Buod ng kumpanya

| Fineco Buod ng Pagsusuri | |

| Itinatag | 2002 |

| Rehistradong Bansa/Rehiyon | Italya |

| Regulasyon | Walang Regulasyon |

| Mga Produkto sa Paghahalal | CFDs, ETF, ETC & ETNs, Bonds, Futures, Options |

| EUR/USD Spread | Mula sa 1 pip |

| Platform ng Paghahalal | FinecoX |

| Minimum na Deposito | / |

| Suporta sa Customer | Social Media: Facebook, Twitter, LinkedIn, Instagram, Spotify, Reddit |

| Address: 20131 Milan - P.zza Durante, 11 | |

Impormasyon Tungkol sa Fineco

Itinatag ang Fineco noong 2002 at rehistrado ito sa Italya. Nag-aalok ito ng malawak na hanay ng mga produkto sa paghahalal, kabilang ang CFDs, ETF, ETC & ETNs, Bonds, Futures, at Options sa pamamagitan ng kanilang sariling plataporma na FinecoX.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Iba't ibang mga produkto sa paghahalal | Walang regulasyon |

| Walang komisyon sa CFD trading | Limitadong mga paraan ng pagbabayad |

| Walang direktang paraan ng pakikipag-ugnayan |

Tunay ba ang Fineco?

Ang Fineco ay hindi regulado sa kasalukuyan, kaya't dapat mag-ingat ang mga mangangalakal sa pagtitingin.

Ano ang Maaari Kong I-trade sa Fineco?

Nag-aalok ang Fineco ng malawak na hanay ng mga produkto na maaaring i-trade, kabilang ang CFDs, ETF, ETC & ETNs, Bonds, Futures, at Options.

| Mga Produkto sa Paghahalal | Available |

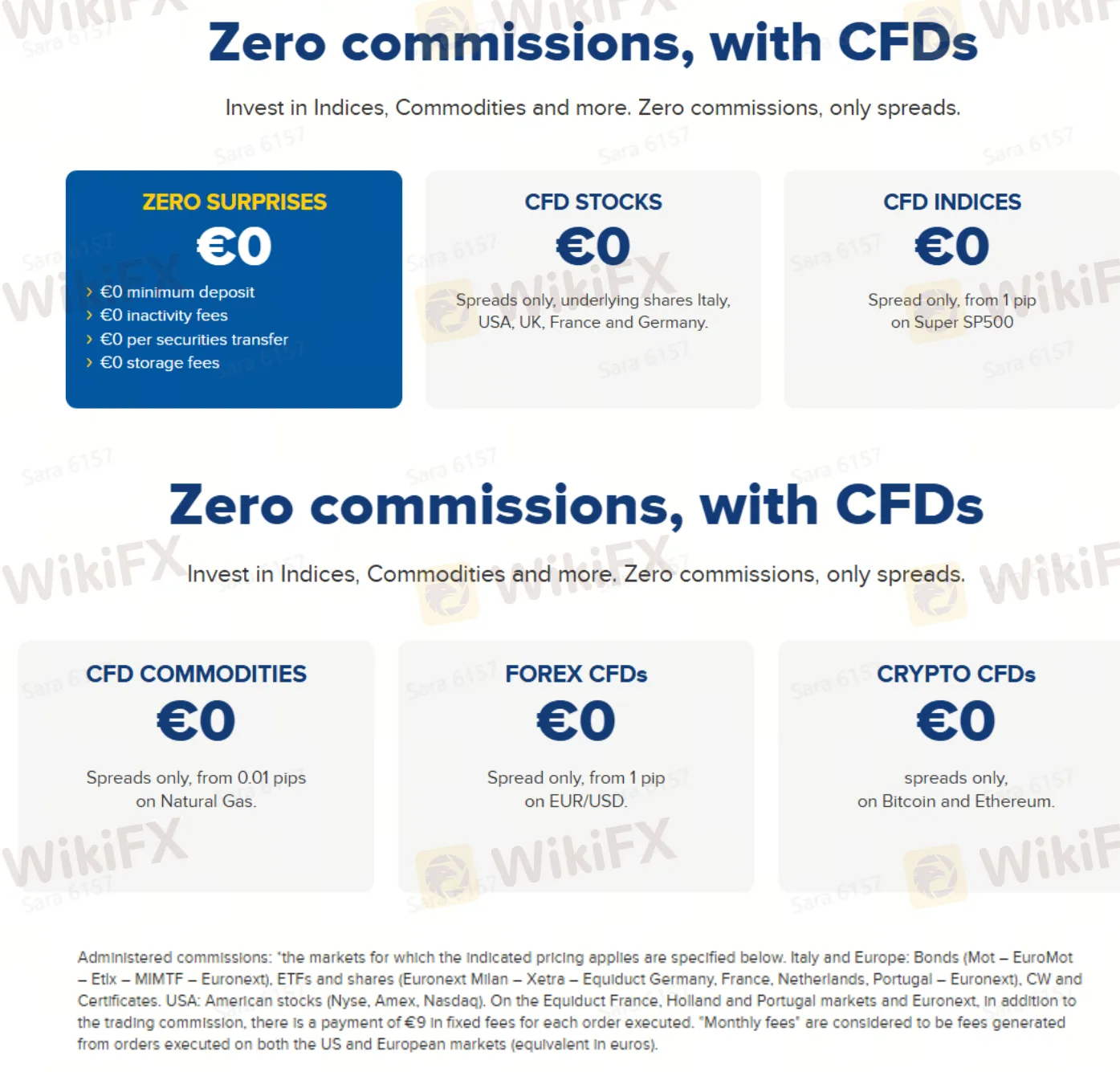

| CFD Stocks | ✔ |

| CFD Indices | ✔ |

| CFD Commodities | ✔ |

| Forex CFDs | ✔ |

| Crypto CFDs | ✔ |

| ETF, ETC & ETN | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Options | ✔ |

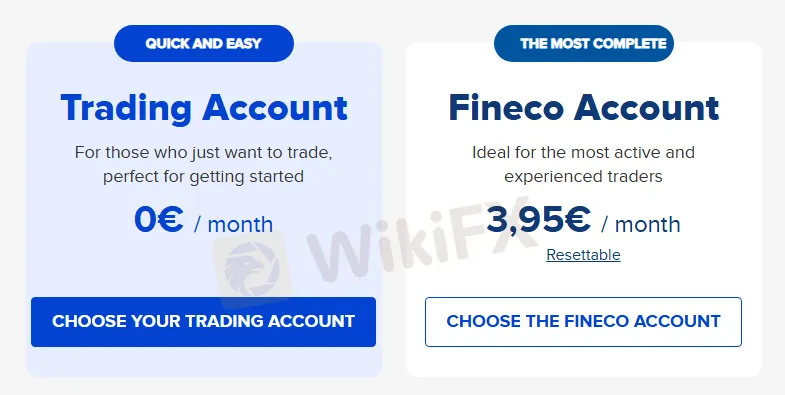

Uri ng Account

Fineco ay nag-aalok ng dalawang uri ng account: Trading Account at Fineco Account. Ang mga pagkakaiba sa pagitan ng dalawang account ay ang mga sumusunod:

| Uri ng Account | Buwang Bayad | Komisyon | Multicurrency Service | Suporta sa Customer |

| Trading Account | €0 | 0.19% ng halaga ng order (Min. €2.95 - Max. €19) | Hindi | Mail lamang |

| Fineco Account | €3.95/buwan | Fixed mula €19 hanggang €2.95 bawat operasyon o asset (maaaring i-reset pagkatapos ng dalawang buwan) | Oo | Sa pamamagitan ng email at telepono |

Bayad

Spread: Ang CFDs ay inaalok nang walang komisyon, mayroon lamang bayad sa spread. Ang mga spread ay nag-iiba depende sa asset; halimbawa, ang EUR/USD spread ay nagsisimula sa 1 pip, at ang Super SP500 index spread ay nagsisimula rin sa 1 pip.

Komisyon: Walang komisyon sa CFD trading.

Management Commission: Ang mga order na isinasagawa sa US at European markets ay may fixed fee na 9 euros bukod pa sa transaction commission.

Plataforma ng Trading

Fineco ay sumusuporta sa mga trader sa pag-conduct ng mga transaksyon sa pamamagitan ng kanilang sariling FinecoX platform.

| Plataforma ng Trading | Supported | Available Devices | Suitable for |

| FinecoX | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposito at Pag-Wiwithdraw

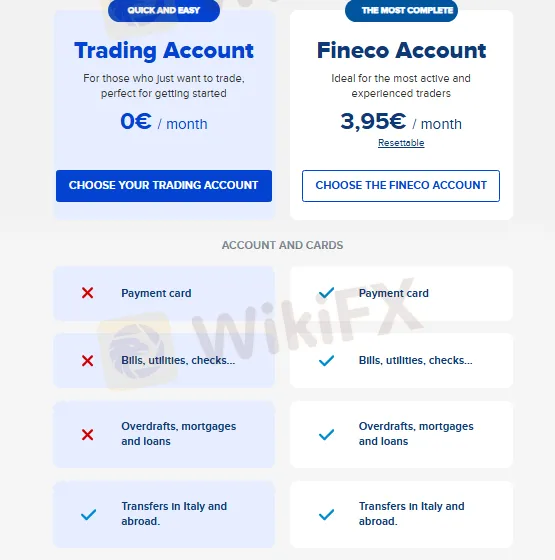

Ang iba't ibang mga account ni Fineco ay nag-iiba sa mga paraan ng pagbabayad at serbisyong pinansiyal. Narito ang isang paghahambing ng mga function ng pag-iimbak at pag-withdraw ng dalawang uri ng account:

| Uri ng Account | Payment Card | Bills, Utilities, Checks | Overdrafts, Mortgages, and Loans | Transfers sa Italy at Abroad |

| Trading Account | ✗ | ✗ | ✗ | ✓ |

| Fineco Account | ✓ | ✓ | ✓ | ✓ |