Buod ng kumpanya

| RICO Buod ng Pagsusuri | |

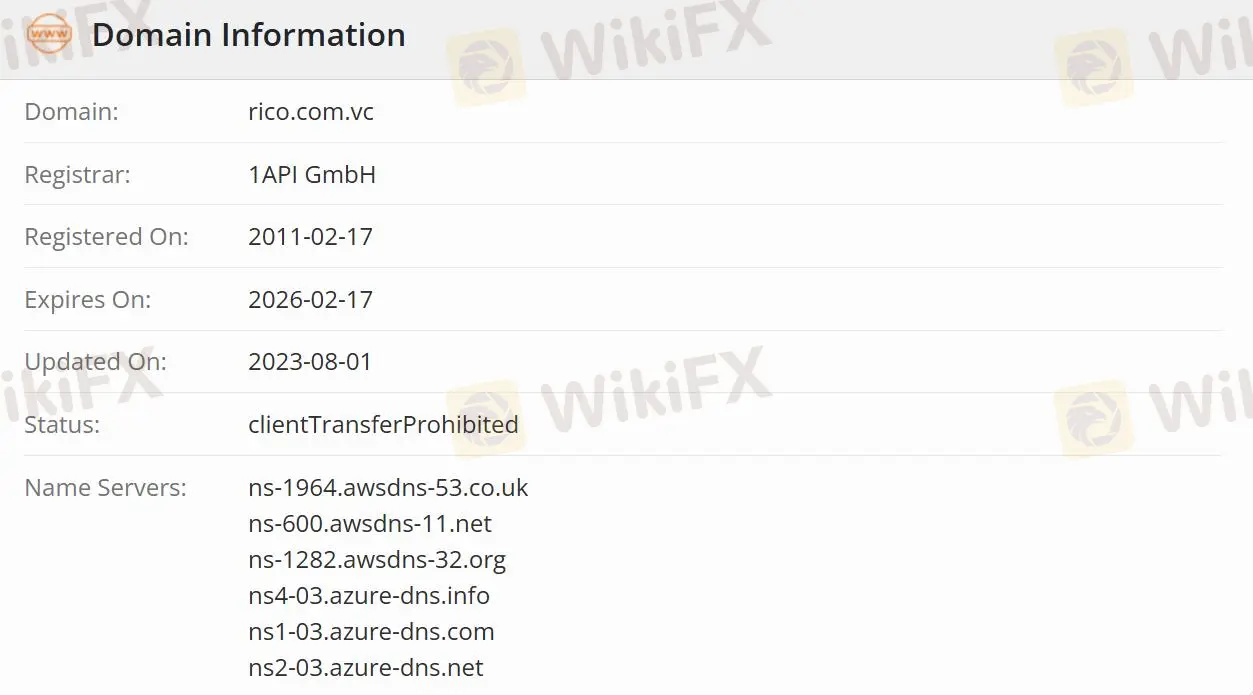

| Itinatag | 2011-02-17 |

| Rehistradong Bansa/Rehiyon | Brazil |

| Regulasyon | Hindi Regulado |

| Mga Produkto | Lahat ng Investments/Direktang Treasury/Tixed Income/Iba pang mga Investments/Ang Stock Market at BM&F |

| Demo Account | ✅ |

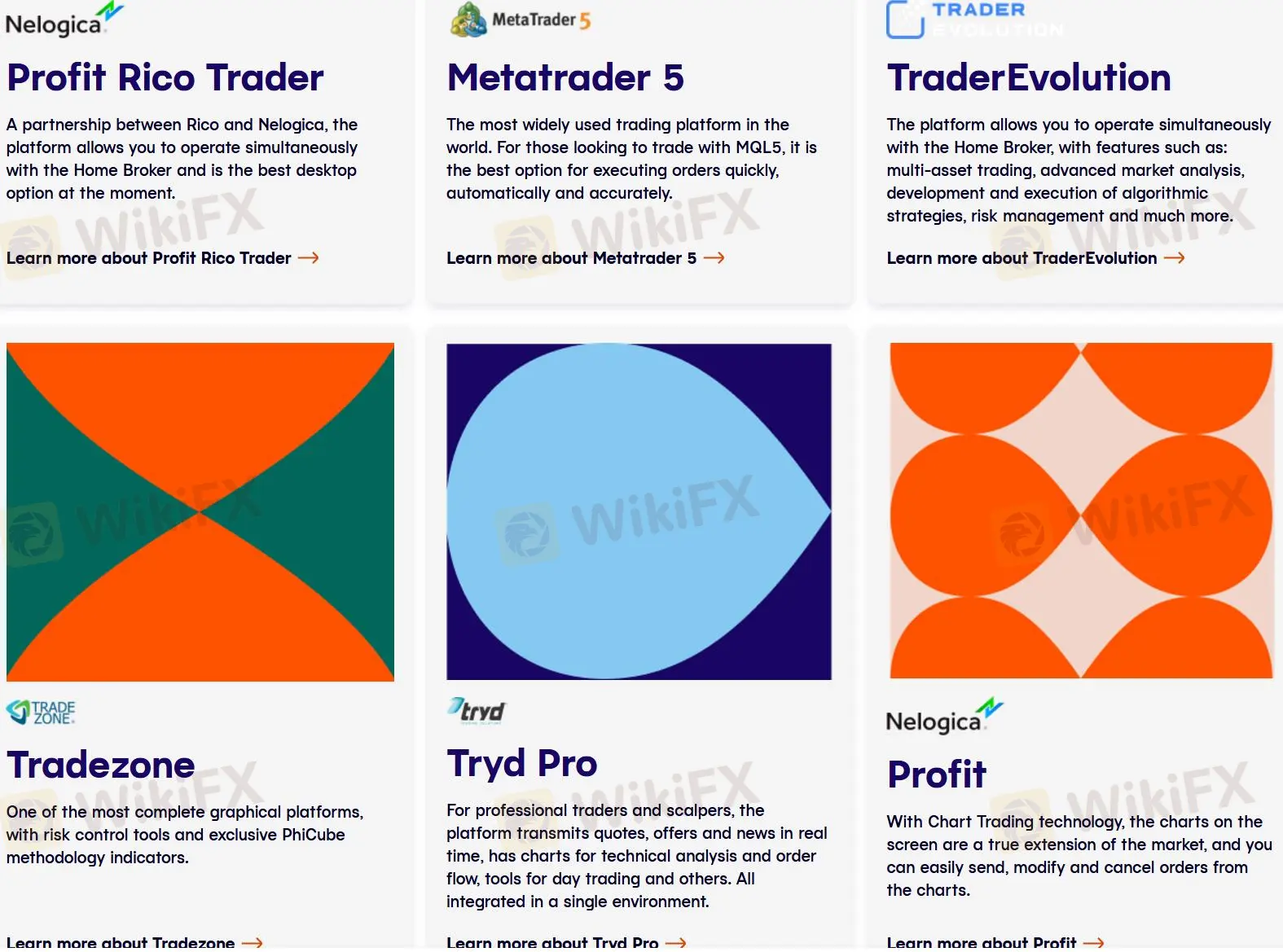

| Plataforma ng Pag-trade | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| Suporta sa Customer | Telepono: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

RICO Impormasyon

Itinatag noong 2011, ang RICO ay isang hindi reguladong kumpanya sa pamumuhunan na naka-rehistro sa Brazil. Nagbibigay ang kumpanya ng iba't ibang mga produkto kabilang ang lahat ng mga investment at mga simulator at 5 pangunahing plataporma na may iba't ibang bayarin, tulad ng Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro, at Profit. Nag-aalok ang RICO ng mga investment account para sa pag-iinvest at digital account para sa pang-araw-araw na transaksyon.

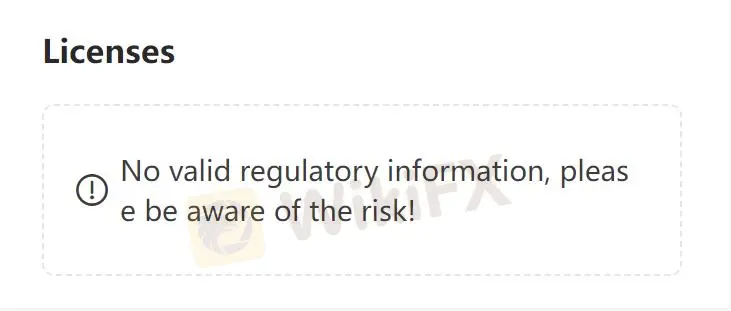

Totoo ba ang RICO?

Ang RICO ay hindi regulado, kaya mas hindi ligtas kumpara sa mga reguladong kumpanya.

Ano ang mga produkto na ibinibigay ng RICO?

Nagbibigay ang kumpanya ng iba't ibang mga produkto kabilang ang lahat ng mga investment, direktang treasury, fixed income, CBD, LC, LCA, LCI, at debentures. Nag-aalok din ang RICO ng iba pang mga investment, tulad ng mga investment fund, real estate fund, COE, CRI, CRA, at public offering-lPO. Bukod dito, kasama rin ang stock market at BM&F na may kinalaman sa Stock rental, Options, Futures contracts, Mini contracts, Stock futures, at Liquidity Provider-RLP.

Uri ng Account

Nag-aalok ang Rico ng dalawang account na may iba't ibang balanse. Sa pamamagitan ng investment account, maaaring mamuhunan ng mga gumagamit sa fixed-income at variable-income applications, at gamitin ang digital account para sa pang-araw-araw na transaksyon tulad ng pagbabayad ng mga bill, pagpapadala at pagtanggap ng PIX at TED, at pagtanggap ng sahod.

Plataforma ng Pag-trade

Sa RICO, malaya ang mga gumagamit na pumili ng anumang plataporma kabilang ang Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro, at Profit. Bukod sa Metatrader5 (real at demo account), ang mga plataporma ng Tradezone Web (Webchart) at TraderEvolution Web ay libre. Ang bayad na kinakaltas ng bawat plataporma ay iba-iba rin:

R$ 60.00 – Tradezone Desktop;

R$ 160.00 – TraderEvolution Desktop;

R$ 14.90 – RicoTrader;

R$ 100.00 – Tryd Pro;

R$ 19.90 – Tryd Trader;

R$ 120.00 – ProfitPlus at

R$ 139.90 – ProfitPro.

Gayunpaman, para sa mga bayad na plataporma, mayroon ding gastos ng ISS na 10.68% ng halaga na kinakaltas.

| Plataporma ng Pagkalakalan | Supported | Available Devices |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Desktop/Mobile |

| Tradezone | ✔ | Desktop/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

Mga Pagpipilian sa Suporta sa Customer

Maaaring sundan ng mga mangangalakal ang RICO sa YouTube, Instagram,Facebook, at Twitter at makipag-ugnayan sa kumpanya sa pamamagitan ng pagtawag sa WhatsApp at telepono.

| Mga Pagpipilian sa Pakikipag-ugnayan | Mga Detalye |

| Telepono | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| Social Media | YouTube, Instagram, Facebook, Twitter |

| Supported Language | Portuguese |

| Website Language | Portuguese |

| Physical Address | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |