회사 소개

| RICO 리뷰 요약 | |

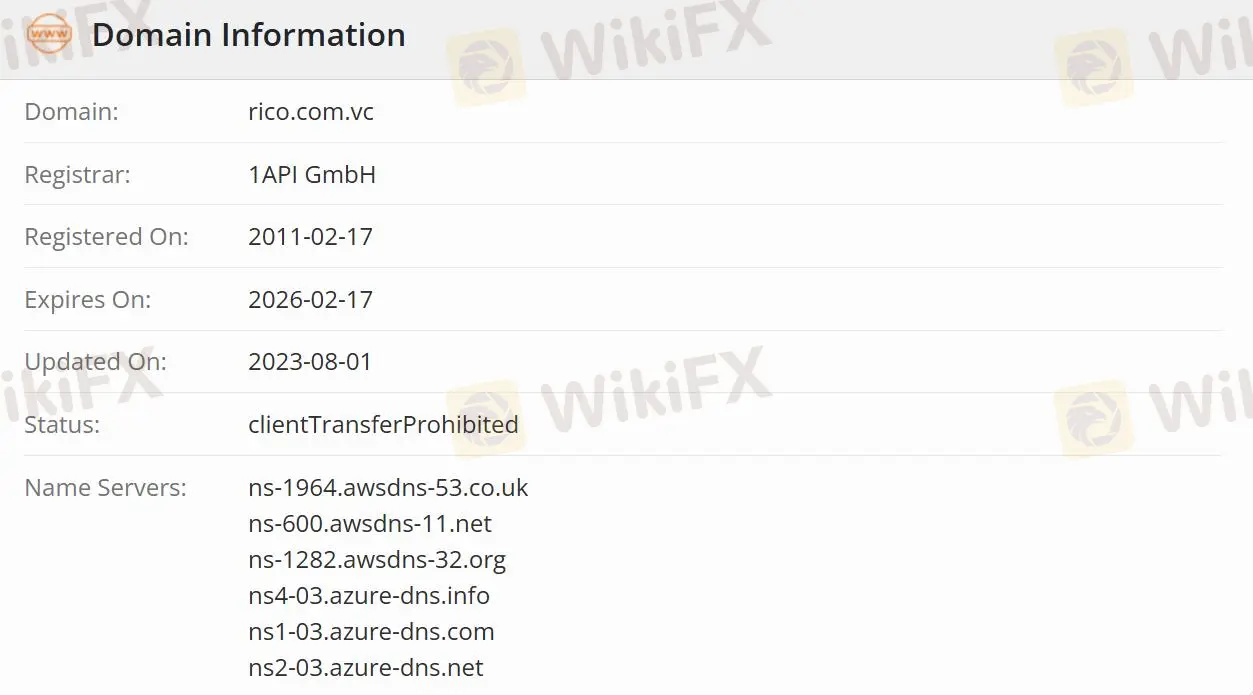

| 설립일 | 2011-02-17 |

| 등록 국가/지역 | 브라질 |

| 규제 | 규제되지 않음 |

| 제품 | 모든 투자/직접 채권/고정 수입/기타 투자/주식 시장 및 BM&F |

| 데모 계정 | ✅ |

| 거래 플랫폼 | Profit Rico Trader/MetaTrader 5/TraderEvolution/Tradezone/Tryd Pro/Profit |

| 고객 지원 | 전화: +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| Whatsapp: +55 11 4935-2740 | |

| YouTube, Instagram, Facebook, Twitter | |

RICO 정보

RICO은 2011년에 설립된 규제되지 않은 투자 회사로 브라질에 등록되어 있습니다. 해당 회사는 모든 투자 및 시뮬레이터와 수수료가 다른 5개의 주요 플랫폼인 Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro 및 Profit을 포함한 다양한 제품을 제공합니다. RICO은 투자 계정과 일상 거래를 처리하기 위한 디지털 계정을 제공합니다.

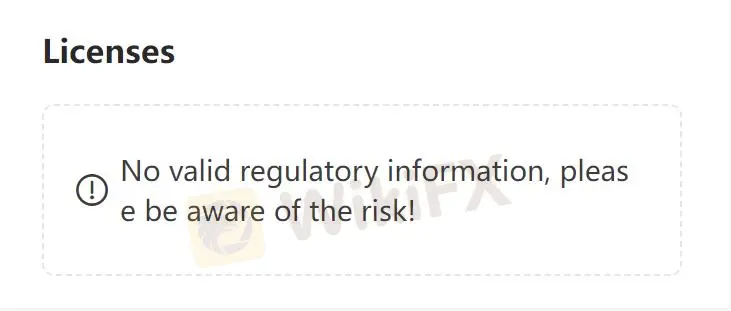

RICO의 신뢰성

RICO은 규제되지 않음으로 규제된 회사보다 안전성이 낮습니다.

RICO이 어떤 제품을 제공하나요?

해당 회사는 모든 투자, 직접 채권, 고정 수입, CBD, LC, LCA, LCI 및 양도 채권 등 다양한 제품을 제공합니다. 또한 RICO은 투자 펀드, 부동산 펀드, COE, CRI, CRA 및 공개 청약-lPO와 같은 기타 투자도 제공합니다. 추가로, 주식 시장과 BM&F은 주식 임대, 옵션, 선물 계약, 미니 계약, 주식 선물 및 유동성 제공자-RLP를 포함합니다.

계정 유형

Rico는 잔액이 다른 두 가지 계정을 제공합니다. 투자 계정을 통해 사용자는 고정 수입 및 변동 수입 애플리케이션에 투자하고 디지털 계정을 사용하여 청구서 지불, PIX 및 TED 송금 및 수령, 급여 수령 등 일상 거래를 처리할 수 있습니다.

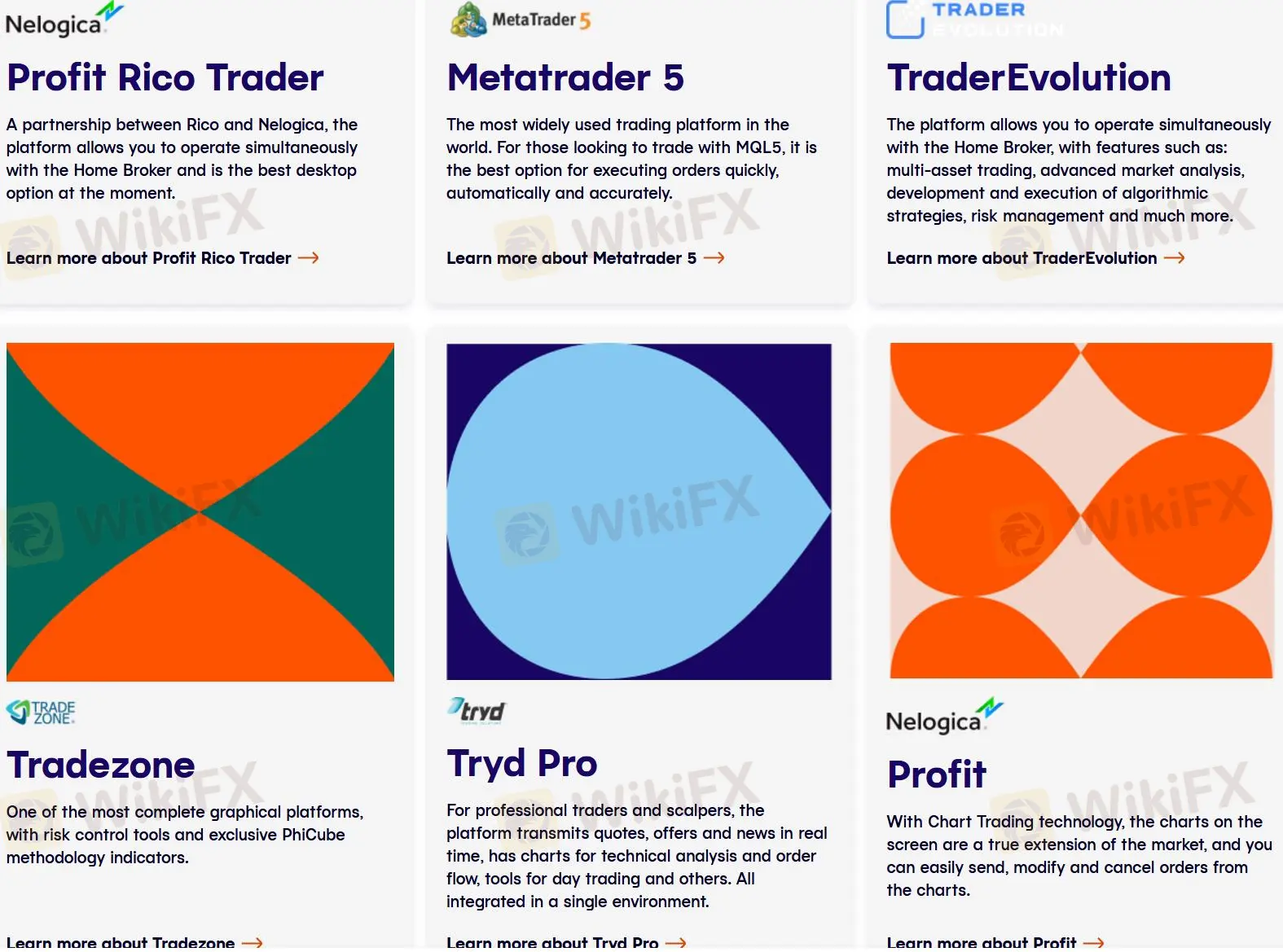

거래 플랫폼

RICO에서는 사용자가 Profit Rico Trader, MetaTrader 5, TraderEvolution, Tradezone, Tryd Pro 및 Profit를 포함한 어떤 플랫폼을 선택해도 됩니다. Metatrader5 (실제 및 데모 계정) 외에도 Tradezone Web (Webchart) 및 TraderEvolution Web 플랫폼은 무료입니다. 각 플랫폼에 부과되는 수수료도 다릅니다:

R$ 60.00 – Tradezone Desktop;

R$ 160.00 – TraderEvolution Desktop;

R$ 14.90 – RicoTrader;

R$ 100.00 – Tryd Pro;

R$ 19.90 – Tryd Trader;

R$ 120.00 – ProfitPlus 및

R$ 139.90 – ProfitPro.

그러나 유료 플랫폼의 경우 청구 금액의 10.68%에 해당하는 ISS 비용도 부과됩니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| Profit Rico Trader | ✔ | - |

| MetaTrader 5 | ✔ | MetaTrader |

| TraderEvolution | ✔ | Web/Desktop/Mobile |

| Tradezone | ✔ | Desktop/WebCharts |

| Tryd Pro | ✔ | - |

| Profit | ✔ | - |

고객 지원 옵션

트레이더는 YouTube, Instagram,Facebook 및 Twitter에서 RICO를 팔로우하고 WhatsApp 및 전화로 회사와 연락을 유지할 수 있습니다.

| 연락 옵션 | 세부 정보 |

| 전화 | +55 11 3003-5465/+55 11 4007-2465/800-771-5465 |

| +55 11 4935-2740 | |

| 소셜 미디어 | YouTube, Instagram, Facebook, Twitter |

| 지원되는 언어 | 포르투갈어 |

| 웹사이트 언어 | 포르투갈어 |

| 실제 주소 | Av. Chedid Jafet, 75 - Torre sul - Vila Olimpia, São Paulo - SP, 04551-060 |