Unternehmensprofil

| U.S. BankBerichtszusammenfassung | |

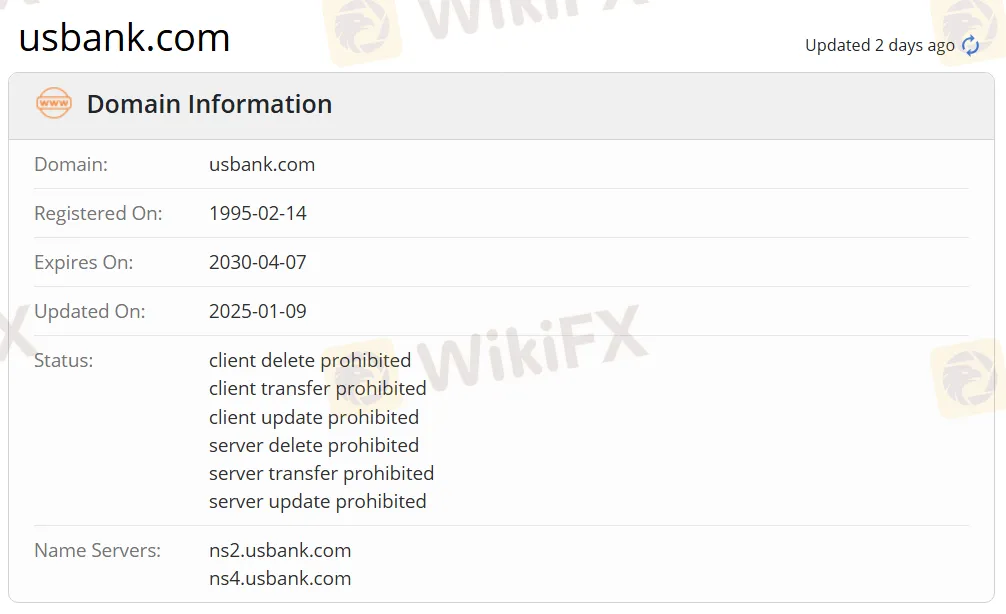

| Gegründet | 1995 |

| Registriertes Land/Region | Vereinigte Staaten |

| Regulierung | Keine Regulierung |

| Produkte & Dienstleistungen | Bankdienstleistungen, Vermögensverwaltung |

| Demokonto | / |

| Hebel | / |

| Spread | / |

| Handelsplattform | U.S. Bank App |

| Mindesteinzahlung | $25 |

| Kundensupport | Soziale Medien: Facebook, Twitter, Instagram |

| Adresse: U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

U.S. Bank Informationen

U.S. Bank wurde 1995 gegründet und ist in den Vereinigten Staaten registriert. Es bietet eine vielfältige Palette von Bankdienstleistungen für private, institutionelle und Unternehmenskunden an, darunter Kreditkarten, Girokonten, Sparkonten, Festgelder (CDs), Hypothekendarlehen, Anlageverwaltung und Vermögensplanung. Obwohl es ein bequemes Handelserlebnis mit einer Mindesteinzahlung von $25 bietet, ist das Unternehmen nicht reguliert, daher sollten Anleger vorsichtig sein hinsichtlich seiner Legitimität und Transparenz. U.S. Bank bietet vier Hauptkontotypen an: gewerbliche Girokonten, gewerbliche Sparkonten, gewerbliche Geldmarktkonten und gewerbliche Festgelder (CDs), die den Liquiditätsmanagement- und Wachstumsbedarf verschiedener Unternehmen erfüllen.

Vor- und Nachteile

| Vorteile | Nachteile |

| Spezialisierte Bankdienstleistungen | Keine Regulierung |

| Langjährige Betriebshistorie in den USA |

Ist U.S. Bank legitim?

U.S. Bank ist nicht reguliert. Händler sollten beim Handel vorsichtig sein und die Gelder sorgfältig verwenden.

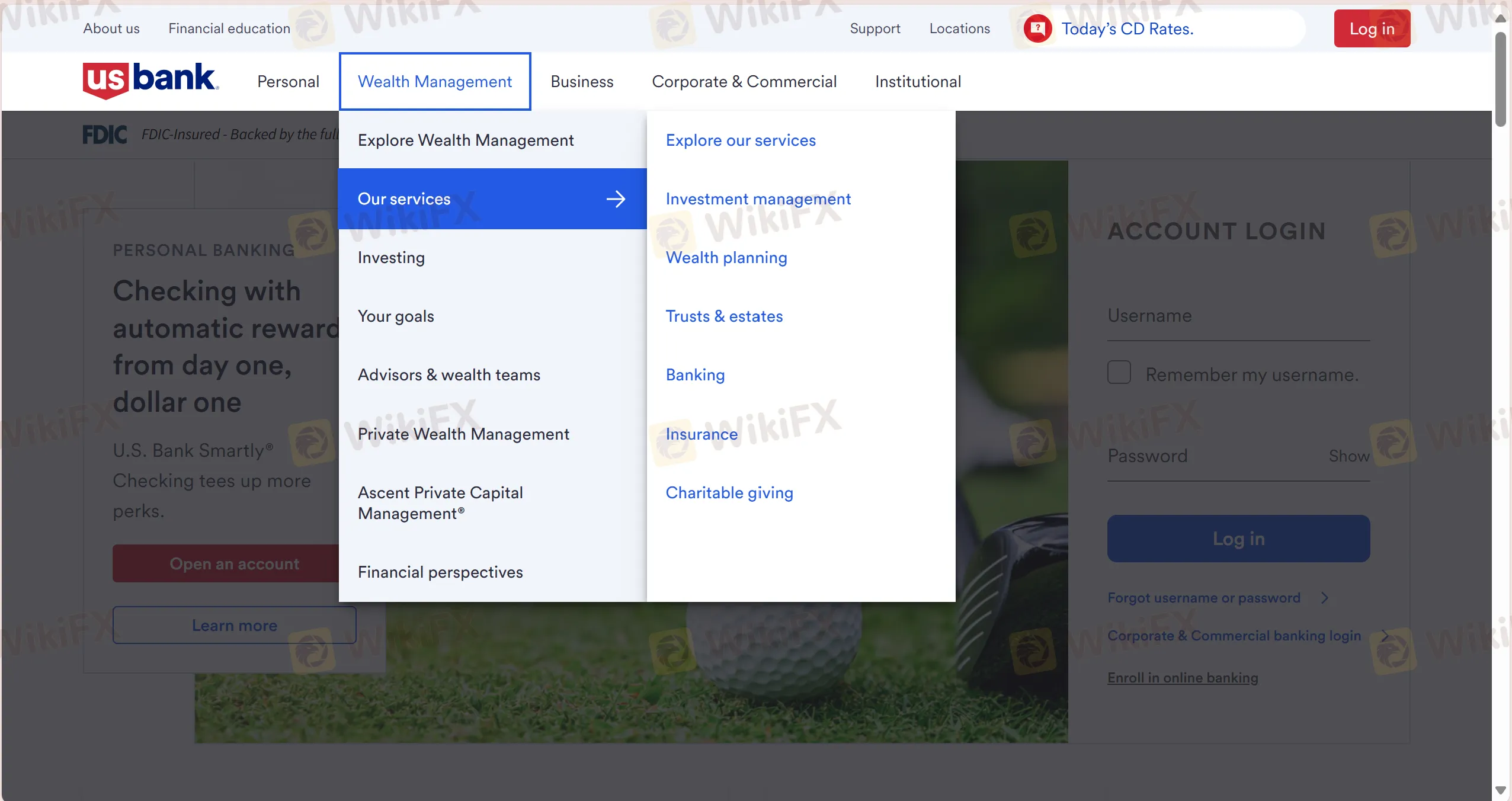

Produkte & Dienstleistungen

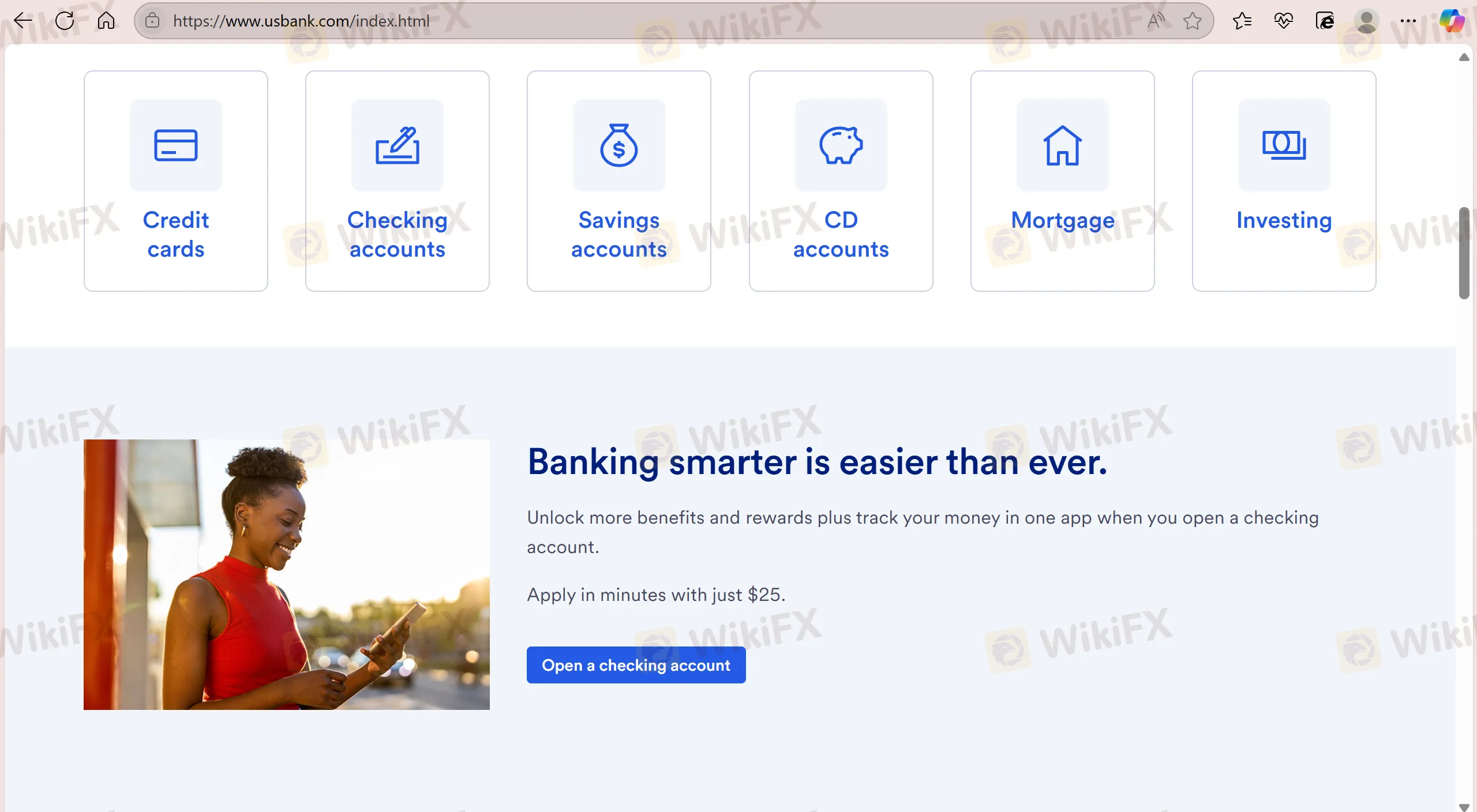

U.S. Bank bietet eine umfassende Palette von Finanzprodukten und -dienstleistungen, einschließlich Kreditkarten, Girokonten, Sparkonten, Festgeldkonten, Hypotheken, Investitionen, Hypotheken, Autokredite, Home Equity Line of Credit (HELOC), Anlageverwaltung, Vermögensplanung, Treuhand- und Nachlassdienstleistungen, Bankwesen, Versicherungen und Wohltätigkeit.

| Produkte & Dienstleistungen | Unterstützt |

| Kreditkarten | ✔ |

| Girokonten | ✔ |

| Sparkonten | ✔ |

| Festgeldkonten | ✔ |

| Hypotheken | ✔ |

| Investitionen | ✔ |

| Autokredite | ✔ |

| Home Equity Line of Credit (HELOC) | ✔ |

| Anlageverwaltung | ✔ |

| Vermögensplanung | ✔ |

| Treuhand- und Nachlassdienstleistungen | ✔ |

| Bankwesen | ✔ |

| Versicherungen | ✔ |

| Wohltätigkeit | ✔ |

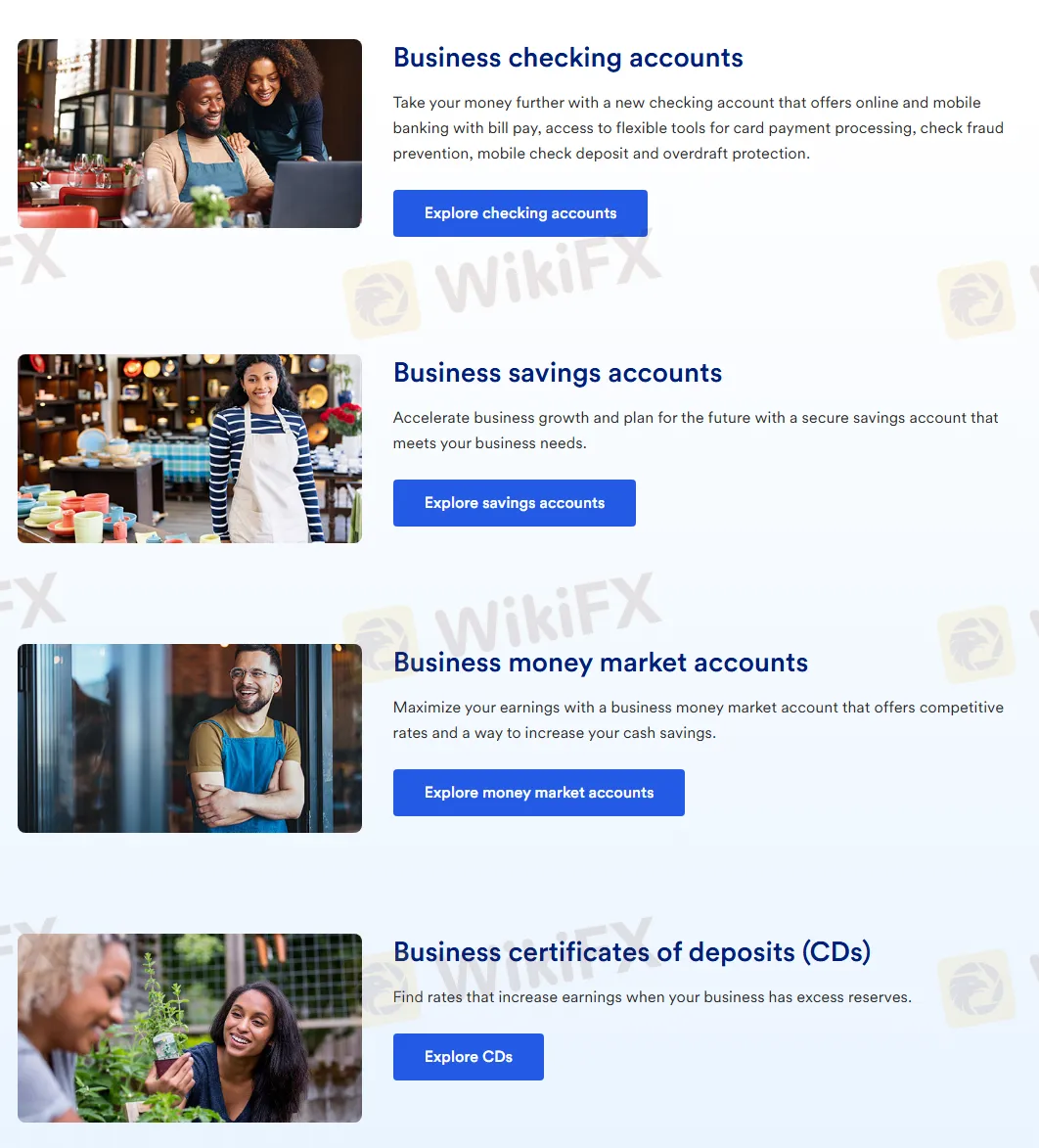

Kontotypen

U.S. Bank bietet vier Arten von Konten an, darunter Geschäftsgirokonten, Geschäftssparkonten, Geschäftstagesgeldkonten und Geschäftsfestgeldkonten (CDs).

Hier sind ihre Hauptmerkmale:

| Kontotyp | Beschreibung | Geeignet für |

| Geschäftsgirokonten | Unterstützt Online- und Mobile-Banking-Funktionen wie Rechnungszahlung, Kartenzahlungsabwicklungstools, Scheckbetrugsprävention, mobile Scheckeinreichung und Überziehungsschutz. | Für Unternehmen, die eine umfassende Banklösung benötigen. |

| Geschäftssparkonten | Bietet sichere Sparkonten, um Unternehmen beim Beschleunigen des Wachstums und bei der Deckung von Finanzierungsbedarf zu unterstützen. | Unternehmen, die Mittel für zukünftiges Wachstum ansammeln möchten. |

| Geschäftstagesgeldkonten | Bieten wettbewerbsfähige Zinssätze, um Unternehmen zu helfen, Renditen zu maximieren und den Bargeldbestand zu erhöhen. | Unternehmen, die höhere Renditen anstreben und gleichzeitig Liquidität erhalten möchten. |

| Geschäftsfestgeldkonten (CDs) | Bieten Zinsoptionen, um Renditen zu steigern, wenn Unternehmen über überschüssige Reserven verfügen. | Unternehmen, die hohe Renditen über einen bestimmten Zeitraum sichern möchten. |

Gebühren

Mindesteinlage: Die Mindesteinlage für U.S. Bank beträgt $25.

Handelsplattform

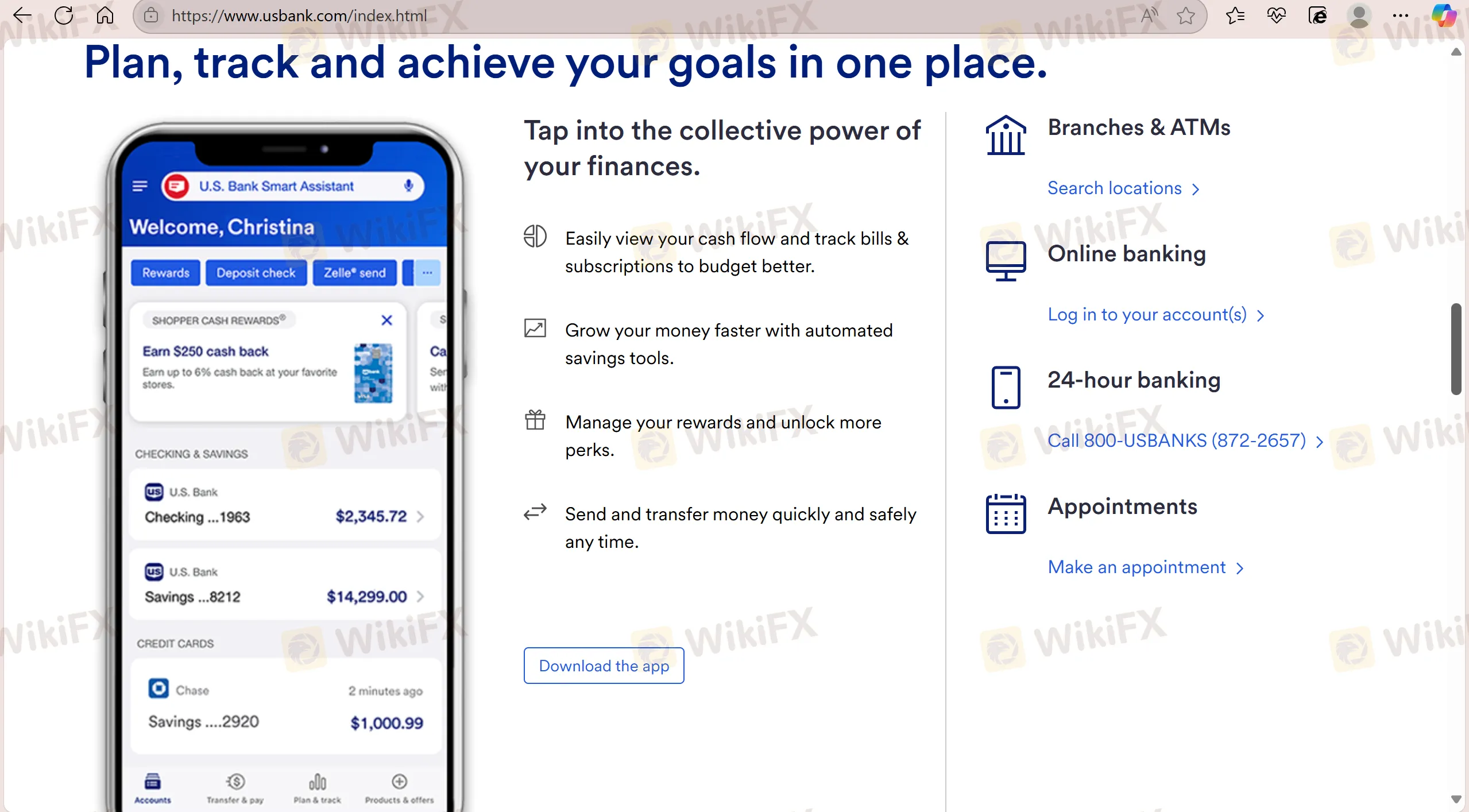

U.S. Bank unterstützt Transaktionen über seine eigene U.S. Bank App. Die App bietet einen 24-Stunden-Service.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| U.S. Bank APP | ✔ | Mobil | / |