Perfil de la compañía

| RICO Resumen de la reseña | |

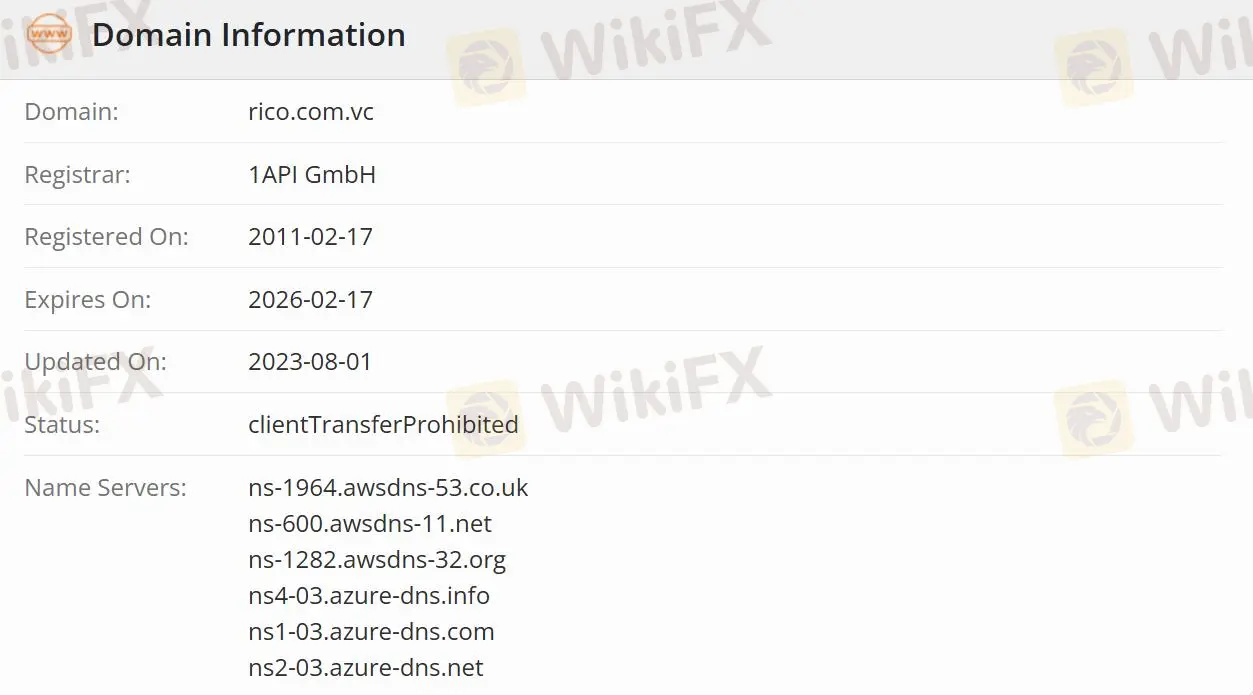

| Fundado | 2011-02-17 |

| País/Región registrado | Brasil |

| Regulación | No regulado |

| Productos | Todas las inversiones/Tesorería directa/Ingresos fijos/Otras inversiones/El mercado de valores y BM&F |

| Cuenta de demostración | ✅ |

| Plataforma de negociación | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| Soporte al cliente | Teléfono: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

RICO Información

Fundada en 2011, RICO es una empresa de inversión no regulada registrada en Brasil. La empresa ofrece varios productos, incluyendo todas las inversiones y simuladores, y 5 plataformas principales con diferentes cargos, como Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro y Profit. RICO ofrece cuentas de inversión para invertir y cuentas digitales para manejar transacciones diarias.

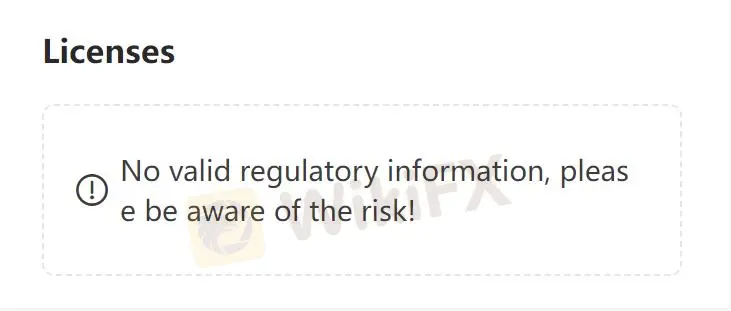

¿Es RICO legítimo?

RICO no está regulado, lo que lo hace menos seguro que las empresas reguladas.

¿Qué productos ofrece RICO?

La empresa ofrece varios productos, incluyendo todas las inversiones, tesorería directa, ingresos fijos, CBD, LC, LCA, LCI y debentures. RICO también ofrece otras inversiones, como fondos de inversión, fondos inmobiliarios, COE, CRI, CRA y oferta pública-lPO. Además, el mercado de valores y BM&F involucran alquiler de acciones, opciones, contratos de futuros, mini contratos, futuros de acciones y proveedor de liquidez-RLP.

Tipo de cuenta

Rico ofrece dos tipos de cuentas con diferentes saldos. A través de la cuenta de inversión, los usuarios pueden invertir en aplicaciones de renta fija y renta variable, y utilizar la cuenta digital para manejar transacciones diarias como pagar facturas, enviar y recibir PIX y TED, y recibir salarios.

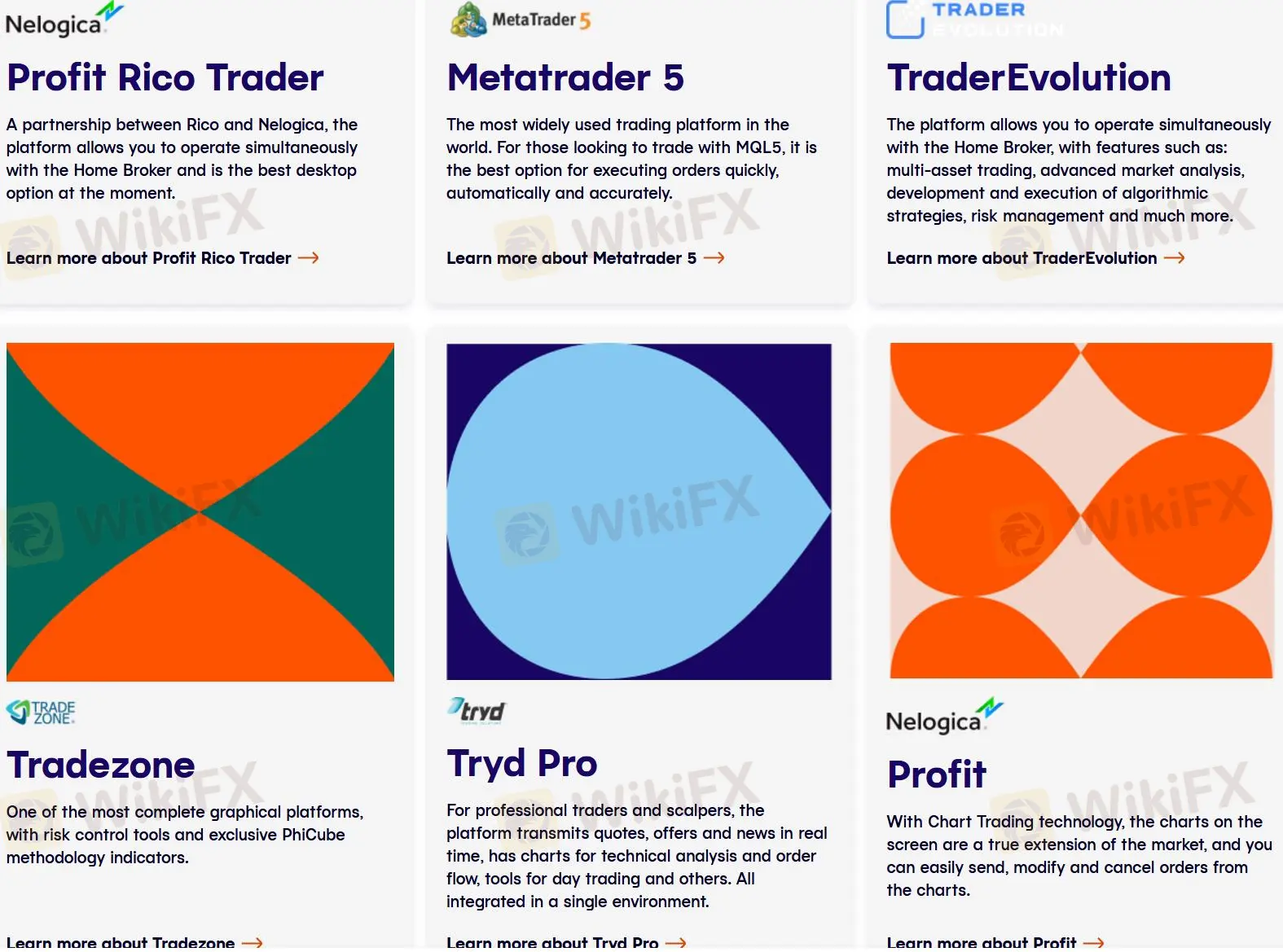

Plataforma de negociación

En RICO, los usuarios pueden elegir cualquier plataforma, incluyendo Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro y Profit. Aparte de Metatrader5 (cuenta real y de demostración), las plataformas Tradezone Web (Webchart) y TraderEvolution Web son gratuitas. Las tarifas cobradas por cada plataforma también son diferentes:

R$ 60.00 – Tradezone Desktop;

R$ 160.00 – TraderEvolution Desktop;

R$ 14.90 – RicoTrader;

R$ 100.00 – Tryd Pro;

R$ 19.90 – Tryd Trader;

R$ 120.00 – ProfitPlus y

R$ 139.90 – ProfitPro.

Sin embargo, para las plataformas de pago, también hay un costo de ISS del 10.68% del monto cobrado.

| Plataforma de Trading | Soportada | Dispositivos Disponibles |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Escritorio/Móvil |

| Tradezone | ✔ | Escritorio/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

Opciones de Soporte al Cliente

Los traders pueden seguir a RICO en YouTube, Instagram,Facebook y Twitter y mantenerse en contacto con la empresa llamando a WhatsApp y teléfono.

| Opciones de Contacto | Detalles |

| Teléfono | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| Redes Sociales | YouTube, Instagram, Facebook, Twitter |

| Idioma Soportado | Portugués |

| Idioma del Sitio Web | Portugués |

| Dirección Física | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |