Resumo da empresa

| U.S. BankResumo da Revisão | |

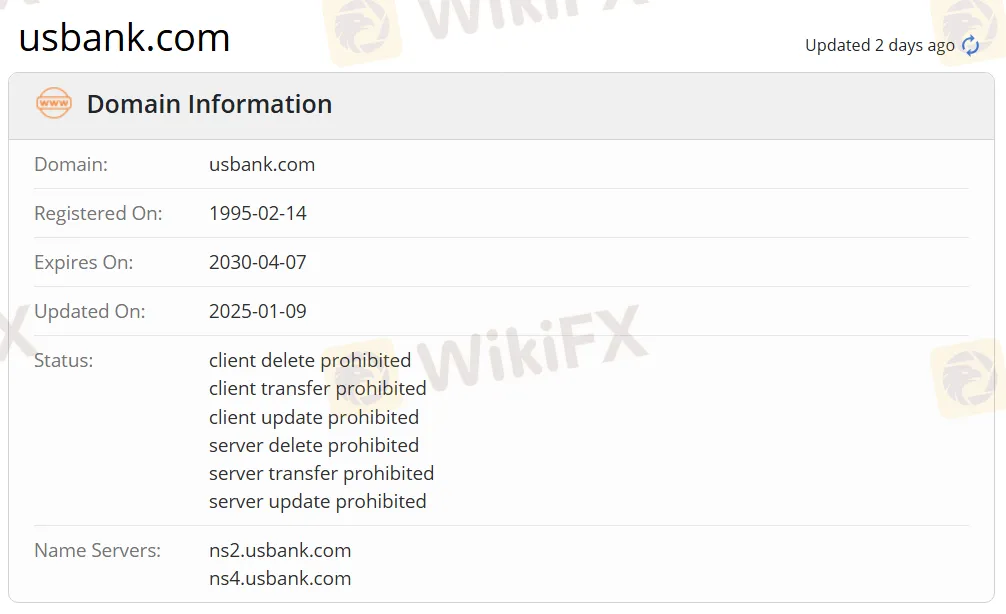

| Fundação | 1995 |

| País/Região Registrada | Estados Unidos |

| Regulação | Sem Regulação |

| Produtos e Serviços | Serviços bancários, gestão de patrimônio |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | Aplicativo U.S. Bank |

| Depósito Mínimo | $25 |

| Suporte ao Cliente | Mídias Sociais: Facebook, Twitter, Instagram |

| Endereço: U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

Informações sobre U.S. Bank

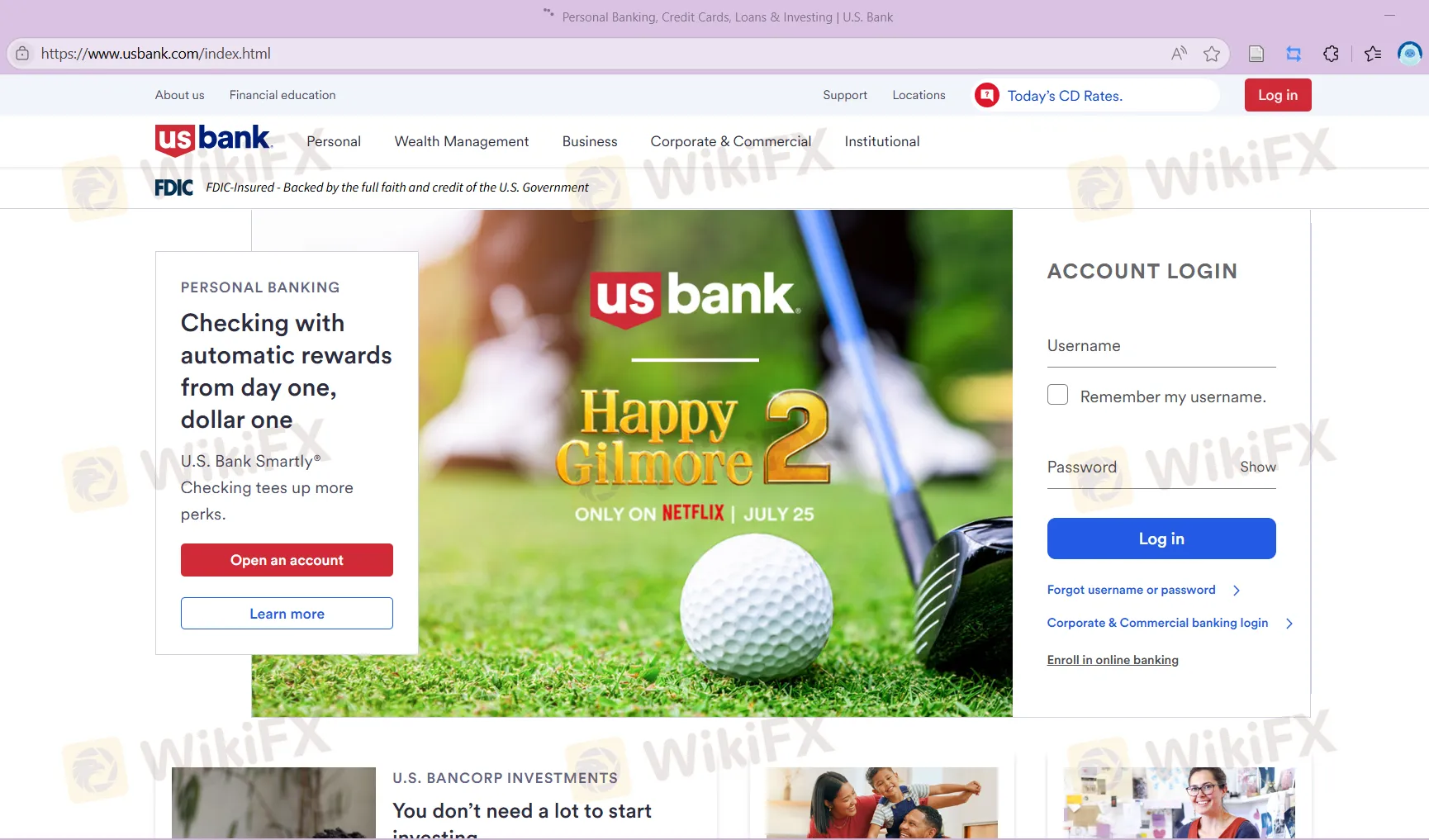

U.S. Bank foi fundada em 1995 e está registrada nos Estados Unidos. Oferece uma ampla gama de serviços bancários para clientes pessoais, institucionais e corporativos, incluindo cartões de crédito, contas correntes, contas poupança, certificados de depósito (CDs), empréstimos hipotecários, gestão de investimentos e planejamento patrimonial. Embora forneça uma experiência de negociação conveniente com um depósito mínimo de $25, a empresa não é regulamentada, portanto, os investidores precisam ser cautelosos quanto à sua legitimidade e transparência. U.S. Bank oferece quatro tipos principais de contas: contas correntes comerciais, contas poupança comerciais, contas de mercado monetário comerciais e certificados de depósito comerciais (CDs), que atendem às necessidades de gerenciamento de caixa e crescimento de diferentes empresas.

Prós e Contras

| Prós | Contras |

| Serviços bancários especializados | Sem regulação |

| Longa história de operação nos EUA |

U.S. Bank é Legítimo?

U.S. Bank não é regulamentado. Os traders devem ter cautela ao negociar e usar os fundos com prudência.

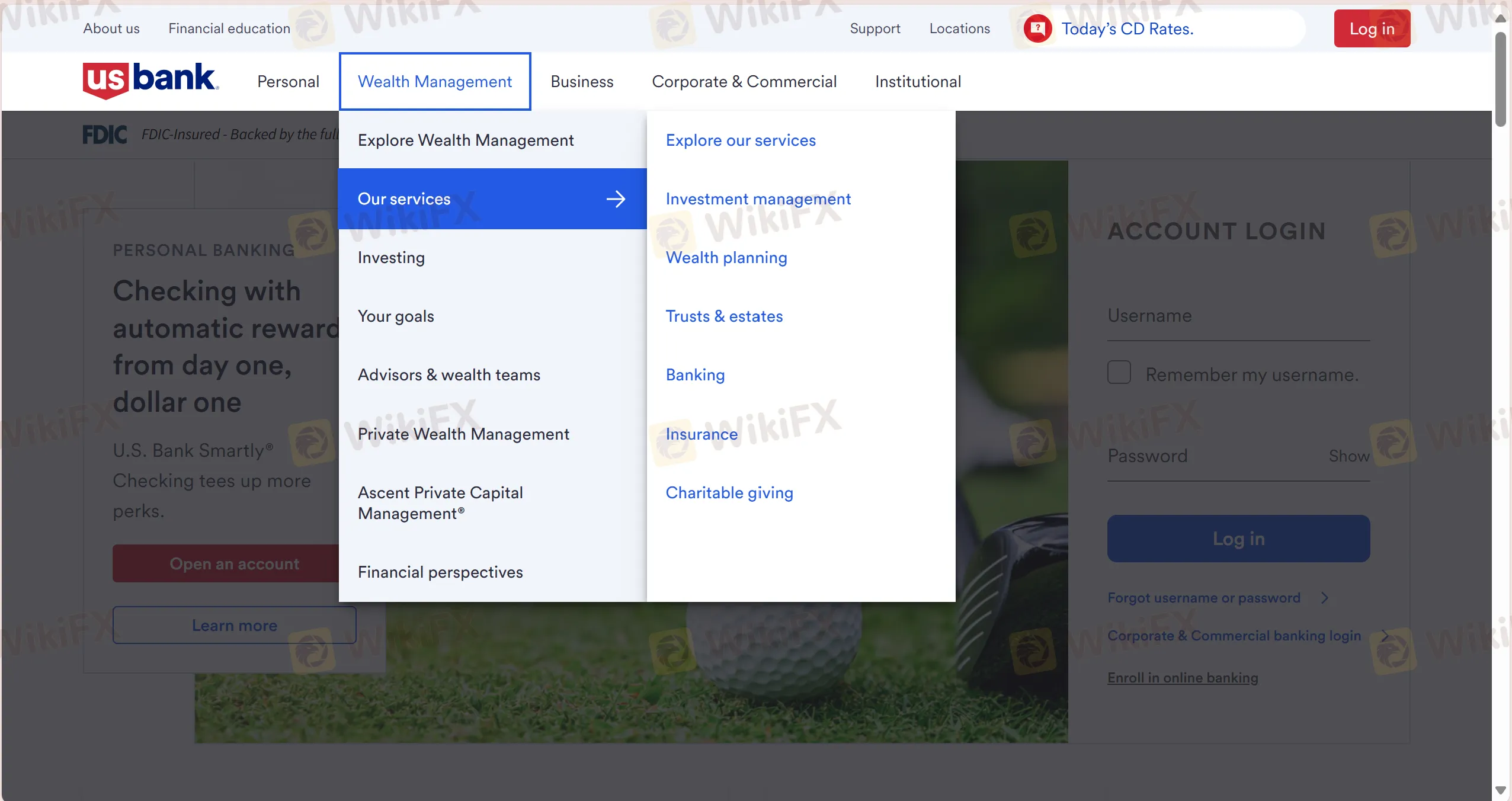

Produtos e Serviços

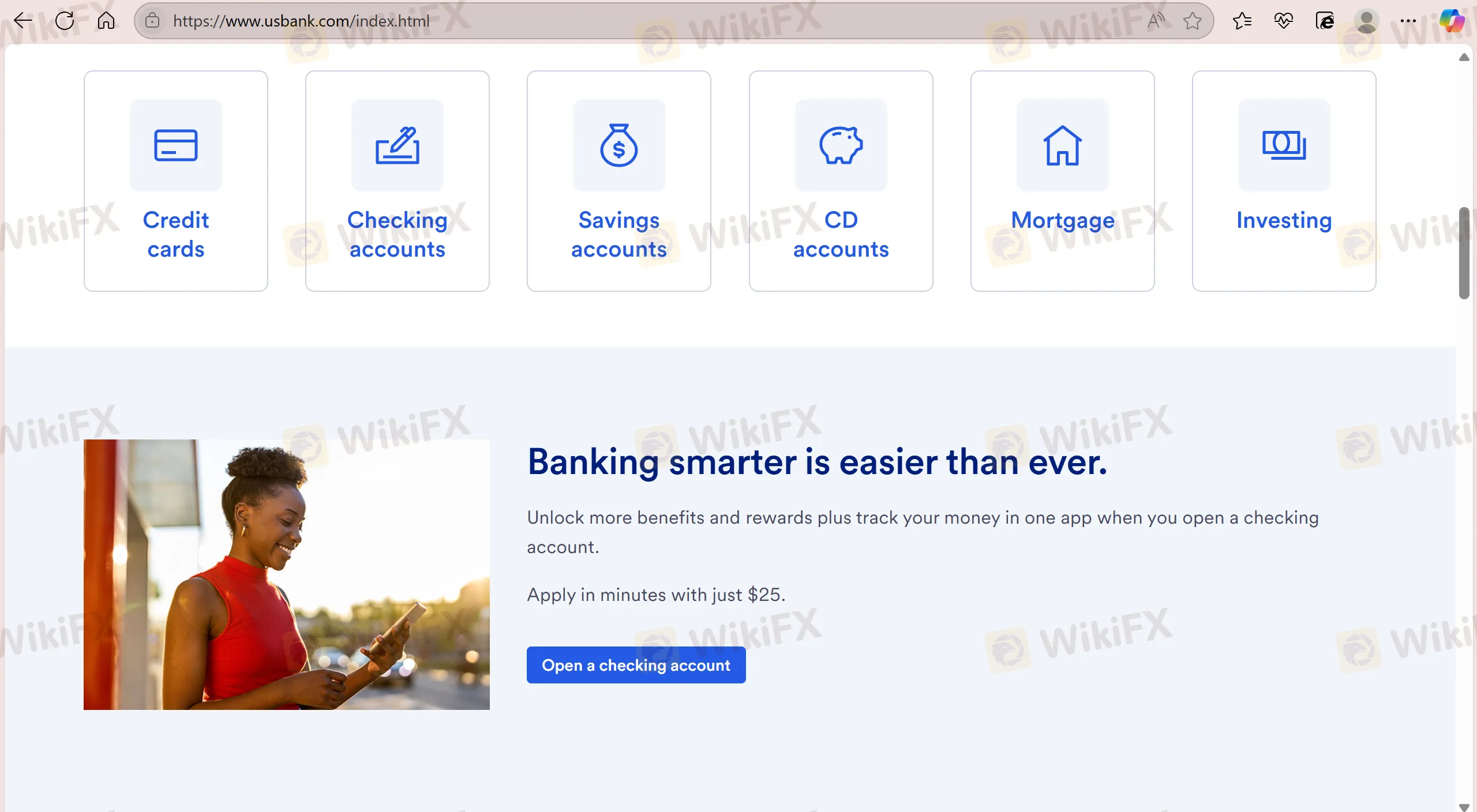

U.S. Bank oferece uma ampla gama de produtos e serviços financeiros, incluindo Cartões de Crédito, Contas Correntes, Contas Poupança, Contas de CD, Hipoteca, Investimentos, Hipoteca Residencial, Empréstimo de Automóvel, Linha de Crédito com Garantia Hipotecária (HELOC), Gestão de Investimentos, Planejamento Patrimonial, Trustes e Heranças, Serviços Bancários, Seguros e Doações Beneficentes.

| Produtos e Serviços | Suportado |

| Cartões de Crédito | ✔ |

| Contas Correntes | ✔ |

| Contas Poupança | ✔ |

| Contas de CD | ✔ |

| Hipoteca | ✔ |

| Investimentos | ✔ |

| Empréstimo de Automóvel | ✔ |

| Linha de Crédito com Garantia Hipotecária (HELOC) | ✔ |

| Gestão de Investimentos | ✔ |

| Planejamento Patrimonial | ✔ |

| Trustes e Heranças | ✔ |

| Serviços Bancários | ✔ |

| Seguros | ✔ |

| Doações Beneficentes | ✔ |

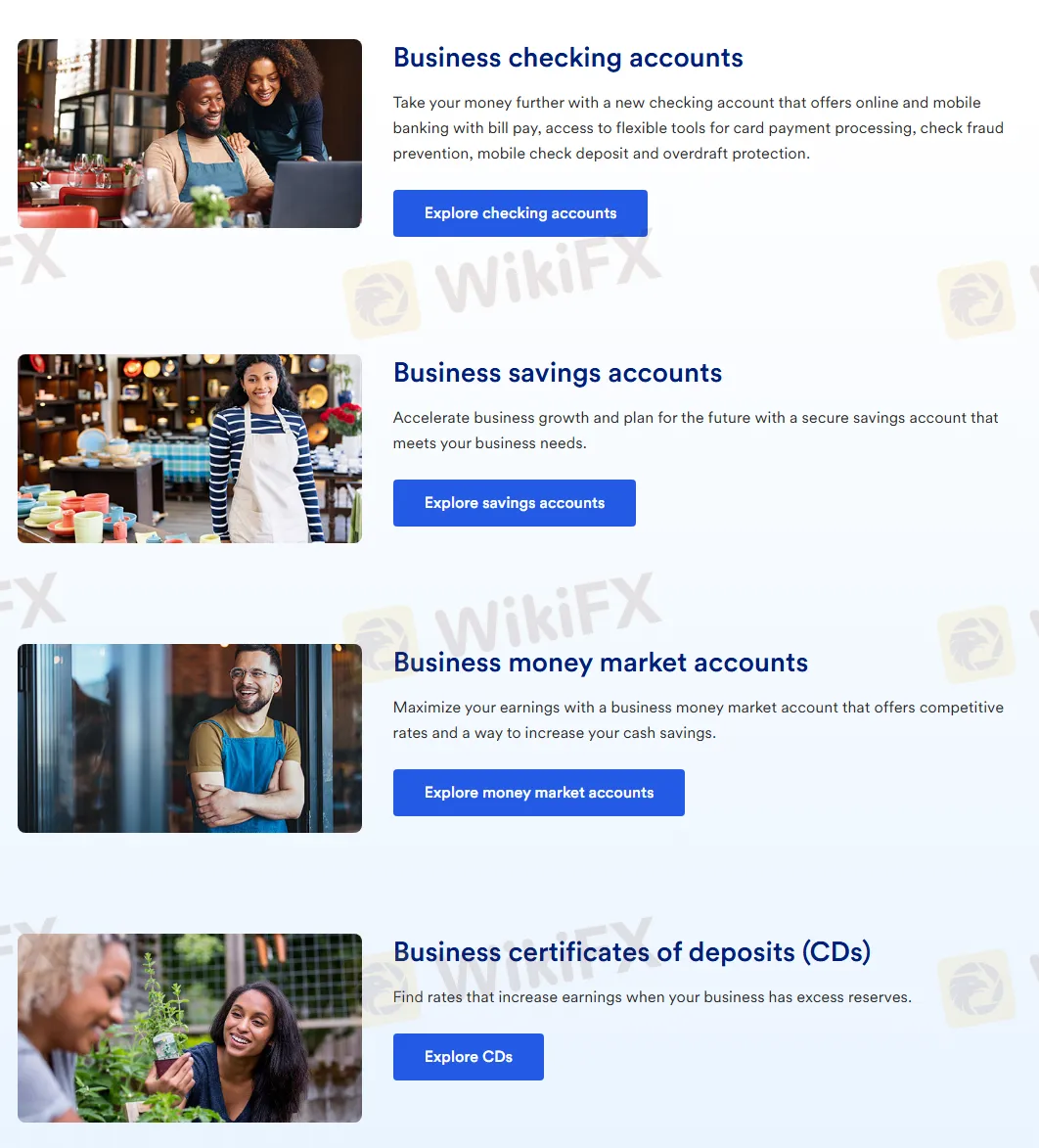

Tipos de Conta

U.S. Bank oferece quatro tipos de contas, incluindo Contas Correntes Empresariais, Contas Poupança Empresariais, Contas de Mercado Monetário Empresariais e Certificados de Depósito Empresariais (CDs).

A seguir estão suas principais características:

| Tipo de Conta | Descrição | Adequado para |

| Contas Correntes Empresariais | Suporta recursos bancários online e móveis, como pagamento de contas, ferramentas de processamento de pagamentos com cartão, prevenção de fraudes em cheques, depósito de cheques móveis e proteção contra cheque especial. | Para empresas que precisam de uma solução bancária abrangente. |

| Contas Poupança Empresariais | Oferece contas de poupança seguras para ajudar as empresas a acelerar o crescimento e atender às necessidades de financiamento. | Empresas que buscam acumular fundos para crescimento futuro. |

| Contas de Mercado Monetário Empresariais | Oferece taxas de juros competitivas para ajudar as empresas a maximizar retornos e aumentar as economias em dinheiro. | Empresas que buscam retornos mais altos mantendo a liquidez. |

| Certificados de Depósito Empresariais (CDs) | Oferece opções de taxa de juros para aumentar os retornos quando as empresas têm reservas excedentes. | Empresas visam garantir altos retornos por um período específico. |

Taxas

Depósito mínimo: O depósito mínimo para U.S. Bank é de $25.

Plataforma de Negociação

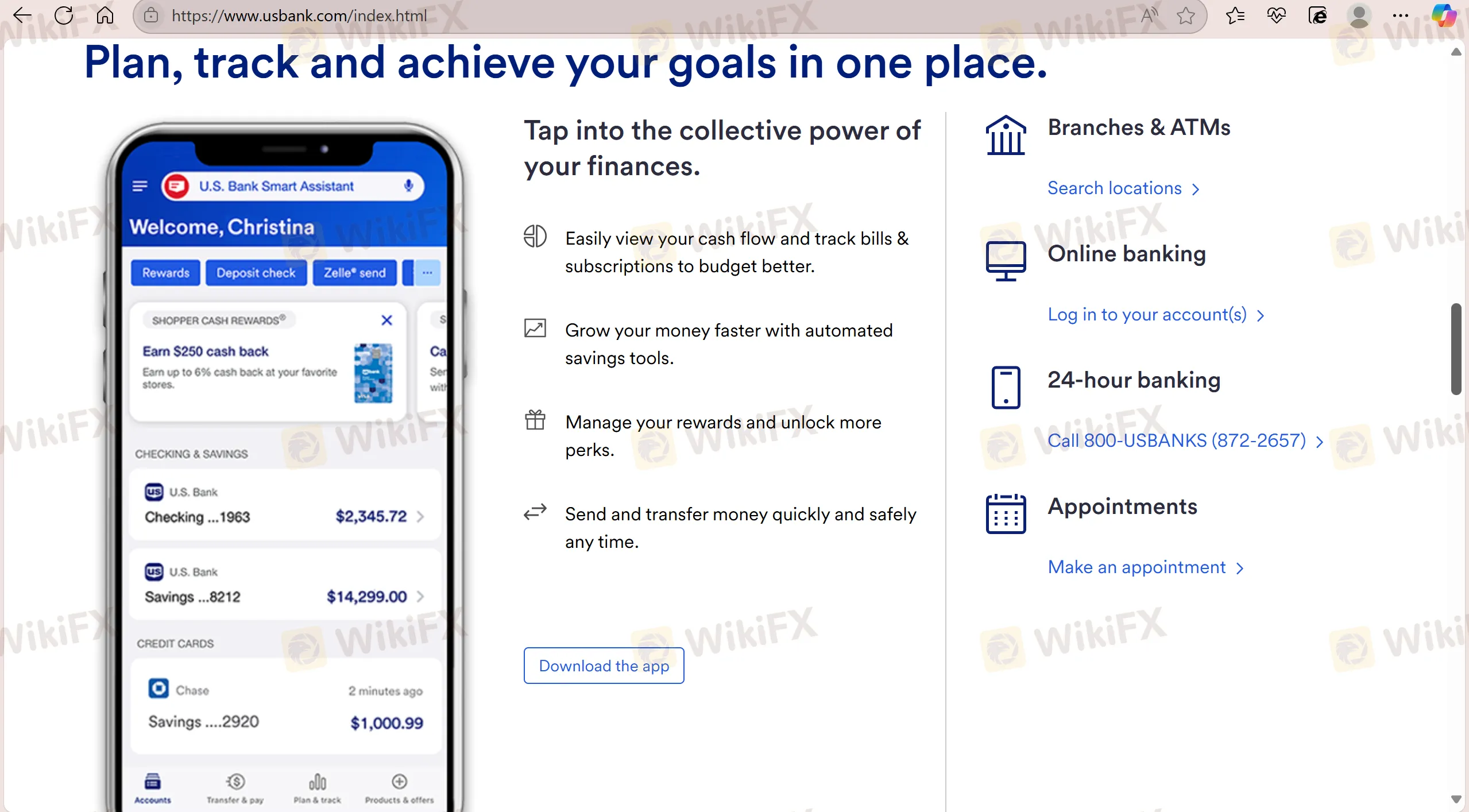

U.S. Bank suporta transações através de seu aplicativo exclusivo U.S. Bank app. O aplicativo oferece serviço 24 horas.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Aplicativo U.S. Bank | ✔ | Móvel | / |