Perfil de la compañía

| Finansia Resumen de la revisión | |

| Establecido | 2002 |

| País/Región Registrada | Tailandia |

| Regulación | Sin regulación |

| Producto de Trading | Valores |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Finansia HERO (PC, iOS, Android) |

| Depósito Mínimo | / |

| Soporte al Cliente | Tel: 02 782 2400 |

| Email: cxcenter@fnsyrus.com | |

Información de Finansia

Establecida en 2002 y con sede en Tailandia, Finansia Syrus Securities es una empresa de corretaje que ofrece una amplia gama de servicios que incluyen trading de valores, suscripciones a IPO y seminarios educativos. Aunque opera como Broker No. 24 en la Bolsa de Tailandia, no está controlada a nivel global y no ofrece opciones de cuenta demo o islámica.

Pros y Contras

| Pros | Contras |

| Seminarios de inversión gratuitos | Sin regulación |

| Ofrece múltiples tipos de cuentas | Sin cuenta demo para práctica |

| Potente plataforma de trading interna (Finansia HERO) | Depósito mínimo no claro |

| Larga historia operativa |

¿Es Finansia Legítimo?

Finansia no es una entidad con licencia o regulada por ningún organismo regulador financiero importante. Aunque está registrada en Tailandia, la Comisión de Valores y Bolsa de Tailandia (SEC) no controla sus servicios de corretaje internacionales o de divisas.

Los registros WHOIS muestran que el dominio fnsyrus.com se registró el 26 de mayo de 2009 y se modificó por última vez el 16 de mayo de 2025. Caducará el 26 de mayo de 2026. Su estado actual es "prohibido el traslado del cliente", lo que sugiere que está activo y protegido contra modificaciones o transferencias no autorizadas, lo que indica que es un dominio activo y funcional bajo políticas de protección estándar.

Servicios de Finansia

Centrándose en el corretaje de valores para clientes minoristas e institucionales en Tailandia, Finansia Syrus Securities ofrece un amplio espectro de servicios de inversión. Con una presencia significativa en la Bolsa de Tailandia (Broker No. 24), ofrece herramientas de trading digitales, investigación de mercado y apoyo educativo.

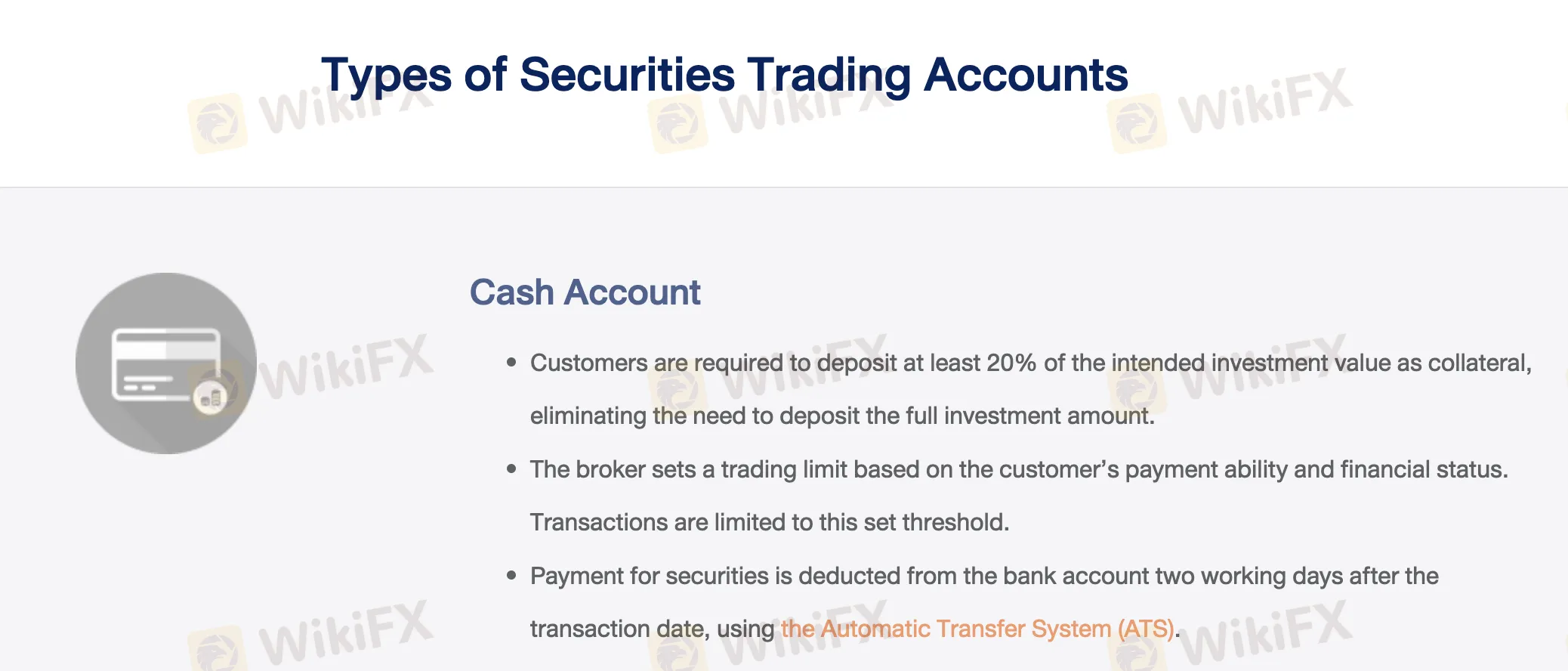

Tipo de Cuenta

Finansia ofrece tres tipos de cuentas de trading reales: Cuenta de Efectivo, Cuenta de Saldo en Efectivo y Cuenta de Saldo de Crédito. Cada una se adapta a varios requisitos de trading según la flexibilidad financiera y la actitud de riesgo. El sitio web oficial no muestra señales de cuentas demo o cuentas islámicas (libres de intercambio).

| Tipo de Cuenta | Característica Clave | Adecuado para |

| Efectivo | Depositar ≥20% del valor del trade como garantía; pagar más tarde a través de ATS | Traders con capital flexible |

| Saldo en Efectivo | Pre-financiar el 100% del monto del trade; genera intereses | Inversionistas conservadores, buscadores de intereses |

| Saldo de Crédito | Trading con margen con garantía; préstamo automático del broker | Traders experimentados con alta tolerancia al riesgo |

Tarifas de Finansia

Especialmente para clientes que utilizan canales de trading por internet, donde los costos de corretaje pueden ser tan bajos como 0.10% para traders de alto volumen, las tarifas de trading de Finansia Syrus Securities son bastante económicas en comparación con el promedio de la industria tailandesa. El sistema de tarifas es escalonado, por lo que tasas más bajas premian una mayor actividad de trading.

| Volumen Diario de Trading (THB) | Con Asesor de Inversiones (Cuenta de Efectivo) | Cuenta de Saldo en Efectivo / Cuenta de Saldo de Crédito | Canal en Línea |

| ≤ 5 millones | 0.25% | 0.20% | 0.15% |

| 5M < valor ≤ 10 millones | 0.22% | 0.18% | 0.13% |

| 10M < valor ≤ 20 millones | 0.18% | 0.15% | 0.11% |

| > 20 millones | 0.15% | 0.12% | 0.10% |

Plataforma de Trading

Compatible con PC, iOS y Android, Finansia Syrus Securities ofrece el sistema de trading Finansia HERO. Los traders activos y expertos en tecnología que buscan estadísticas en tiempo real, órdenes automáticas, backtesting y escaneos de acciones configurables lo encontrarán perfecto.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Finansia HERO | ✔ | PC, iOS, Android | Traders activos que buscan herramientas impulsadas por IA, automatización y selecciones en tiempo real |

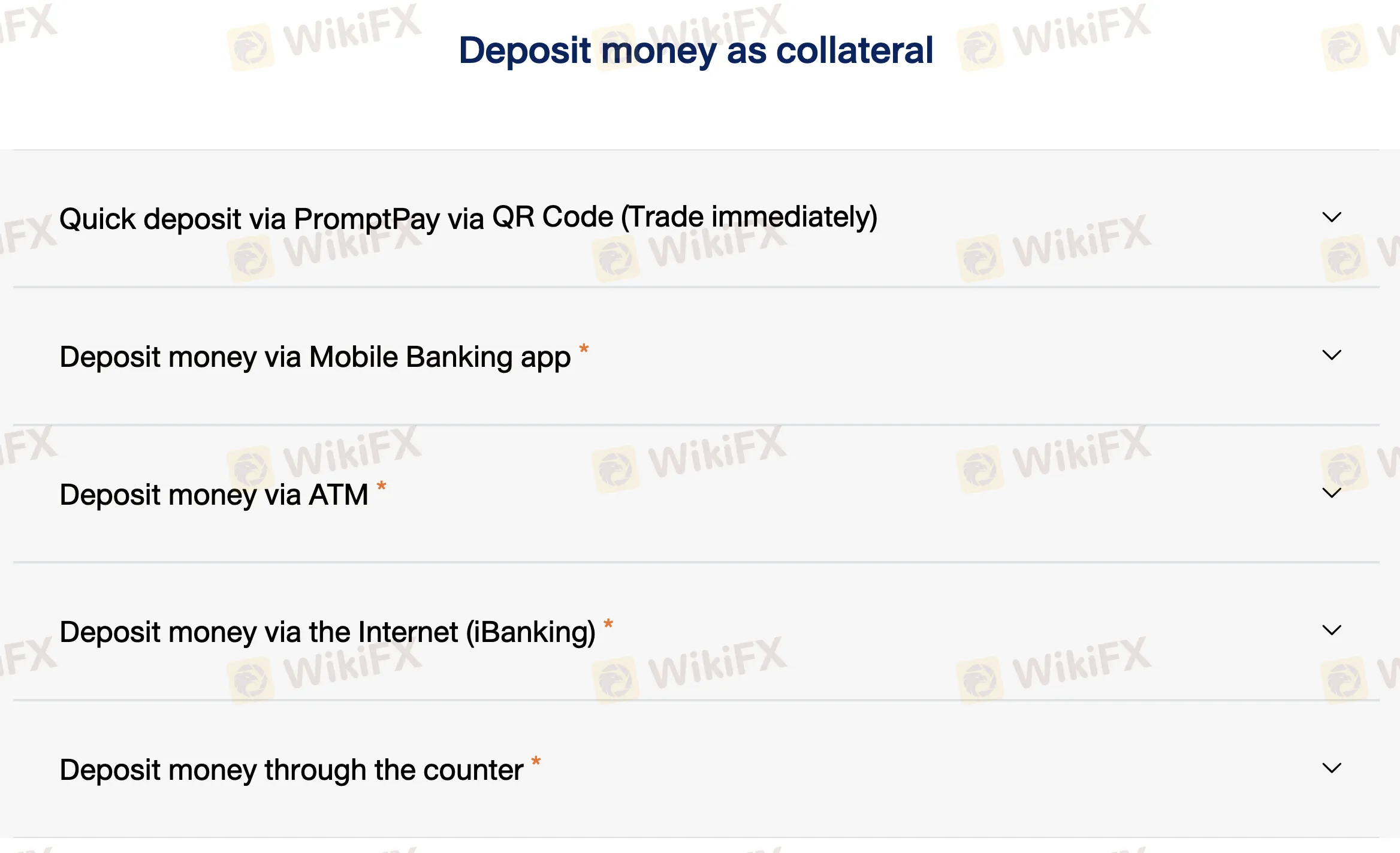

Depósito y Retiro

Aunque se admiten depósitos de hasta 2,000,000 THB a través de PromptPay QR, Finansia no impone tarifas de depósito y el requisito de depósito mínimo no está definido explícitamente. Los depósitos deben provenir de una cuenta a nombre del propietario de la cuenta de trading de valores.

| Método de Pago | Tarifas | Tiempo de Procesamiento |

| Código QR de PromptPay | Gratis | Inmediato (8:00–18:00) |

| App de Banca Móvil | Varía según el banco | |

| Transferencia ATM | ||

| Banca por Internet (iBanking) | ||

| Depósito en Ventanilla Bancaria |