Şirket özeti

| RICO İnceleme Özeti | |

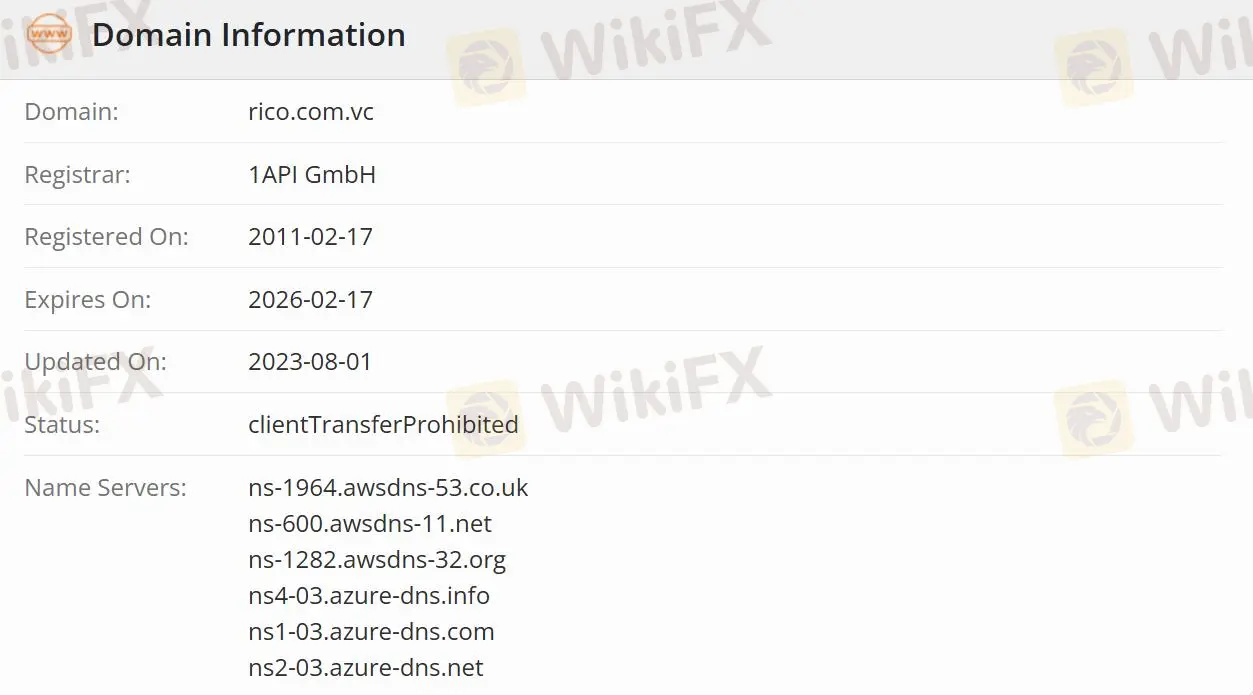

| Kuruluş Tarihi | 2011-02-17 |

| Kayıtlı Ülke/Bölge | Brezilya |

| Düzenleme | Düzenlenmemiş |

| Ürünler | Tüm Yatırımlar/Doğrudan Hazine/Sabit Gelir/Diğer Yatırımlar/Hisse Senedi Piyasası ve BM&F |

| Deneme Hesabı | ✅ |

| İşlem Platformu | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| Müşteri Desteği | Telefon: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

RICO Bilgileri

2011 yılında kurulan RICO, Brezilya'da kayıtlı olan düzenlenmemiş bir yatırım şirketidir. Şirket, tüm yatırımlar ve simülatörler dahil olmak üzere çeşitli ürünler sunmaktadır ve farklı ücretlerle 5 farklı platforma sahiptir: Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro ve Profit. RICO, yatırım yapmak için yatırım hesapları ve günlük işlemleri yönetmek için dijital hesaplar sunmaktadır.

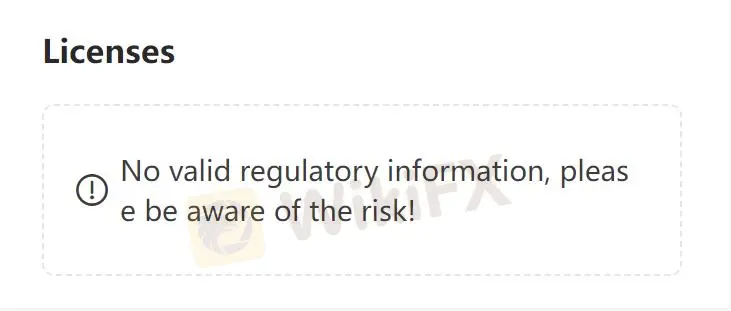

RICO Güvenilir mi?

RICO düzenlenmemiş olduğundan, düzenlenmiş şirketlere göre daha güvenli değildir.

RICO Hangi Ürünleri Sunuyor?

Şirket, CBD, LC, LCA, LCI ve tahviller de dahil olmak üzere tüm yatırımlar, doğrudan hazine, sabit gelir, CBD, LC, LCA, LCI ve tahviller gibi çeşitli ürünler sunmaktadır. RICO, yatırım fonları, gayrimenkul fonları, COE, CRI, CRA ve halka arz-lPO gibi diğer yatırımlar da sunmaktadır. Ayrıca, hisse senedi piyasası ve BM&F, Hisse senedi kiralama, Opsiyonlar, Vadeli işlem sözleşmeleri, Mini sözleşmeler, Hisse senedi vadeli işlemleri ve Likidite Sağlayıcı-RLP gibi ürünleri içermektedir.

Hesap Türü

Rico, farklı bakiyelere sahip iki hesap sunmaktadır. Yatırım hesabı aracılığıyla kullanıcılar sabit gelir ve değişken gelir uygulamalarına yatırım yapabilir ve dijital hesap aracılığıyla faturaları ödeme, PIX ve TED gönderme ve alma, maaş alma gibi günlük işlemleri yönetebilir.

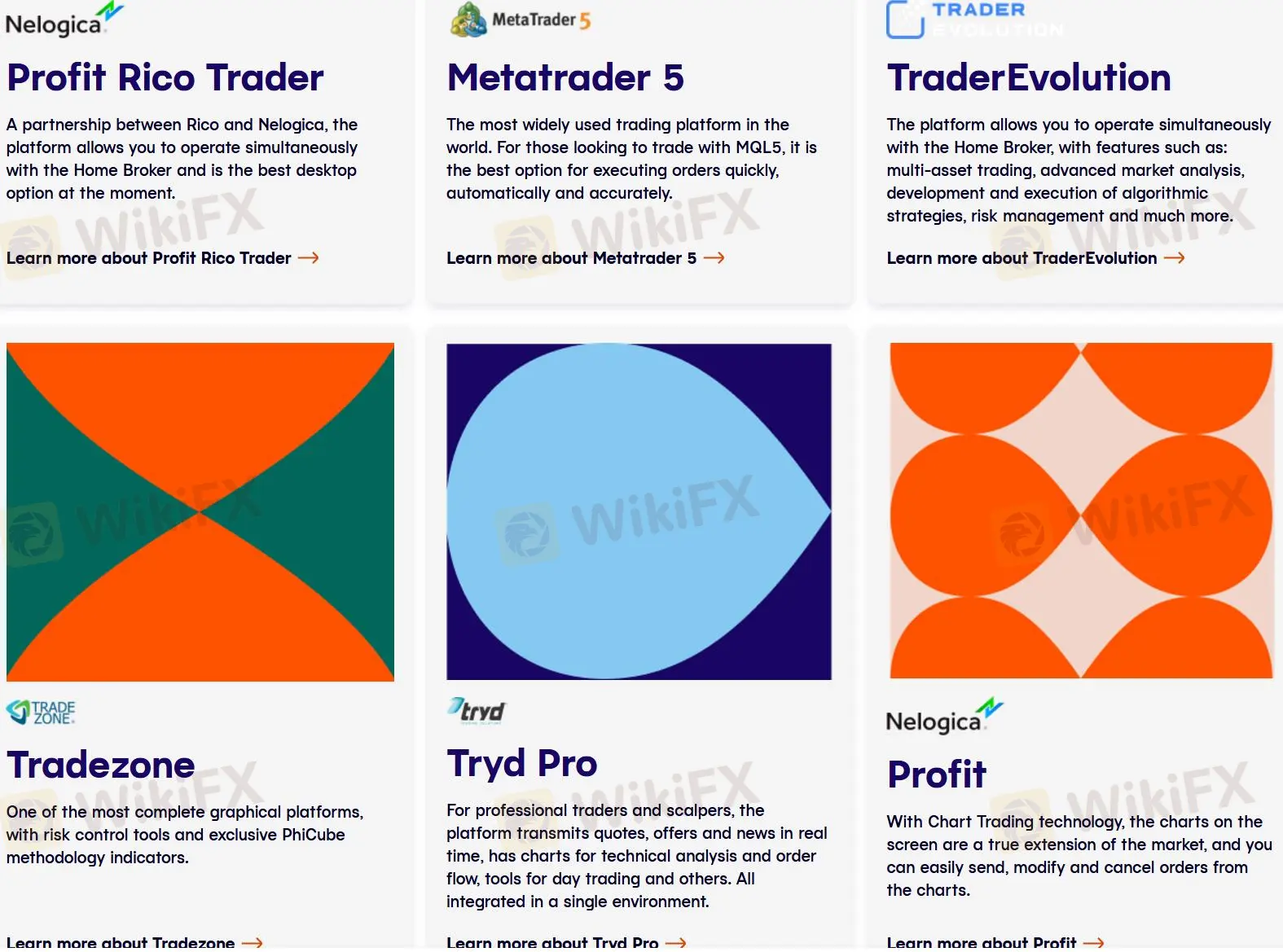

İşlem Platformu

RICO kullanıcıları, Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro ve Profit gibi Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro ve Profit dahil olmak üzere herhangi bir platformu seçme özgürlüğüne sahiptir. Metatrader5 (gerçek ve deneme hesabı) dışındaki Tradezone Web (Webchart) ve TraderEvolution Web platformları ücretsizdir. Her platform tarafından alınan ücretler de farklıdır:

R$ 60.00 – Tradezone Masaüstü;

R$ 160.00 – TraderEvolution Masaüstü;

R$ 14.90 – RicoTrader;

R$ 100.00 – Tryd Pro;

R$ 19.90 – Tryd Trader;

R$ 120.00 – ProfitPlus ve

R$ 139.90 – ProfitPro.

Ancak, ücretli platformlar için tahsil edilen tutarın %10.68'i kadar ISS maliyeti de bulunmaktadır.

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Masaüstü/Mobil |

| Tradezone | ✔ | Masaüstü/Web Grafikleri |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

Müşteri Destek Seçenekleri

Tüccarlar, şirketle iletişim kurmak için YouTube, Instagram,Facebook ve Twitter'da RICO'ı takip edebilir ve WhatsApp ve telefon aracılığıyla iletişimde kalabilirler.

| İletişim Seçenekleri | Detaylar |

| Telefon | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| Sosyal Medya | YouTube, Instagram, Facebook, Twitter |

| Desteklenen Dil | Portekizce |

| Web Sitesi Dili | Portekizce |

| Fiziksel Adres | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |