Présentation de l'entreprise

| Morrison Résumé de l'examen | |

| Fondé | 2002 |

| Pays/Région Enregistré | Australie |

| Régulation | Réglementé par l'ASIC |

| Instruments de Marché | Actions au comptant, options sur actions, bons de souscription, ETF, XTB, LIC, LIT et Tracers |

| Compte de Démo | ❌ |

| Plateforme de Trading | Iress, TradeCentre, TradeFloor, Refintiv, Terminal Bloomberg |

| Dépôt Minimum | / |

| Support Client | Formulaire de contact |

| Téléphone: 1300 130 545 | |

| Email: contactus@morrisonsecurities.com | |

| Adresse: Suite 38.01, Niveau 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison Securities Pty Limited est un fournisseur de services financiers multifacettes. Opérant avec une licence des organismes de réglementation australiens depuis 2002, il propose de nombreuses plateformes de trading offrant diverses interfaces de trading, y compris des solutions propriétaires et tierces.

Voici la page d'accueil du site officiel de ce courtier:

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par l'ASIC | Structure tarifaire peu claire |

| Plusieurs plateformes de trading | |

| Divers moyens de les contacter | |

| Services financiers fournis |

Morrison est-il Légitime ?

Morrison est réglementé par la Commission Australienne des Valeurs Mobilières et des Investissements (ASIC), avec un traitement direct (STP), No. 241737.

| Statut Réglementaire | Réglementé |

| Réglementé par | Australie |

| Institution Licenciée | Morrison Securities Pty Limited |

| Type de Licence | Traitement Direct (STP) |

| Numéro de Licence | 241737 |

Que Puis-je Trader sur Morrison ?

Morrison se connecte aux principales bourses en Australie pour une exécution sans faille. Ils sont membres des bourses ASX, Cboe Australia, NSX et SSE. Ils proposent des actions au comptant, des options sur actions (à la fois des actions individuelles et des indices au niveau 1 et niveau 2), warrants, ETF (fonds négociés en bourse), XTB (obligations négociées en bourse), LIC (sociétés d'investissement cotées), LIT (fiducies d'investissement cotées) et Tracers (actions américaines Cboe Australia - reçus de garde transférables).

| Instruments de trading | Pris en charge |

| Actions au comptant | ✔ |

| Options sur actions | ✔ |

| Warrants | ✔ |

| ETF | ✔ |

| Obligations | ✔ |

| Fiducies d'investissement | ✔ |

| Actions | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

Services financiers

Morrison propose également des services financiers, y compris des conseillers financiers, gestionnaires de patrimoine, traders actifs, gestionnaires de fonds et plateformes fintech, qui fournissent des API pour l'intégration et le développement d'applications fintech personnalisées.

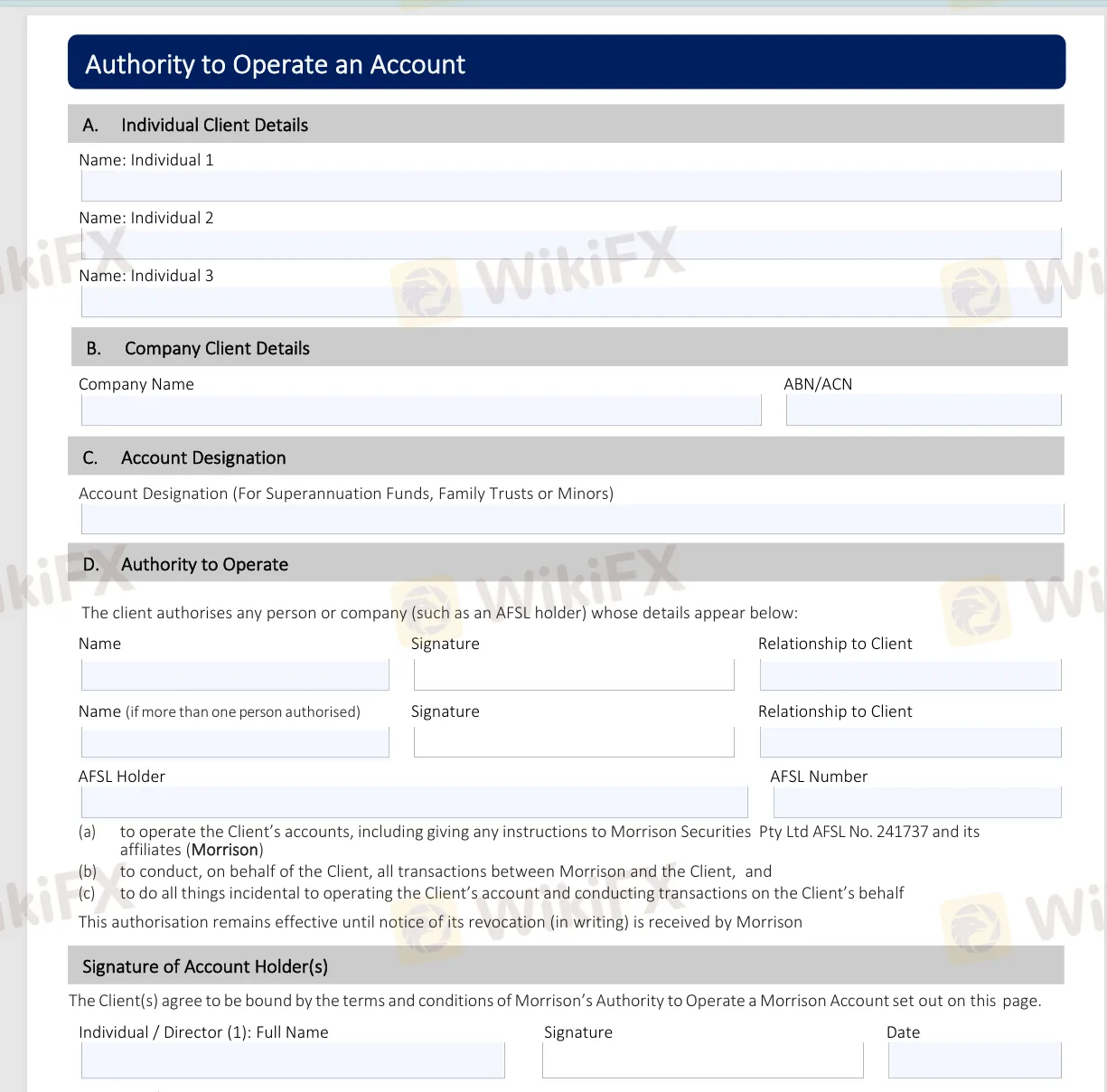

Compte

Pour ouvrir un compte chez Morrison, remplissez les formulaires de maintenance de compte nécessaires disponibles sur leur site web. Ces formulaires incluent le formulaire de modification du nom du compte, l'autorisation de gérer un compte, le changement de coordonnées, la direction des revenus, la demande de prélèvement automatique et la liste d'identification à 100 points. Une fois ces formulaires remplis, envoyez-les à accounts@morrisonsecurities.com.

Plateforme de trading

Morrison propose différentes plateformes de trading, y compris des logiciels pour passer des ordres, créer des listes de surveillance, visualiser les portefeuilles des clients et des packages de graphiques avancés. Ils prennent en charge :

| Plateforme de trading | Composants pris en charge |

| Iress | Viewpoint, Web, versions Pro |

| TradeCentre | Bourse Analyser, TC Web, TC Wealth |

| TradeFloor | Trading d'options et gestion des risques |

| Refintiv | Plateforme Eikon |

| Terminal Bloomberg | EMSX |

De plus, si vous avez votre propre plateforme préférée, ils offrent la compatibilité via FIX, Webservices et APIs.