seejay

1-2年

Is KGI Asia overseen by any regulators, and if so, which financial authorities are responsible?

From my experience as an independent trader, regulatory oversight is paramount when evaluating any broker, especially given the risks inherent to financial markets. In the case of KGI Asia, I can confirm that it is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The SFC is a reputable financial authority known for its strict compliance standards and regular monitoring of licensed entities. For me, knowing that KGI Asia operates under a license from the SFC (license number ADW991) provides a degree of reassurance regarding their business conduct and client fund safety.

Being regulated by the SFC means KGI Asia is required to meet standards related to capital adequacy, segregation of client assets, and transparent business practices. These requirements can help mitigate some operational risks, although they do not eliminate all possible issues, as there have been both positive and negative user experiences spotlighted by individuals who have interacted with the broker. As with any investment or trading decision, I always recommend thoroughly reviewing regulatory status and maintaining a conservative approach—regulatory oversight is just one critical component of due diligence, but an important one in reducing unnecessary risk.

DoreenVanDenHeever

1-2年

Which types of trading instruments does KGI Asia offer, such as stocks, forex, indices, commodities, or cryptocurrencies?

In my experience exploring KGI Asia, I found their product range to be quite broad within traditional financial markets, but notably lacking in areas popular with retail traders, such as forex and cryptocurrencies. KGI Asia focuses on wealth products that include mutual funds, bonds, structured products, insurance, and MPF, as well as direct access to global stocks, warrants, CBBCs, IPO subscriptions, grey market trading, futures, options, HK stock options, and ETFs. For someone who, like me, values regulatory oversight, it’s worth noting that they are regulated by the Securities and Futures Commission in Hong Kong, which I consider a positive for trustworthiness.

However, I must emphasize that if your primary interest lies in trading forex pairs or digital assets like cryptocurrencies, KGI Asia does not provide these instruments. Their offerings are more tailored towards equities, fixed income, and derivative contracts tied to indices and commodities, but not spot forex or digital currencies. For stocks, bonds, futures, and options, I found their platforms and market access sufficiently robust, aided by a range of trading and research tools.

Ultimately, the absence of forex and crypto might be a drawback for traders with those specific interests. Those looking for a broad multi-asset brokerage with advanced tools but limited to regulated, conventional instruments may find KGI Asia suitable, though caution is always required to ensure that their available products actually match your individual trading objectives.

Broker Issues

Account

Leverage

Platform

Instruments

Aman A

1-2年

How do the swap fees (overnight financing charges) at KGI Asia compare to other brokers?

As an experienced trader, when I evaluated KGI Asia, I specifically looked for clarity regarding swap fees or overnight financing charges, since these directly impact the overall cost of longer-term positions. In my due diligence, I found that KGI Asia does not provide explicit information about swap fees or overnight financing on their disclosed products or within their fee structures. This lack of transparency makes it challenging for me to directly compare KGI Asia’s swap fees to those of other brokers—a crucial consideration for anyone considering position trading or holding leveraged products overnight.

From what I have gathered, KGI Asia mainly focuses on stocks, futures, and options rather than traditional spot forex or contracts-for-difference (CFDs), which are the instruments most commonly associated with swap or rollover charges. Their core offerings are centered around equities and derivatives, and the detailed commission and fee structures provided relate more to those asset classes. Meanwhile, its competitors often publish clear, accessible tables of overnight financing rates, especially on forex and CFD instruments, which KGI Asia does not offer.

For me, the inability to compare swap fees directly means I would exercise extra caution if my trading strategy depended on the cost of overnight positions, as unexpected or hidden charges could erode profits. Whenever fee transparency is lacking, I believe it signals a need for heightened diligence and possibly reaching out directly to the broker for clarification before committing significant funds. That’s a standard practice I recommend to all serious traders, especially when managing financial risk.

Broker Issues

Fees and Spreads

Karoline Hardy

1-2年

How much leverage does KGI Asia provide for major forex pairs, and how does their leverage policy differ for other types of assets?

As someone who spends considerable time evaluating brokers for my trading needs, I've taken a close look at KGI Asia's offerings. Based on my thorough review, KGI Asia does not provide access to major forex pairs, and therefore, leverage for forex trading simply isn’t available through this broker. This is an important distinction for anyone primarily seeking leveraged FX exposure, as KGI Asia’s product range is focused on equities, bonds, futures, options, and structured wealth products rather than forex and CFDs.

For the other asset classes they offer—such as stocks, futures, and options—the available information from my research doesn’t specify exact leverage ratios. In my experience, this lack of transparency on margin requirements and maximum leverage can be a concern, particularly if you rely on leverage as part of your trading strategy. However, since KGI Asia is licensed by the SFC in Hong Kong, clients are generally afforded a degree of regulatory oversight, and margin policies for futures or options would be set according to local regulatory guidelines, which usually tend to be more conservative than brokers focused on high-leverage CFD/forex trading.

Ultimately, if your trading goals require leveraged forex trading, KGI Asia is not a suitable option. Their strength lies more in providing access to regulated regional equity and derivatives markets, and their leverage terms—where disclosed—are likely to reflect the relatively strict standards of Hong Kong's financial authorities. For me, the absence of forex leverage is a deciding factor when weighing KGI Asia against brokers that specialize in FX.

Broker Issues

Instruments

Leverage

Account

Platform

一搏跆拳道馆

香港

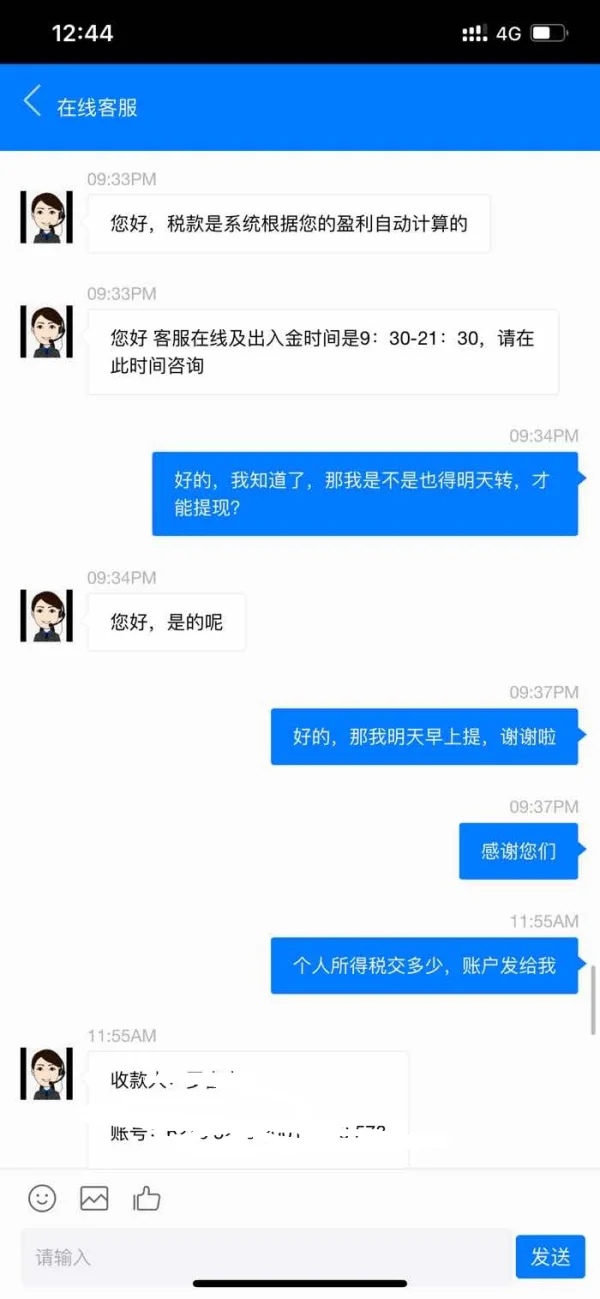

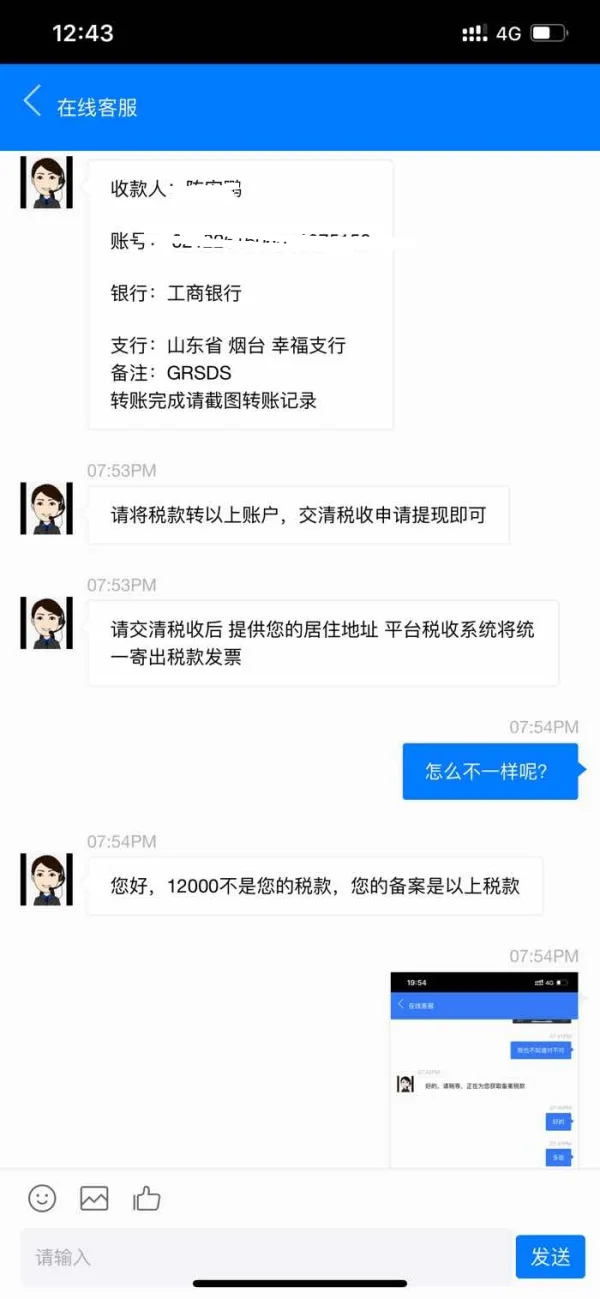

投了25万,收益加本钱160多万,提现是让交个人所得税

曝光

FX3052352045

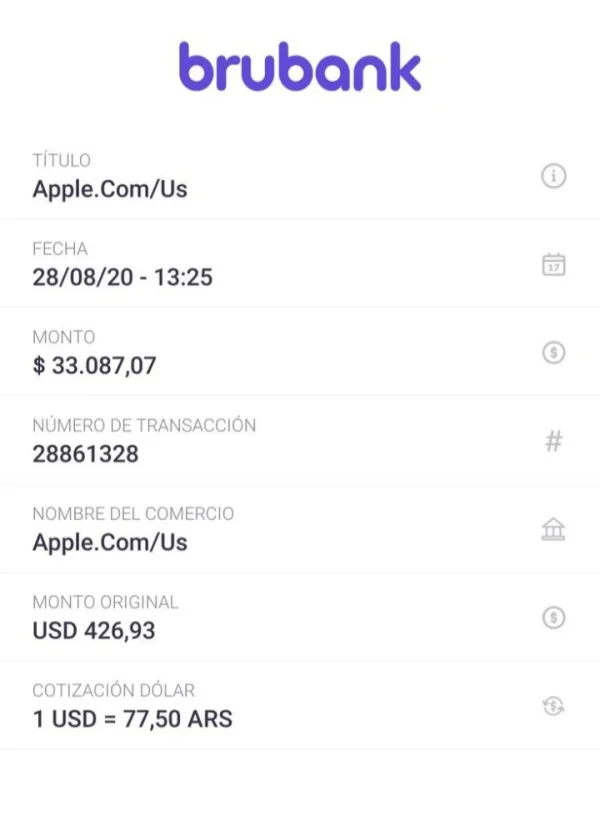

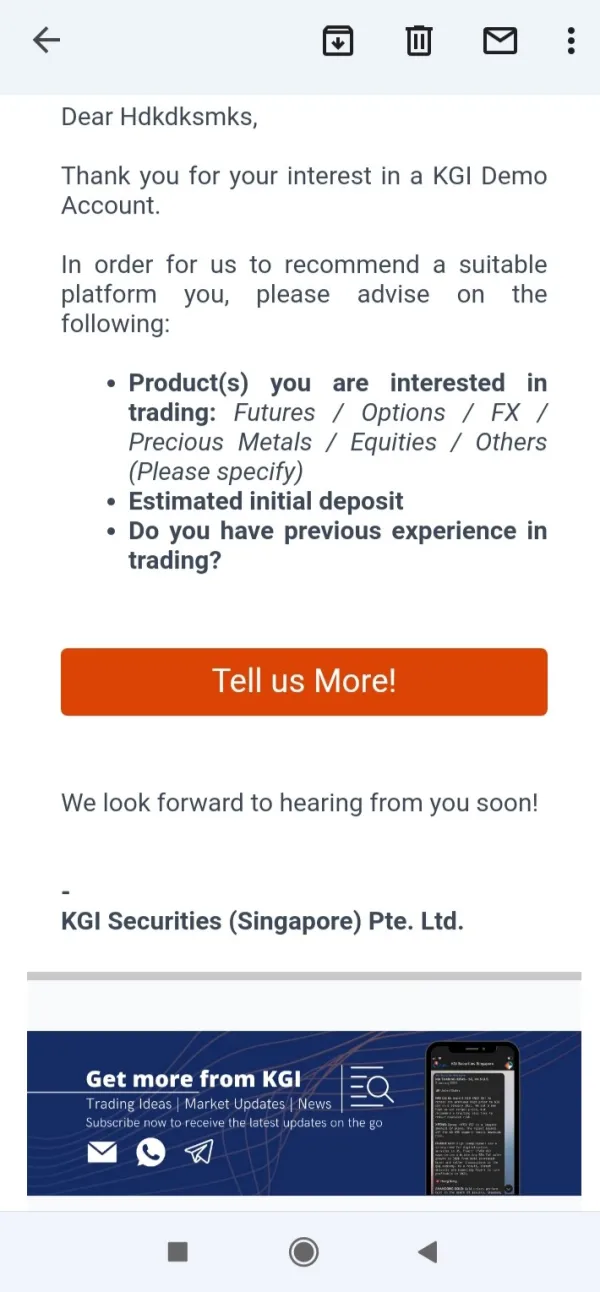

阿根廷

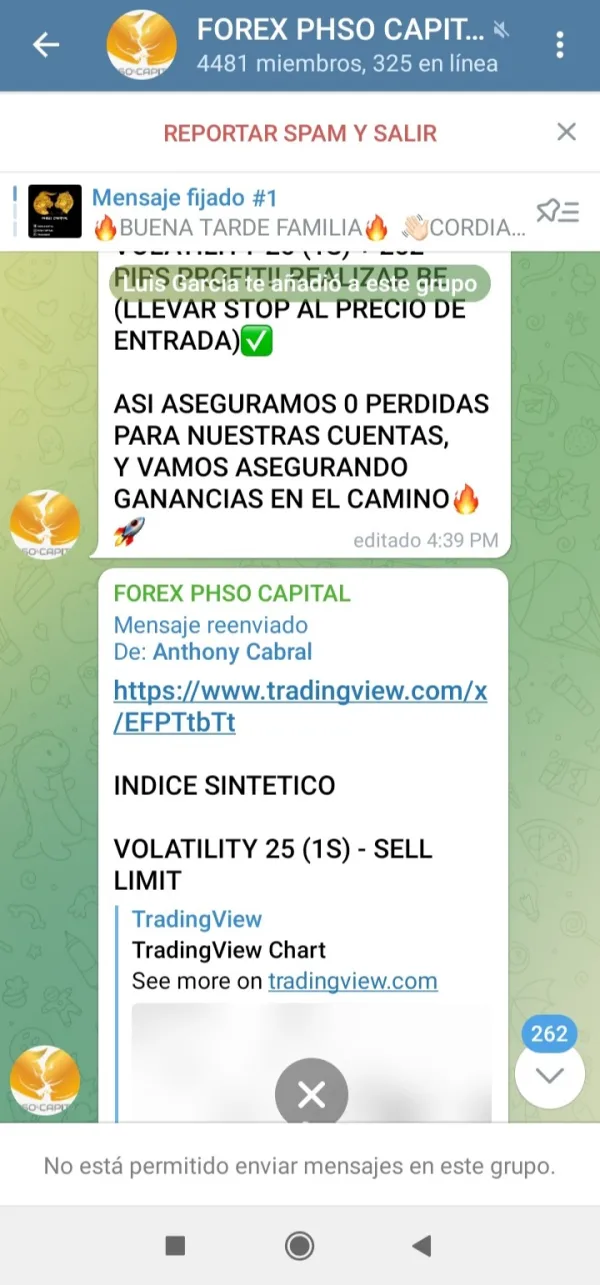

我想请我收回我投资的426美元,突然,在我的运营并获得超过3000美元的利润后,他们不想支付给我,由于页面不允许,我无法截图,我附上了您的电报群,是的,我收到的邮件和收据,我需要它

曝光

FX1398449580

美国

凯基亚洲提供广泛的金融产品和服务,包括财富管理、股票、债券、保险、互惠基金等,旨在为投资者提供全方位的投资选择。该网站还提供实时市场数据和分析工具,帮助投资者做出明智的投资决策。此外,凯基香港的交易平台易于使用,操作简单,执行迅速,客户服务非常专业和高效。

好评

用笑宣泄悲伤

澳大利亚

凯基亚洲是一家彻头彻尾的骗局公司。他们用各种手段吸引你存款。你存款之后,他们的目的就达到了,他们对你的态度突然就变了!

中评