Profil perusahaan

| Morrison Ringkasan Ulasan | |

| Didirikan | 2002 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | Diatur oleh ASIC |

| Instrumen Pasar | Ekuitas tunai, opsi ekuitas, waran, ETF, XTB, LIC, LIT, dan Tracers |

| Akun Demo | ❌ |

| Platform Perdagangan | Iress, TradeCentre, TradeFloor, Refintiv, Bloomberg Terminal |

| Deposit Minimum | / |

| Dukungan Pelanggan | Formulir kontak |

| Telepon: 1300 130 545 | |

| Email: contactus@morrisonsecurities.com | |

| Alamat: Suite 38.01, Level 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Morrison Securities Pty Limited adalah penyedia layanan keuangan multifaset. Beroperasi dengan lisensi dari badan regulasi Australia sejak tahun 2002, menawarkan banyak platform perdagangan yang menawarkan berbagai antarmuka perdagangan, termasuk solusi properti dan pihak ketiga.

Berikut adalah halaman utama situs resmi pialang ini:

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh ASIC | Struktur biaya yang tidak jelas |

| Banyak platform perdagangan | |

| Berbagai cara untuk menghubungi mereka | |

| Layanan keuangan yang disediakan |

Apakah Morrison Legal?

Morrison diatur oleh Australian Securities and Investments Commission (ASIC), dengan Straight Through Processing (STP), No. 241737.

| Status Regulasi | Diatur |

| Diatur oleh | Australia |

| Institusi Berlisensi | Morrison Securities Pty Limited |

| Tipe Lisensi | Straight Through Processing (STP) |

| Nomor Lisensi | 241737 |

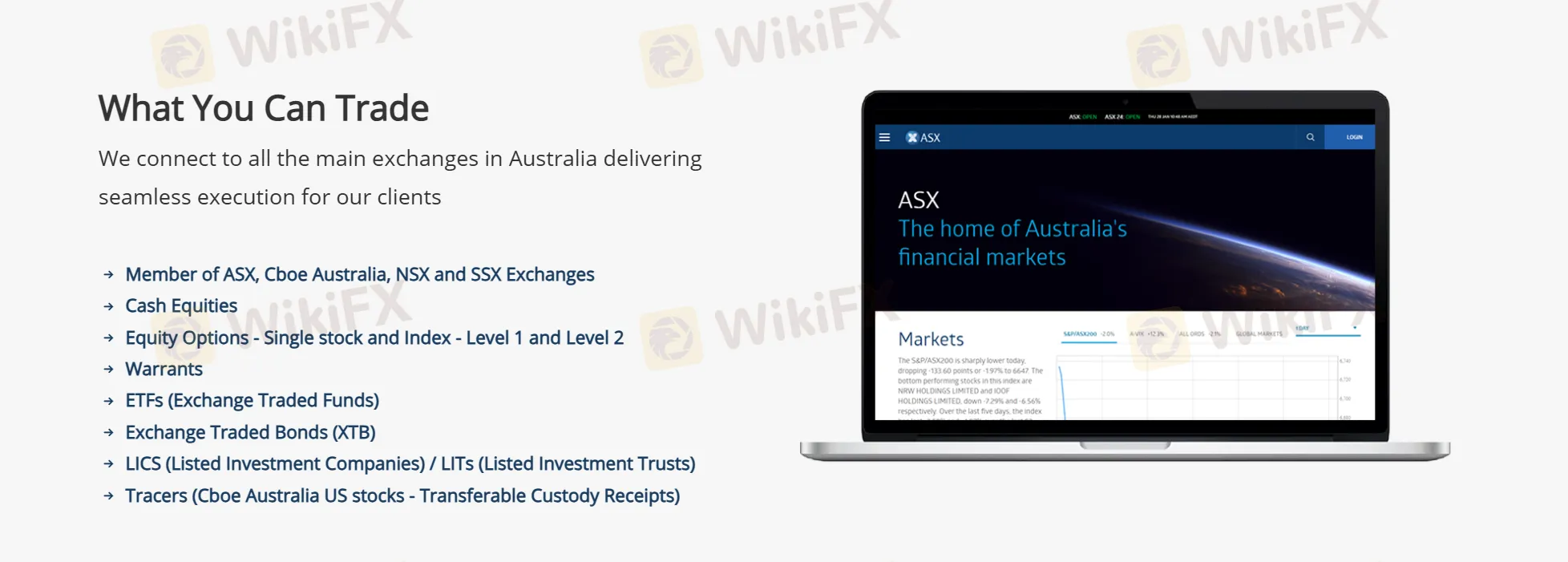

Apa yang Dapat Saya Perdagangkan di Morrison?

Morrison terhubung ke bursa utama di Australia untuk eksekusi yang mulus. Mereka adalah anggota dari Bursa Efek Australia (ASX), Cboe Australia, NSX, dan Bursa SSE. Mereka menawarkan ekuitas tunai, opsi ekuitas (baik saham tunggal maupun indeks di Level 1 dan Level 2), waran, ETF (Exchange Traded Funds), XTB (Exchange Traded Bonds), LIC (Listed Investment Companies), LIT (Listed Investment Trusts), dan Tracers (Cboe Australia saham AS Amerika - Transferable Custody Receipts).

| Instrumen Perdagangan | Didukung |

| Ekuitas tunai | ✔ |

| Opsi ekuitas | ✔ |

| Waran | ✔ |

| ETF | ✔ |

| Obligasi | ✔ |

| Trust investasi | ✔ |

| Saham | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

Layanan Keuangan

Morrison juga menawarkan layanan keuangan termasuk konsultan keuangan, manajer kekayaan, pedagang aktif, manajer dana, dan platform fintech, yang menyediakan API untuk integrasi dan pengembangan aplikasi fintech yang disesuaikan.

Akun

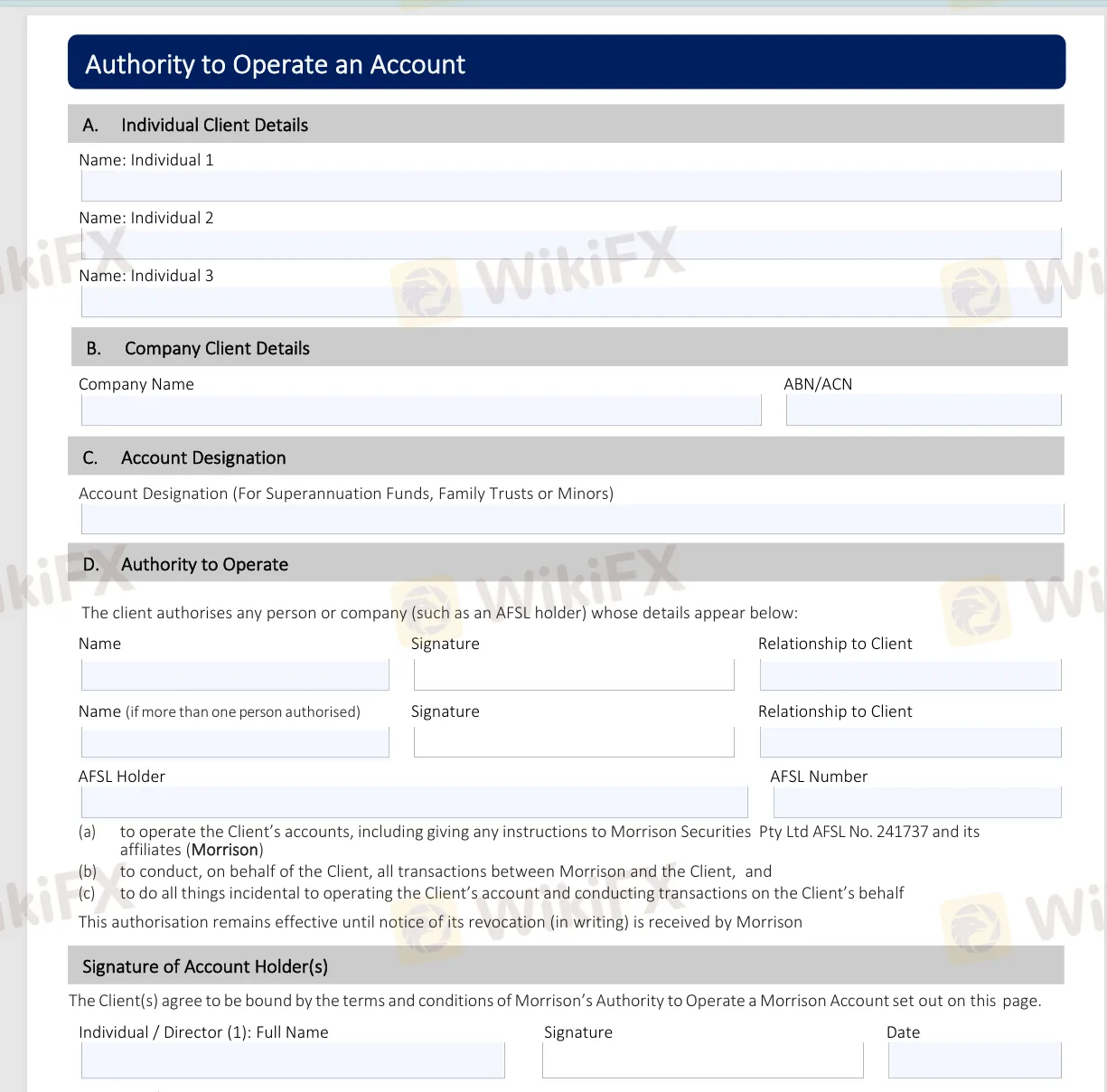

Untuk membuka rekening dengan Morrison, lengkapi formulir pemeliharaan akun yang diperlukan yang tersedia di situs web mereka. Formulir-formulir ini termasuk Formulir Perubahan Nama Akun, Otorisasi untuk Mengoperasikan Akun, Perubahan Rincian Kontak, Arah Pendapatan, Permintaan Debit Langsung, dan Daftar ID 100 Poin. Setelah mengisi formulir-formulir ini, kirimkan ke accounts@morrisonsecurities.com.

Platform Perdagangan

Morrison menawarkan berbagai platform perdagangan termasuk perangkat lunak untuk penempatan pesanan, membuat daftar pantauan, melihat portofolio klien, dan paket grafik canggih. Mereka mendukung:

| Platform Perdagangan | Komponen yang Didukung |

| Iress | Viewpoint, Web, Versi Pro |

| TradeCentre | Bourse Analyser, TC Web, TC Wealth |

| TradeFloor | Perdagangan opsi dan manajemen risiko |

| Refintiv | Platform Eikon |

| Bloomberg Terminal | EMSX |

Selain itu, jika Anda memiliki platform pilihan sendiri, Mereka menawarkan kompatibilitas melalui FIX, Webservices, dan API.