Buod ng kumpanya

| U.S. BankBuod ng Pagsusuri | |

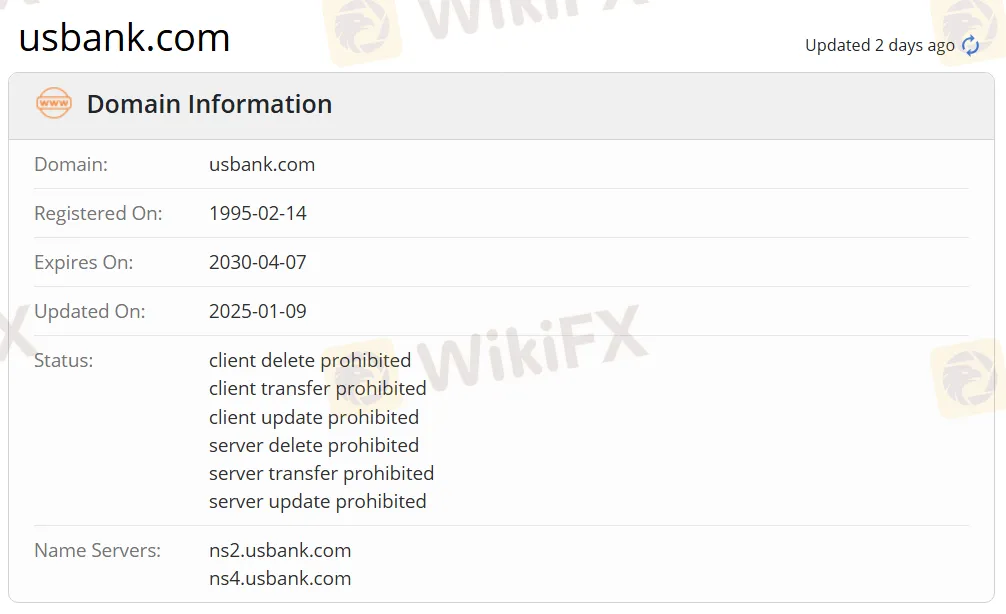

| Itinatag | 1995 |

| Rehistradong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | Walang Regulasyon |

| Mga Produkto at Serbisyo | Serbisyong Bangko, pamamahala ng kayamanan |

| Demo Account | / |

| Levage | / |

| Spread | / |

| Platform ng Pagsusuri | App ng U.S. Bank |

| Minimum na Deposito | $25 |

| Suporta sa Kustomer | Social Media: Facebook, Twitter, Instagram |

| Address: U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

Impormasyon ng U.S. Bank

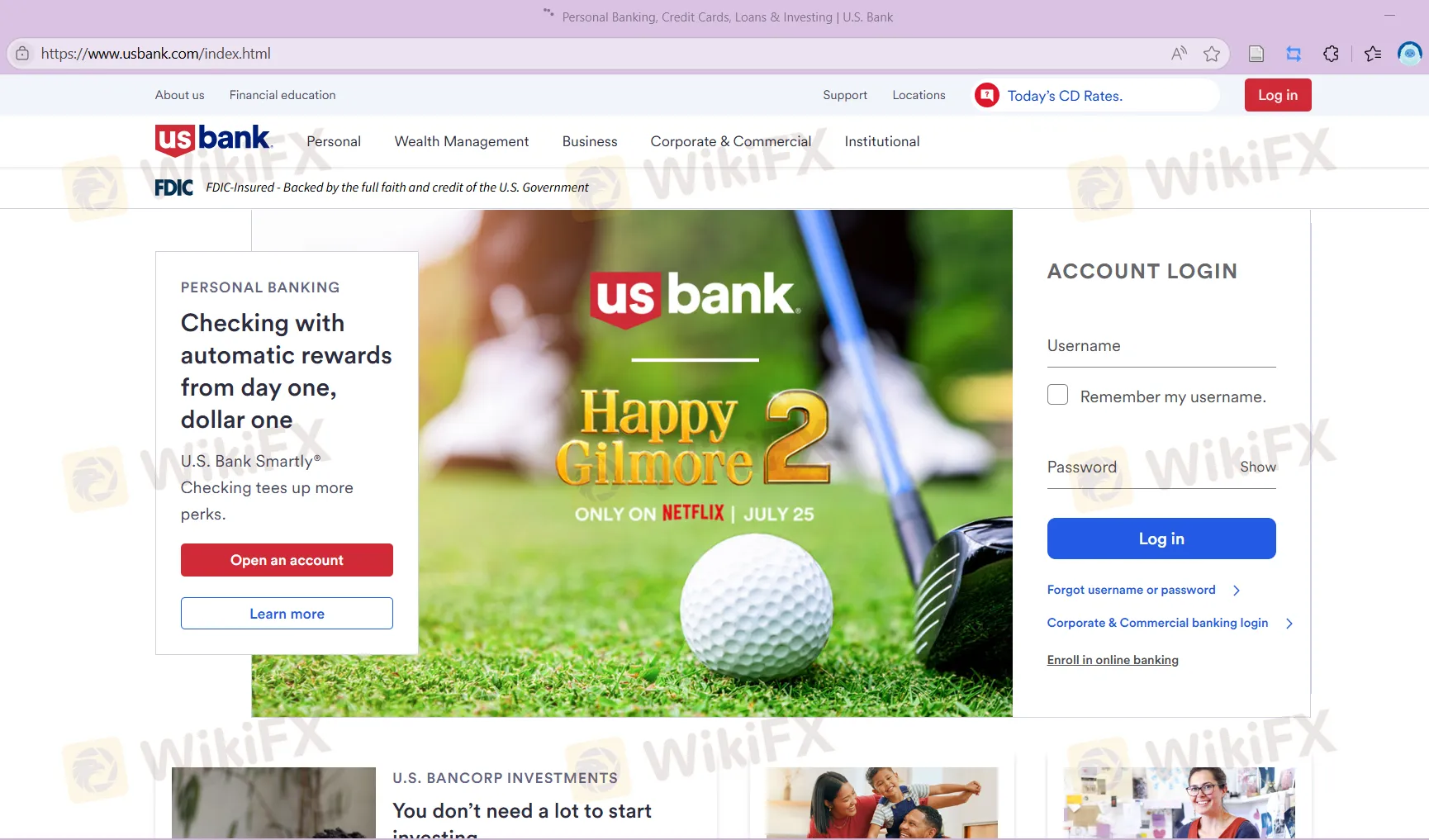

Ang U.S. Bank ay itinatag noong 1995 at rehistrado sa Estados Unidos. Nag-aalok ito ng iba't ibang mga serbisyong bangko sa personal, institusyonal, at korporasyon na mga kliyente, kabilang ang credit cards, checking accounts, savings accounts, certificates of deposit (CDs), mortgage loans, investment management, at wealth planning. Bagaman nagbibigay ito ng maginhawang karanasan sa pagsusuri na may minimum na deposito na $25, hindi ito nairegula, kaya't dapat maging maingat ang mga mamumuhunan sa kanyang lehitimidad at transparansiya. Nag-aalok ang U.S. Bank ng apat na pangunahing uri ng account: commercial checking accounts, commercial savings accounts, commercial money market accounts, at commercial certificates of deposit (CDs), na tumutugon sa mga pangangailangan sa pamamahala ng pera at paglago ng iba't ibang negosyo.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Napiling mga serbisyong bangko | Walang regulasyon |

| Mahabang kasaysayan ng operasyon sa US |

Tunay ba ang U.S. Bank?

Ang U.S. Bank ay hindi nairegula. Dapat maging maingat ang mga mangangalakal sa pagtitingi at gamitin nang maingat ang pondo.

Mga Produkto at Serbisyo

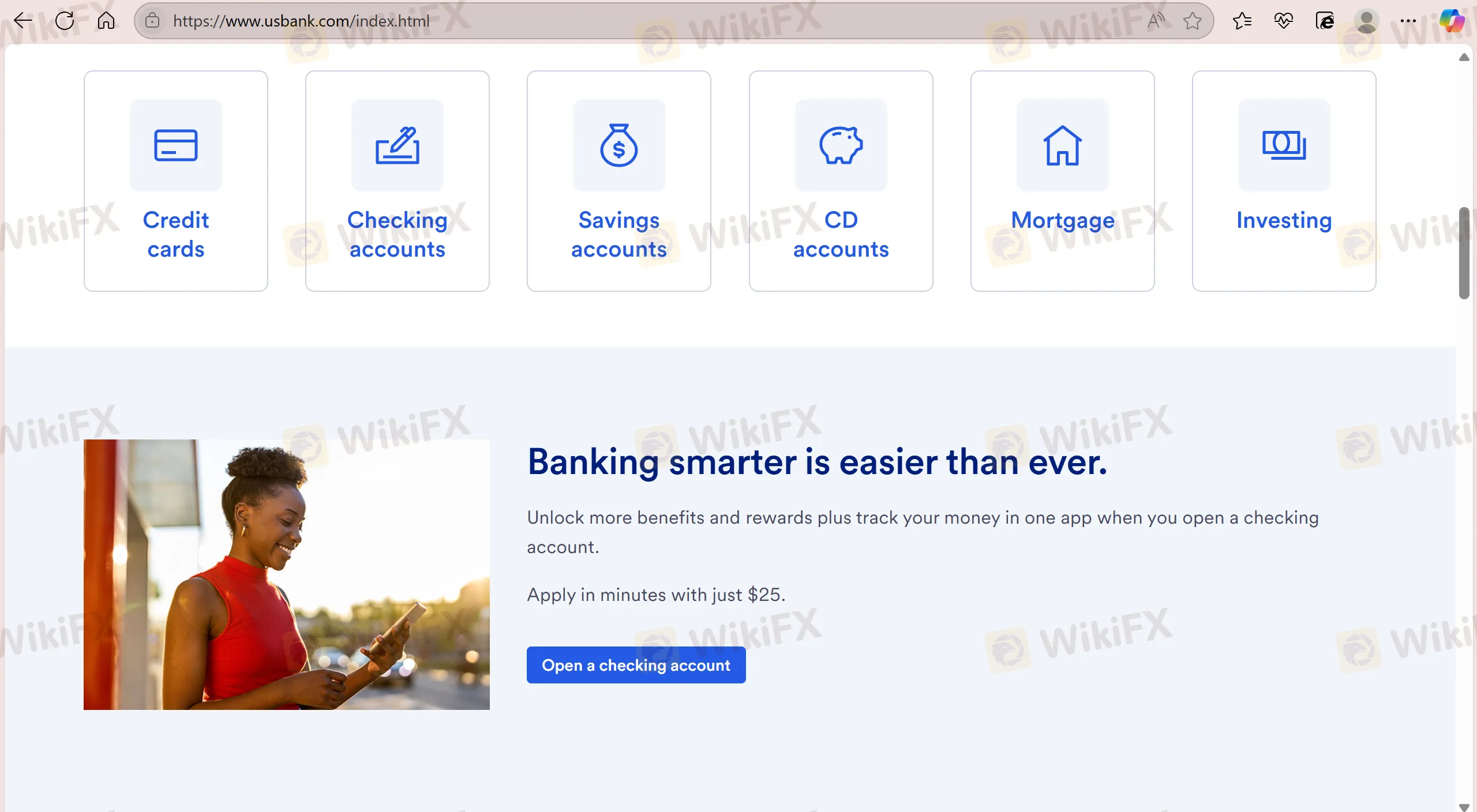

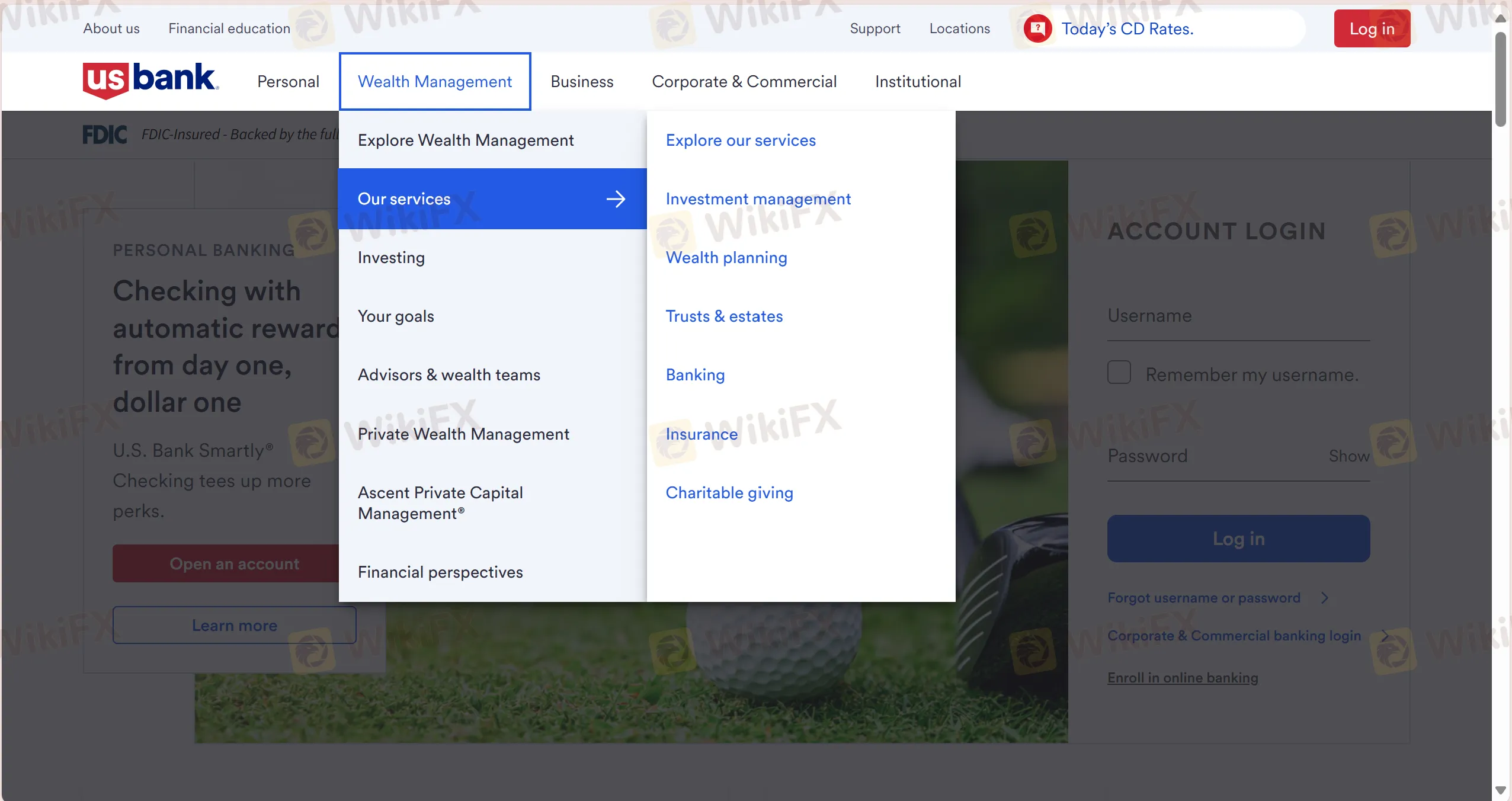

U.S. Bank ay nag-aalok ng isang kumpletong hanay ng mga produkto at serbisyo sa pinansyal, kabilang ang Credit Cards, Checking Accounts, Savings Accounts, CD Accounts, Mortgage, Investing, Home Mortgage, Auto Loan, Home Equity Line of Credit (HELOC), Investment Management, Wealth Planning, Trusts & Estates, Banking, Insurance, at Charitable Giving.

| Mga Produkto at Serbisyo | Supported |

| Credit Cards | ✔ |

| Checking Accounts | ✔ |

| Savings Accounts | ✔ |

| CD Accounts | ✔ |

| Mortgage | ✔ |

| Investing | ✔ |

| Auto Loan | ✔ |

| Home Equity Line of Credit (HELOC) | ✔ |

| Investment Management | ✔ |

| Wealth Planning | ✔ |

| Trusts & Estates | ✔ |

| Banking | ✔ |

| Insurance | ✔ |

| Charitable Giving | ✔ |

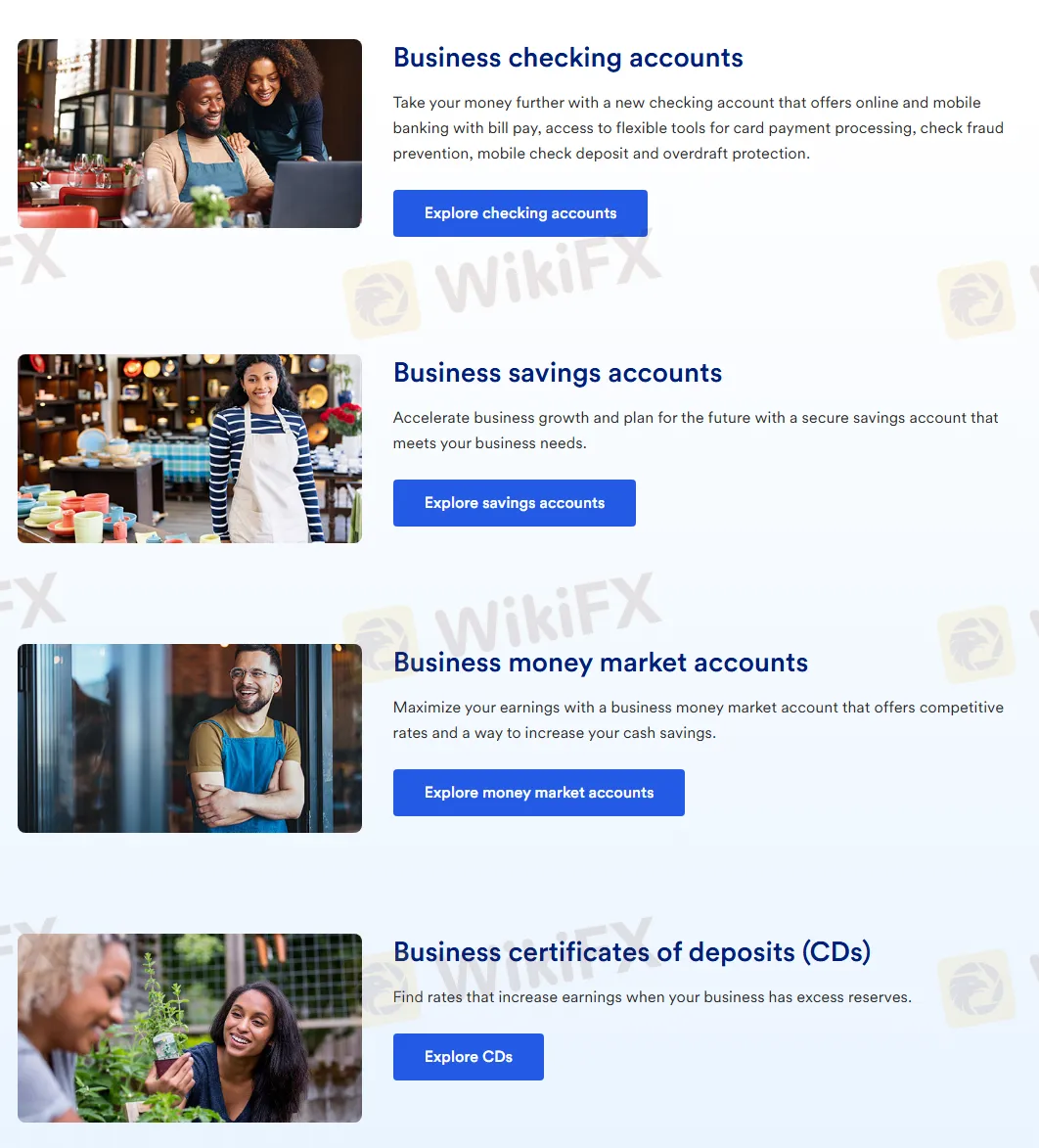

Uri ng Account

U.S. Bank ay nag-aalok ng apat na uri ng account, kabilang ang Business Checking Accounts, Business Savings Accounts, Business Money Market Accounts, at Business Certificates of Deposit (CDs).

Narito ang kanilang pangunahing mga feature:

| Uri ng Account | Paglalarawan | Angkop para sa |

| Business Checking Accounts | Sumusuporta sa online at mobile banking features tulad ng bill payment, card payment processing tools, check fraud prevention, mobile check deposit, at overdraft protection. | Para sa mga negosyo na nangangailangan ng kumprehensibong solusyon sa bangko. |

| Business Savings Accounts | Nag-aalok ng ligtas na mga savings account upang matulungan ang mga negosyo na mapabilis ang paglago at matugunan ang mga pangangailangan sa pondo. | Mga negosyo na naghahanap na mag-ipon ng pondo para sa hinaharap na paglago. |

| Business Money Market Accounts | Nag-aalok ng kompetitibong mga rate ng interes upang matulungan ang mga negosyo na paramihin ang kanilang kita at dagdagan ang kanilang cash savings. | Mga negosyo na naghahanap ng mas mataas na kita habang pinananatili ang liquidity. |

| Business Certificates of Deposits (CDs) | Nag-aalok ng mga opsyon sa rate ng interes upang mapataas ang kita kapag may sobra na pondo ang mga negosyo. | Mga negosyo na layuning itakda ang mataas na kita sa isang tiyak na termino. |

Mga Bayarin

Minimum deposit: Ang minimum deposit para sa U.S. Bank ay $25.

Plataforma ng Pagtetrade

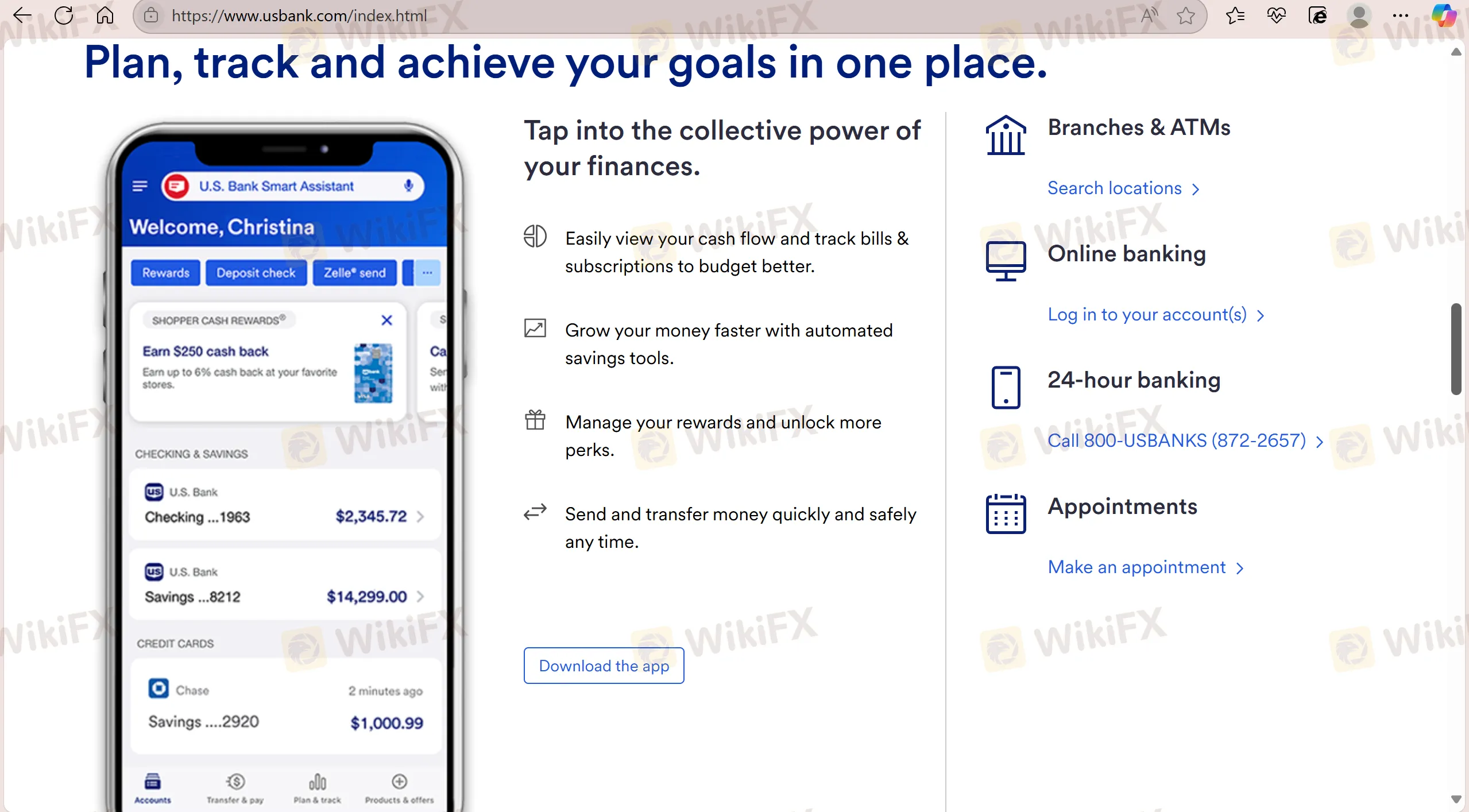

Ang U.S. Bank ay sumusuporta sa mga transaksyon sa pamamagitan ng kanilang sariling U.S. Bank app. Ang app ay nag-aalok ng 24-oras na serbisyo.

| Plataforma ng Kalakalan | Sumusuporta | Available Devices | Angkop para sa |

| U.S. Bank APP | ✔ | Mobile | / |