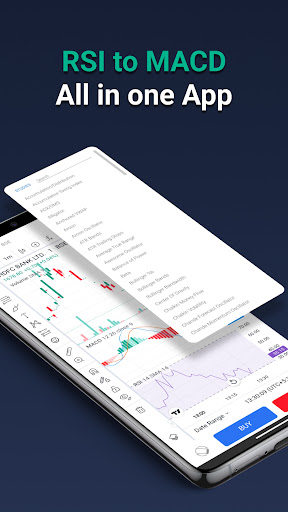

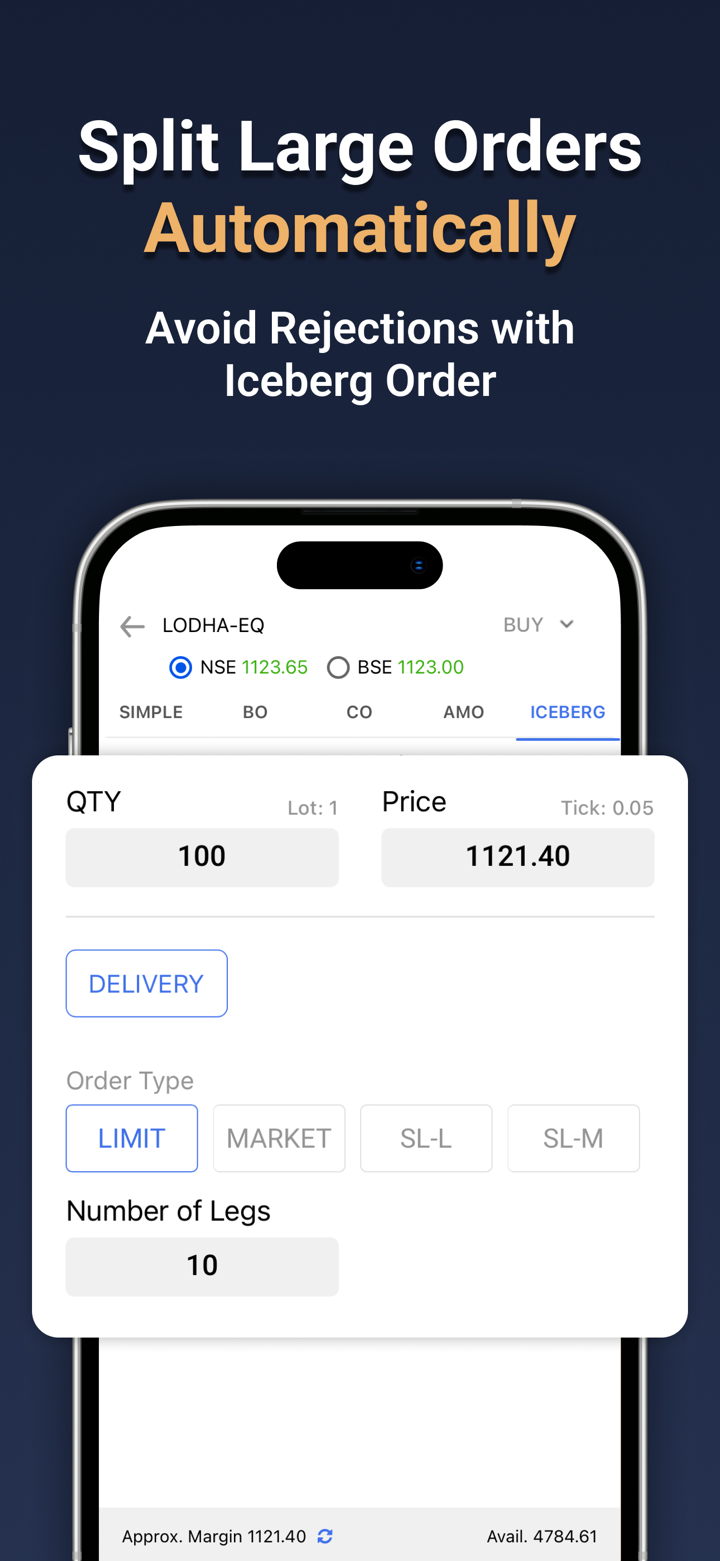

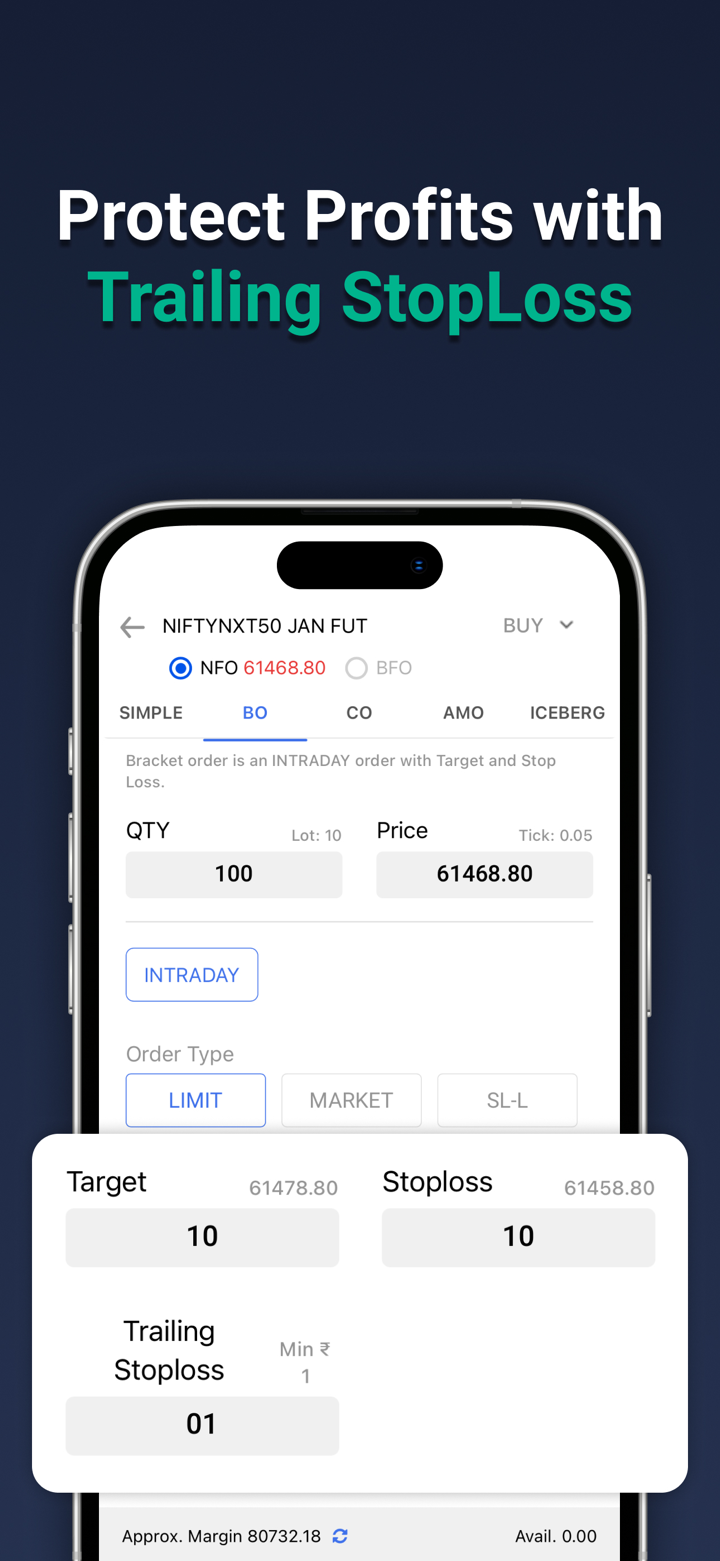

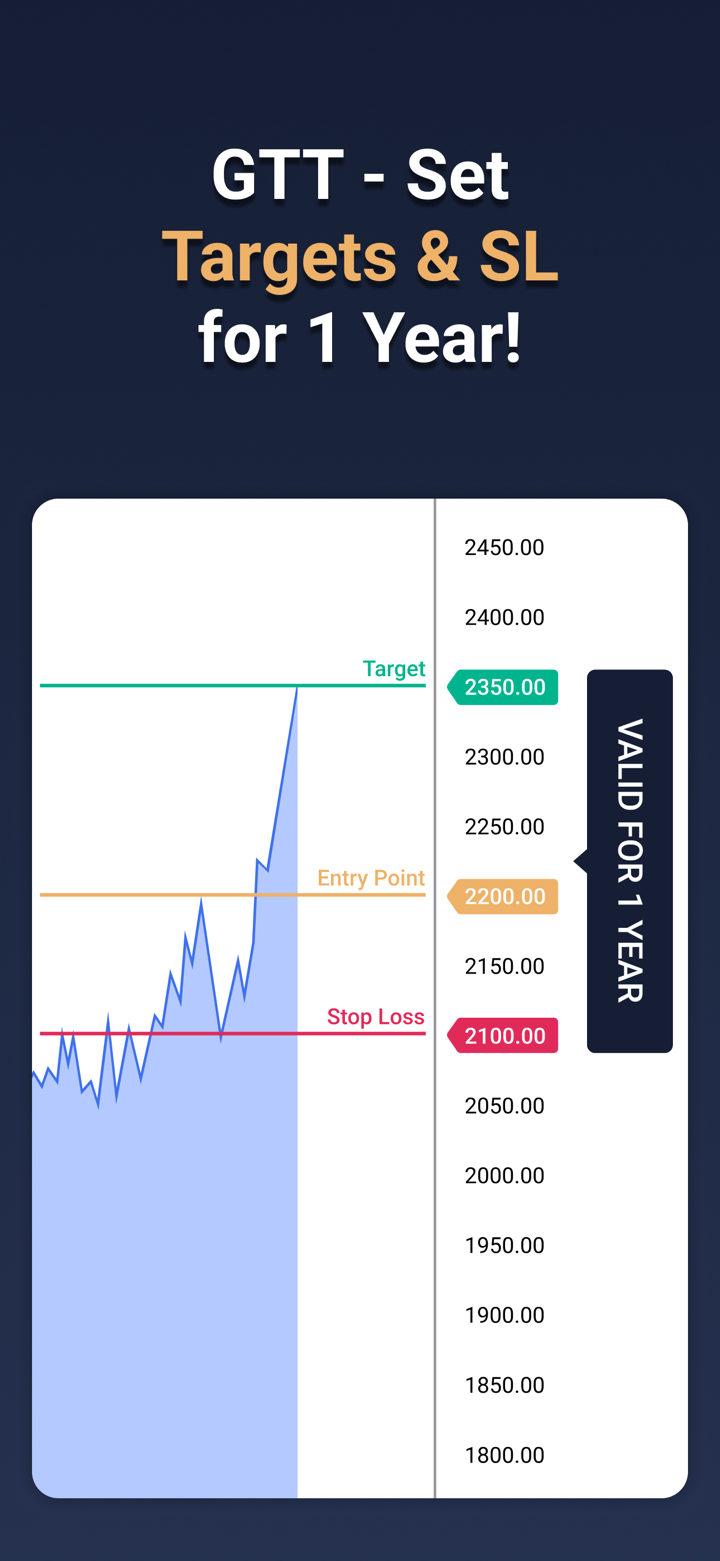

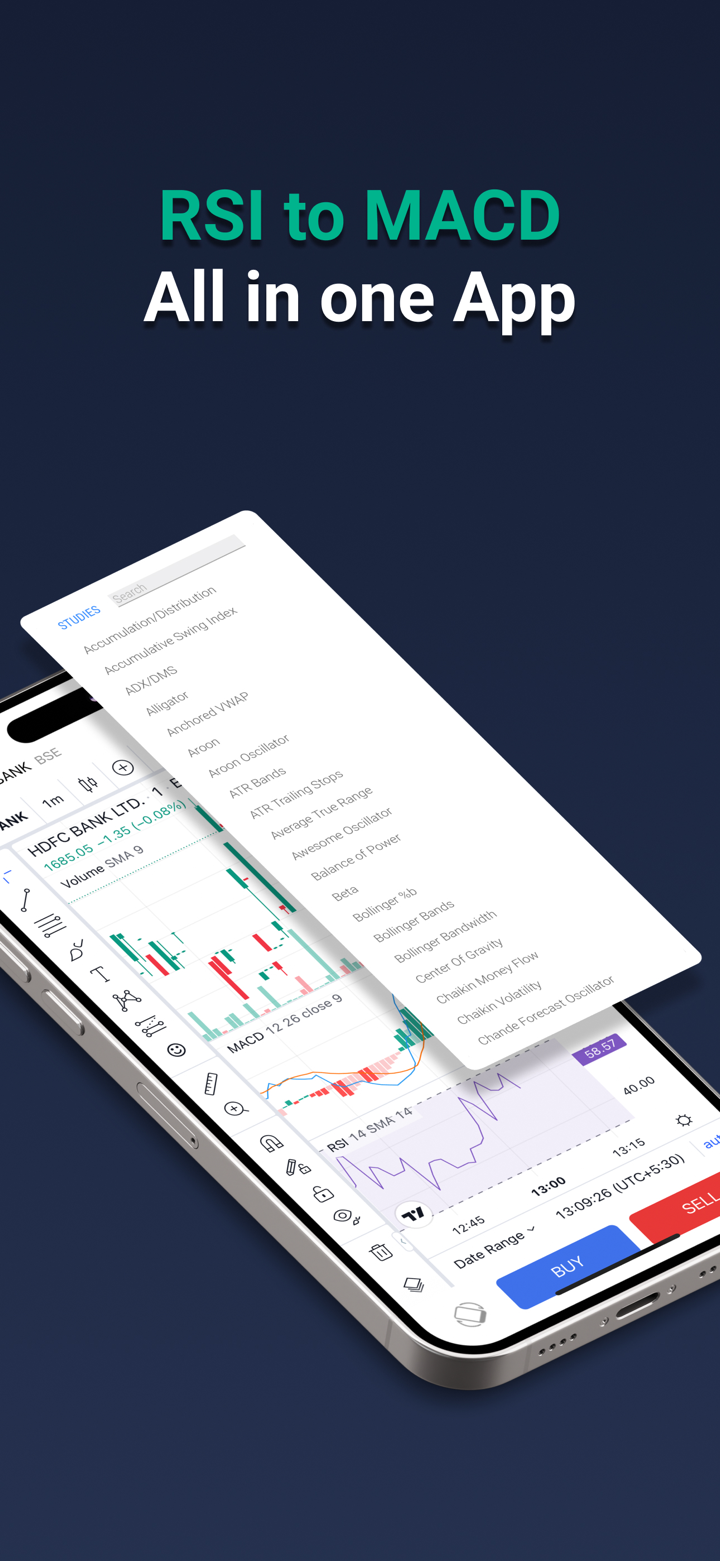

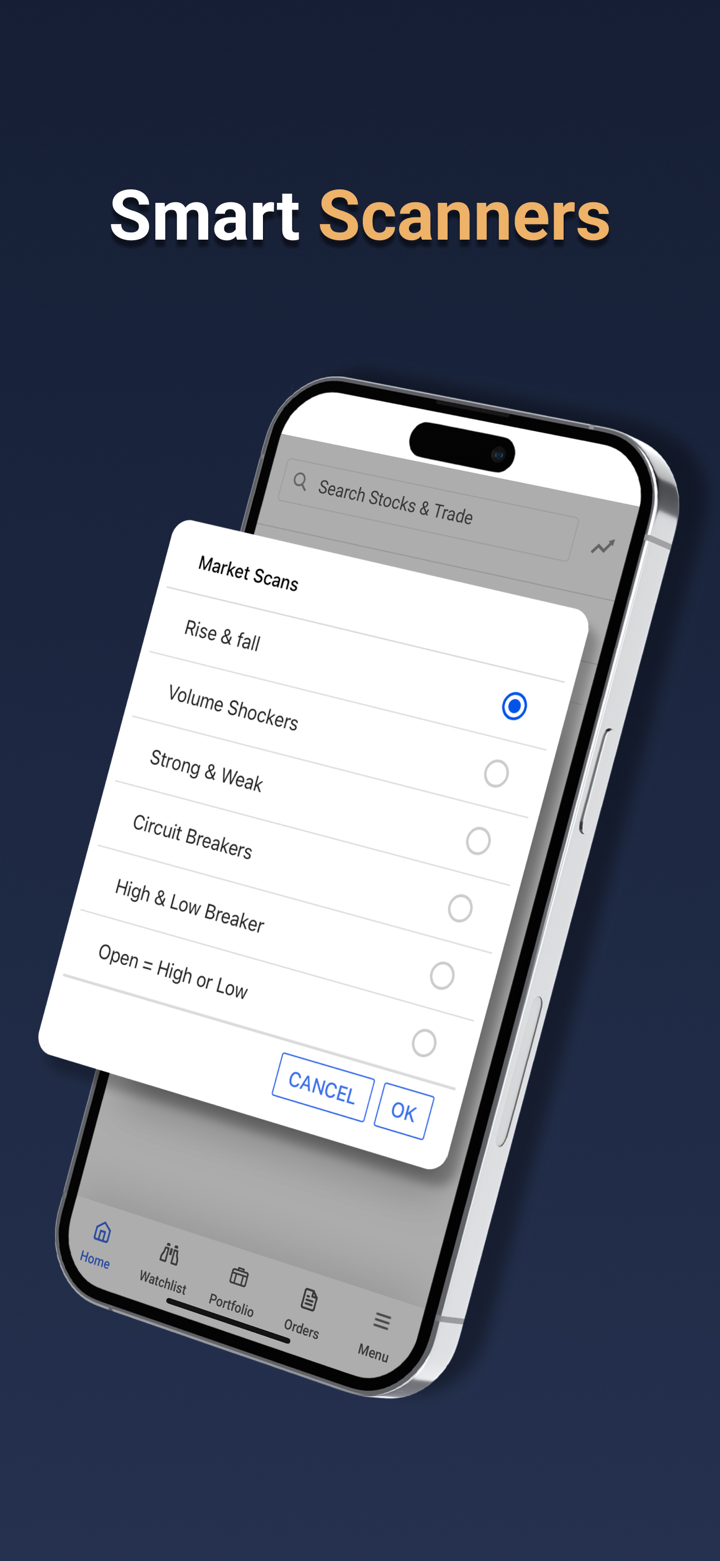

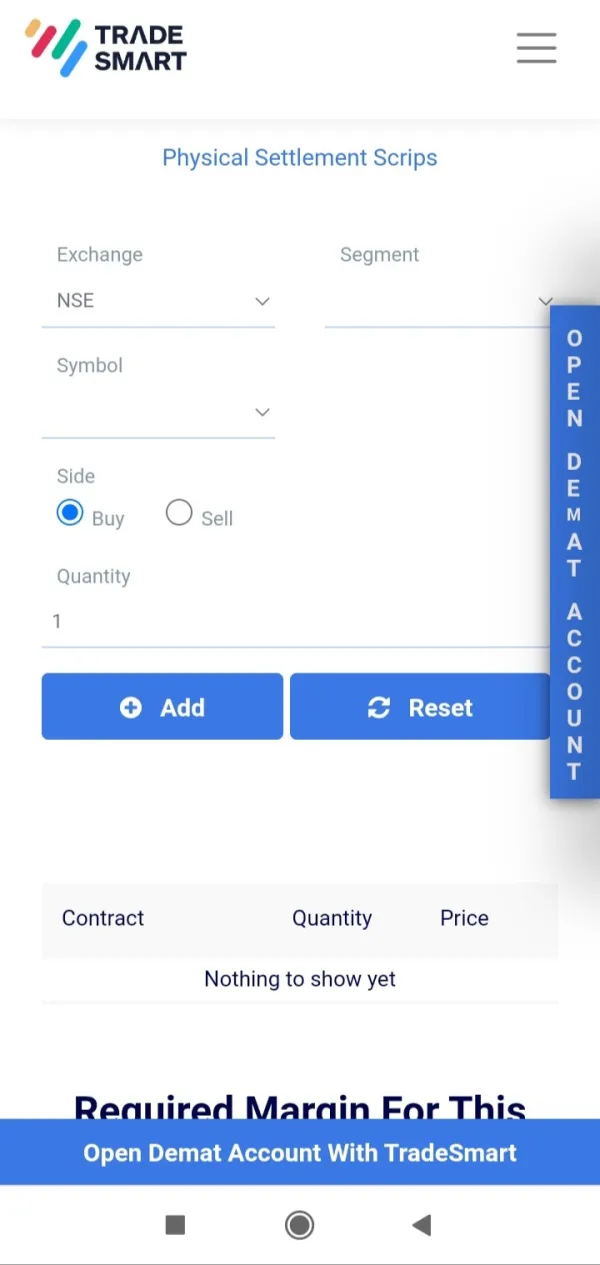

Die Produkte von TraderSmart umfassen eine Vielzahl von Handelstools: TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption und Integrationen.

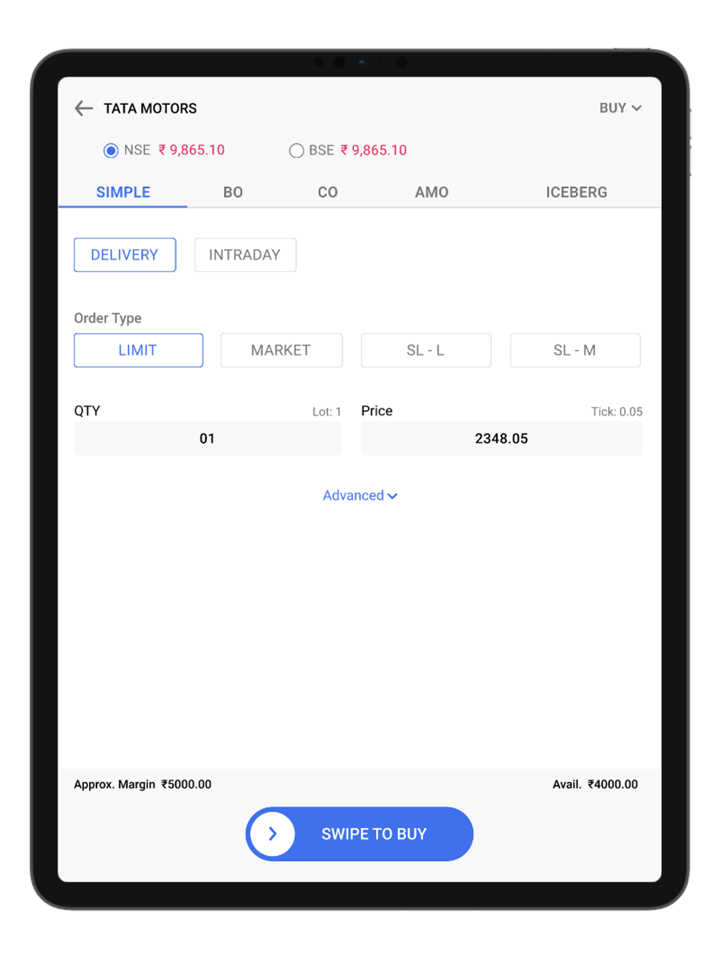

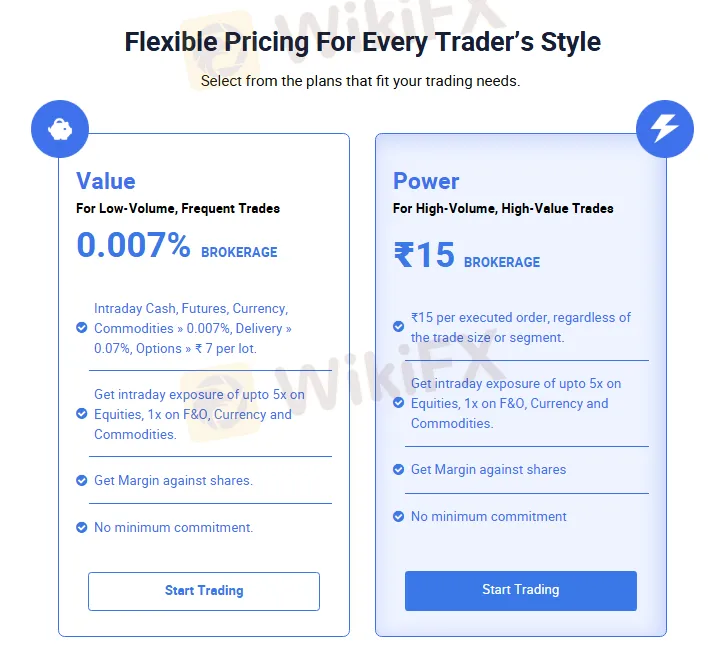

Kontotypen & Gebühren

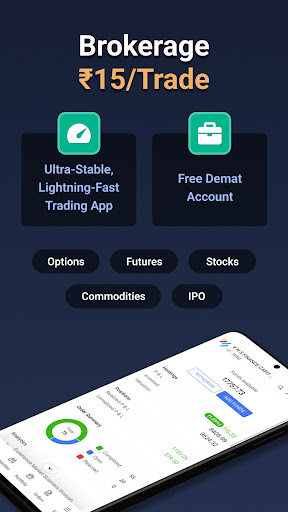

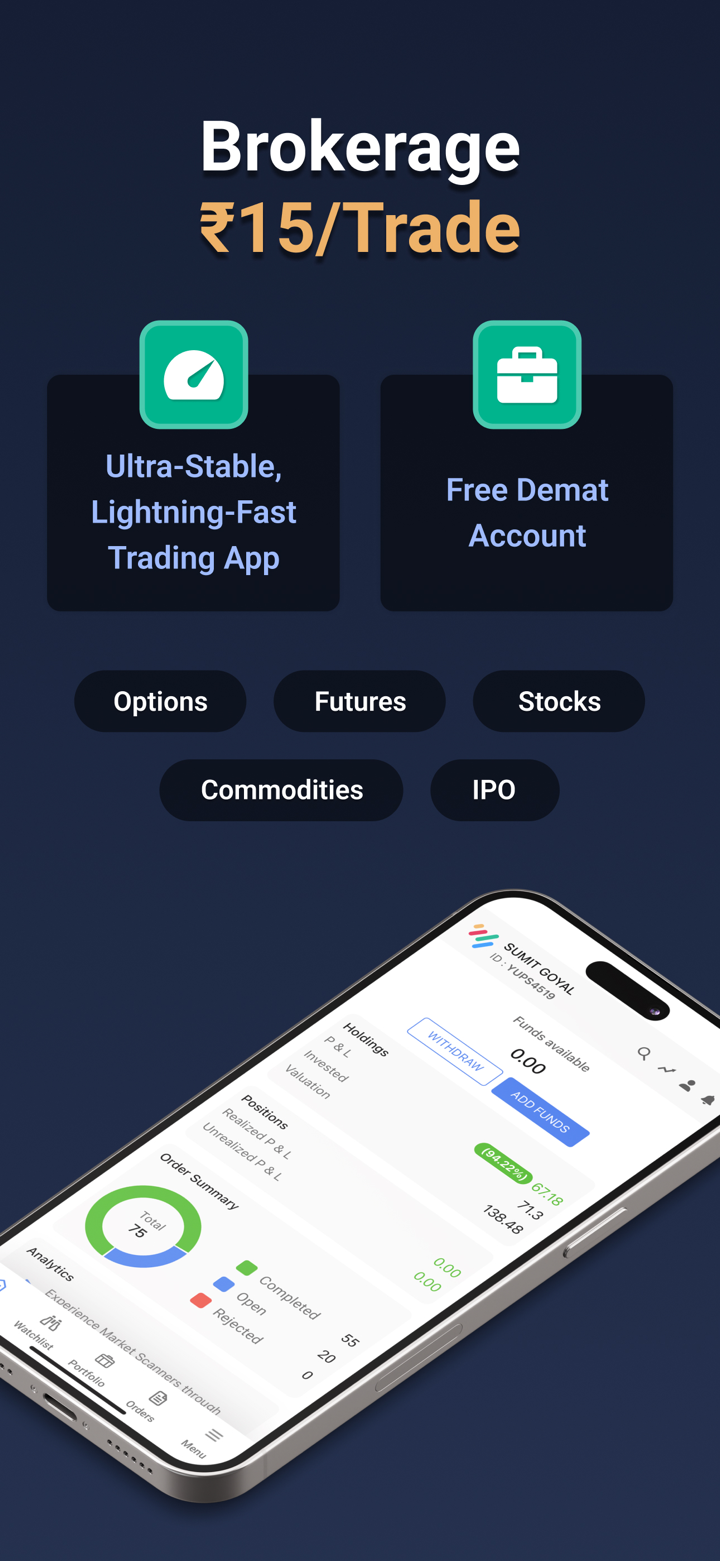

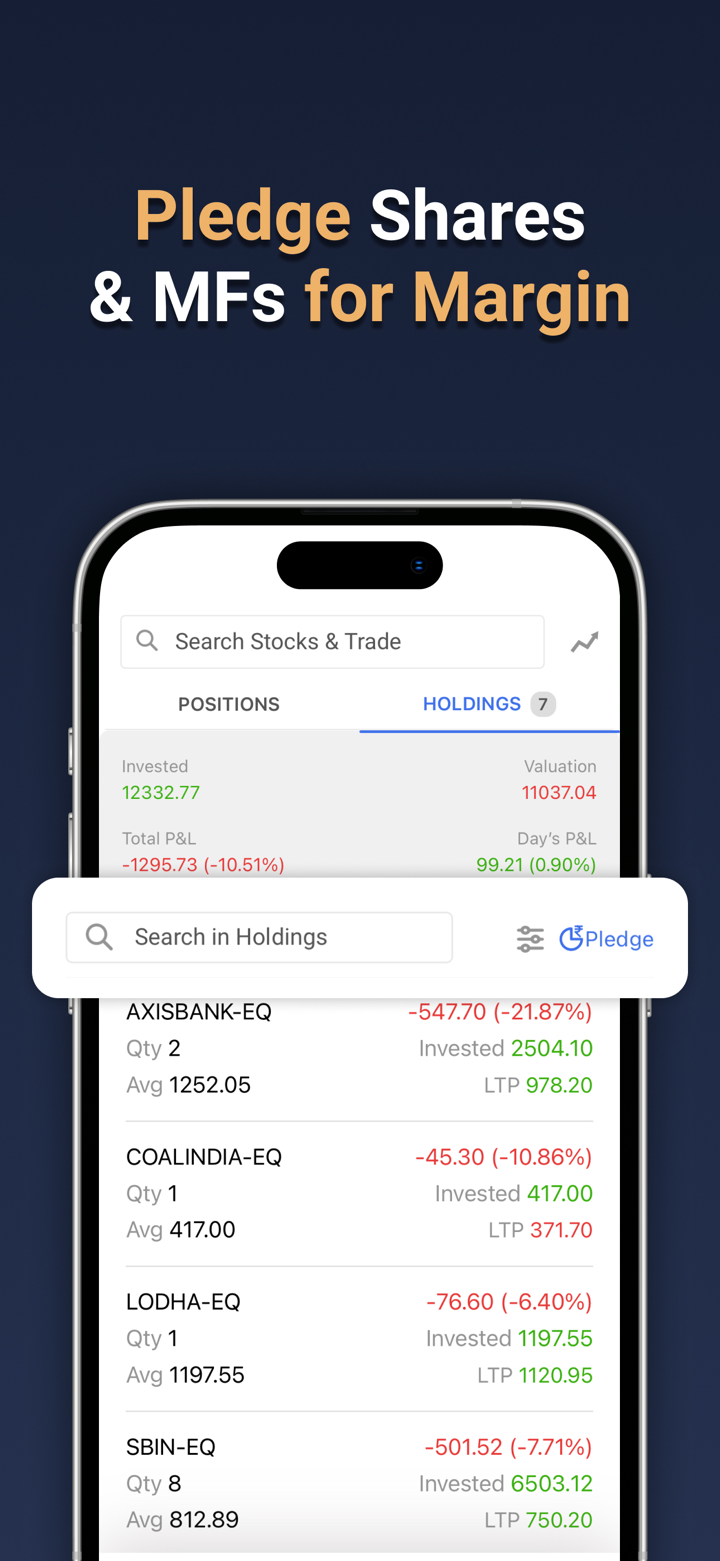

TradeSmart bietet Händlern Demat-Konten für den Handel an. Es stehen zwei verschiedene Programme zur Auswahl: Value und Power, aus denen Händler wählen können.

Die Hauptaufgabe eines Demat-Kontos besteht darin, die Speicherung, Verwaltung und den Handel mit Wertpapieren zu digitalisieren und Anlegern ein effizientes, sicheres und transparentes Anlageerlebnis zu bieten.

Hier finden Sie Informationen zu den beiden Kontoplänen:

| Value-Konto | Power-Konto | |

| Zielhändler | Händler mit niedrigem Volumen und hoher Frequenz | Händler mit hohem Volumen und hohem Wert |

| Maklergebühr | 0,007% | ₹15 pro Auftrag (unabhängig von Handelsgröße oder -typ) |

| Intraday Cash, Futures, Währung | Geeignet für den Handel mit niedrigem Volumen und hoher Frequenz | Geeignet für den Handel mit hohem Volumen und hohem Wert |

| Waren > 0,007%, Lieferung > 0,07%, Optionen > ₹7 pro Lot | Unterstützt kostengünstigen Waren- und Optionshandel | Unterstützt teureren Waren- und Optionshandel |

| Hebel | Bis zu 1:5 (Aktien, F&O, Währung und Waren) | Bis zu 1:5 (Aktien, F&O, Währung und Waren) |

| Marge gegen Aktienunterstützung | Ja | Ja |

| Mindestverpflichtung | Nein | Nein |

Hebel

TradeSmart bietet einen Hebel von 1:5 für Aktien, F&O, Währungen und Waren. Bitte beachten Sie, dass ein hoher Hebel nicht nur Gewinne, sondern auch Verluste verstärken kann.

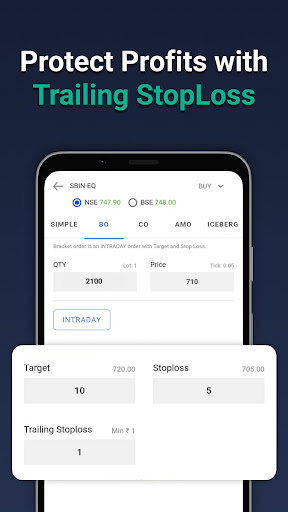

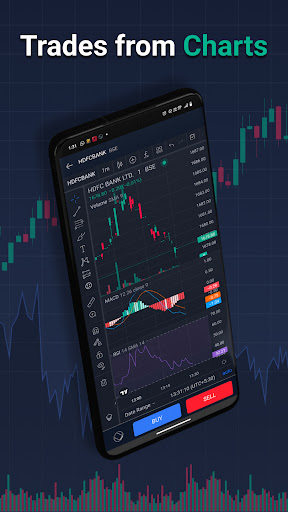

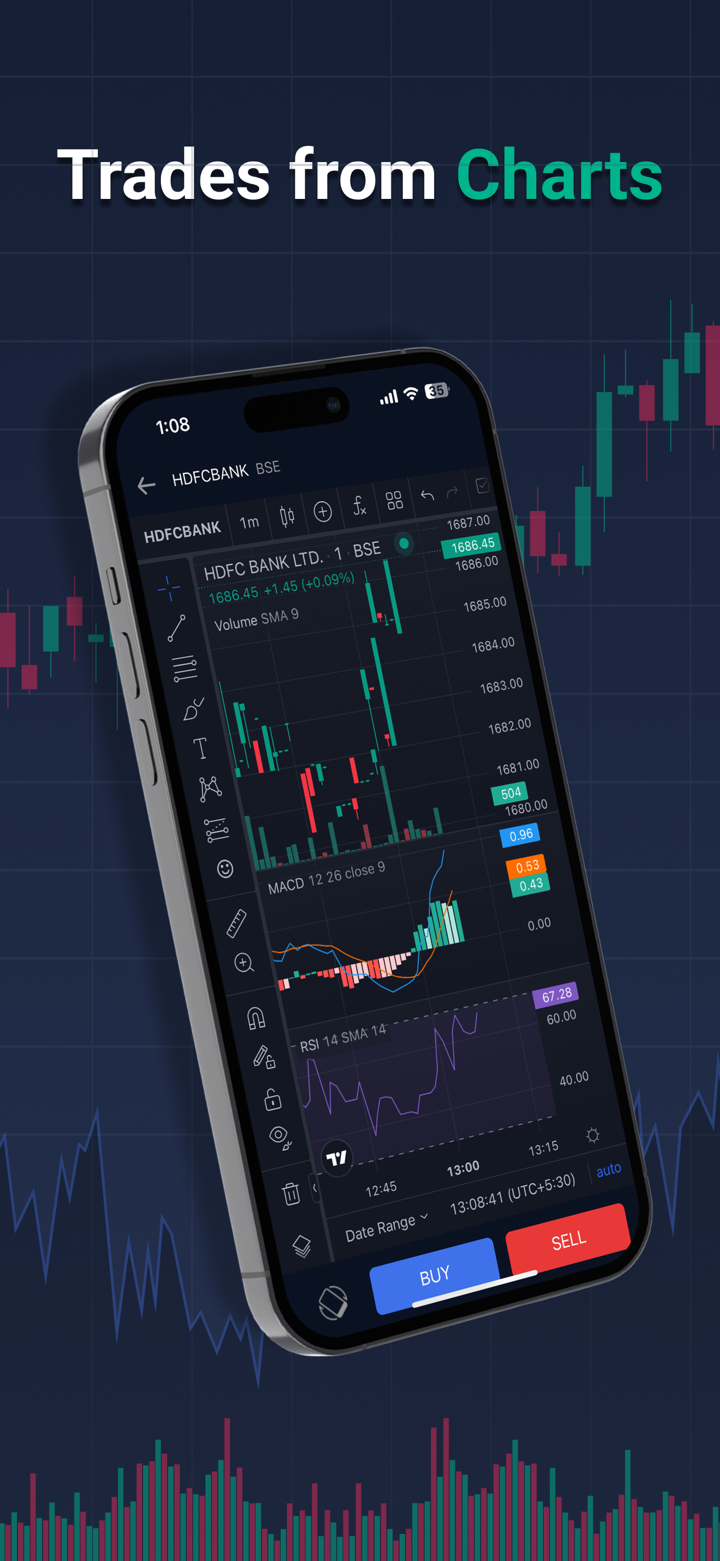

Handelsplattform

TradeSmart unterstützt den Handel mit der hauseigenen TraderSmart APP. Es wird nur Rs. 15 pro Trade als Provision für den Handel auf dieser Plattform berechnet.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| TraderSmart | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Händler |

Ein- und Auszahlung

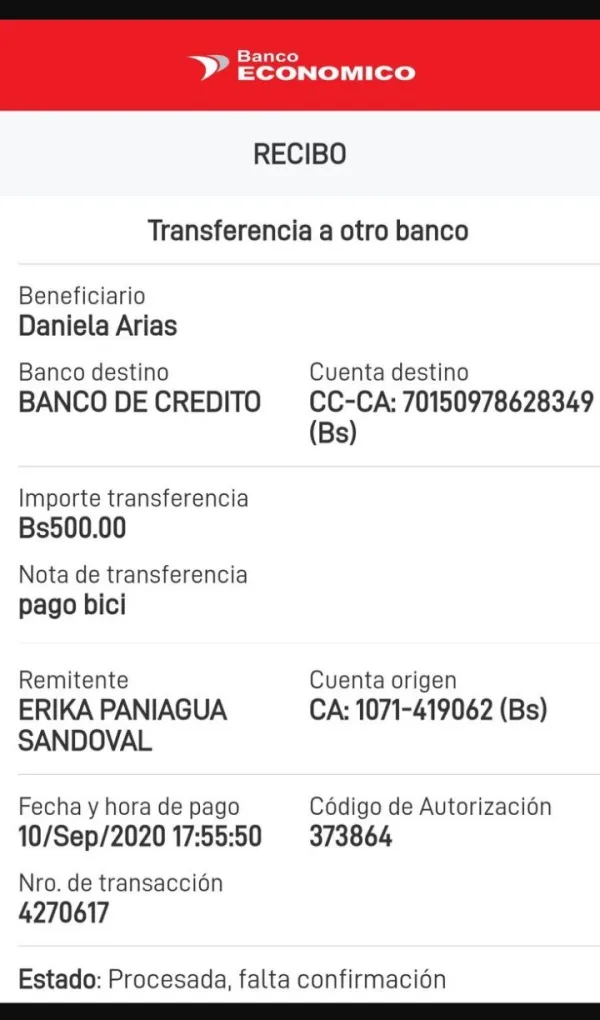

TraderSmart akzeptiert Zahlungen per Banküberweisung und NEFT-Überweisung.

Insgesamt werden 29 Banken unterstützt, wie unten aufgeführt:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank und AU Small Finance Bank.