Buod ng kumpanya

| TradeSmartBuod ng Pagsusuri | |

| Itinatag | 2013 |

| Rehistradong Bansa/Rehiyon | India |

| Regulasyon | Walang Regulasyon |

| Mga Kasangkapan sa Paghahalal | Mga Stock, futures, options, currencies, at commodities |

| Mga Produkto | TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, at Integrations |

| Leverage | Hanggang sa 1:5 |

| Spread | / |

| Platform ng Paghahalal | TraderSmart APP |

| Minimum na Deposito | / |

| Suporta sa Kustomer | Telepono: +91 022-61208000 |

| Email: contactus@vnsfin. com | |

| Social Media: Facebook, Twitter, Instagram, LinkedIn, YouTube, Telegram | |

| Address: A-401, Mangalya, Marol, Andheri East, Mumbai - 400059 | |

Impormasyon Tungkol sa TradeSmart

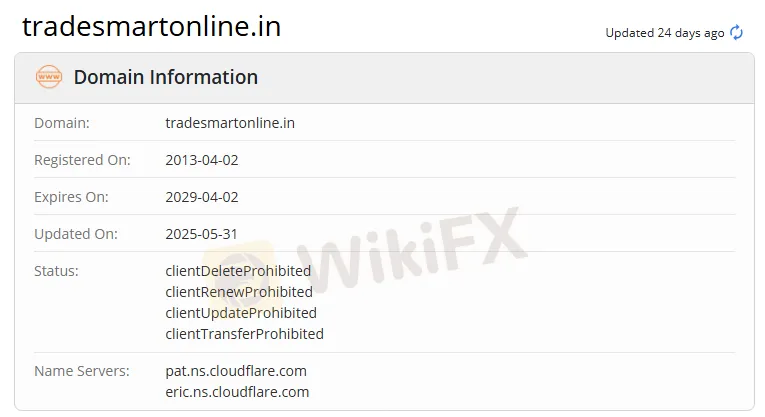

Itinatag noong 2013 at may punong tanggapan sa India, ang TradeSmart ay isang tagapagbigay ng mga serbisyong pinansyal. Nag-aalok ito ng iba't ibang mga kasangkapan at plataporma sa paghahalal, kabilang ang TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, at Integrations. Upang matugunan ang mga pangangailangan ng iba't ibang mga kliyente, mayroon ang kumpanya ng dalawang uri ng mga account: Mga Value account para sa mga mangangalakal na may mababang pagsasagawa at maliit na mangangalakal, at Power accounts para sa mga mangangalakal na may mataas na pagsasagawa at malalaking bulto ng kalakalan.

Gayunpaman, ang TradeSmart ay kasalukuyang hindi regulado at ang kanyang legalidad ay isang sanhi ng pag-aalala.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga produkto na inaalok | Walang regulasyon |

| Limitadong impormasyon sa mga tampok ng account | |

| Di-malinaw na istraktura ng bayad | |

| Limitadong impormasyon sa pagdedeposito at pag-withdraw |

Tunay ba ang TradeSmart?

Hindi nireregula ang No. TradeSmart, at dapat mag-ingat ang mga mangangalakal sa pagtitingin.

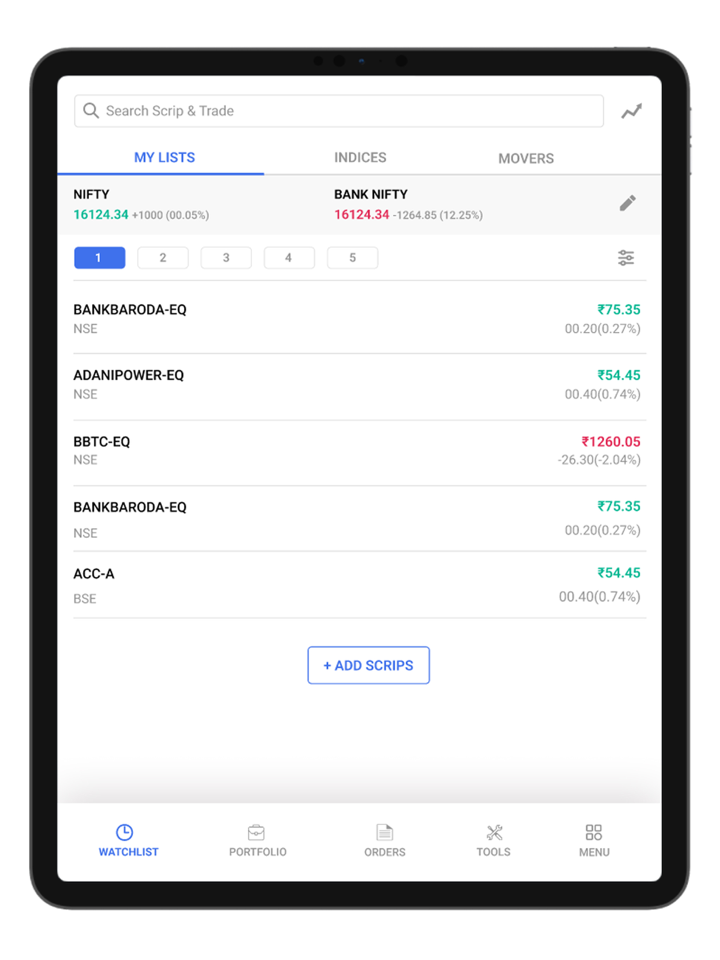

Ano ang Maaari Kong I-trade sa TraderSmart?

| Mga Kasangkapan sa Paghahalal | Supported |

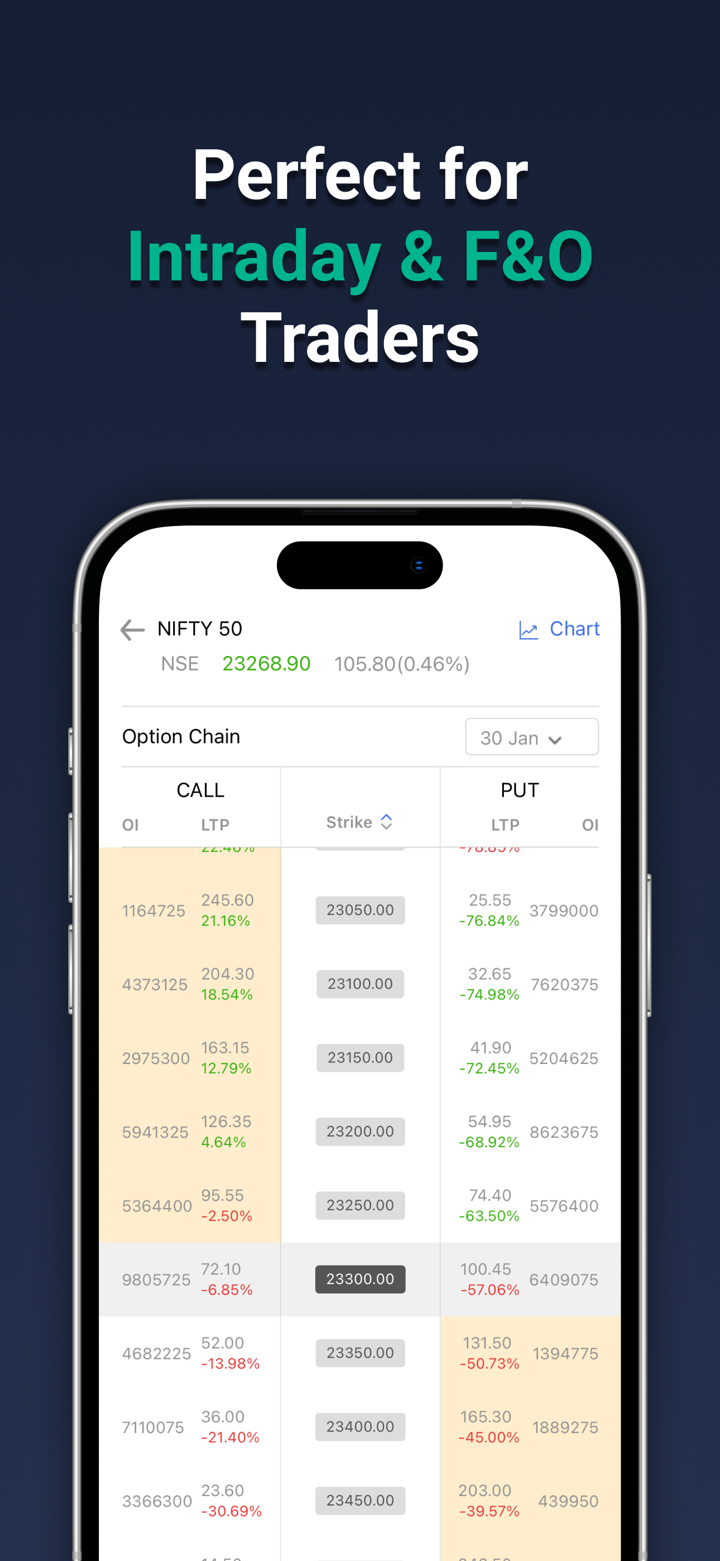

| Mga Stocks | ✔ |

| Mga Futures | ✔ |

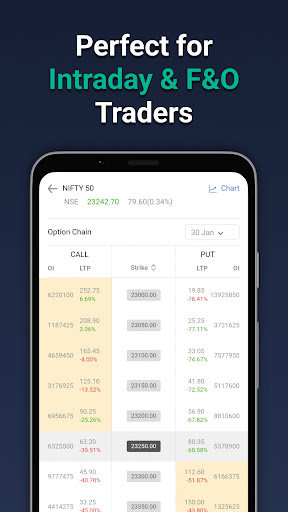

| Mga Options | ✔ |

| Mga Currency | ✔ |

| Mga Commodity | ✔ |

| Mga Indices | ❌ |

| Mga Cryptocurrency | ❌ |

| Mga Bonds | ❌ |

| Mga ETFs | ❌ |

Mga Produkto

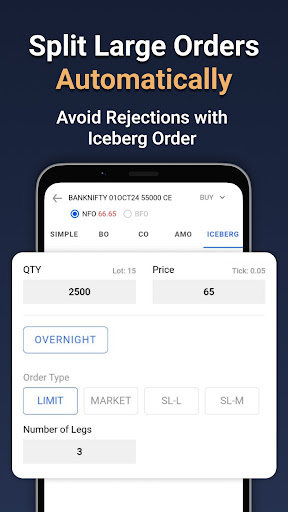

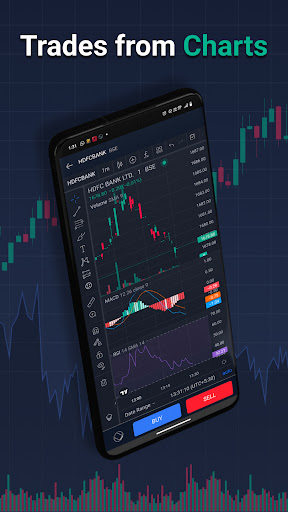

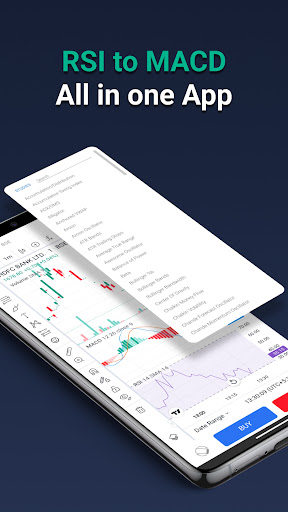

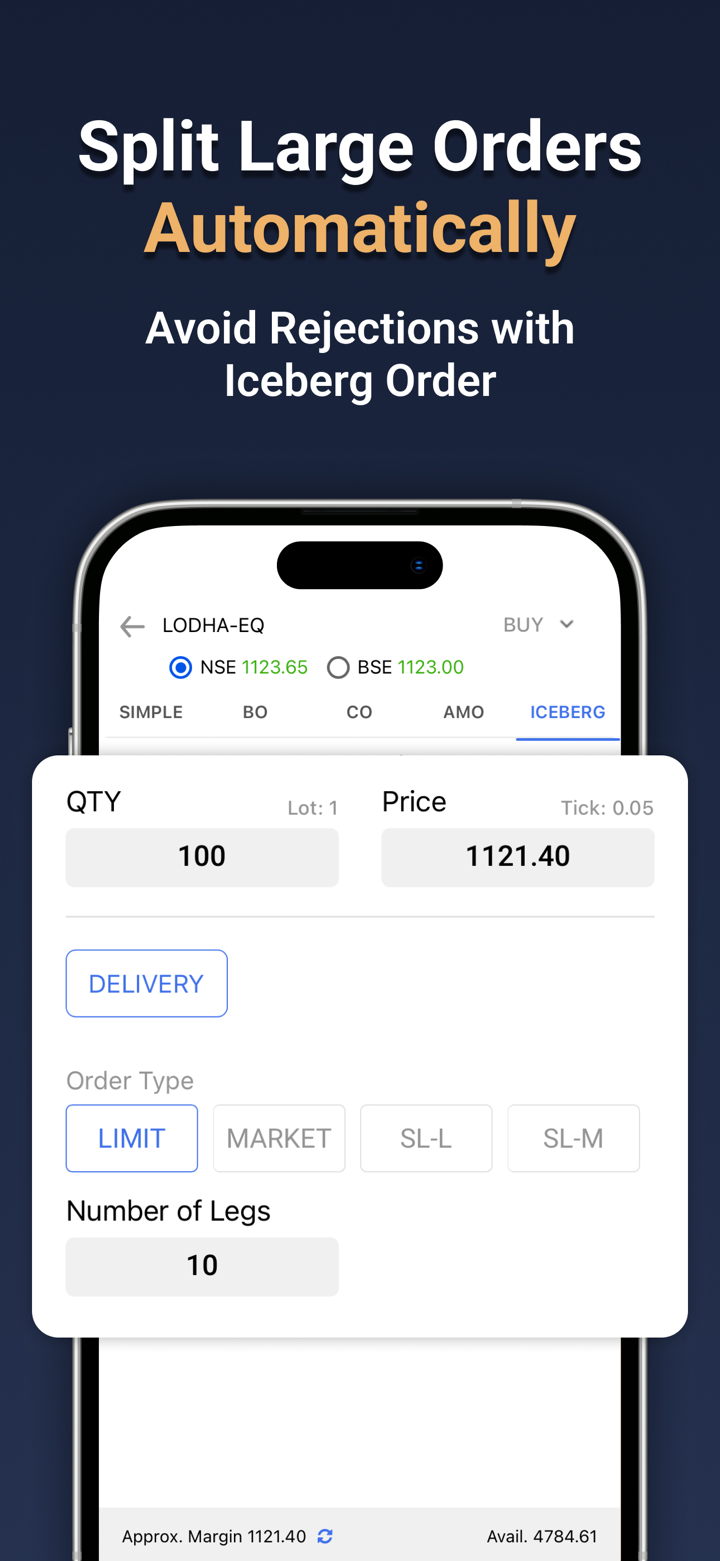

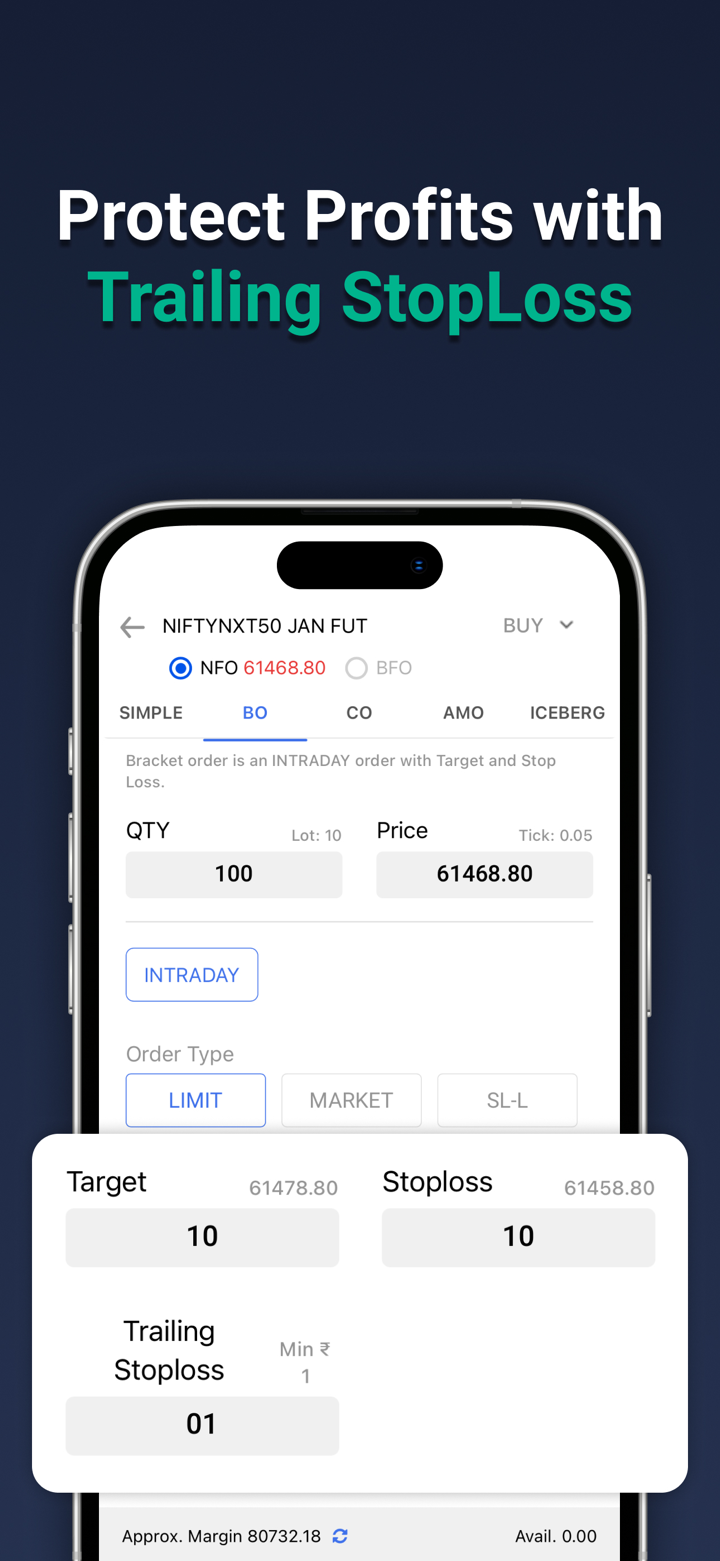

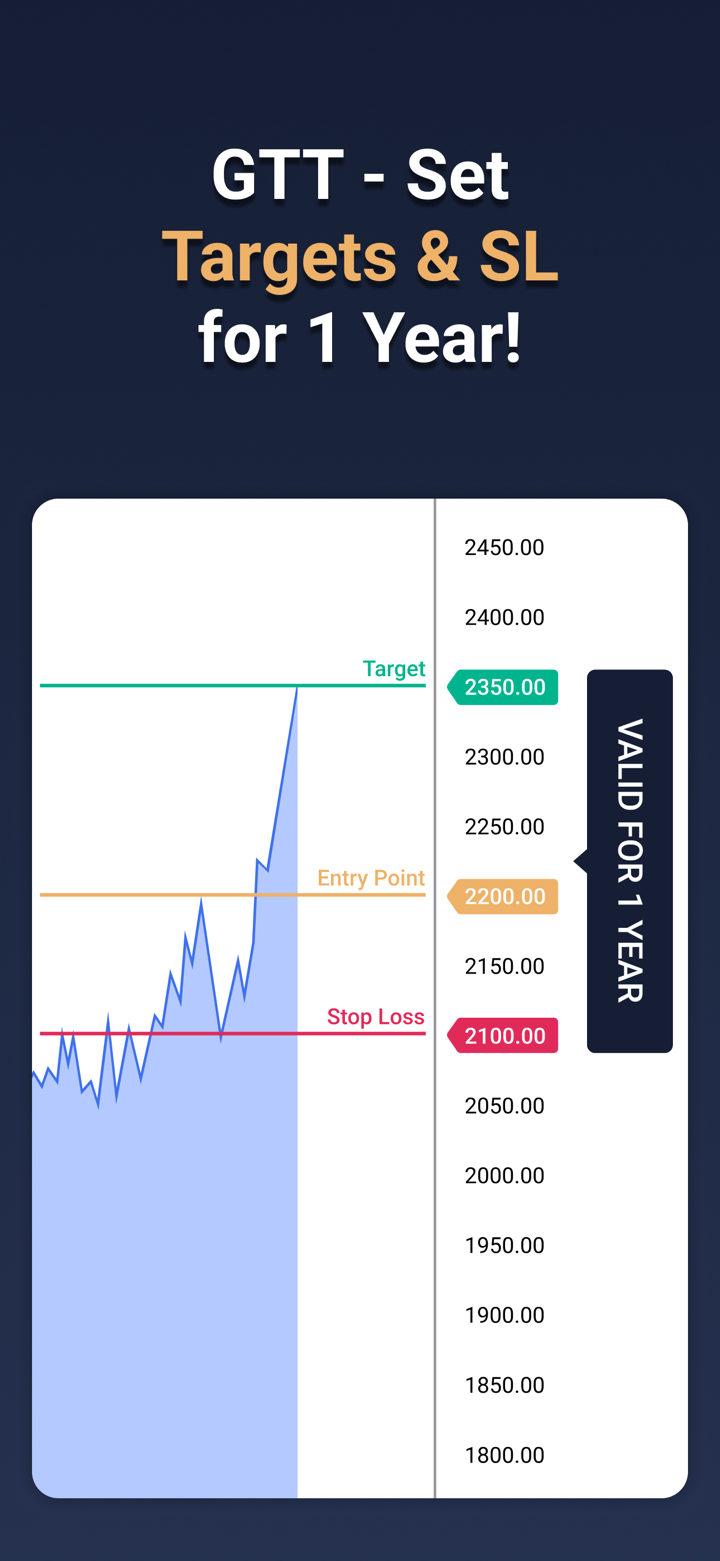

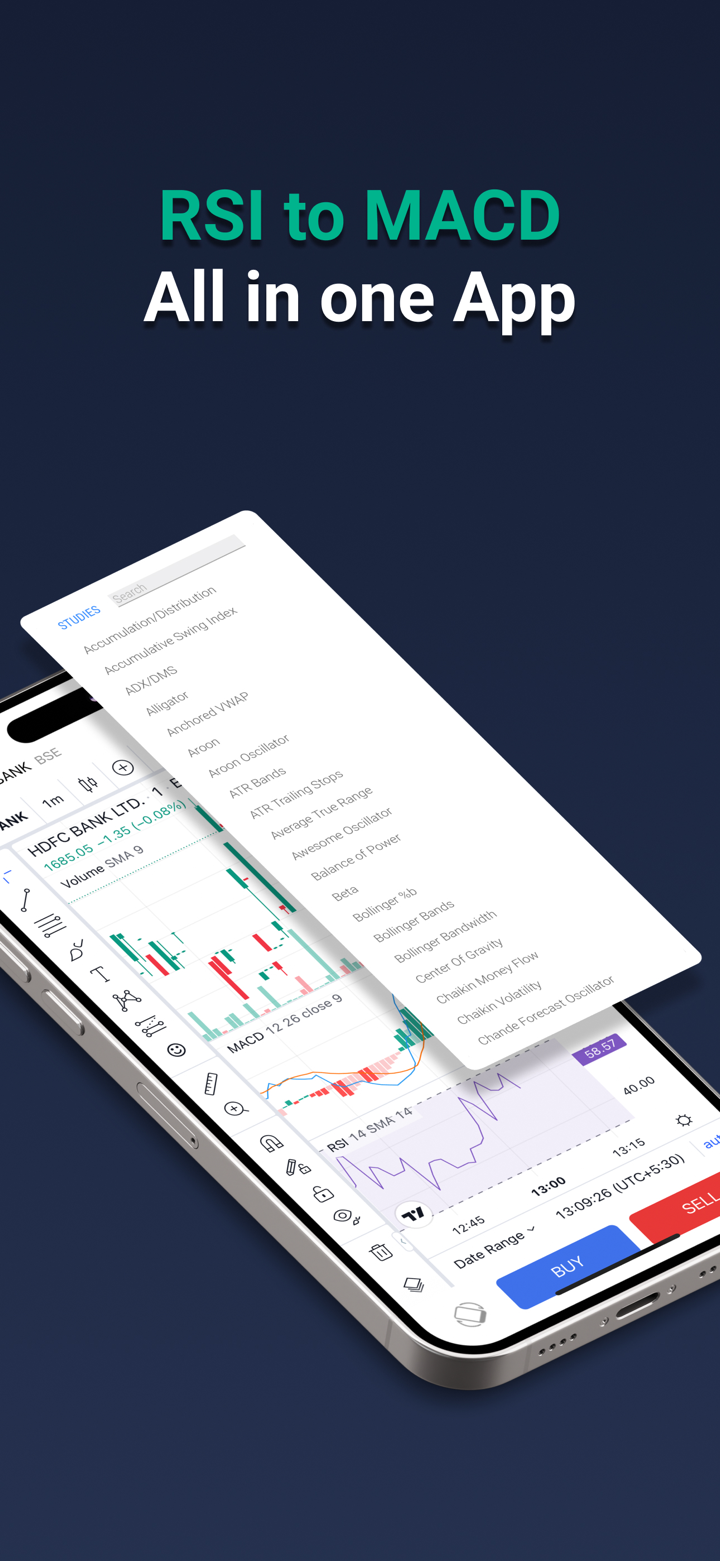

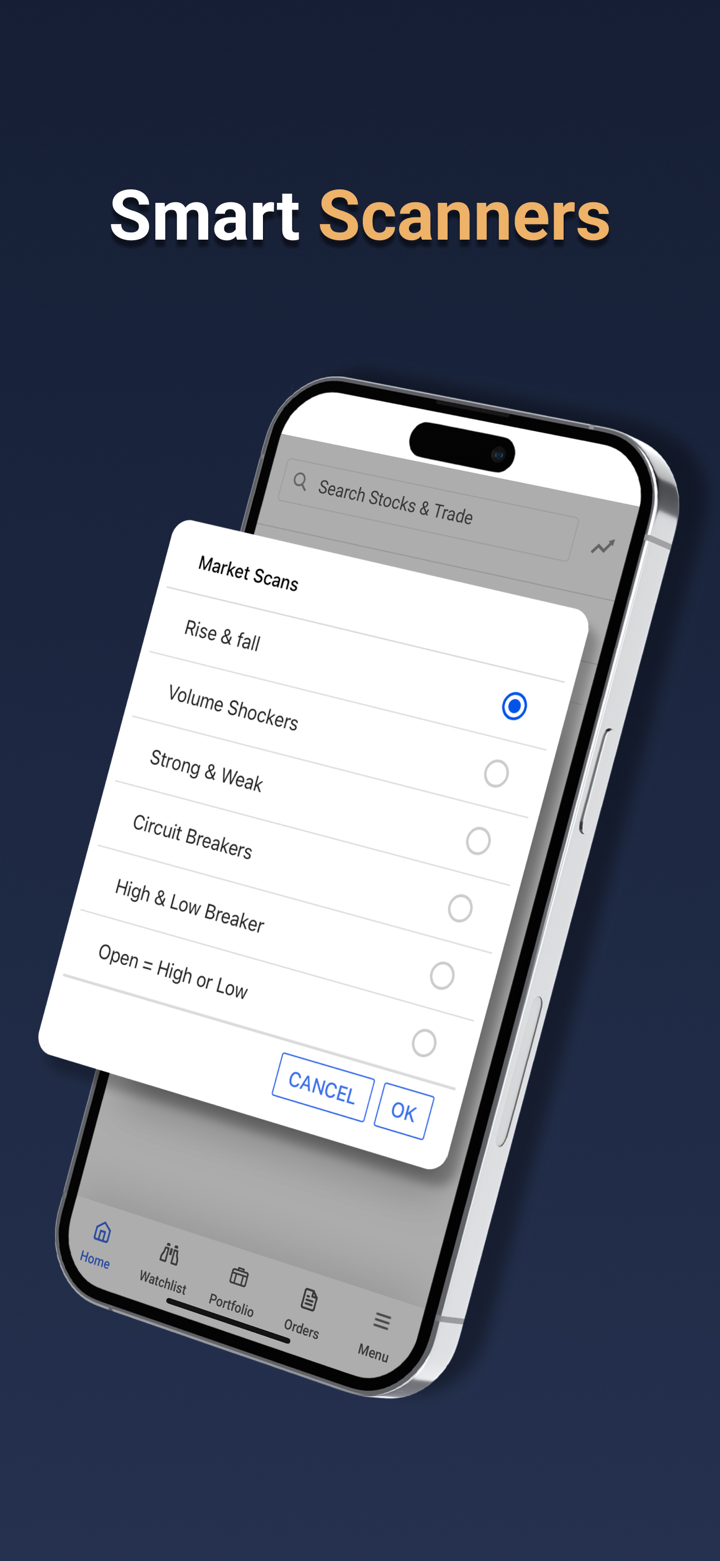

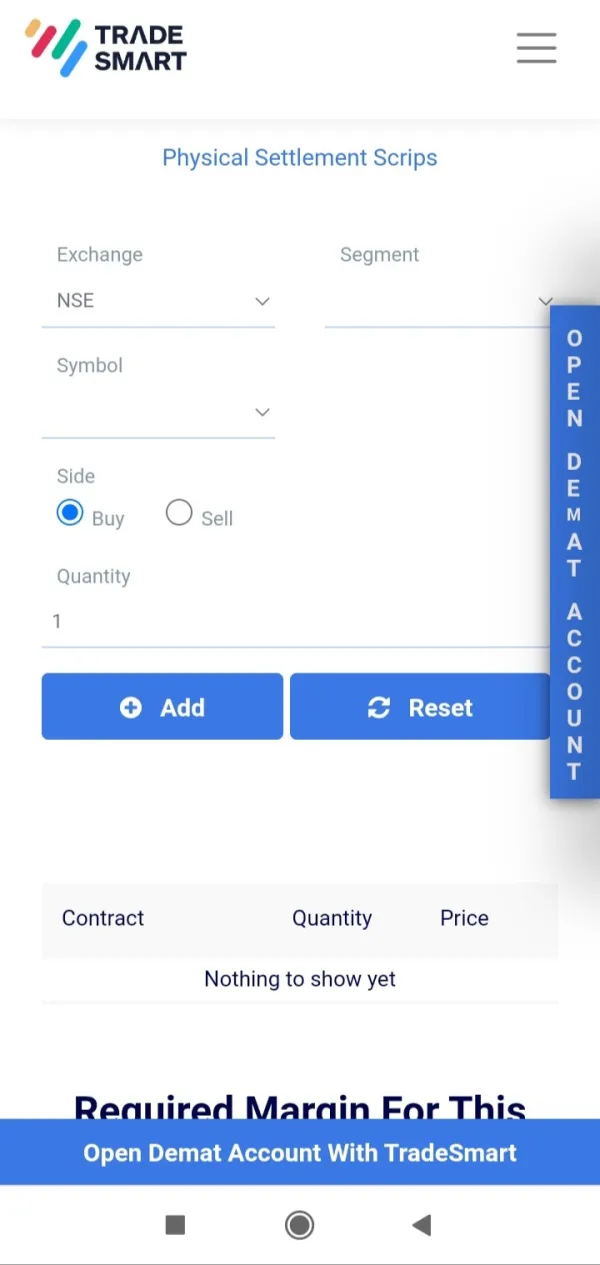

Kabilang sa mga produkto ng TraderSmart ang iba't ibang mga kasangkapan sa pagtitingin: TradeSmart Mobile App, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption, at Integrations.

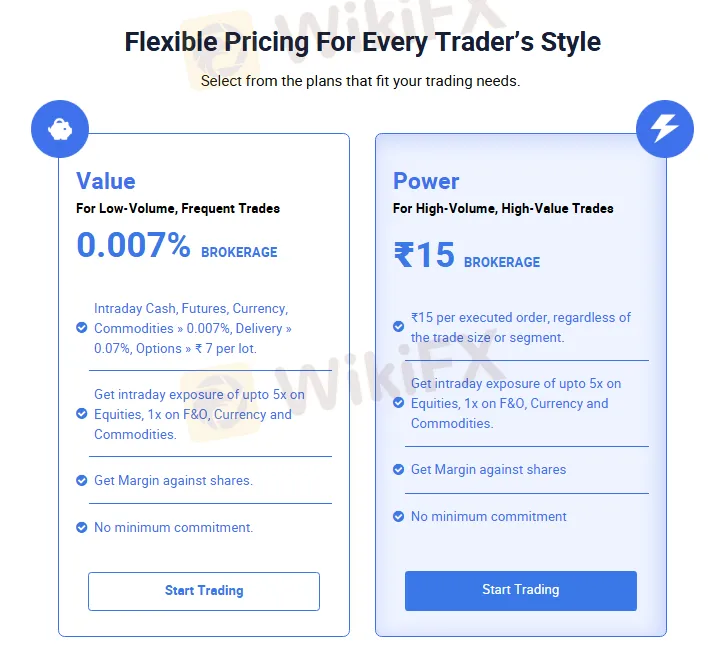

Uri ng Account at Mga Bayarin

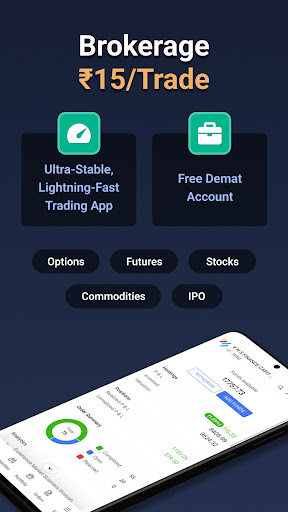

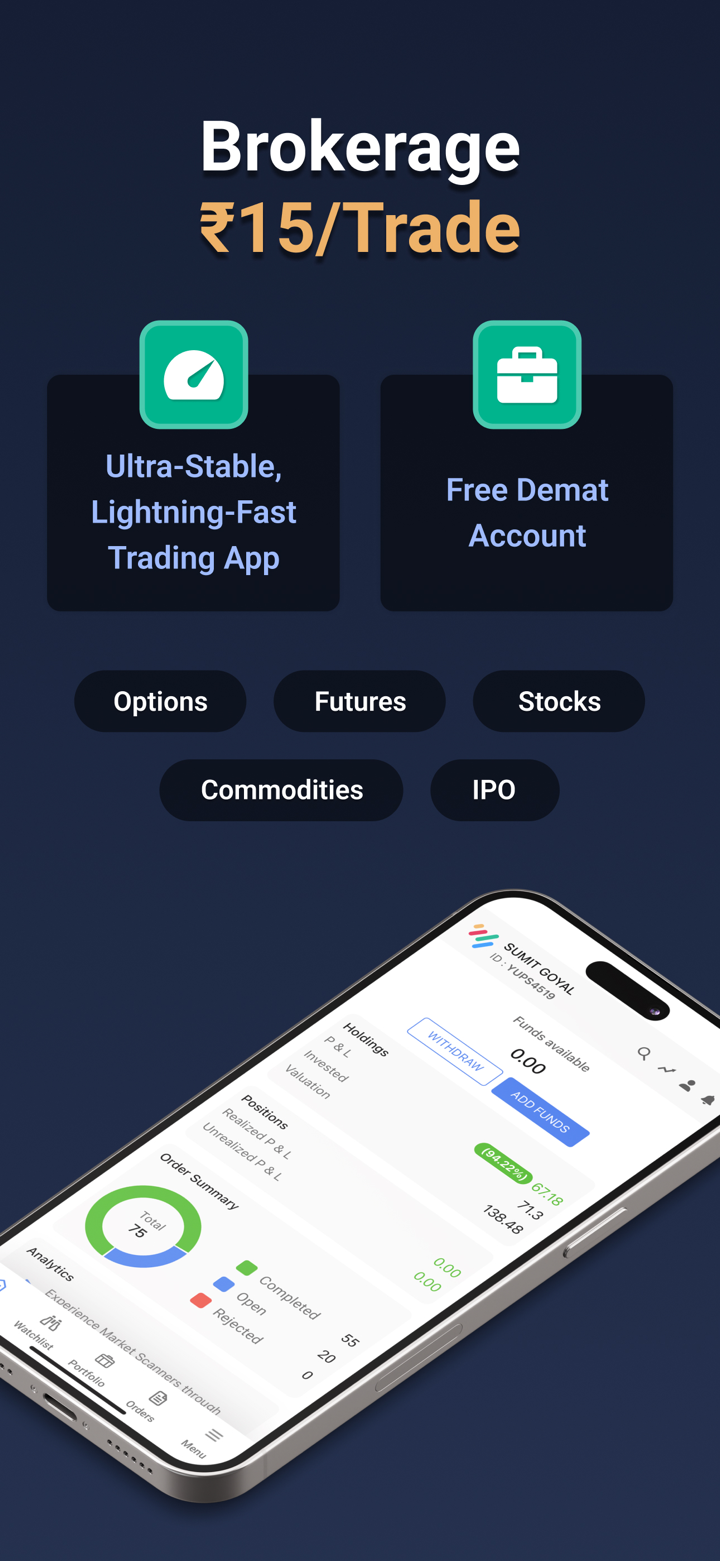

Nag-aalok ang TradeSmart ng mga Demat account para sa pagtitingin. May dalawang magkaibang programa na available: Value at Power, para sa mga mangangalakal na pumili.

Ang pangunahing papel ng isang Demat account ay ang pagdidigitize ng imbakan, pamamahala, at pagtitingin ng mga securities, na nagbibigay sa mga mamumuhunan ng isang maaasahang, ligtas, at transparent na karanasan sa pamumuhunan.

Narito ang impormasyon sa dalawang plano ng account:

| Value Account | Power Account | |

| Mga Target na Mangangalakal | Mga mangangalakal na may mababang dami, mataas na pagsasagawa | Mga mangangalakal na may mataas na dami, mataas na halaga |

| Bayad sa Brokerage | 0.007% | ₹15 bawat order (anuman ang laki o uri ng kalakalan) |

| Intraday Cash, Futures, Currency | Angkop para sa mababang dami, mataas na pagsasagawa sa pagtitingin | Angkop para sa mataas na dami, mataas na halaga sa pagtitingin |

| Mga Commodity > 0.007%, Delivery > 0.07%, Options > ₹7 bawat lot | Sumusuporta sa murang mga kalakal at pagtitingin sa mga opsyon | Sumusuporta sa mas mahal na mga kalakal at pagtitingin sa mga opsyon |

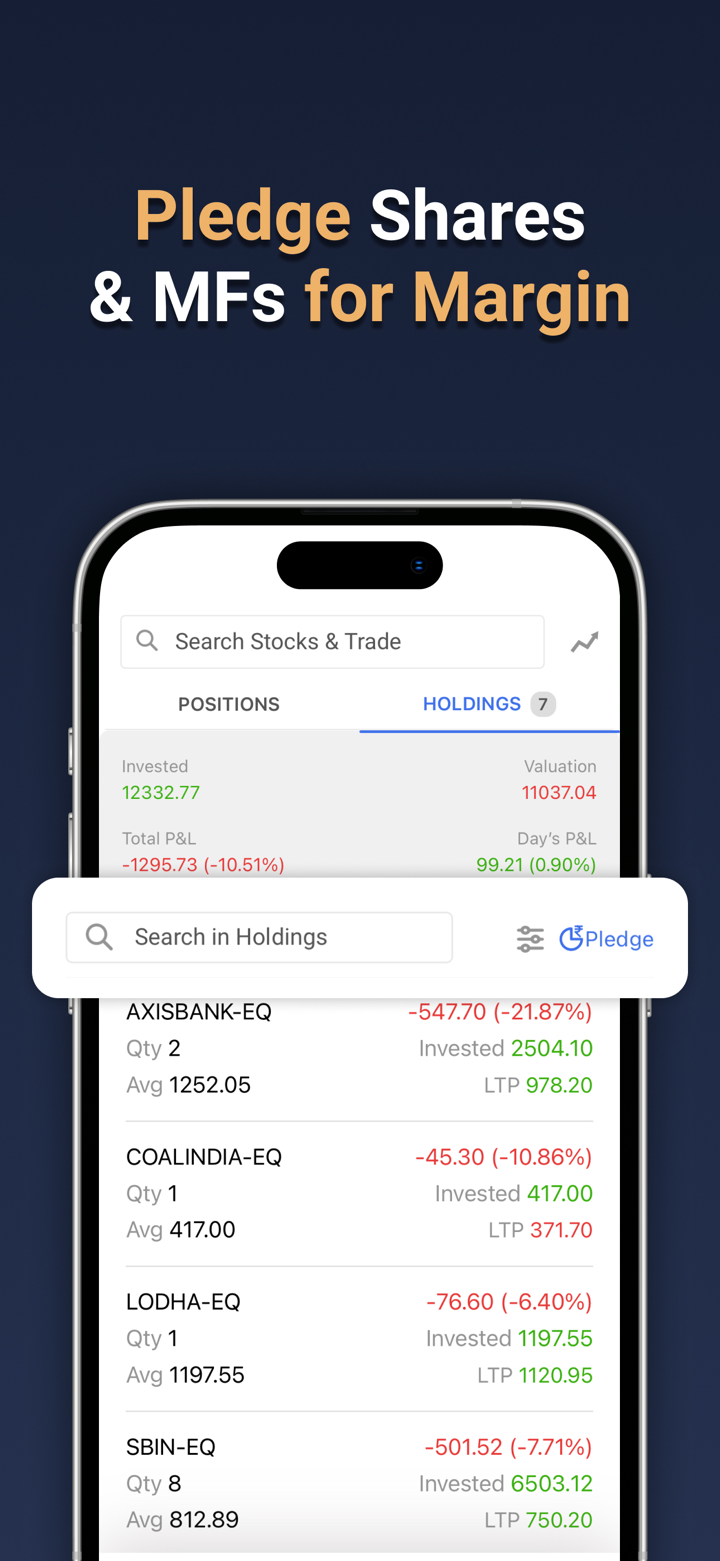

| Leverage | Hanggang sa 1:5 (Equity, F&O, Currency, at Commodities) | Hanggang sa 1:5 (Equity, F&O, Currency, at Commodities) |

| Suporta sa Margin Laban sa mga Shares | Oo | Oo |

| Minimum na Commitment | Hindi | Hindi |

Leverage

Ang TradeSmart ay may 1:5 na leverage sa mga stocks, F&O, currencies, at commodities. Mangyaring tandaan na ang mataas na leverage ay maaaring magpalakas hindi lamang ng kita kundi pati na rin ng mga pagkalugi.

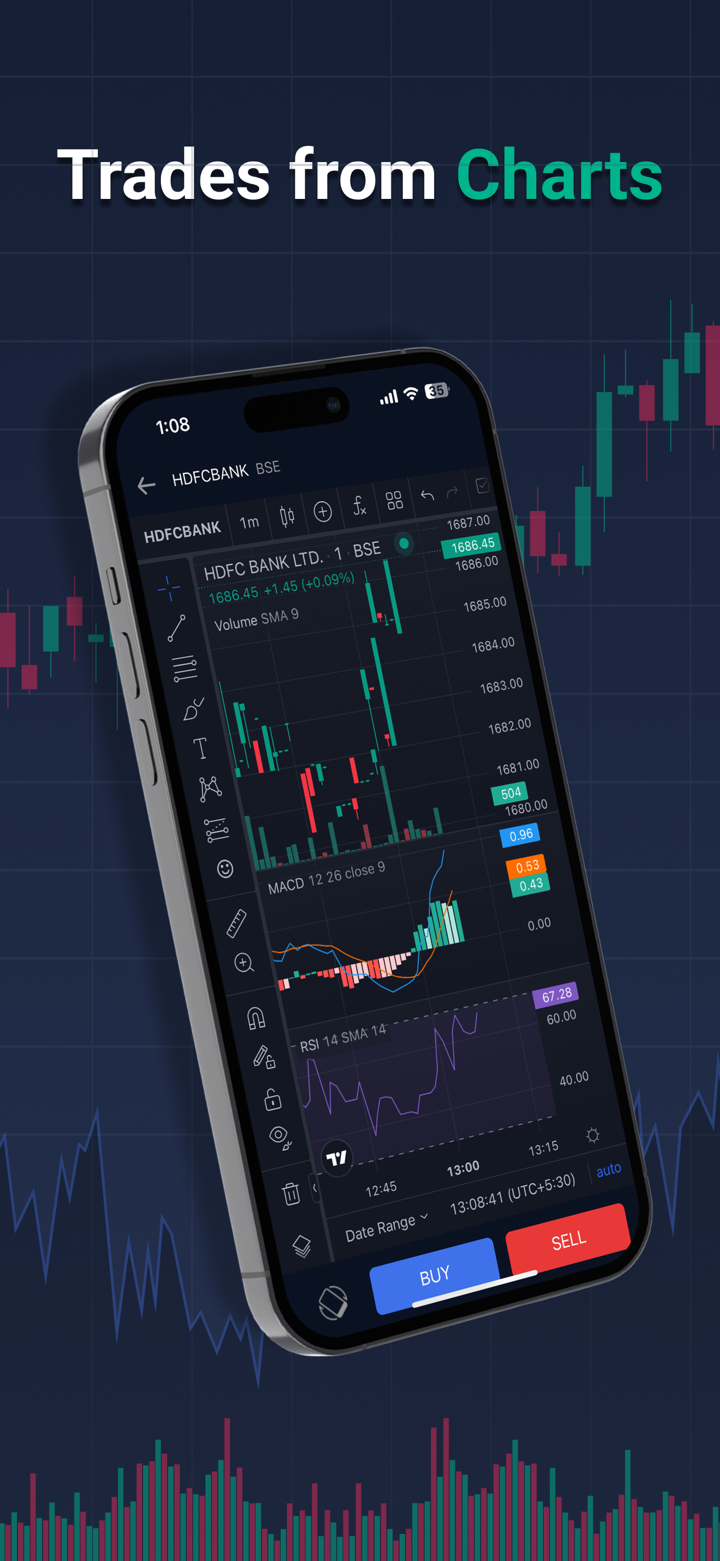

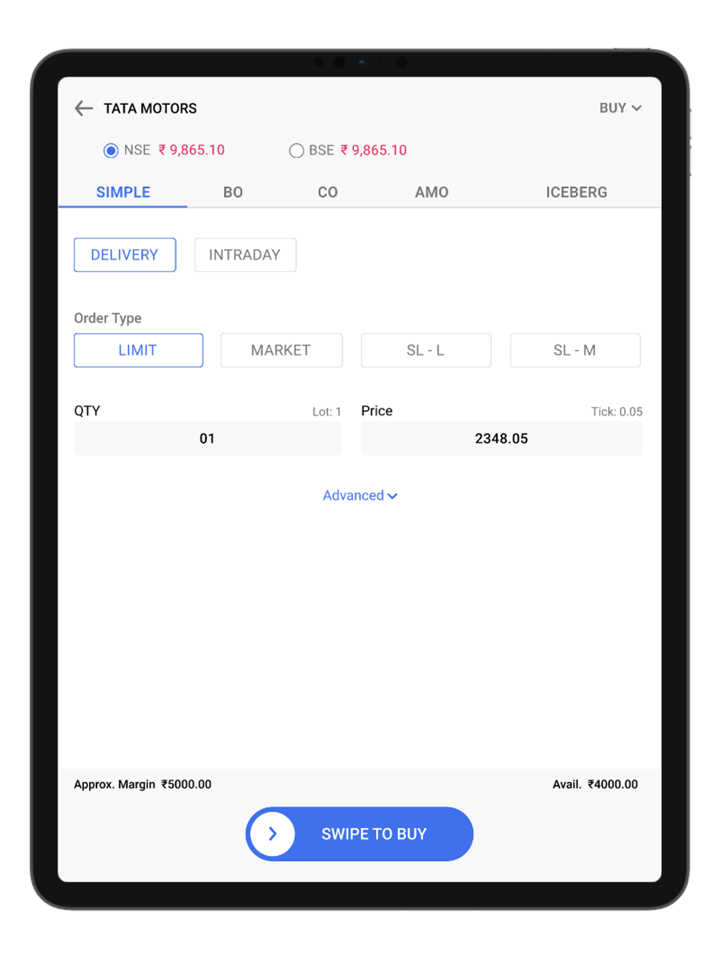

Plataforma ng Paghahalal

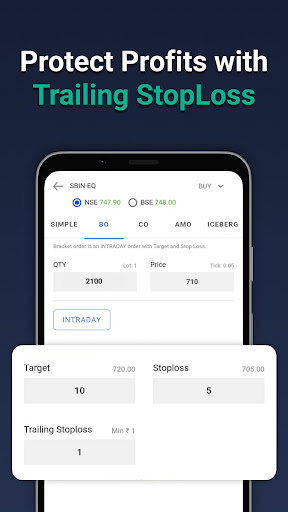

TradeSmart ay sumusuporta sa kalakalan gamit ang sariling TraderSmart APP. Tanging Rs. 15 bawat kalakalan ang singil bilang komisyon para sa pagkalakal sa platapormang ito.

| Plataporma ng Kalakalan | Sumusuporta | Available Devices | Angkop para sa |

| TraderSmart | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Mga Baguhan |

| MT5 | ❌ | / | Mga Karanasan na mga mangangalakal |

Deposito at Pag-Atas

Ang TraderSmart ay tumatanggap ng mga bayad sa pamamagitan ng bank wire transfer at NEFT transfer.

Kabuuang 29 bangko ang sinusuportahan tulad ng nakalista sa ibaba:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank, at AU Small Finance Bank.