Grundlegende Informationen

Brasilien

Brasilien

Bewertung

Brasilien

|

5-10 Jahre

|

Brasilien

|

5-10 Jahre

| http://www.rico.com.vc

Website

Bewertungsindex

Einfluss

A

Einflussindex NO.1

Brasilien 8.76

Brasilien 8.76 Lizenzen

LizenzenKeine gültigen Verordnungsinformationen gefunden, bitte beachten Sie das Risiko!

Brasilien

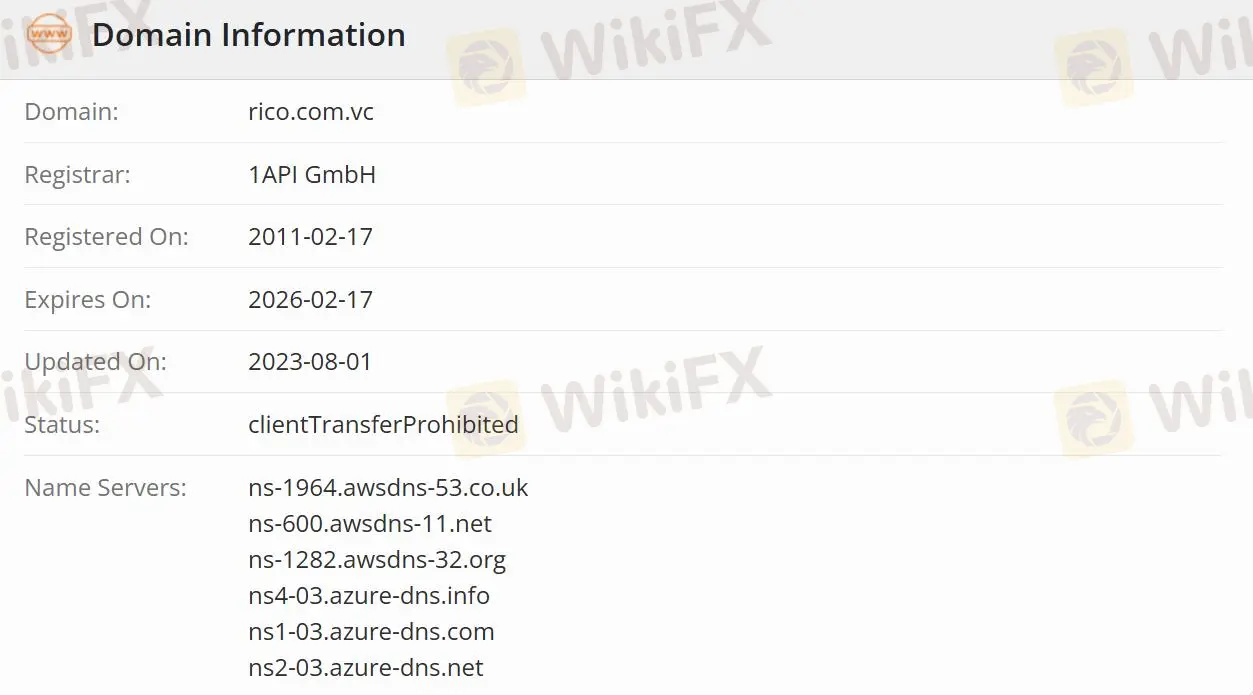

Brasilien rico.com.vc

rico.com.vc Vereinigte Staaten

Vereinigte Staaten| RICO Überprüfungszusammenfassung | |

| Gegründet | 2011-02-17 |

| Registriertes Land/Region | Brasilien |

| Regulierung | Unreguliert |

| Produkte | Alle Investitionen/Direkte Schatzanweisungen/Festverzinsliche Wertpapiere/Andere Investitionen/Der Aktienmarkt und BM&F |

| Demo-Konto | ✅ |

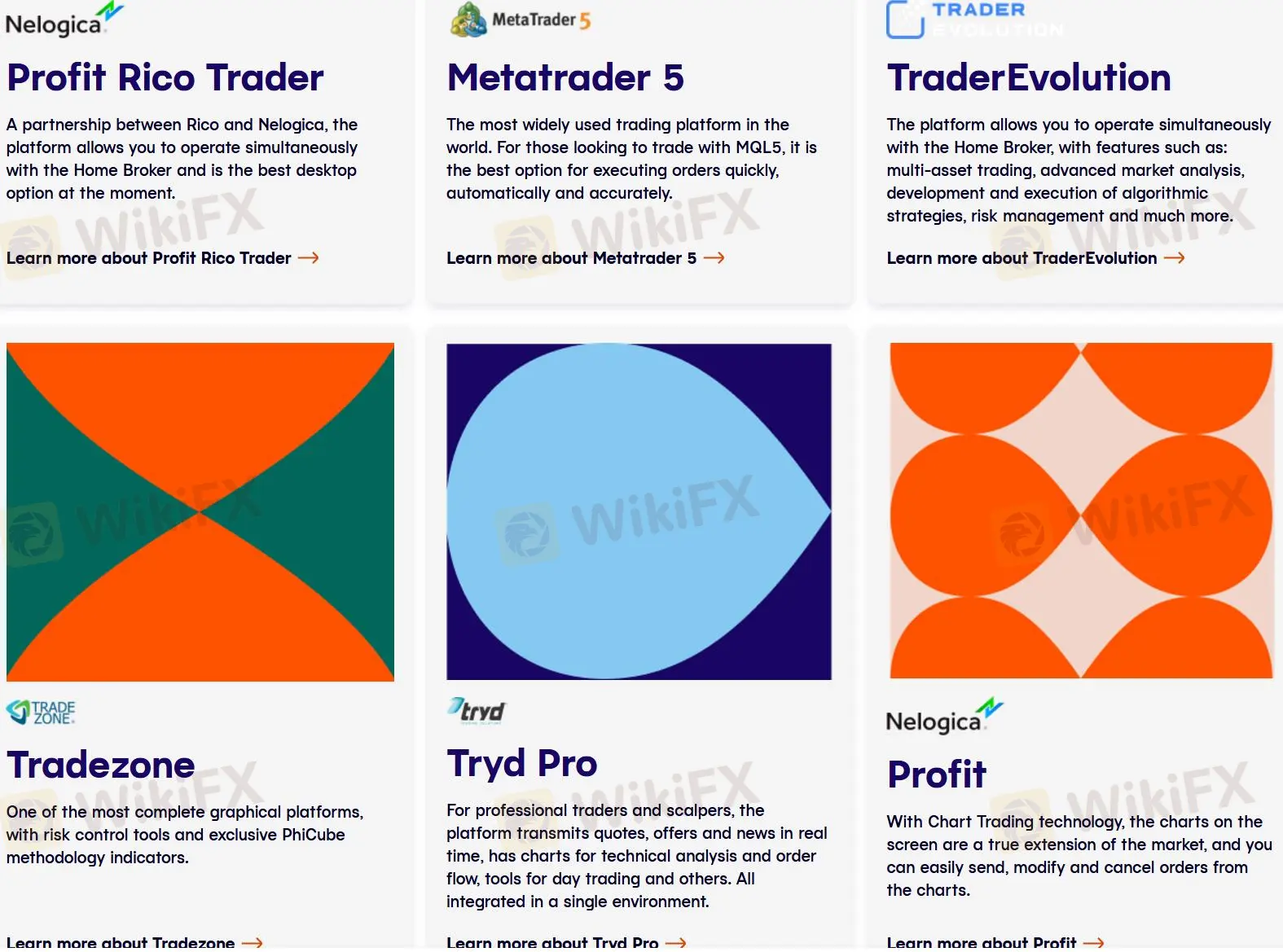

| Handelsplattform | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| Kundensupport | Telefon: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

Gegründet im Jahr 2011, ist RICO ein unreguliertes Investmentunternehmen mit Sitz in Brasilien. Das Unternehmen bietet verschiedene Produkte an, darunter alle Investitionen und Simulatoren sowie 5 große Plattformen mit unterschiedlichen Gebühren, wie Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro und Profit. RICO bietet Anlagekonten für Investitionen und digitale Konten zur Abwicklung täglicher Transaktionen an.

RICO ist nicht reguliert, was es weniger sicher macht als regulierte Unternehmen.

Das Unternehmen bietet verschiedene Produkte an, darunter alle Investitionen, direkte Schatzanweisungen, festverzinsliche Wertpapiere, CBD, LC, LCA, LCI und Anleihen. RICO bietet auch andere Investitionen wie Investmentfonds, Immobilienfonds, COE, CRI, CRA und öffentliche Angebote-IPO an. Darüber hinaus umfasst der Aktienmarkt und BM&F Aktienverleih, Optionen, Futures-Kontrakte, Mini-Kontrakte, Aktien-Futures und Liquiditätsanbieter-RLP.

Rico bietet zwei Konten mit unterschiedlichen Guthaben an. Über das Anlagekonto können Benutzer in festverzinsliche und variable Anwendungen investieren und das Digitalkonto verwenden, um tägliche Transaktionen wie Rechnungen bezahlen, PIX und TED senden und empfangen sowie Gehälter erhalten zu verwalten.

Bei RICO können Benutzer jede Plattform frei wählen, einschließlich Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro und Profit. Abgesehen von Metatrader5 (Echt- und Demokonto) sind Tradezone Web (Webchart) und TraderEvolution Web-Plattformen kostenlos. Die Gebühren, die von jeder Plattform erhoben werden, sind ebenfalls unterschiedlich:

R$ 60,00 – Tradezone Desktop;

R$ 160,00 – TraderEvolution Desktop;

R$ 14,90 – RicoTrader;

R$ 100,00 – Tryd Pro;

R$ 19,90 – Tryd Trader;

R$ 120,00 – ProfitPlus und

R$ 139,90 – ProfitPro.

Jedoch gibt es für kostenpflichtige Plattformen auch eine ISS-Gebühr in Höhe von 10,68% des Betrags.

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Desktop/Mobile |

| Tradezone | ✔ | Desktop/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

Händler können RICO auf YouTube, Instagram,Facebook und Twitter folgen und über WhatsApp und Telefon mit dem Unternehmen in Kontakt bleiben.

| Kontaktmöglichkeiten | Details |

| Telefon | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| Soziale Medien | YouTube, Instagram, Facebook, Twitter |

| Unterstützte Sprache | Portugiesisch |

| Websprache | Portugiesisch |

| Adresse | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |

As an independent trader with years of experience evaluating brokers, I approach every platform with caution and a keen focus on its product range and regulatory standing. When I looked into RICO, I noted that the broker is a Brazil-registered investment company offering diverse instruments but, importantly, remains unregulated—an aspect that raises significant safety concerns for me and dictates extra vigilance. From my assessment, RICO does not focus exclusively on forex. Instead, it takes a broader approach, providing access to a variety of investment products. RICO offers instruments such as stocks, options, futures contracts (including mini and stock futures), stock rental, and liquidity provider services within the BM&F Brazilian market ecosystem. Additionally, there are direct treasury, fixed income products, debentures, and other investment options like real estate funds, investment funds, COEs, CRIs, CRAs, and IPOs. However, despite offering MetaTrader 5—which is popular among forex traders—I couldn’t find clear evidence of dedicated forex or cryptocurrency trading. The emphasis seems much more geared toward the Brazilian equity and derivatives landscape rather than global forex or crypto assets. Given these nuances, RICO’s strength lies in accommodating Brazilian market instruments and fixed-income products rather than serving as a well-rounded international CFD or forex provider. If your trading interests are primarily in forex or digital assets, my experience suggests that this broker may not fulfill those needs. Most importantly, due to the lack of regulation, I would personally exercise considerable caution before considering significant capital exposure here.

Based on my review and experience in assessing brokers, understanding the complete cost structure is crucial before considering trading indices like the US100 on RICO. What stands out immediately for me is that RICO is unregulated and flagged as high risk, which, from my perspective, already demands extra caution. In regulated environments, trading costs are generally well-disclosed and somewhat standardized. However, with RICO, the breakdown is far less transparent. The primary trading costs for indices like the US100 on RICO are composed of both platform fees and any embedded trading costs (such as spreads or commissions). RICO offers several platforms, but some, including Tradezone Desktop and TraderEvolution Desktop, carry fixed monthly fees—R$60 and R$160, respectively—while others like RicoTrader and Tryd Pro also incur ongoing charges. On top of that, there’s a mandatory ISS tax of 10.68% added to those fees. For me, these platform charges are quite significant, especially compared to brokers where platforms are often free. What isn’t clearly detailed by RICO is the specific spread or commission per trade for indices such as the US100. That lack of transparency is a major red flag in my experience; it means I wouldn’t be able to estimate my total trading costs reliably. Between recurring platform fees, additional taxes, and uncertain on-trade charges, the true cost of trading indices on RICO could easily outweigh any potential benefits, especially when safer, more transparent alternatives exist. For me, the combination of high fixed costs and regulatory uncertainty makes this broker an unattractive choice for index trading.

Drawing on my experience as an independent trader, I have significant reservations regarding RICO, particularly when it comes to platform stability and customer support. The foremost concern for me is that RICO operates without valid regulation or oversight, which introduces a substantial element of risk that cannot be understated. This lack of regulatory protection is a red flag and affects my overall trust in any services they offer—including their technical performance and user help channels. In terms of platform stability, while RICO provides a range of trading platforms such as MetaTrader 5, Profit Rico Trader, and others, I am cautious. The diversity in platform offerings is appealing on the surface, but when these are tied to an unregulated broker, I worry about service reliability, execution integrity, and potential for technical disruptions—especially during volatile market periods. Stability is crucial in active trading, and without the backing of robust oversight, any assurances about uptime or order processing feel less convincing. Customer support is another critical area for me. Although RICO offers multiple contact methods, including WhatsApp, phone, and several social media channels, the effectiveness of these services, in my view, is ultimately questionable without strict industry supervision. Responsive and accountable support is essential for resolving trading or account issues promptly, and for me, this assurance is lacking when dealing with an entity flagged for high risk and no regulatory backing. Ultimately, my cautious stance with RICO is shaped by these observations. For traders prioritizing safety and dependable service, I believe it is vital to weigh these drawbacks very seriously before committing funds or relying on their support or technology.

In my experience, making an initial withdrawal from an unregulated broker like RICO requires particular caution. As RICO operates without any formal regulatory oversight, there is less transparency and no mandated standard for documentation requirements. However, most investment platforms—especially those based in Brazil and offering both investment and digital accounts—generally request certain documents to comply with internal policies and banking partners’ anti-fraud measures. Typically, I expect to need to provide a government-issued photo ID, such as a passport or national identity card, along with proof of address, which could include a recent utility bill, bank statement, or similar official document showing my name and address. Depending on the platform's internal procedures, a selfie holding my ID or additional verification steps may sometimes be necessary, especially since RICO seems to deploy multiple platforms and technologies, further increasing the importance of proper identification. Since RICO is unregulated and WikiFX has flagged it with high risk and a suspicious license, I am acutely aware that withdrawal rules might change, delays can happen, and extra documentation might be requested—sometimes at short notice. Personally, I always keep my account registration details, transactional history, and any correspondence with support saved, as these can become crucial if I ever have to demonstrate account ownership. Ultimately, the lack of regulatory supervision means I approach withdrawals from RICO with added vigilance and always make sure I am prepared to supply basic ID and address documents as a minimum, with the possibility of further requests depending on the firm’s risk management approach.

Bitte eingeben...

TOP

TOP

Chrome

Chrome Plug-In

Aufsichtsrechtliche Anfrage zu globalen Forex-Brokern

Es durchsucht die Forex-Broker-Websites und identifiziert die legitimen und betrügerischen Broker genau

Jetzt installieren