Présentation de l'entreprise

| U.S. BankRésumé de l'examen | |

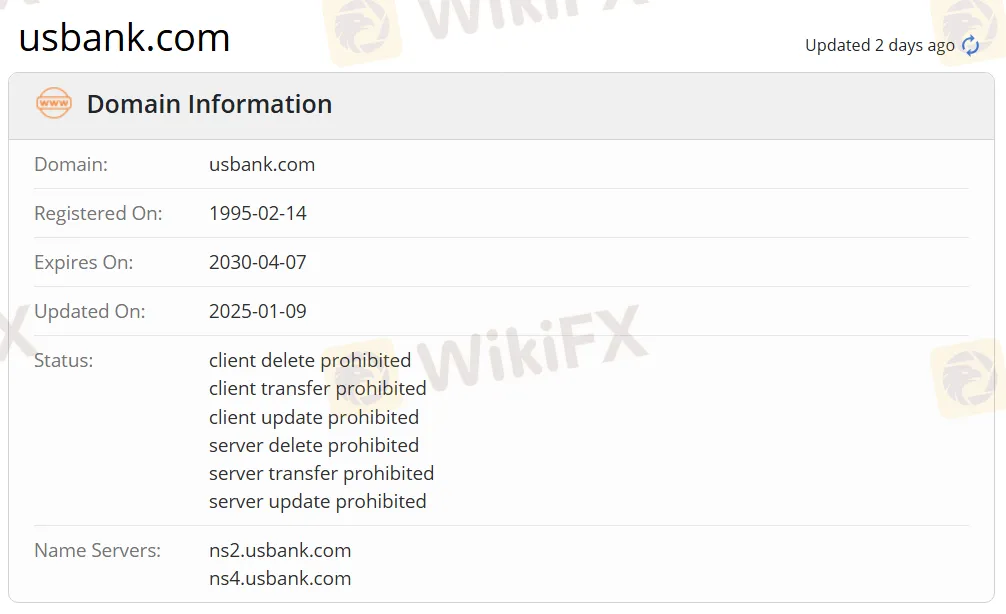

| Fondé | 1995 |

| Pays/Région d'enregistrement | États-Unis |

| Régulation | Pas de régulation |

| Produits et Services | Services bancaires, gestion de patrimoine |

| Compte de démonstration | / |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | Application U.S. Bank |

| Dépôt minimum | $25 |

| Support client | Réseaux sociaux : Facebook, Twitter, Instagram |

| Adresse : U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

Informations sur U.S. Bank

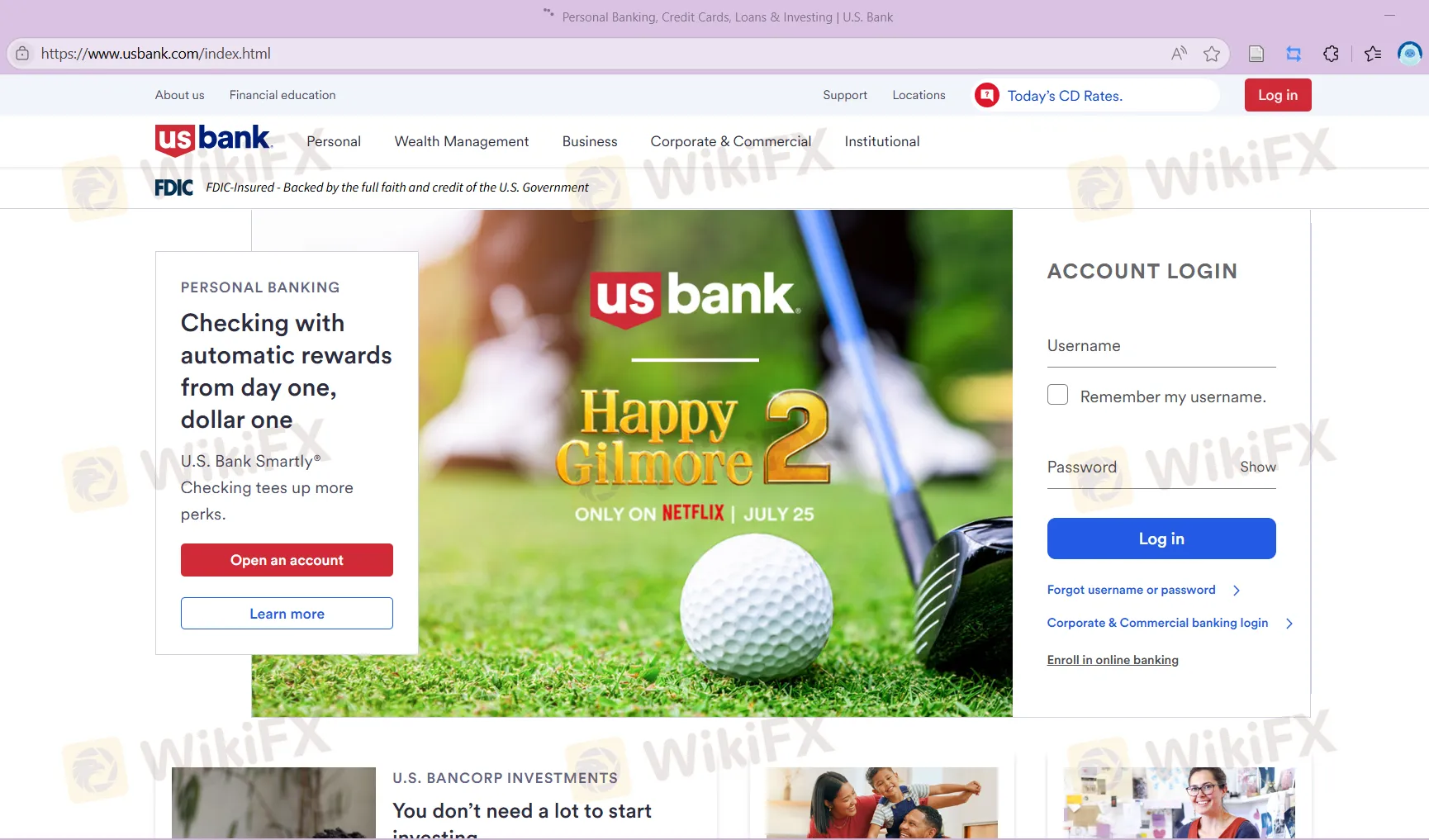

U.S. Bank a été fondé en 1995 et est enregistré aux États-Unis. Il propose une gamme diversifiée de services bancaires aux clients particuliers, institutionnels et corporatifs, comprenant des cartes de crédit, des comptes chèques, des comptes d'épargne, des certificats de dépôt (CD), des prêts hypothécaires, la gestion de placements et la planification patrimoniale. Bien qu'il offre une expérience de trading pratique avec un dépôt minimum de $25, l'entreprise n'est pas réglementée, donc les investisseurs doivent être prudents quant à sa légitimité et sa transparence. U.S. Bank propose quatre principaux types de comptes : comptes chèques commerciaux, comptes d'épargne commerciaux, comptes du marché monétaire commercial et certificats de dépôt commerciaux (CD), qui répondent aux besoins de gestion de trésorerie et de croissance des différentes entreprises.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Services bancaires spécialisés | Pas de régulation |

| Longue histoire d'opération aux États-Unis |

U.S. Bank est-il légitime ?

U.S. Bank n'est pas réglementé. Les traders doivent faire preuve de prudence lorsqu'ils tradent et utiliser les fonds de manière prudente.

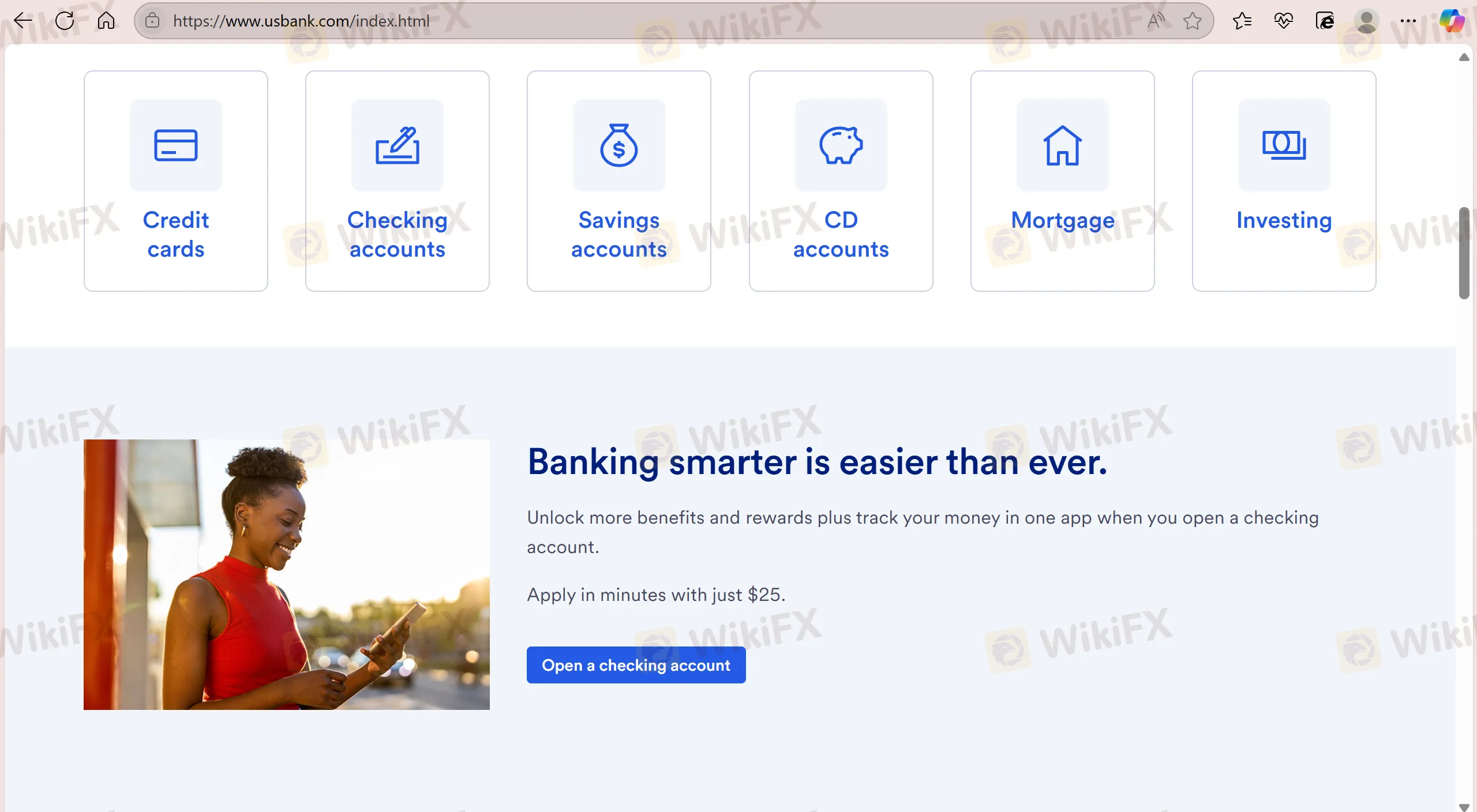

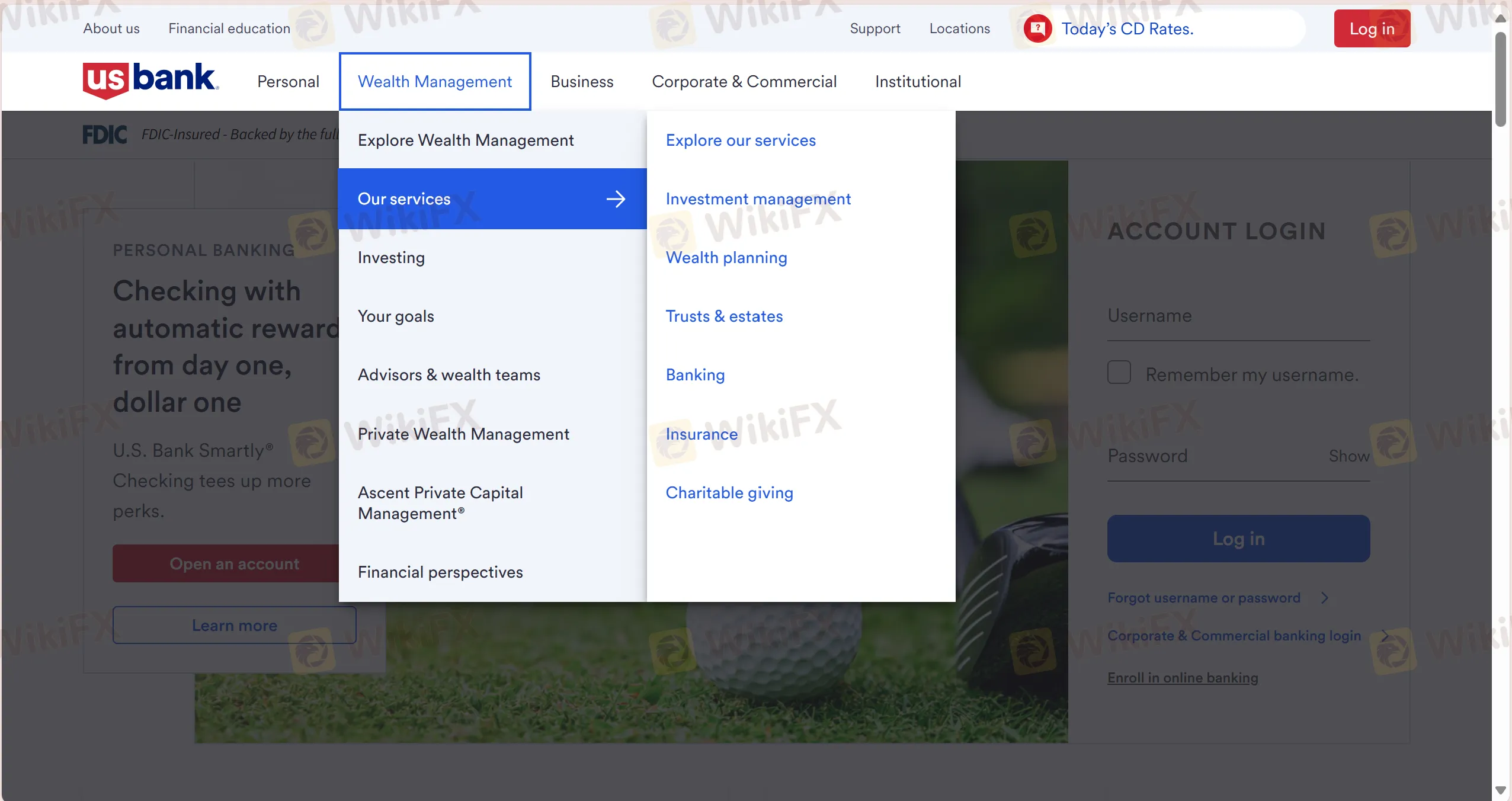

Produits & Services

U.S. Bank propose une gamme complète de produits et services financiers, y compris des cartes de crédit, des comptes-chèques, des comptes d'épargne, des comptes à terme, des prêts hypothécaires, des investissements, des prêts auto, des lignes de crédit sur valeur domiciliaire (HELOC), de la gestion de placements, de la planification patrimoniale, des fiducies et successions, des services bancaires, des assurances et des dons de bienfaisance.

| Produits & Services | Pris en charge |

| Cartes de crédit | ✔ |

| Comptes-chèques | ✔ |

| Comptes d'épargne | ✔ |

| Comptes à terme | ✔ |

| Prêts hypothécaires | ✔ |

| Investissements | ✔ |

| Prêt auto | ✔ |

| Ligne de crédit sur valeur domiciliaire (HELOC) | ✔ |

| Gestion de placements | ✔ |

| Planification patrimoniale | ✔ |

| Fiducies et successions | ✔ |

| Services bancaires | ✔ |

| Assurances | ✔ |

| Dons de bienfaisance | ✔ |

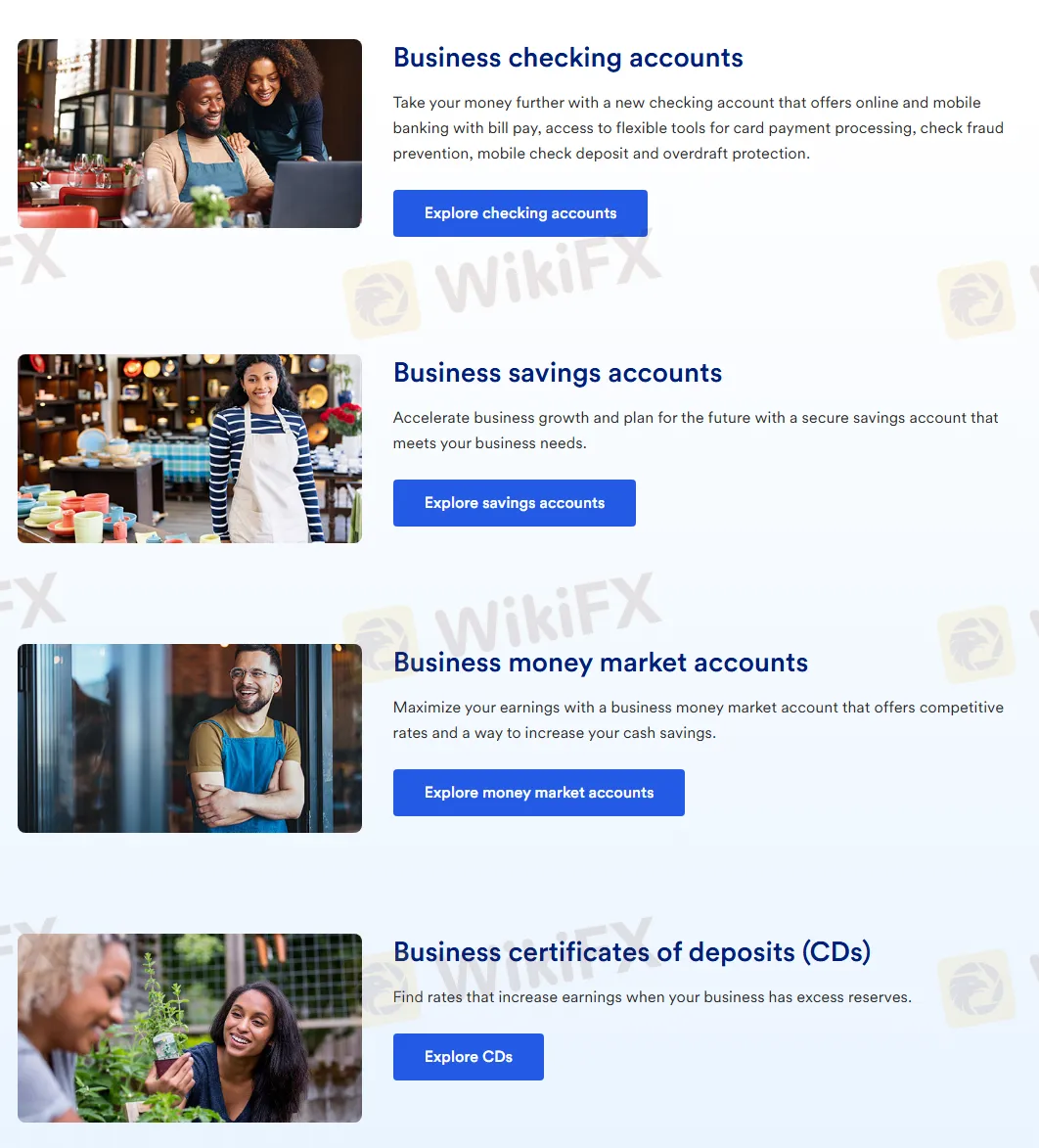

Types de Comptes

U.S. Bank propose quatre types de comptes, notamment des comptes-chèques d'entreprise, des comptes d'épargne d'entreprise, des comptes du marché monétaire d'entreprise et des certificats de dépôt d'entreprise (CD).

Voici leurs principales caractéristiques :

| Type de Compte | Description | Adapté pour |

| Comptes-chèques d'entreprise | Prend en charge les fonctionnalités bancaires en ligne et mobile telles que le paiement de factures, les outils de traitement des paiements par carte, la prévention de la fraude aux chèques, le dépôt de chèques mobile, et la protection contre les découverts. | Pour les entreprises ayant besoin d'une solution bancaire complète. |

| Comptes d'épargne d'entreprise | Offre des comptes d'épargne sécurisés pour aider les entreprises à accélérer leur croissance et répondre à leurs besoins de financement. | Les entreprises cherchent à accumuler des fonds pour une croissance future. |

| Comptes du marché monétaire d'entreprise | Propose des taux d'intérêt compétitifs pour aider les entreprises à maximiser leurs rendements et augmenter leurs économies de trésorerie. | Les entreprises recherchent des rendements plus élevés tout en maintenant leur liquidité. |

| Certificats de dépôt d'entreprise (CD) | Offre des options de taux d'intérêt pour améliorer les rendements lorsque les entreprises disposent de réserves excédentaires. | Les entreprises visent à verrouiller des rendements élevés sur une durée spécifique. |

Frais

Dépôt minimum : Le dépôt minimum pour U.S. Bank est de 25 $.

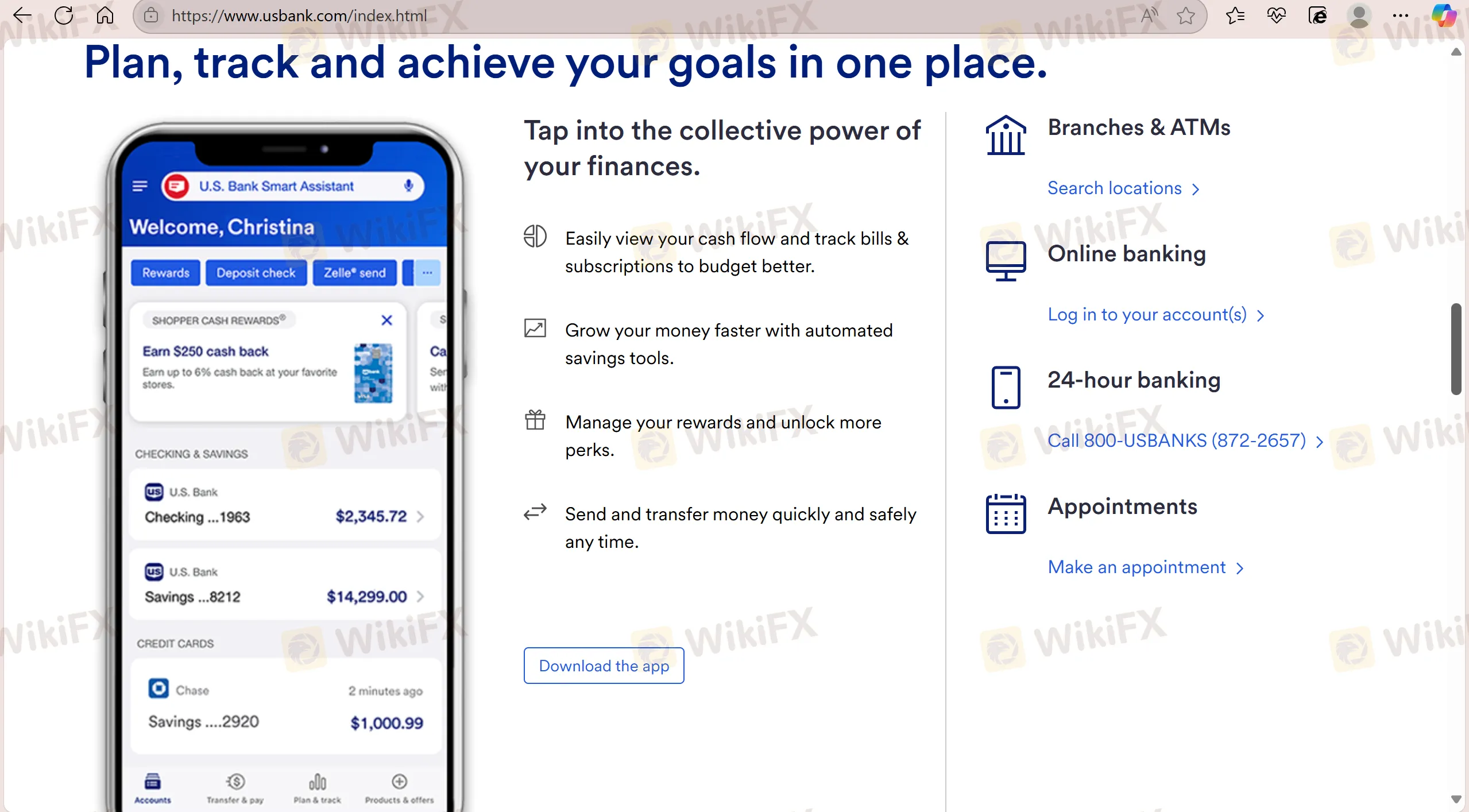

Plateforme de Trading

U.S. Bank prend en charge les transactions via son application propriétaire U.S. Bank app. L'application offre un service 24 heures sur 24.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Application U.S. Bank | ✔ | Mobile | / |