Buod ng kumpanya

| Morrison Buod ng Pagsusuri | |

| Itinatag | 2002 |

| Nakarehistrong Bansa/Rehiyon | Australia |

| Regulasyon | Regulated by ASIC |

| Mga Kasangkapan sa Merkado | Cash equities, equity options, warrants, ETFs, XTBs, LICs, LITs, at Tracers |

| Demo Account | ❌ |

| Platform ng Paggawa ng Kalakalan | Iress, TradeCentre, TradeFloor, Refintiv, Bloomberg Terminal |

| Minimum Deposit | / |

| Suporta sa Customer | Form ng Pakikipag-ugnayan |

| Telepono: 1300 130 545 | |

| Email: contactus@morrisonsecurities.com | |

| Address: Suite 38.01, Antas 38, Australia Square Towers, 264 George Street, Sydney, NSW 2000 | |

Ang Morrison Securities Pty Limited ay isang komprehensibong tagapagbigay ng mga serbisyong pinansyal. Sa lisensya mula sa mga ahensiyang regulasyon ng Australia mula noong 2002, ito ay nag-aalok ng maraming plataporma ng kalakalan na nag-aalok ng iba't ibang mga interface ng kalakalan, kabilang ang mga proprietary at third-party solutions.

Narito ang home page ng opisyal na site ng mga broker:

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulated by ASIC | Unclear fee structure |

| Maraming plataporma ng kalakalan | |

| Iba't ibang paraan ng pakikipag-ugnayan sa kanila | |

| Mga serbisyong pinansyal na ibinibigay |

Tunay ba ang Morrison?

Morrison ay regulado ng Australian Securities and Investments Commission (ASIC), na may Straight Through Processing (STP), No. 241737.

| Status ng Regulasyon | Regulated |

| Regulated by | Australia |

| Lisensiyadong Institusyon | Morrison Securities Pty Limited |

| Uri ng Lisensya | Straight Through Processing (STP) |

| Numero ng Lisensya | 241737 |

Ano ang Maaari Kong Kalakalan sa Morrison?

Morrison nakikipag-ugnayan sa mga pangunahing palitan sa Australia para sa walang hadlang na pagpapatupad. Sila ay miyembro ng ASX, Cboe Australia, NSX, at SSE Exchanges. Nag-aalok sila ng cash equities, equity options (parehong single stock at index sa Level 1 at Level 2), warrants, ETFs (Exchange Traded Funds), XTBs (Exchange Traded Bonds), LICs (Listed Investment Companies), LITs (Listed Investment Trusts), at Tracers (Cboe Australia US stocks - Transferable Custody Receipts).

| Mga Kasangkapan sa Paghahalal | Supported |

| Cash equities | ✔ |

| Equity options | ✔ |

| Warrants | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Investment trusts | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Mga Serbisyong Pinansiyal

Morrison ay nag-aalok din ng mga serbisyong pinansiyal kabilang ang financial advisers, wealth managers, active traders, fund managers, at fintech platforms, na nagbibigay ng APIs para sa integrasyon at pag-develop ng mga custom fintech applications.

Account

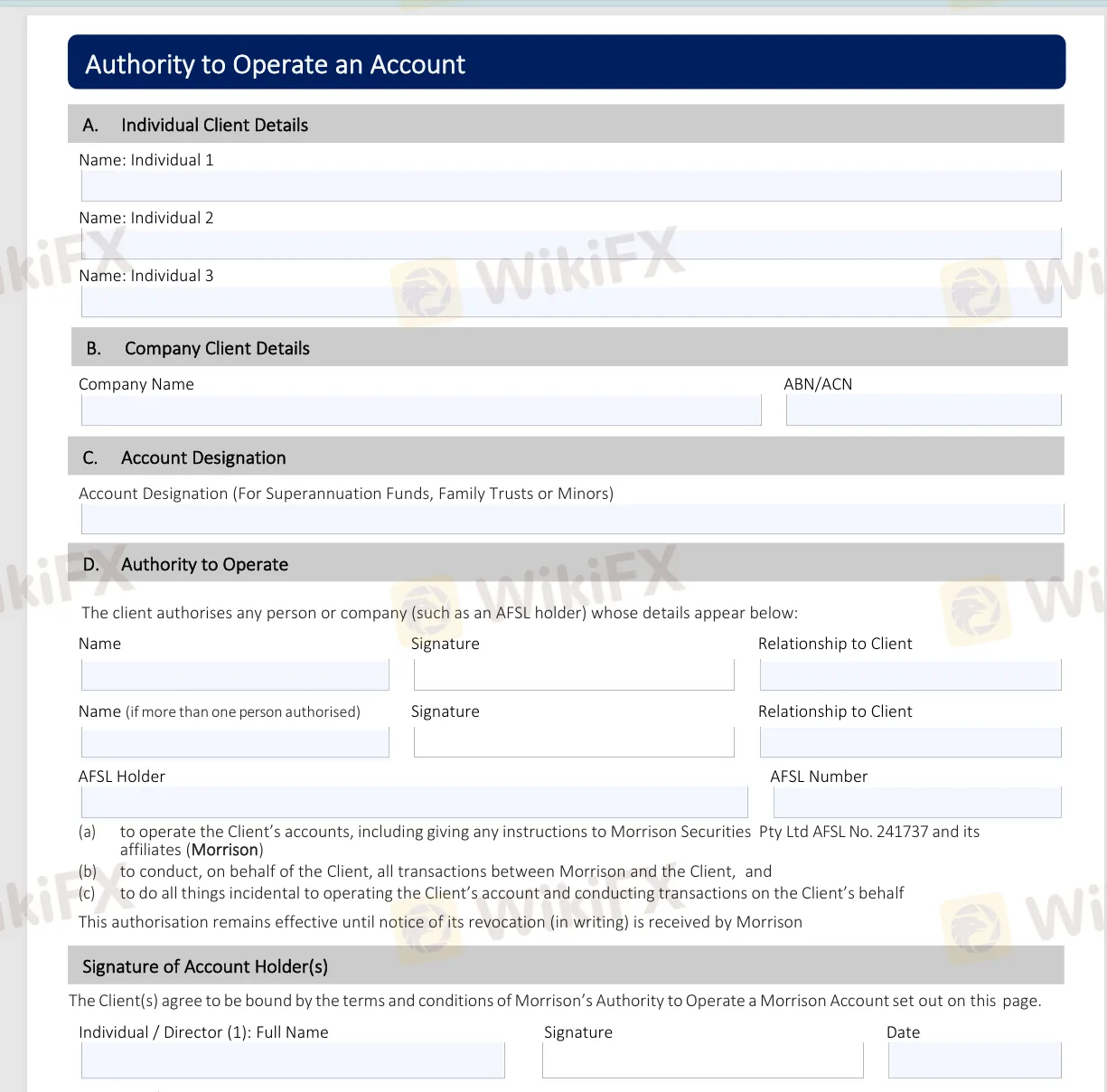

Upang magbukas ng isang account sa Morrison, kumpletuhin ang kinakailangang mga form ng pagpapanatili ng account na makukuha sa kanilang website. Kasama sa mga form na ito ang Account Name Amendment Form, Authority to Operate an Account, Change of Contact Details, Income Direction, Direct Debit Request, at ang 100 Point ID List. Kapag natapos nang punan ang mga form na ito, ipadala ang mga ito sa accounts@morrisonsecurities.com.

Plataforma ng Paghahalal

Nag-aalok si Morrison ng iba't ibang mga plataporma ng paghahalal kabilang ang software para sa paglalagay ng order, paglikha ng watchlists, pagtingin sa mga portfolio ng kliyente, at advanced charting packages. Sinusuportahan nila ang:

| Plataforma ng Paghahalal | Supported Components |

| Iress | Viewpoint, Web, Pro versions |

| TradeCentre | Bourse Analyser, TC Web, TC Wealth |

| TradeFloor | Options trading and risk management |

| Refintiv | Eikon platform |

| Bloomberg Terminal | EMSX |

Bukod dito, kung mayroon kang sariling piniling plataporma, nag-aalok sila ng kakayahan sa pamamagitan ng FIX, Webservices, at APIs.