Buod ng kumpanya

| GEX Buod ng Pagsusuri | |

| Pangalan ng Kumpanya | GEX Ventures Pte Ltd. |

| Rehistradong Bansa/Rehiyon | Singapore |

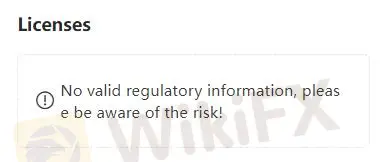

| Regulasyon | Walang Regulasyon |

| Mga Serbisyo | payo sa negosyo ng korporasyon, pagtaas ng puhunan, pinansyal na mga pamumuhunan |

| Suporta sa Customer | Form ng Pakikipag-ugnayan, Tel: +65 6559 8888 |

| Tirahan ng Kumpanya | 238A Thomson Road Novena Square Office Tower A |

Ano ang GEX?

GEX Ventures Pte Ltd., na may punong-tanggapan sa Singapore, pangunahing nag-ooperasyon bilang isang kumpanyang pinansyal na nag-aalok ng payo. Ang kumpanya ay walang regulasyon sa kasalukuyan.

Mga Kalamangan at Disadvantage

| Mga Kalamangan | Mga Disadvantage |

| N/A |

|

|

Mga Disadvantage:

Walang Regulasyon: Ang GEX ay walang regulasyon, na nag-aalala sa mga gumagamit tungkol sa kanilang pananagutan at pagiging transparent.

Kakulangan ng Impormasyon sa Kanilang Website: Maaring makita lamang ang limitadong impormasyon sa kanilang opisyal na website, na magiging hadlang sa mga potensyal na kliyente sa paggawa ng mga matalinong desisyon.

Tunay ba o Panloloko ang GEX?

Regulatory Sight: Ang GEX ay walang kasalukuyang regulasyon at anumang lisensya na magpapahintulot sa kanila na ipatupad ang kanilang mga pamantayan sa operasyon sa pamilihan ng pinansya. Ang kakulangan ng regulasyon na ito ay nagdudulot ng maraming panganib sa mga mamumuhunan, tulad ng kakulangan ng pagiging transparent, mga alalahanin sa seguridad, at walang garantiya ng pagsunod sa mga pamantayan at kasanayan ng industriya.

Feedback ng User: Dapat suriin ng mga gumagamit ang mga review at feedback mula sa ibang mga kliyente upang makakuha ng mas malawak na pananaw sa broker, o hanapin ang mga review sa mga kilalang website at forum.

Mga Hakbang sa Seguridad: Sa ngayon, hindi pa namin natagpuan ang anumang impormasyon tungkol sa mga hakbang sa seguridad para sa broker na ito.

Mga Serbisyo

Ang GEX ay nagbibigay ng mga serbisyong pangpayo na sumasaklaw sa maraming aspeto ng negosyo ng korporasyon, kasama ang pagtaas ng puhunan at pinansyal na mga pamumuhunan. Ang kanilang kasanayan ay naglalayong magbigay ng gabay sa mga usapin ng korporasyon, tumulong sa mga kliyente sa pag-navigate sa mga kumplikadong larangan ng pinansya, at mag-facilitate ng mga inisyatibang pangtaas ng puhunan.

Suporta sa Customer

Ang GEX ay nag-aalok ng suporta sa customer sa pamamagitan ng iba't ibang mga channel, kasama ang isang form ng pakikipag-ugnayan sa kanilang website at isang linya ng telepono sa +65 6559 8888. Nagbibigay din ang GEX ng kanilang pisikal na address, na matatagpuan sa 238A Thomson Road Novena Square Office Tower A, kaya maaaring pumili ang mga kliyente ng personal na tulong kung kinakailangan.

Konklusyon

Bilang isang kumpanyang pinansyal, ang GEX ay nagbibigay ng pangunahing mga serbisyong pangpayo. Mayroon lamang limitadong impormasyon sa opisyal na website nito at wala itong mga regulasyon.

Mga Madalas Itanong (FAQs)

Tanong: Ipinaparehistro ba o hindi ang GEX?

Sagot: Hindi, hindi ito ipinaparehistro.

Tanong: Nagbibigay ba ang GEX ng pangpayo para sa mga indibidwal?

Sagot: Oo.

Tanong: Magandang pagpipilian ba ang GEX o hindi?

Sagot: Hindi. Kakulangan ito sa pagiging transparent sa impormasyon at mga regulasyon.

Babala sa Panganib

Ang online trading ay may malaking panganib, at maaaring mawala mo ang lahat ng iyong ininvest na kapital. Hindi ito angkop para sa lahat ng mga mangangalakal o mamumuhunan. Mangyaring tiyakin na nauunawaan mo ang mga panganib na kasama nito at tandaan na ang impormasyong ibinigay sa pagsusuri na ito ay maaaring magbago dahil sa patuloy na pag-update ng mga serbisyo at patakaran ng kumpanya.