Resumo da empresa

| RICO Resumo da Revisão | |

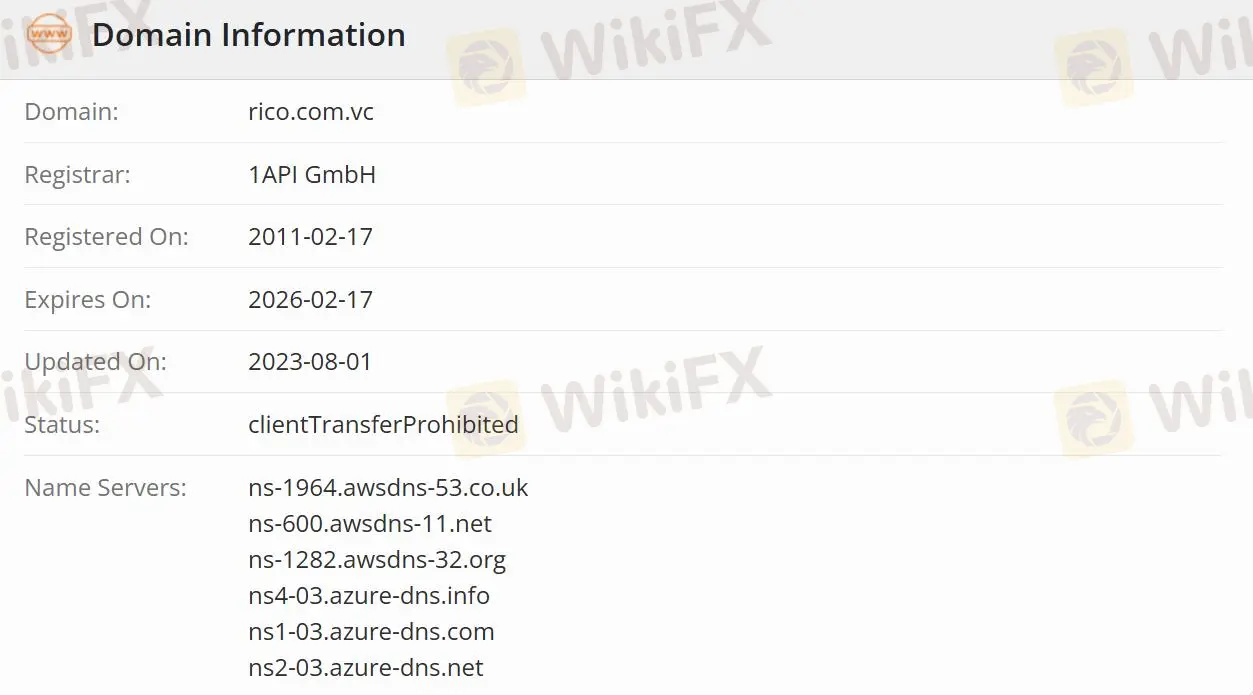

| Fundado | 2011-02-17 |

| País/Região Registrado | Brasil |

| Regulação | Não regulamentado |

| Produtos | Todos os Investimentos/Tesouro Direto/Renda Fixa/Outros Investimentos/Mercado de Ações e BM&F |

| Conta Demo | ✅ |

| Plataforma de Negociação | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| Suporte ao Cliente | Telefone: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

RICO Informação

Fundada em 2011, RICO é uma empresa de investimentos não regulamentada registrada no Brasil. A empresa oferece diversos produtos, incluindo todos os investimentos e simuladores, e 5 principais plataformas com diferentes taxas, como Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro e Profit. RICO oferece contas de investimento para investir e contas digitais para lidar com transações diárias.

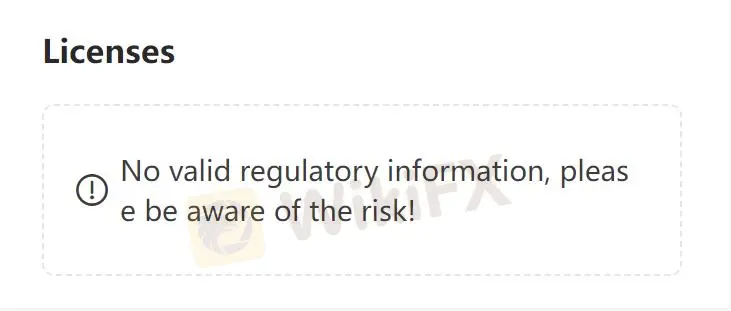

RICO é Legítimo?

RICO não é regulamentado, o que o torna menos seguro do que empresas regulamentadas.

Quais produtos RICO oferece?

A empresa oferece diversos produtos, incluindo todos os investimentos, tesouro direto, renda fixa, CBD, LC, LCA, LCI e debêntures. RICO também oferece outros investimentos, como fundos de investimento, fundos imobiliários, COE, CRI, CRA e oferta pública-IPO. Além disso, o mercado de ações e BM&F envolvem aluguel de ações, opções, contratos futuros, mini contratos, futuros de ações e provedor de liquidez-RLP.

Tipo de Conta

A Rico oferece duas contas com saldos diferentes. Através da conta de investimento, os usuários podem investir em aplicações de renda fixa e renda variável, e usar a conta digital para lidar com transações diárias, como pagar contas, enviar e receber PIX e TED, e receber salários.

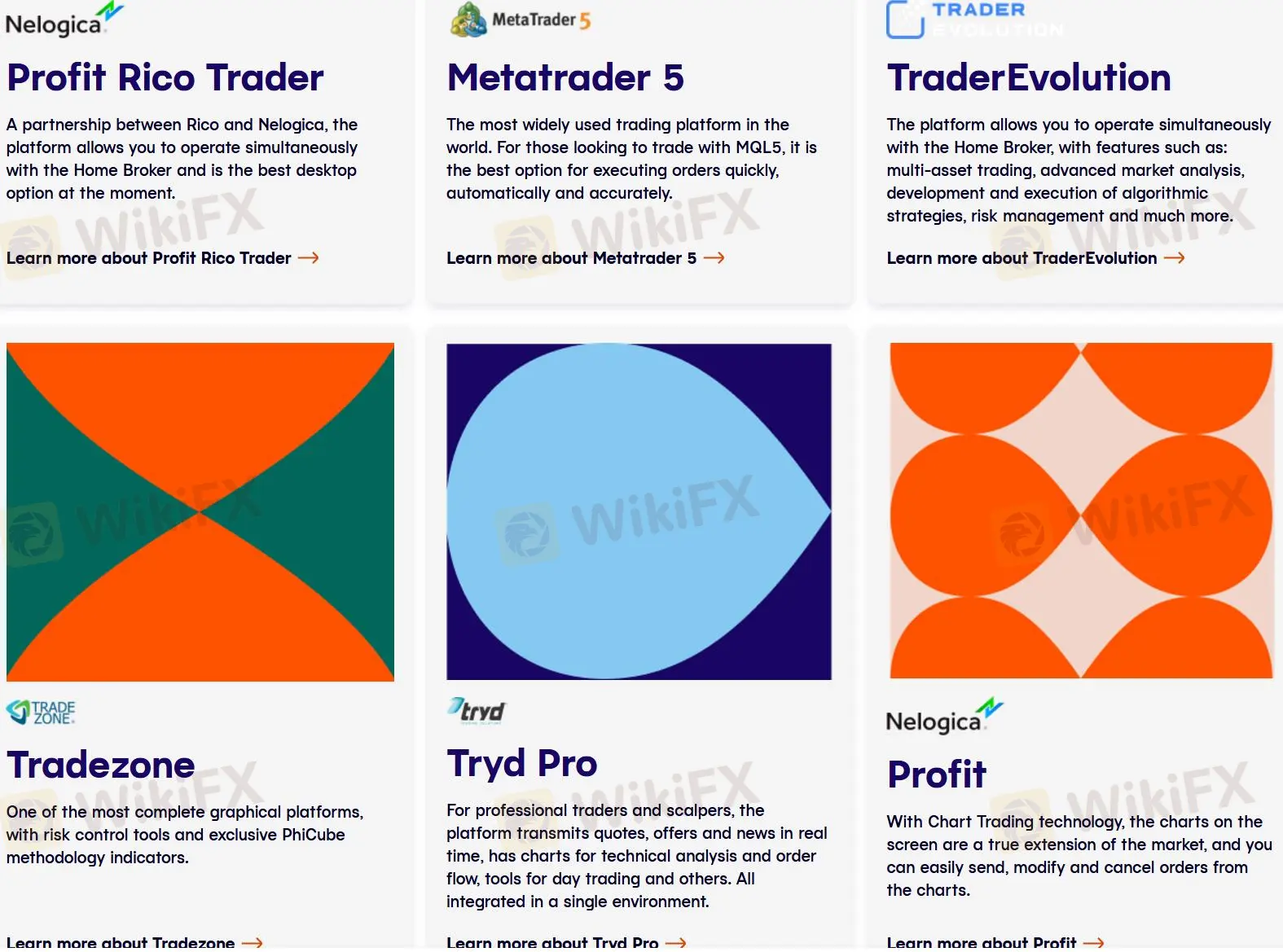

Plataforma de Negociação

Na RICO, os usuários são livres para escolher qualquer plataforma, incluindo Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro e Profit. Além do Metatrader5 (conta real e demo), Tradezone Web (Webchart) e as plataformas TraderEvolution Web são gratuitas. As taxas cobradas por cada plataforma também são diferentes:

R$ 60,00 - Tradezone Desktop;

R$ 160,00 - TraderEvolution Desktop;

R$ 14,90 - RicoTrader;

R$ 100,00 - Tryd Pro;

R$ 19,90 - Tryd Trader;

R$ 120,00 - ProfitPlus e

R$ 139,90 - ProfitPro.

No entanto, para plataformas pagas, também há um custo de ISS de 10,68% do valor cobrado.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Desktop/Mobile |

| Tradezone | ✔ | Desktop/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

Opções de Suporte ao Cliente

Os traders podem seguir RICO no YouTube, Instagram,Facebook e Twitter e manter contato com a empresa ligando para WhatsApp e telefone.

| Opções de Contato | Detalhes |

| Telefone | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| Redes Sociais | YouTube, Instagram, Facebook, Twitter |

| Idioma Suportado | Português |

| Idioma do Site | Português |

| Endereço Físico | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |