公司简介

公司简介

企业简介

基本信息&监管机构

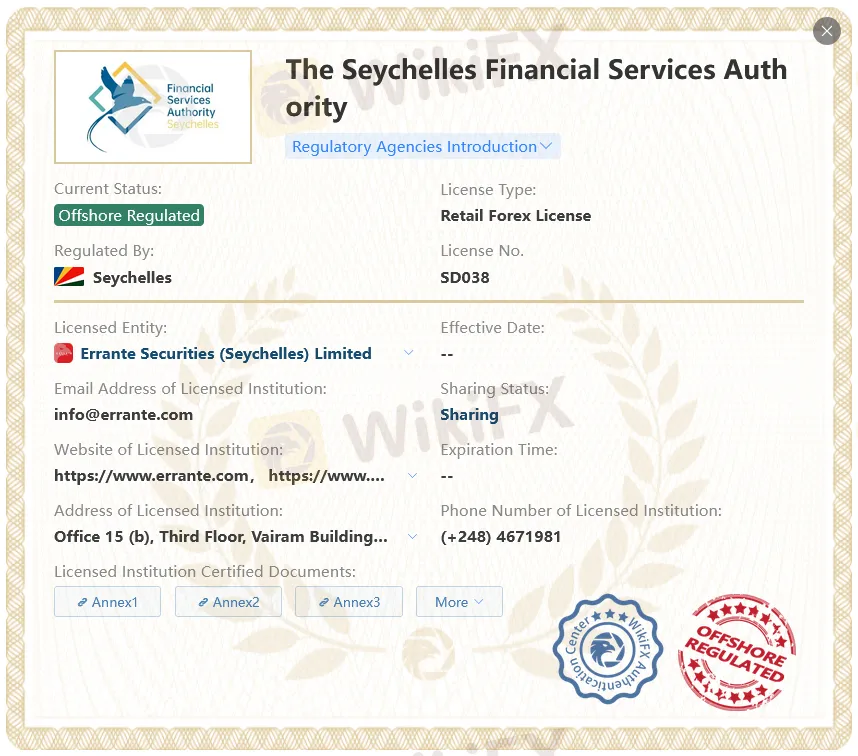

Errante是一家在线交易经纪商,成立于1999年,至今已拥有30年的行业经验。 Errante目前受塞舌尔金融服务管理局的离岸监管(监管号:DS038)。

安全性分析

Errante目前没有受到任何主流监管机构的监管,只持有塞舌尔FSA的零售外汇牌照,安全保障相对没有那么高。此外,Errante设置的交易杠杆相对较高,因此投资者在选择该平台的时候要应谨慎考虑。

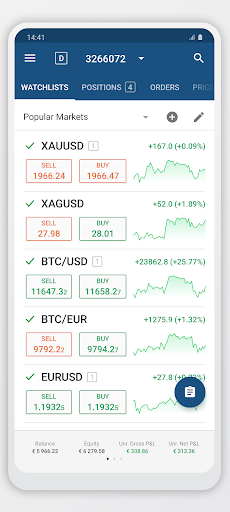

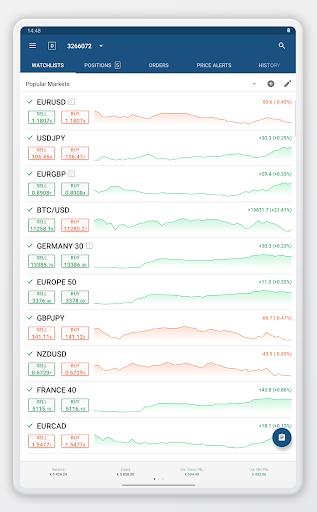

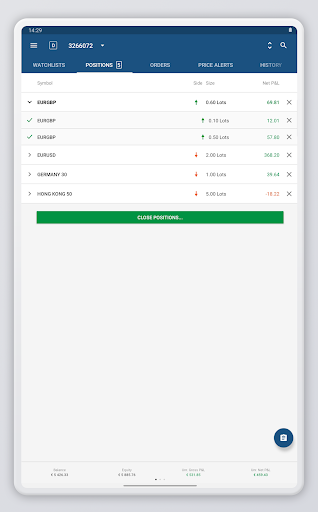

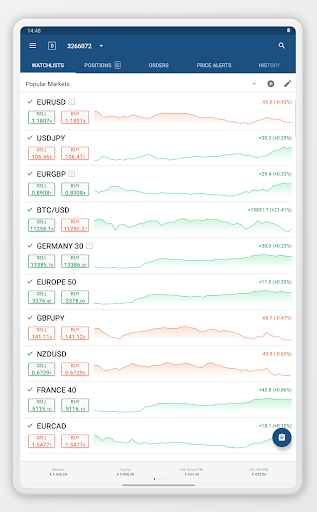

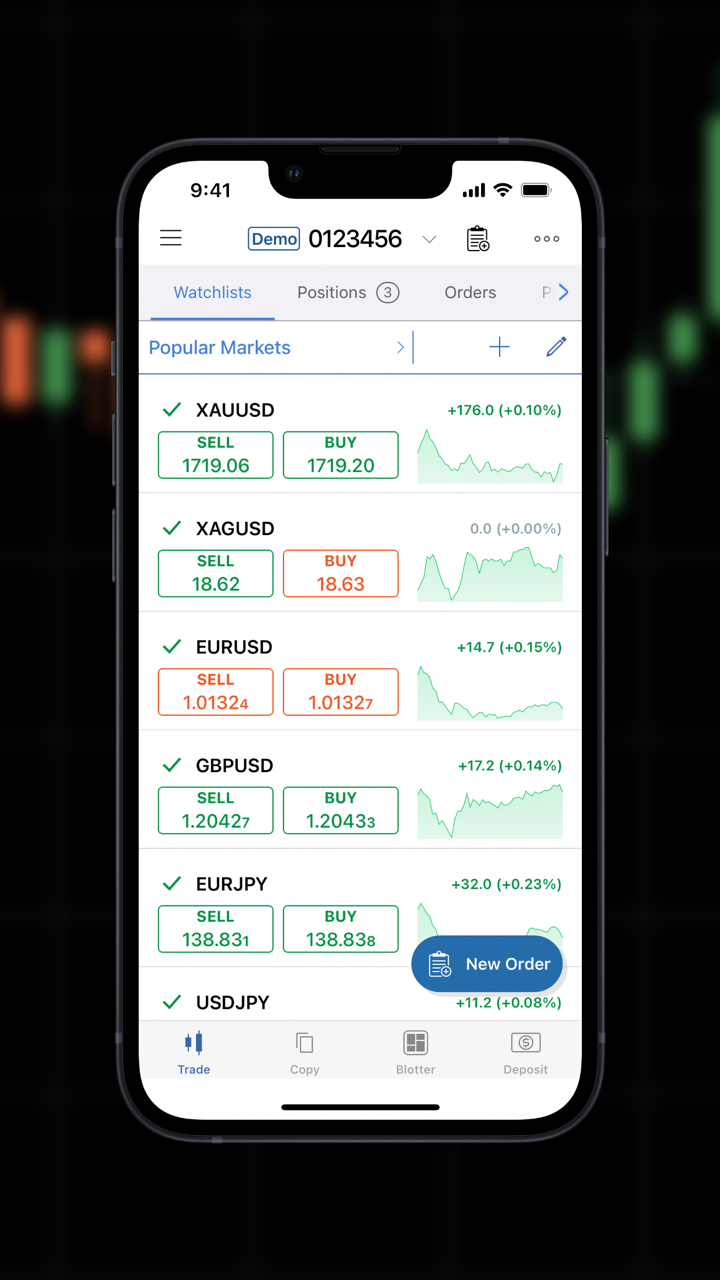

主营业务

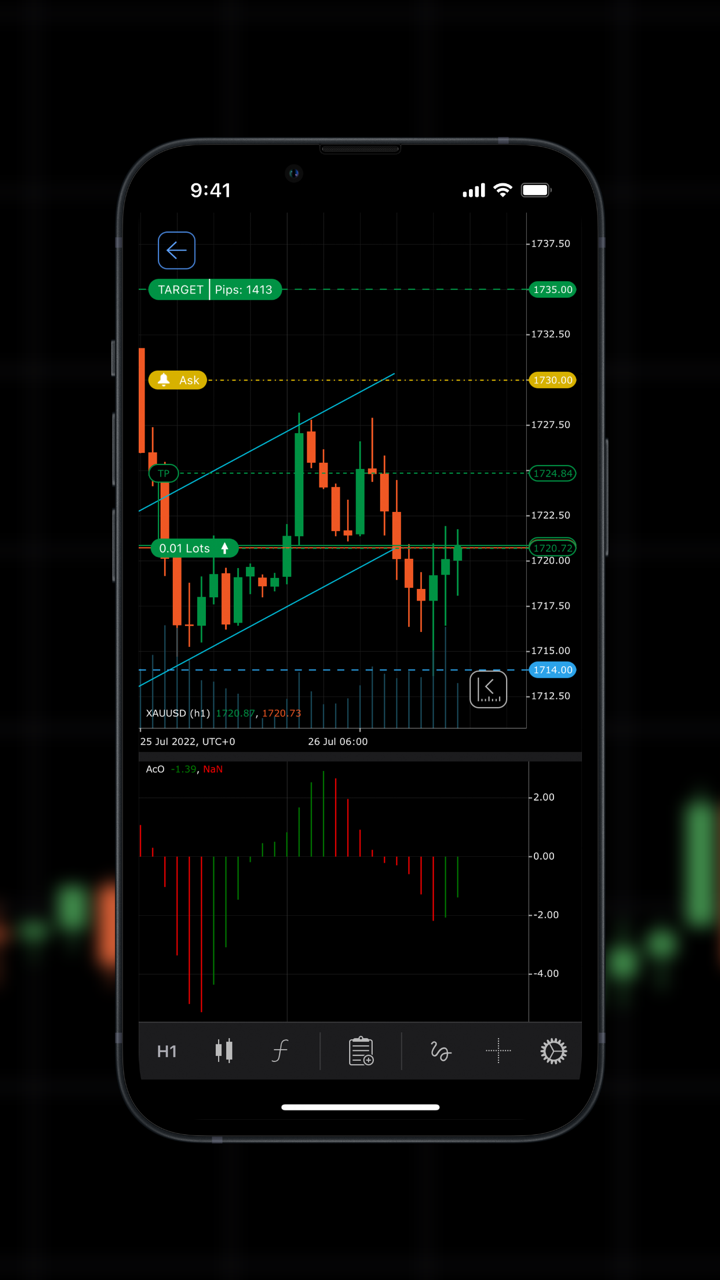

Errante给投资者提供了全球金融市场伤主流及热门的交易工具,主要是外汇(可交易50多个货币对),股票,指数,金属,能源,加密货币。

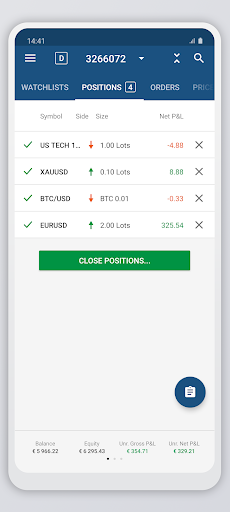

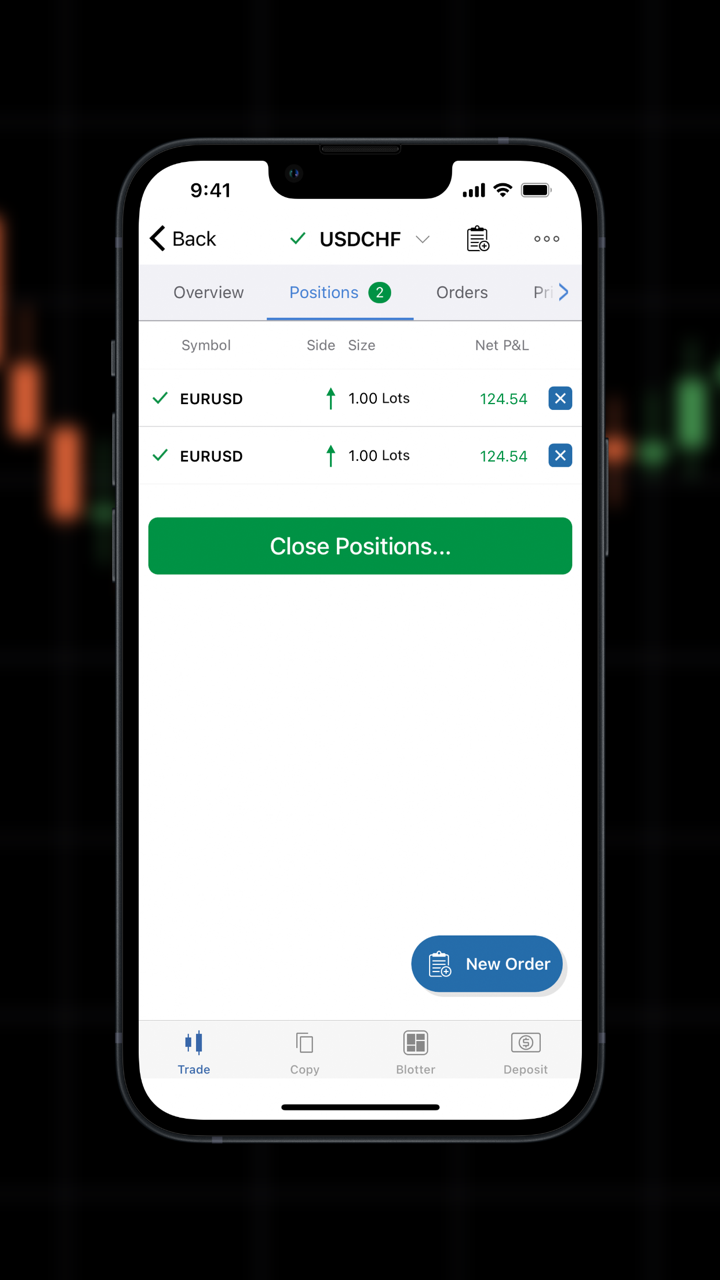

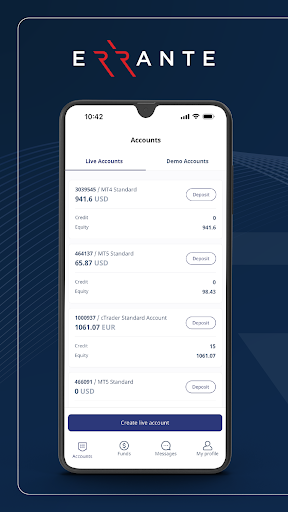

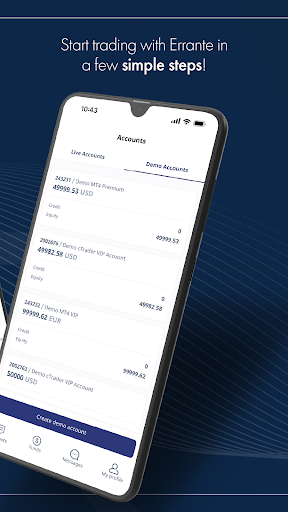

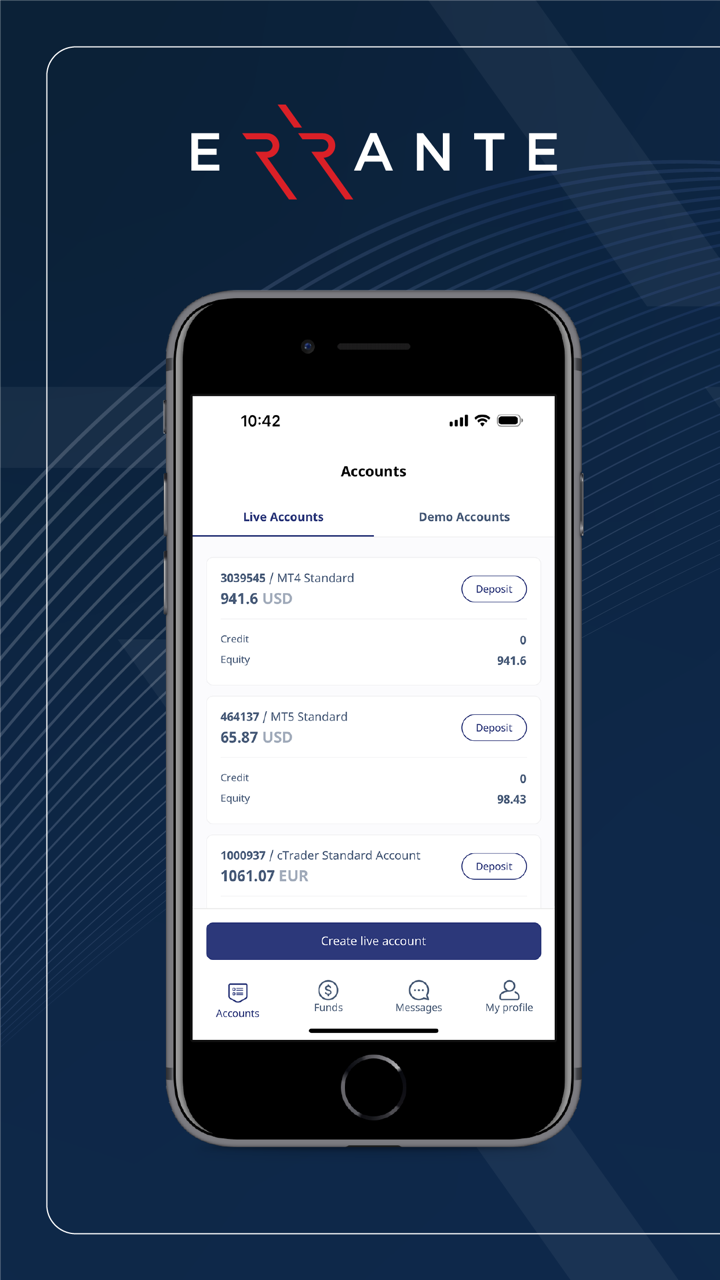

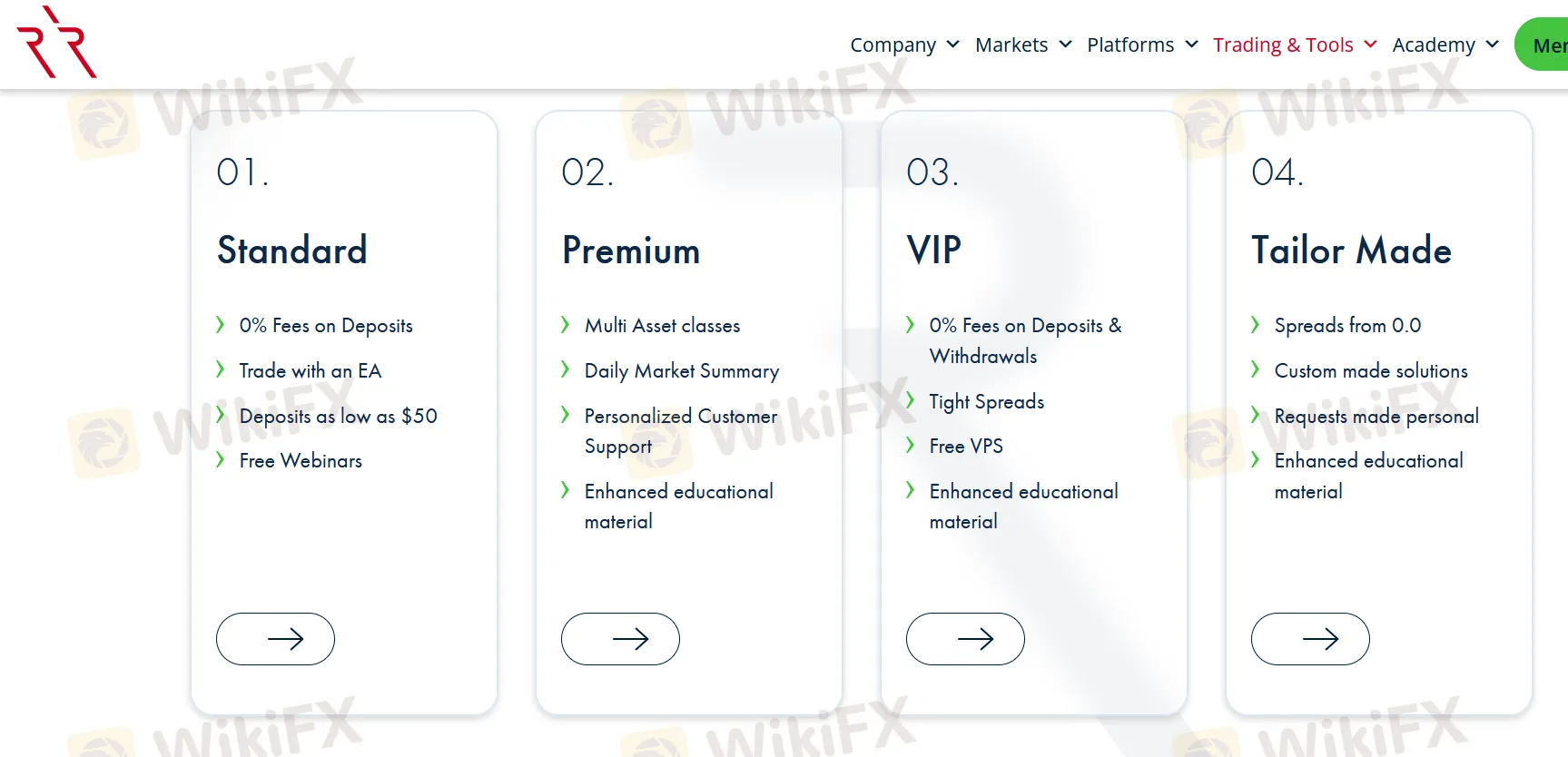

杠杆&账户

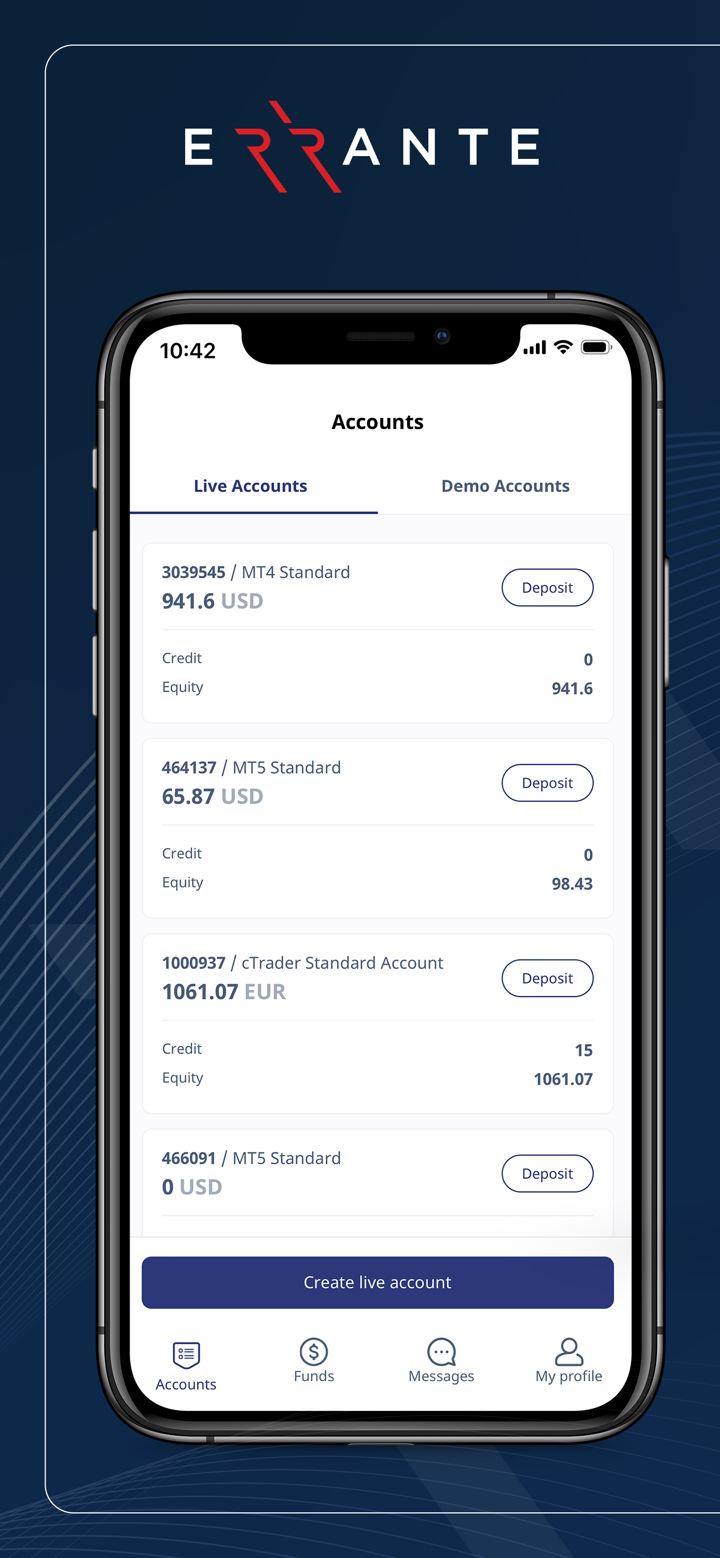

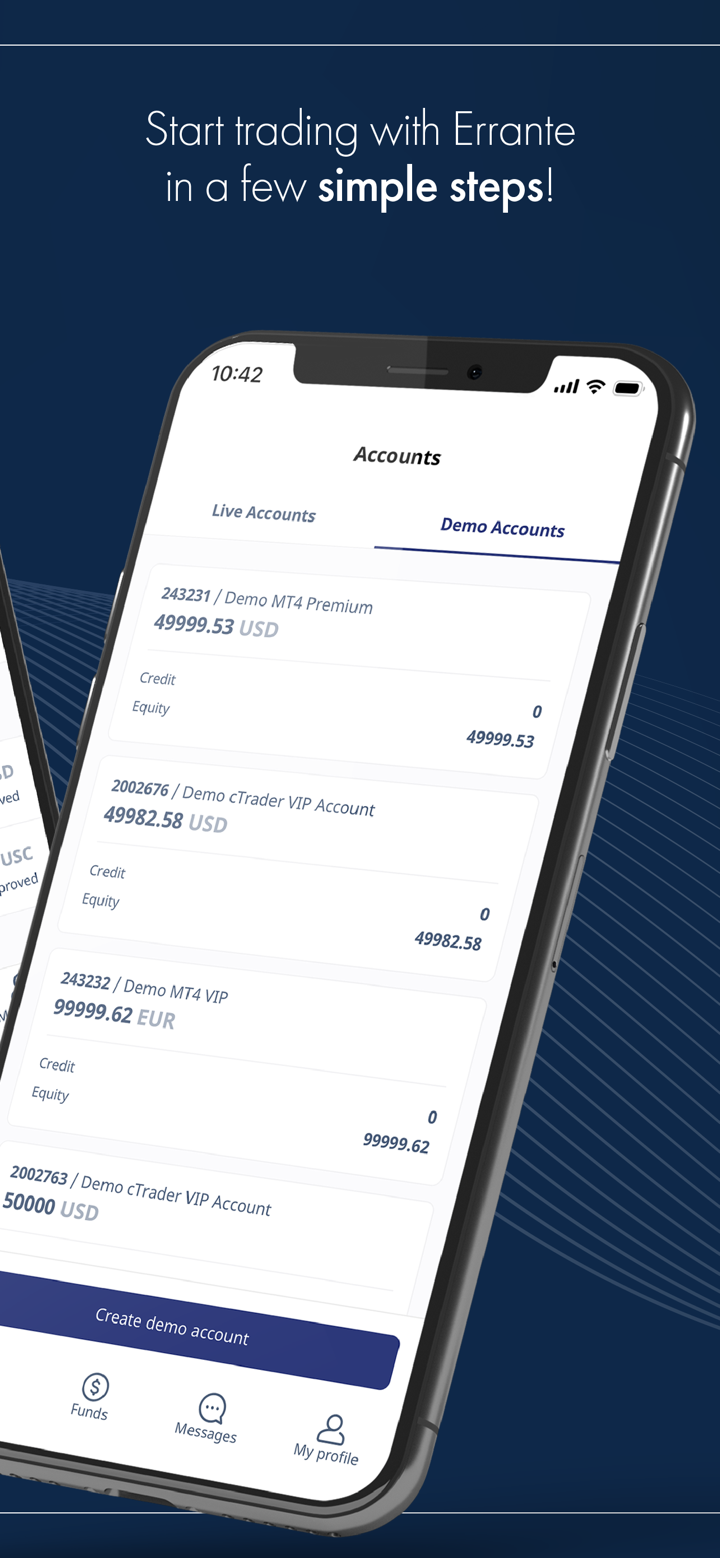

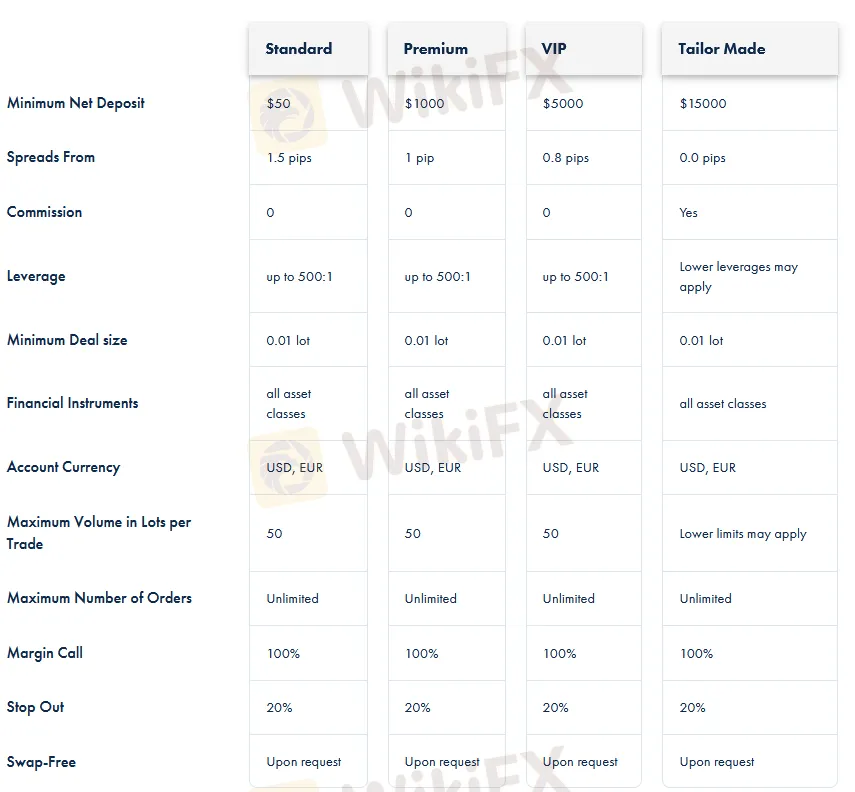

主要货币对的最大交易杠杆为1:500,次要货币对的最大杠杆为1:200,贵金属(黄金,白银的)的交易杠杆为1:100,股票的交易杠杆为1:20,指数产品的交易杠杆高达1:100,原油交易杠杆为1:100,天然气杠杆为1:20,加密货币的杠杆为1:10。为满足不同投资者的投资需求和交易体验,Errante设置了四种不同类型的账户,即标准账户(最低入金50美元),高级账户(最低入金1000美元),VIP账户(最低入金5000美元),专属定制账户(最低入金15,000美元)。

点差&佣金费用

标准账户的平均点差为1.5点,高价账户的平均点差为1.0点,VIP账户的平均点差为0.2点,专属定制账户的平均点差为0.0点。四种账户的外汇交易均不收取佣金。

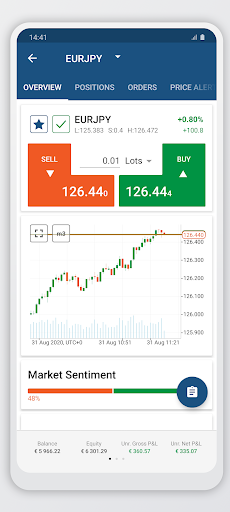

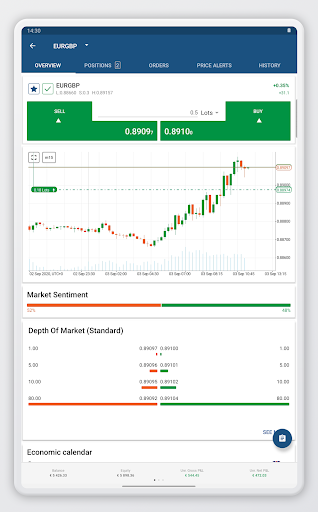

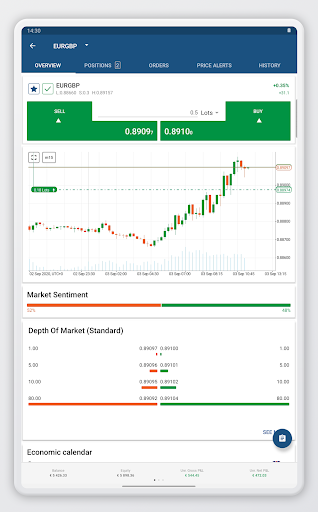

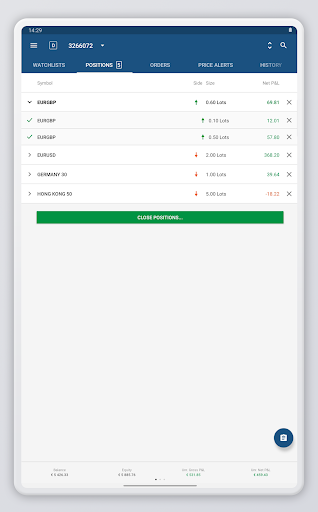

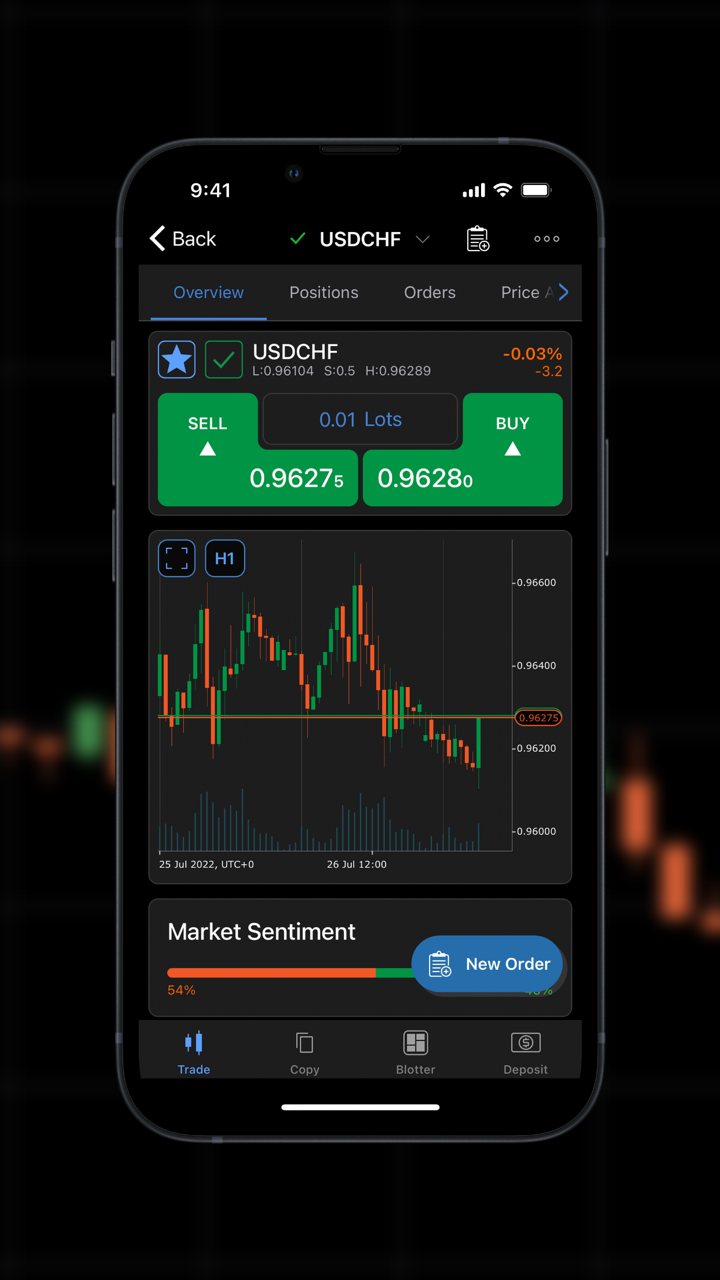

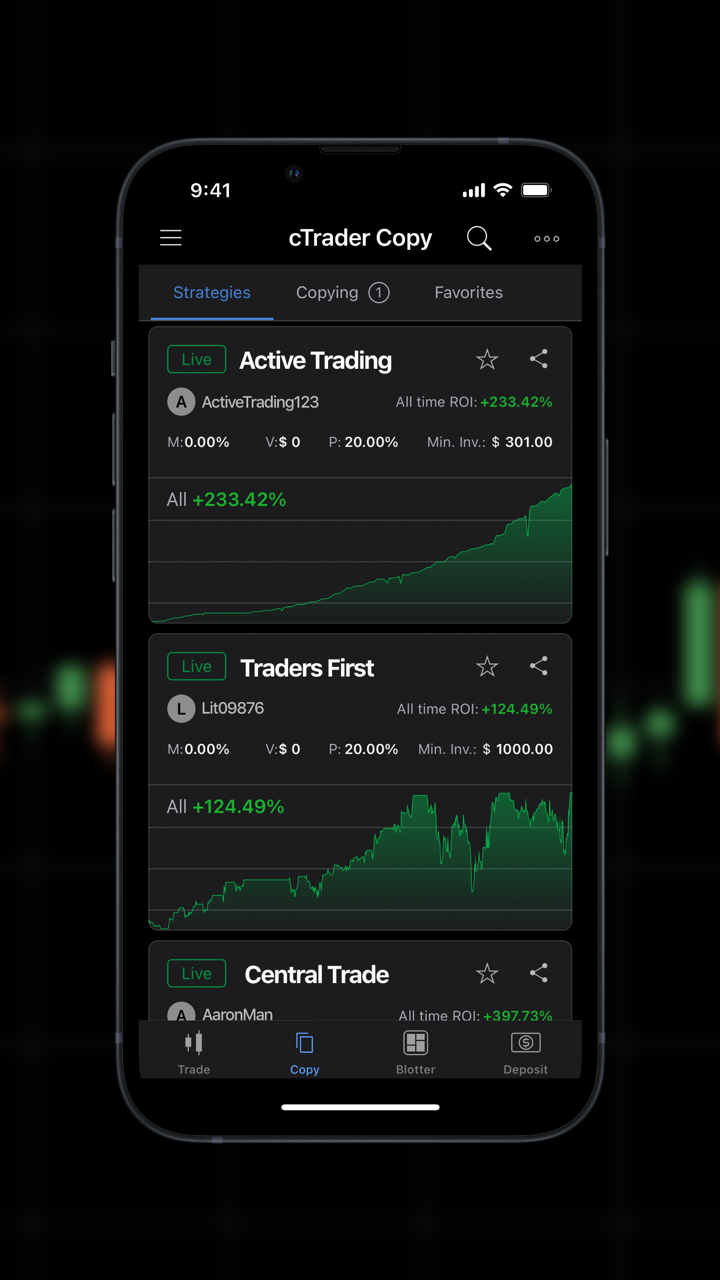

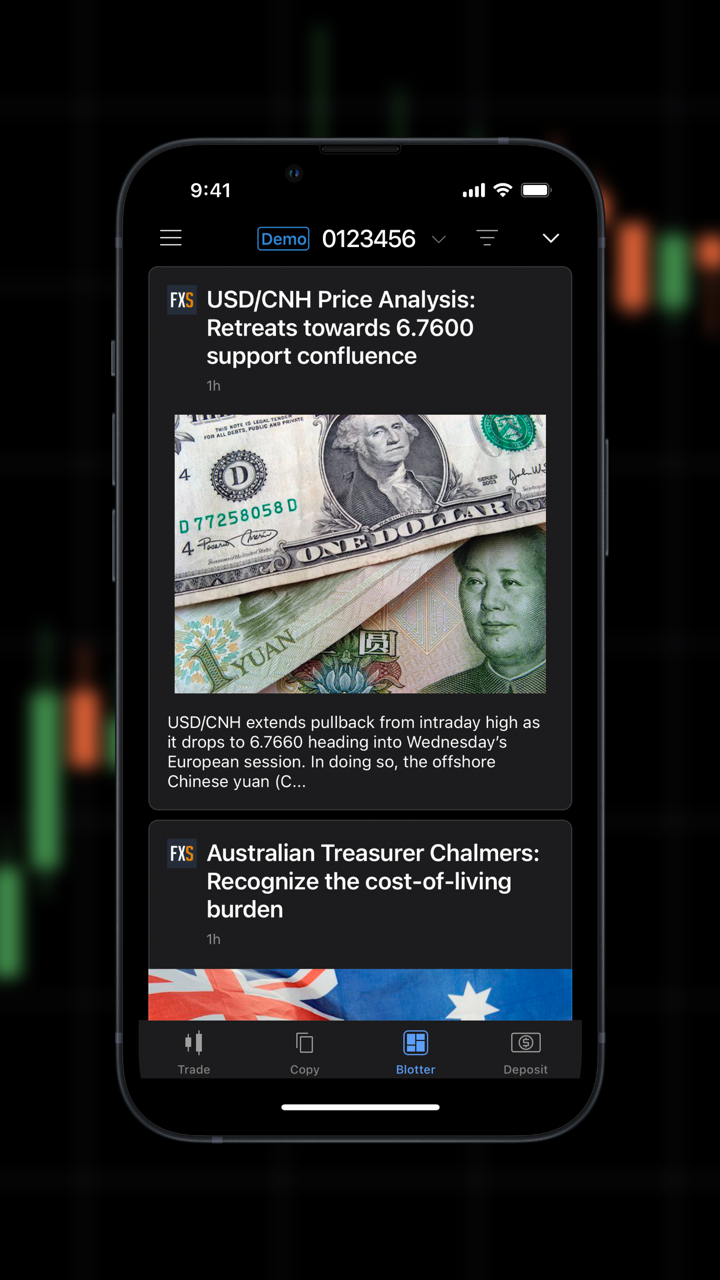

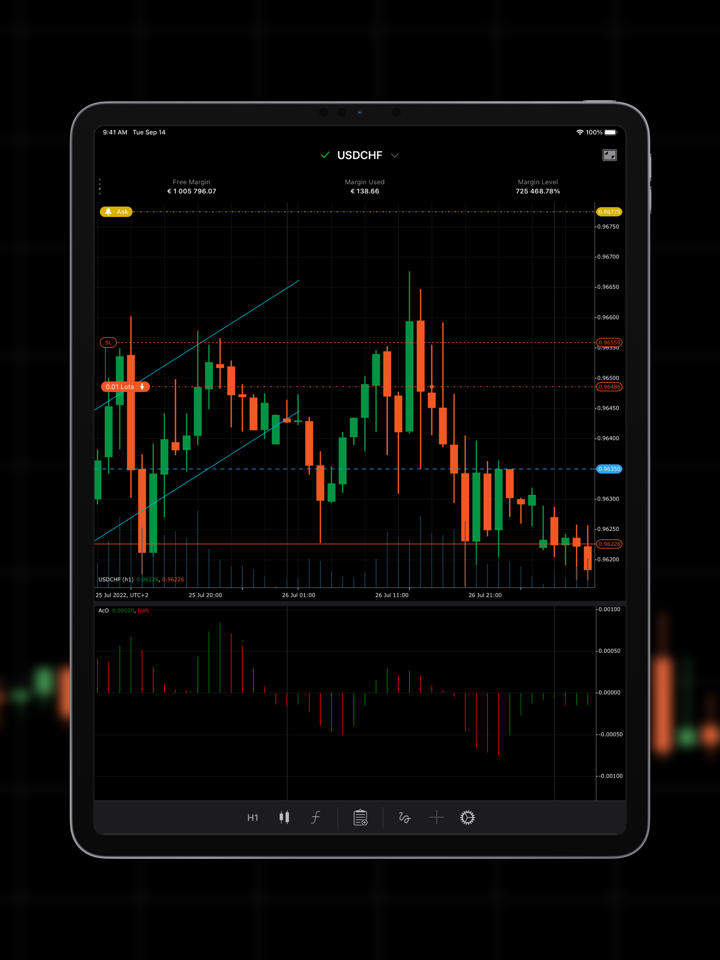

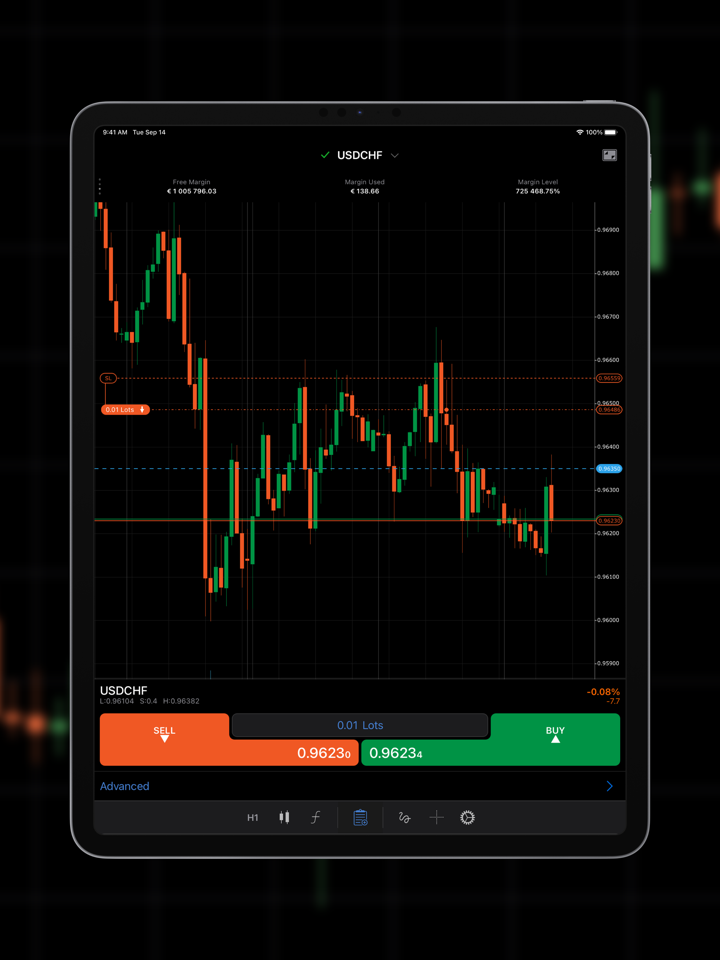

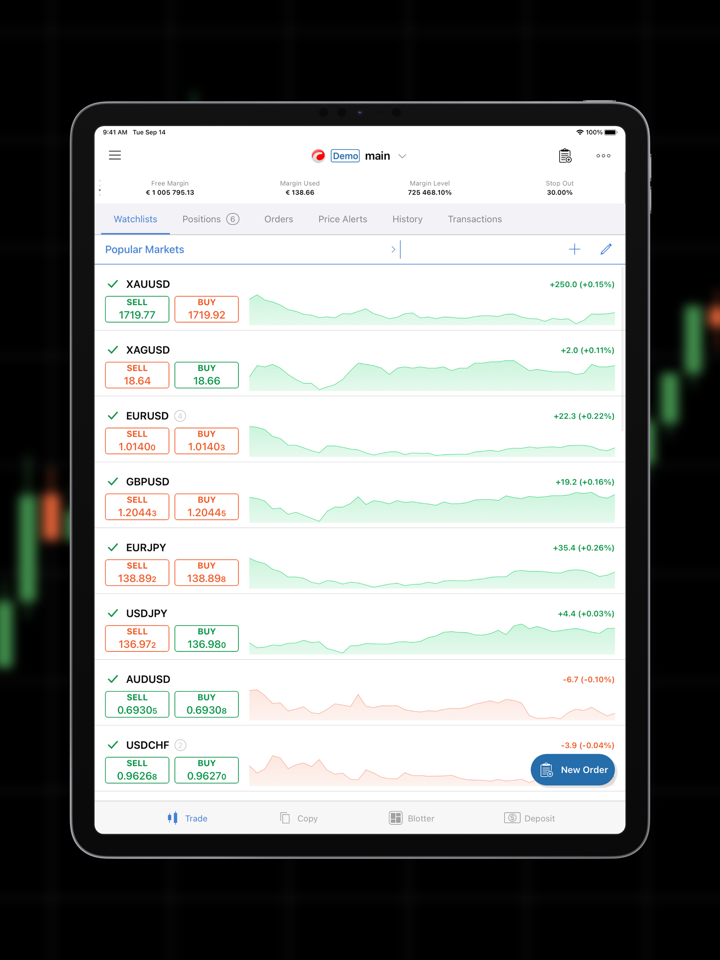

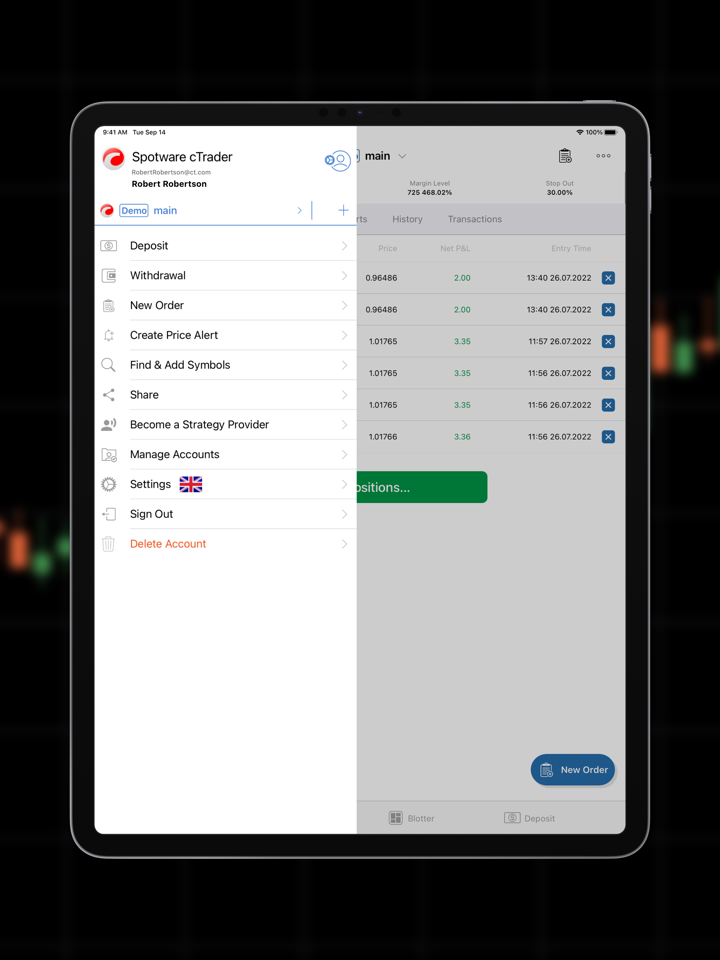

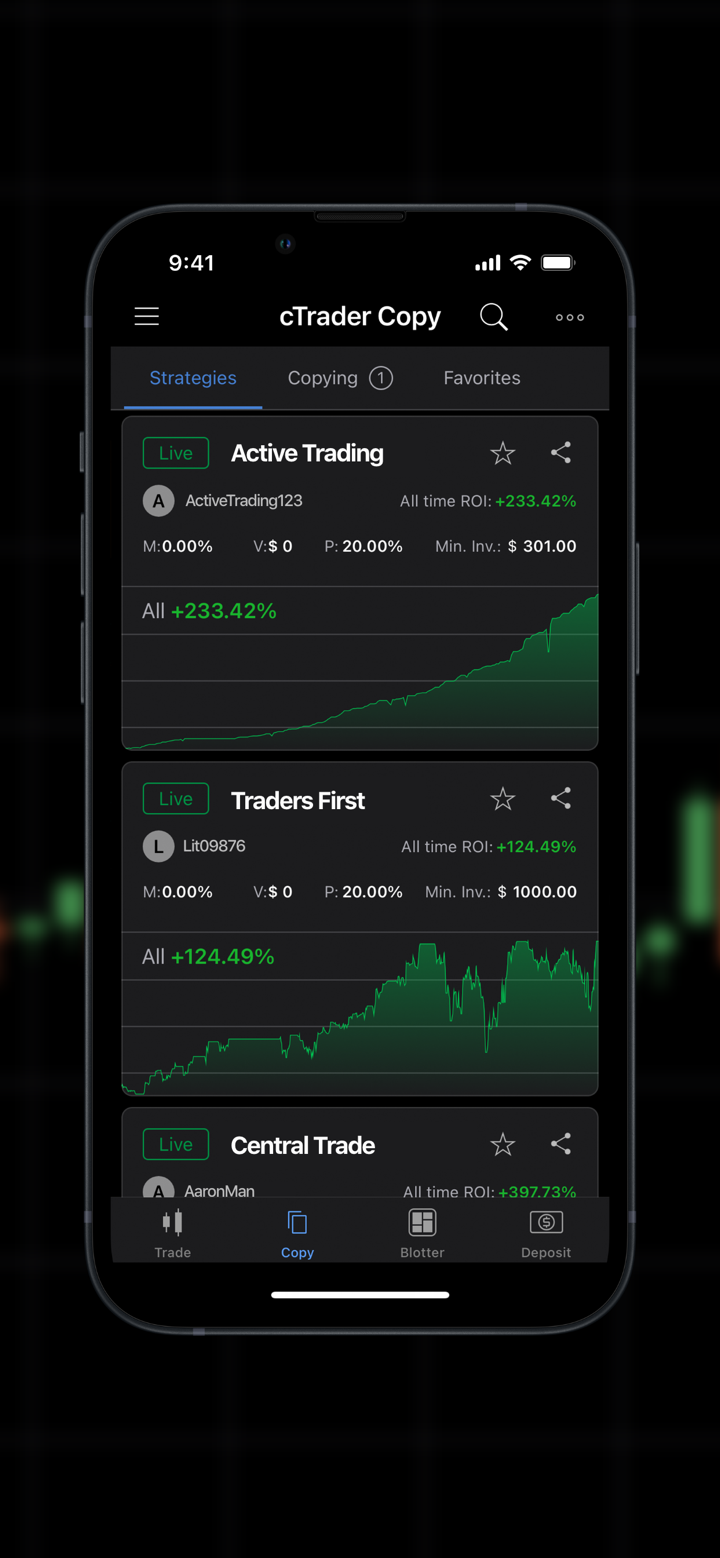

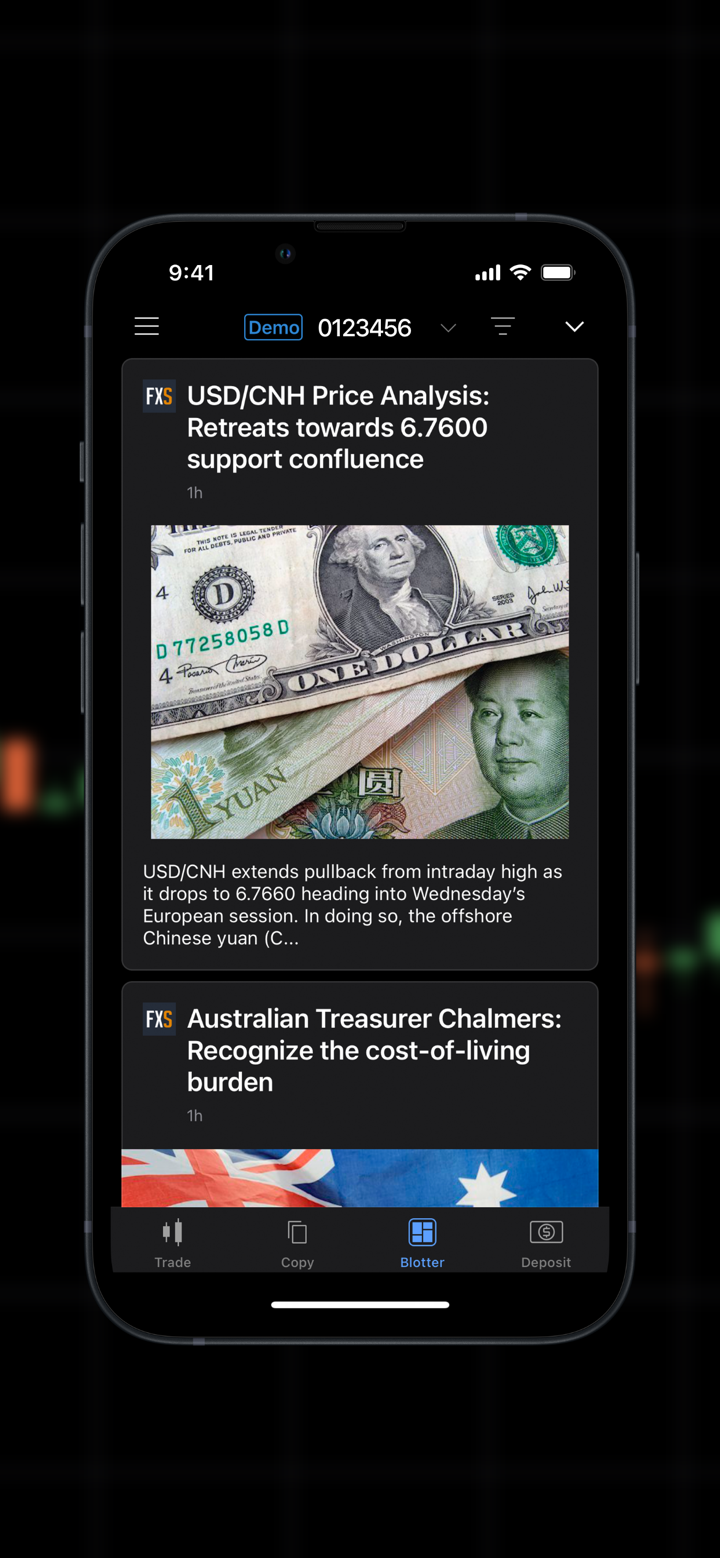

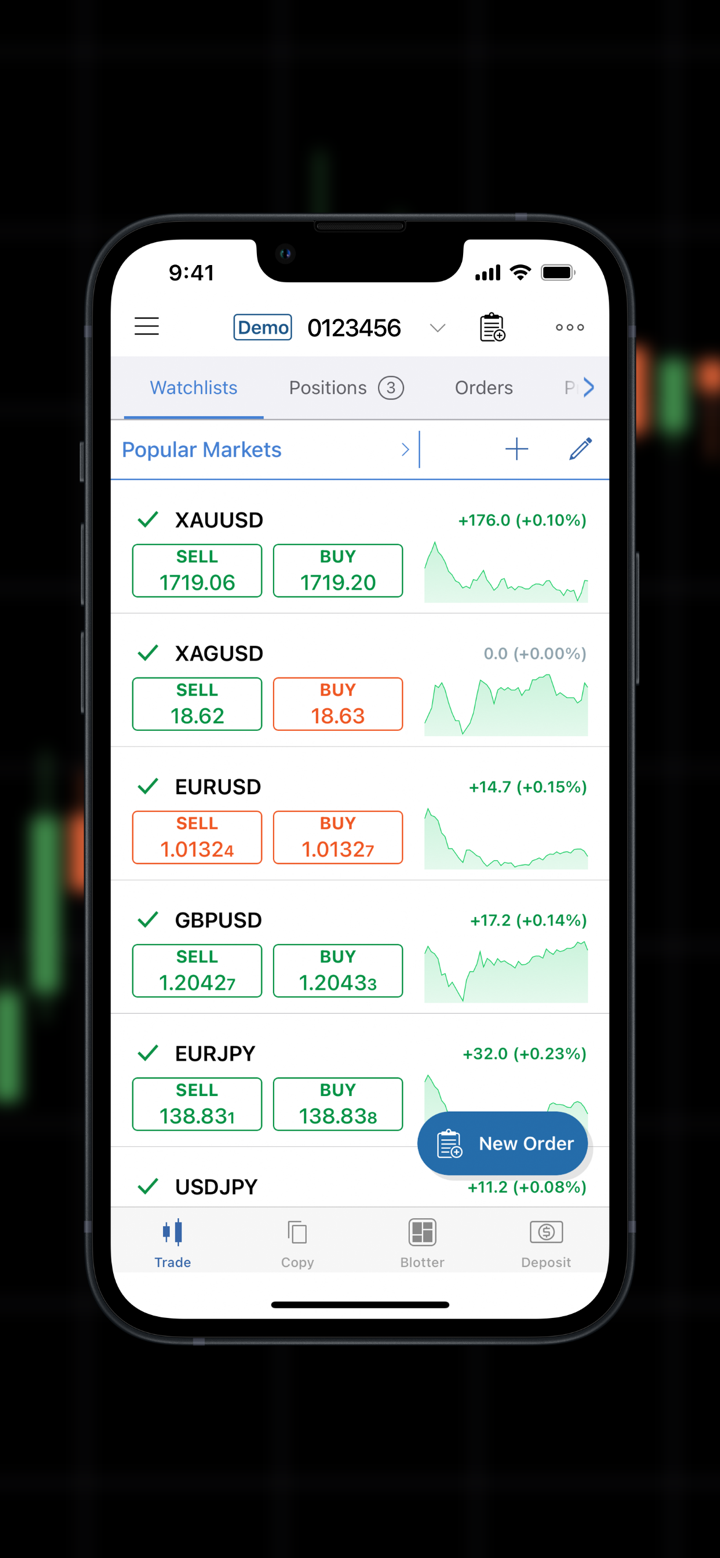

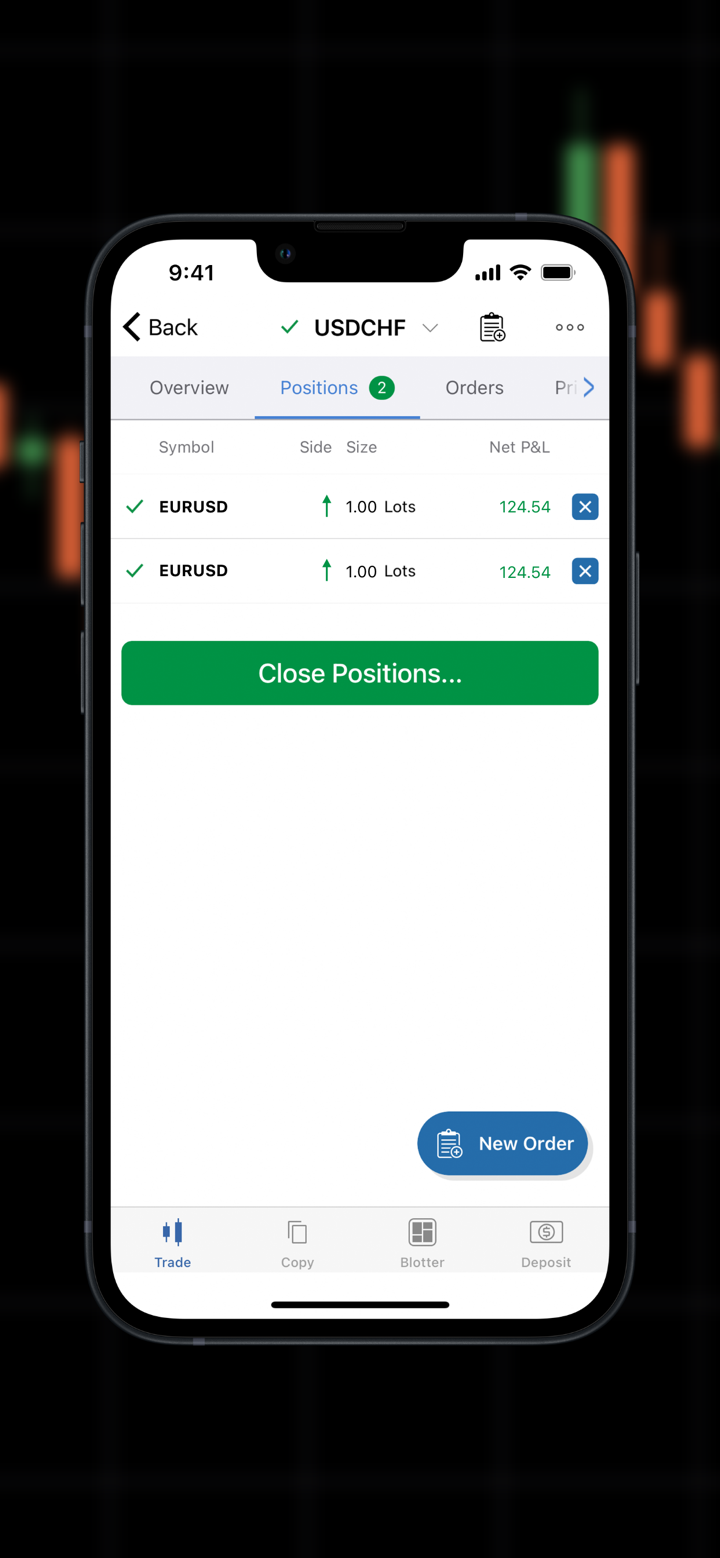

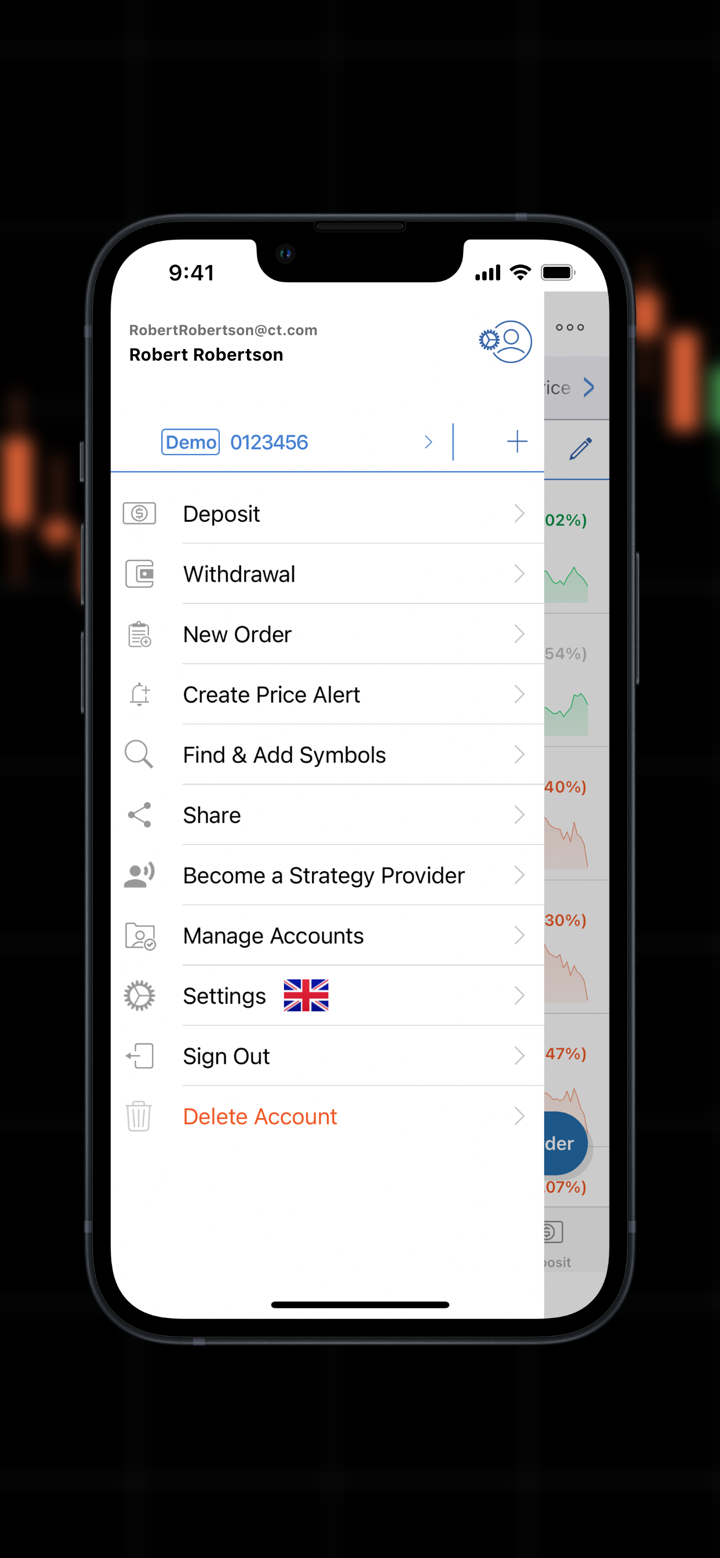

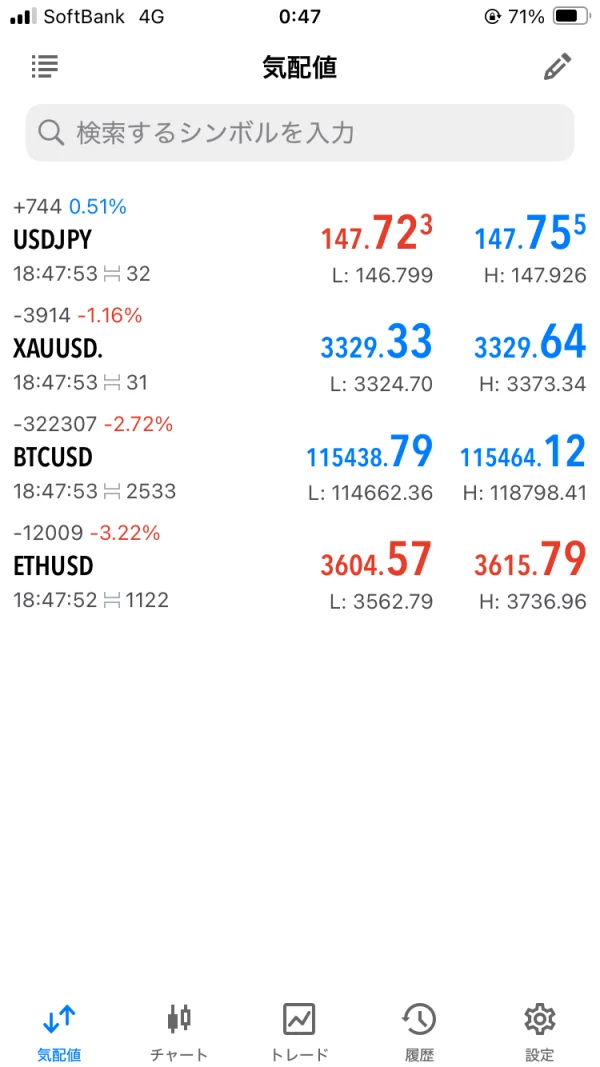

交易平台

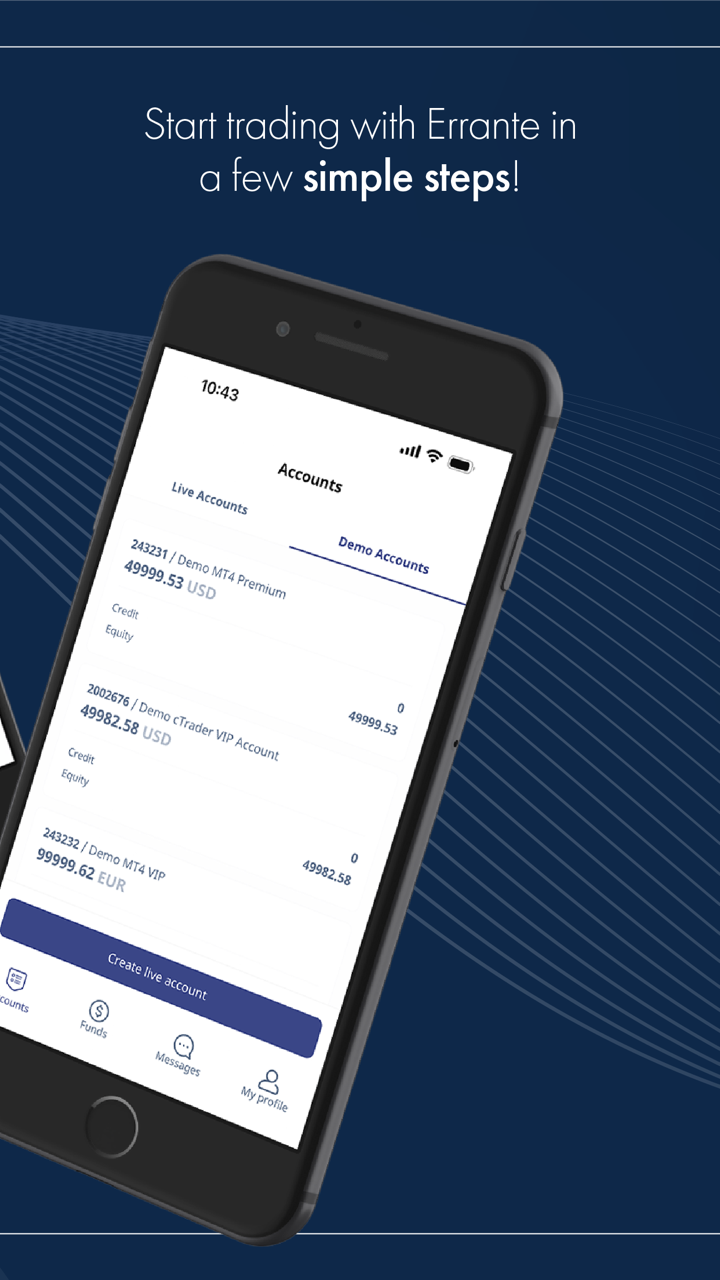

Errante为交易者提供了MT4和MT5交易平台,MT4是全球金融市场上最受欢迎,最强大的交易软件之一,MT5是MT4的最新版,交易者可以根据自己的需求灵活选择适合自己的交易软件。

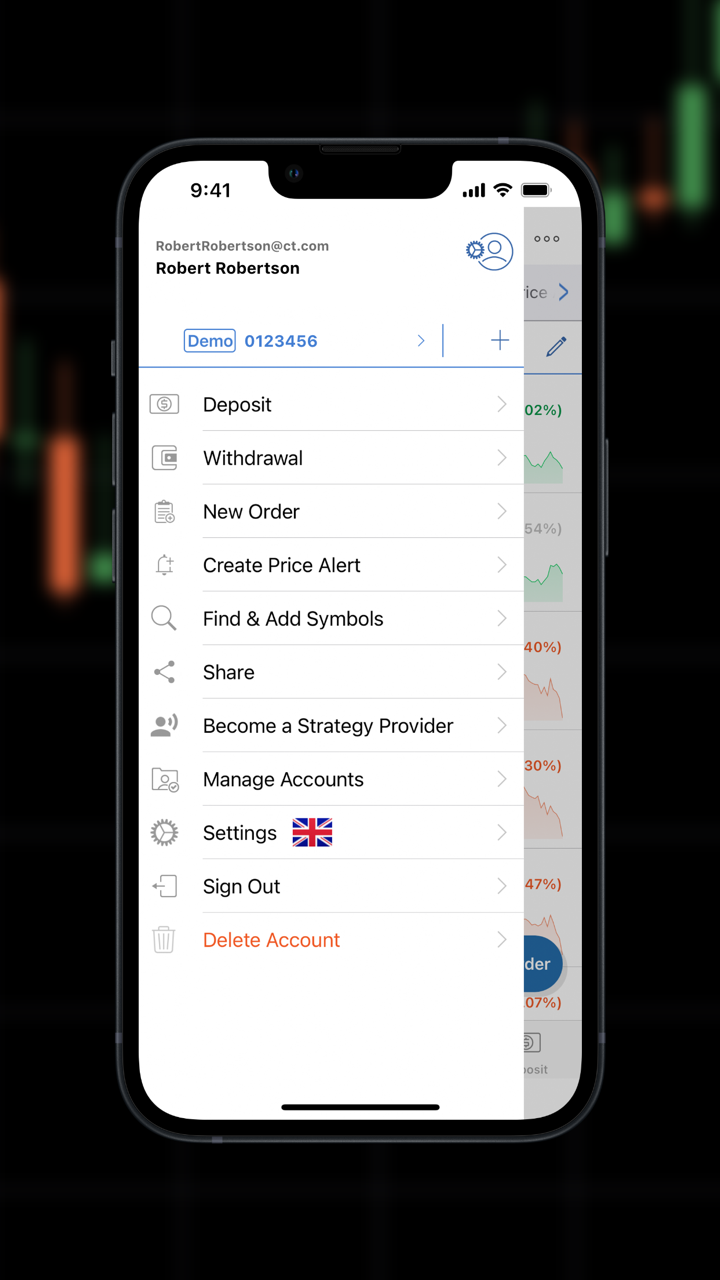

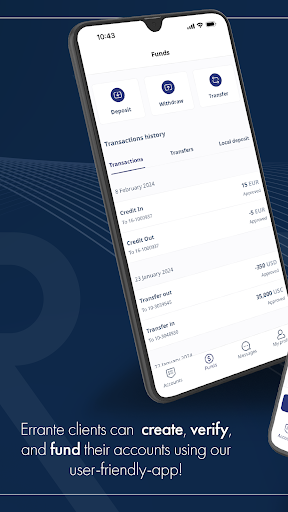

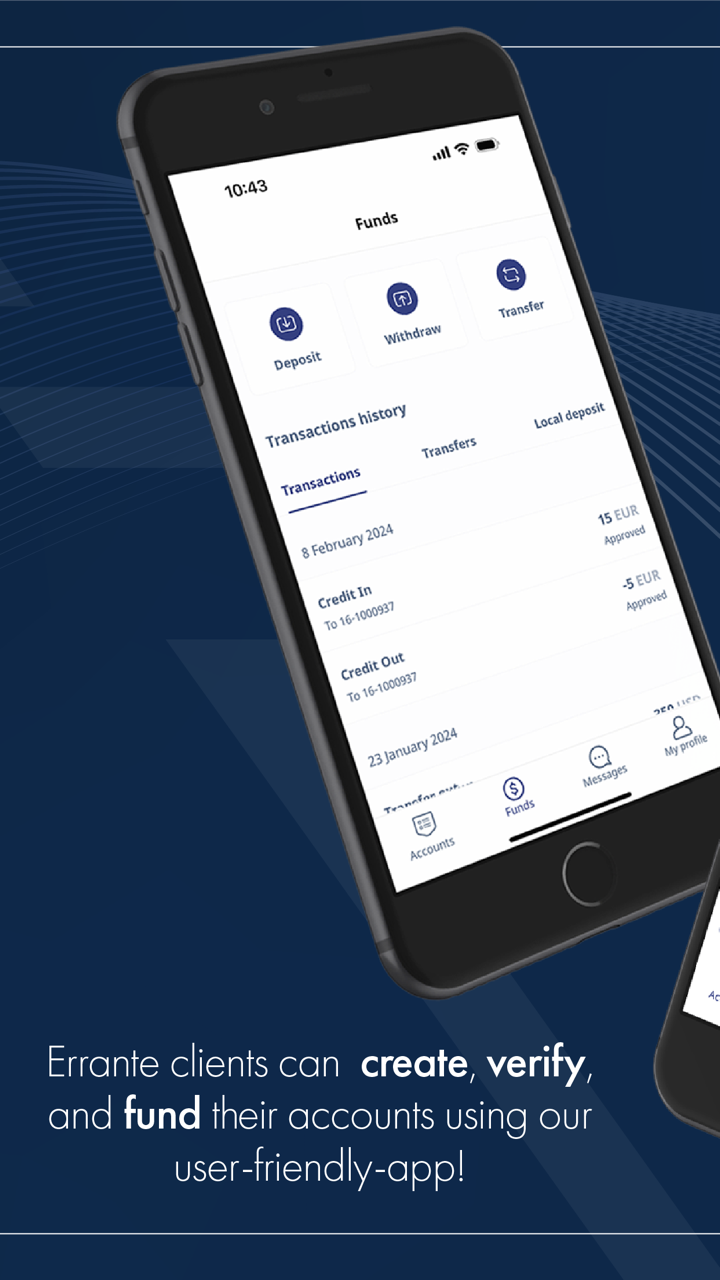

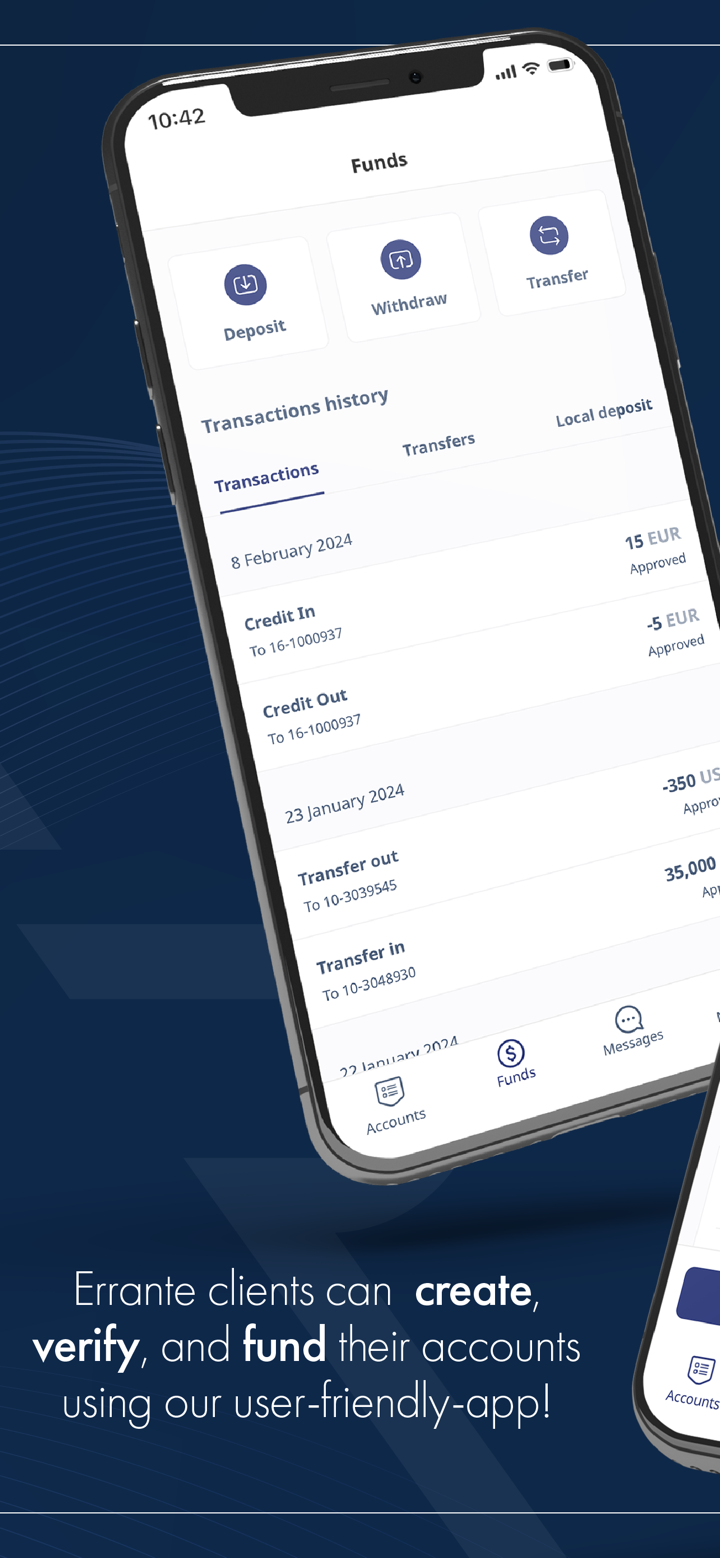

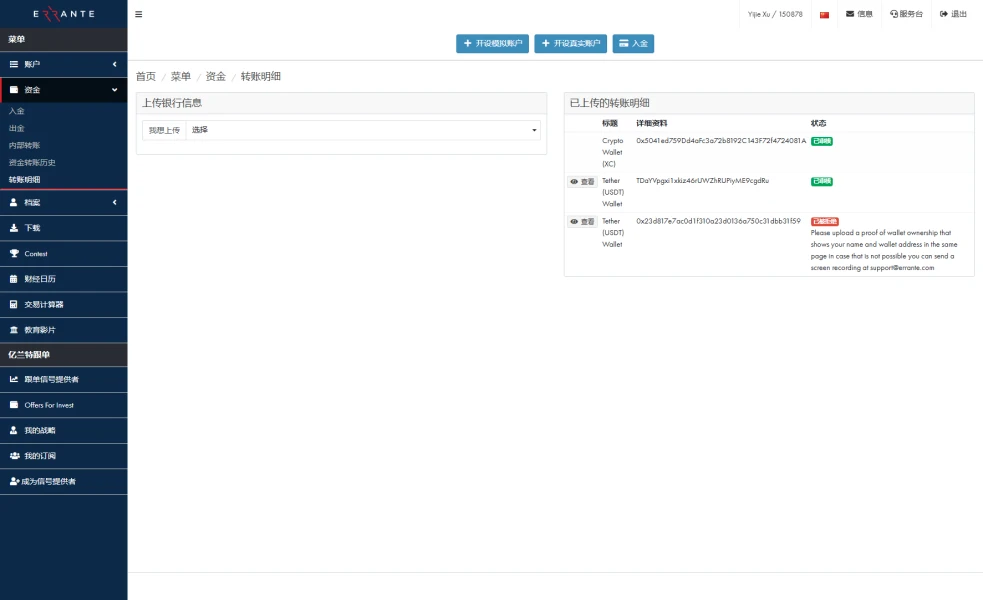

出入金

Errante为投资者提供多种便捷安全的出入金方式,主要有电汇(支持欧元,美元,最低入金50美元/欧元,最低出金100欧元/美元,出入金无手续费),VISA, MasterCard借记卡/信用卡(支持欧元,美元,最低入金50美元/欧元,最低出金20美元/欧元,无手续费),NETELLER,STICPAY, Skrill, Perfect Money, CASHU(这些电子支付方式支持欧元,美元,最低入金50美元/欧元,最低出金20美元/欧元,出金需需支付1%的手续费),加密货币支付如比特币,莱特币,以太坊等(最低入金50欧元/美元,最低出金20欧元/美元,出入金无手续费)。

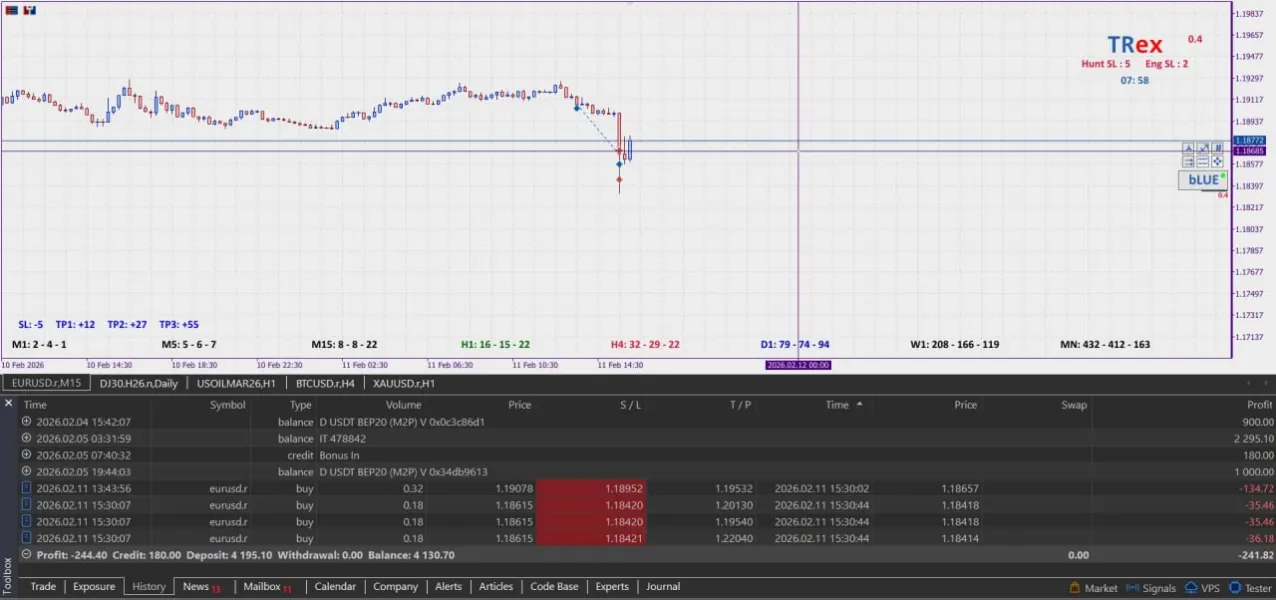

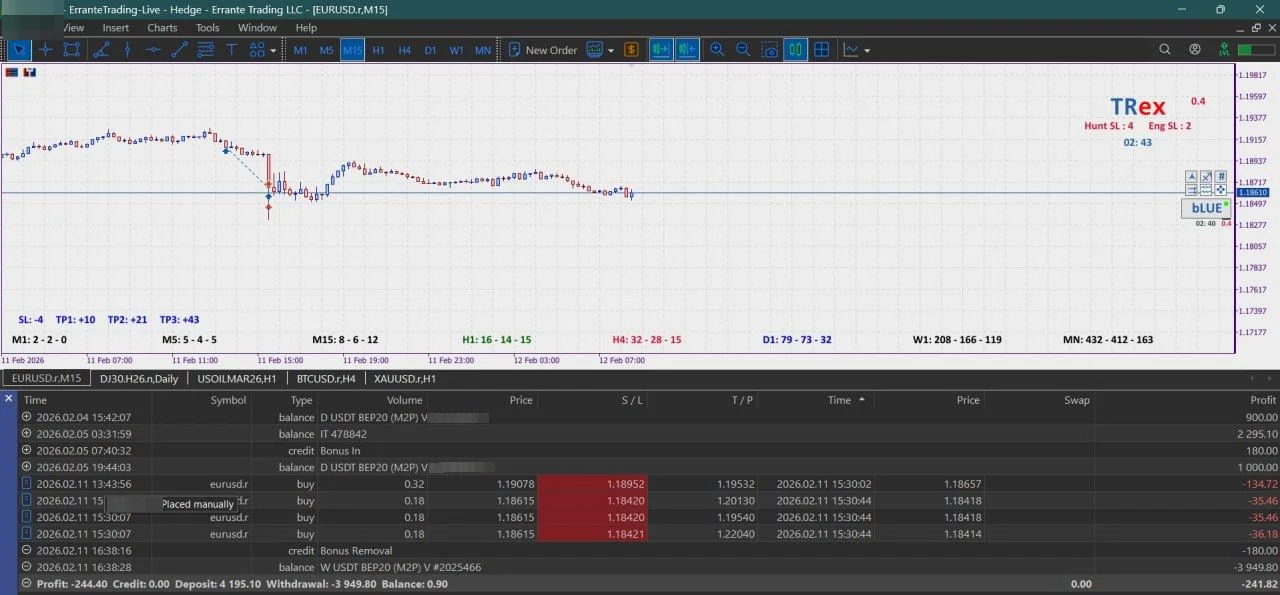

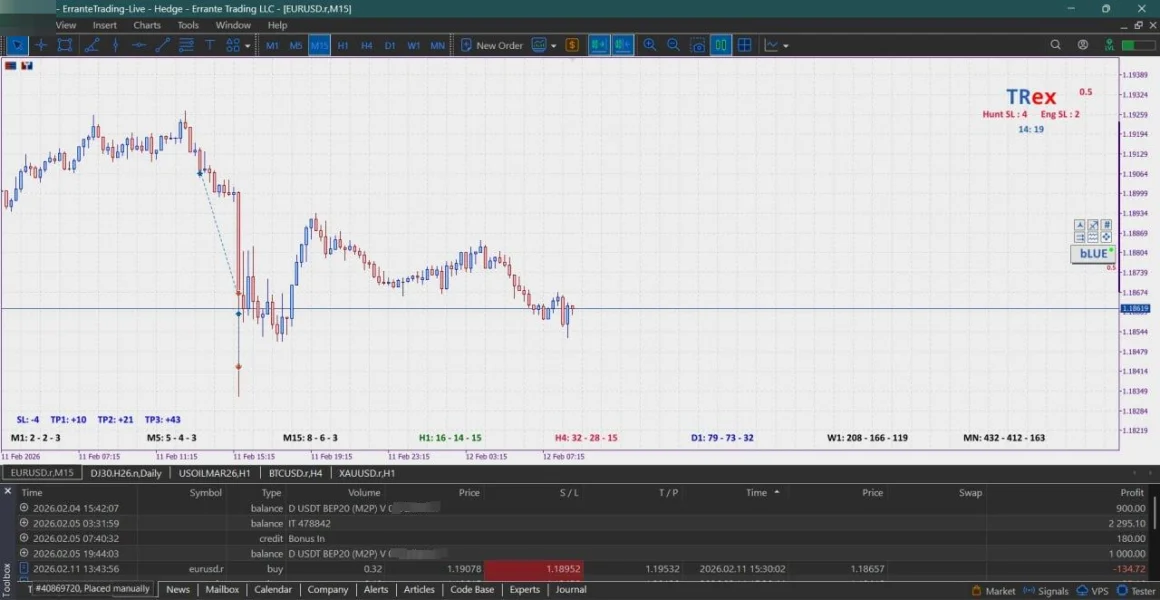

rasool2757

美国

昨天这家黑平台在我的欧元/美元VIP账户上恶意触发止损,一下打掉我40个点!我去找客服,他们居然用“市场滑点”这种借口来搪塞!千万别再用这个诈骗经纪商了!🚫🚫🚫⛔️⛔️❌️❌️🆘️🆘️

曝光

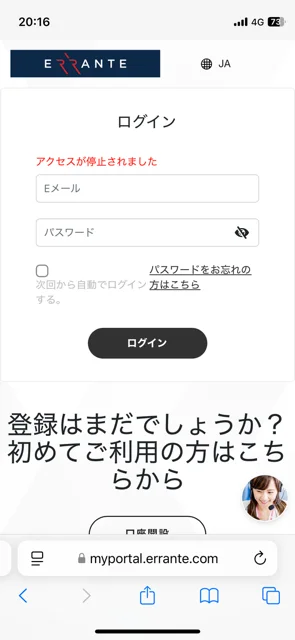

FX2788163487

日本

当我试图提取我的利润时,我收到了以下电子邮件。 ------------ 我们在我们的负责部门检查了您的使用环境,并发现同一个IP地址被多个账户使用(这些账户似乎属于不同的客户)。这种情况很可能违反我们的服务条款,我们遗憾地撤销了相关交易的利润。此外,我们采取了措施冻结您的账户。感谢您的理解。 ------------ 我的家人没有进行外汇交易,所以我不知道这是从哪里来的。这是一种不公平的对待。

曝光

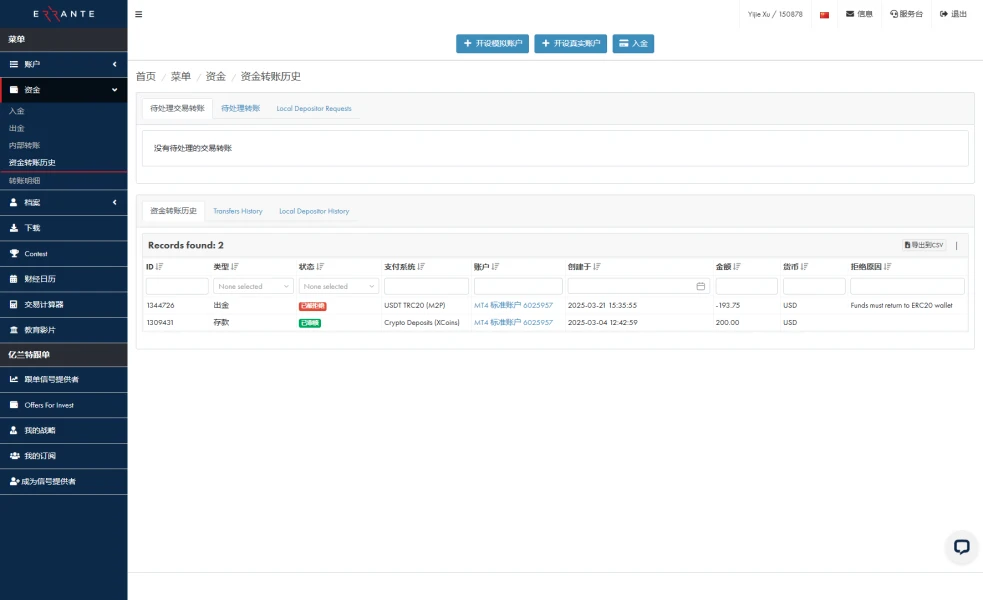

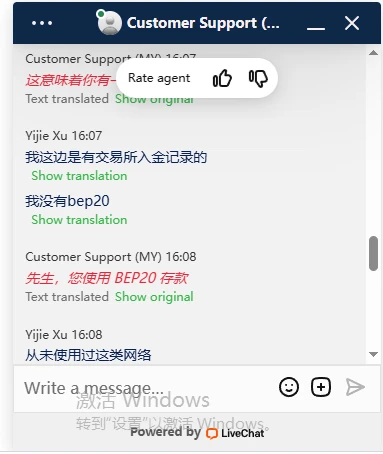

gh5479

香港

黑平台,只能进不能出,我出金选用trc20出金,平台给我拒绝,理由是资金返回需使用erc20,随后我又绑定了erc20,平台又拒绝出金理由需要上传交易所姓名以及钱包地址,询问平台客服之后,平台客服居然说我入金的网络是bep20,我入金使用的是欧易交易所,笑死交易所都没这网络,客服随便又说,我必须绑定bep20钱包地址才可以出金,纯纯黑平台,只进不出

曝光

R Y

日本

由于我拙劣的交易导致全损,很快就停止使用了,但订单执行等方面没有问题,我认为是一家不错的公司。

中评

FX2563990896

日本

与其他平台相比,点差感觉算是普通水平。 滑点等现象也基本没有出现。 值得注意的是,该平台采用了根据交易量动态调整杠杆的动态杠杆制度。

中评

FX1825073414

日本

我是冲着开户奖金注册的,但感觉也就那样吧……谈不上好也谈不上坏。既没有特别突出的忠诚度计划,点差也不算窄……硬要说是否有作为主账户的价值,我觉得存疑。另外坊间也有无法提款的传闻,考虑到这点就更觉得……大概就是这种感受吧。

中评

ナカみどり

日本

入金也很顺利。因为也能出金,所以可以放心了。

好评

FX8823628920

日本

成功领取了开户奖金5000日元!由于提款条件相对宽松,我认为可以顺利达成。

好评

Wingwing Ng

白俄罗斯

ERRANTE的最低存款与行业内其他平台相当。他们的存款和提款流程简单可靠,但与其他经纪人相比,没有太多突出之处。

中评

Larance Chris

澳大利亚

外汇、商品和指数在这里表现不错。点差还可以,交易条件似乎总体上还不错。ERRANTE很棒,我仍然在这里交易外汇和指数。免费的VPS也加快了交易执行速度,当我开设专业账户时,我可以使用它。正常的交易执行也非常不错。

好评

Lilybrown

美国

ERRANTE,我的贸易船。受监管且多样化的服务使其成为稳定的旅程。多个帐户和可靠的平台增添了旅程。留意有限的监管范围和潜在的杠杆风险。定制账户的佣金费用令人惊讶,但总体而言,18 个月后感到满意

中评

daniel1530

马来西亚

我想再次曝光errante 我想调解不是要吵架但是客服都不能够理解 我相信如果交易商的老板知道这件事情他一定会帮忙我解决这个案例 我们哪里知道几时系统出错 系统问题也不是我们照成的 我只想协调拿回我应该拿的钱 不是小数目USD24000 亏了我们自己亏 赚了又是自己亏

曝光

amir9354

英国

非常好的经纪人,出色的支持,提款很快就受到 cysec 监管。 Metatrader 4-5 和流行的 Ctrader 程序的完整许可证。公平的点差。仅在翻转期间才会感觉到滑移。

好评

daniel1530

马来西亚

我在Errante平台交易盈利了将近有24000USD,平台商说系统出错就把我所有账户封锁了,连我本金都不归还,不让我登录进去截图证据,客服&Facebook&Instagram也把我拉黑了,这是正规平台的操作吗?这么对待用户, 这间公司还强行关闭我的账号因为还有浮亏限定我20小时关单 这间公司系统不是出问题一次了 我跟了两年遇到到三次但是都是没有要承担后果 如果今天我的事件没有得到解决又会有下个交易员遇到同样问题 希望第三方人员能够处理好这件事情 现在我也遇到户口封锁所以证据还不止这些

曝光

daniel1530

马来西亚

我盈利了但是公司自动扣除说系统问题报价出错 但是还是连续两天都开放给顾客交易理由是因为假日没有技术人员维修 但是有技术人员扣除顾客的盈利 我其他证据都要之前户口里 公司把我封锁到连户口都开不到 我两天盈利USD24000 希望这个平台可以帮忙我追究 我也担心自己说错话被告所以要求你们帮忙我解决

曝光

随缘化

美国

这真的很令人惊讶,但我以 1000 美元开始了一项投资,他们提供最好的服务,并且将客户的最大利益放在心上。你可以亲眼看看,你会着迷的。

中评

FX2409997059

巴西

我曾经合作过的最好的经纪人....出色的支持并满足我们的所有要求......

好评

。94447

英国

该平台确实有良好的交易条件,但经常出现高滑点,高达 5 倍的点差。好吧,这似乎不是一个理想的交易平台......

中评

金鑫23788

哥伦比亚

大家好,我是wikifx用户,最近看到这里出现了一个版块:评论。所以我来这里是为了填补空白!好吧,我是一个流浪的顾客。这是一个很好的经纪人,因为它是安全的!您知道这些外汇经纪商每天犯下多少骗局吗?好吧,流浪不是那样的。这些条件,虽然不可能满足每个人的需要,但对我来说是公平和有吸引力的。

好评

FX5179656533

香港

之前加了10美金的点差 想着刷返佣 结果今天发现账户返佣全部以佣金更正为由变成0了 交易账户的钱也被扣干净了 请问这种行为是什么样的一家平台才能干出来的事儿呢 请大家远离这种无良平台 mt4 3013708

曝光

Gustavo@Fring

马来西亚

交易商Errante用客户投资的钱付给销售人员,还故意拖延时间,让客户赔钱。

曝光

Gustavo@Fring

马来西亚

交易商Errante不允许用户出金资金并限制他们访问账户。Errante目前已收到5个用户投诉。投诉基本涉及无法取款、异常交易、故意制造滑点、拿客户钱给员工发工资等问题,6月份只解决了1个投诉,其余投诉Errante都没有回应。

曝光

勉为其难

香港

直接封掉后台,佣金不给出,本金也不给出。金额3000美金。黑平台给黑吃黑了

曝光