Perfil de la compañía

| U.S. BankResumen de la reseña | |

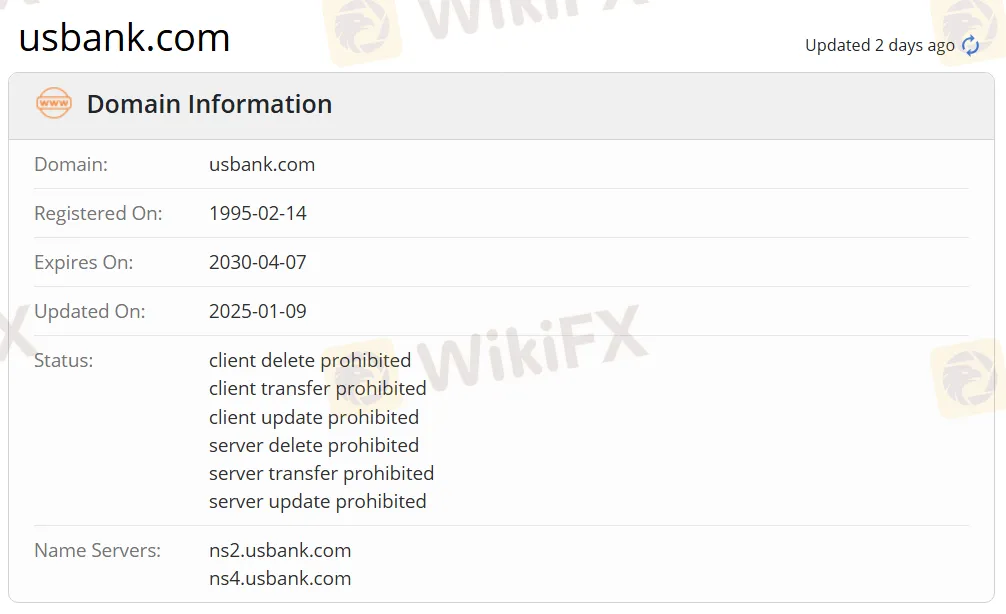

| Establecido | 1995 |

| País/Región Registrada | Estados Unidos |

| Regulación | Sin regulación |

| Productos y Servicios | Servicios bancarios, gestión de patrimonio |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | Aplicación U.S. Bank |

| Depósito Mínimo | $25 |

| Soporte al Cliente | Redes Sociales: Facebook, Twitter, Instagram |

| Dirección: U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

Información de U.S. Bank

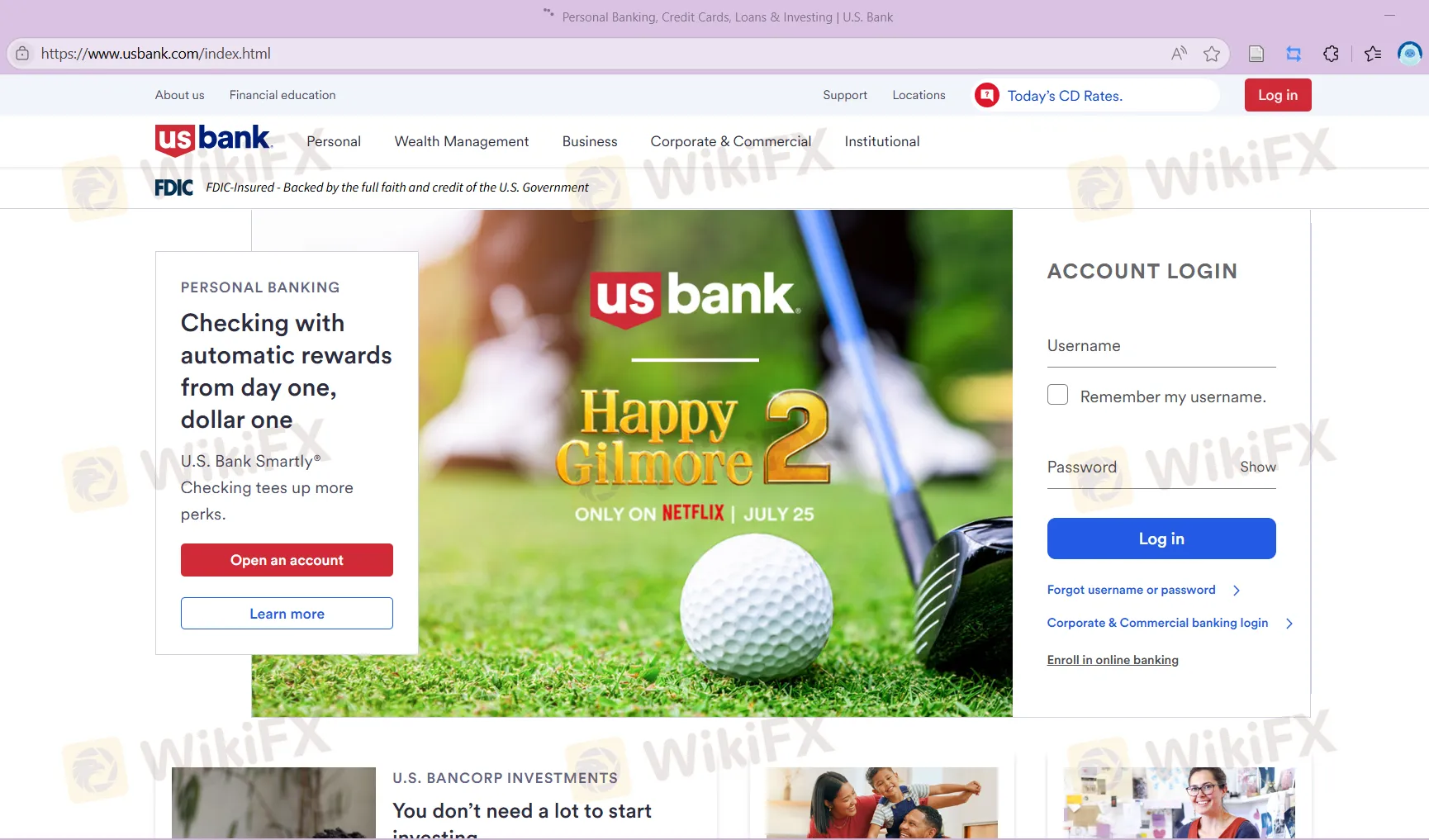

U.S. Bank fue establecido en 1995 y está registrado en Estados Unidos. Ofrece una amplia gama de servicios bancarios a clientes personales, institucionales y corporativos, que incluyen tarjetas de crédito, cuentas corrientes, cuentas de ahorro, certificados de depósito (CD), préstamos hipotecarios, gestión de inversiones y planificación patrimonial. Aunque proporciona una experiencia comercial conveniente con un depósito mínimo de $25, la empresa no está regulada, por lo que los inversores deben ser cautelosos acerca de su legitimidad y transparencia. U.S. Bank ofrece cuatro tipos de cuentas principales: cuentas corrientes comerciales, cuentas de ahorro comerciales, cuentas de mercado monetario comerciales y certificados de depósito comerciales (CD), que satisfacen las necesidades de gestión de efectivo y crecimiento de diferentes empresas.

Pros y Contras

| Pros | Contras |

| Servicios bancarios especializados | Sin regulación |

| Larga historia de operación en EE. UU. |

¿Es U.S. Bank Legítimo?

U.S. Bank no está regulado. Los traders deben ser cautelosos al operar y utilizar los fondos de manera prudente.

Productos y Servicios

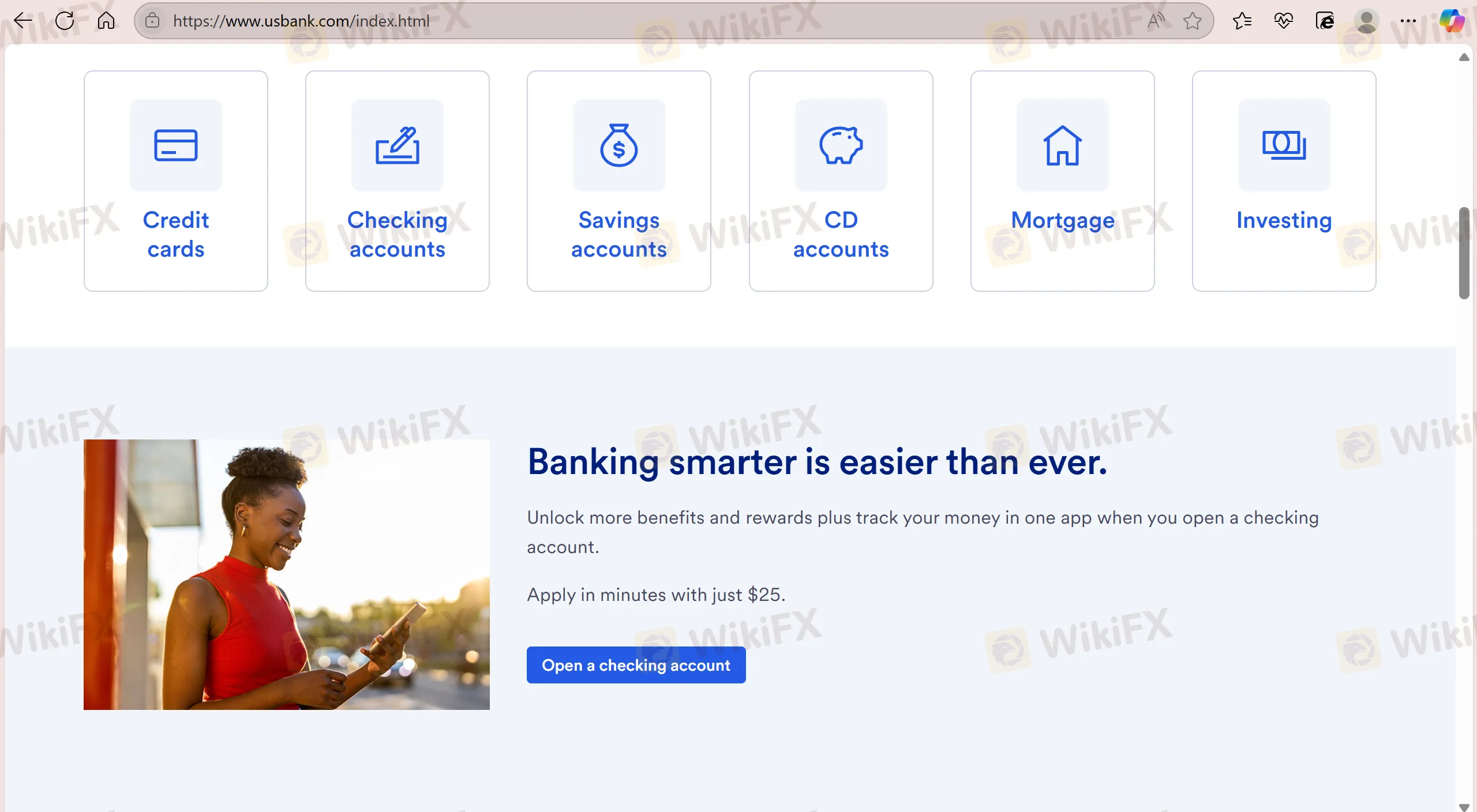

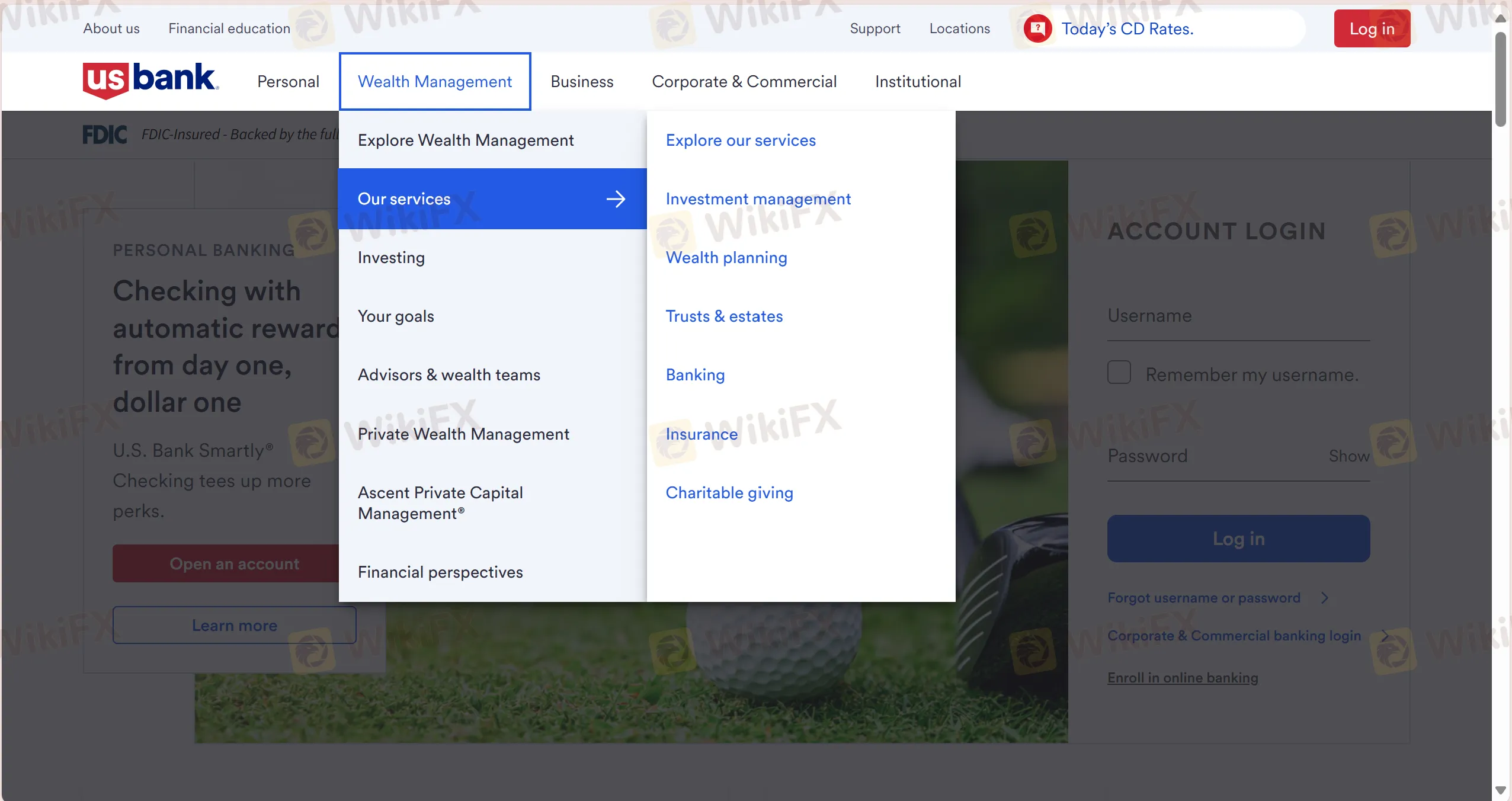

U.S. Bank ofrece una amplia gama de productos y servicios financieros, que incluyen Tarjetas de Crédito, Cuentas Corrientes, Cuentas de Ahorro, Cuentas de CD, Hipotecas, Inversiones, Hipoteca de Vivienda, Préstamos de Auto, Línea de Crédito con Garantía Hipotecaria (HELOC), Gestión de Inversiones, Planificación Patrimonial, Fideicomisos y Patrimonios, Banca, Seguros y Donaciones Benéficas.

| Productos y Servicios | Soportado |

| Tarjetas de Crédito | ✔ |

| Cuentas Corrientes | ✔ |

| Cuentas de Ahorro | ✔ |

| Cuentas de CD | ✔ |

| Hipotecas | ✔ |

| Inversiones | ✔ |

| Préstamos de Auto | ✔ |

| Línea de Crédito con Garantía Hipotecaria (HELOC) | ✔ |

| Gestión de Inversiones | ✔ |

| Planificación Patrimonial | ✔ |

| Fideicomisos y Patrimonios | ✔ |

| Banca | ✔ |

| Seguros | ✔ |

| Donaciones Benéficas | ✔ |

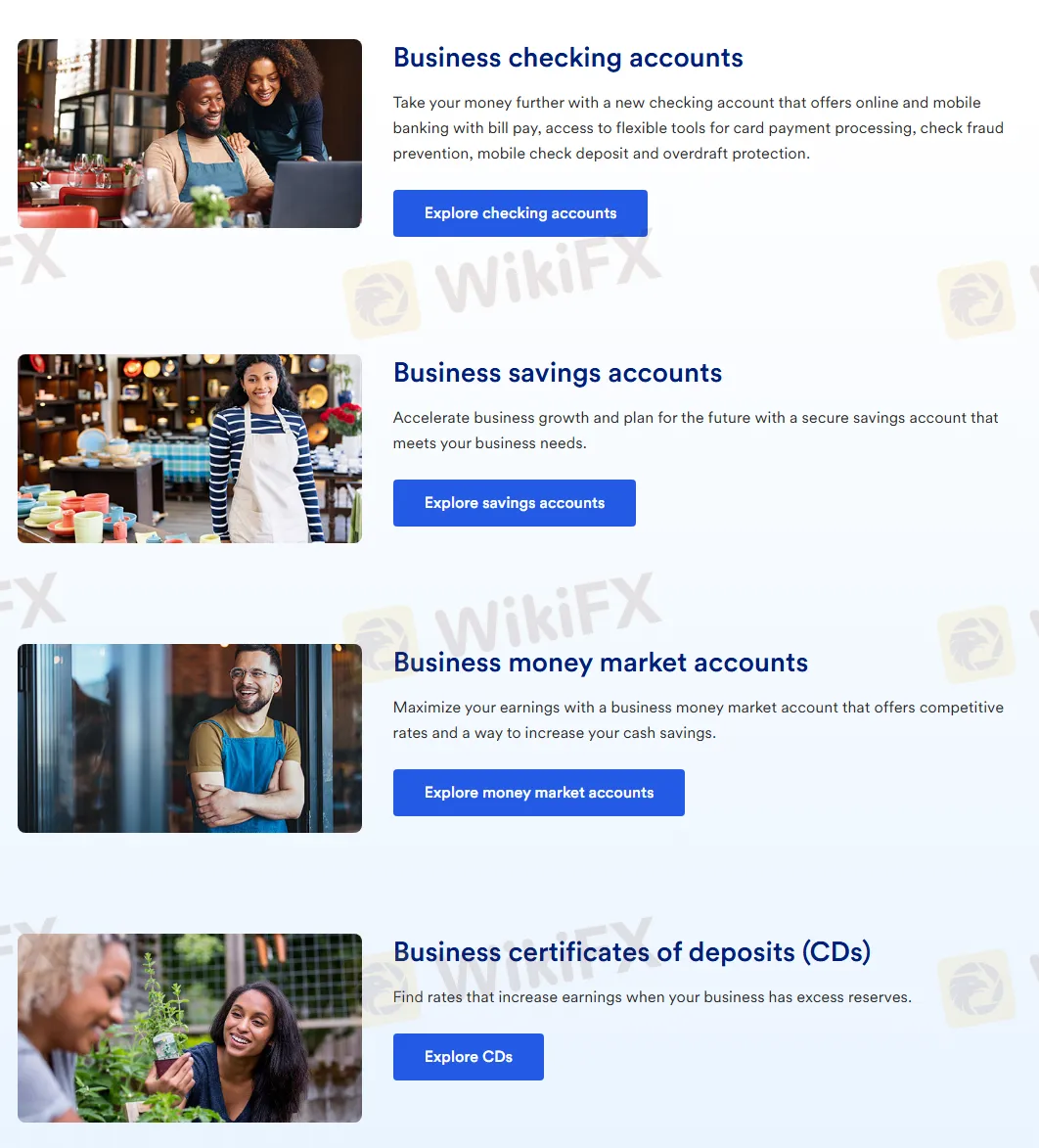

Tipos de Cuenta

U.S. Bank ofrece cuatro tipos de cuentas, que incluyen Cuentas Corrientes Comerciales, Cuentas de Ahorro Comerciales, Cuentas de Mercado Monetario Comerciales y Certificados de Depósito Comerciales (CDs).

A continuación se presentan sus principales características:

| Tipo de Cuenta | Descripción | Adecuado para |

| Cuentas Corrientes Comerciales | Ofrece funciones bancarias en línea y móviles como pago de facturas, herramientas de procesamiento de pagos con tarjeta, prevención de fraudes con cheques, depósito móvil de cheques y protección contra sobregiros. | Para empresas que necesitan una solución bancaria integral. |

| Cuentas de Ahorro Comerciales | Ofrece cuentas de ahorro seguras para ayudar a las empresas a acelerar el crecimiento y satisfacer las necesidades de financiamiento. | Empresas que buscan acumular fondos para un crecimiento futuro. |

| Cuentas de Mercado Monetario Comerciales | Ofrece tasas de interés competitivas para ayudar a las empresas a maximizar los rendimientos y aumentar los ahorros en efectivo. | Empresas que buscan mayores rendimientos manteniendo la liquidez. |

| Certificados de Depósito Comerciales (CDs) | Ofrece opciones de tasas de interés para mejorar los rendimientos cuando las empresas tienen reservas excedentes. | Empresas que buscan asegurar altos rendimientos durante un plazo específico. |

Tarifas

Depósito mínimo: El depósito mínimo para U.S. Bank es de $25.

Plataforma de Trading

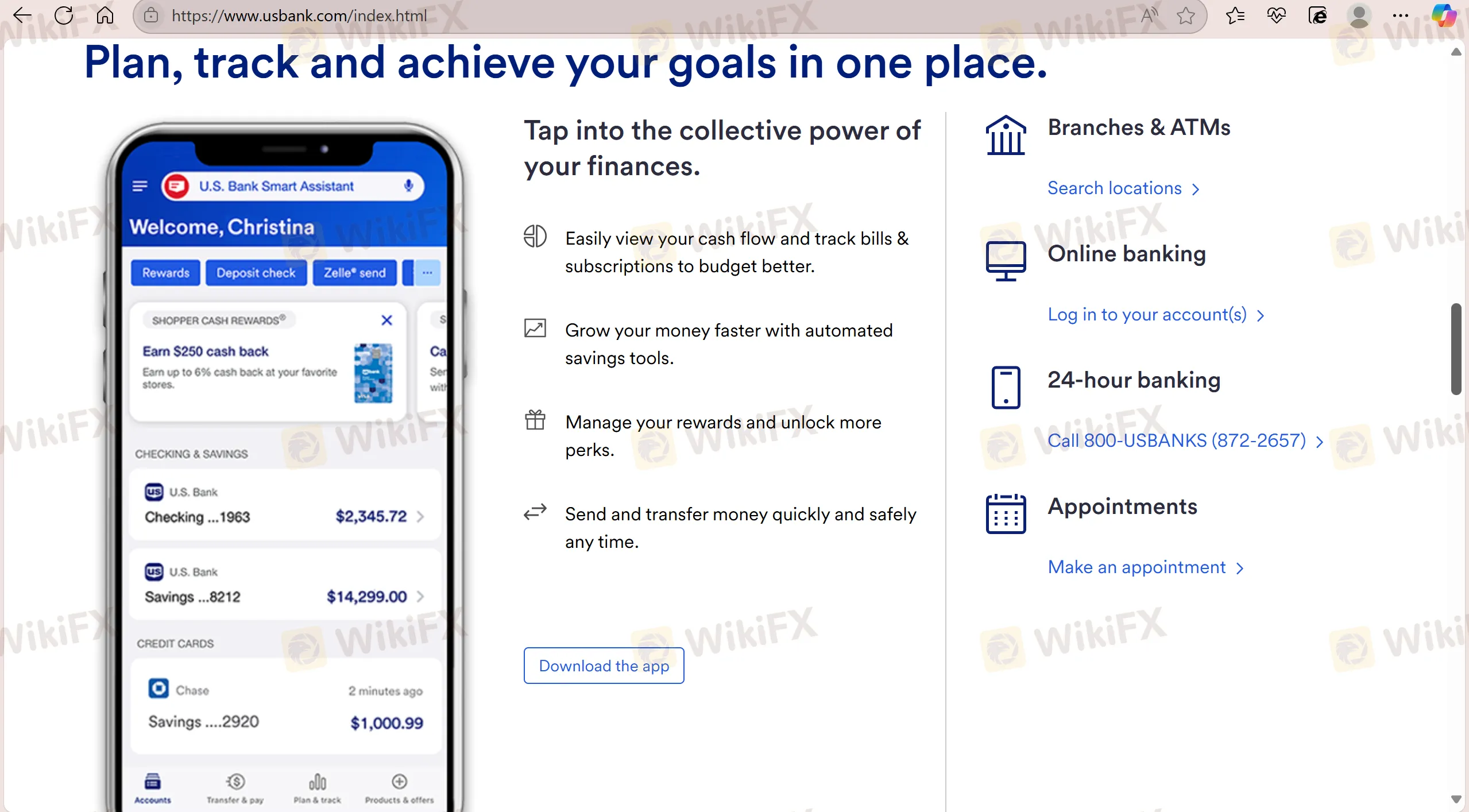

U.S. Bank admite transacciones a través de su aplicación propietaria U.S. Bank app. La aplicación ofrece servicio las 24 horas.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| U.S. Bank APP | ✔ | Móvil | / |