公司简介

| U.S. Bank评论摘要 | |

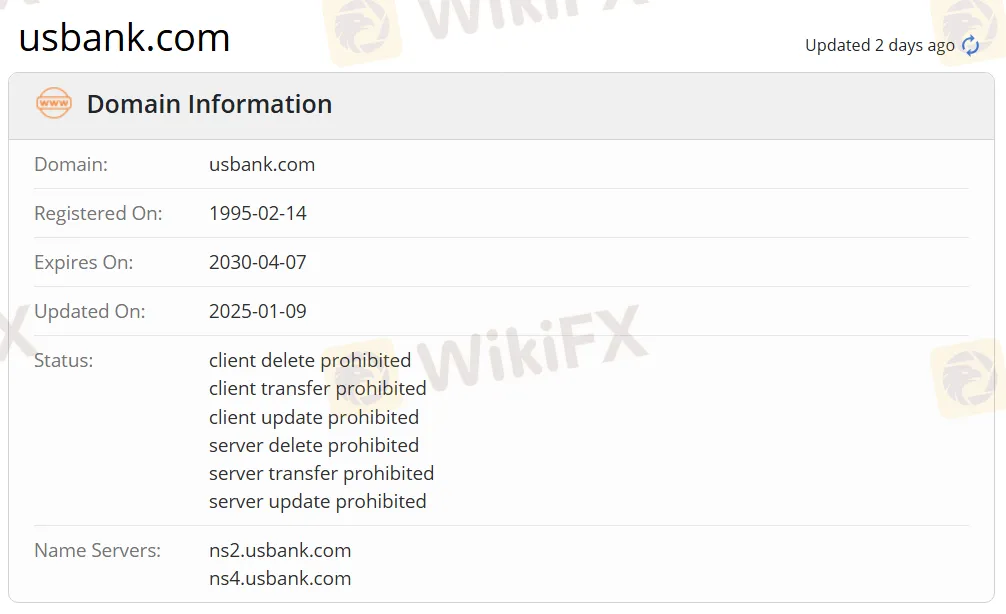

| 成立时间 | 1995 |

| 注册国家/地区 | 美国 |

| 监管 | 无监管 |

| 产品与服务 | 银行服务,财富管理 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | U.S. Bank 应用 |

| 最低存款 | $25 |

| 客户支持 | 社交媒体:Facebook,Twitter,Instagram |

| 地址:U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

U.S. Bank 信息

U.S. Bank 成立于1995年,注册地点为美国。它为个人、机构和公司客户提供多样化的银行服务,包括信用卡、支票账户、储蓄账户、定期存款(CDs)、抵押贷款、投资管理和财富规划。尽管提供了最低存款为$25的便利交易体验,但该公司没有受到监管,因此投资者需要对其合法性和透明度保持谨慎。U.S. Bank 提供四种主要账户类型:商业支票账户、商业储蓄账户、商业货币市场账户和商业定期存款(CDs),满足不同企业的现金管理和增长需求。

优点与缺点

| 优点 | 缺点 |

| 专业的银行服务 | 无监管 |

| 在美国有悠久的运营历史 |

U.S. Bank 是否合法?

U.S. Bank 没有受到监管。交易者在交易时应谨慎使用资金。

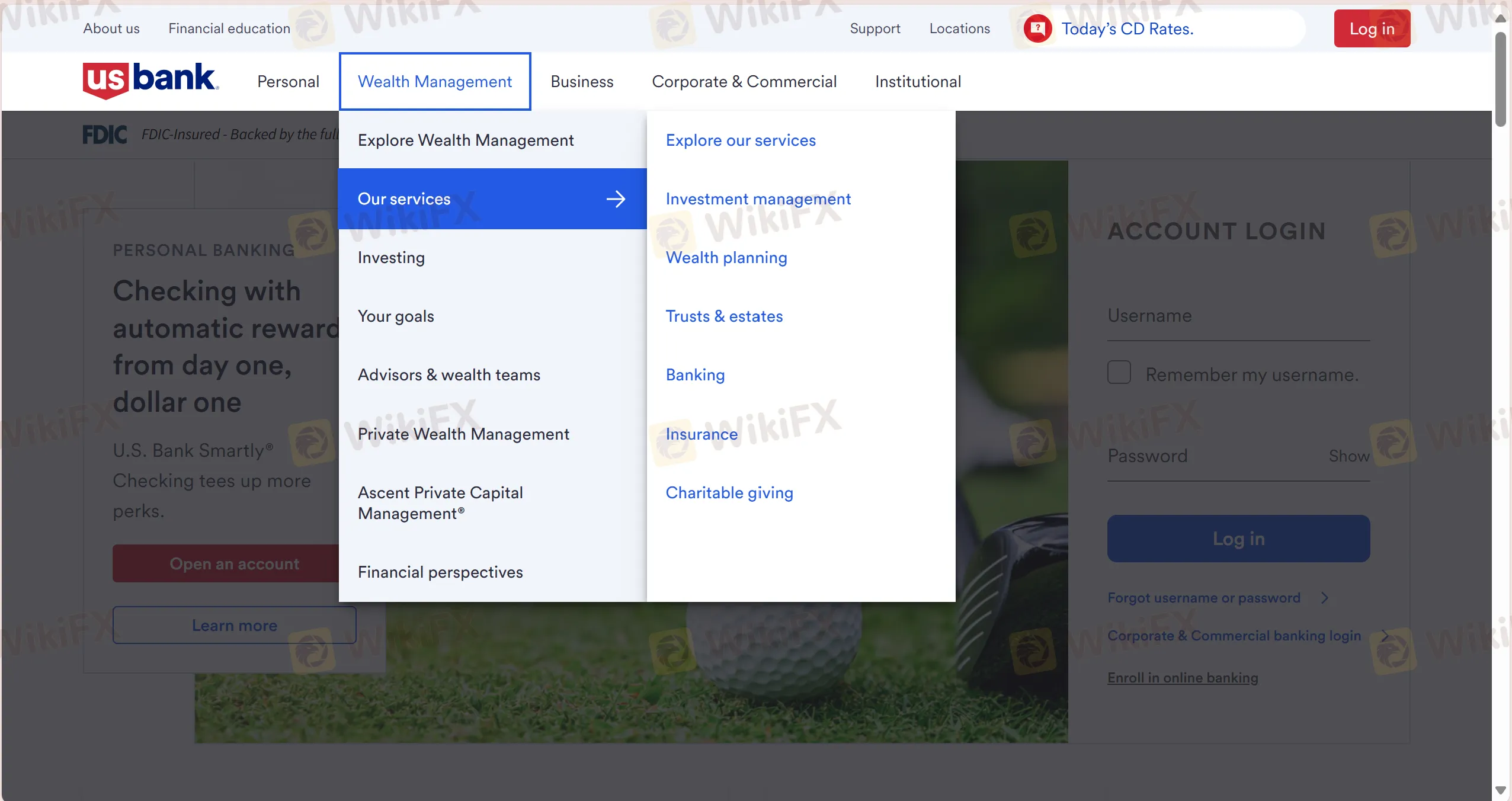

产品与服务

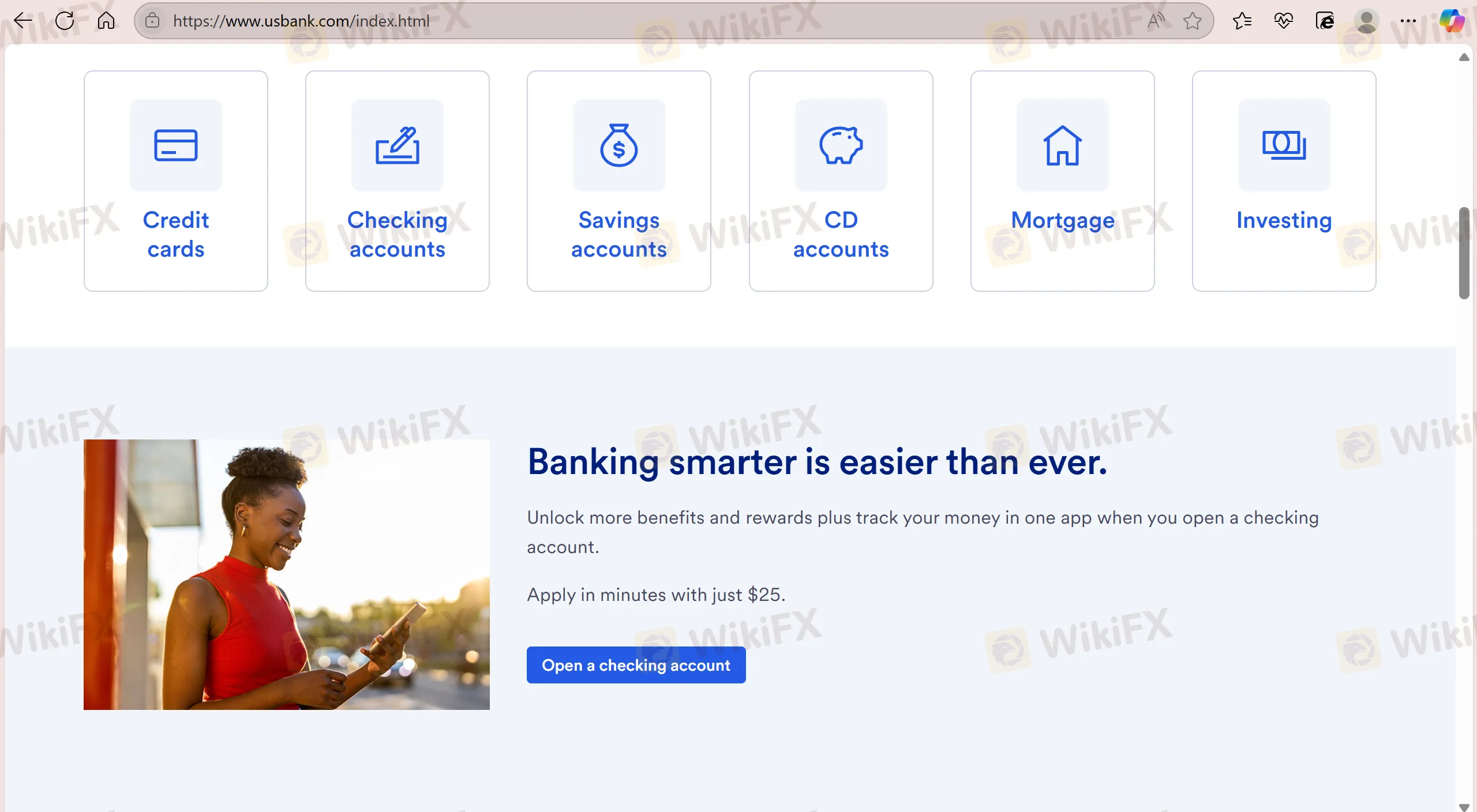

U.S. Bank 提供全面的金融产品和服务,包括信用卡、支票账户、储蓄账户、CD账户、抵押贷款、投资、房屋抵押贷款、汽车贷款、房屋净值信用额度(HELOC)、投资管理、财富规划、信托与遗产、银行业务、保险和慈善捐赠。

| 产品与服务 | 支持 |

| 信用卡 | ✔ |

| 支票账户 | ✔ |

| 储蓄账户 | ✔ |

| CD账户 | ✔ |

| 抵押贷款 | ✔ |

| 投资 | ✔ |

| 汽车贷款 | ✔ |

| 房屋净值信用额度(HELOC) | ✔ |

| 投资管理 | ✔ |

| 财富规划 | ✔ |

| 信托与遗产 | ✔ |

| 银行业务 | ✔ |

| 保险 | ✔ |

| 慈善捐赠 | ✔ |

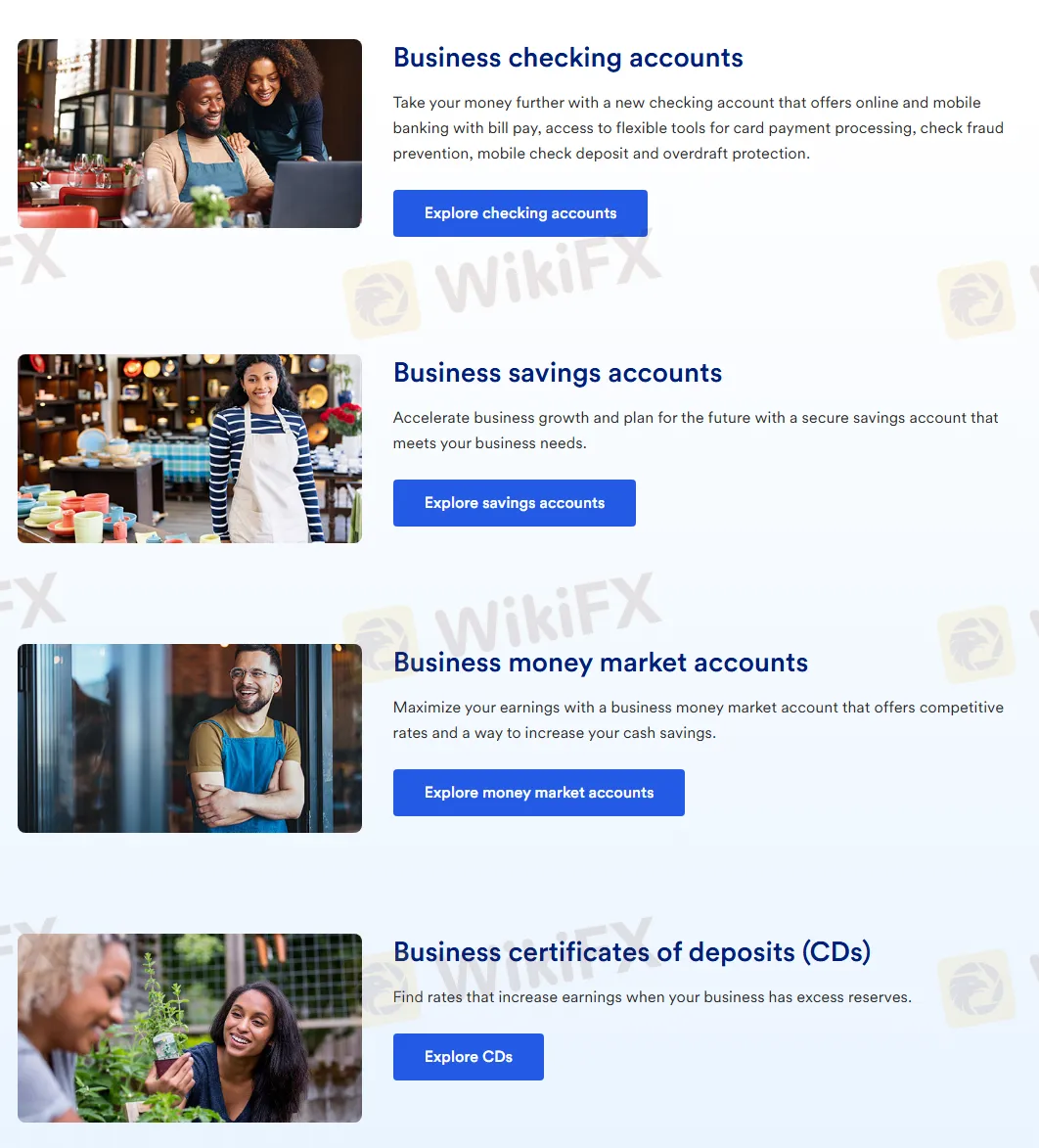

账户类型

U.S. Bank 提供四种账户,包括 商业支票账户、商业储蓄账户、商业货币市场账户和商业定期存款证书(CDs)。

以下是它们的主要特点:

| 账户类型 | 描述 | 适用对象 |

| 商业支票账户 | 支持在线和移动银行功能,如账单支付、卡支付处理工具、支票欺诈防范、移动支票存款和透支保护。 | 适用于需要全面银行解决方案的企业。 |

| 商业储蓄账户 | 提供安全的储蓄账户,帮助企业加速增长并满足资金需求。 | 企业希望积累未来增长所需资金。 |

| 商业货币市场账户 | 提供竞争性利率,帮助企业最大化回报并增加现金储蓄。 | 企业寻求更高回报同时保持流动性。 |

| 商业定期存款证书(CDs) | 提供利率选择,帮助企业在资金过剩时增加回报。 | 企业旨在在特定期限内锁定高回报。 |

费用

最低存款: U.S. Bank 的最低存款为$25。

交易平台

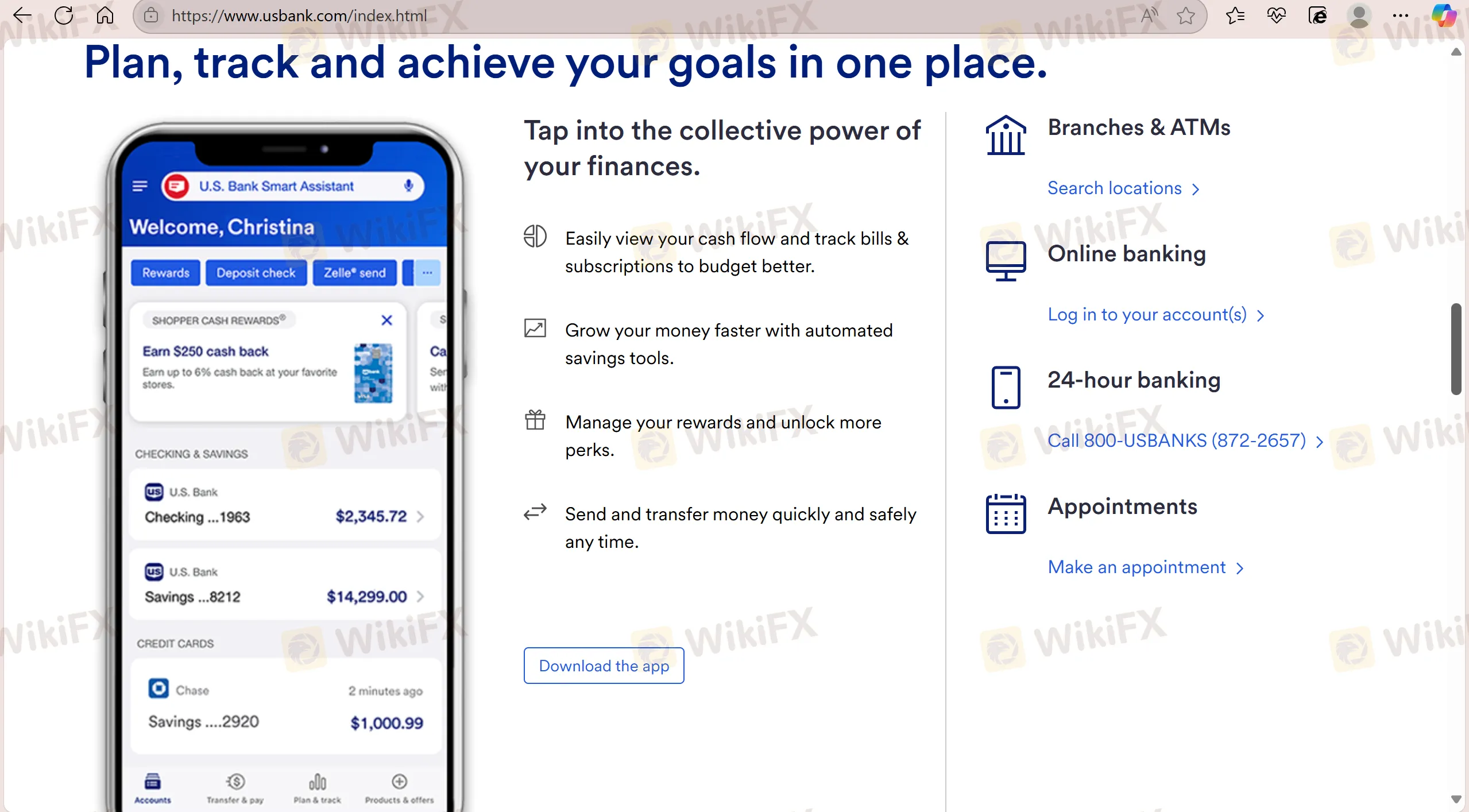

U.S. Bank 通过其专有的 U.S. Bank 应用 支持交易。该应用提供24小时服务。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| U.S. Bank 应用 | ✔ | 移动设备 | / |