Profil perusahaan

| U.S. BankRingkasan Ulasan | |

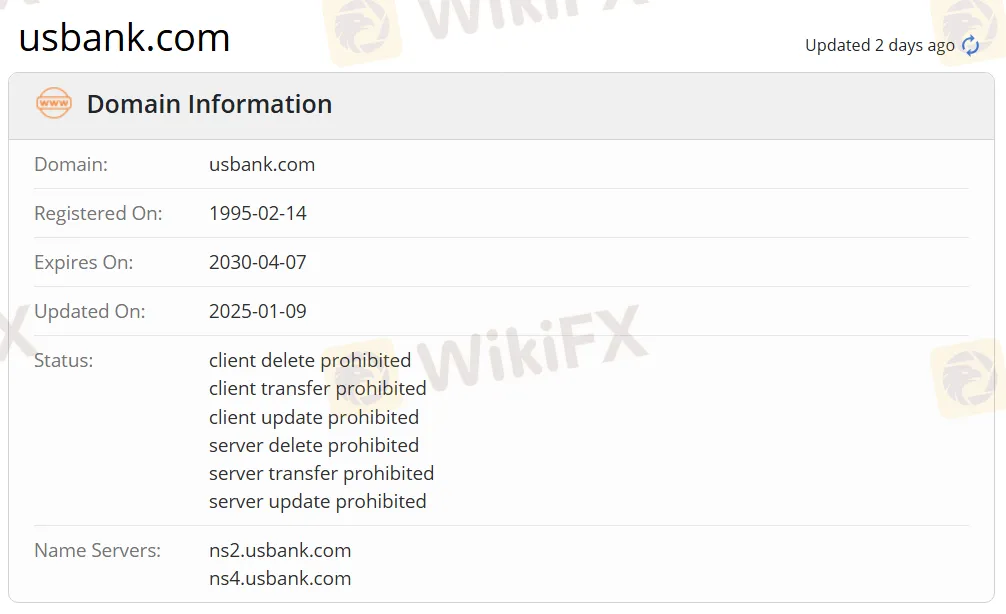

| Dibentuk | 1995 |

| Negara/Daerah Terdaftar | Amerika Serikat |

| Regulasi | Tidak Diatur |

| Produk & Layanan | Layanan perbankan, manajemen kekayaan |

| Akun Demo | / |

| Daya Ungkit | / |

| Spread | / |

| Platform Perdagangan | Aplikasi U.S. Bank |

| Deposit Minimum | $25 |

| Dukungan Pelanggan | Media Sosial: Facebook, Twitter, Instagram |

| Alamat: U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

Informasi U.S. Bank

U.S. Bank didirikan pada tahun 1995 dan terdaftar di Amerika Serikat. Perusahaan ini menawarkan beragam layanan perbankan kepada klien personal, institusi, dan korporat, termasuk kartu kredit, rekening checking, rekening tabungan, sertifikat deposito (CD), pinjaman hipotek, manajemen investasi, dan perencanaan kekayaan. Meskipun menyediakan pengalaman perdagangan yang nyaman dengan deposit minimum sebesar $25, perusahaan ini tidak diatur, sehingga investor perlu berhati-hati terkait legitimasi dan transparansinya. U.S. Bank menawarkan empat jenis akun utama: rekening checking komersial, rekening tabungan komersial, rekening pasar uang komersial, dan sertifikat deposito komersial (CD), yang memenuhi kebutuhan manajemen kas dan pertumbuhan berbagai bisnis.

Pro & Kontra

| Pro | Kontra |

| Layanan perbankan khusus | Tidak diatur |

| Sejarah operasi panjang di AS |

Apakah U.S. Bank Legal?

U.S. Bank tidak diatur. Para trader sebaiknya berhati-hati saat bertransaksi dan menggunakan dana dengan bijaksana.

Produk & Layanan

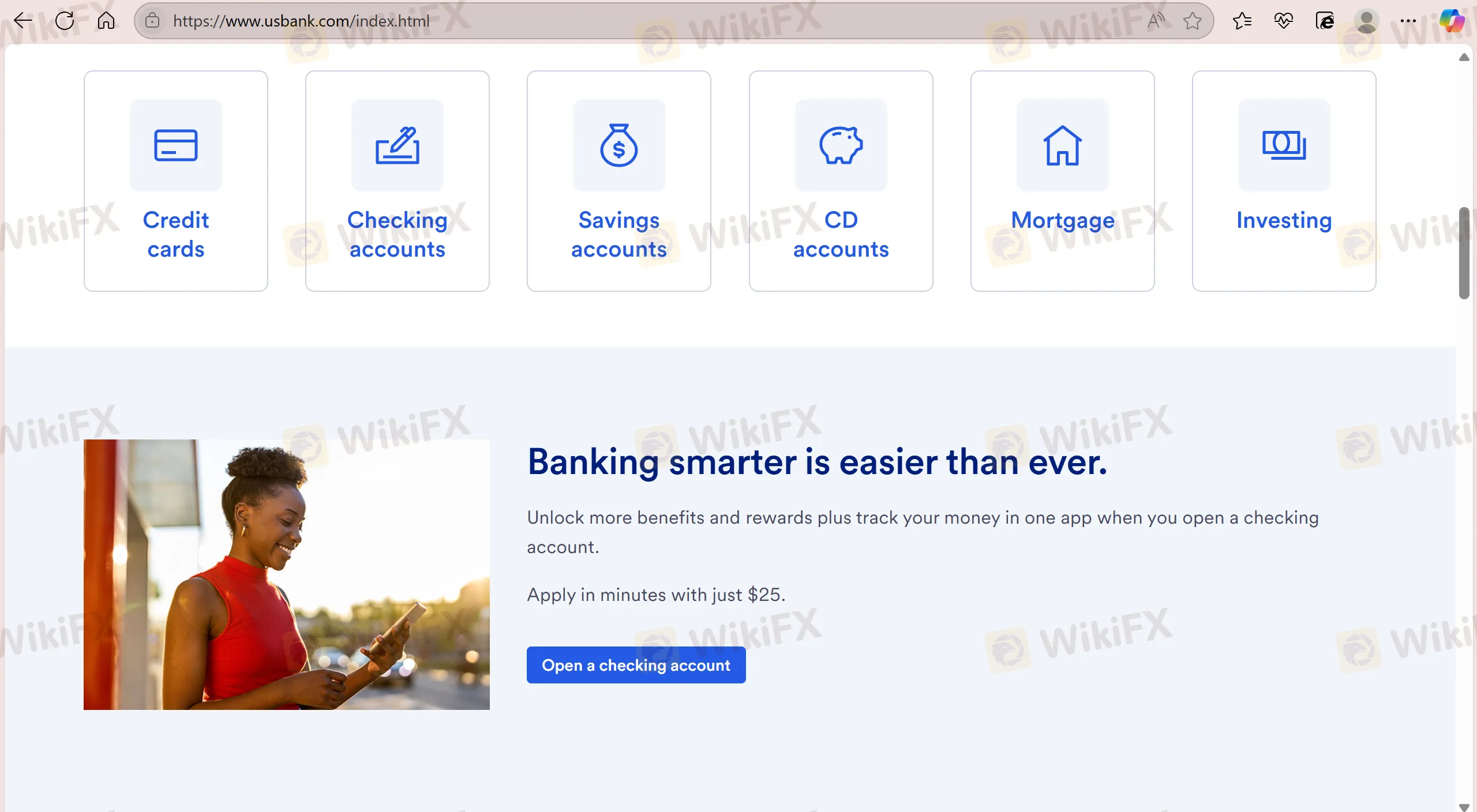

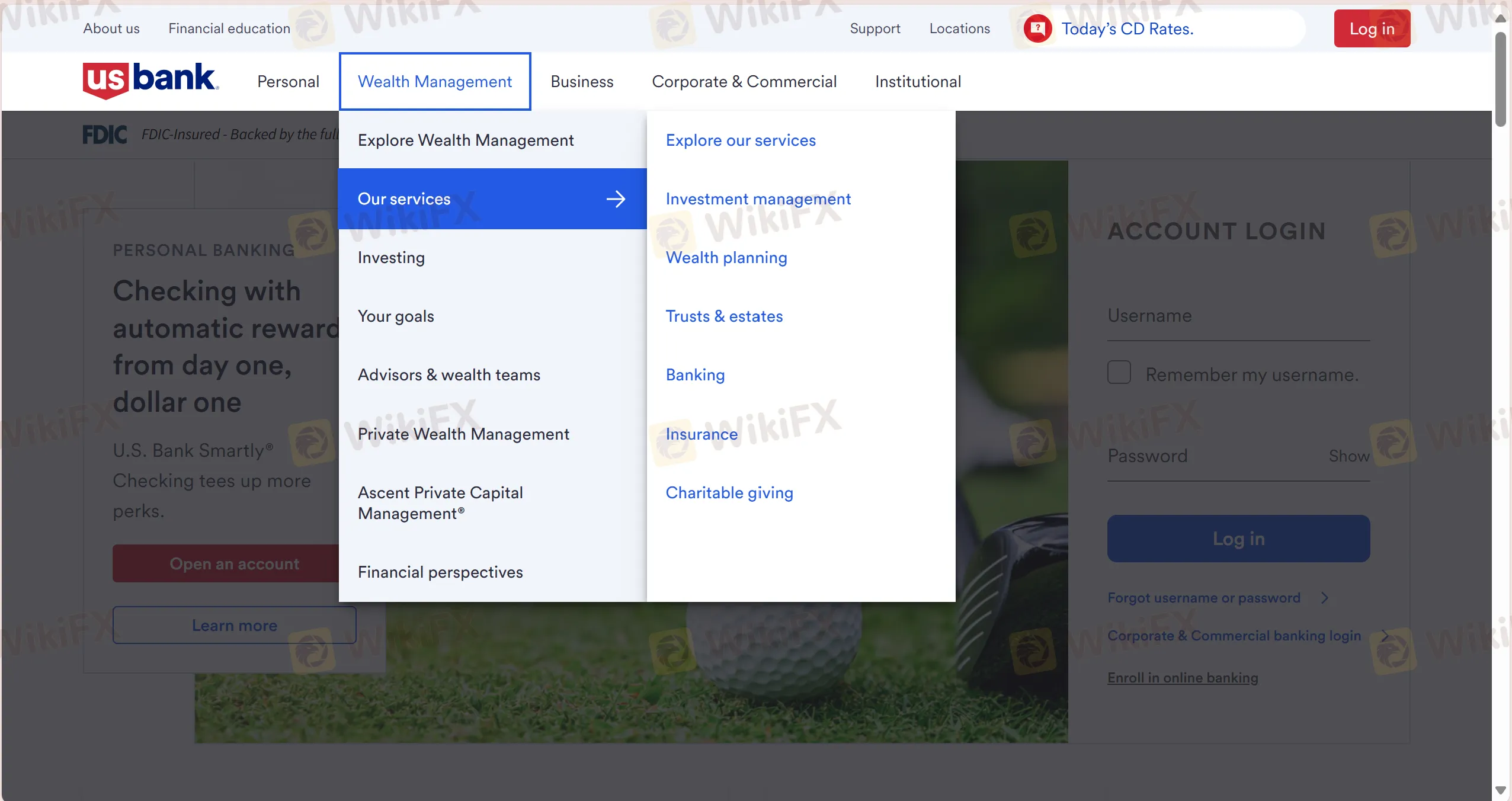

U.S. Bank menawarkan berbagai produk dan layanan keuangan yang komprehensif, termasuk Kartu Kredit, Rekening Checking, Rekening Tabungan, Rekening CD, Hipotek, Investasi, Hipotek Rumah, Pinjaman Otomatis, Home Equity Line of Credit (HELOC), Manajemen Investasi, Perencanaan Keuangan, Trust & Estates, Perbankan, Asuransi, dan Pemberian Amal.

| Produk & Layanan | Didukung |

| Kartu Kredit | ✔ |

| Rekening Checking | ✔ |

| Rekening Tabungan | ✔ |

| Rekening CD | ✔ |

| Hipotek | ✔ |

| Investasi | ✔ |

| Pinjaman Otomatis | ✔ |

| Home Equity Line of Credit (HELOC) | ✔ |

| Manajemen Investasi | ✔ |

| Perencanaan Keuangan | ✔ |

| Trust & Estates | ✔ |

| Perbankan | ✔ |

| Asuransi | ✔ |

| Pemberian Amal | ✔ |

Jenis Akun

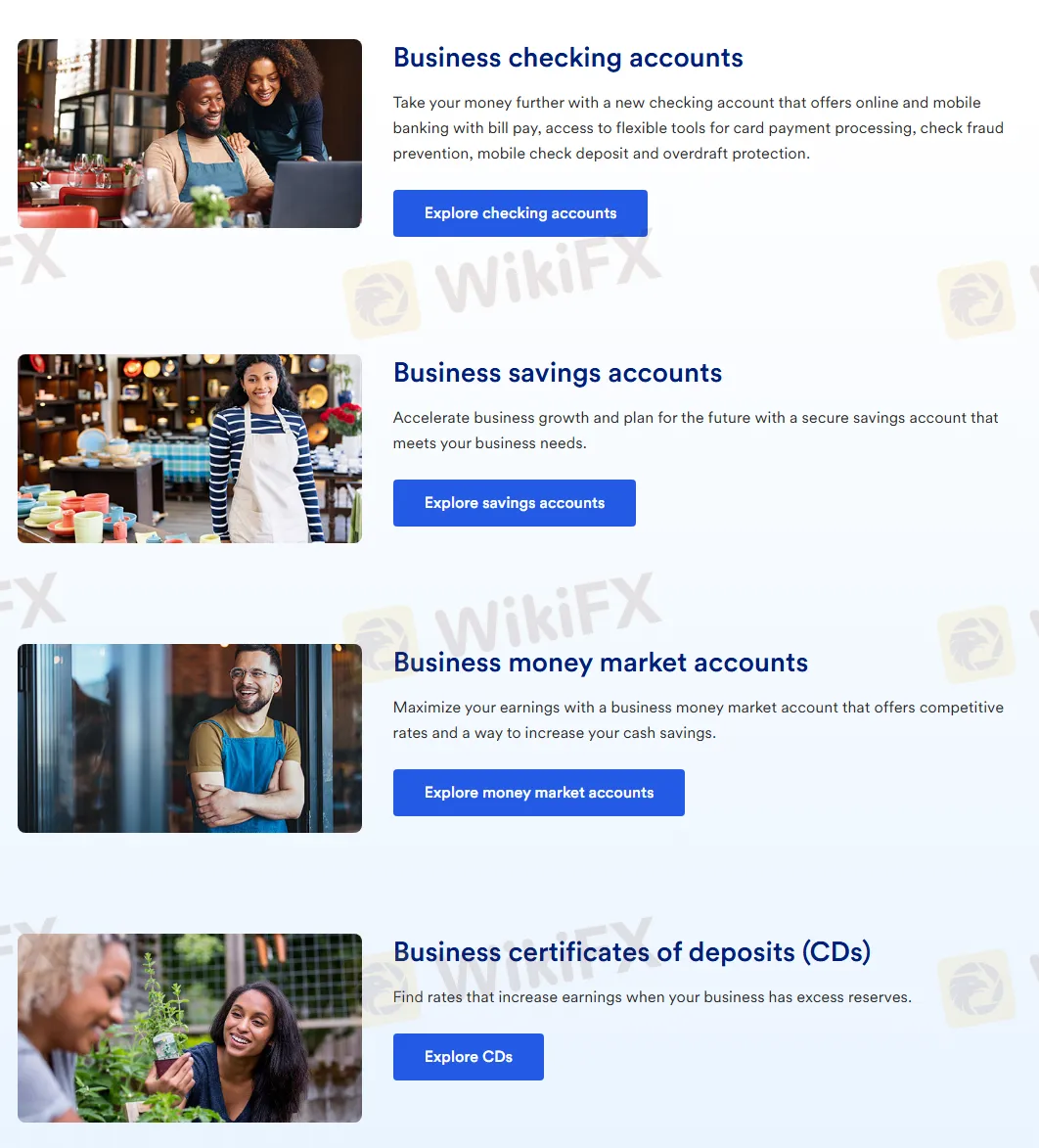

U.S. Bank menawarkan empat jenis akun, termasuk Rekening Checking Bisnis, Rekening Tabungan Bisnis, Rekening Pasar Uang Bisnis, dan Sertifikat Deposito Bisnis (CDs).

Berikut adalah fitur utama mereka:

| Jenis Akun | Deskripsi | Cocok untuk |

| Rekening Checking Bisnis | Mendukung fitur perbankan online dan seluler seperti pembayaran tagihan, alat pemrosesan pembayaran kartu, pencegahan penipuan cek, deposit cek seluler, dan perlindungan overdraft. | Untuk bisnis yang membutuhkan solusi perbankan komprehensif. |

| Rekening Tabungan Bisnis | Menawarkan rekening tabungan yang aman untuk membantu bisnis mempercepat pertumbuhan dan memenuhi kebutuhan pendanaan. | Bisnis yang ingin mengumpulkan dana untuk pertumbuhan masa depan. |

| Rekening Pasar Uang Bisnis | Menawarkan tingkat bunga kompetitif untuk membantu bisnis memaksimalkan pengembalian dan meningkatkan tabungan tunai. | Bisnis yang mencari pengembalian yang lebih tinggi sambil menjaga likuiditas. |

| Sertifikat Deposito Bisnis (CDs) | Menawarkan opsi tingkat bunga untuk meningkatkan pengembalian ketika bisnis memiliki cadangan berlebih. | Bisnis bertujuan untuk mengunci pengembalian tinggi selama jangka waktu tertentu. |

Biaya

Deposit minimum: Deposit minimum untuk U.S. Bank adalah $25.

Platform Perdagangan

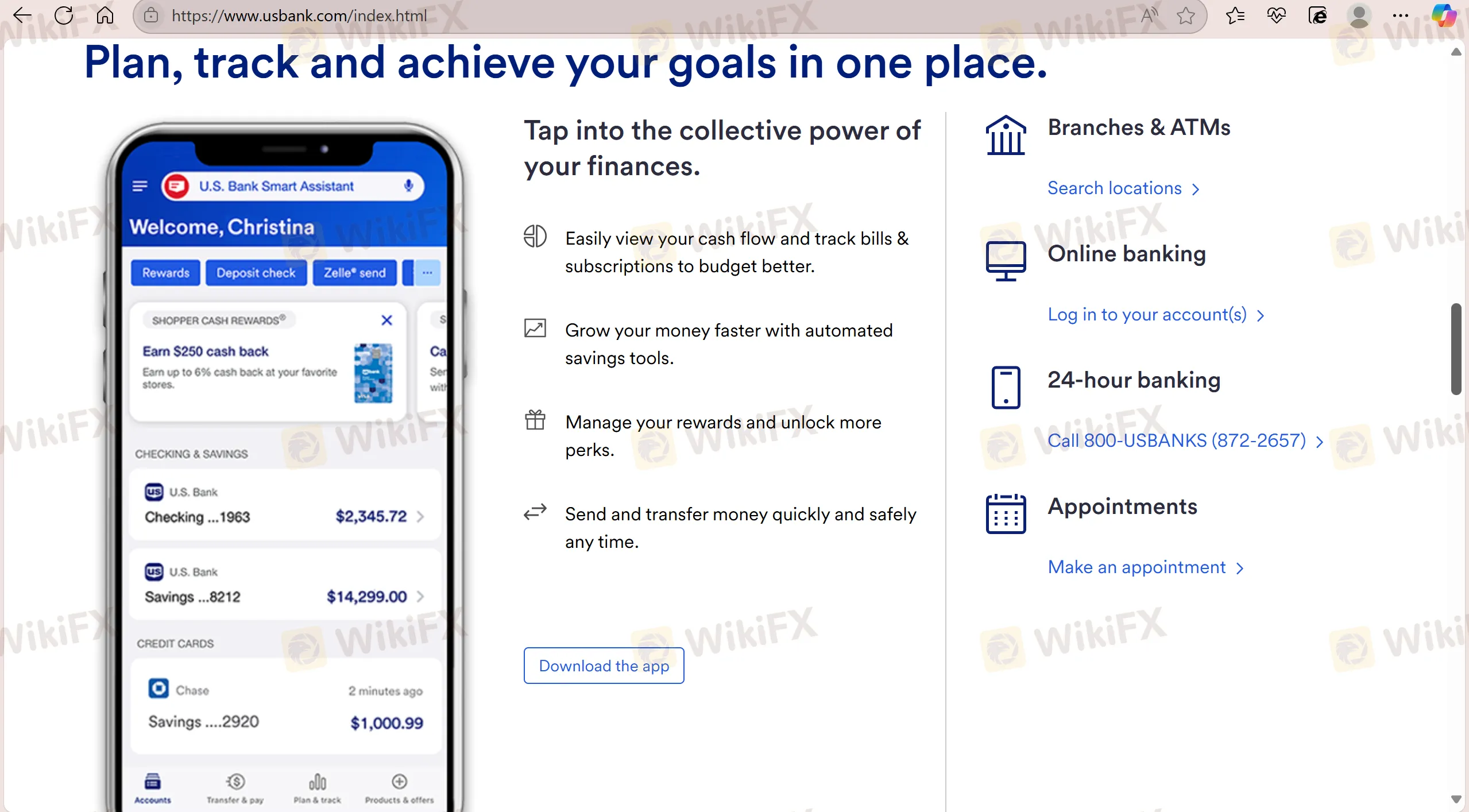

U.S. Bank mendukung transaksi melalui aplikasi miliknya U.S. Bank app. Aplikasi ini menawarkan layanan 24 jam.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Aplikasi U.S. Bank | ✔ | Mobile | / |