Resumo da empresa

| TradeSmartResumo da Revisão | |

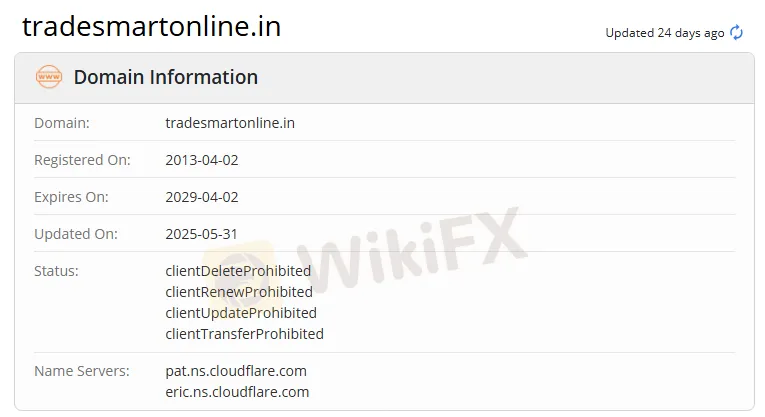

| Fundada | 2013 |

| País/Região Registrada | Índia |

| Regulação | Sem Regulação |

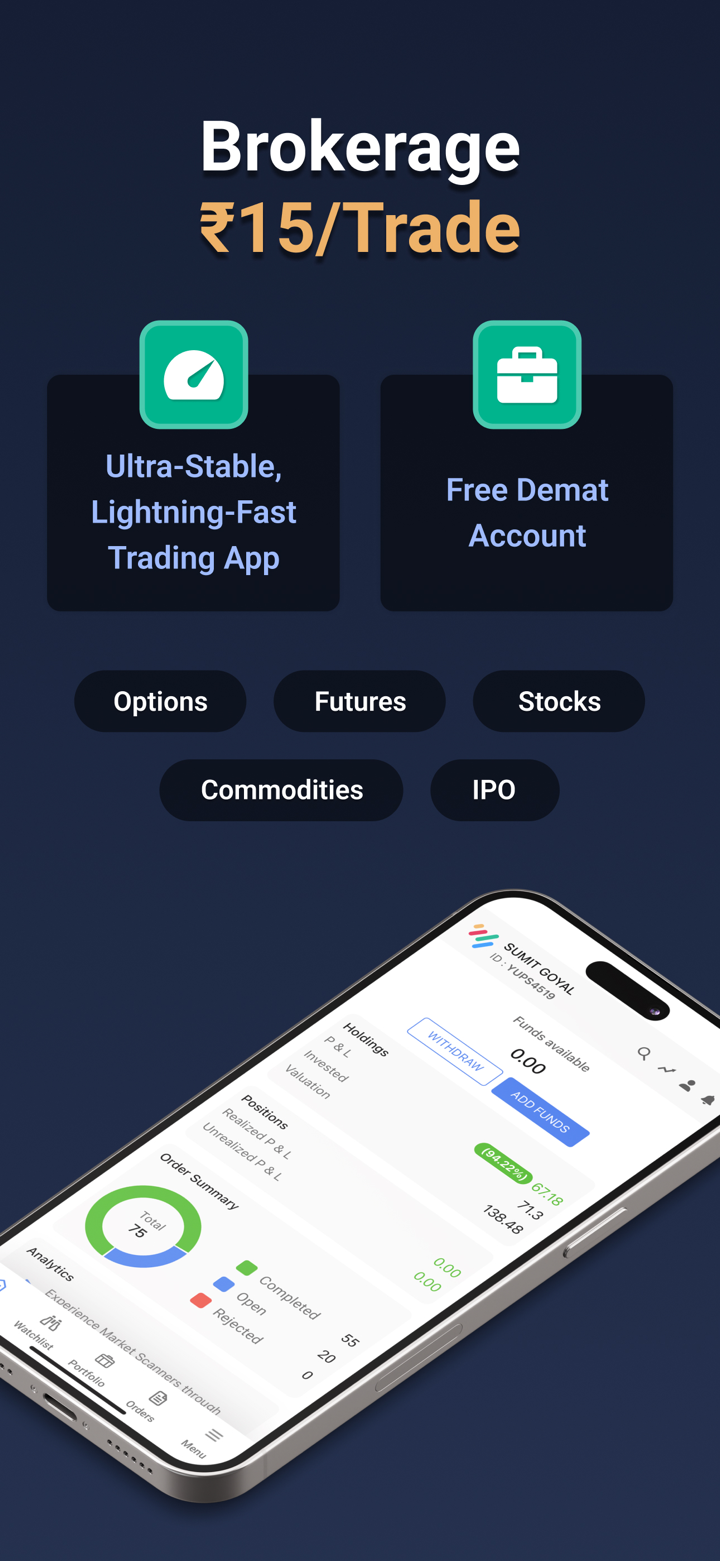

| Instrumentos de Negociação | Ações, futuros, opções, moedas e commodities |

| Produtos | TradeSmart Aplicativo Móvel, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption e Integrações |

| Alavancagem | Até 1:5 |

| Spread | / |

| Plataforma de Negociação | TraderSmart APP |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: +91 022-61208000 |

| E-mail: contactus@vnsfin. com | |

| Redes Sociais: Facebook, Twitter, Instagram, LinkedIn, YouTube, Telegram | |

| Endereço: A-401, Mangalya, Marol, Andheri East, Mumbai - 400059 | |

Informações sobre TradeSmart

Fundada em 2013 e sediada na Índia, TradeSmart é um provedor de serviços financeiros. Oferece uma ampla gama de ferramentas e plataformas de negociação, incluindo o TradeSmart Aplicativo Móvel, TradeSmart Desktop, TradeSmart Web, TradeSmart API, BOX, TradeSmart MF, Instaoption e Integrações. Para atender às necessidades de diferentes clientes, a empresa possui dois tipos de contas: contas Value para traders de baixa frequência e pequeno porte, e contas Power para traders de alta frequência e alto volume.

No entanto, TradeSmart atualmente não é regulamentada e sua legitimidade é motivo de preocupação.

Prós e Contras

| Prós | Contras |

| Diversos produtos oferecidos | Sem regulação |

| Informações limitadas sobre as características da conta | |

| Estrutura de taxas pouco clara | |

| Informações limitadas sobre depósito e saque |

TradeSmart é Legítimo?

O No. TradeSmart não é regulamentado, e os traders devem ter cautela ao negociar.

O que posso negociar na TraderSmart?

| Instrumentos de Negociação | Suportado |

| Ações | ✔ |

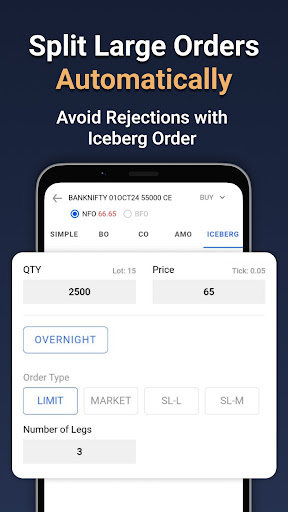

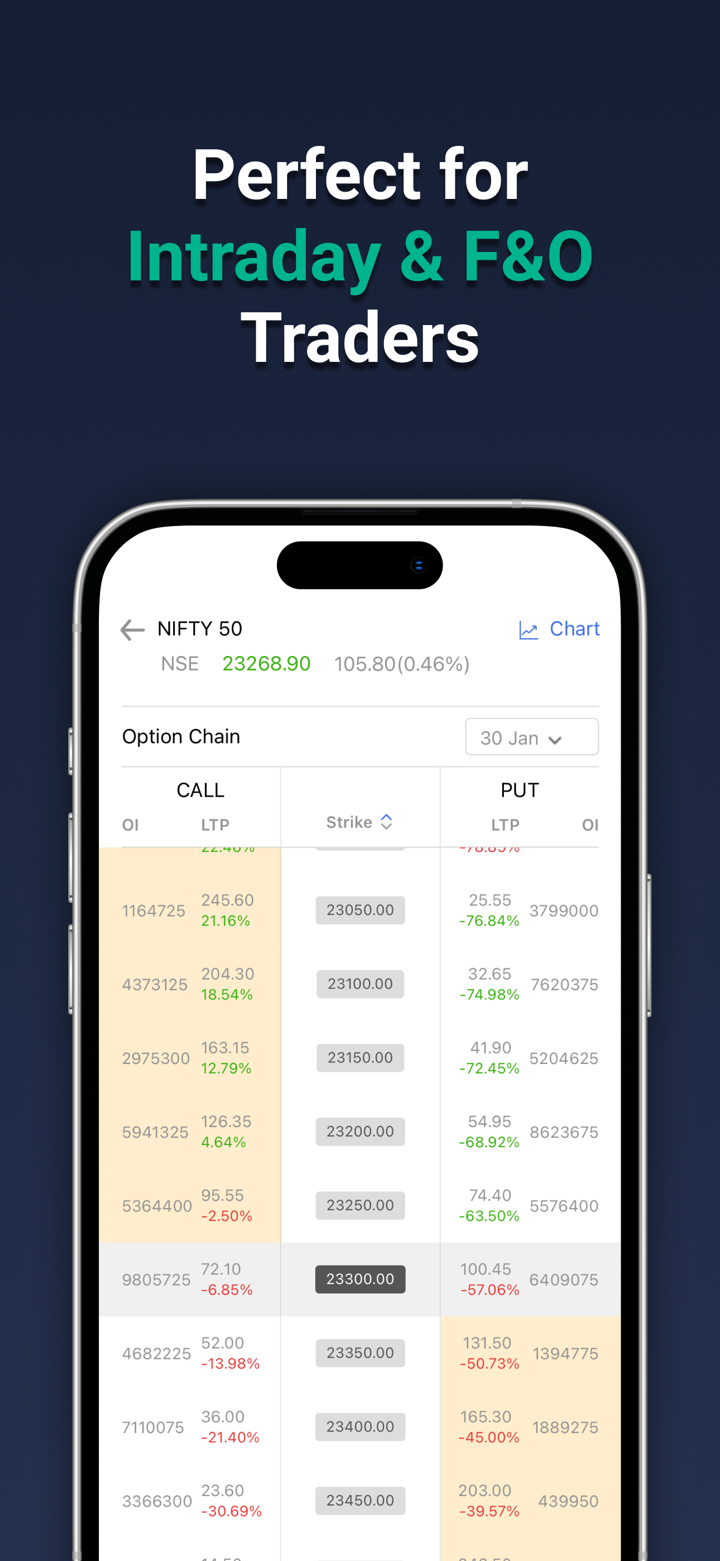

| Futuros | ✔ |

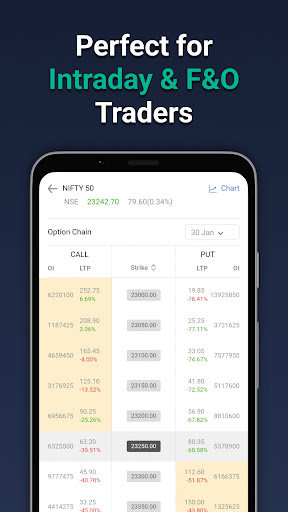

| Opções | ✔ |

| Moedas | ✔ |

| Commodities | ✔ |

| Índices | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| ETFs | ❌ |

Produtos

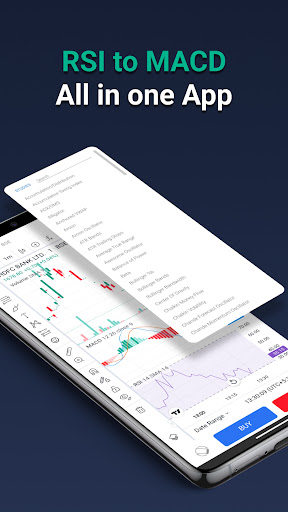

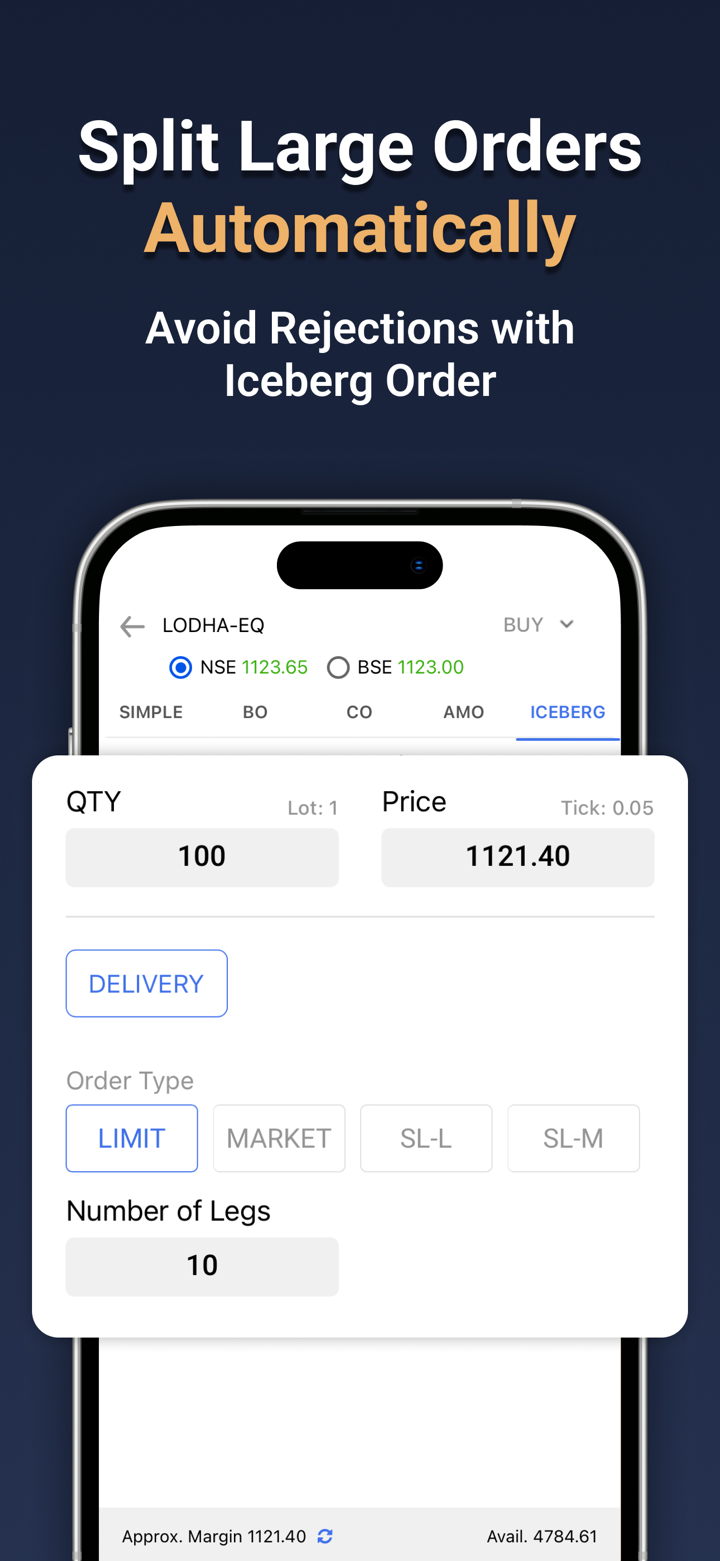

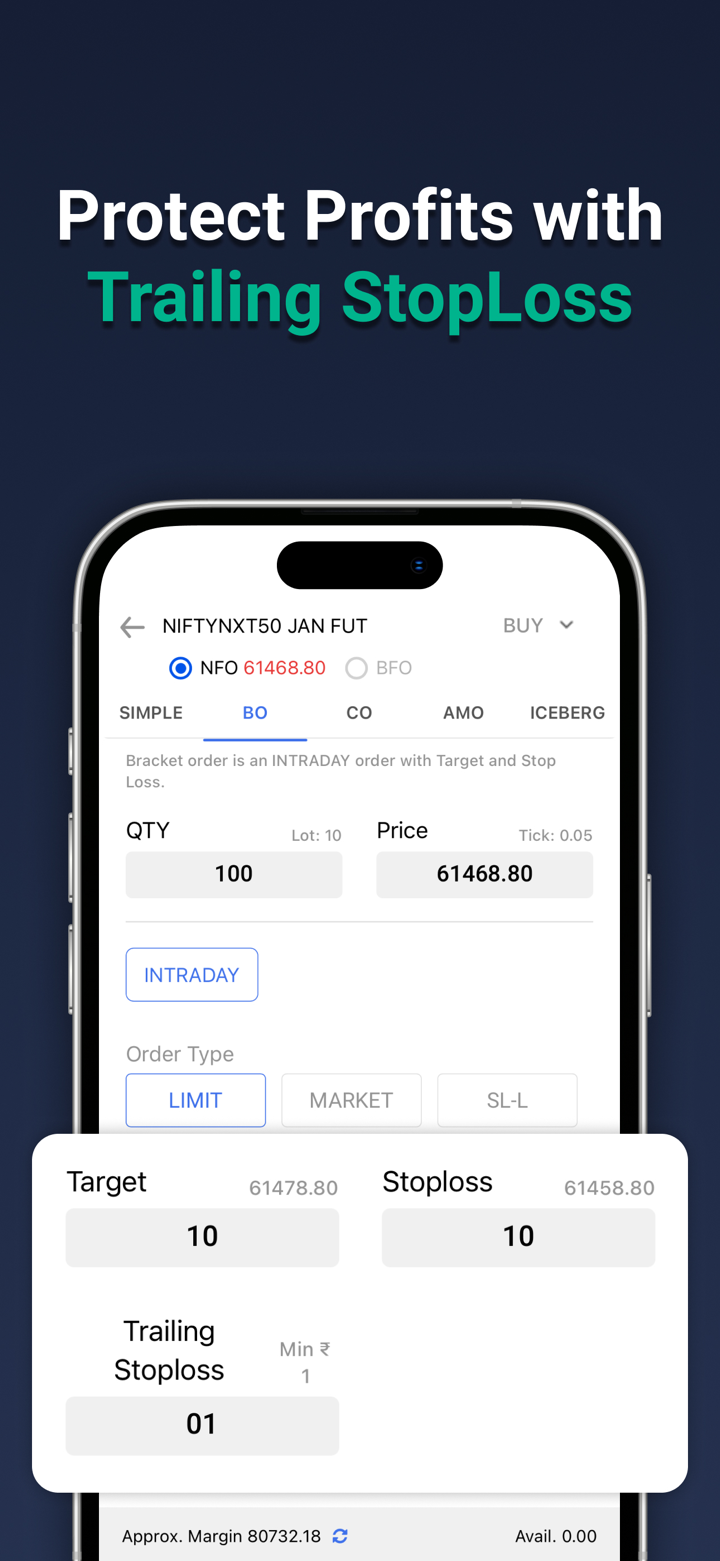

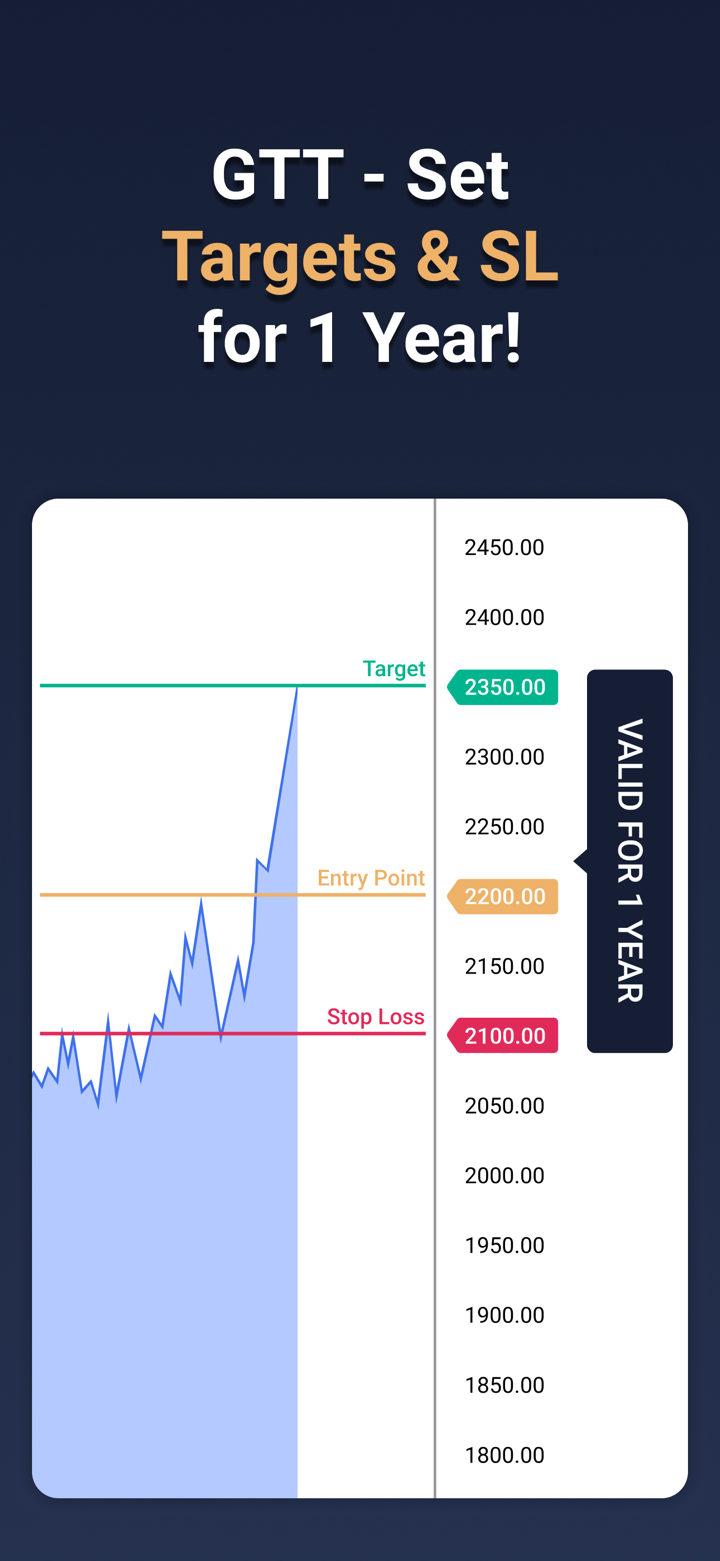

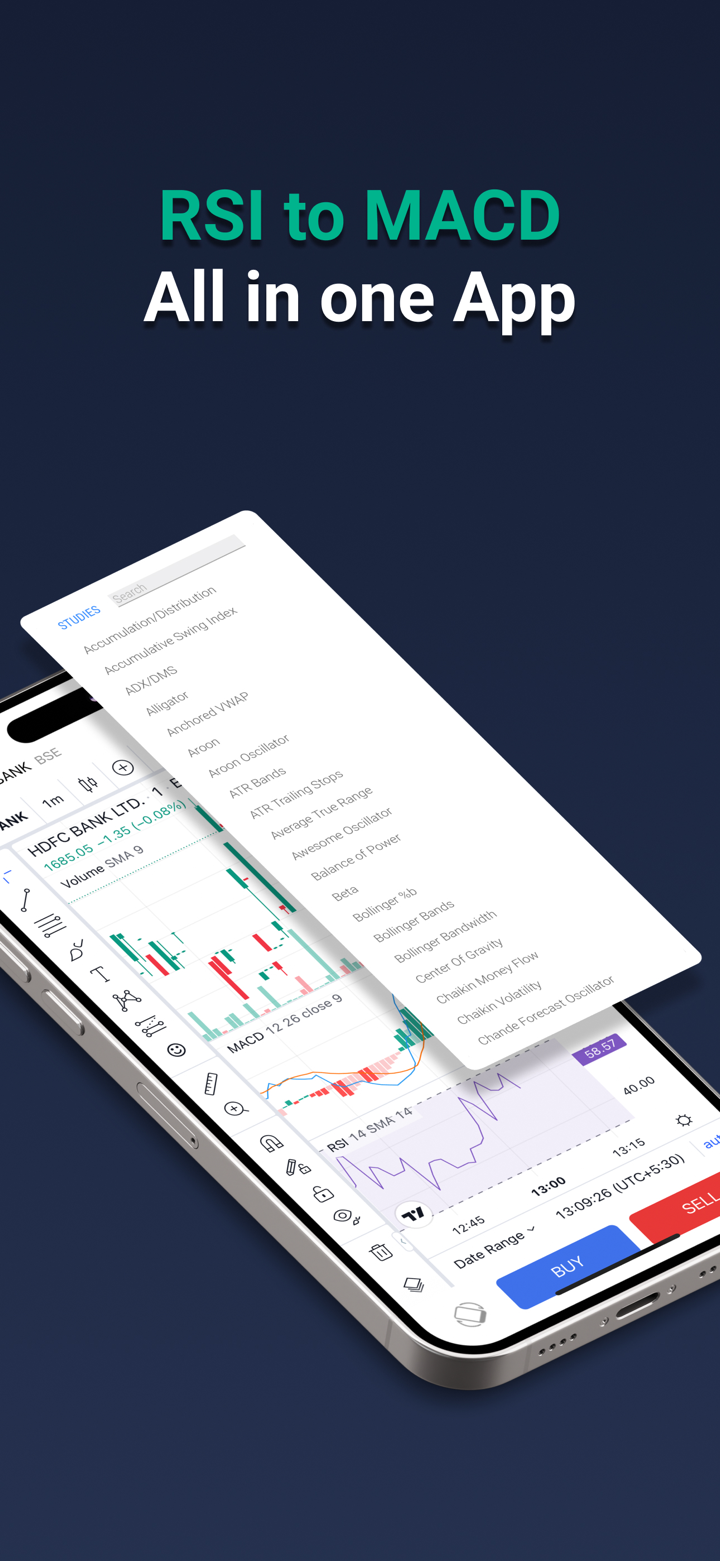

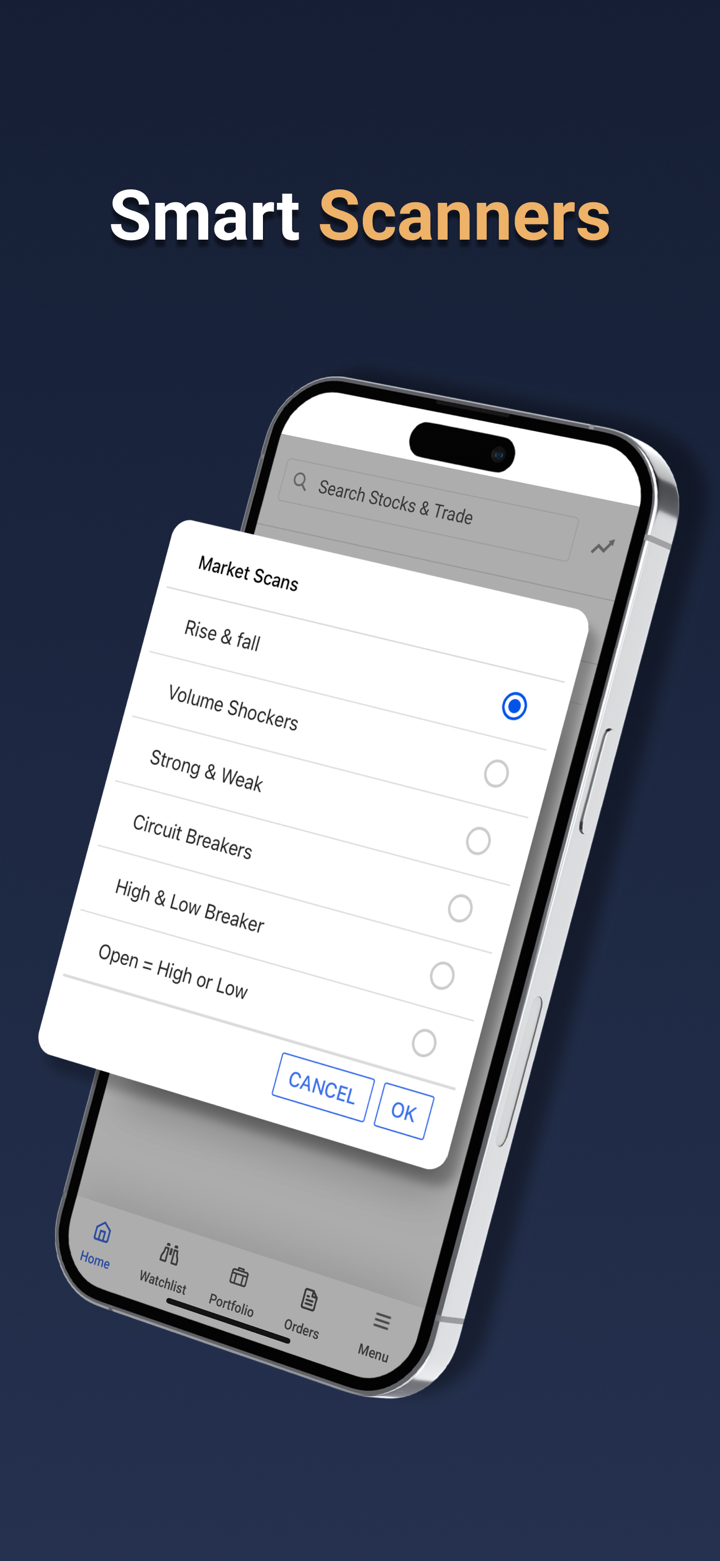

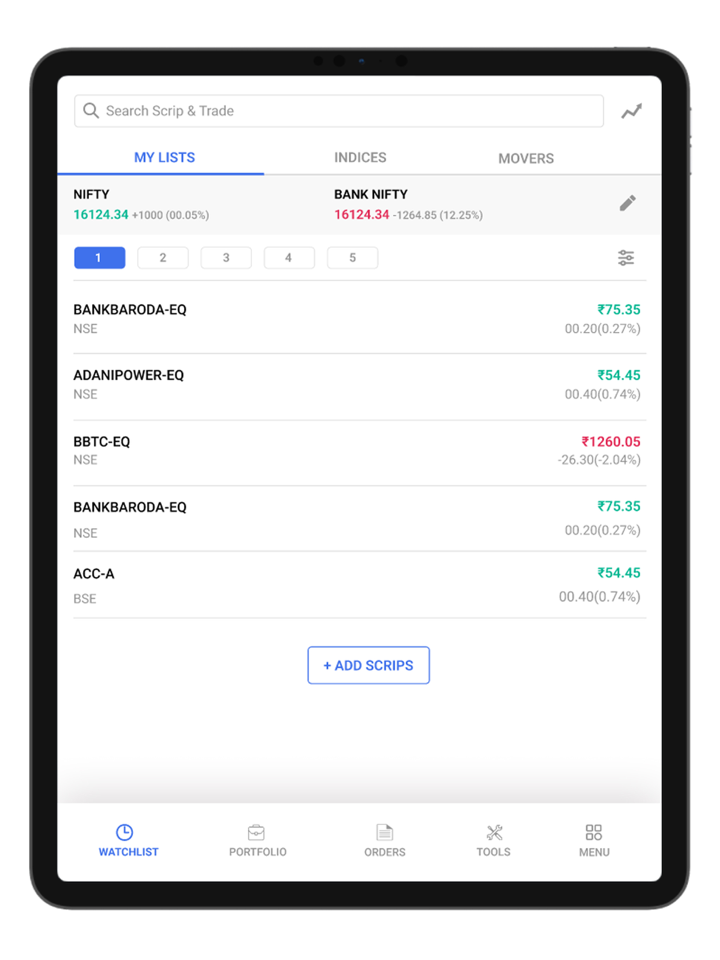

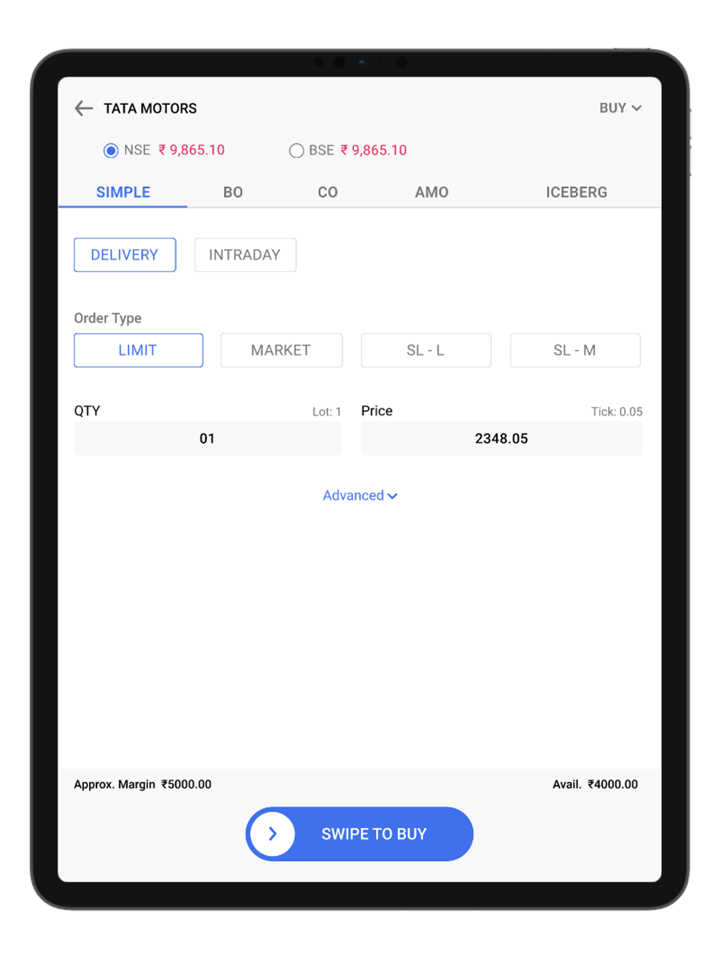

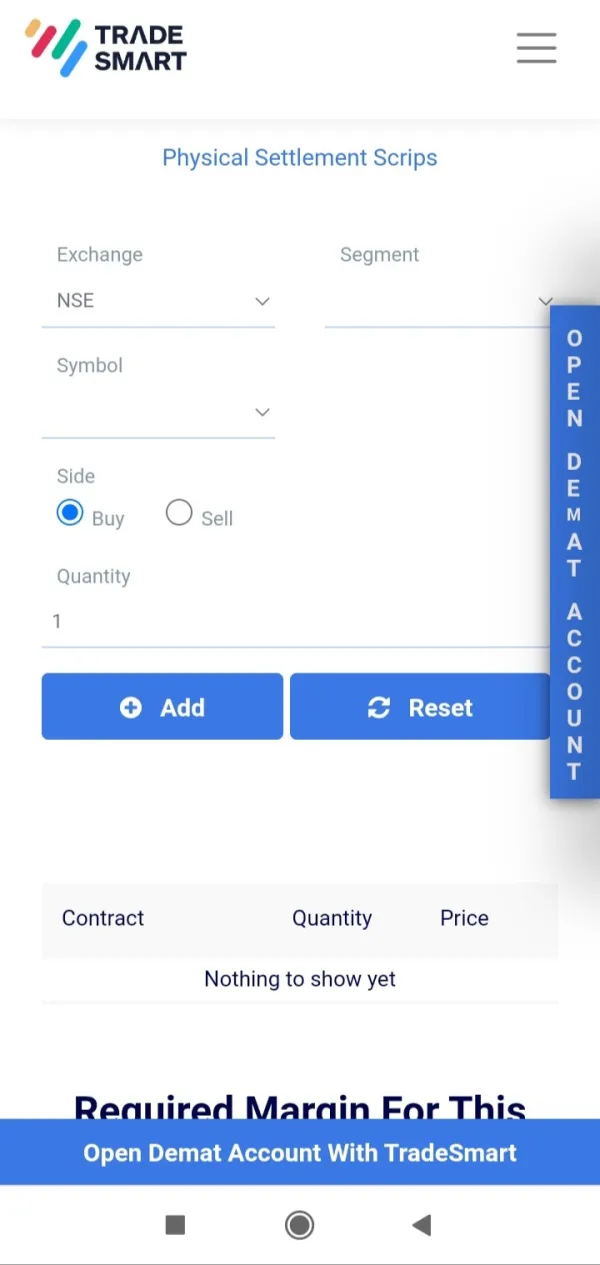

Os produtos da TraderSmart incluem uma variedade de ferramentas de negociação: Aplicativo Móvel TradeSmart, Desktop TradeSmart, Web TradeSmart, API TradeSmart, BOX, TradeSmart MF, Instaoption e Integrações.

Tipos de Conta e Taxas

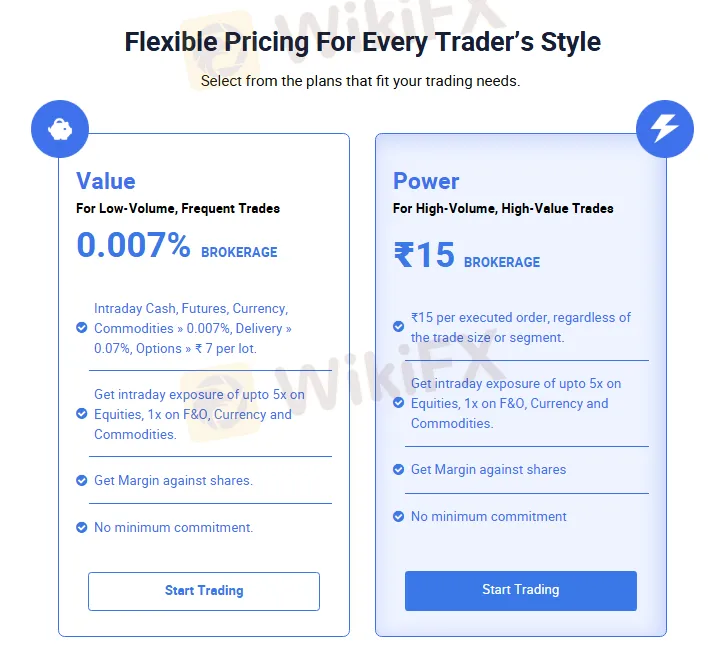

TradeSmart oferece aos traders contas Demat para negociação. Existem dois programas diferentes disponíveis: Value e Power, para os traders escolherem.

O papel principal de uma conta Demat é digitalizar o armazenamento, gerenciamento e negociação de títulos, proporcionando aos investidores uma experiência de investimento eficiente, segura e transparente.

Abaixo estão informações sobre os dois planos de conta:

| Conta Value | Conta Power | |

| Traders Alvo | Traders de baixo volume e alta frequência | Traders de alto volume e alto valor |

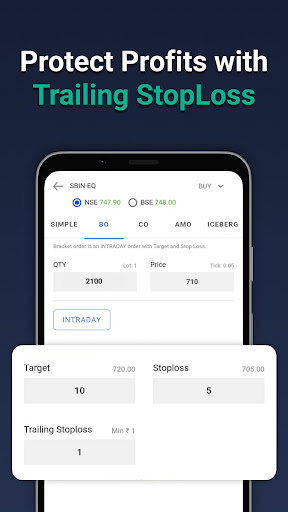

| Taxa de Corretagem | 0,007% | ₹15 por ordem (independentemente do tamanho ou tipo de negociação) |

| Intraday em Dinheiro, Futuros, Moeda | Adequado para negociações de baixo volume e alta frequência | Adequado para negociações de alto volume e alto valor |

| Commodities > 0,007%, Entrega > 0,07%, Opções > ₹7 por lote | Suporta negociações de commodities e opções de baixo custo | Suporta negociações de commodities e opções de alto custo |

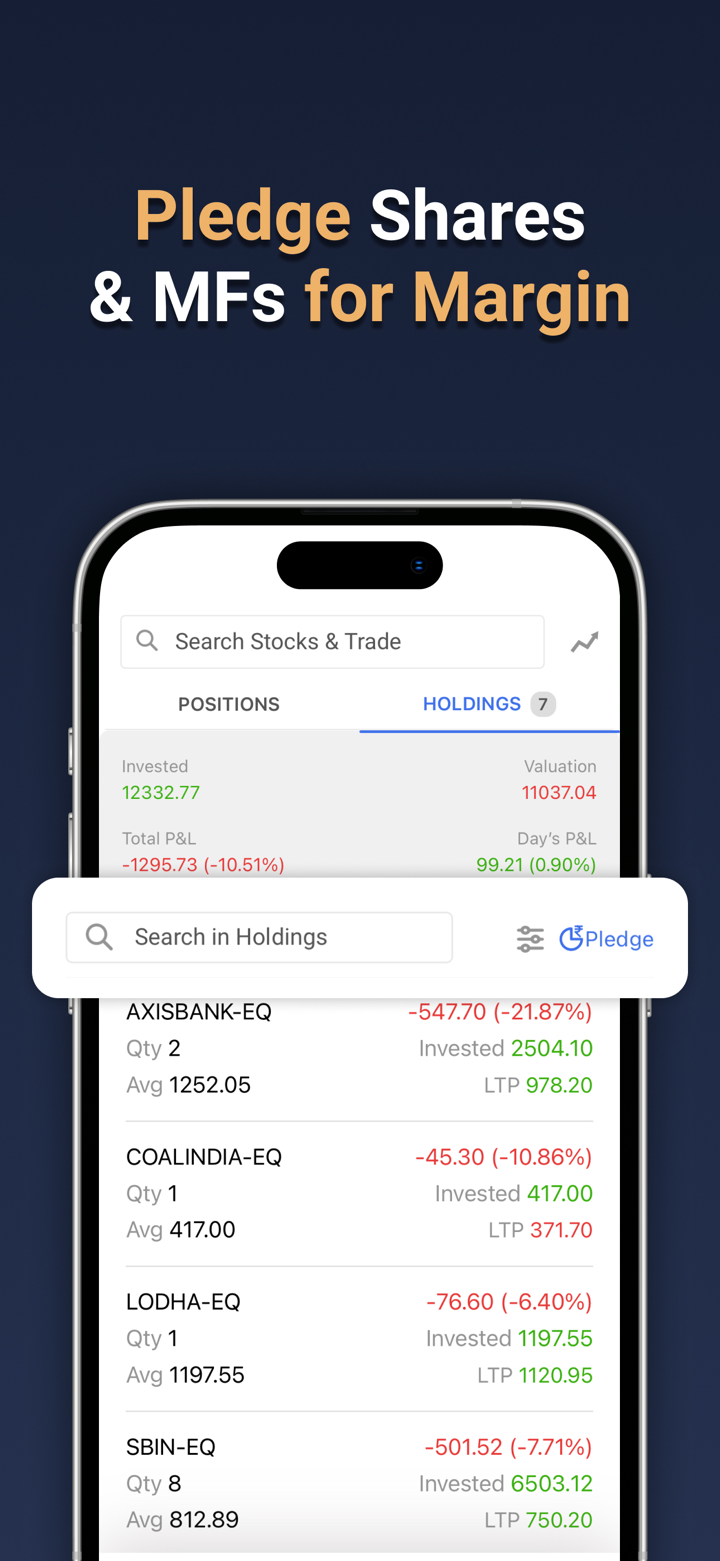

| Alavancagem | Até 1:5 (Ações, F&O, Moeda e Commodities) | Até 1:5 (Ações, F&O, Moeda e Commodities) |

| Suporte de Margem Contra Ações | Sim | Sim |

| Compromisso Mínimo | Não | Não |

Alavancagem

TradeSmart tem alavancagem de 1:5 em ações, F&O, moedas e commodities. Por favor, note que a alta alavancagem pode amplificar não apenas os lucros, mas também as perdas.

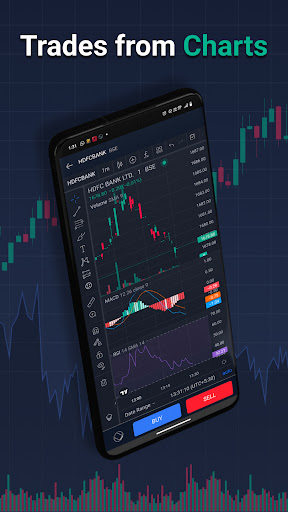

Plataforma de Negociação

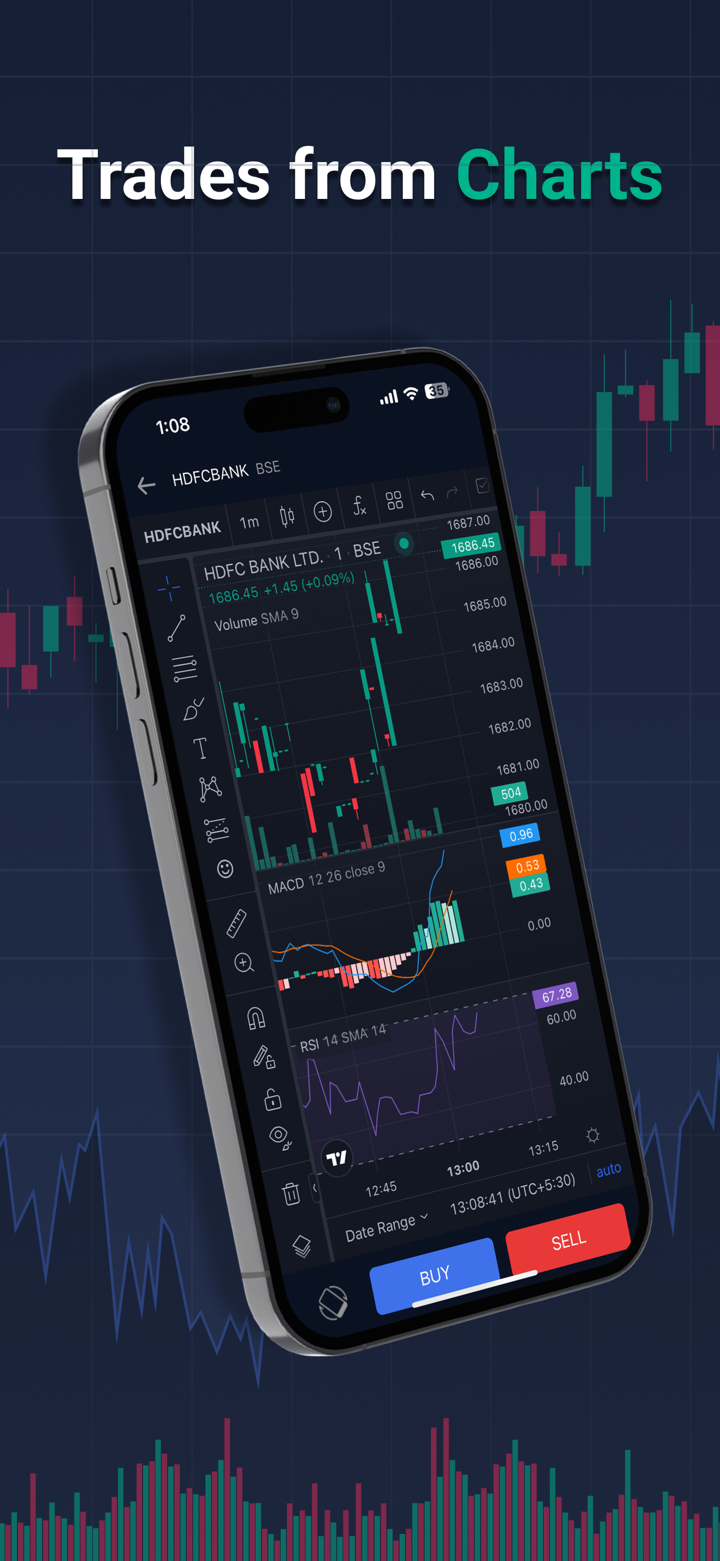

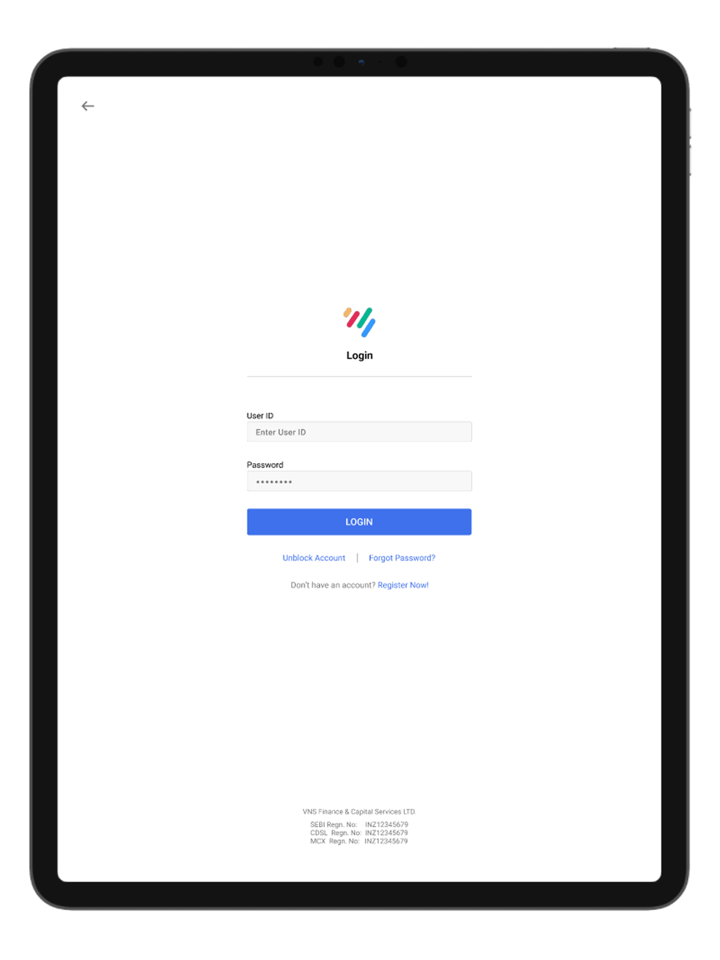

TradeSmart suporta a negociação usando o aplicativo exclusivo TraderSmart APP. Apenas Rs. 15 por negociação são cobrados como comissão para negociar nesta plataforma.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| TraderSmart | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |

Depósito e Retirada

O TraderSmart aceita pagamentos via transferência bancária e transferência NEFT.

Um total de 29 bancos são suportados conforme listado abaixo:

Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Capital Small Financec Bank, Catholic Syrian Bank, City Union Bank, Deutsche Bank, Dhanlaxmi Bank, Federal Bank, HDFC Bank, IDFC First Bank, ICICI Bank, Indian Bank, Indian Overseas Bank, Indusined Bank, Jammu and Kashmir Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Punjab National Bank, Saraswat Bank, State Bank of India, Tamilnad Mercantile Bank, Union Bank of India, YES Bank e AU Small Finance Bank.