Présentation de l'entreprise

| RICO Résumé de l'examen | |

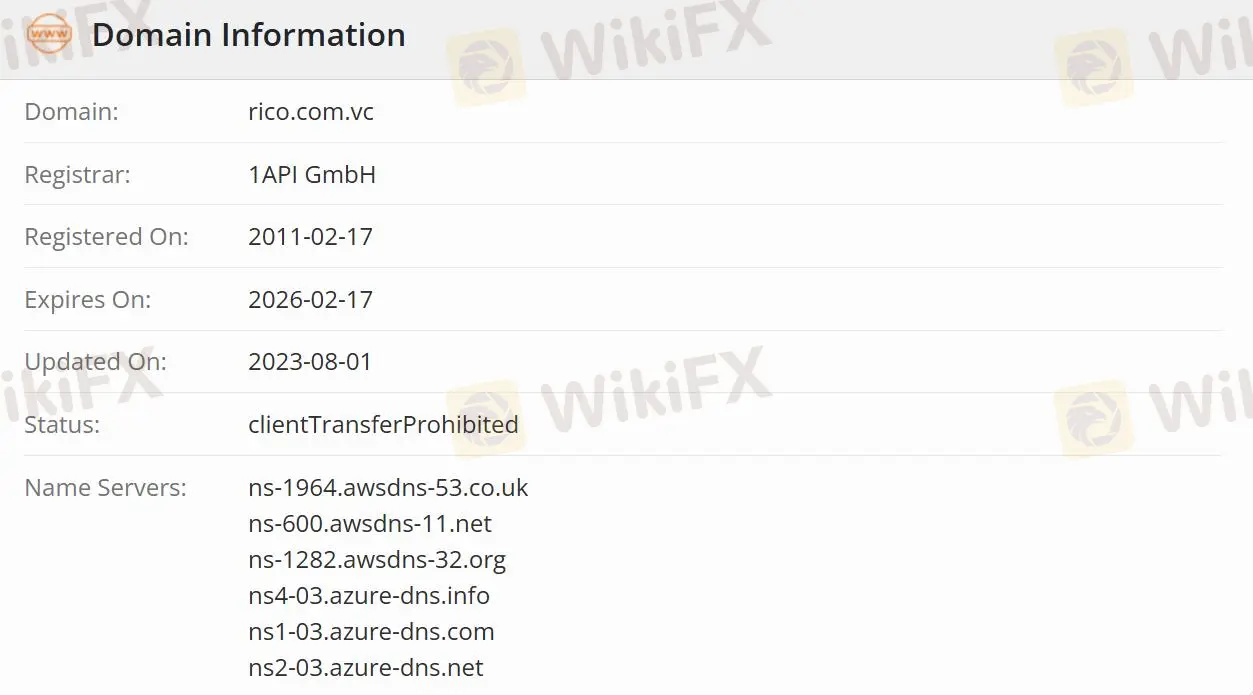

| Fondé | 2011-02-17 |

| Pays/Région enregistré | Brésil |

| Réglementation | Non réglementé |

| Produits | Tous les investissements/Trésorerie directe/Revenu fixe/Autres investissements/Le marché boursier et BM&F |

| Compte de démonstration | ✅ |

| Plateforme de trading | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| Assistance clientèle | Téléphone: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

RICO Informations

Fondée en 2011, RICO est une société d'investissement non réglementée enregistrée au Brésil. La société propose divers produits, y compris tous les investissements et simulateurs, ainsi que 5 grandes plateformes avec des frais différents, tels que Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro et Profit. RICO propose des comptes d'investissement pour investir et des comptes numériques pour gérer les transactions quotidiennes.

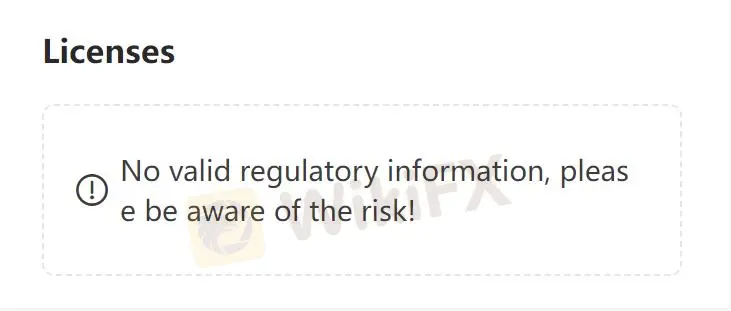

RICO est-il légitime ?

RICO n'est pas réglementé, ce qui le rend moins sûr que les sociétés réglementées.

Quels produits RICO propose-t-il ?

La société propose divers produits, y compris tous les investissements, la trésorerie directe, les revenus fixes, CBD, LC, LCA, LCI et les obligations. RICO propose également d'autres investissements, tels que des fonds d'investissement, des fonds immobiliers, COE, CRI, CRA et des offres publiques-lPO. De plus, le marché boursier et BM&F impliquent la location d'actions, les options, les contrats à terme, les mini-contrats, les contrats à terme sur actions et le fournisseur de liquidité-RLP.

Type de compte

Rico propose deux comptes avec des soldes différents. Grâce au compte d'investissement, les utilisateurs peuvent investir dans des applications à revenu fixe et à revenu variable, et utiliser le compte numérique pour gérer les transactions quotidiennes telles que le paiement des factures, l'envoi et la réception de PIX et TED, et la réception des salaires.

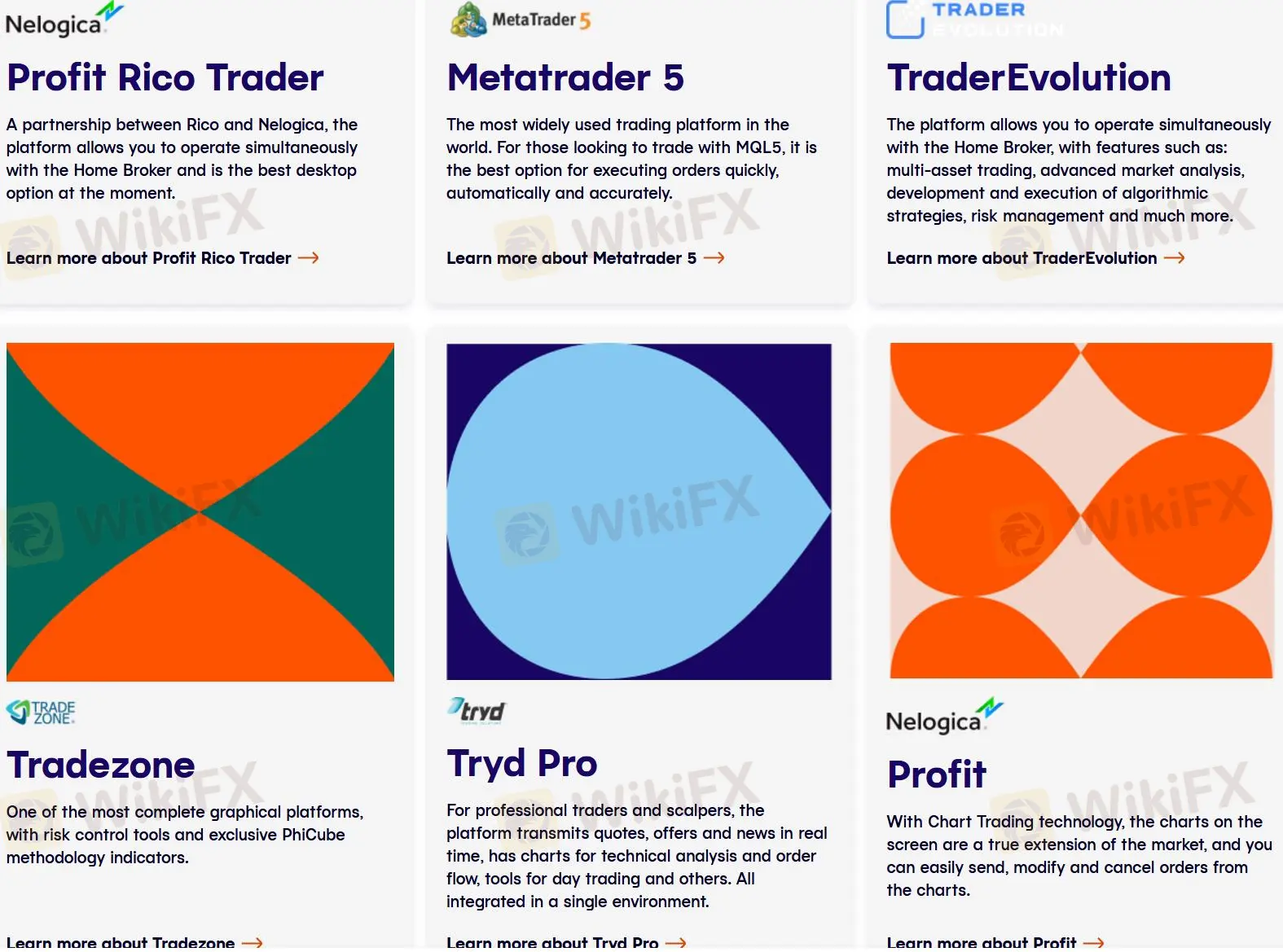

Plateforme de trading

Chez RICO, les utilisateurs sont libres de choisir n'importe quelle plateforme, y compris Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro et Profit. En dehors de Metatrader5 (compte réel et compte de démonstration), Tradezone Web (Webchart) et les plateformes Web TraderEvolution sont gratuites. Les frais facturés par chaque plateforme sont également différents :

R$ 60.00 – Tradezone Desktop;

R$ 160.00 – TraderEvolution Desktop;

R$ 14.90 – RicoTrader;

R$ 100.00 – Tryd Pro;

R$ 19.90 – Tryd Trader;

R$ 120.00 – ProfitPlus et

R$ 139.90 – ProfitPro.

Cependant, pour les plateformes payantes, il y a également un coût de 10,68% du montant facturé pour l'ISS.

| Plateforme de trading | Pris en charge | Appareils disponibles |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Desktop/Mobile |

| Tradezone | ✔ | Desktop/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

Options de support client

Les traders peuvent suivre RICO sur YouTube, Instagram,Facebook et Twitter et rester en contact avec l'entreprise en appelant WhatsApp et téléphone.

| Options de contact | Détails |

| Téléphone | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| Réseaux sociaux | YouTube, Instagram, Facebook, Twitter |

| Langue prise en charge | Portugais |

| Langue du site web | Portugais |

| Adresse physique | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |