Présentation de l'entreprise

| KCB Résumé de l'examen | |

| Fondé | 1896 |

| Pays/Région enregistré | Burundi |

| Réglementation | Pas de réglementation |

| Produits et Services | Carte, Prêt, Investissements, Forex |

| Compte de démonstration | ❌ |

| Dépôt minimum | / |

| Assistance clientèle | Téléphone : +25776522500 |

| Email : serviceclientele@bi.kcbbankgroup.com | |

| Formulaire de contact, médias sociaux | |

Fondée en 1896, KCB est une société financière non réglementée basée au Burundi. Elle propose des services de cartes, de prêts, d'investissements et de Forex.

Avantages et inconvénients

| Avantages | Inconvénients |

| Services multiples | Pas de réglementation |

| Types de compte diversifiés | |

| Multiples canaux de support client |

KCB est-il légitime ?

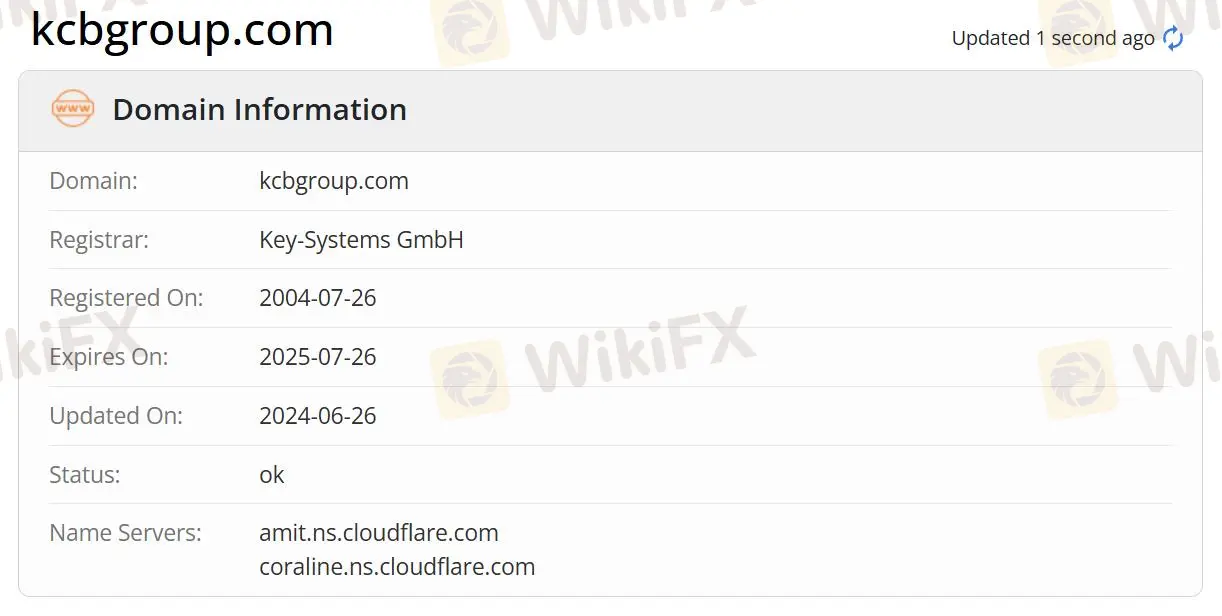

Actuellement, KCB ne dispose pas d'une réglementation valide. Son domaine a été enregistré le 26 juillet 2004 et son statut actuel est "ok". Veuillez accorder une attention particulière à la sécurité de vos fonds si vous choisissez ce courtier.

Produits et services

KCB propose des services de cartes, de prêts, d'investissements et de Forex.

Type de compte

KCB propose deux types de comptes : Comptes de transaction et Compte d'épargne. Le compte de transaction comprend Compte étudiant et Compte courant, et le compte d'épargne comprend Compte d'épargne Simba et Compte Cub.

Moyens bancaires

KCB prend en charge les moyens bancaires via AGENCES, DAB, AGENTS DE KCB BANK, BANQUE MOBILE, BANQUE EN LIGNE et SERVICES DE TRANSFERT D'ARGENT.