Buod ng kumpanya

| United Securities Co. Buod ng Pagsusuri | |

| Itinatag | 1996 |

| Rehistradong Bansa/Rehiyon | Palestine |

| Regulasyon | Walang regulasyon |

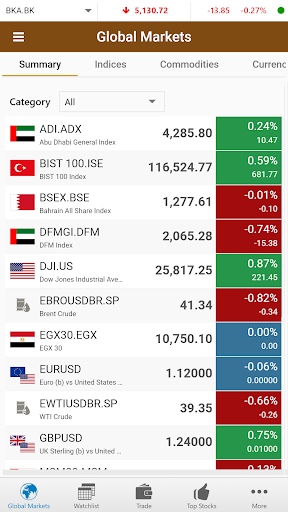

| Mga Serbisyo | Proprietary trading, Trading on behalf of others, Issuance management, Portfolio management, Custodian services, Trading in foreign markets, Trading Applications, E-Trade |

| Demo Account | ❌ |

| Leverage | Hanggang sa 1:300 |

| Spread | Mula sa 0 pips |

| Platform ng Trading | United Securities Co., MT5 |

| Minimum na Deposit | $100 |

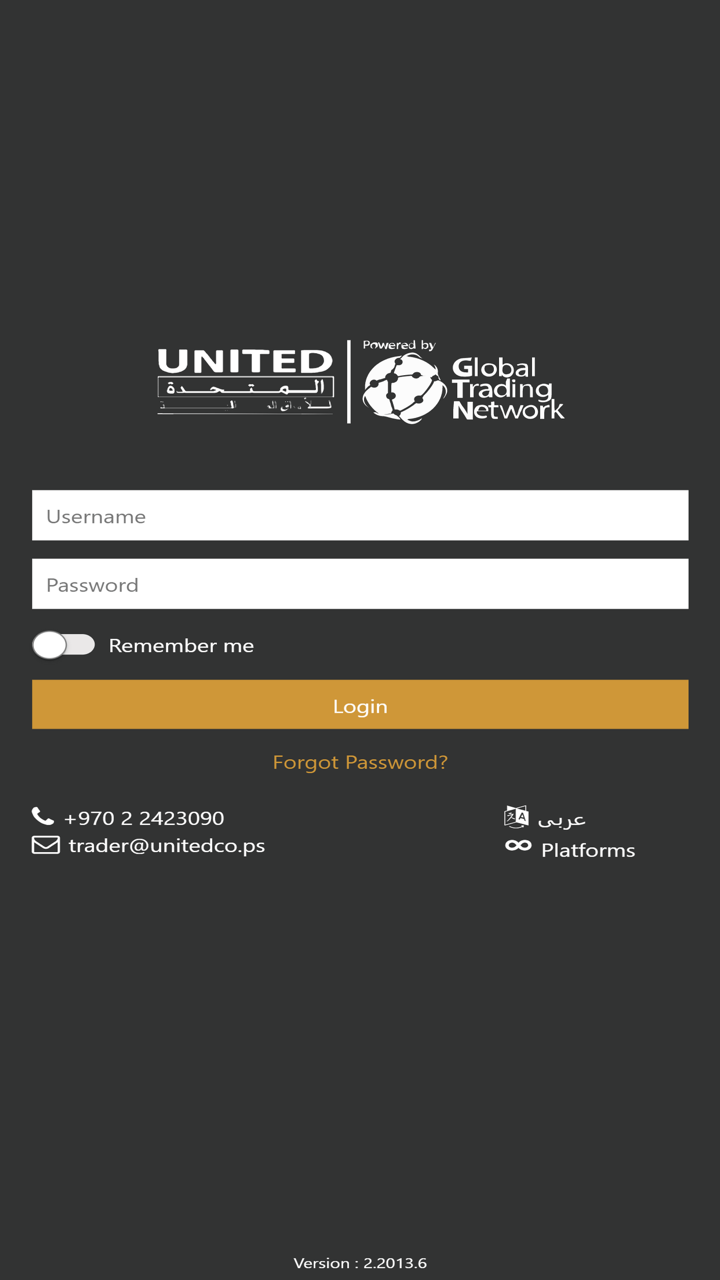

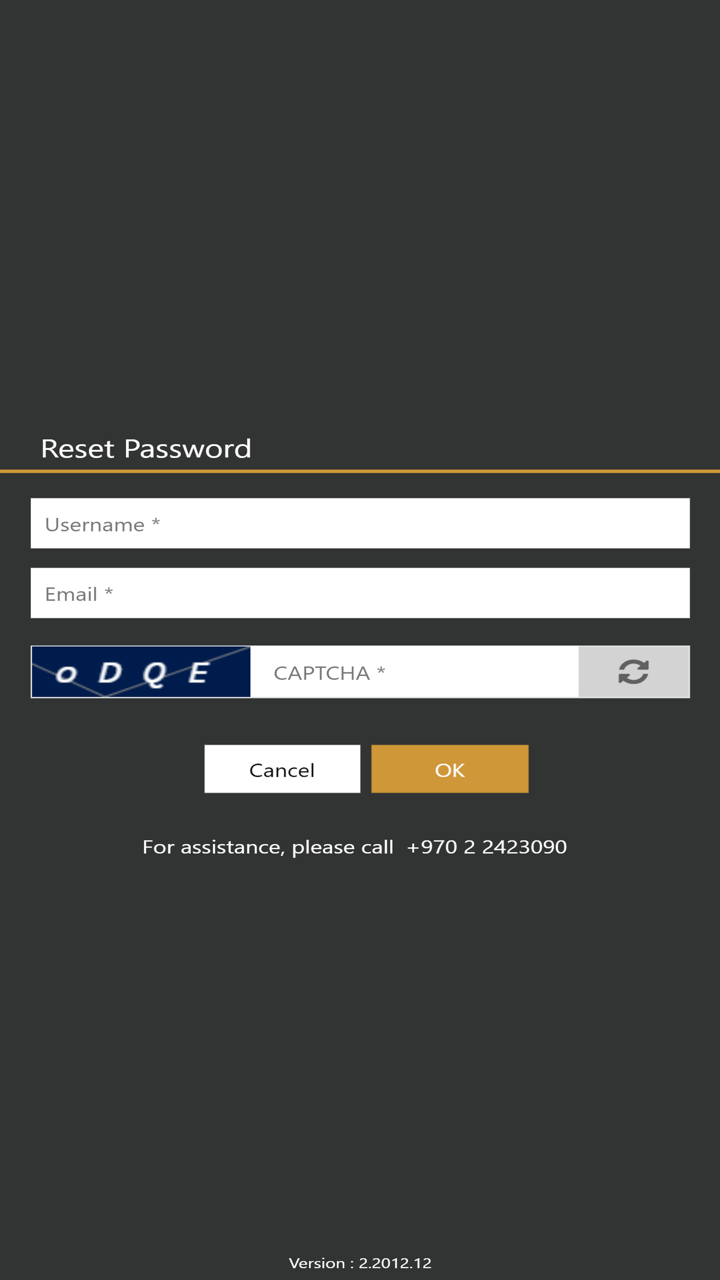

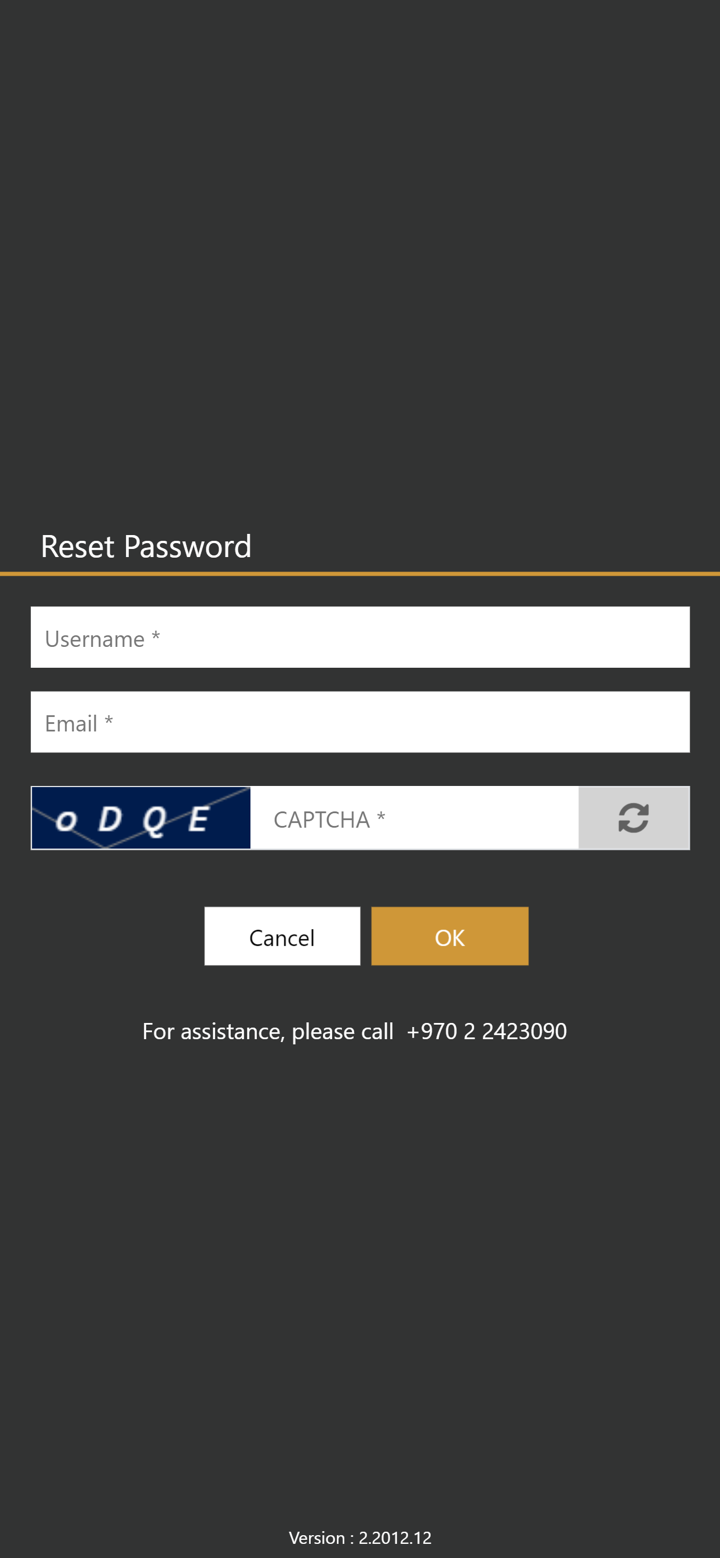

| Suporta sa Customer | Live chat, contact form |

| Tel: 02-2423090 | |

| Email: info@unitedco.ps | |

| Address: Rawabi City Q Center, Office Building, first floor | |

| Social media: Facebook, Whatsapp, Instagram, LinkedIn | |

Impormasyon Tungkol sa United Securities Co.

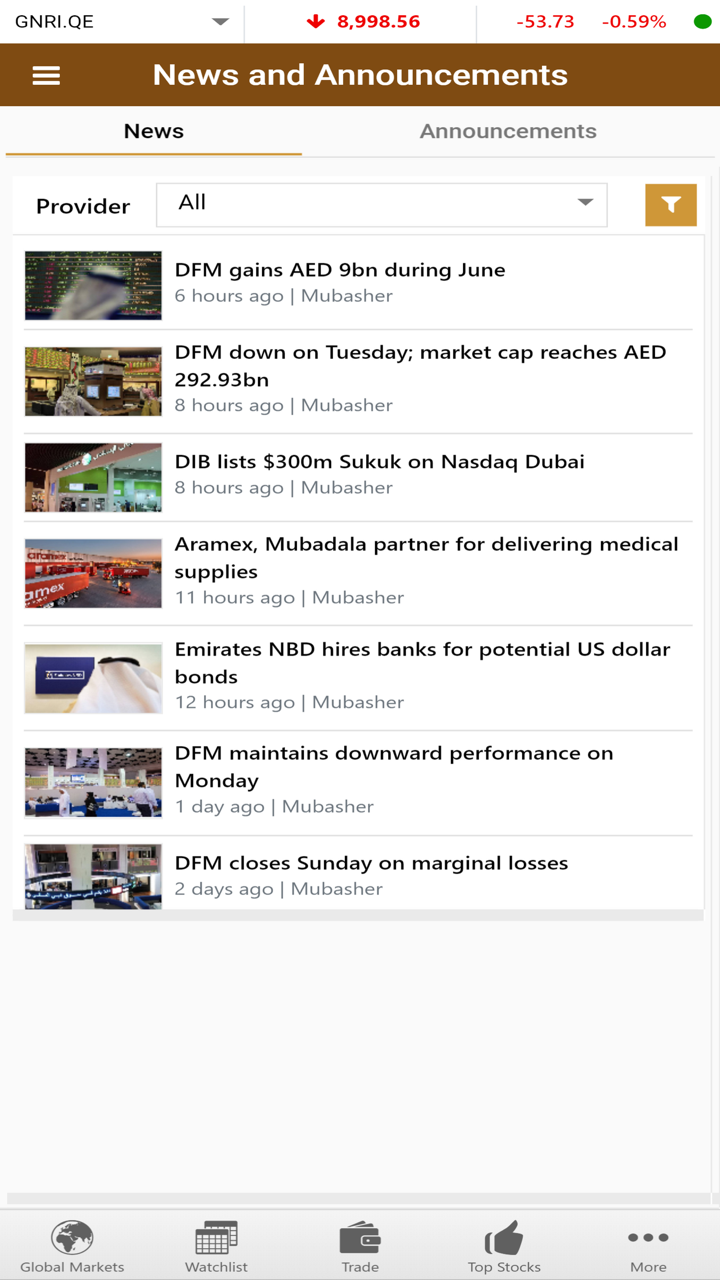

United Securities Co. ay isang hindi nairehistrong tagapagbigay ng pangunahing brokerage at serbisyong pinansyal, na itinatag sa Palestine noong 1996. Nag-aalok ito ng mga serbisyo sa Proprietary trading, Trading on behalf of others, Issuance management, Portfolio management, Custodian services, Trading in foreign markets, Trading Applications at E-Trade.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Mahabang oras ng operasyon | Kawalan ng regulasyon |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Walang demo accounts |

| Iba't ibang mga produkto sa trading | Walang plataporma ng MT4 |

| Plataporma ng MT5 | May bayad na komisyon |

| Limitadong mga pagpipilian sa account |

Tunay ba ang United Securities Co.?

Walang United Securities Co. na mayroong walang bisa na regulasyon. Mangyaring maging maingat sa panganib!

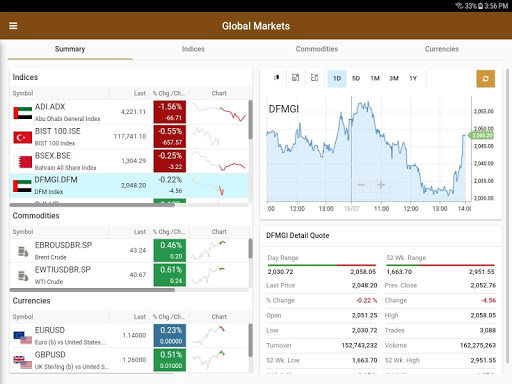

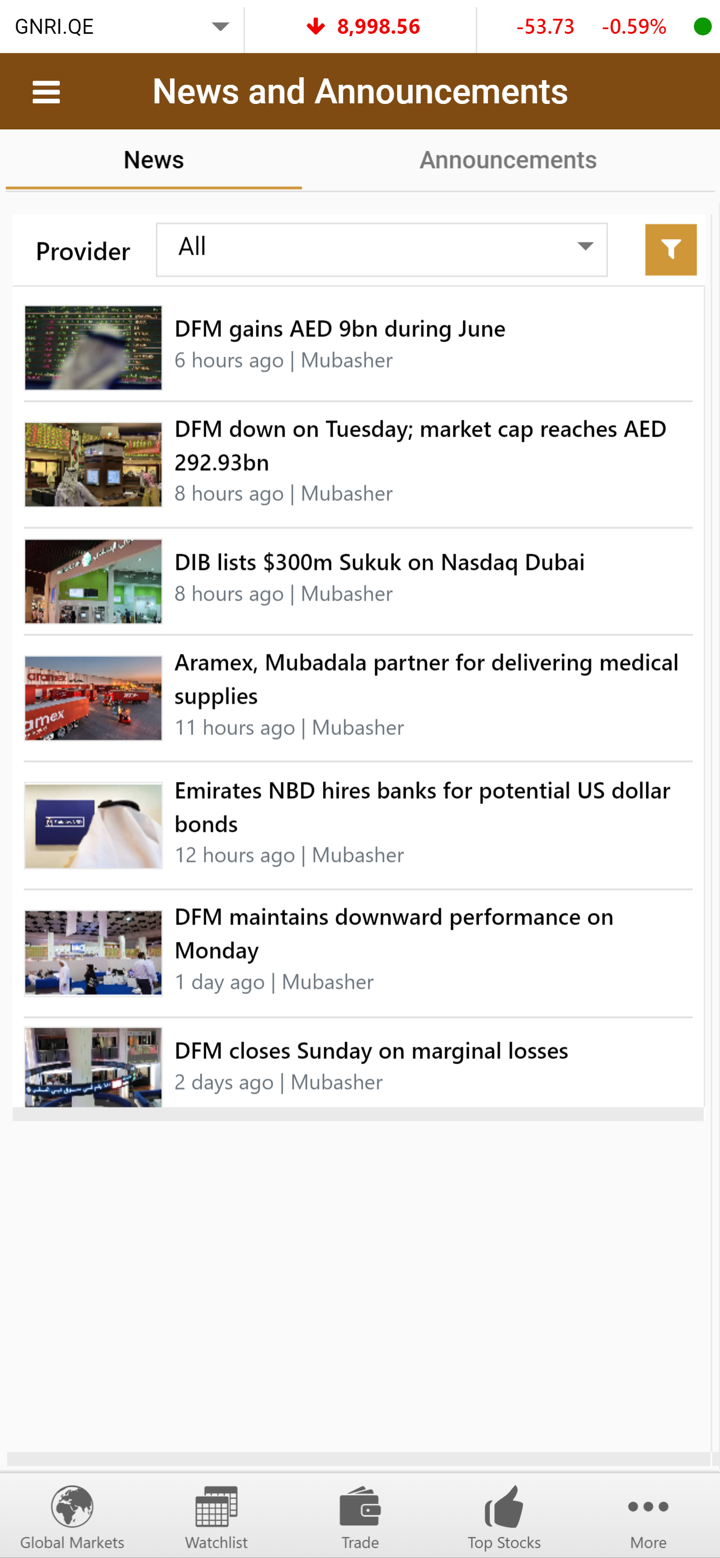

United Securities Co. Serbisyo

| Serbisyo | Suportado |

| Pribadong trading | ✔ |

| Trading sa ngalan ng iba | ✔ |

| Pamamahala sa paglabas | ✔ |

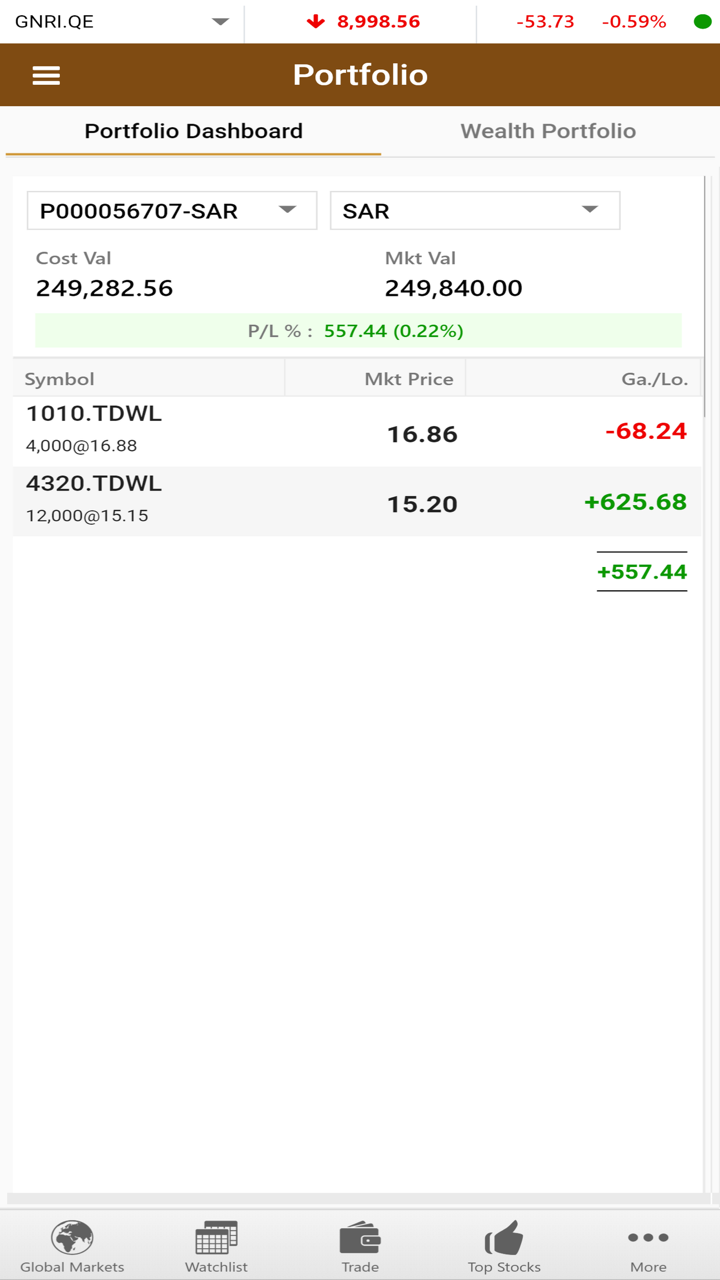

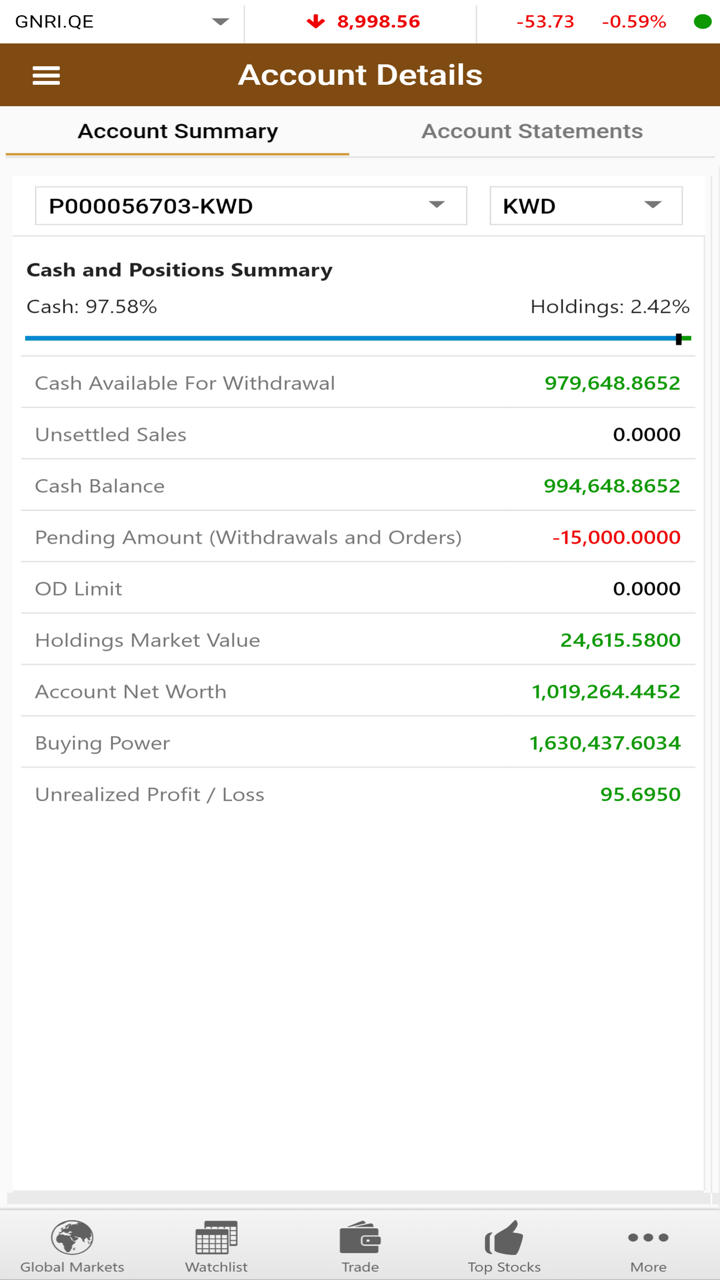

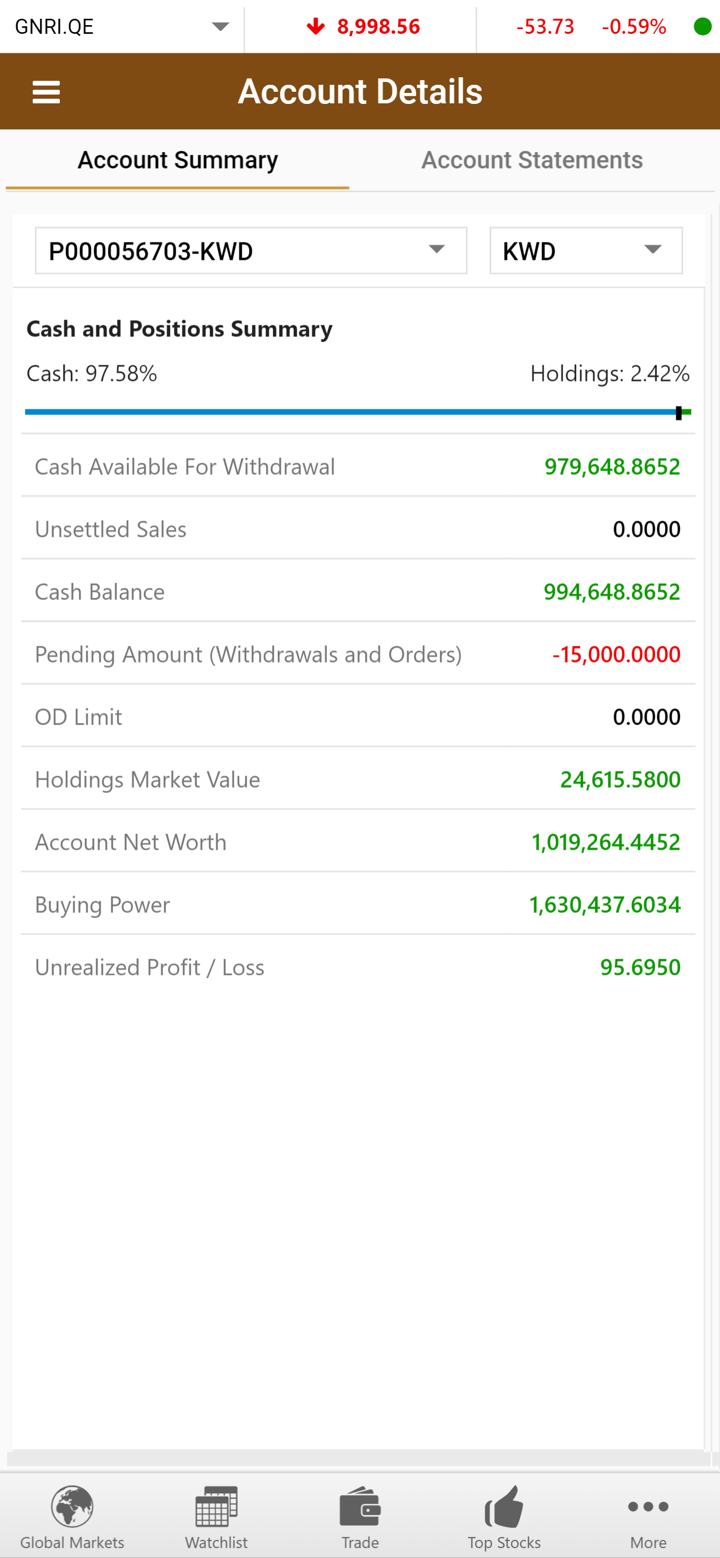

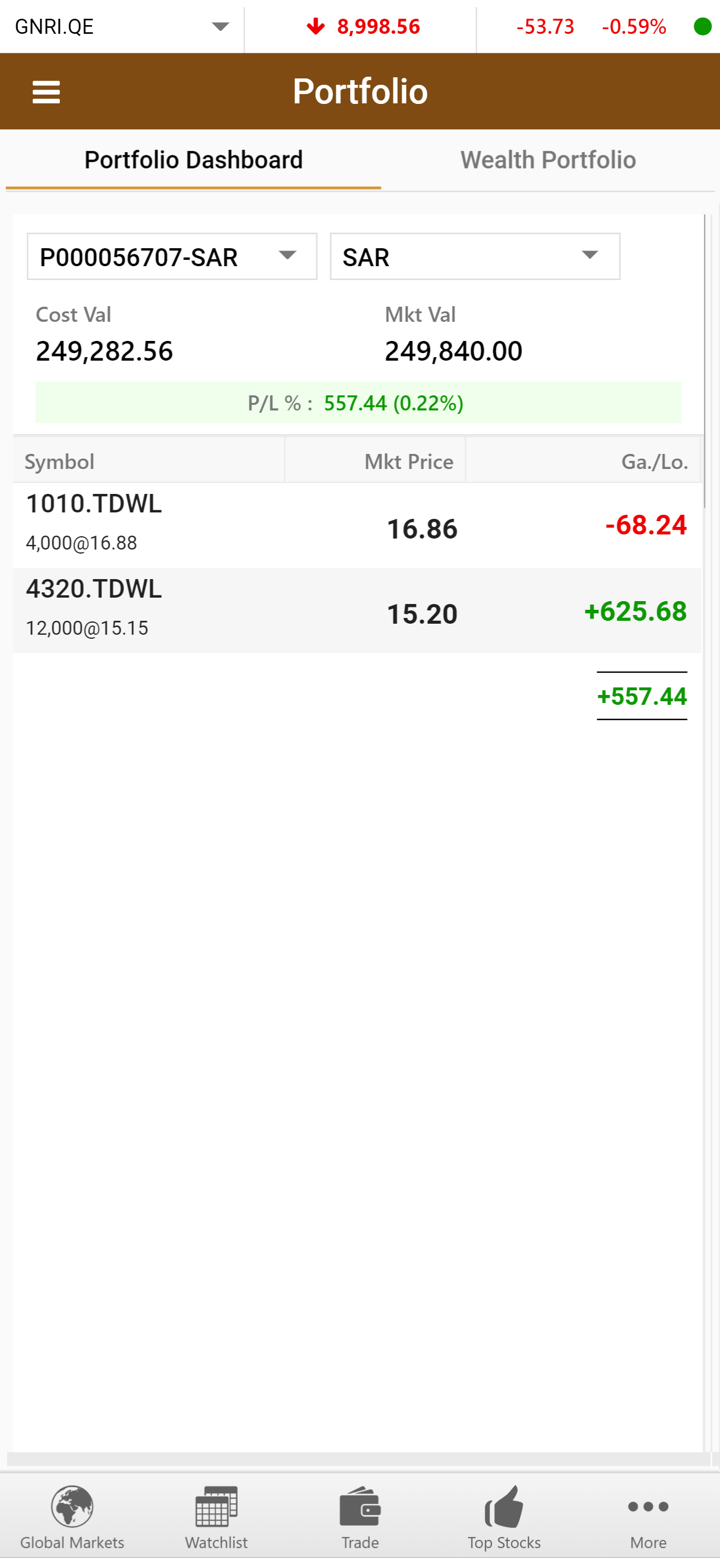

| Pamamahala ng portfolio | ✔ |

| Serbisyong tagapangalaga | ✔ |

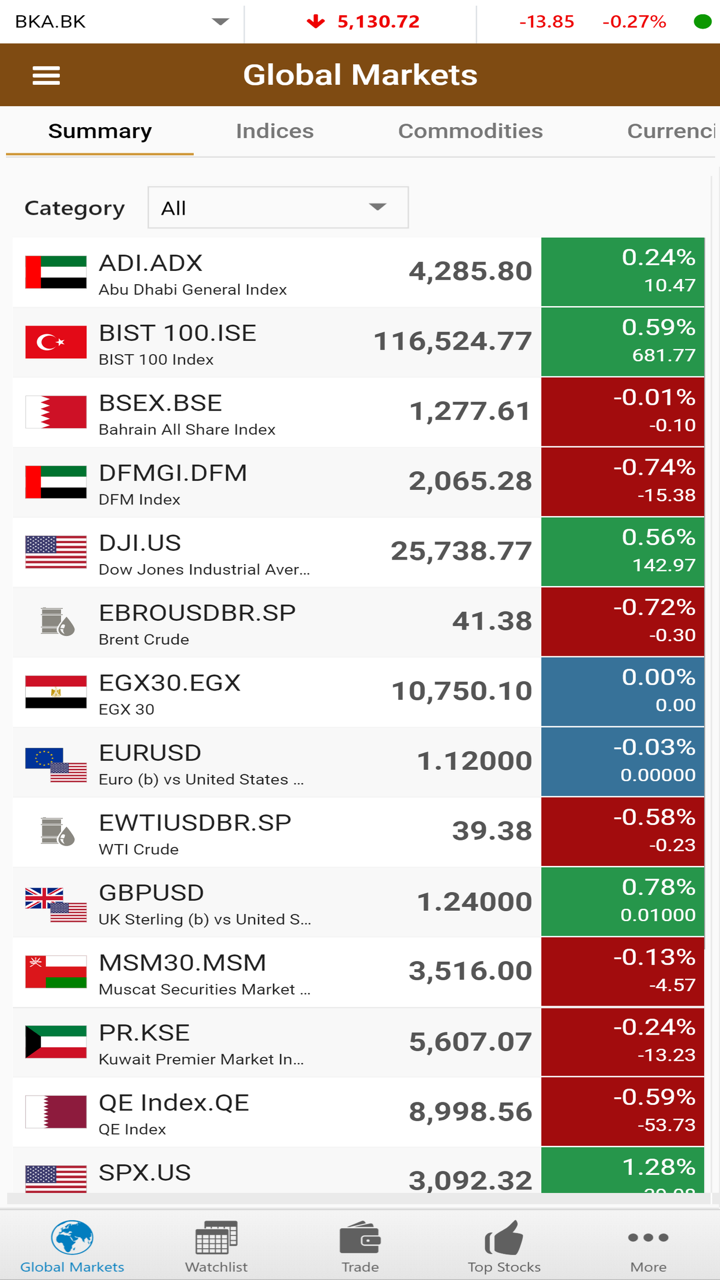

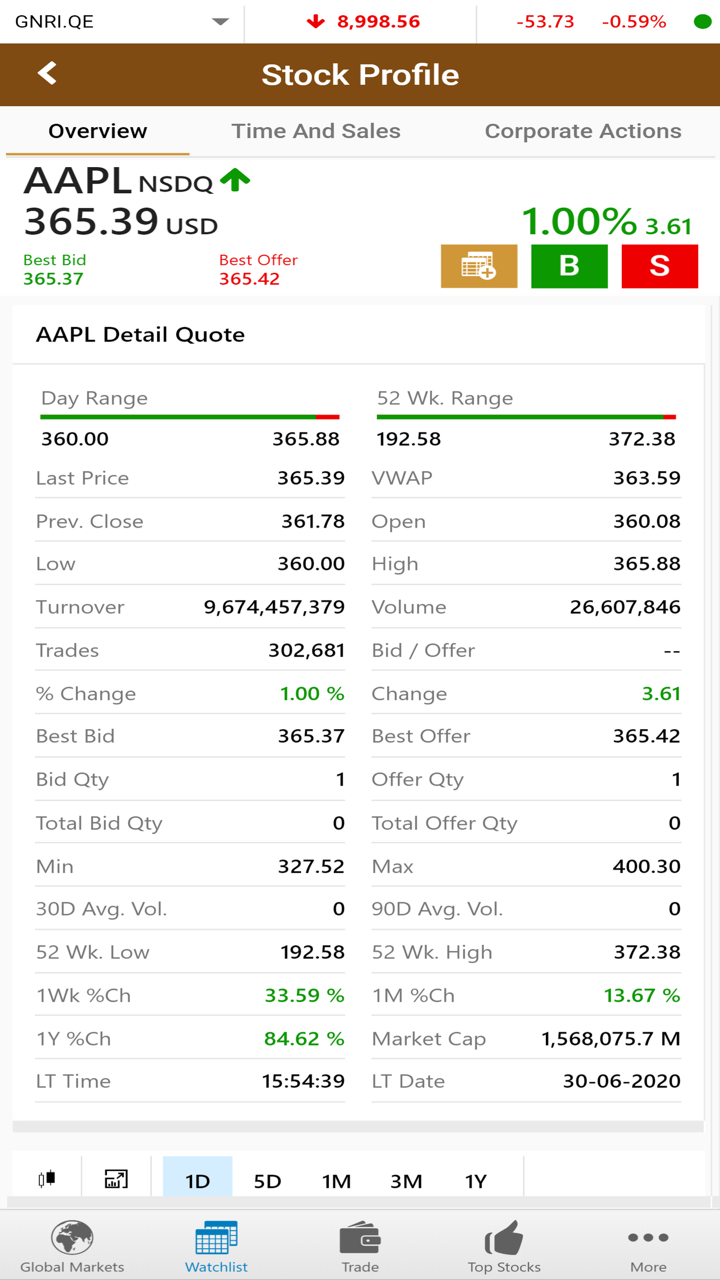

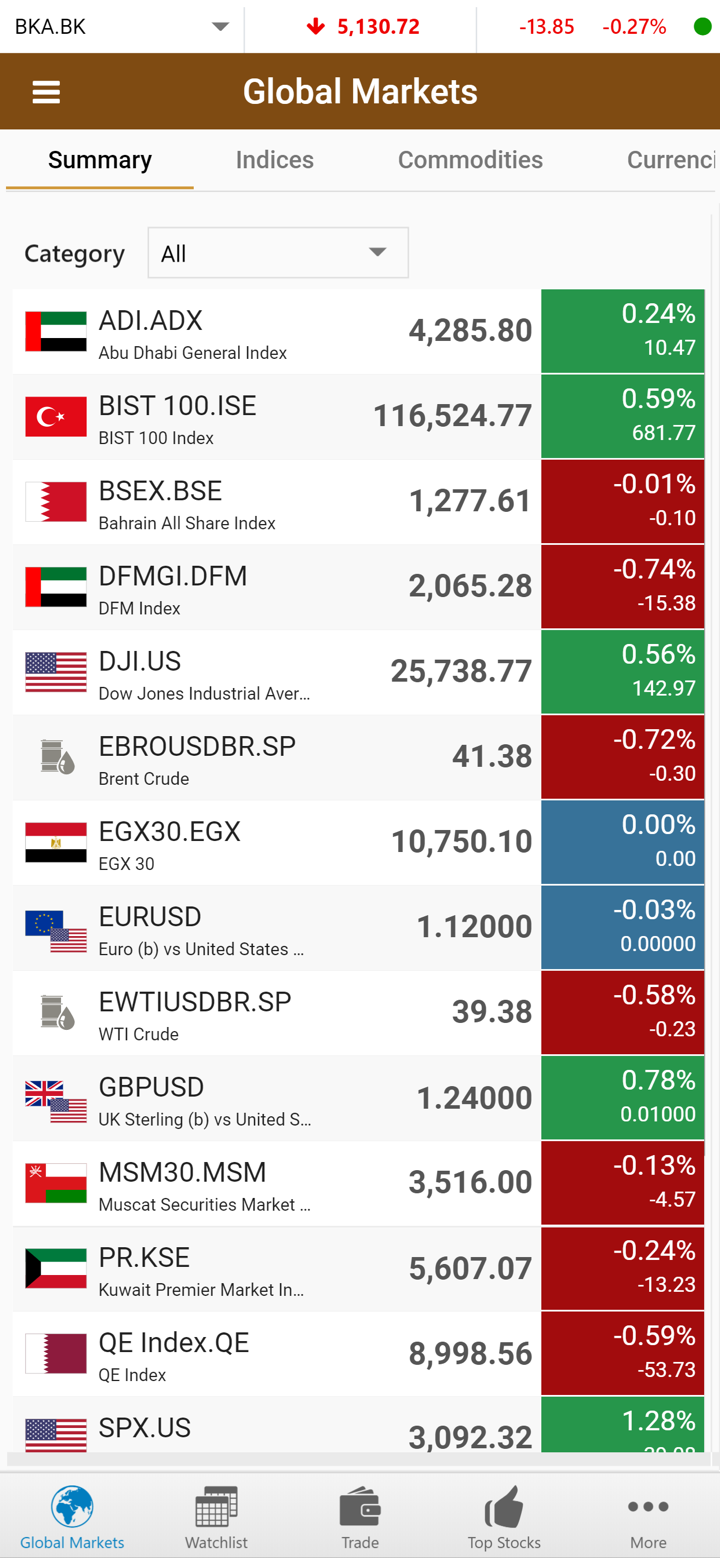

| Trading sa dayuhang merkado | ✔ |

| Mga aplikasyon sa trading | ✔ |

| E-Trade | ✔ |

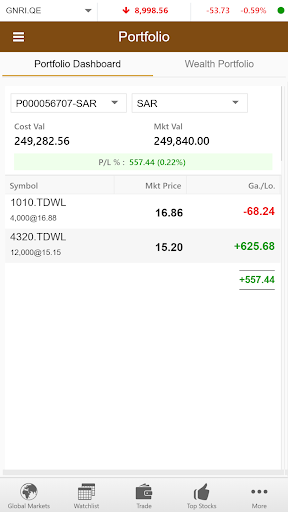

Uri ng Account & Mga Bayad

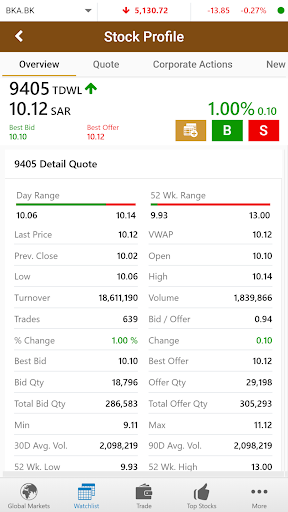

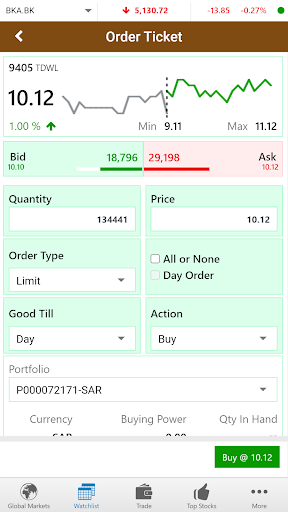

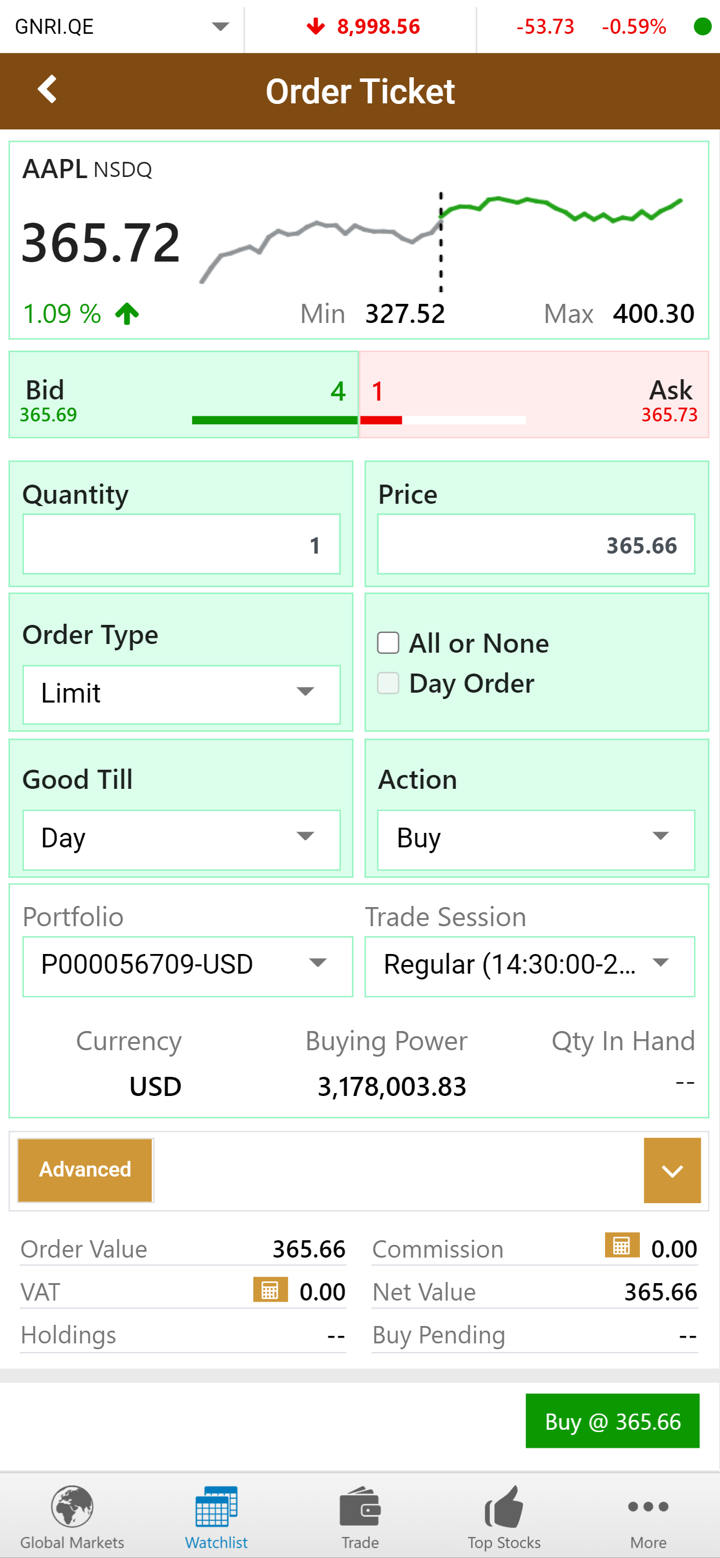

| Uri ng Account | Minimum na Deposit | Maximum na Leverage | Spread | Komisyon |

| Propesyonal | $1,000 | 1:300 | 0 pips | $4/side |

| Karaniwan | $100 | 1:300 | 1 pip | ❌ |

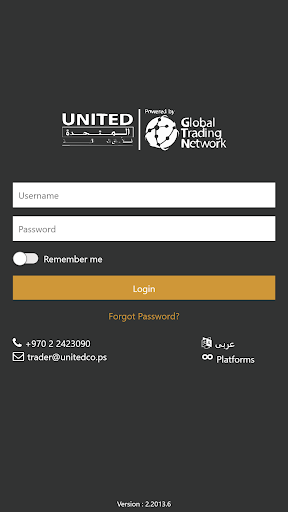

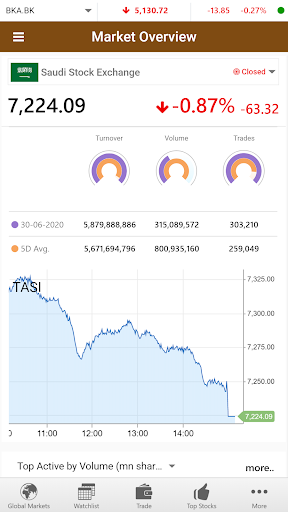

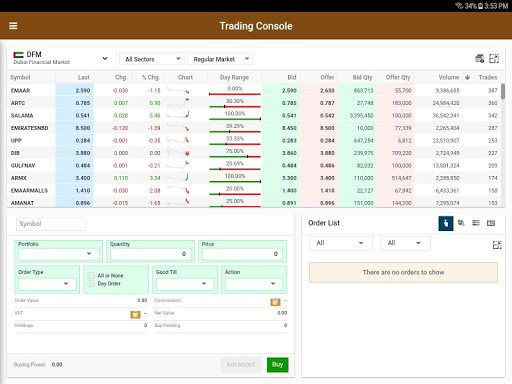

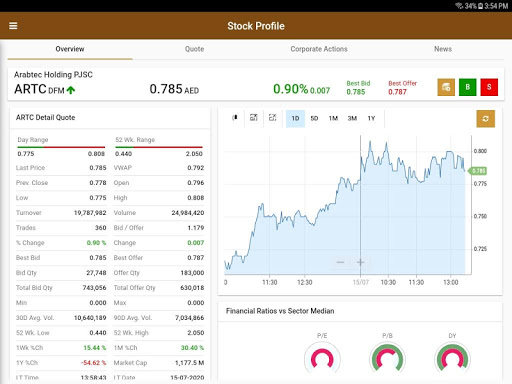

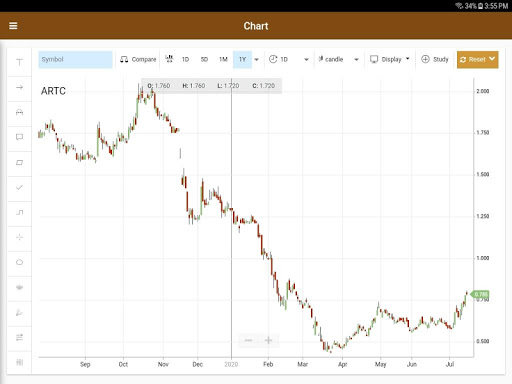

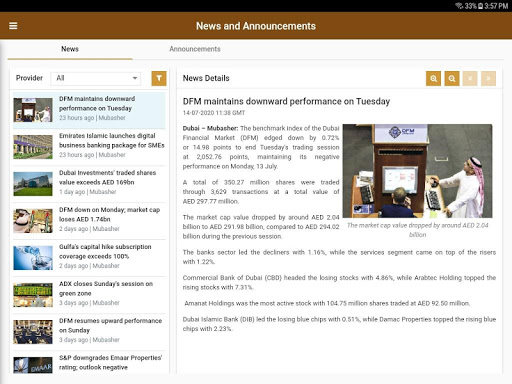

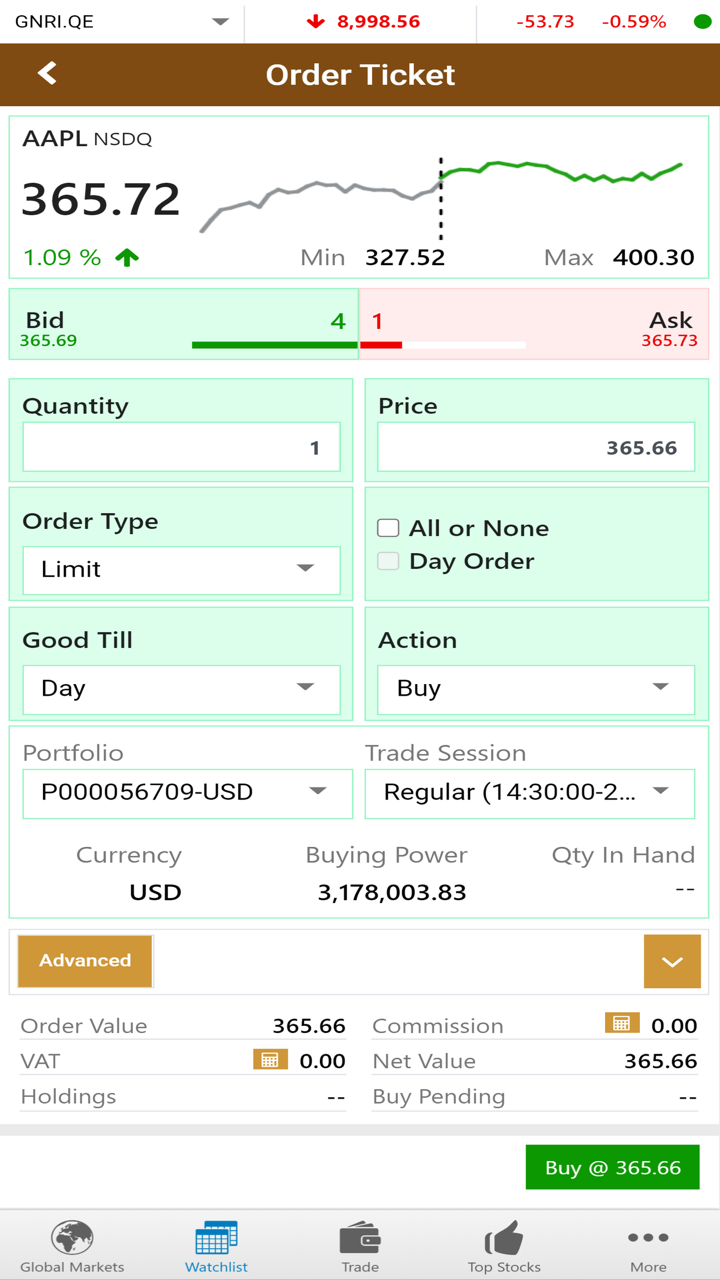

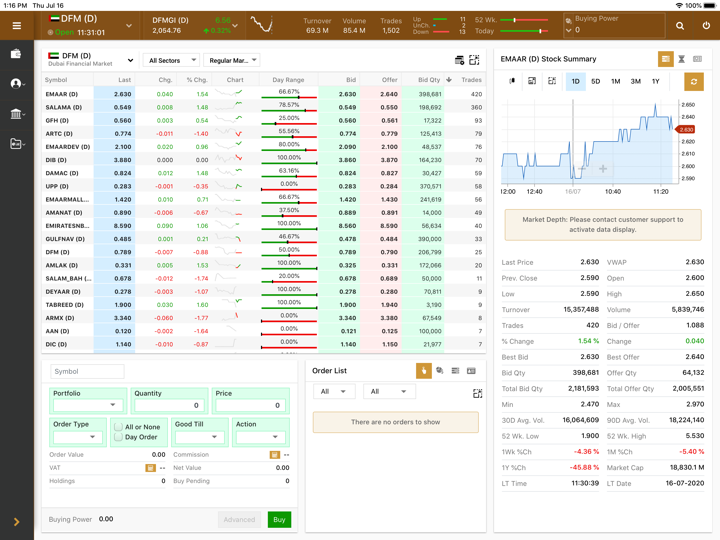

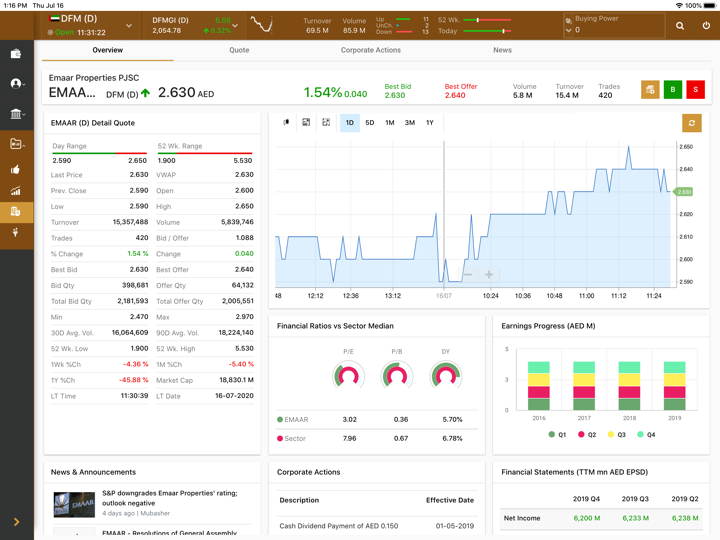

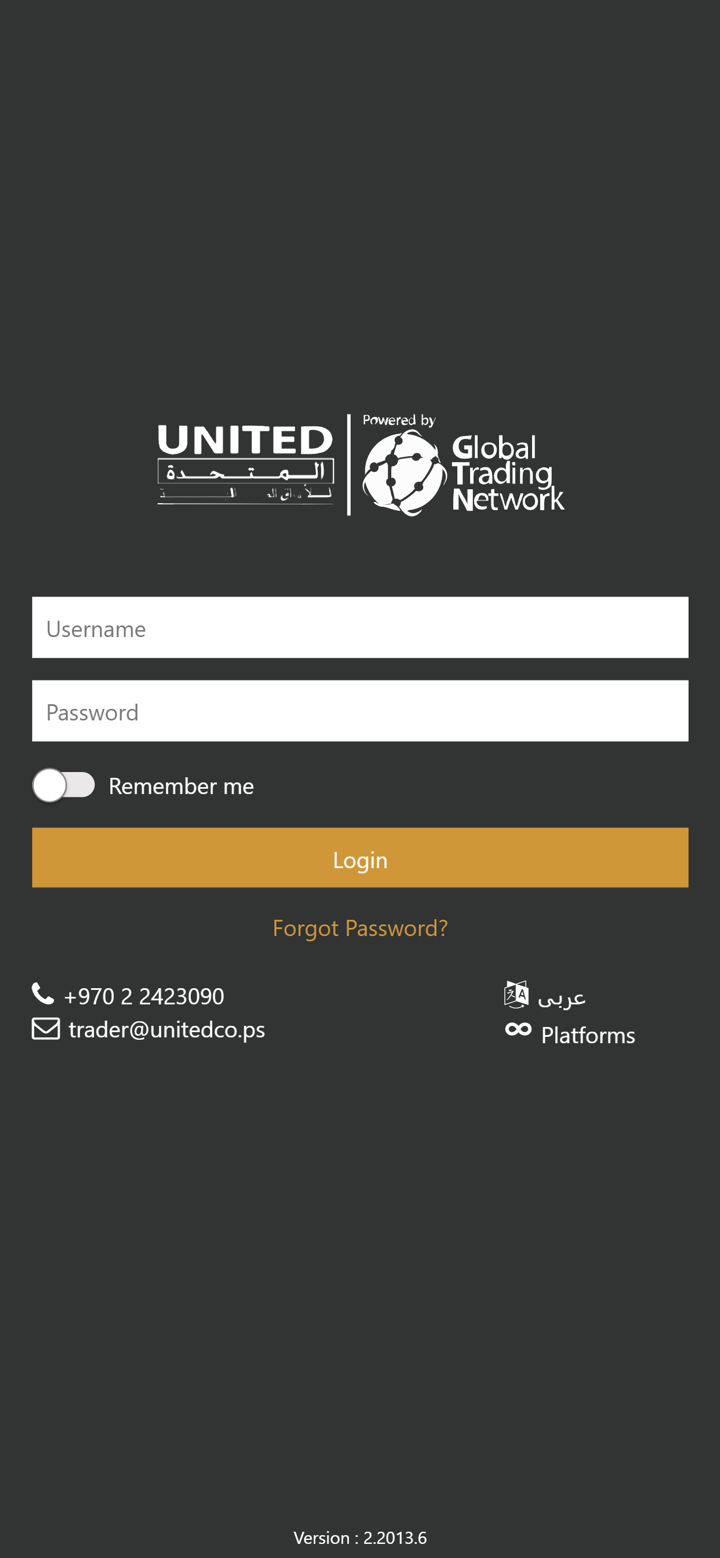

Plataforma ng Trading

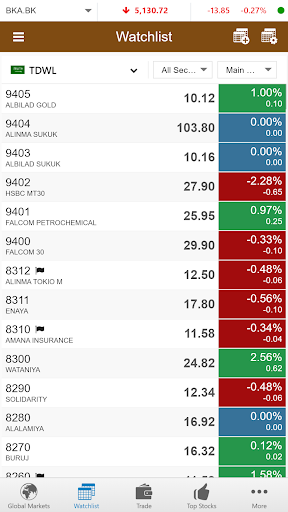

| Plataforma ng Trading | Supported | Available Devices | Akma para sa |

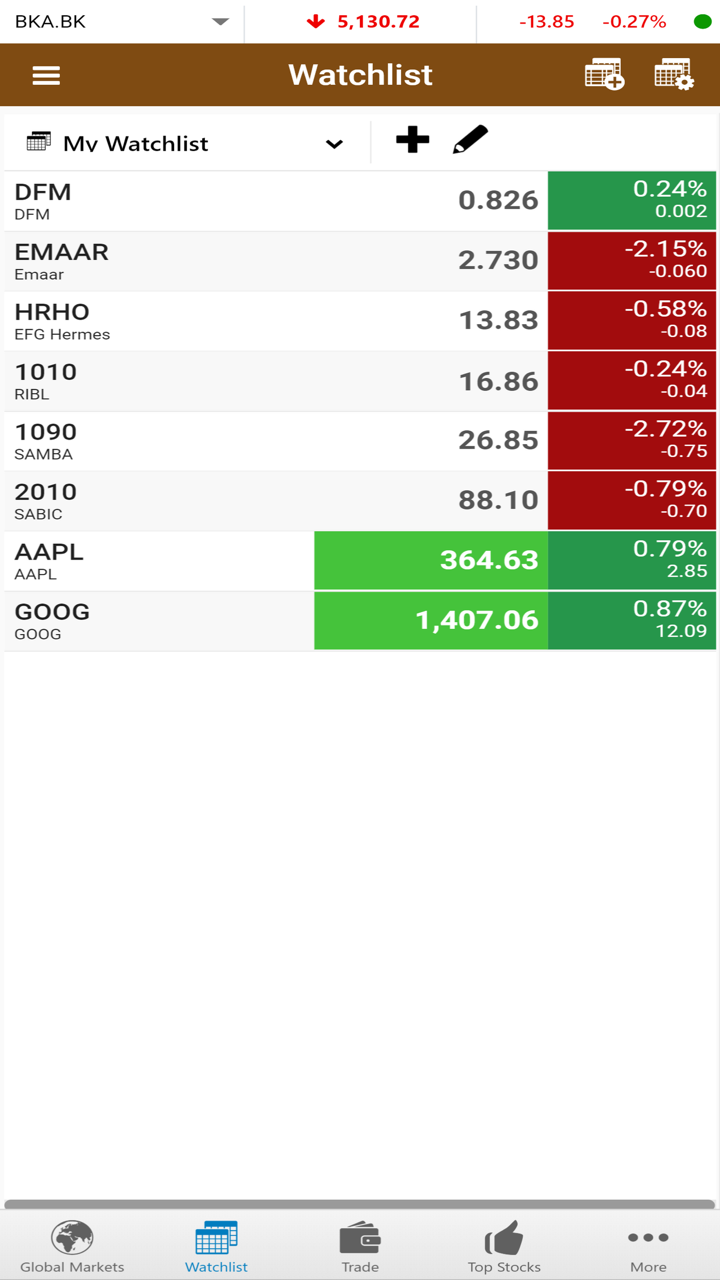

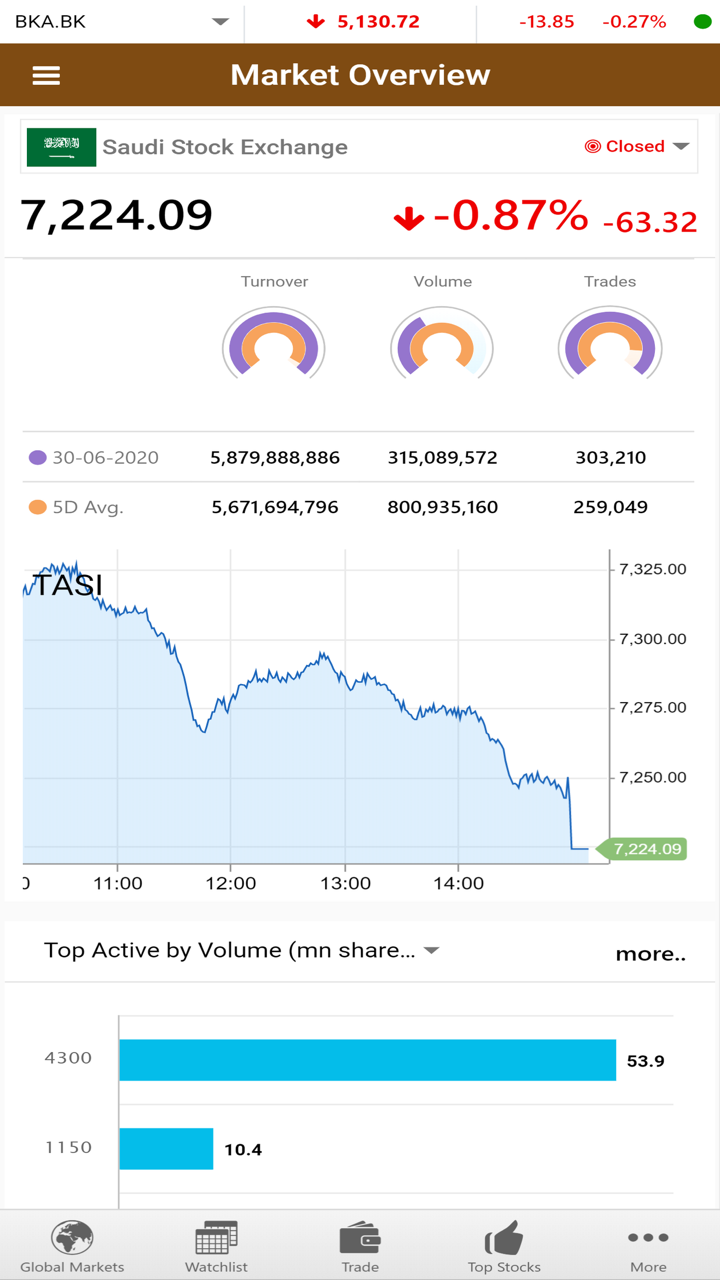

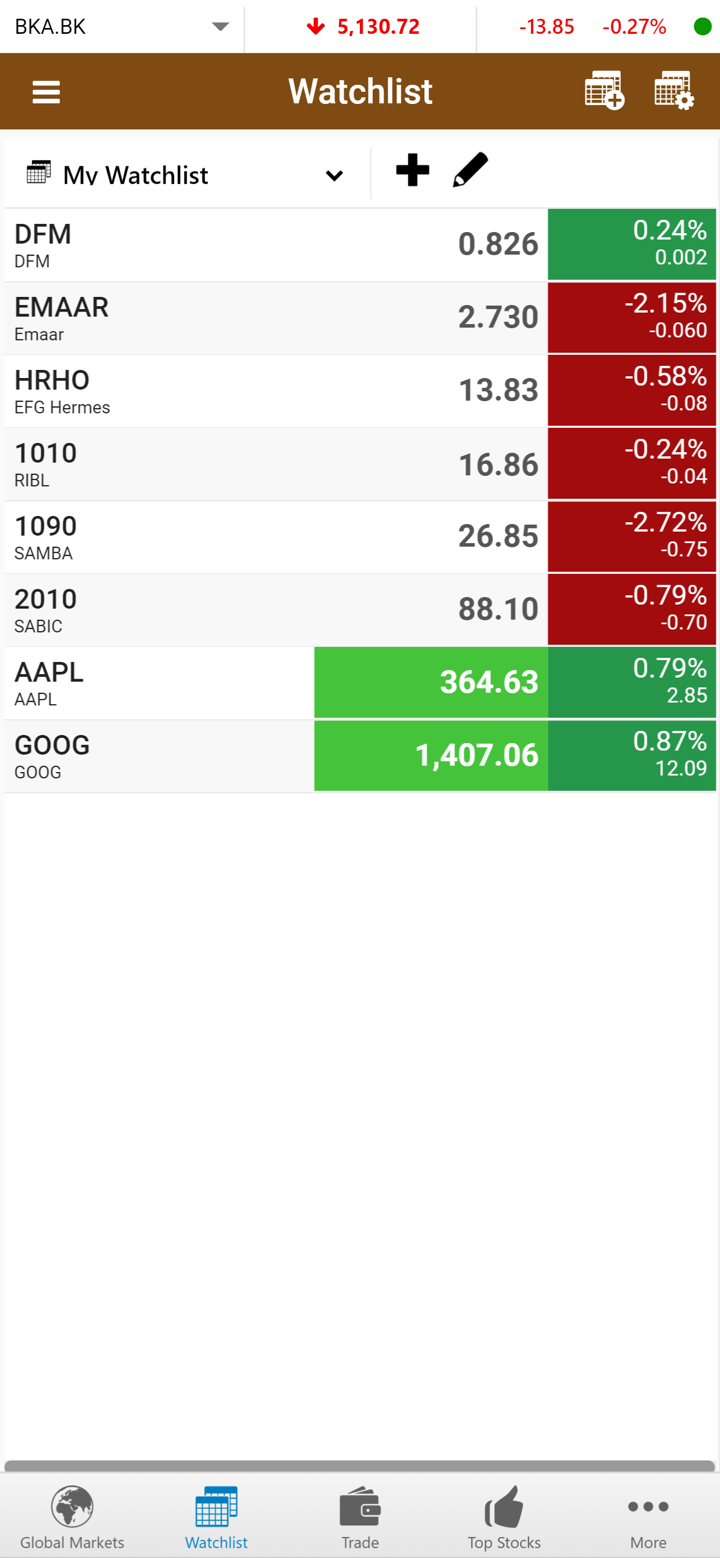

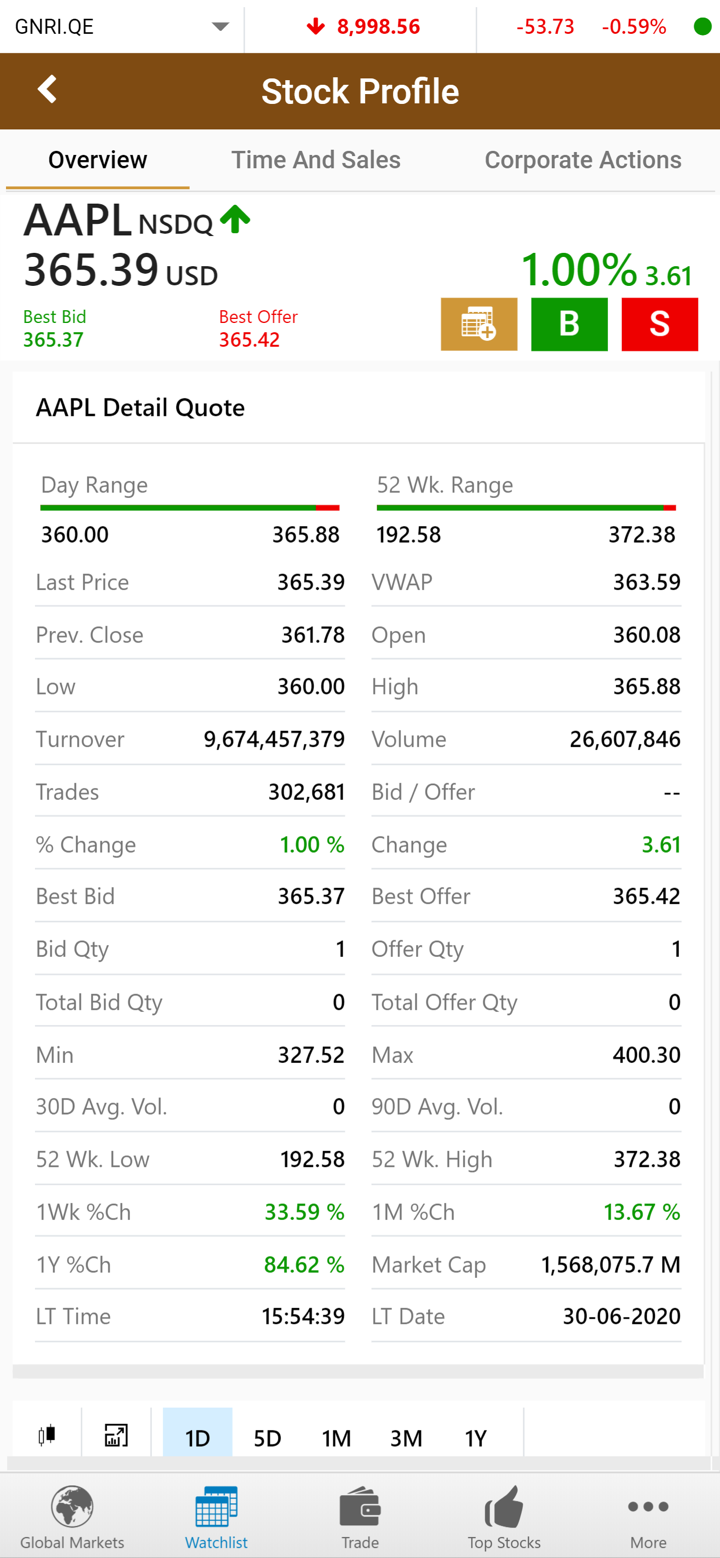

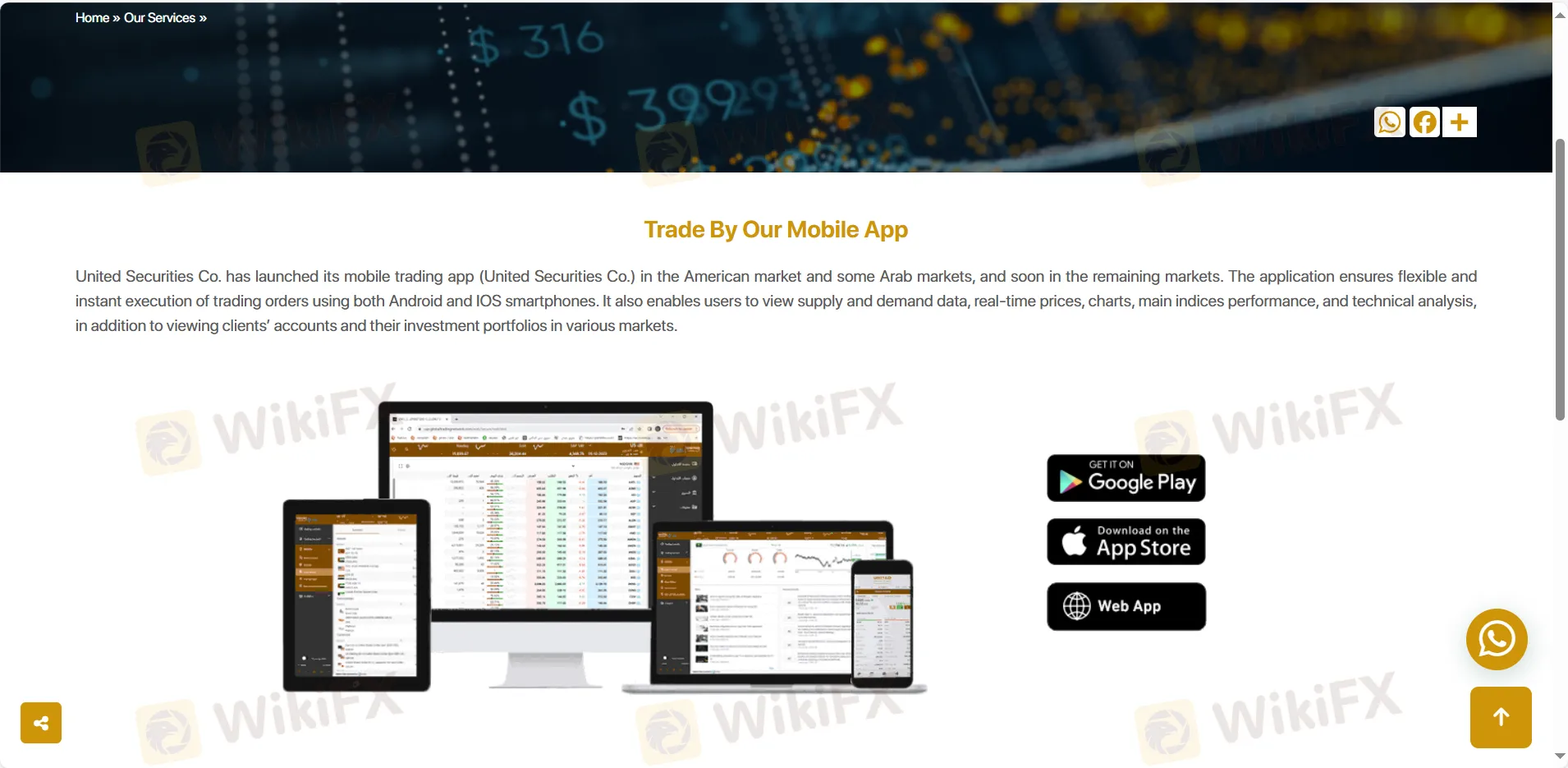

| United Securities Co. app | ✔ | Mobile, desktop, laptop | / |

| MT5 | ✔ | Mobile, desktop, web | Mga may karanasan na trader |

| MT4 | ❌ | / | Mga nagsisimula pa lamang |

Deposito at Pag-withdraw

United Securities Co. tumatanggap ng mga bayad na ginawa sa pamamagitan ng VISA, mastercard at banktransfer.