Présentation de l'entreprise

| BBH Résumé de l'examen | |

| Fondé | 1995 |

| Pays/Région Enregistré | États-Unis |

| Régulation | SFC (réglementé), FCA (dépassé) |

| Services | Services de fonds alternatifs, Connecteurs BBH, Services de Fonds Transfrontaliers, Garde et Services de Fonds, Dépositaire & Trustee, Services ETF, Change, Intelligence Réglementaire, Prêt de Titres, Solutions d'Infrastructure Partagée, Agence de Transfert |

| Support Client | Email: contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

Informations sur BBH

BBH est un courtier enregistré aux États-Unis avec une histoire de 30 ans, offrant une grande variété de services financiers. BBH reste risqué en raison de son statut dépassé.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Longue histoire opérationnelle depuis 1995 | Pas de support client 24/7 |

| Réglementé par la SFC | Pas de méthode de transfert spécifique |

| Divers services financiers | Licence FCA dépassée |

BBH Est-il Légitime?

| Pays Réglementé | Statut Actuel | Autorité Réglementée | Entité Réglementée | Type de Licence | Numéro de Licence |

| Chine (Hong Kong) | Réglementé | Commission des Valeurs et des Contrats à Terme de Hong Kong (SFC) | BROWN BROTHERS HARRIMAN (HONG KONG) LIMITED | Trading de change à effet de levier | AAF778 |

| Royaume-Uni | Dépassé | Autorité de Conduite Financière (FCA) | Brown Brothers Harriman Investor Services Ltd | Licence de Conseil en Investissement | 190266 |

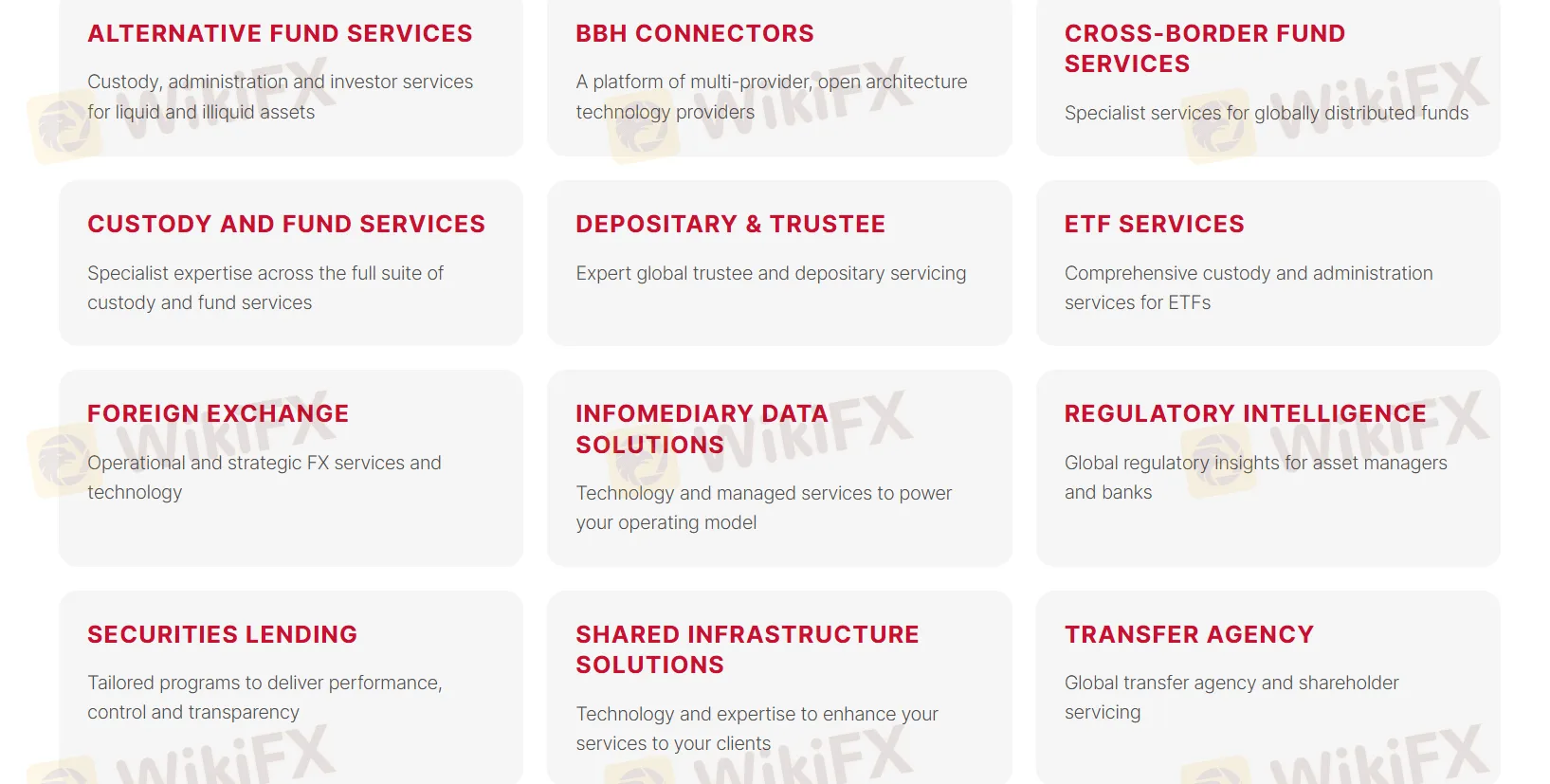

Services de BBH

BBH propose une large gamme de services, notamment :

Services de fonds alternatifs: Garde, administration et services aux investisseurs pour actifs liquides et illiquides.

Connecteurs BBH: Une plateforme de fournisseurs multiples, fournisseurs de technologie à architecture ouverte.

Services de Fonds Transfrontaliers: Services spécialisés pour les fonds distribués mondialement.

Garde et Services de Fonds: Expertise spécialisée sur l'ensemble des services de garde et de fonds.

Dépositaire & Trustee: Service de dépositaire et de fiduciaire mondial expert.

Services ETF: Services complets de garde et d'administration pour les ETF.

Change: Services et technologie opérationnels et stratégiques en matière de change.

Intelligence Réglementaire: Informations réglementaires mondiales pour les gestionnaires d'actifs et les banques.

Prêt de Titres: Programmes sur mesure pour offrir des performances, un contrôle et une transparence.

Solutions d'infrastructure partagée: Technologie et expertise pour améliorer vos services à vos clients.

Agence de transfert: Agence de transfert mondiale et service aux actionnaires.

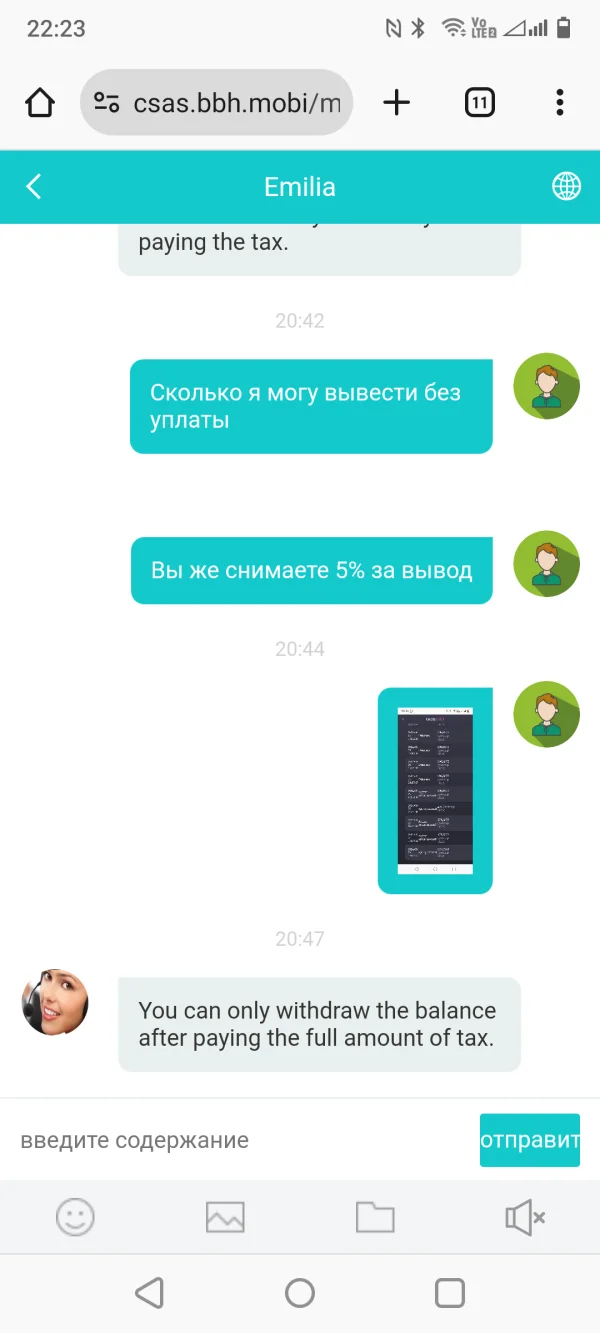

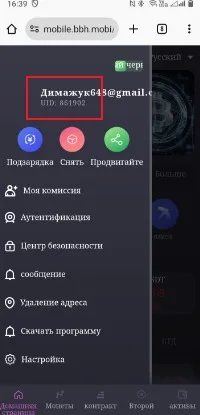

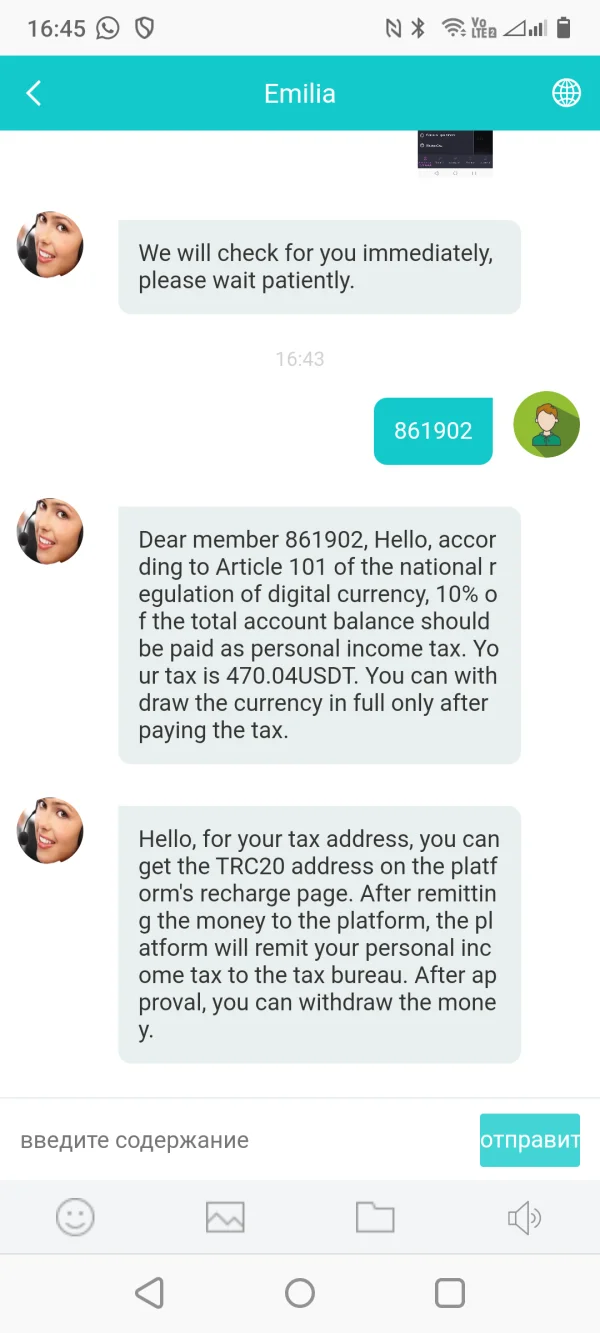

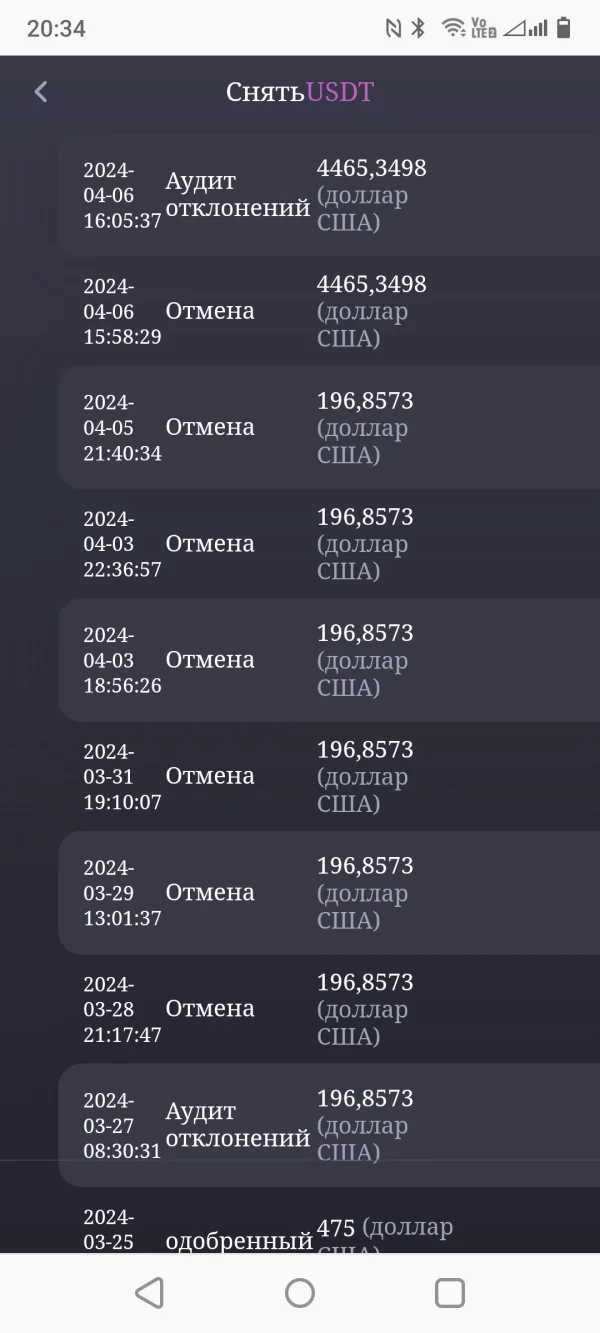

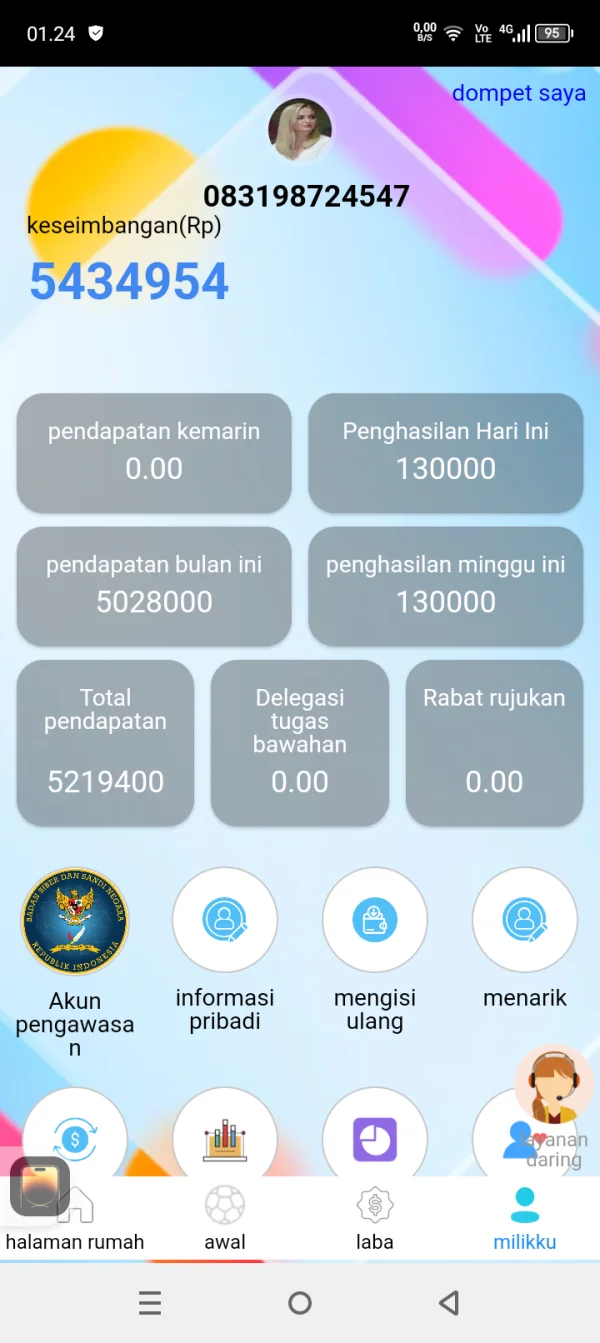

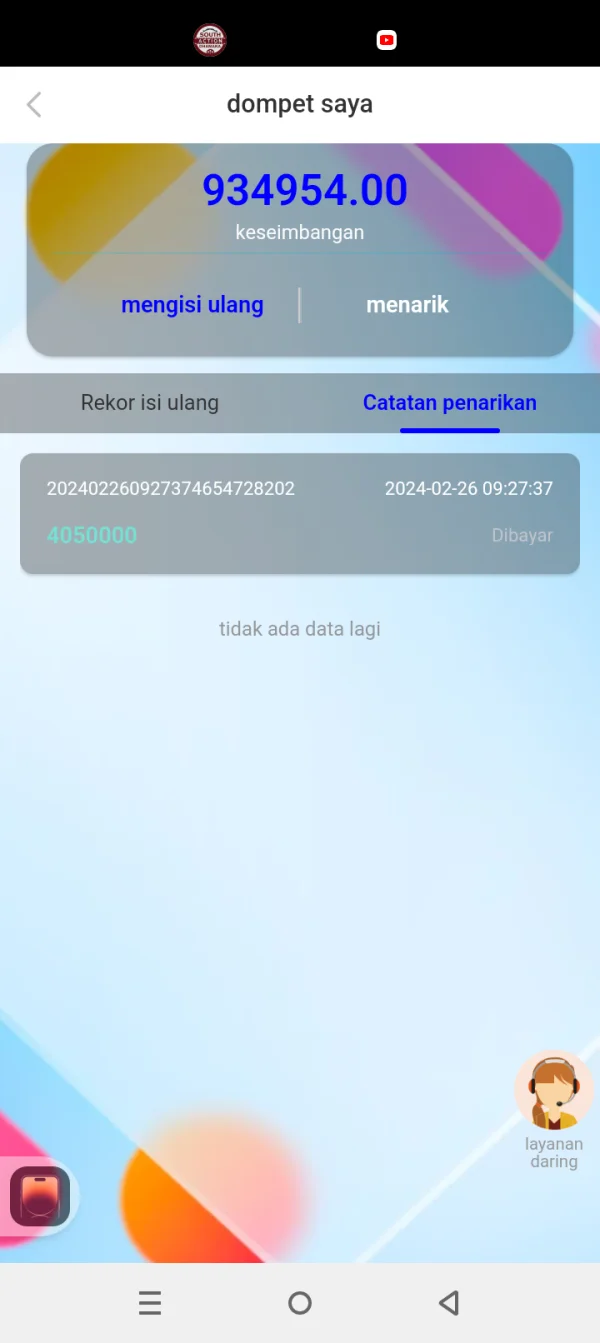

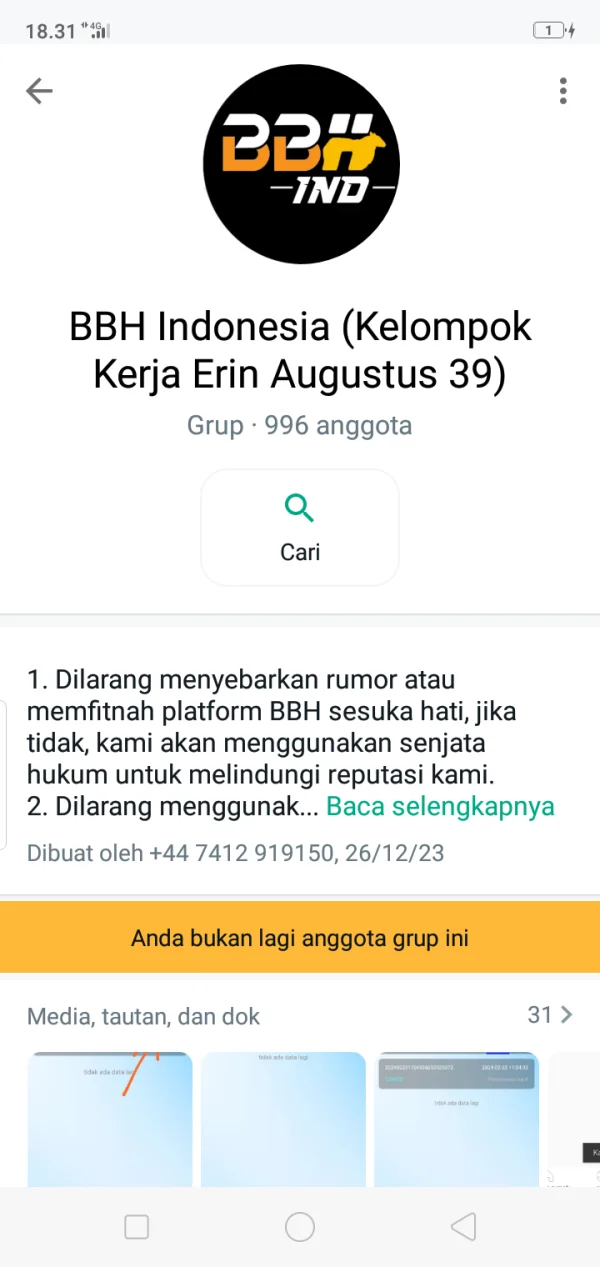

FX3413326667

La russie

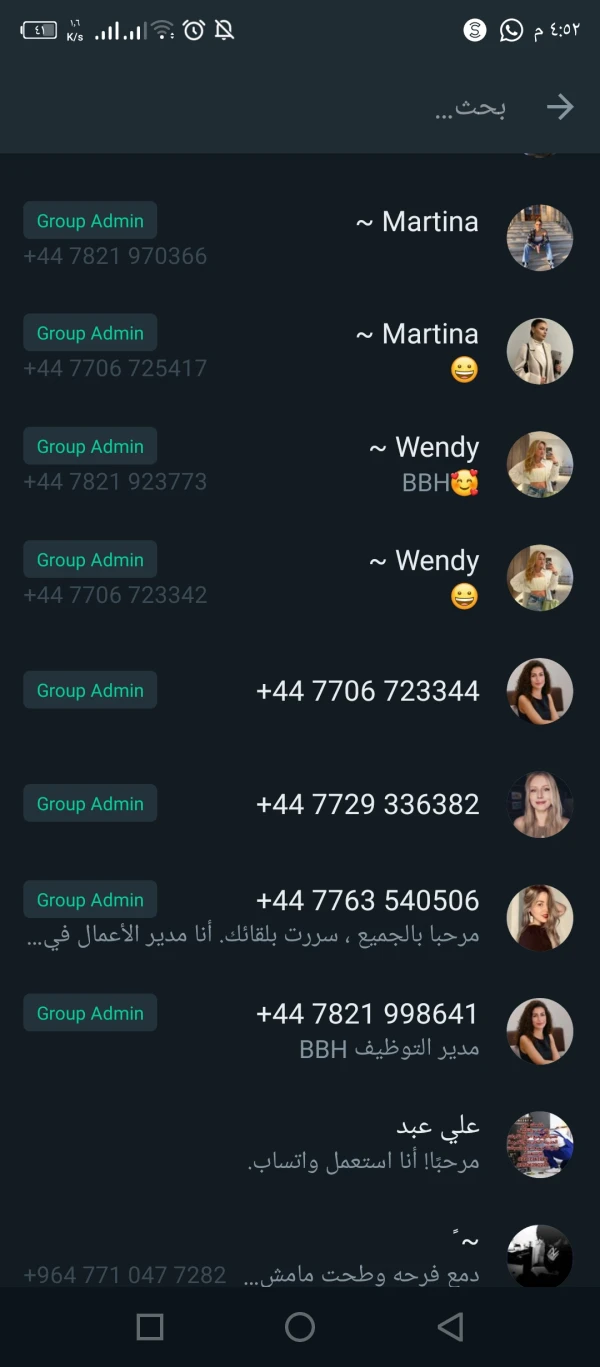

Une fille chinoise rencontre et propose cet échange BBH comme investissement. Quelques fois, ils me permettent de retirer de l'argent, puis le retrait n'est plus possible. Ils me demandent de payer une taxe de 10% pour le retrait. Faites attention, ce sont des extorqueurs et des escrocs !

Divulgation

hendra164

L'Indonésie

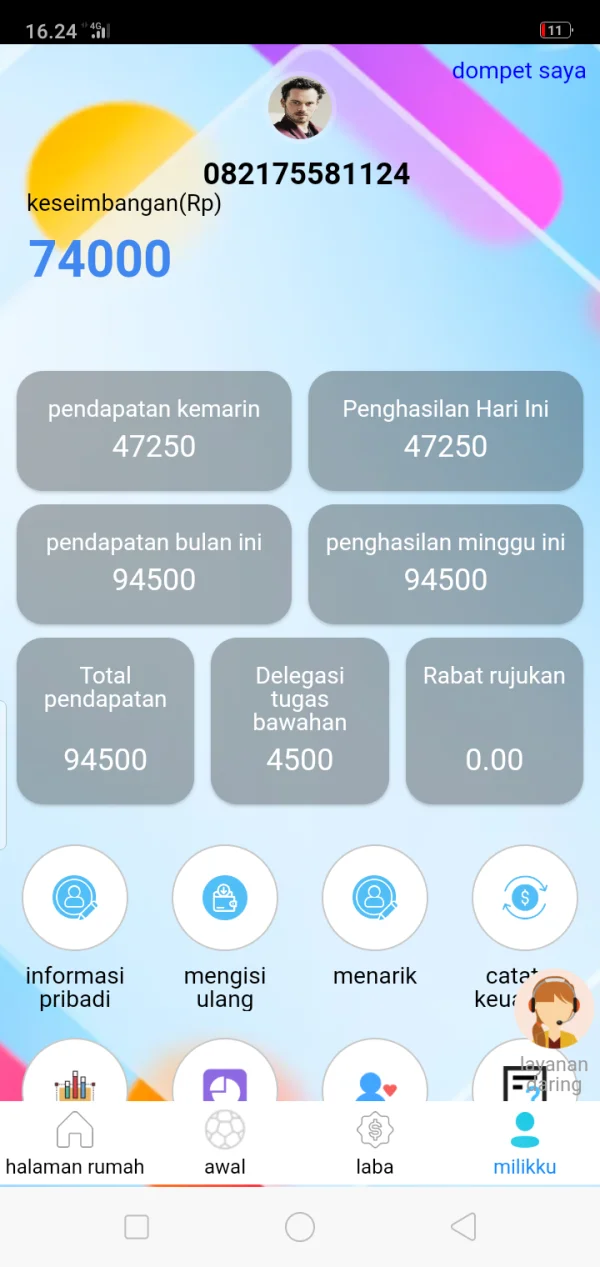

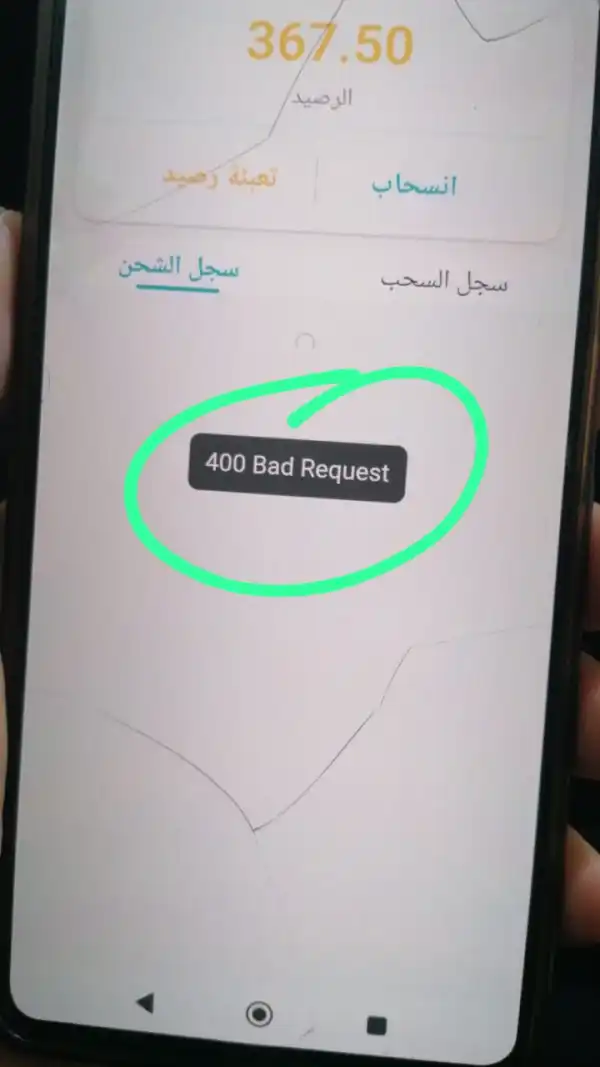

J'ai fait un retrait, il n'a pas encore été encaissé

Divulgation

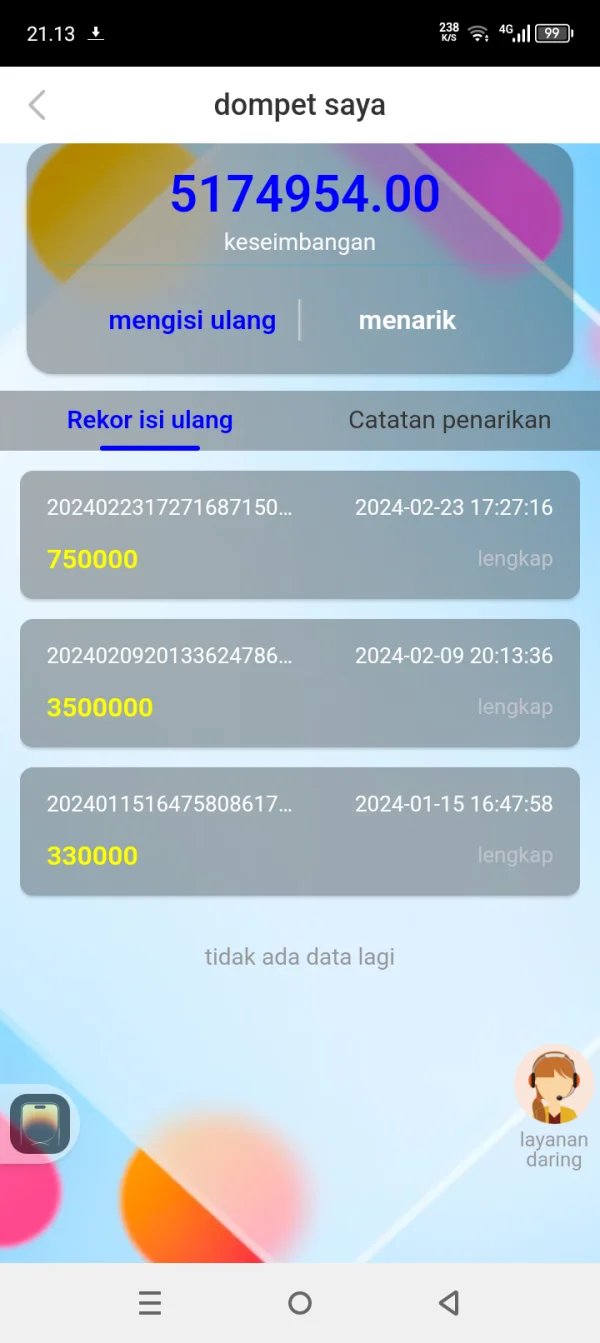

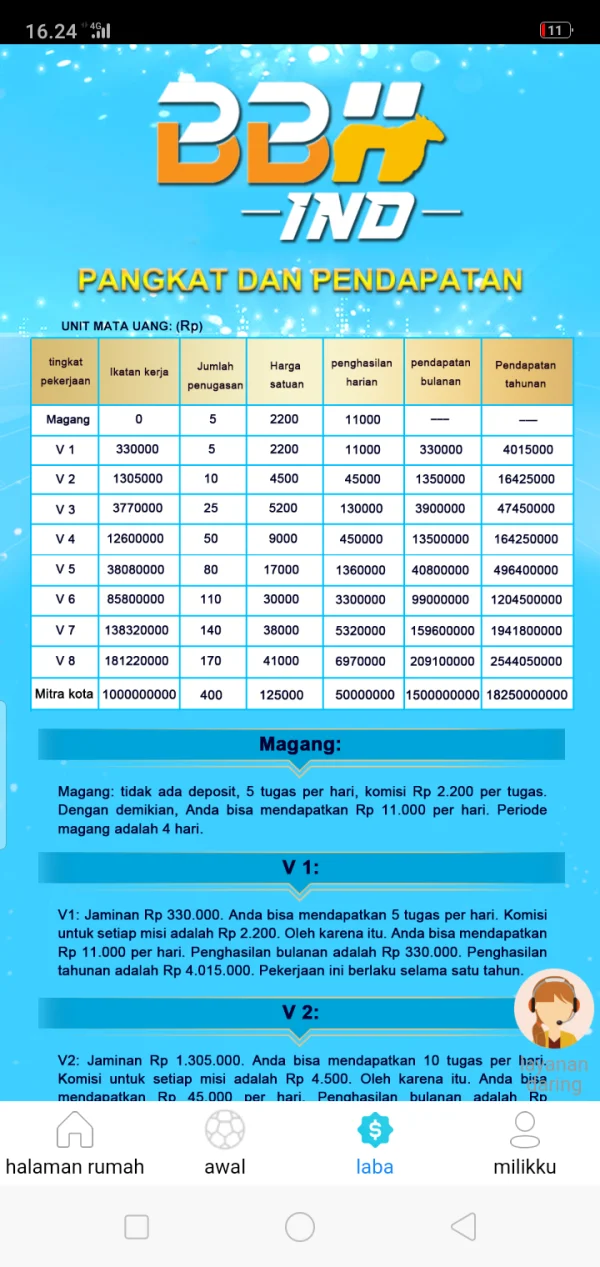

indra518

L'Indonésie

Ils ont vidé notre solde... notre solde aurait dû être de 2000000 à 0 et ils nous ont dit de payer des impôts, nous ne pouvons pas retirer des fonds pendant 2 semaines... il nous a dit de payer des impôts... 2 millions pour V2... même si notre argent était vide en solde... comment pouvons-nous payer des impôts...

Divulgation

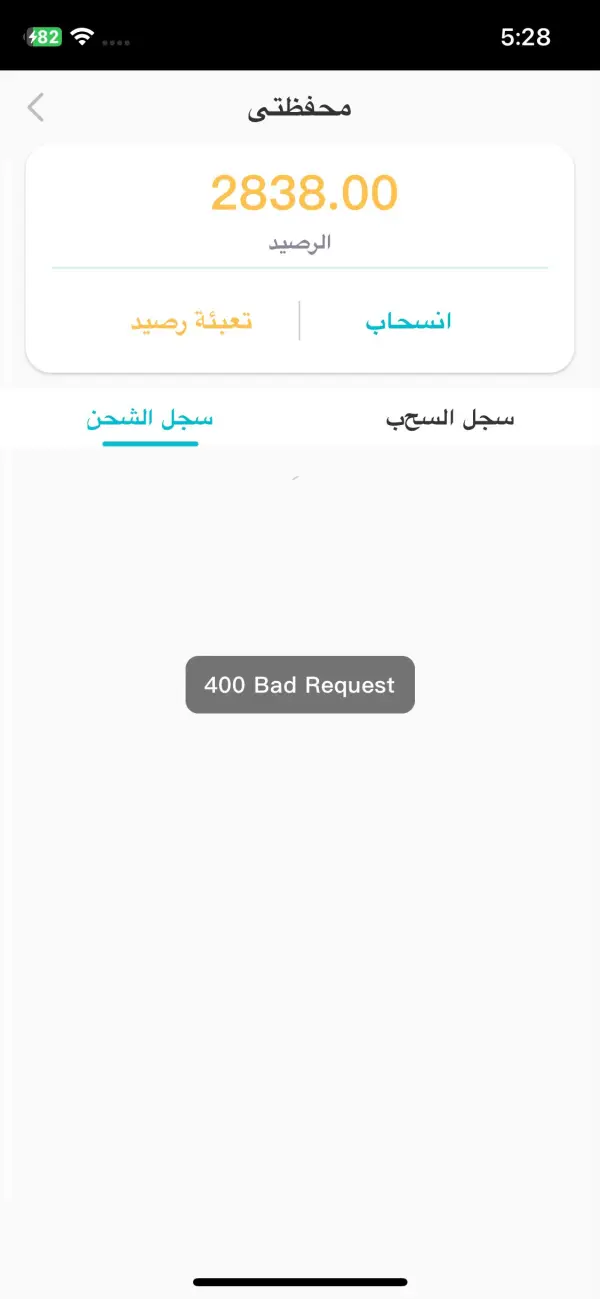

FX3147252051

Irak

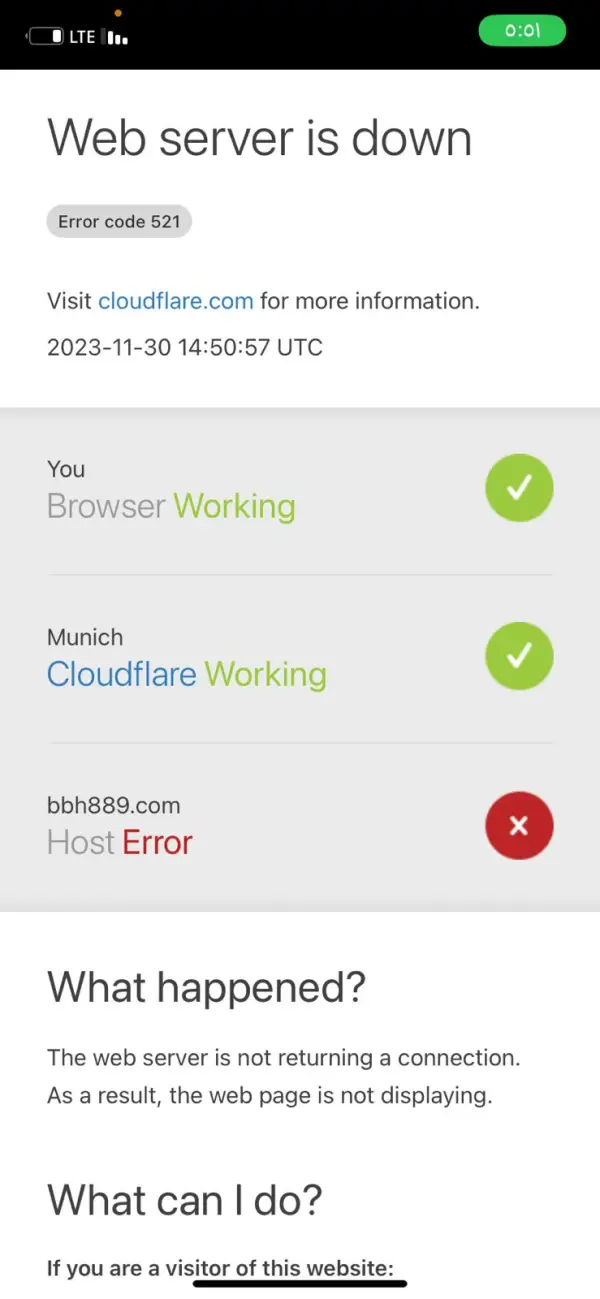

Ils ont fermé le programme. Nous avons été arnaqués avec une grosse somme d'argent. Ils nous avaient promis que nous recevrions les bénéfices tous les jeudis, mais ils n'ont pas tenu parole.

Divulgation

alfalahi

Irak

Ils ont promis aux gens de se retirer tous les jeudis, mais maintenant ils ont fermé le programme et les courtiers ne répondent pas aux abonnés

Divulgation