Perfil de la compañía

| NetDaniaResumen de la reseña | |

| Fundado | 1998 |

| País/Región Registrado | Dinamarca |

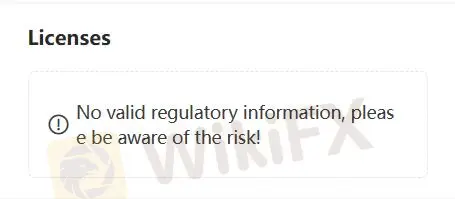

| Regulación | No regulado |

| Plataforma de Trading | NetDania Mobile & NetDania NetStation |

| Soporte al Cliente | Tel: +44 (0) 207 558 8405 |

| Formulario de Contacto | |

| Dirección de la compañía: Holmens Kanal 71060 Copenhagen Denmark | |

NetDania es una plataforma de trading no regulada con sede en Dinamarca. Se especializa en tecnología de precios en tiempo real para bancos de nivel 1, corredores y analistas. La compañía ofrece una variedad de soluciones financieras, incluyendo aplicaciones de escritorio, móviles y web.

Pros y Contras

| Pros | Contras |

| Ninguno | Falta de regulación |

| Condiciones de trading no transparentes | |

| Falta de información sobre instrumentos de mercado |

¿Es NetDania legítimo?

NetDania no está regulado por ninguna autoridad. Operar en esta plataforma de trading puede ser extremadamente peligroso.

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| NetDania Mobile & NetDania NetStation | ✔ | Escritorio, Móvil, Web | / |

| MT5 | ❌ | Escritorio, Móvil, Web | Traders experimentados |

| MT4 | ❌ | Escritorio, Móvil, Web | Principiantes |

| Trading View | ❌ | Escritorio, Móvil, Tablets, Web | Principiantes |

Servicio al Cliente

| Opciones de Contacto | Detalles |

| Teléfono | +44 (0) 207 558 8405 |

| Formulario de Contacto | ✔ |

| Idioma del Sitio Web | Inglés |

| Dirección Física | Holmens Kanal 71060 Copenhagen Denmark |

Preguntas Frecuentes

¿Es NetDania legítimo?

No. NetDania sigue siendo una plataforma no regulada.

¿Es NetDania seguro?

No. NetDania no es seguro ya que no ha sido debidamente regulado.

¿Es NetDania bueno para principiantes?

No. NetDania no es bueno para principiantes.