Perfil de la compañía

| Metaverse Securities Resumen de la reseña | |

| Establecido | 2021 |

| País/Región Registrada | Hong Kong |

| Regulación | SFC |

| Instrumentos de Mercado | Acciones, Forex, Fondos Mutuos, ETFs, REITs |

| Plataforma de Trading | MetaStock, Fuyuan Benben y Yisheng Polestar Futures |

| Soporte al Cliente | Teléfono: 400-688-3187 (Fast Track) |

| Teléfono: (00852) 2523 8221 (Orden por Teléfono) | |

| Fax: (00852) 2810 7978, (0755) 2665 8431 | |

| Dirección: 4806-07, 48/F, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong | |

Información de Metaverse Securities

Metaverse Securities es un corredor con sede en Hong Kong que ofrece una variedad de instrumentos de trading como acciones, forex, ETFs y REITs. A pesar de la amplia gama de productos y una ejecución rápida, su licencia regulatoria (AAW177) ha caducado, por lo que los inversores deben ser cautelosos. La plataforma está principalmente dirigida a principiantes, con soporte para MetaStock, Fuyuan Benben y Yisheng Polestar Futures, pero no ofrece plataformas de trading avanzadas como MT5. La mayoría de los servicios básicos son gratuitos, pero se cobra una tarifa de HK$20 por mes por cuentas inactivas.

Pros y Contras

| Pros | Contras |

| Regulado por SFC | Métodos de pago limitados |

| Variedades de trading abundantes | |

| Interpretación intradía rápida |

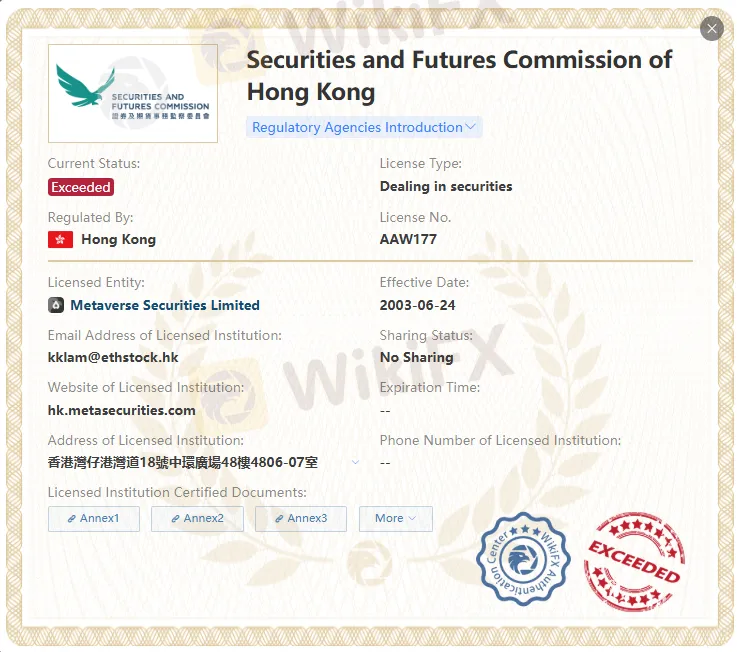

¿Es Metaverse Securities Legítimo?

Metaverse Securities excede el alcance comercial regulado por la SFC de China Hong Kong. Aunque Metaverse Securities afirma estar regulado por dos reguladores, el certificado regulatorio con el número de licencia AAW177 ha caducado. ¡Por favor, tenga en cuenta el riesgo!

| País Regulado | Autoridad Reguladora | Estado Regulatorio | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Comisión de Valores y Futuros de Hong Kong (SFC) | Regulado | Meta Futures Limited | Operaciones en contratos de futuros | BSM300 |

| Comisión de Valores y Futuros de Hong Kong (SFC) | Excedido | Metaverse Securities Limited | Operaciones en valores | AAW177 |

¿Qué puedo comerciar en Metaverse Securities?

Metaverse Securities ofrece más de 30,000 productos de inversión y apalancamiento. Las variedades de trading incluyen: forex, acciones, ETFs, REITs, fondos mutuos, etc.

| Activos de Trading | Disponibles |

| Forex | ✔ |

| Acciones | ✔ |

| Fondos Mutuos | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

Tarifas

La mayoría de los servicios (como depósitos, retiros, transferencias de acciones, tarifas de custodia, etc.) son gratuitos.

Tarifas específicas se aplican a servicios específicos (por ejemplo, tarifas de transferencia de sellos, tarifas de registro y transferencia, procesamiento de dividendos, etc.).

Las cuentas inactivas están sujetas a una tarifa mensual de HK$20.

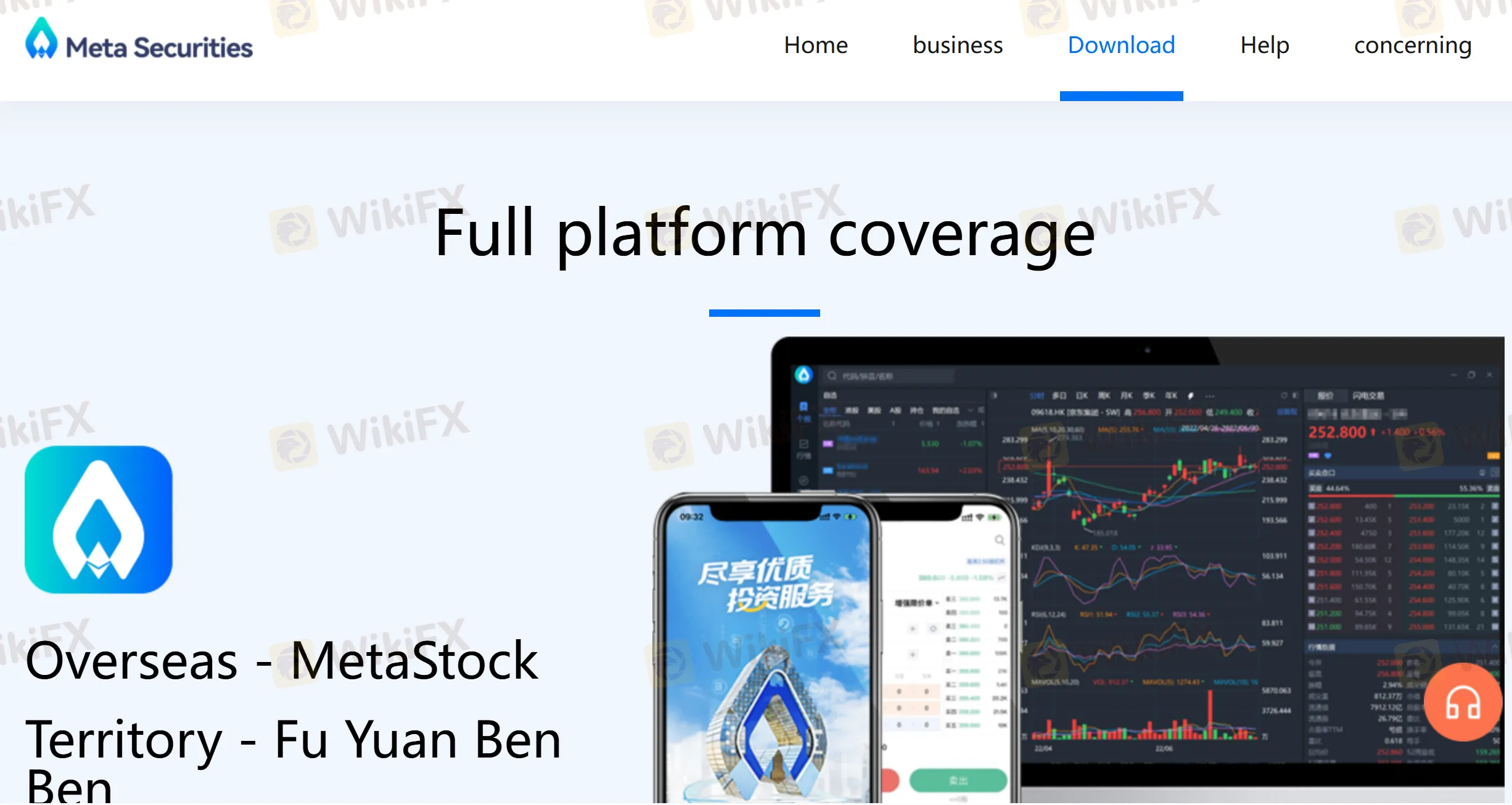

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| MetaStock | ✔ | Escritorio, Móvil, Web |

| Fuyuan Benben | ✔ | Móvil |

| Yisheng Polestar Futures | ✔ | Escritorio, Móvil |

Depósito y Retiro

Metaverse Securities acepta pagos a través de los siguientes bancos: Banco de China (Hong Kong), Banco de Comunicaciones (Hong Kong), CMB Wing Lung Bank, China Minsheng Bank, Centron Bank, Nanyang Commercial Bank, Bank of East Asia, the Hongkong and Shanghai Banking Corporation Limited.