Perfil de la compañía

| TCM Resumen de la reseña | |

| Fecha de fundación | 2019 |

| País/Región registrado | Chipre |

| Regulación | CYSEC (Regulado), FSCA (Clon sospechoso) |

| Instrumentos de mercado | CFDs |

| Cuenta demo | ❌ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de trading | / |

| Depósito mínimo | / |

| Soporte al cliente | Teléfono: +357 22 030446 |

| Email: info@tradecapitalmarkets.com | |

| Dirección de la empresa: 148 Strovolos Avenue, 1st floor, CY 2048, Nicosia, Chipre | |

| Redes sociales: LinkedIn | |

| Restricciones regionales | Japón, Canadá, España, Bélgica, Estados Unidos |

Información de TCM

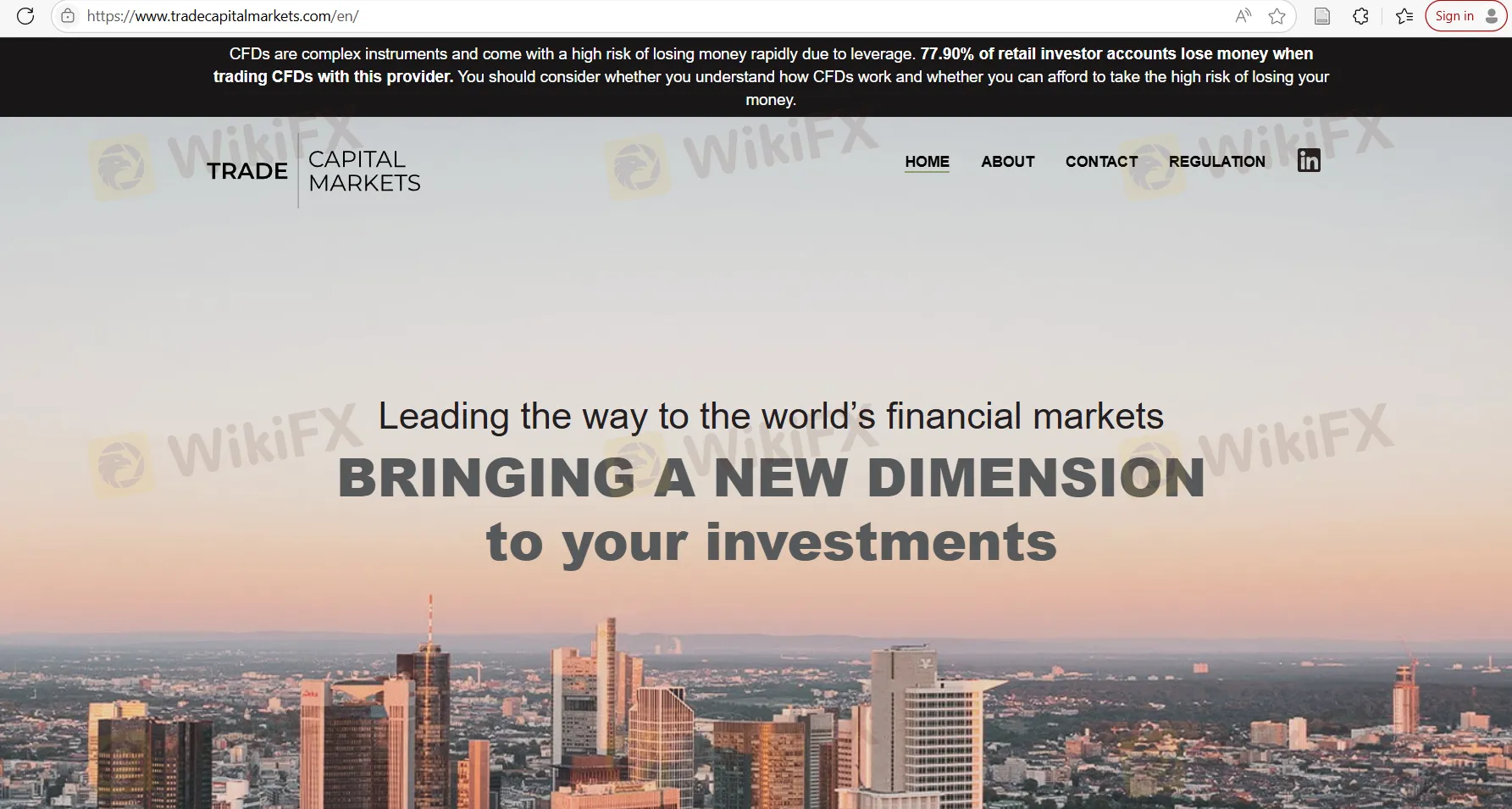

TCM (Trade Capital Markets) es una plataforma de trading en línea con sede en Chipre. TCM afirma ofrecer una amplia gama de productos y servicios de inversión en trading de CFDs. Esta plataforma ha sido regulada por la Comisión de Valores y Bolsa de Chipre (CySEC) y la Autoridad de Conducta del Sector Financiero (FSCA), pero se sospecha que su licencia FSCA es un clon falso.

Pros y contras

| Pros | Contras |

| Regulado por CYSEC | Licencia FSCA clon sospechosa |

| Múltiples canales de contacto | Restricciones regionales |

| Cuentas demo no disponibles | |

| Estructura de tarifas poco clara |

¿Es TCM legítimo?

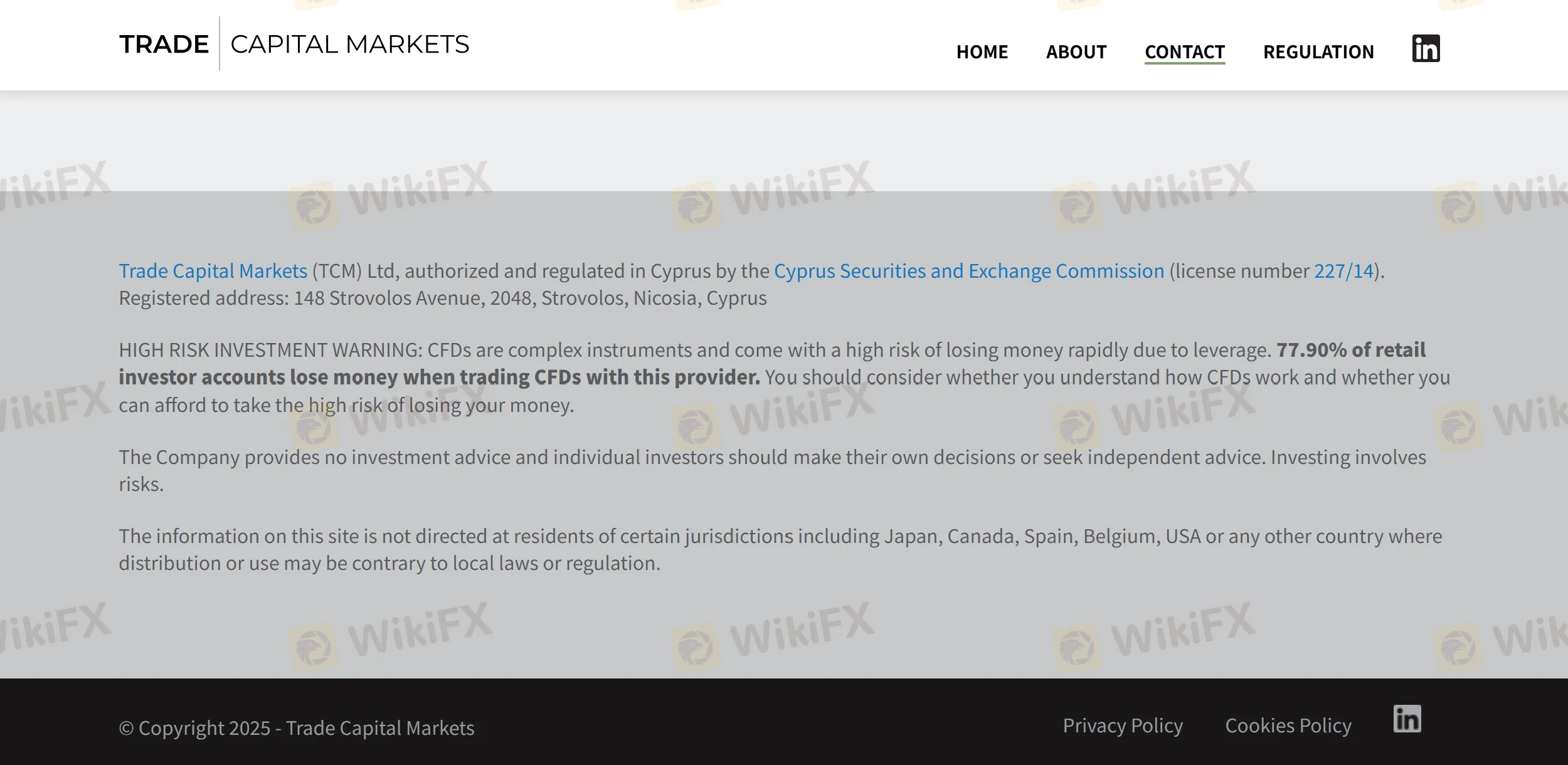

TCM está autorizado y regulado en Chipre por la Comisión de Valores y Bolsa de Chipre (CySEC, número de licencia 227/14). Mientras tanto, TCM posee una licencia de clon sospechosa de la Autoridad de Conducta del Sector Financiero (FSCA).

| País Regulado | Autoridad Reguladora | Estado Regulatorio | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Comisión de Valores y Bolsa de Chipre (CySEC) | Regulado | Trade Capital Markets (TCM) Ltd | Creador de Mercado (MM) | 227/14 |

| Autoridad de Conducta del Sector Financiero (FSCA) | Clon Sospechoso | TRADE CAPITAL MARKETS (TCM) LTD | Corporativo de Servicios Financieros | 47857 |

Encuesta de Campo de WikiFX

El equipo de encuestas de campo de WikiFX visitó la dirección de TCM en Chipre y encontramos su oficina física en el lugar.

¿Qué puedo comerciar en TCM?

TCM se especializa en comercio de CFD y afirma ofrecer una amplia gama de productos y servicios de inversión con los más altos estándares de calidad.

FX8831647032

Hong Kong

No te dejes engañar

Exposición

+95798

Hong Kong

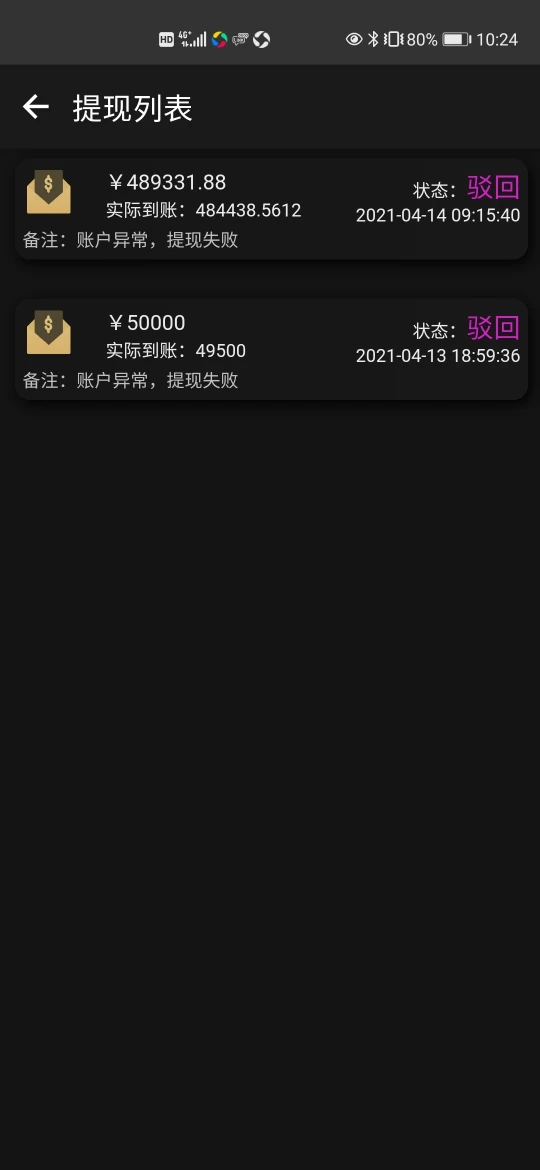

No se pueden retirar fondos en absoluto. ¿Cómo puedo obtener mi capital? Estas dos personas nos engañan.

Exposición

( ・᷅ὢ・᷄ )Amy

Hong Kong

Pula sus ojos y no se deje engañar por el fraude. Deberías recibir una advertencia de nosotros

Exposición

xukrat

Nueva Zelanda

TCM es un completo mentiroso. Dicen que la plataforma es casi perfecta antes de depositar, usan todo tipo de palabras para engañarlo e ignorarlo a usted y su solicitud de retiro después de depositar.

Positivo

涛哥33986

España

En términos generales, creo que las condiciones comerciales proporcionadas por TCM son muy atractivas, como márgenes bajos y alto apalancamiento., MT5, cuenta demo, una variedad de instrumentos comerciales... Pero la interfaz de la licencia regulatoria no parece muy confiable, decidí no correr este riesgo.

Neutral