公司簡介

| U.S. Bank評論摘要 | |

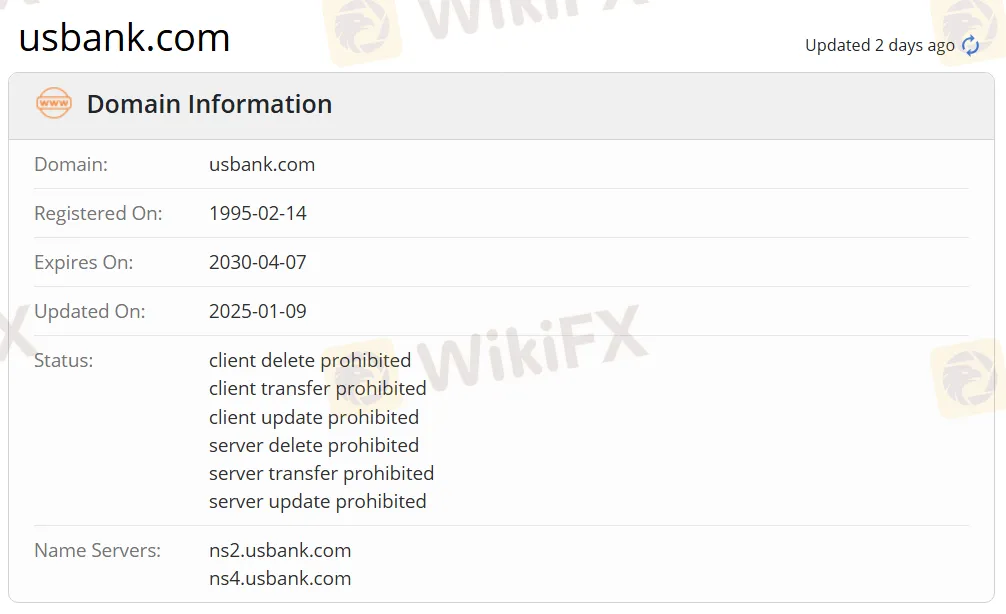

| 成立年份 | 1995 |

| 註冊國家/地區 | 美國 |

| 監管 | 無監管 |

| 產品與服務 | 銀行服務、財富管理 |

| 模擬帳戶 | / |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | U.S. Bank 應用程式 |

| 最低存款 | $25 |

| 客戶支援 | 社交媒體:Facebook、Twitter、Instagram |

| 地址:U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

U.S. Bank 資訊

U.S. Bank 成立於1995年,註冊地點為美國。公司為個人、機構和企業客戶提供多元化的銀行服務,包括信用卡、支票帳戶、儲蓄帳戶、定期存款證書(CDs)、按揭貸款、投資管理和財富規劃。儘管最低存款為$25,提供方便的交易體驗,但公司並未受到監管,因此投資者需要對其合法性和透明度保持警惕。U.S. Bank 提供四種主要帳戶類型:商業支票帳戶、商業儲蓄帳戶、商業貨幣市場帳戶和商業定期存款證書(CDs),滿足不同企業的資金管理和增長需求。

優點與缺點

| 優點 | 缺點 |

| 專業的銀行服務 | 無監管 |

| 在美國有悠久的運營歷史 |

U.S. Bank 是否合法?

U.S. Bank 未受監管。交易者在交易時應謹慎使用資金。

產品與服務

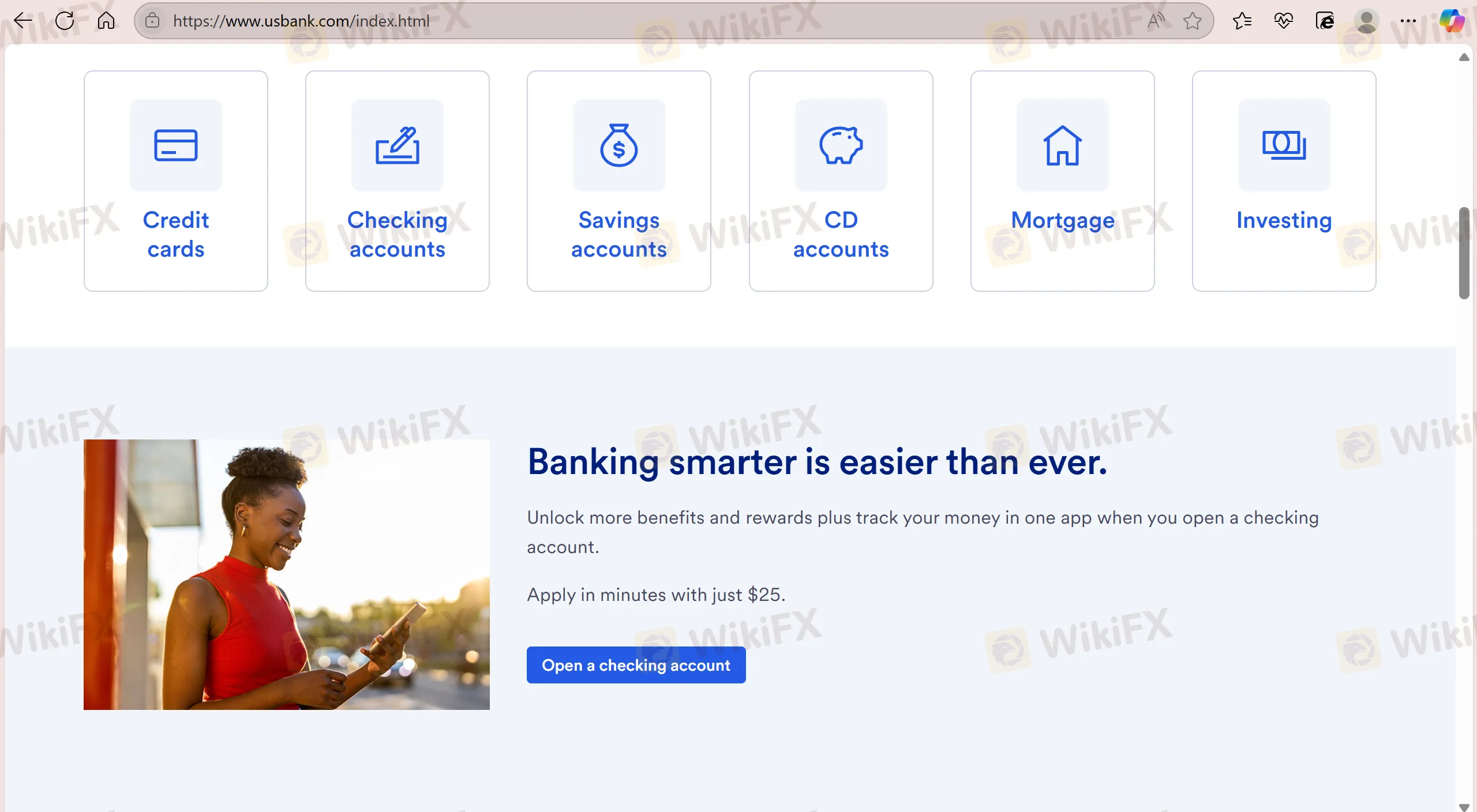

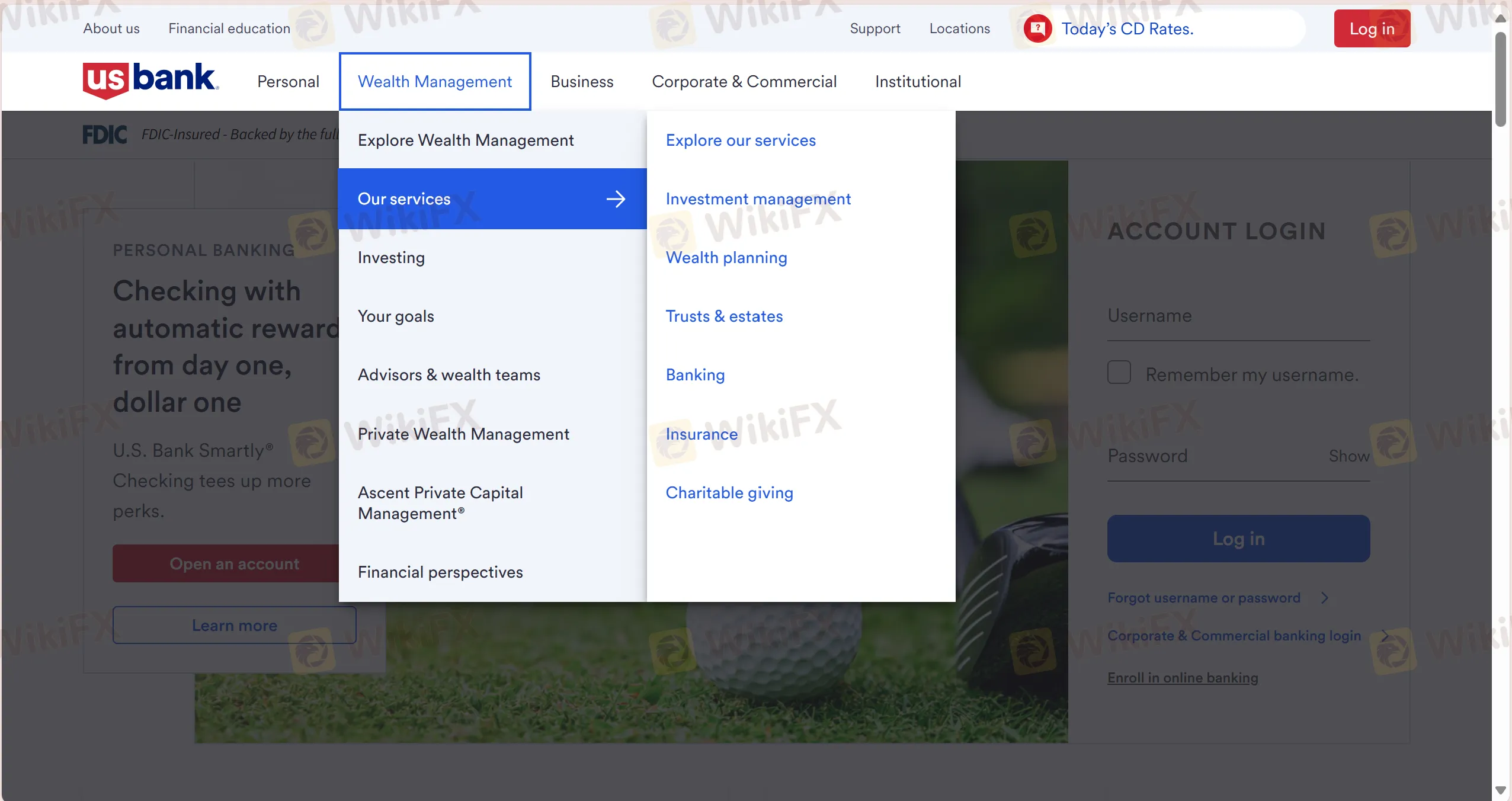

U.S. Bank 提供一系列全面的金融產品和服務,包括信用卡、支票帳戶、儲蓄帳戶、定期存款帳戶、抵押貸款、投資、房屋抵押貸款、汽車貸款、房屋股本信貸(HELOC)、投資管理、財富規劃、信託與遺產、銀行業務、保險和慈善捐助。

| 產品與服務 | 支援 |

| 信用卡 | ✔ |

| 支票帳戶 | ✔ |

| 儲蓄帳戶 | ✔ |

| 定期存款帳戶 | ✔ |

| 抵押貸款 | ✔ |

| 投資 | ✔ |

| 汽車貸款 | ✔ |

| 房屋股本信貸(HELOC) | ✔ |

| 投資管理 | ✔ |

| 財富規劃 | ✔ |

| 信託與遺產 | ✔ |

| 銀行業務 | ✔ |

| 保險 | ✔ |

| 慈善捐助 | ✔ |

帳戶類型

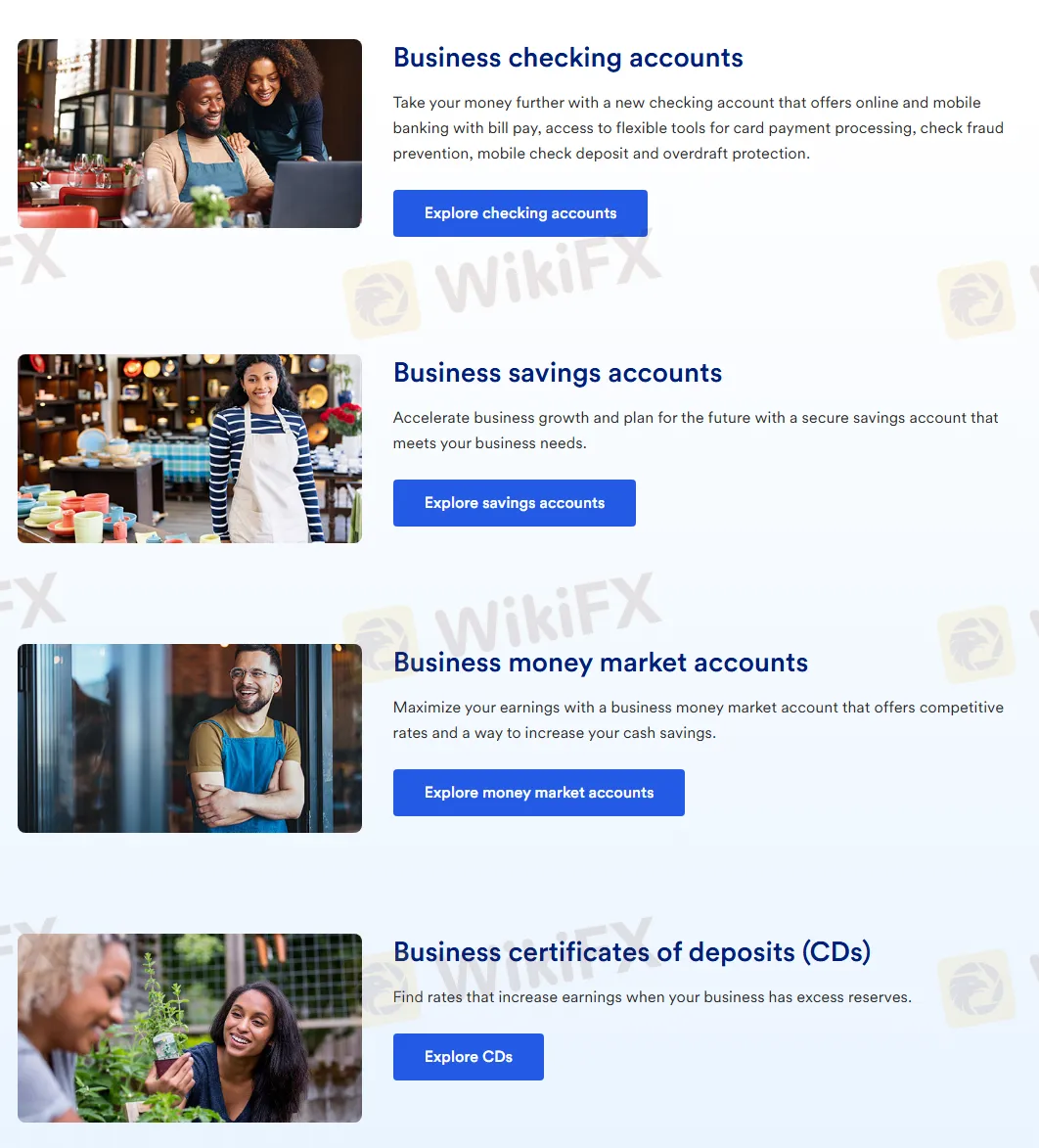

U.S. Bank 提供四種類型的帳戶,包括商業支票帳戶、商業儲蓄帳戶、商業貨幣市場帳戶和商業定期存款(CDs)。

以下是它們的主要特點:

| 帳戶類型 | 描述 | 適合對象 |

| 商業支票帳戶 | 支持線上和手機銀行功能,如帳單支付、信用卡支付處理工具、支票詐騙防範、手機支票存款和透支保護。 | 適用於需要全面銀行解決方案的企業。 |

| 商業儲蓄帳戶 | 提供安全的儲蓄帳戶,幫助企業加速增長並滿足資金需求。 | 企業希望積累資金以支持未來增長。 |

| 商業貨幣市場帳戶 | 提供競爭性利率,幫助企業最大化回報並增加現金儲蓄。 | 企業希望在保持流動性的同時獲得更高回報。 |

| 商業定期存款(CDs) | 提供利率選擇,當企業有多餘儲備時增加回報。 | 企業希望在特定期限內獲得高回報。 |

費用

最低存款: U.S. Bank 的最低存款為$25。

交易平台

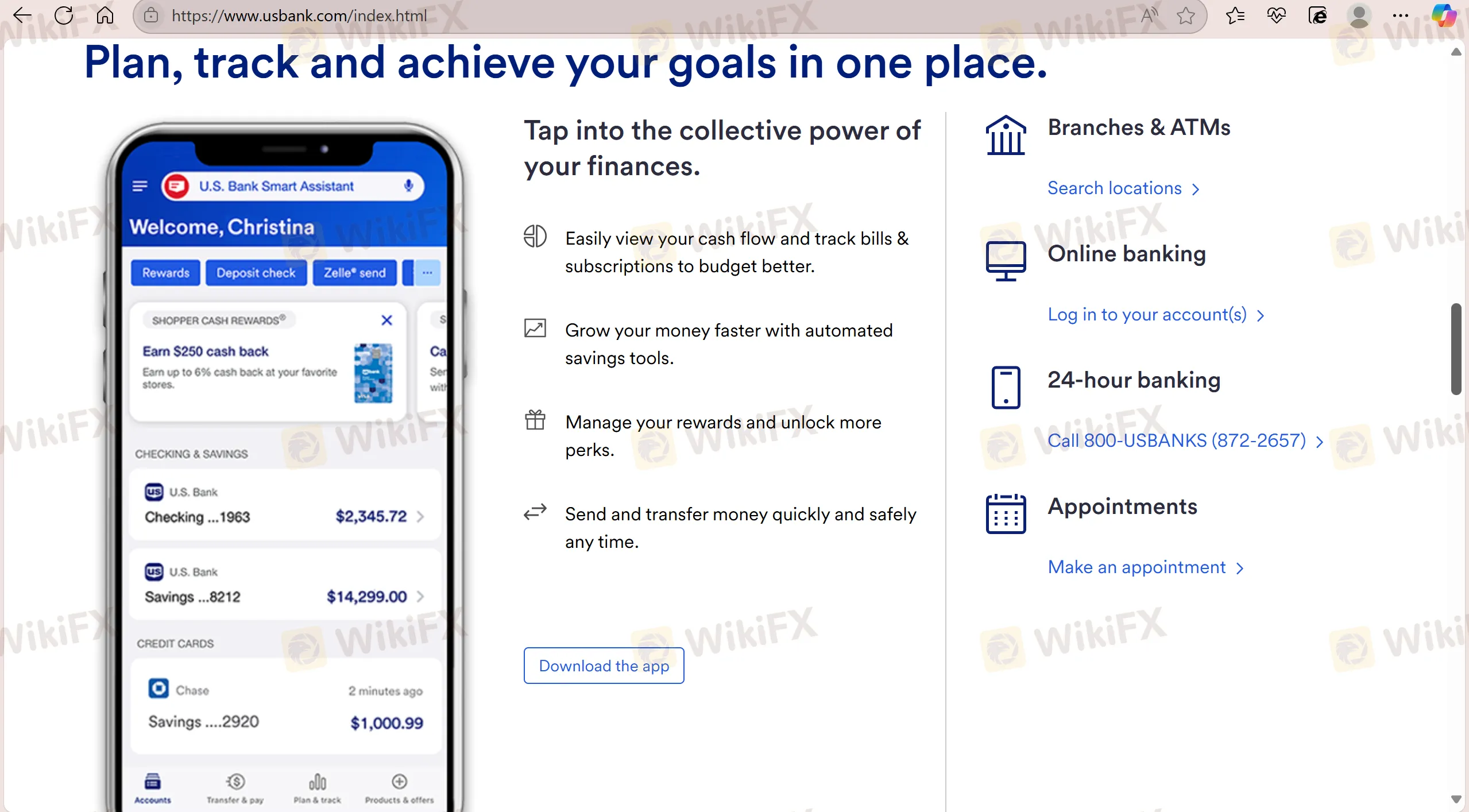

U.S. Bank 透過其專屬的 U.S. Bank app 支持交易。該應用程式提供全天候服務。

| 交易平台 | 支援 | 可用設備 | 適用對象 |

| U.S. Bank APP | ✔ | 手機 | / |